Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FNCB Bancorp, Inc. | v379296_8k.htm |

First National Community Bancorp, Inc. Annual Meeting of Shareholders May 21, 2014 1

Welcome FNCB Shareholders 2 Steven R. Tokach President & Chief Executive Officer

2014 Annual Meeting Agenda • Introduction of Directors, Management and Guests • Present Meeting Notice and Proxy • Review Rules of Conduct • Report of Judge of Election • Establish that a Quorum Exists • Review Annual Meeting Proposals • Voting • Overview of Voting Results • Formal Meeting Adjourned • Management Presentation and Q&A to Follow 3

Introduction of Meeting Secretary Mary Griffin Cummings General Counsel 4

Annual Meeting Rules of Conduct • Please comply with distributed rules of conduct • Please refrain from using electronic devices • Only proposals and nominations submitted in accordance with the Company’s Bylaws will be considered • Only shareholders of record or their proxy may address the meeting • Please hold all comments and questions until question and answer period • Please limit remarks and questions to matters which are relevant to the Company 5

Annual Meeting Voting Procedures • Shares will be voted in the manner you have specified in your proxy • Voting on the matters to be considered at this meeting will be by ballot • Unless changing your vote or unless you have not yet voted, it is not necessary to submit a paper ballot at this meeting 6 Report of Judge of Election

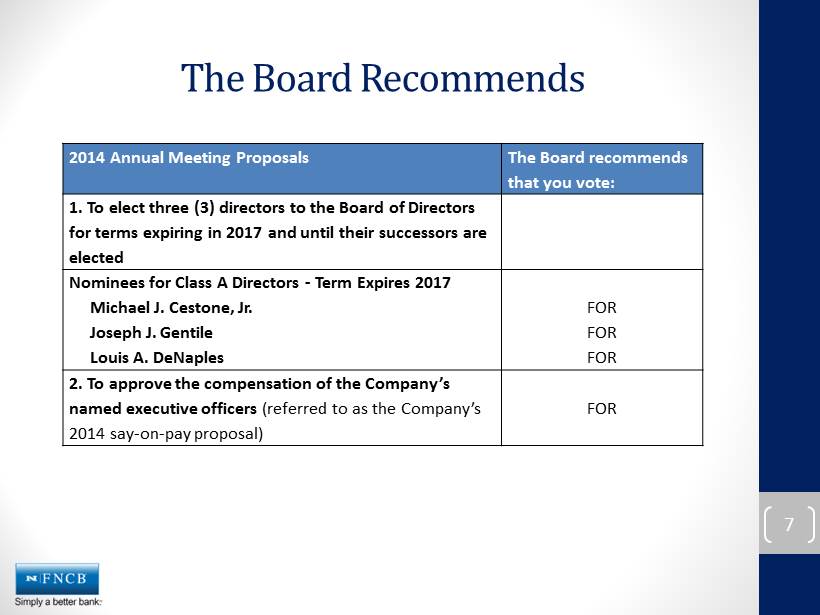

The Board Recommends 7 2014 Annual Meeting Proposals The Board recommends that you vote: 1. To elect three (3) directors to the Board of Directors for terms expiring in 2017 and until their successors are elected Nominees for Class A Directors - Term Expires 2017 Michael J. Cestone , Jr. Joseph J. Gentile Louis A. DeNaples FOR FOR FOR 2. To approve the compensation of the Company’s named executive officers (referred to as the Company’s 2014 say - on - pay proposal) FOR

First National Community Bancorp, Inc. Annual Meeting Management Presentation May 21, 2014 Steven R. Tokach President & CEO 8

Forward - Looking Statements This communication contains forward - looking statements as defined in the Private Securities Litigation Reform Act of 1995. Actual results and trends could differ materially from those set forth in such statements due to various risks, uncertainties an d other factors (some of which are beyond the Company’s control). The words “may,” “could,” “should,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “intend,” “plan” and similar expressions are intended to identify forward - looking statements . Such risks, uncertainties and other factors that could cause actual results and experience to differ include, but are not lim ite d to, the following: the strength of the United States economy in general and the strength of the local economies in the Company’s markets; the effects of, and changes in trade, monetary and fiscal policies and laws, including interest rate policies of the Bo ard of Governors of the Federal Reserve System; inflation, interest rate, market and monetary fluctuations; the timely developmen t of and acceptance of new products and services; the ability of the Company to compete with other institutions for business; t he composition and concentrations of the Company’s lending risk and the adequacy of the Company’s reserves to manage those risks; the valuation of the Company’s investment securities; the ability of the Company to pay dividends or repurchase common shares; the ability of the Company to retain key personnel; the impact of any pending or threatened litigation against the Company; the marketability of shares of the Company and fluctuations in the value of the Company’s share price; the impact of the Company’s ability to comply with its regulatory agreements and orders; the effectiveness of the Company’s system of inter nal controls; the ability of the Company to attract additional capital investment; the impact of changes in financial services’ l aws and regulations (including laws concerning capital adequacy, taxes, banking, securities, and insurance); the impact of technological changes and security risks upon the Company’s information technology systems; changes in consumer spending and saving habits; the nature, extent, and timing of governmental actions and reforms, and the success of the Company at managing the risks involved in the foregoing and other risks and uncertainties, including those detailed in the Company’s filings with the Securities and Exchange Commission . The Company cautions that the foregoing list of important factors is not all inclusive. Readers are also cautioned not to pl ace undue reliance on any forward - looking statements, which reflect management’s analysis only as of the date of this release, even if subsequently made available by the Company on its website or otherwise. The Company does not undertake to update any forward - looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company to reflect events or circumstances occurring after the date of this release. Readers should carefully review the risk factors d esc ribed in the Annual Report and other documents that the Company periodically files with the Securities and Exchange Commission, including its Form 10 - K for the year ended December 31, 2013. 9

