Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SmartStop Self Storage, Inc. | d733775d8k.htm |

2013 and First

Quarter 2014 Update 2013 and First Quarter 2014 Update

Strategic Storage Trust, Inc.

Exhibit 99.1 |

Disclaimer and

Risk Factors 2

Disclaimers

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS Certain

statements contained in this material, other than historical facts, may be considered forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities

Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”). We intend for all such forward looking statements to be covered by the applicable

safe harbor provisions for forward-looking statements contained in Section 27A of the

Securities Act and Section 21E of the Exchange Act, as applicable. Such statements

include, in particular, statements about our plans, strategies, and prospects and are subject to

certain risks and uncertainties, including known and unknown risks, which could cause actual

results to differ materially from those projected or anticipated. Therefore, such

statements are not intended to be a guarantee of our performance in future periods. Such

forward-looking statements can generally be identified by our use of forward-looking

terminology such as “may,” “will,” “expect,”

“intend,” “anticipate,” “estimate,” “believe,”

“continue,” or other similar words. Readers are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date this report is filed

with the Securities and Exchange Commission. We cannot guarantee the accuracy of any

such forward looking statements contained in this material, and we do not intend to

publicly update or revise any forward-looking statements, whether as a result of new

information, future events, or otherwise.

Any such forward-looking statements are subject to risks, uncertainties, and other factors

and are based on a number of assumptions involving judgments with respect to, among

other things, future economic, competitive, and market conditions, all of which are

difficult or impossible to predict accurately. To the extent that our assumptions differ from

actual results, our ability to meet such forward-looking statements, including our

ability to generate positive cash flow from operations and provide distributions to

stockholders, and our ability to find suitable investment properties, may be significantly

hindered. All forward-looking statements should be read in light of the risks

identified in our 2013 Annual Report on Form 10-K.

|

Disclaimer and

Risk Factors 3

Risk Factors

See our Form 10-K, and recent Form 10-Q for specific risks associated with an

investment in Strategic Storage Trust, Inc. As of March 31, 2014, our accumulated

deficit was approximately $70 million and we may have a net loss in 2014. No public

market currently exists for shares of our common stock. It may be difficult to sell your shares. If you sell your shares,

it will likely be at a substantial discount.

We have paid distributions from sources other than our cash flows from operations. We are not

prohibited from undertaking such activities by our charter, bylaws or investment

policies, and we may use an unlimited amount from any source to pay our distributions.

We also may be required to sell assets or issue new securities for cash in order to pay distributions. Any such

actions could reduce the amount of capital we ultimately invest in assets and negatively

impact the amount of income available for future distributions.

We have no employees and must depend on our advisor to select investments and conduct our

operations, and there is no guarantee that our advisor will devote adequate time or

resources to us. Our board of directors may change any of our investment objectives,

including our focus on self storage facilities. We

will

pay

substantial

fees

and

expenses

to

our

advisor

and

its

affiliates

which

will

reduce

cash

available

for

investment

and

distribution.

There are substantial conflicts of interest among us and our sponsor, advisor and property

manager. We

may

fail

to

remain

qualified

as

a

REIT,

which

could

adversely

affect

our

operations

and

our

ability

to

make

distributions.

We may incur substantial debt, which could hinder our ability to

pay distributions to our stockholders or could decrease the

value of your investment.

Future distribution declarations are at the sole discretion of our board of directors and are

not guaranteed. Since our inception, our cumulative distributions have exceeded

cumulative GAAP earnings. We cannot assure you that we will achieve any of our

investment objectives.

We encourage you to review our SEC filings at www.sec.gov.

|

Agenda

4

•

Overview

•

Performance Highlights

•

Acquisitions

•

Development/Lease-up Performance

•

Toronto, Canada Solar Installations

•

Self Storage Industry Update |

Overview

•

First publicly registered non-traded REIT

focused on self storage

•

Sponsor was ranked 7th in Mini-Storage

Messenger’s Top Operators List in 2013

•

As of 3/31/14, SSTI owned 125 properties in

17 states and Ontario, Canada with

approximately 80,000 units and 10.4 million

rentable square feet

5 |

Overview

6

*As of April 5, 2014

Owned Properties by Quarter |

Overview

7

Square Footage by State (as of 3/31/2014)

