Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CrossAmerica Partners LP | d729656d8k.htm |

Exhibit 99.1 |

2

Forward Looking and Cautionary Statements

This

presentation

and

oral

statements

made

regarding

the

subjects

of

this

presentation

may

contain

forward-looking

statements

which

may

include,

but

are

not

limited

to,

statements

regarding

our

plans,

objectives,

expectations

and

intentions

and

other

statements

that

are

not

historical

facts,

including

statements

identified

by

words

such

as

"outlook,"

"intends,"

"plans,"

"estimates,"

"believes,"

"expects,"

"potential,"

"continues,"

"may,"

"will,"

"should,"

"seeks,"

"approximately,"

"predicts,"

"anticipates,"

"foresees,"

or

the

negative

version

of

these

words

or

other

comparable

expressions.

All

statements

addressing

operating

performance,

events,

or

developments

that

the

Partnership

expects

or

anticipates

will

occur

in

the

future,

including

statements

relating

to

revenue

growth

and

earnings

or

earnings

per

unit

growth,

as

well

as

statements

expressing

optimism

or

pessimism

about

future

operating

results,

are

forward-looking

statements.

The

forward-looking

statements

are

based

upon

our

current

views

and

assumptions

regarding

future

events

and

operating

performance

and

are

inherently

subject

to

significant

business,

economic

and

competitive

uncertainties

and

contingencies

and

changes

in

circumstances,

many

of

which

are

beyond

our

control.

The

statements

in

this

presentation

are

made

as

of

the

date

of

this

presentation,

even

if

subsequently

made

available

by

us

on

our

website

or

otherwise.

We

do

not

undertake

any

obligation

to

update

or

revise

these

statements

to

reflect

events

or

circumstances

occurring

after

the

date

of

this

presentation.

Although

the

Partnership

does

not

make

forward-looking

statements

unless

it

believes

it

has

a

reasonable

basis

for

doing

so,

the

Partnership

cannot

guarantee

their

accuracy.

Achieving

the

results

described

in

these

statements

involves

a

number

of

risks,

uncertainties

and

other

factors

that

could

cause

actual

results

to

differ

materially,

including

the

factors

discussed

in

this

presentation

and

those

described

in

the

“Risk

Factors”

section

of

the

Partnership’s

Form

10-K

filed

on

March

10,

2014,

with

the

Securities

and

Exchange

Commission

as

well

as

in

the

Partnership’s

other

filings

with

the

Securities

and

Exchange

Commission.

No

undue

reliance

should

be

placed

on

any

forward-looking

statements. |

3

•

Lehigh Gas Partners LP (“LGP”

or “Lehigh Gas”) is a

leading wholesale distributor of motor fuels and owner

and lessee of real estate related to retail fuel distribution.

Its Predecessor was founded in 1992

Focused on distributing fuels to and owning and

leasing sites primarily located in metropolitan and

urban areas

•

Completed a $138 million Initial Public Offering on

October 30, 2012

and a $91.4 million follow-on offering

in December 2013.

(1)

•

Equity market capitalization of $504.5 million and

enterprise value of $754.2 million as of 3/31/14

•

As of 3/31/2014, distribute to over 1,100 locations

primarily in the Northeastern United States, Florida,

Tennessee, Virginia and Ohio

(2)

259 sites owned or leased and operated by

Lehigh-Gas Ohio, LLC

;

85 sites owned or leased

and operated by the Partnership; 238 sites

operated by lessee dealers; 55 commission

sites

(2)

Also distribute to 389 independent dealer sites

and through 13 sub-wholesalers

(2)

•

Distributed 637.8 million gallons of motor fuel in 2013

Lehigh Gas Overview

Top 10

Distributor for

(3)

:

(1)

$138 million Includes $18 million exercise of over-allotment; $91.4 million of

net proceeds. (2)

As of March 31, 2014, pro forma for PMI acquisition.