Continued Meaningful Improvement in 2013 10 • Improved balance sheet • Improved asset quality • Increasing capital ratios • Enhanced capital position without shareholder dilution • Improved operating performance • Retail banking market redefined • Progress towards restoring cash dividend

11 James M. Bone, Jr. CPA Executive Vice President & Chief Financial Officer Financial Review

2013 Accomplishments • Return to profitability • Stronger capital position • Loan growth • Non - interest expense management • Continued improvement in asset quality • Strong loan loss reserves • Enhanced shareholder value • Significant progress meeting Consent Order and Written Agreement requirements 12

First Quarter 2014 Financial Results • Continued profitability • Net interest income • Capital accretion and progress toward achieving minimum capital ratio requirement • Loan growth • Non - interest expense • Continued improvement in asset quality • Strong loan loss reserves • Sale of Monroe County retail banking activities 13

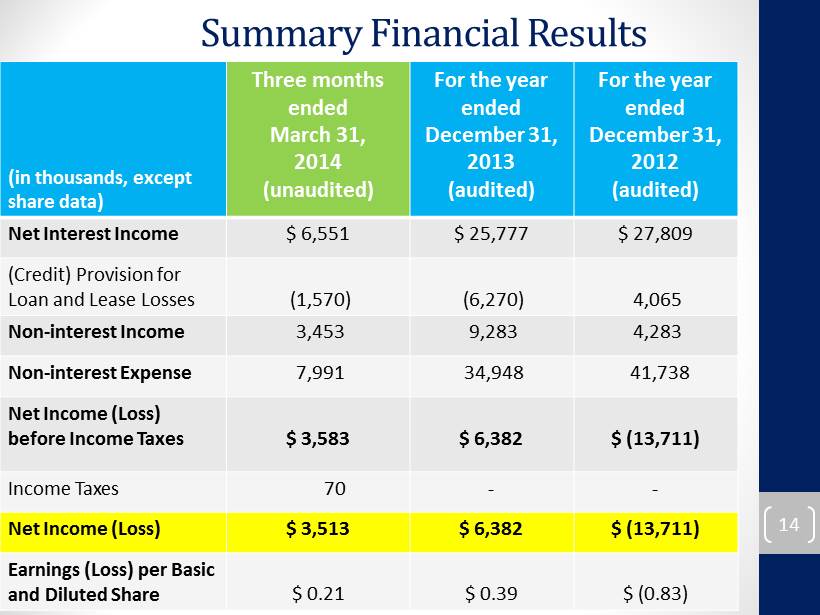

Summary Financial Results (in thousands, except share data) Three months ended March 31, 2014 (unaudited) For the year ended December 31, 2013 (audited) For the year ended December 31, 2012 (audited) Net Interest Income $ 6,551 $ 25,777 $ 27,809 (Credit) Provision for Loan and Lease Losses (1,570) (6,270) 4,065 Non - interest Income 3,453 9,283 4,283 Non - interest Expense 7,991 34,948 41,738 Net Income (Loss) before Income Taxes $ 3,583 $ 6,382 $ (13,711) Income Taxes 70 - - Net Income (Loss) $ 3,513 $ 6,382 $ (13,711) Earnings (Loss) per Basic and Diluted Share $ 0.21 $ 0.39 $ (0.83) 14