•

125 properties

•

17 states, 1 province

•

80,000 units

•

10.4 million SF

8.9%

2.8%

6.2%

13.8%

2.1%

2.1%

3.8%

4.0%

4.0%

16.4%

9.6%

2.0%

4.0%

2.8%

0.8%

4.0%

8.4%

4.3% |

Self Storage

Footprint 8

Population

26,059,203

Population

75,232,171

Population

6,054,191

Population

47,353,616

This map depicts the locations of our primary target markets, although we may acquire

properties elsewhere. Population

39,135,452 |

Agenda

•

Overview

•

Performance Highlights

•

Acquisitions

•

Development/Lease-up Performance

•

Toronto, Canada Solar Installations

•

Self Storage Industry Update

9 |

Performance

Highlights – Fourth Quarter 2013

10

Cash Flow from Operations

•

$3.1 Million for Three Months Ended 12/31/2012

•

$5.2 Million for Three Months Ended 12/31/2013

67%

•

$9.6 Million for Twelve Months Ended 12/31/2012

•

$19.3 Million for Twelve Months Ended 12/31/2013

102%

IPA Modified Funds from Operations

•

$4.2 Million

for Three Months Ended 12/31/2012

•

$5.6 Million for Three Months Ended 12/31/2013

33%

•

$9.0 Million for Twelve Months Ended 12/31/2012

•

$20.6 Million for Twelve Months Ended 12/31/2013

129% |

Performance

Highlights – Fourth Quarter 2013

11

Fourth Quarter 2013 vs. 2012

•

Revenues

8.6%

•

Net Operating Income

13.9%

2013

2012

•

Property Operating Expenses as a Percentage of

Revenue

37.9%

40.8%

•

Number of Facilities

101

101

Same Store Performance |

Performance

Highlights 12

Prior Year Occ Sq Ft (%)

76.4%

76.1%

78.3%

78.4%

77.4%

73.3%

79.0%

80.4%

79.3%

80.6%

Current Year Occ Sq Ft (%)

77.2%

77.1%

82.6%

82.3%

82.0%

81.6%

84.6%

84.5%

83.0%

84.5%

No. of Properties

41

45

60

71

76

89

89

90

100

108

Q4-11

Q1-12

Q2-12

Q3-12

Q4-12

Q1-13

Q2-13

Q3-13

Q4-13

Q1-14

70.0%

72.0%

74.0%

76.0%

78.0%

80.0%

82.0%

84.0%

86.0%

88.0%

(1,200)

800

2,800

4,800

6,800

8,800

Same Store Occupancy

Q4-2011 to Q1-2014

Move Ins

Move Outs

Net

Current Year Occ Sq Ft (%)

* Does not include Canadian properties, but does include consolidated joint venture, SF

property. |

Performance

Highlights

–

First

Quarter

2014

13

Cash Flow from Operations

•

$4.0 Million for Three Months Ended 3/31/2013

•

$6.3 Million for Three Months Ended 3/31/2014

57%

IPA Modified Funds from Operations

•

$4.6 Million

for Three Months Ended 3/31/2013

•

$6.3 Million for Three Months Ended 3/31/2014

35% |

Performance

Highlights

–

First

Quarter

2014

14

First Quarter 2014 vs. 2013

•

Revenues

7.6%

•

Net Operating Income

8.1%

2014

2013

•

Property Operating Expenses as a Percentage of

Revenue

39.4%

39.7%

•

Number of Facilities

109

109

Same Store Performance |

NOI and MFFO

Definition 15

Net

Operating

Income

(“NOI”)

•

Funds

from

Operations

(“FFO”)

and

Modified

Funds

from

Operations

(“MFFO”)

•

•

NOI is a non-GAAP measure that we define as net income (loss), computed in accordance

with GAAP, generated from properties before corporate general and administrative

expenses, asset management fees, interest expense, depreciation, amortization,

acquisition expenses and other non-property related expenses. We believe that net

operating income is useful for investors as it provides a measure of the operating

performance of our operating assets because net operating income excludes certain items

that are not associated with the operation of the properties. Additionally, we believe

that NOI is a widely accepted measure of comparative operating performance in the real

estate community. However, our use of the term NOI may not be comparable to that of

other real estate companies as they may have different methodologies for computing this amount.

