Attached files

| file | filename |

|---|---|

| 8-K - 8-K - KINGSWAY FINANCIAL SERVICES INC | a8k052814.htm |

KINGSWAY FINANCIAL SERVICES INC. INVESTOR PRESENTATION MAY 2014

FORWARD-LOOKING STATEMENTS This presentation contains forward-looking statements related to our future growth, trends in our operating companies' businesses and industries and our financial and operational results and performance that are based on management’s current expectations, forecasts and assumptions involving risks and uncertainties that could cause outcomes and results to differ materially. A number of factors could cause actual events, performance or results to differ materially from the events, performance and results discussed in the forward- looking statements. For information identifying important factors that could cause actual results to differ materially from those anticipated in the forward- looking statements, see Kingsway's securities filings, including its 2013 Annual Report on Form 10-K, under the heading Risk Factors. The securities filings can be accessed on the Canadian Securities Administrators' website at www.sedar.com, and on the EDGAR section of the U.S. Securities and Exchange Commission's website at www.sec.gov or through the Company's website at www.kingsway- financial.com. Kingsway Financial Services Inc. does not undertake to update the forward-looking statements to reflect the impact of circumstances or events that may arise after the date of this presentation. All dollar amounts set forth in this presentation are in U.S. dollars. 2

VALUE BUILDING PHILOSOPHY 3 Compounding capital in the long‐term with investments/acquisitions/financings that offer asymmetric risk/reward potential with a margin of safety supported by private market values

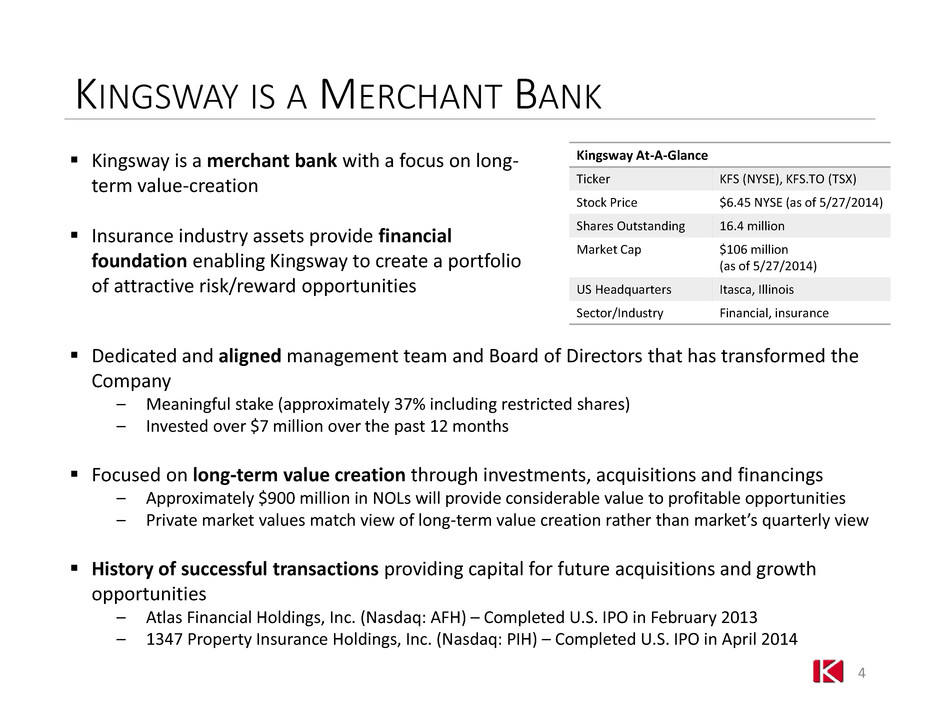

KINGSWAY IS A MERCHANT BANK Kingsway At-A-Glance Ticker KFS (NYSE), KFS.TO (TSX) Stock Price $6.45 NYSE (as of 5/27/2014) Shares Outstanding 16.4 million Market Cap $106 million (as of 5/27/2014) US Headquarters Itasca, Illinois Sector/Industry Financial, insurance 4 Kingsway is a merchant bank with a focus on long- term value-creation Insurance industry assets provide financial foundation enabling Kingsway to create a portfolio of attractive risk/reward opportunities Dedicated and aligned management team and Board of Directors that has transformed the Company – Meaningful stake (approximately 37% including restricted shares) – Invested over $7 million over the past 12 months Focused on long-term value creation through investments, acquisitions and financings – Approximately $900 million in NOLs will provide considerable value to profitable opportunities – Private market values match view of long-term value creation rather than market’s quarterly view History of successful transactions providing capital for future acquisitions and growth opportunities – Atlas Financial Holdings, Inc. (Nasdaq: AFH) – Completed U.S. IPO in February 2013 – 1347 Property Insurance Holdings, Inc. (Nasdaq: PIH) – Completed U.S. IPO in April 2014

