Attached files

| file | filename |

|---|---|

| 8-K - FORM 8K 051514 - KINGSTONE COMPANIES, INC. | form8k.htm |

| EX-99.2 - PRESS RELEASE DATED MAY 16, 2014 - KINGSTONE COMPANIES, INC. | ex99_2.htm |

|

|

Kingstone Companies, Inc.

Kingston, NY 12401

Phone: (845) 802-7900

www.kingstonecompanies.com

Contact: Victor Brodsky, CFO

|

News Release

KINGSTONE REPORTS FIRST QUARTER 2014 RESULTS

Company elects to reduce Personal Lines Quota Share

Kingston, New York—May 15, 2014--Kingstone Companies, Inc. (NASDAQ: KINS) reported its results of operations for the quarter ended March 31, 2014. Net income was $327,000, or $.04 per diluted common share, up from the $191,000, or $.05 per diluted common share earned for the quarter ended March 31, 2013. Net operating income1 for Q1 2014 was $203,000, or $.01 per diluted common share, as compared to $122,000, or $.03 per diluted common share generated in Q1 2013. Book value per share was $4.98, up 1.4% from year end 2013. Policies in force at March 31, 2014 totaled 38,493, up 23.5% over Q1 2013.

1This measure is not based on U.S. generally accepted accounting principles (“GAAP”) and is defined and reconciled to the most directly comparable GAAP measure in “Information Regarding Non-GAAP Measures.”

(1) These measures are not based on GAAP and are defined and reconciled to the most directly comparable GAAP measures in “Information Regarding Non-GAAP Measures.”

Management Commentary

Barry Goldstein, KINS Chairman and CEO, said “We are quite pleased with our core operating performance. Direct and net premiums written grew by 27.3% and 32.5%, respectively. Other underwriting expenses increased by only 3.1%. As a percentage of direct written premiums, other underwriting expenses declined to 14.0% from last year’s 17.2%. Net investment income was ahead of last year by 33.9%.

The growth rate in our major lines accelerated. Personal lines writings increased by 32.8% and commercial lines were ahead by 38.3% as compared to the same period last year. For the quarter, personal and commercial lines combined to represent 88.0% of our total direct written premiums, with personal lines at 70.9% and commercial lines accounting for 17.1%.

Our investment portfolio (at fair market value) at March 31, 2014 totaled $49.6 million, an increase of $12.0 million over year-end 2013. Of this increase, $10.2 million was attributable to our putting to work the proceeds of our December 2013 stock offering. The .31% decline in our fixed income yield to 4.28% is attributable to the decline in overall interest rates along with our increased allocation to municipal bonds.

On Monday, May 12, 2014, Kingstone Insurance Company (“KICO”), our wholly owned subsidiary, notified our personal lines reinsurers of its election to reduce the ceding percentage in the Quota Share treaty from 75% to 55% effective July 1, 2014. It was this ability to reduce our ceded premiums that was a prime factor in proceeding with last December’s underwritten public offering. We continue to pursue the most advantageous terms for all reinsurance treaties, and have a long-term strategy to reduce our quota share reinsurance as our need for surplus support is reduced. In addition, recent pricing levels for catastrophe coverage are well below our in-force rates, and we hope to see these savings on our July 1 purchases.

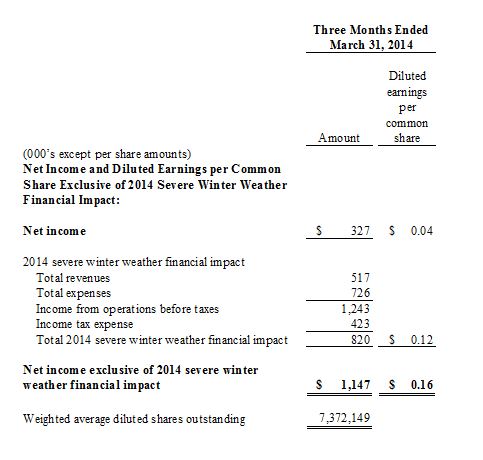

Abnormally high weather-related losses, caused by the harsh winter and categorized as a catastrophe, weighed heavily upon the quarter, adding 15.9% to our net loss ratio. Our net combined ratio for the first quarter of 2014 was 95.5%. The unusual winter-related losses added 21.9% to the net combined ratio. Thus, the net combined ratio excluding the effect of the catastrophes was 73.6%. On a per share basis, the 2014 severe winter weather, categorized as a catastrophe, reduced diluted earnings per share by $.12.1”

Ben Walden, KICO Vice President and Chief Actuary, analyzed the impact of the harsh weather. Mr. Walden stated, “The winter of 2013-14 was one of the worst in recent history for New York State. National Oceanic and Atmospheric Administration meteorological records for the last 10 years from Islip, NY show that this winter season had the lowest average temperature, highest snowfall total, and most number of days where temperatures did not reach the freezing point. This year was unusual because of both the severity of the cold temperatures and the prolonged length of the various cold spells, which caught many homeowners off guard.

1 These measures are not based on GAAP and are defined and reconciled to the most directly comparable GAAP measures in “Information Regarding Non-GAAP Measures.”