Due to certain unique operating characteristics of real estate companies, the National

Association of Real Estate Investment Trusts, or NAREIT, an industry trade group, has

promulgated a measure known as funds from operations, or FFO, which we believe to be

an appropriate supplemental measure to reflect the operating performance of a REIT. The

use of FFO is recommended by the REIT industry as a supplemental performance measure.

FFO is not equivalent to our net income (loss) as determined under GAAP.

We define FFO, a non-GAAP measure, consistent with the standards established by the White

Paper on FFO approved by the Board of Governors of NAREIT, as revised in

February 2004, or the White Paper. The White Paper defines FFO as net income

(loss) computed in accordance with GAAP, excluding gains or losses from sales of property and

asset impairment writedowns, plus depreciation and amortization, and after adjustments

for unconsolidated partnerships and joint ventures. Adjustments for unconsolidated

partnerships and joint ventures are calculated to reflect FFO on the same basis. Our

FFO calculation complies with NAREIT’s policy described above.

|

NOI and MFFO

Definition – Con’t

16

•

The historical accounting convention used for real estate assets requires straight-line

depreciation of buildings and improvements, which implies that the value of real estate

assets diminishes predictably over time. Diminution in value may occur if such assets

are not adequately maintained or repaired and renovated as required by relevant circumstances or other

measures necessary to maintain the assets are not undertaken. However, we believe that, since

real estate values historically rise and fall with market conditions, including

inflation, interest rates, the business cycle, unemployment and consumer spending,

presentations of operating results for a REIT using historical accounting for depreciation may be less informative. In

addition, in the determination of FFO, we believe it is appropriate to disregard impairment

charges, as this is a fair value adjustment that is largely based on market

fluctuations and assessments regarding general market conditions which can change over

time. An asset will only be evaluated for impairment if certain impairment indications exist and if the carrying

value, or book value, exceeds the total estimated undiscounted future cash flows (including

net rental revenues, net proceeds on the sale of the property, and any other ancillary

cash flows at a property or group level under GAAP) from such asset. Testing for

impairment is a continuous process and is analyzed on a quarterly basis. Investors should note, however, that

determinations of whether impairment charges have been incurred are based partly on

anticipated operating performance, because estimated undiscounted future cash flows

from a property, including estimated future net rental revenues, net proceeds on the

sale of the property, and certain other ancillary cash flows, are taken into account in determining whether an

impairment charge has been incurred. While impairment charges are excluded from the

calculation of FFO as described above, investors are cautioned that due to the fact

that impairments are based on estimated future undiscounted cash flows and that we

intend to have a relatively limited term of our operations, it could be difficult to recover any impairment charges

through the eventual sale of the property. To date, we have not recognized any impairments. •

Historical accounting for real estate involves the use of GAAP. Any other method of accounting

for real estate such as the fair value method cannot be construed to be any more

accurate or relevant than the comparable methodologies of real estate valuation found

in GAAP. Nevertheless, we believe that the use of FFO, which excludes the impact of real estate related

depreciation and amortization and impairments, assists in providing a more complete

understanding of our performance to investors and to our management, and when compared

year over year, reflects the impact on our operations from trends in occupancy rates,

rental rates, operating costs, general and administrative expenses, and interest costs, which may not be

immediately apparent from net income (loss). |

NOI and MFFO

Definition – Con’t

17

•

However, FFO or Modified FFO (“MFFO”), discussed below, should not be construed to

be more relevant or accurate than

the current GAAP methodology in calculating net income (loss) or

in its applicability in evaluating our operating

performance. The method utilized to evaluate the value and performance of real estate under

GAAP should be considered a more relevant measure of operational performance and is,

therefore, given more prominence than the non-GAAP FFO and MFFO measures and the

adjustments to GAAP in calculating FFO and MFFO.