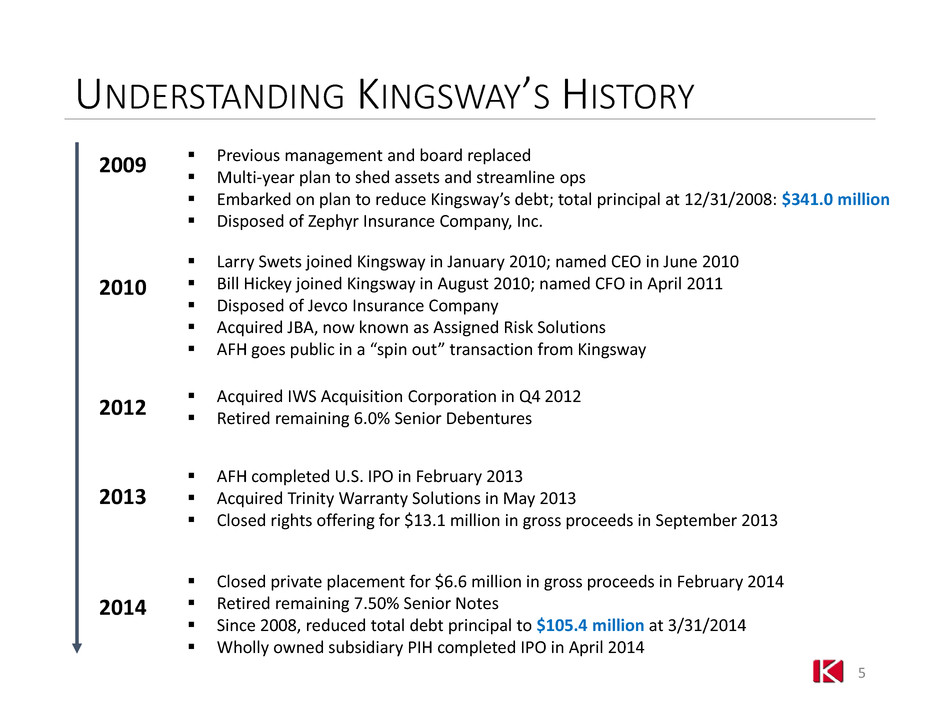

UNDERSTANDING KINGSWAY’S HISTORY 5 AFH completed U.S. IPO in February 2013 Acquired Trinity Warranty Solutions in May 2013 Closed rights offering for $13.1 million in gross proceeds in September 2013 Previous management and board replaced Multi-year plan to shed assets and streamline ops Embarked on plan to reduce Kingsway’s debt; total principal at 12/31/2008: $341.0 million Disposed of Zephyr Insurance Company, Inc. Larry Swets joined Kingsway in January 2010; named CEO in June 2010 Bill Hickey joined Kingsway in August 2010; named CFO in April 2011 Disposed of Jevco Insurance Company Acquired JBA, now known as Assigned Risk Solutions AFH goes public in a “spin out” transaction from Kingsway Closed private placement for $6.6 million in gross proceeds in February 2014 Retired remaining 7.50% Senior Notes Since 2008, reduced total debt principal to $105.4 million at 3/31/2014 Wholly owned subsidiary PIH completed IPO in April 2014 2009 2010 2013 Acquired IWS Acquisition Corporation in Q4 2012 Retired remaining 6.0% Senior Debentures 2012 2014