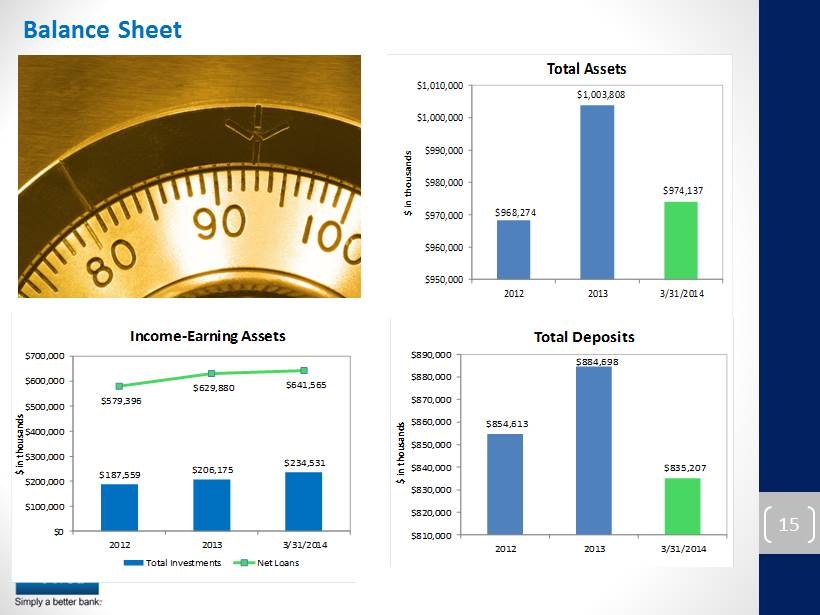

15 $968,274 $1,003,808 $974,137 $950,000 $960,000 $970,000 $980,000 $990,000 $1,000,000 $1,010,000 2012 2013 3/31/2014 $ in thousands Total Assets $854,613 $884,698 $835,207 $810,000 $820,000 $830,000 $840,000 $850,000 $860,000 $870,000 $880,000 $890,000 2012 2013 3/31/2014 $ in thousands Total Deposits $187,559 $206,175 $234,531 $579,396 $629,880 $641,565 $0 $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 $700,000 2012 2013 3/31/2014 $ in thousands Income - Earning Assets Total Investments Net Loans Balance Sheet

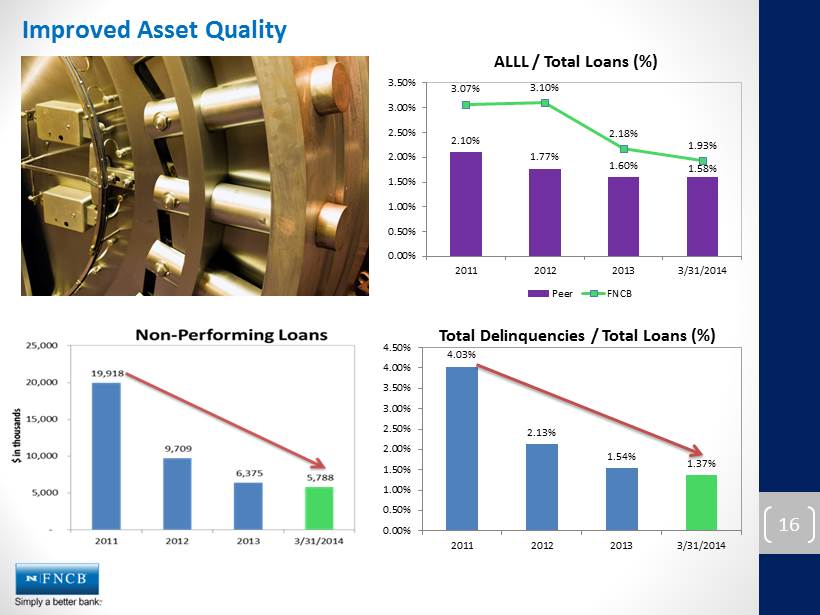

16 4.03% 2.13% 1.54% 1.37% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 2011 2012 2013 3/31/2014 Total Delinquencies / Total Loans (%) Improved Asset Quality 2.10% 1.77% 1.60% 1.58% 3.07% 3.10% 2.18% 1.93% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 2011 2012 2013 3/31/2014 ALLL / Total Loans (%) Peer FNCB