•

Changes in the accounting and reporting rules under GAAP that were put into effect and other

changes to GAAP accounting for real estate subsequent to the establishment of

NAREIT’s definition of FFO have prompted an increase in cash-settled

expenses, specifically acquisition fees and expenses, as items that are expensed as operating

expenses under GAAP. We believe these fees and expenses do not affect our overall

long-term operating performance. Publicly registered, non-traded REITs

typically have a significant amount of acquisition activity and are substantially more dynamic during their initial years

of investment and operation. The purchase of properties, and the

corresponding expenses associated with that process, is a

key feature of our business plan in order to generate operational income and cash flow in

order to make distributions to investors. While other start-up entities may also

experience significant acquisition activity during their initial years, we

believe that publicly registered, non-traded REITs are unique in that they typically have

a limited life with targeted exit strategies within a relatively limited time frame

after the acquisition activity ceases. Our board of directors is in the process of

determining which liquidity event, if any, is in the best interests of us and our stockholders (i.e., listing of our shares of

common stock on a national securities exchange, a merger or sale, the sale of all or

substantially all of our assets, or another similar transaction). We expect to achieve

a liquidity event within three years, which is generally comparable to other publicly

registered, non-traded REITs. Thus, we do not intend to continuously purchase assets and intend to have a limited

life. The decision whether to engage in any liquidity event is in the sole discretion of our

board of directors. Due to the above factors and other unique features of publicly

registered, non-traded REITs, the Investment Program Association, or the IPA, an

industry trade group, has standardized a measure known as modified funds from operations, or MFFO, which

the IPA has recommended as a supplemental measure for publicly registered, non-traded

REITs and which we believe to be another appropriate supplemental measure to reflect

the operating performance of a publicly registered, non-traded REIT |

NOI and MFFO

Definition – Con’t

18

having the characteristics described above. MFFO is not equivalent to our net income (loss) as

determined under GAAP, and MFFO may not be a useful measure of the impact of

long-term operating performance on value if we do not ultimately engage in a

liquidity event. We believe that, because MFFO excludes acquisition fees and expenses that affect our operations only in

periods in which properties are acquired and that we consider more reflective of investing

activities, as well as other non- operating items included in FFO, MFFO can provide,

on a going-forward basis, an indication of the sustainability (that is, the capacity

to continue to be maintained) of our operating performance after the period in which we are acquiring our properties

and once our portfolio is in place. By providing MFFO, we believe we are presenting useful

information that assists investors and analysts to better assess the sustainability of

our operating performance now that our offering has been completed. We also believe

that MFFO is a recognized measure of sustainable operating performance by the publicly registered, non-traded

REIT industry. Further, we believe MFFO is useful in comparing the sustainability of our

operating performance now that our offering has been completed and we expect our

acquisition activity over the near term to be less vigorous, with the

sustainability

of

the

operating

performance

of

other

real

estate

companies

that

are

not

as

involved

in

acquisition

activities.

Investors are cautioned that MFFO should only be used to assess the sustainability of our

operating performance now that our offering has been completed and we expect our

acquisition activity over the near term to be less vigorous, as it excludes acquisition

fees and expenses that have a negative effect on our operating performance during the

periods in which properties are acquired.

•

We define MFFO, a non-GAAP measure, consistent with the IPA’s Guideline 2010-01,

Supplemental Performance Measure for Publicly Registered, Non-Listed REITs:

Modified Funds from Operations (the “Practice Guideline”) issued by the IPA in

November 2010. The Practice Guideline defines MFFO as FFO further adjusted for the following

items included in the determination of GAAP net income (loss): acquisition fees and

expenses; amounts relating to straight line rents and amortization of above or below

intangible lease assets and liabilities; accretion of discounts and amortization of premiums on

debt investments; non-recurring impairments of real estate related investments;

mark-to-market adjustments included in net income; non-recurring gains or

losses included in net income from the extinguishment or sale of debt, hedges |

NOI and MFFO

Definition – Con’t

19

foreign exchange, derivatives or securities holdings where trading of such holdings is not a

fundamental attribute of the business plan, unrealized gains or losses resulting from

consolidation from, or deconsolidation to, equity accounting, and after adjustments for

consolidated and unconsolidated partnerships and joint ventures, with such adjustments