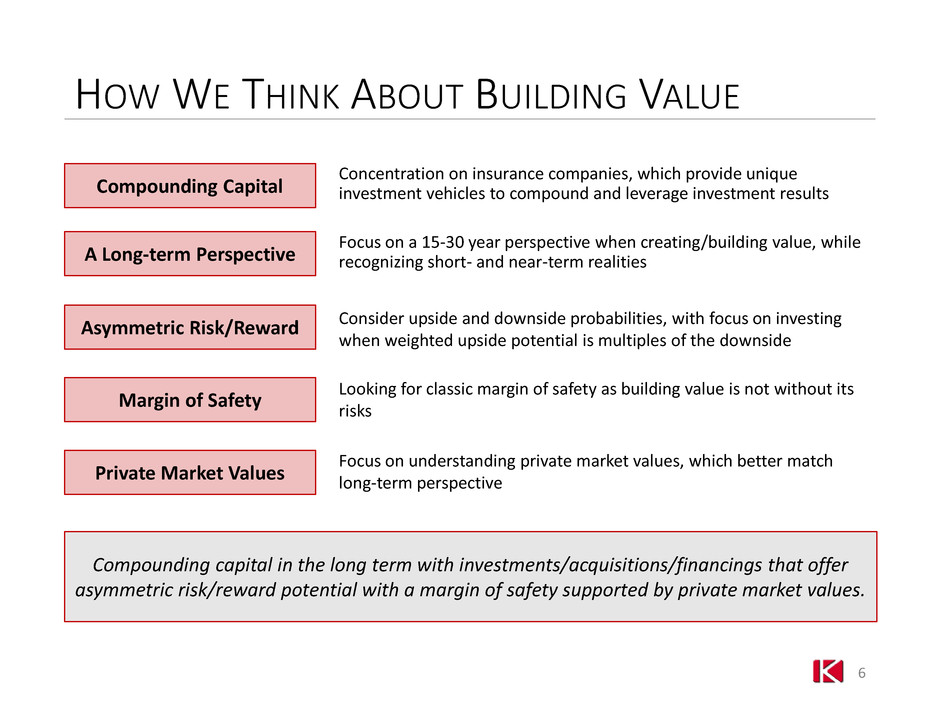

HOW WE THINK ABOUT BUILDING VALUE Concentration on insurance companies, which provide unique investment vehicles to compound and leverage investment results Focus on a 15-30 year perspective when creating/building value, while recognizing short- and near-term realities Consider upside and downside probabilities, with focus on investing when weighted upside potential is multiples of the downside Looking for classic margin of safety as building value is not without its risks Focus on understanding private market values, which better match long-term perspective 6 A Long-term Perspective Compounding Capital Asymmetric Risk/Reward Margin of Safety Private Market Values Compounding capital in the long term with investments/acquisitions/financings that offer asymmetric risk/reward potential with a margin of safety supported by private market values.

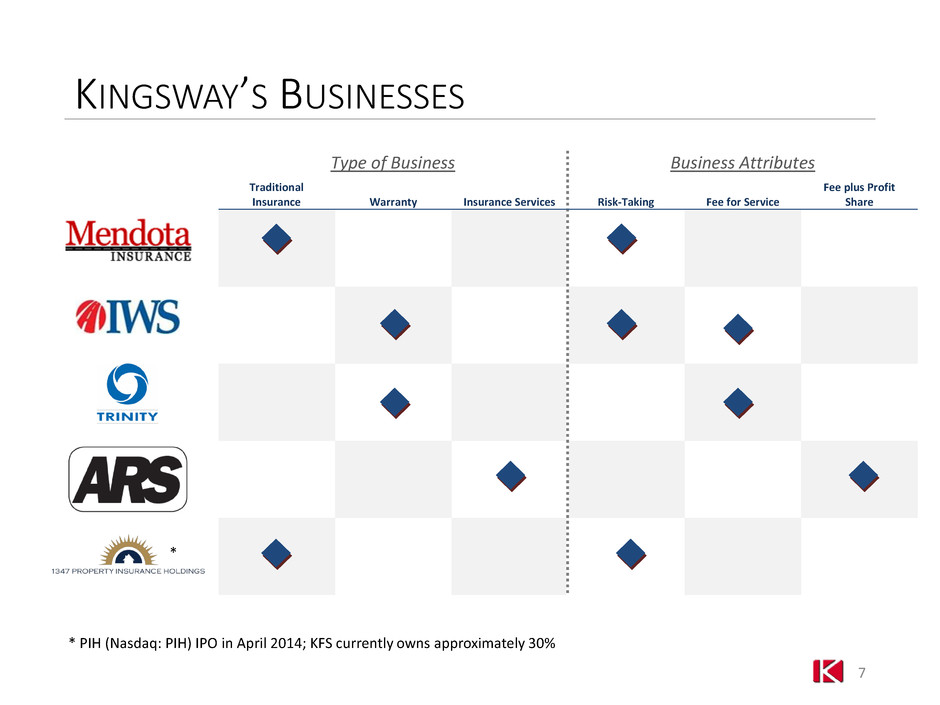

KINGSWAY’S BUSINESSES 7 Type of Business Business Attributes Traditional Insurance Warranty Insurance Services Risk-Taking Fee for Service Fee plus Profit Share * PIH (Nasdaq: PIH) IPO in April 2014; KFS currently owns approximately 30% *

INSURANCE UNDERWRITING – NSA BUSINESS 8 Mendota is a non-standard automobile (“NSA”) insurance carrier; current management has substantially repositioned the business relative to prior strategic direction Previous NSA View on Premium Kingsway wrote total NSA premium of $350 million in 33 states at its “peak” Established goals based on growth targets Today’s NSA View on Premium Focused solely on writing profitable premiums In first quarter 2014, Kingsway wrote total NSA premium of $32.7 million Aiming to achieve return on capital of 10%-15% over the long term

INSURANCE SERVICES IWS Acquisition Corporation (“IWS”) Kingsway acquired in November 2012 in a highly structured transaction for total consideration consisting of cash, future contingent payments and common equity in a newly formed entity Providing after-market vehicle protection services since 1991 Achieved 16% growth in number of contracts serviced in 2013 compared to 2012 Expect IWS will again grow number of contracts by double digits in 2014 Trinity Warranty Solutions (“TWS”) Kingsway acquired in May 2013 Provides warranty and dispatch services on heating, ventilation, air-conditioning (HVAC) equipment Assigned Risk Solutions (“ARS”) Combination of Northeast Alliance Insurance Agency and JBA & Associates Partners with Berkshire Hathaway’s National Liability & Fire Insurance Company Currently profitable, generates free cash flow and acceptable margin on revenue 9