Extremely cold weather hit the NYC Metropolitan area on January 7 and 8 and again from January 22 to 24, with low temperatures reaching the single digits and highs only in the teens. The cold weather resulted in numerous pipe freeze/burst situations with subsequent water damage claims for the Company’s personal lines business. Higher snowfall totals combined with the below average temperatures meant that snow stayed on roofs much longer than in an average winter, creating ice dams and subsequent water damage claims. The weight of snow/ice damaged and collapsed awnings, pool liners, and exterior structure roofs such as garages, carports, and sheds.

To quantify the impact of the severe winter weather, a detailed review of personal lines claims received in the first quarter was performed to determine exact causes of loss. Claims and losses that were specifically caused by the severe winter weather were identified and these amounts were compared to the number of claims and losses that would be expected in an average winter, using historical experience applied to the same number of policies exposed this year. In the first quarter of 2014, 212 reported claims were attributed to the severe winter weather. In an average winter the Company would have expected 56 winter weather-related claims. The average size of claims reported in the first quarter of 2014 was also larger than would be expected in a normal winter, as many of the pipe freeze/burst claims involved significant water damage and loss to personal property contents.

The difference between what was observed this year and what would be expected during an average winter is the impact on the Company’s results due to the extreme winter weather. The abnormal losses from the severe winter weather, categorized as a catastrophe, were determined to be approximately $941,000, or a 15.9 percentage point impact on the net loss ratio.”

Victor Brodsky, KINS Chief Financial Officer, commented on the financial results for the first quarter of 2014. “As mentioned by Barry, we are seeing continued and accelerating growth in almost all of our lines of business. We pay particular attention to our ability to service the needs of our selected producers. In order to keep up with the increased number of submissions, we’ve added additional staff, and will continue to do so as needed. We expanded and reorganized our claims department, splitting property damage from bodily injury, and hired an experienced bodily injury claims manager to manage that area. While our other underwriting expenses for Q1 2014 were up 3.1% over the same period in 2013, this is far less than our premium growth rate, and helps to account for the decline in our ratio of other underwriting expenses to direct premiums written.”

An analysis of our gross premiums written, net premiums written, net premiums earned, net loss and loss adjustment expenses, and net loss ratios by major product type is shown below:

These measures are not based on GAAP and are defined and reconciled to the most directly comparable GAAP measures in “Information Regarding Non-GAAP Measures.”

Information Regarding Non-GAAP Measures

Direct premiums written - represents the total premiums charged on policies issued by the Company during the respective fiscal period.

Net premiums written - represents direct premiums written less premiums ceded to reinsurers.

Net operating income - is net income exclusive of realized investment gains, net of tax. Net income is the GAAP measure most closely comparable to net operating income. Management uses net operating income, along with other measures, to gauge the Company’s performance and evaluate results, which can be skewed when including realized investment gains, which may vary significantly between periods. Net operating income is provided as supplemental information, is not a substitute for net income and does not reflect the Company’s overall profitability.

Net combined ratio excluding the effect of catastrophes - is a non-GAAP ratio, which is computed as the difference between GAAP net combined ratio and the effect of catastrophes on the net combined ratio. We believe that this ratio is useful to investors and it is used by management to reveal the trends in our business that may be obscured by catastrophe losses. Catastrophe losses cause our loss trends to vary significantly between periods as a result of their incidence of occurrence and magnitude, and can have a significant impact on the net combined ratio. We believe it is useful for investors to evaluate this component separately and in the aggregate when reviewing our underwriting performance. We also provide it to facilitate a comparison to our outlook on the net combined ratio excluding the effect of catastrophes. The most directly comparable GAAP measure is the net combined ratio. The net combined ratio excluding the effect of catastrophes should not be considered a substitute for the net combined ratio and does not reflect the Company’s overall profitability.

The following table reconciles the net combined ratio excluding the effects of catastrophes to the net combined ratio:

Net income and diluted earnings per common share exclusive of 2014 severe winter weather financial impact - is net income and diluted earnings per common share exclusive of the impact of 2014 severe winter weather. Management uses net income and diluted earnings per common share exclusive of 2014 severe winter weather financial impact, along with other measures, to gauge the Company’s performance and evaluate results. Financial performance, which can be skewed when including catastrophes, such as from the 2014 severe winter weather, may vary significantly between periods. The most directly comparable GAAP measures are net income and diluted earnings per common share. Net income and diluted earnings per common share exclusive of 2014 severe winter weather financial impact are provided as supplemental information, are not substitutes for net income and diluted earnings per common share, and do not reflect the Company’s overall profitability.

# # #

About Kingstone

Kingstone is a property and casualty insurance holding company whose principal operating subsidiary, Kingstone Insurance Company, is domiciled in the State of New York. Kingstone is a multi-line regional property and casualty insurance company writing business exclusively through independent retail and wholesale agents and brokers. Kingstone is licensed to write insurance policies in New York and Pennsylvania. Kingstone offers property and casualty insurance products to individuals and small businesses primarily in New York State.

Forward-Looking Statements

Statements in this press release may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, may be forward-looking statements. These statements are based on management’s current expectations and are subject to uncertainty and changes in circumstances. These statements involve risks and uncertainties that could cause actual results to differ materially from those included in forward-looking statements due to a variety of factors. More information about these factors can be found in Kingstone’s filings with the Securities and Exchange Commission, including its latest Annual Report filed with the Securities and Exchange Commission on Form 10-K. Kingstone undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.