calculated to reflect MFFO on the same basis. The accretion of discounts and

amortization of premiums on debt investments, unrealized gains and losses on hedges,

foreign exchange, derivatives or securities holdings, unrealized gains and losses resulting from

consolidations, as well as other listed cash flow adjustments are adjustments made to net

income (loss) in calculating cash flows from operations and, in some cases, reflect

gains or losses which are unrealized and may not ultimately be realized. Our MFFO

calculation complies with the IPA’s Practice Guideline described above. In calculating MFFO, we exclude acquisition

related expenses, the amortization of fair value adjustments related to debt, realized and

unrealized gains and losses on foreign exchange holdings and the adjustments of such

items related to noncontrolling interests. The other adjustments included in the

IPA’s Practice Guideline are not applicable to us for the periods presented. Acquisition

fees and expenses are paid in cash by us, and we have not set aside or put into escrow

any specific amount of proceeds from our offering to be used to fund acquisition

fees and expenses. Acquisition fees and expenses include payments to our Advisor and third

parties. Acquisition related expenses under GAAP are considered operating expenses and

as expenses included in the determination of net income (loss) and income (loss) from

continuing operations, both of which are performance measures under GAAP. All paid and accrued

acquisition fees and expenses will have negative effects on returns to investors, the

potential for future distributions, and cash flows generated by us, unless earnings

from operations or net sales proceeds from the disposition of other properties are

generated to cover the purchase price of the property, these fees and expenses and other costs

related to such property. In the future, if we are not able to raise additional

proceeds from our distribution reinvestment plan offering or other potential

offerings, this could result in us paying acquisition fees or reimbursing acquisition expenses

due to our Advisor, or a portion thereof, with net proceeds from borrowed funds,

operational earnings or cash flows, net proceeds from the sale of properties, or

ancillary cash flows. As a result, the amount of proceeds available for investment and operations would be reduced, or we

may incur additional interest expense as a result of borrowed funds

|

NOI and MFFO

Definition – Con’t

20

•

Further, under GAAP, certain contemplated non-cash fair value and other non-cash

adjustments are considered operating non-cash adjustments to net income (loss) in

determining cash flows from operations. In addition, we view fair value adjustments of

derivatives and the amortization of fair value adjustments related to debt as items which are unrealized

and may not ultimately be realized or as items which are not reflective of on-going

operations and are therefore typically adjusted for when assessing operating

performance. We use MFFO and the adjustments used to calculate it in order to evaluate our performance

against other publicly registered, non-traded REITs which intend to have limited

lives with short and defined acquisition periods and targeted exit strategies shortly

thereafter. As noted above, MFFO may not be a useful measure of the impact of long-term operating

performance if we do not continue to operate in this manner. We believe that our use of MFFO

and the adjustments used to calculate it allow us to present our performance in a

manner that reflects certain characteristics that are unique to publicly registered,

non-traded REITs, such as their limited life, limited and defined acquisition period and targeted exit

strategy, and hence that the use of such measures may be useful to investors. For example,

acquisition fees and expenses were intended to be funded from the proceeds of our

offering and other financing sources and not from operations. By excluding expensed

acquisition fees and expenses, the use of MFFO provides information consistent with management’s

analysis of the operating performance of the properties. Additionally, fair value

adjustments, which are based on the impact of current market fluctuations and

underlying assessments of general market conditions, but can also result from

operational factors such as rental and occupancy rates, may not be directly related or

attributable to our current operating performance. By excluding such charges that may

reflect anticipated and unrealized gains or losses, we believe MFFO provides useful

supplemental information.