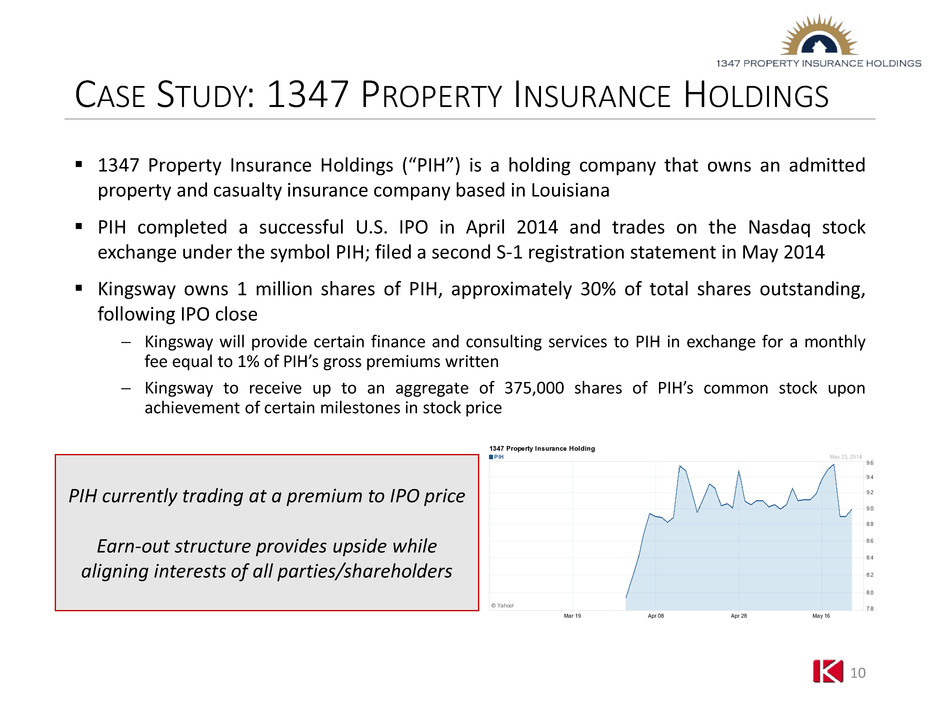

CASE STUDY: 1347 PROPERTY INSURANCE HOLDINGS 1347 Property Insurance Holdings (“PIH”) is a holding company that owns an admitted property and casualty insurance company based in Louisiana PIH completed a successful U.S. IPO in April 2014 and trades on the Nasdaq stock exchange under the symbol PIH; filed a second S-1 registration statement in May 2014 Kingsway owns 1 million shares of PIH, approximately 30% of total shares outstanding, following IPO close Kingsway will provide certain finance and consulting services to PIH in exchange for a monthly fee equal to 1% of PIH’s gross premiums written Kingsway to receive up to an aggregate of 375,000 shares of PIH’s common stock upon achievement of certain milestones in stock price 10 PIH currently trading at a premium to IPO price Earn-out structure provides upside while aligning interests of all parties/shareholders