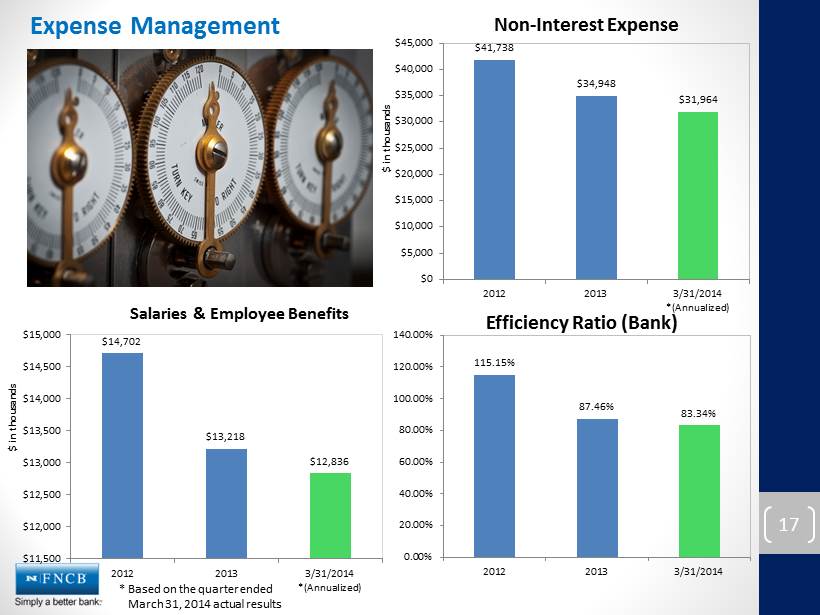

17 Expense Management * Based on the quarter ended March 31, 2014 actual results $41,738 $34,948 $31,964 $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 $40,000 $45,000 2012 2013 3/31/2014 *(Annualized) $ in thousands Non - Interest Expense 115.15% 87.46% 83.34% 0.00% 20.00% 40.00% 60.00% 80.00% 100.00% 120.00% 140.00% 2012 2013 3/31/2014 Efficiency Ratio (Bank) $14,702 $13,218 $12,836 $11,500 $12,000 $12,500 $13,000 $13,500 $14,000 $14,500 $15,000 2012 2013 3/31/2014 *(Annualized) $ in thousands Salaries & Employee Benefits

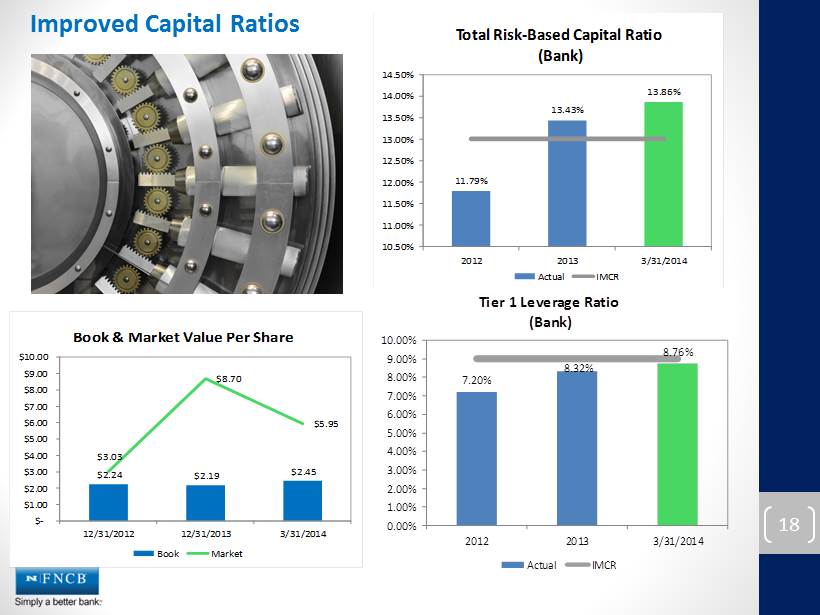

18 11.79% 13.43% 13.86% 10.50% 11.00% 11.50% 12.00% 12.50% 13.00% 13.50% 14.00% 14.50% 2012 2013 3/31/2014 Total Risk - Based Capital Ratio (Bank) Actual IMCR 7.20% 8.32% 8.76% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% 2012 2013 3/31/2014 Tier 1 Leverage Ratio (Bank) Actual IMCR $2.24 $2.19 $2.45 $3.03 $8.70 $5.95 $- $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 $8.00 $9.00 $10.00 12/31/2012 12/31/2013 3/31/2014 Book & Market Value Per Share Book Market Improved Capital Ratios

Looking Forward: Well Positioned for the Next Step 19 Jerry A. Champi Chief Operating Officer

Foundation for Sustained Performance • Comprehensive strategic plan o Regulatory compliance o Enhancing customer experience o Enhanced risk management • Capital management • Profitability enhancement program o Revenue enhancement o Process improvement o Expense analysis o Organization structure 20

Investment Considerations • Strong deposit share in primary markets of Lackawanna, Luzerne and Wayne counties • Diversified loan portfolio with strong growth in 2013 • Solid and stable asset quality metrics • Dedicated and experienced management team • Committed to prudent growth through a diversified balance sheet • Seek to restore a cash dividend as soon as feasible 21

Thank You for Attending the 2014 Annual Meeting of Shareholders Management Q&A 22