• |

NOI and MFFO

Definition – Con’t

21

•

Presentation of this information is intended to provide useful information to investors as

they compare the operating performance of different REITs, although it should be noted

that not all REITs calculate FFO and MFFO the same way, so comparisons with other REITs

may not be meaningful. Furthermore, FFO and MFFO are not necessarily indicative of cash

flow available to fund cash needs and should not be considered as an alternative to net income

(loss) or income (loss) from continuing operations as an indication of our performance,

as an alternative to cash flows from operations, which is an indication of our

liquidity, or indicative of funds available to fund our cash needs including our ability to make

distributions to our stockholders. FFO and MFFO should be reviewed in conjunction with other

measurements as an indication of our performance. MFFO may be useful in assisting

management and investors in assessing the sustainability of operating performance in

future operating periods, and in particular, after the offering and acquisition stages are

complete and net asset value is disclosed. FFO and MFFO are not useful measures in evaluating

net asset value because impairments are taken into account in determining net asset

value but not in determining FFO and MFFO.

|

Agenda

22

•

Overview

•

Performance Highlights

•

Acquisitions

•

Development/Lease-up Performance

•

Toronto, Canada Solar Installations

•

Self Storage Industry Update |

Acquisitions

– First Quarter 2014

23

Chandler, Arizona

•

•

•

San Francisco, California*

•

•

•

Hampton, Virginia

•

•

•

*SSTI owns 98% of the San Francisco property

Centennial, Toronto (Development)

•

•

•

Land Parcel

480 units

51,000 NRSF

93.6% Occupancy

1,100 units

76,200 NRSF

86.4% Occupancy

500 units

71,500 NRSF

90.4% Occupancy

2.5 Acres

870 units (est. upon completion)

78,000 NRSF (est. upon completion) |

Agenda

24

•

Strategic Storage Trust, Inc. Overview

•

Performance Highlights

•

Acquisitions

•

Development/Lease-up Performance

•

Toronto, Canada Solar Installations

•

Self Storage Industry Update |

Development/Lease-up

25

Located at 600 Granite Ct,

Pickering,

Ontario, Canada

Phase 1 and phase 2 will have

approximately

890

units

and

approximately

91,000 net

rentable Sq. Ft.

All units will be 100% climate controlled

Phase 1 estimated completion in First

quarter 2015 (60,000 Sq. Ft)

Phase 2 estimated completion

early

Fourth

quarter 2015 (31,000 Sq. Ft.)

Phase 1 construction is expected to start in

Third quarter 2014

Granite Development |

Development/Lease-up

26

Occ

SqFt (%)

51.00%

61.00%

67.10%

69.00%

74.60%

80.70%

83.50%

80.80%

82.10% |

Development/Lease-up

27

No. of Properties

8

16

16

16

16

16

16

Occ Sq Ft (%)

63.00%

73.80%

77.40%

83.50%

84.30%

82.09%

83.90%

Q3-2012

Q4-2012

Q1-2013

Q2-2013

Q3-2013

Q4-2013

Q1-2014

55.00%

60.00%

65.00%

70.00%

75.00%

80.00%

85.00%

90.00%

(250)

250

750

1,250

1,750

2,250

Former Stockade Portfolio Occupancy %

Q3-2012 to Q1-2014

Move Ins

Move Outs

Net

Occ Sq Ft (%)

Note:

At

acquisition,

occupancy

for

this

portfolio

was:

71.3%

for

combined

16

stores |

Development/Lease-up

28

Occ Sq Ft (%)

10.90%

46.40%

48.20%

34.10%

41.30%

51.90%

58.20%

63.80%

75.10%

Q1-2012

Q2-2012

Q3-2012

Q4-2012

Q1-2013

Q2-2013

Q3-2013

Q4-2013

Q1-2014

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

70.00%

80.00%

$-

$50,000

$100,000

$150,000

$200,000

$250,000

Mavis Rental Income & Occupancy

Q1-2012 to Q1-2014

Note: Rental Income is rounded to the nearest thousand. Mavis Occ Sq Ft (%) includes

developmental stages of construction; building conversion was completed in Dec-11 and phases of

new construction began in Mar-12 and were completed in Dec-12. Sep-12 included the

addition of 123 new units or 16,329 net rentable sq. ft. Final additions were made in Dec-12 with

another 262 new units or 35,297 net rentable sq. ft. added.

|

Development/Lease-up

29

Occ Sq Ft (%)