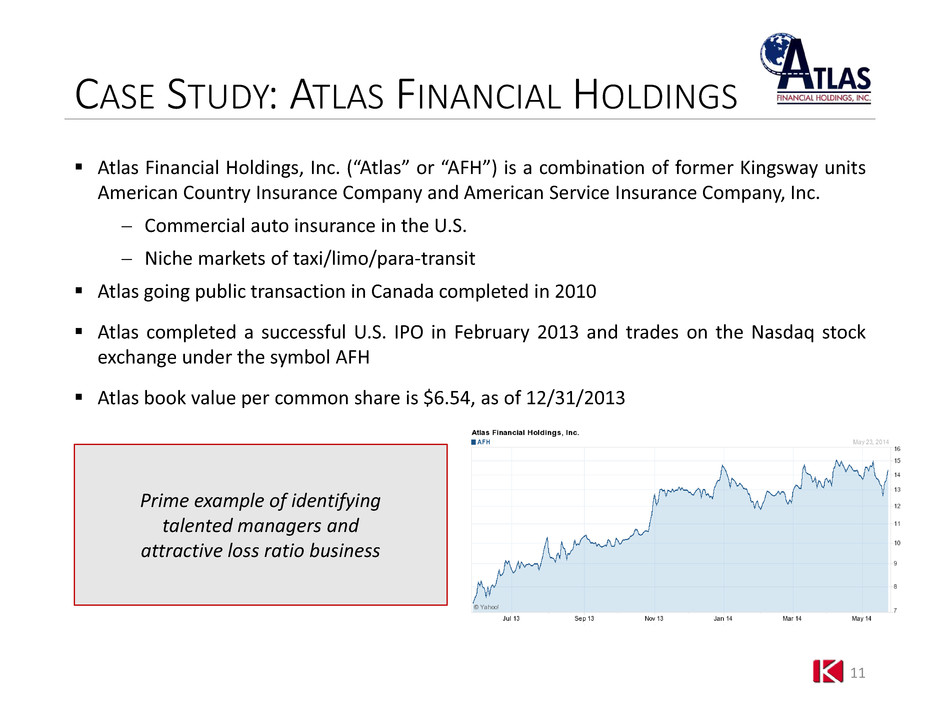

CASE STUDY: ATLAS FINANCIAL HOLDINGS Atlas Financial Holdings, Inc. (“Atlas” or “AFH”) is a combination of former Kingsway units American Country Insurance Company and American Service Insurance Company, Inc. Commercial auto insurance in the U.S. Niche markets of taxi/limo/para-transit Atlas going public transaction in Canada completed in 2010 Atlas completed a successful U.S. IPO in February 2013 and trades on the Nasdaq stock exchange under the symbol AFH Atlas book value per common share is $6.54, as of 12/31/2013 11 Prime example of identifying talented managers and attractive loss ratio business

1347 CAPITAL LLC Identifies and targets specialty insurance businesses and special situation investments for acquisition or financing with a goal of managing, improving, and growing to create value for Kingsway’s shareholders Principals of 1347 Capital LLC have been active in public and private markets using financial tools appropriate for each situation Sponsored insurance-focused public company stock offerings, including FMG Acquisition Corp., a special purpose acquisition company that merged with United Insurance to form United Insurance Holdings Corp (Nasdaq: UIHC) Held controlling interests in Risk Enterprise Management Limited and Avalon Risk Management Insurance Agency LLC Formation, reverse merger, and public stock offering of Atlas (Nasdaq: AFH) Founding and public stock offering of PIH (Nasdaq: PIH) In March 2014, Gordon G. Pratt (CEO of Fund Management Group) appointed Chairman of 1347 Capital LLC as Kingsway looks to accelerate merchant banking strategy In April 2014, formed 1347 Capital Corp, a special purpose acquisition company intended to enter into a business combination with one or more businesses or entities In May 2014, 1347 Capital Corp filed registration statement for an IPO 12

