Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Agiliti Health, Inc. | a14-12802_1ex99d1.htm |

| 8-K - 8-K - Agiliti Health, Inc. | a14-12802_18k.htm |

Exhibit 99.2

|

|

UHOS Q1 2014 Earnings Teleconference May 15, 2014 |

|

|

Forward Looking Statements Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: Universal Hospital Services, Inc. believes statements in this presentation looking forward in time involve risks and uncertainties based on management’s current views and assumptions. Actual events may differ materially. Please refer to the cautionary statement regarding forward-looking statements and risk factors that appear in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013, and other filings with the SEC, which can be accessed at www.UHS.com under “Financials.” This presentation contains non-GAAP measures as defined by SEC rules. Reconciliations of these measures to the most directly comparable GAAP measures are contained in the appendix. |

|

|

2014 Results (Adjusted EBITDA) $32.3 $31.9 2013 2014 $120.0 $121.6 2013 2014 $16.1 $120.0 $137.7 1st Quarter LTM Recall Gains |

|

|

Q1 – Continuation of Trends from 2013 Health Care Uncertainty Technology Curve Hospital Volumes Service Experts Solutions Orientation Solutions Focus Hospital Volumes |

|

|

Outlook: 2014 and Beyond |

|

|

Financial Review 1st Quarter 2014 |

|

|

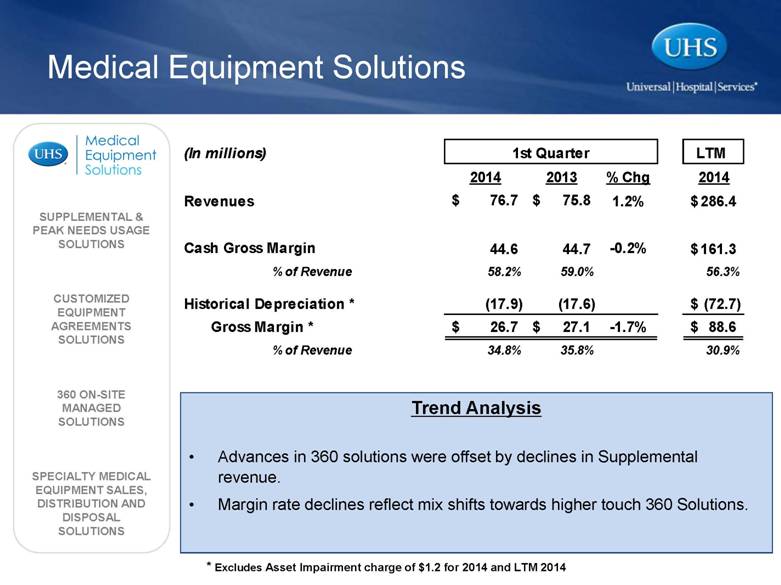

SUPPLEMENTAL & PEAK NEEDS USAGE SOLUTIONS CUSTOMIZED EQUIPMENT AGREEMENTS SOLUTIONS 360 ON-SITE MANAGED SOLUTIONS SPECIALTY MEDICAL EQUIPMENT SALES, DISTRIBUTION AND DISPOSAL SOLUTIONS Trend Analysis Advances in 360 solutions were offset by declines in Supplemental revenue. Margin rate declines reflect mix shifts towards higher touch 360 Solutions. Medical Equipment Solutions * Excludes Asset Impairment charge of $1.2 for 2014 and LTM 2014 (In millions) LTM 2014 2013 % Chg 2014 Revenues 76.7 $ 75.8 $ 1.2% 286.4 $ Cash Gross Margin 44.6 44.7 -0.2% 161.3 $ % of Revenue 58.2% 59.0% 56.3% Historical Depreciation * (17.9) (17.6) (72.7) $ Gross Margin * 26.7 $ 27.1 $ -1.7% 88.6 $ % of Revenue 34.8% 35.8% 30.9% 1st Quarter |

|

|

SUPPLEMENTAL MAINTENANCE AND REPAIR SOLUTIONS 360 ON-SITE MANAGED SOLUTIONS HEALTH CARE TECHNOLOGY ADVISORY SOLUTIONS Trend Analysis Revenue growth accelerated in Q1 with continued advances in managed solutions and supplemental maintenance. Margin rate improvements resulted from a lower level of vendor expenses on supported equipment. Clinical Engineering Solutions (In millions) LTM 2014 2013 % Chg 2014 Revenues 22.7 $ 21.2 $ 6.7% 88.4 $ Cash Gross Margin 5.0 4.4 13.6% 20.5 $ % of Revenue 22.1% 20.6% 23.2% Historical Depreciation (0.2) (0.2) (0.8) $ Gross Margin 4.8 $ 4.2 $ 12.7% 19.7 $ % of Revenue 21.0% 19.9% 22.3% 1st Quarter |

|

|

* Refer to Appendix for ASC 805 depreciation on the Depreciation & Amortization Reconciliation Trend Analysis Revenue trend continues to show solid growth. Cash margin rate declines were driven by higher employee related expenses to support further growth. Surgical Services ON-DEMAND AND SCHEDULED USAGE SOLUTIONS 360 ON-SITE MANAGED SOLUTIONS (In millions) LTM 2014 2013 % Chg 2014 Revenues 13.9 $ 13.3 $ 4.8% 56.7 $ Cash Gross Margin * 6.0 6.1 -1.6% 25.1 $ % of Revenue 42.7% 45.7% 44.3% Historical Depreciation (1.4) (1.2) (5.3) $ Gross Margin * 4.6 $ 4.9 $ -6.1% 19.8 $ % of Revenue 33.1% 36.8% 34.9% 1st Quarter |