4.7%

13.2%

17.7%

22.2%

24.4%

28.1%

33.8%

37.9%

43.6%

Brampton Rental Income & Occupancy

August 2013 to

April 2014

$-

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

40.0%

45.0%

50.0%

Aug-13

Sep-13

Oct-13

Nov-13

Dec-13

Jan-14

Feb-14

Mar-14

Apr-14

Rental Income

Occ Sq Ft % |

SmartStop.com

– Enhanced Technology Based Marketing

30 |

Agenda

31

•

Overview

•

Performance Highlights

•

Acquisitions

•

Development/Lease-up Performance

•

Toronto, Canada Solar Installations

•

Self Storage Industry Update |

Toronto Solar

Installations 32

Site Name

Solar system

size in AC KW

Estimated final

cost of system

Estimated date of

power production

Mavis

250

$1.0 Million

July 2014

Brampton

250

$1.1 Million

July 2014

Dufferin

250

$1.1 Million

August 2014

Mavis

Brampton

Dufferin |

33

Self Storage Industry Update |

Self Storage

Industry Update 34

•

The Fastest Growing Segment of the

Commercial Real Estate Industry Over

the Last 35 Years

(1)

•

Unique in its Ability to Add Value as an

Operating Business

•

Low Capital Expenditure Requirements

•

No Tenant Improvements or No Leasing

Commissions

(2)

Total Self Storage Rentable Space in the US is now 2.3 Billion Square Feet

(1)

Self Storage Association “Industry Fact Sheet”

(11/13)

(2)

We do not pay commissions in connection with the leasing of our self storage units; however,

we pay certain fees associated with the day-to-day management and operations of

our self storage facilities. Percentage of Self Storage Facilities

(1)

Largest Self

Storage Company

Top 50

Companies

4.4%

15%

Single Facility

Owners

60%

85%

Smaller

Owners |

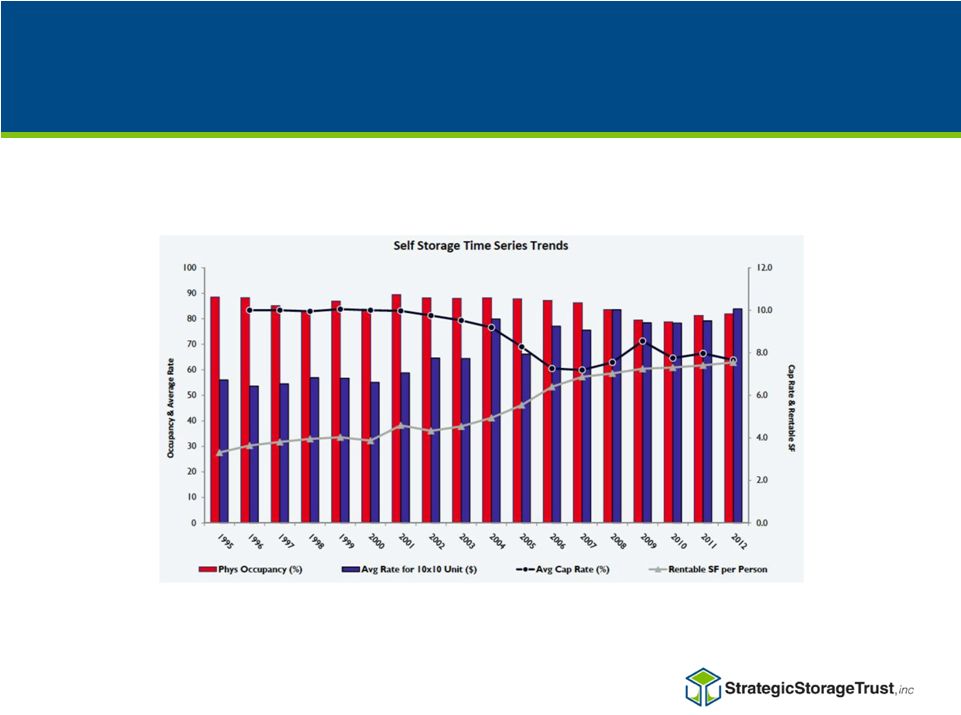

Self Storage

Industry Update 35

Source: Cushman & Wakefield Presentation –

Self Storage: the State of the Industry –

May 2013

Market Trends |

Self Storage

Industry Update 36

Source:

Wells

Fargo

Securities,

LLC,

and

Intex

Solutions,

Inc. -

2013

Mortgage Default History |

|