(3)

Based on 2013 volume. |

4

Investment Highlights

•

Stable Cash Flows from Rental Income

and Wholesale Fuel Distribution

•

Established History of Completing and

Integrating Acquisitions

•

Long-Term Relationships with Major

Integrated Oil Companies and Refiners

•

Prime Real Estate Locations in Areas

with High Traffic

•

Financial Flexibility to Pursue

Acquisitions and Expansion

Opportunities

•

Aligned Equity Ownership

BP Station

Union Centre Blvd., West Chester, OH

(Metro Cincinnati) |

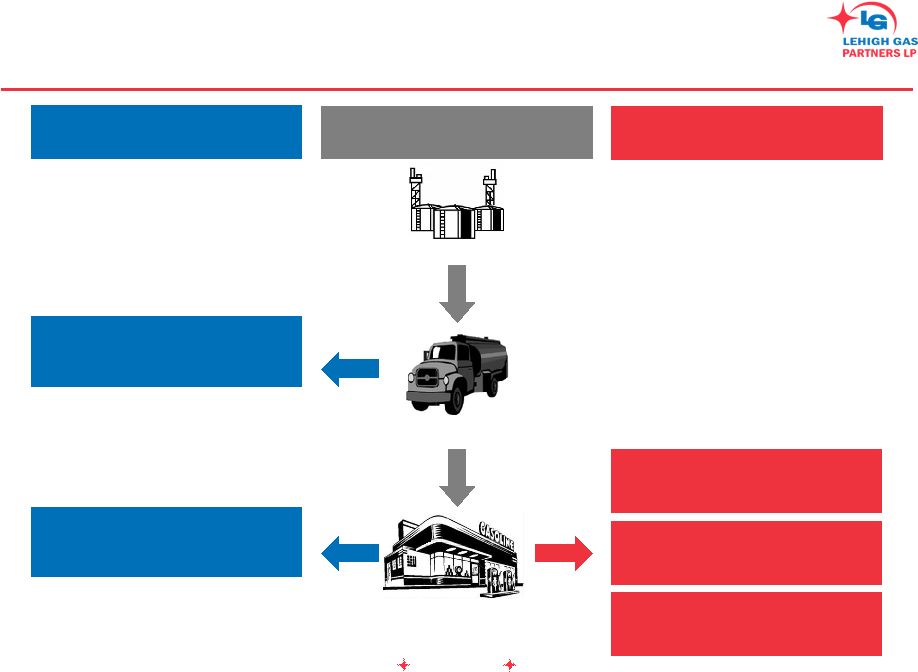

5

Lehigh Gas Operations

Industry Value Chain

Pipeline / Storage

Non-Qualifying MLP Income

Retail Fuel Distribution

(LGWS)

Gasoline Station

Wholesale Distributor

Qualifying MLP Income

Wholesale Distribution

(LGW)

Rental Income from Real

Estate

(LGPR)

•

Stable cash flow

•

Margin per gallon

•

Limited commodity exposure

•

Multi-year contracts

•

Stable cash flow

•

Prime locations

•

Multi-year contracts

Inside Store Sales

(LGWS)

Rental Income from

Equipment

(LGWS) |

6

Lehigh Gas Portfolio Overview

)

Sites Where Lehigh Gas Partners LP

Supplies Wholesale Motor Fuels as of

March 31, 2014

(1)

(1)

Pro forma for PMI acquisition |

7

•

Own or lease sites in prime

locations and seek to enhance

cash flow

•

Expand within and beyond core

geographic markets through

acquisitions

•

Increase motor fuel distribution

business by expanding

market share

•

Maintain strong relationships

with major integrated oil

companies and refiners

•

Serve as a preferred distributor

and dedicated supplier

•

Manage risk and mitigate

exposure

to environmental

liabilities

Shell Station

Route 17, Hasbrouck Heights, NJ

Lehigh Gas Strategy |

8

Wholesale Distribution

Wholesale Distribution

Lehigh Gas Operating Model

(1)

Lehigh Gas –

Ohio, LLC (“LGO”).

Rental Income

Motor Fuels

Independent

Transportation

Contractors

Independent

Dealer

Lessee

Dealer

LGO

(1)

(affiliate of LGP)

Payment Terms /

Discounts

Payment for Fuel

Motor Fuels

Sub-

Wholesaler

Commission

Agents

Suppliers

Retail Distribution

Rental Income

Master Limited Partnership |

9

Stable Cash Flows

Wholesale Distribution Cash Flows

•

Lessee dealer agreements generally have 3 year initial terms

and a remaining term of 2.5 years as of December 31, 2013

•

LGO supply agreement had a 15-year initial term at the time

of the IPO and had a remaining term of approximately 13.8

years as of December 31, 2013

•

Our wholesale supply agreements prohibit the purchase of

motor fuel from other distributors

Rental Income Cash Flows

•

Lease agreements with lessee dealers generally have a 3

year initial term and had an average remaining term of 2.5

years as of December 31, 2013

•

Lease agreements with commission agents generally range

from 5 to 10 years and had an average remaining term of 5.3

as of December 31, 2013

•

LGO lease agreements had an average remaining term of

approximately 14.1 years as of December 31, 2013

•

Our lease agreements generally require the lessees to

purchase their motor fuel from us

LGP

Predecessor

(1)