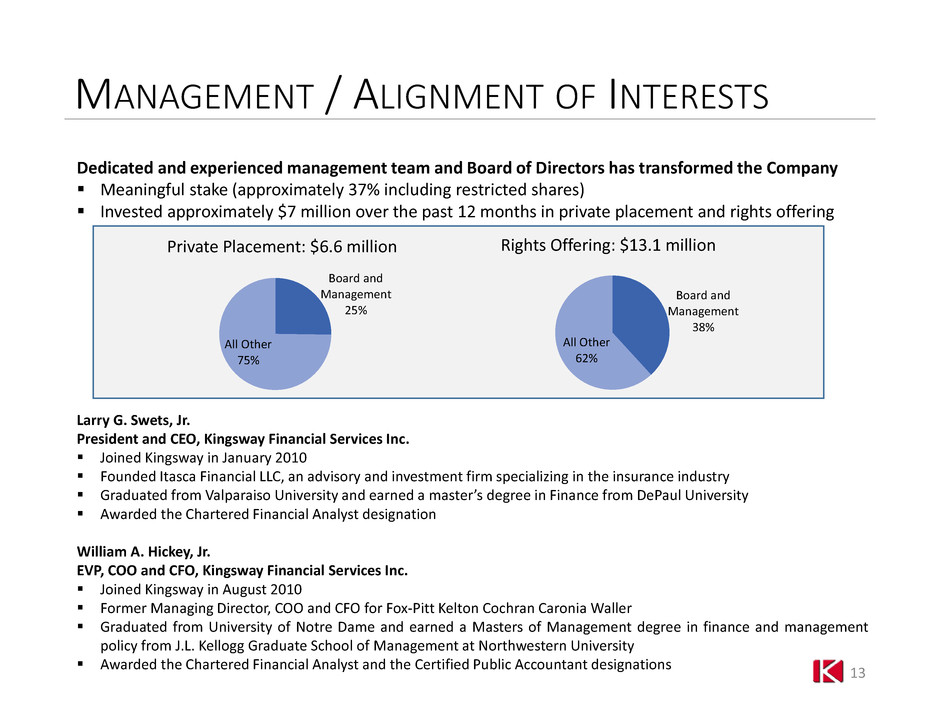

MANAGEMENT / ALIGNMENT OF INTERESTS Dedicated and experienced management team and Board of Directors has transformed the Company Meaningful stake (approximately 37% including restricted shares) Invested approximately $7 million over the past 12 months in private placement and rights offering Larry G. Swets, Jr. President and CEO, Kingsway Financial Services Inc. Joined Kingsway in January 2010 Founded Itasca Financial LLC, an advisory and investment firm specializing in the insurance industry Graduated from Valparaiso University and earned a master’s degree in Finance from DePaul University Awarded the Chartered Financial Analyst designation William A. Hickey, Jr. EVP, COO and CFO, Kingsway Financial Services Inc. Joined Kingsway in August 2010 Former Managing Director, COO and CFO for Fox-Pitt Kelton Cochran Caronia Waller Graduated from University of Notre Dame and earned a Masters of Management degree in finance and management policy from J.L. Kellogg Graduate School of Management at Northwestern University Awarded the Chartered Financial Analyst and the Certified Public Accountant designations 13 Board and Management 25% All Other 75% Private Placement: $6.6 million Board and Management 38% All Other 62% Rights Offering: $13.1 million

KEY TAKEAWAYS Kingsway provides an opportunity to invest in a diverse pool of insurance assets and insurance-related businesses led by experienced leadership team with a history of success Through our merchant bank platform, we have the opportunity to capitalize on changing markets through a variety of funding and investing vehicles Kingsway plans to leverage its relationships and assets to opportunistically seek new sources of revenue and earnings in order to return value to shareholders 14 Compounding Capital Long-Term Pursuing Asymmetric Risk / Reward Opportunities Aligned Management Structure

CONTACT US Investor Relations The Equity Group Carolyne Y. Sohn csohn@equityny.com Adam Prior aprior@equityny.com 15 KINGSWAY FINANCIAL SERVICES INC. INVESTOR PRESENTATION MAY 2014

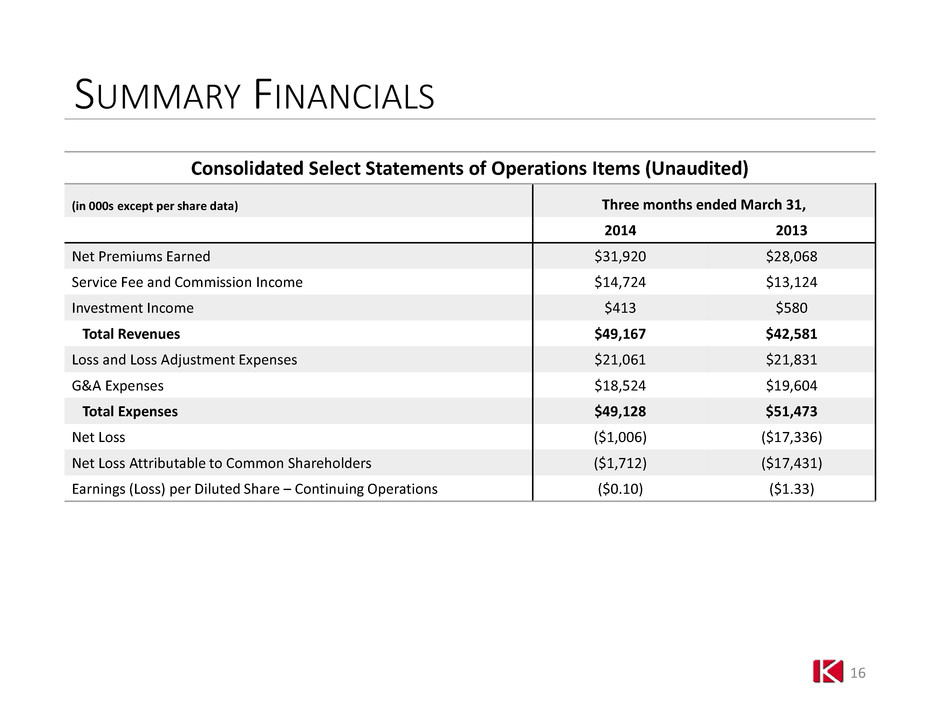

SUMMARY FINANCIALS Consolidated Select Statements of Operations Items (Unaudited) (in 000s except per share data) Three months ended March 31, 2014 2013 Net Premiums Earned $31,920 $28,068 Service Fee and Commission Income $14,724 $13,124 Investment Income $413 $580 Total Revenues $49,167 $42,581 Loss and Loss Adjustment Expenses $21,061 $21,831 G&A Expenses $18,524 $19,604 Total Expenses $49,128 $51,473 Net Loss ($1,006) ($17,336) Net Loss Attributable to Common Shareholders ($1,712) ($17,431) Earnings (Loss) per Diluted Share – Continuing Operations ($0.10) ($1.33) 16