Wholesale Distribution Margin Per Gallon represents revenues from fuel sales minus

costs from fuel sales (including amounts to affiliates) divided by the

gallons of motor fuel distributed. (2)

YE (Year End) represents twelve months ended December 31 of the applicable year and

2012 PF (Pro Forma) represents 2012 pro forma as presented on Form 8-K

filed with the SEC on March 26, 2013. 1Q 2014 represents the quarter

ending March 31, 2014. (3)

Rental income is rental income from lessee dealers and from affiliates.

Information shown in 1QA 2014 represents annualized rental income for the

period ending March 31, 2014. Wholesale

Distribution

Margin

Per

Gallon

(1)(2)

Rental Income

(2)(3)

LGP

Predecessor

Average Margin: $0.0654 |

10

Prime Real Estate Locations

•

We own and lease sites that provide

convenient fueling locations in areas of

high consumer demand

•

We own or lease sites in fourteen states

(1)

Six of the states are in the top ten

states for consumers of gasoline in

the United States

(2)

Five of the states are in the top ten

states for consumers of on-highway

diesel fuel in the United States

(2)

•

Limited availability of undeveloped real

estate in many of our markets presents a

high barrier to entry for the development of

competing sites

•

Due to prime locations, owned real estate

sites have high alternate use values, which

provides additional risk mitigation

(1)

As of March 31, 2014 pro forma for PMI acquisition

(2)

Source EIA. As of December 31, 2012

LGP Controlled Sites by State

(1) |

11

Branded Fuel Suppliers

•

One of the ten largest independent distributors by

volume in the U.S. for ExxonMobil, BP and Shell

branded fuels

Also distribute Valero, Sunoco, Chevron and

Gulf-branded motor fuels

•

Prompt payment history and good credit standing

with suppliers allow us to receive certain term

discounts on fuel purchases, which increases

wholesale profitability

•

Branded fuel is perceived by retail customers as

higher quality and commands a price premium

LGP Fuel Distribution by Brand

(1)

Brands Distributed

Supplier

% of Total Motor Fuel

Distributed

ExxonMobil

43%

BP

25%

Shell

15%

Chevron

5%

Valero

4%

Total

92%

(1)

As of December 31, 2013 |

12

Growth Through Acquisitions

•

Wholesale marketing remains a fragmented and

local industry

•

Long history of successfully sourcing and

executing acquisitions

Predecessor completed over 12

acquisitions of 10 or more sites

•

We seek to acquire sites within our existing

geographic markets to enhance efficiencies and

in new markets with favorable demographic,

economic and fuel market trends

•

Since our IPO, we have completed 5 major

acquisitions for total consideration of $193.2

million

Dunmore increased existing operating

area in PA

Remaining transactions added sites in

scale in new markets in FL, TN and VA

•

Established relationships with oil majors,

customers, industry contacts and brokers to

source new acquisitions

•

Team dedicated to acquisitions

Acquisitions Since Our IPO

(1)

Dunmore

24

29.0

Express Lane

47

45.2

Rogers

17

21.1

Rocky Top

33

36.9

PMI

85

61.0

Total

206

193.2

Total

Consideration

($ million)

Acquisition

Sites Acquired

(Fee &

Leasehold)

(1)

Excludes non-c-store sites acquired in PMI acquisition.

|

13

PMI Acquisition Overview

•

The Partnership acquired PMI, a Roanoke, VA headquartered distributor of petroleum

products and owner and operator of convenience stores, on April 30, 2014, for net total

consideration of $61 million

•

The company operates 85 convenience stores under the Stop in Food Stores brand

•

Sold 91 million gallons of motor fuel in 2013

•

$93 million in non-fuel revenue at the sites

•

50 sites are Shell branded, 22 Exxon branded

•

9 co-located quick service restaurants

•

Petroleum products distribution segment distributes primarily motor fuels along with

other petroleum products throughout Virginia, West Virginia, Tennessee and North

Carolina

•

Distributed approximately 191 million gallons in 2013

•

The Partnership divested the lubricants business at closing for $14 million (which is

reflected in the net total consideration figure)

•

Transaction structured as stock acquisition with the Partnership’s taxable subsidiary

acquiring the corporation

•

Expect to combine operations with Manchester acquisition and realize certain other

efficiencies |

14

PMI Locations

Dealer Site (no real estate control)