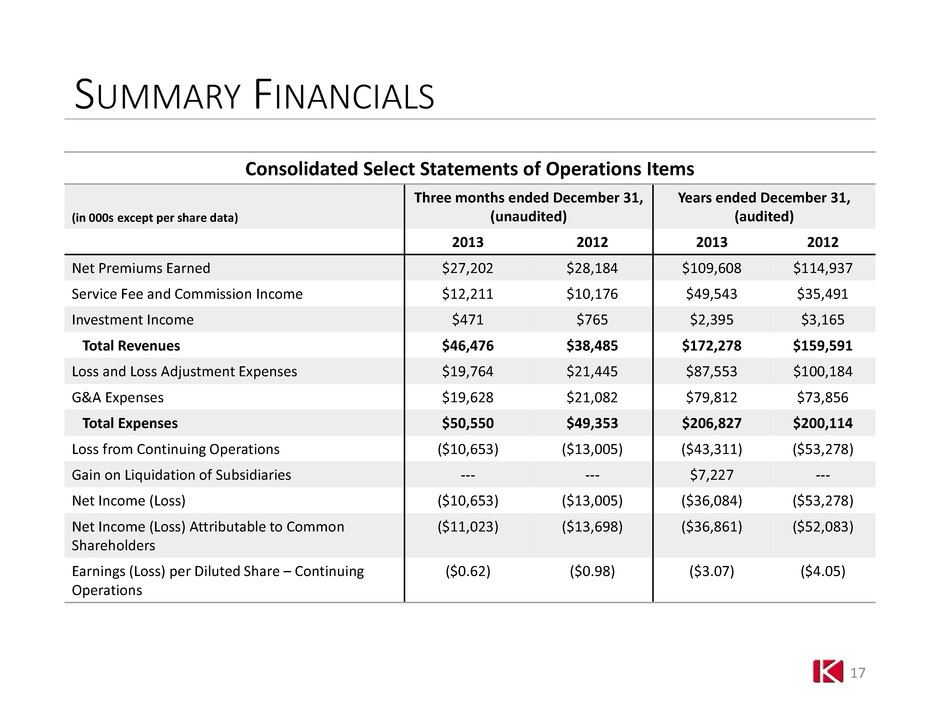

SUMMARY FINANCIALS Consolidated Select Statements of Operations Items (in 000s except per share data) Three months ended December 31, (unaudited) Years ended December 31, (audited) 2013 2012 2013 2012 Net Premiums Earned $27,202 $28,184 $109,608 $114,937 Service Fee and Commission Income $12,211 $10,176 $49,543 $35,491 Investment Income $471 $765 $2,395 $3,165 Total Revenues $46,476 $38,485 $172,278 $159,591 Loss and Loss Adjustment Expenses $19,764 $21,445 $87,553 $100,184 G&A Expenses $19,628 $21,082 $79,812 $73,856 Total Expenses $50,550 $49,353 $206,827 $200,114 Loss from Continuing Operations ($10,653) ($13,005) ($43,311) ($53,278) Gain on Liquidation of Subsidiaries --- --- $7,227 --- Net Income (Loss) ($10,653) ($13,005) ($36,084) ($53,278) Net Income (Loss) Attributable to Common Shareholders ($11,023) ($13,698) ($36,861) ($52,083) Earnings (Loss) per Diluted Share – Continuing Operations ($0.62) ($0.98) ($3.07) ($4.05) 17

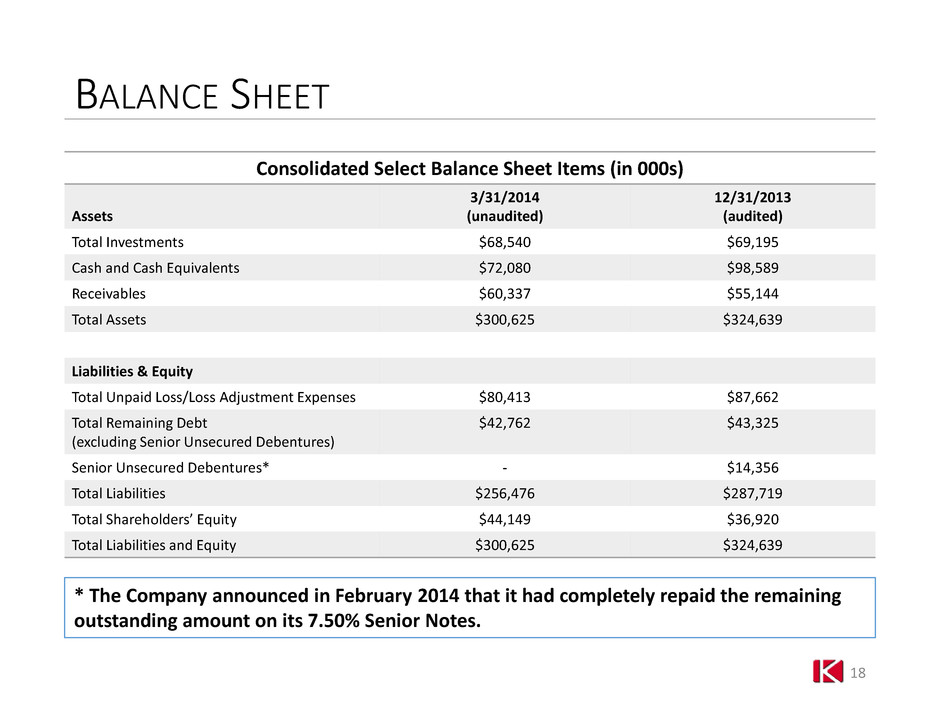

BALANCE SHEET Consolidated Select Balance Sheet Items (in 000s) Assets 3/31/2014 (unaudited) 12/31/2013 (audited) Total Investments $68,540 $69,195 Cash and Cash Equivalents $72,080 $98,589 Receivables $60,337 $55,144 Total Assets $300,625 $324,639 Liabilities & Equity Total Unpaid Loss/Loss Adjustment Expenses $80,413 $87,662 Total Remaining Debt (excluding Senior Unsecured Debentures) $42,762 $43,325 Senior Unsecured Debentures* - $14,356 Total Liabilities $256,476 $287,719 Total Shareholders’ Equity $44,149 $36,920 Total Liabilities and Equity $300,625 $324,639 18 * The Company announced in February 2014 that it had completely repaid the remaining outstanding amount on its 7.50% Senior Notes.

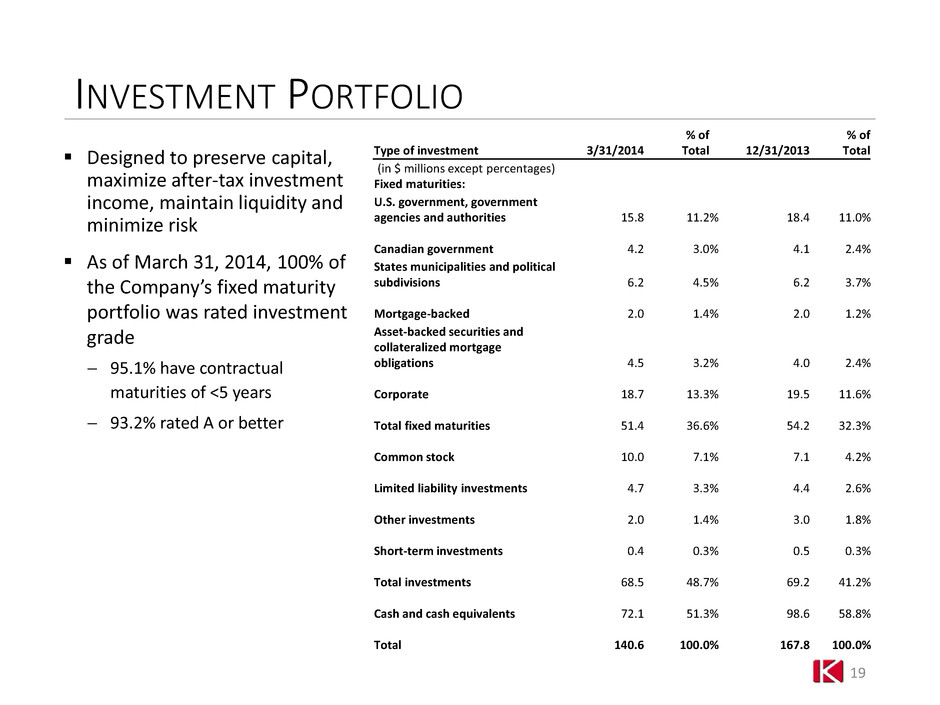

INVESTMENT PORTFOLIO Designed to preserve capital, maximize after-tax investment income, maintain liquidity and minimize risk As of March 31, 2014, 100% of the Company’s fixed maturity portfolio was rated investment grade 95.1% have contractual maturities of <5 years 93.2% rated A or better 19 Type of investment 3/31/2014 % of Total 12/31/2013 % of Total (in $ millions except percentages) Fixed maturities: U.S. government, government agencies and authorities 15.8 11.2 % 18.4 11.0 % Canadian government 4.2 3.0 % 4.1 2.4 % States municipalities and political subdivisions 6.2 4.5 % 6.2 3.7 % Mortgage-backed 2.0 1.4 % 2.0 1.2 % Asset-backed securities and collateralized mortgage obligations 4.5 3.2 % 4.0 2.4 % Corporate 18.7 13.3 % 19.5 11.6 % Total fixed maturities 51.4 36.6 % 54.2 32.3 % Common stock 10.0 7.1 % 7.1 4.2 % Limited liability investments 4.7 3.3 % 4.4 2.6 % Other investments 2.0 1.4 % 3.0 1.8 % Short-term investments 0.4 0.3 % 0.5 0.3 % Total investments 68.5 48.7 % 69.2 41.2 % Cash and cash equivalents 72.1 51.3 % 98.6 58.8 % Total 140.6 100.0 % 167.8 100.0 %