Company Operated Site |

15

Atlas Acquisition Overview

•

The Partnership has entered into a purchase agreement to purchase wholesale supply

and certain other assets from Atlas Oil Company for total consideration of $36.1 million

•

Assets to be purchased primarily consist of:

•

53 wholesale supply contracts

•

11 fee or leasehold sites

•

In addition, LGP is acquiring certain other short term financings assets associated with

the acquired supply contracts

•

Assets are located in the metro Chicago area

•

Supply contracts are long term agreements with a weighted average term remaining of

approximately 15 years

•

The fee and leasehold sites are currently leased to third party commission agents

•

All the sites are BP branded locations

•

Expect to close second quarter 2014 |

16

Commission Agent

Independent Dealer

Lessee Dealer

Other

Atlas Locations |

17

Capital Structure Overview

•

The Partnership completed in March the

syndications of a new $450 million credit

facility

•

New facility provides for increased financial

and operational flexibility and extends the

tenor to 5 years

•

Facility provides for flexibility to

access additional forms of debt capital

•

$100 million accordion feature

•

Continuously evaluate other capital sources

to ensure efficient capital structure

Capitalization

($ in millions)

Actual

3/31/2014

% of Book

Cap

EBITDA

Multiple

Cash

1.4

Long Term Debt

186.1

54.5%

3.1x

Capital Lease Obligations

66.1

19.4%

1.1x

Total Debt

252.2

73.9%

4.2x

Partners' Capital

89.1

26.1%

1.5x

Total Book Capitalization

341.3

100.0%

5.6x

Equity Market Capitalization (3/31/2014)

504.5

8.3x

Enterprise Value

754.2

12.4x

3/31/2014 Pro Forma LTM EBITDA

60.6 |

18

Distributions

Distributions Since Our IPO

(1)

The

4

quarter

of

2012

is

for

the

period

from

October

31

through

December

31,

2012.

The

DCF / unit includes $6.3 million, or $0.42 / unit, in fees and expenses related to

our Initial Public Offering in October 2012.

•

Our primary business objective is to make

quarterly cash distributions to our unitholders

and, over time, to increase our quarterly cash

distributions

•

Our success in the acquisitions market during

the course of the last twelve months has

enabled us to grow our distribution

First quarter distribution of $0.5125 per

unit ($2.05 annualized) represents a

17.1% increase from the initial distribution

amount at the time of the IPO

•

Committed to a prudent, sustainable distribution

growth rate

Quarterly Distribution

Per Unit

0.2948

$

0.4525

$

0.4775

$

0.5025

$

0.5125

$

0.5125

$

Distribution Per Unit on

Annualized Basis

1.75

$

1.81

$

1.91

$

2.01

$

2.05

$

2.05

$

% increase from prior

quarter

-

3.4%

5.5%

5.2%

2.0%

0.0%

Quarterly DCF / Unit

0.1328

$

0.6198

$

0.7449

$

0.7316

$

0.5833

$

0.3870

$

Ratio of DCF / Per Unit

Distribution

0.5x

1.4x

1.6x

1.5x

1.1x

0.8x

1st

Quarter

2014

4th

Quarter

2013

4th

Quarter

2012¹

1st

Quarter

2013

2nd

Quarter

2013

3rd

Quarter

2013

th |

19

Aligned Equity Ownership

•

Chairman and CEO Joe Topper owns approximately 39% of LGP

(1)

Board member John B. Reilly, III owns approximately 5% of LGP to

bring combined

ownership of the two of them to approximately 44%

(1)

Approximately 92% of ownership interest of Topper and Reilly is in the form of

subordinated units

•

Lehigh Gas GP (the general partner) has a non-economic general partner interest

in Lehigh Topper & Reilly vs. Public

Ownership

Topper & Reilly Common vs. Subordinated

Unit Ownership

(1)

(1)

As of March 31, 2014

Reilly

5%

Topper

39%

Public

56% |

20

Investment Highlights

BP Station

Main Street, Lebanon, OH

•

Stable Cash Flows from Rental Income

and Wholesale Fuel Distribution

•

Established History of Completing and

Integrating Acquisitions

•

Long-Term Relationships with Major

Integrated Oil Companies and Refiners

•

Prime Real Estate Locations in Areas

with High Traffic

•

Financial Flexibility to Pursue

Acquisitions and Expansion

Opportunities

•

Aligned Equity Ownership |