|

|

* Refer to Appendix for ASC 805 depreciation and Asset Impairment charge on the Depreciation & Amortization Reconciliation Selected Financial Data (In millions) LTM 2014 2013 % Chg 2014 Consolidated Revenues 113.3 $ 110.4 $ 2.7% 431.3 $ Cash Gross Margin 55.6 55.2 0.7% 206.9 % of Revenues 49.0% 50.0% 48.0% Historical Depreciation (19.5) (19.0) (78.8) Gross Margin * 36.1 36.2 -0.4% 128.1 % of Revenues 31.8% 32.8% 29.7% Cash SG&A 23.2 23.1 0.4% 86.3 % of Revenues 20.5% 20.9% 20.0% Non Controlling Interest 0.1 0.2 0.6 % of Revenues 0.1% 0.2% 0.1% Adjusted EBITDA 32.3 $ 31.9 $ 1.3% 120.0 $ 1st Quarter |

|

|

Capital Structure / Liquidity Liquidity Remains Strong (In millions) 3/31/2014 12/31/2013 Original Notes - 7.625% 425.0 425.0 Add-on Notes - 7.625% 220.0 220.0 Credit Facility 55.1 33.0 Consolidated Capital Leases 19.1 20.1 Subtotal Debt 719.2 698.1 Add: Accrued Interest 6.6 18.9 Total Debt and Interest 725.8 717.0 Memo Adjusted EBITDA 120.0 $ 119.6 $ Leverage* 6.0 6.0 *Excludes unamortized bond premium of $12.3 and $12.7 for 2014 and 2013. Refer to Appendix for reconciliation of Adjusted EBITDA Capital Structure (In millions) 2014 Credit Facility 235.0 $ Borrowing Base 196.7 Borrowings/LOC 59.3 Available Liquidity 137.4 Memo Revolver maturity - July 2017 Original and Add-on Notes maturity - August 2020 Liquidity |

|

|

2013 2014 Guidance Adjusted EBITDA Actual: $119.6 $122 +/- Accrual CAPEX Actual: $65 $75 +/- Year-end Leverage Actual: 6.0x 6.2x +/- (In millions) Street Guidance for 2014 |

|

|

EBITDA Reconciliation: 2014 & 2013 EBITDA Reconciliation: 2007 – 2014 Selected Reconciliations Depreciation and Amortization Reconciliation Other Reconciliations Appendix |

|

|

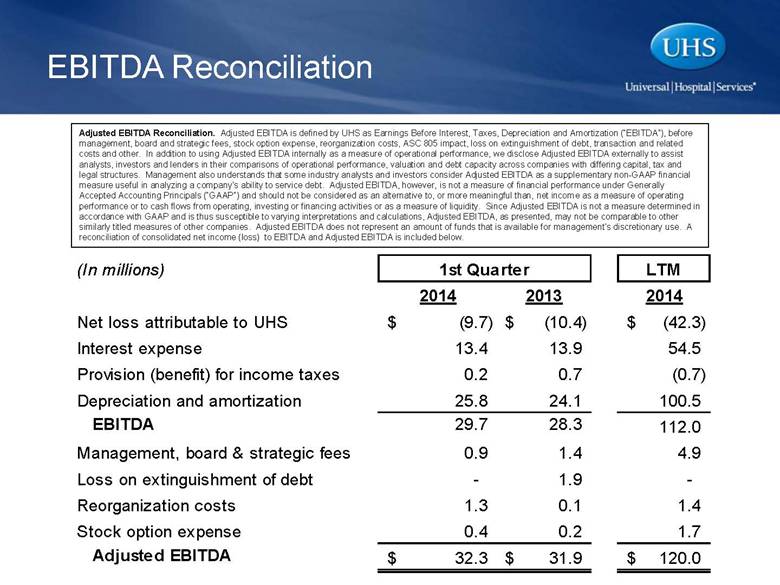

Adjusted EBITDA Reconciliation. Adjusted EBITDA is defined by UHS as Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”), before management, board and strategic fees, stock option expense, reorganization costs, ASC 805 impact, loss on extinguishment of debt, transaction and related costs and other. In addition to using Adjusted EBITDA internally as a measure of operational performance, we disclose Adjusted EBITDA externally to assist analysts, investors and lenders in their comparisons of operational performance, valuation and debt capacity across companies with differing capital, tax and legal structures. Management also understands that some industry analysts and investors consider Adjusted EBITDA as a supplementary non-GAAP financial measure useful in analyzing a company’s ability to service debt. Adjusted EBITDA, however, is not a measure of financial performance under Generally Accepted Accounting Principals (“GAAP”) and should not be considered as an alternative to, or more meaningful than, net income as a measure of operating performance or to cash flows from operating, investing or financing activities or as a measure of liquidity. Since Adjusted EBITDA is not a measure determined in accordance with GAAP and is thus susceptible to varying interpretations and calculations, Adjusted EBITDA, as presented, may not be comparable to other similarly titled measures of other companies. Adjusted EBITDA does not represent an amount of funds that is available for management’s discretionary use. A reconciliation of consolidated net income (loss) to EBITDA and Adjusted EBITDA is included below. EBITDA Reconciliation (In millions) LTM 2014 2013 2014 Net loss attributable to UHS (9.7) $ (10.4) $ (42.3) $ Interest expense 13.4 13.9 54.5 Provision (benefit) for income taxes 0.2 0.7 (0.7) Depreciation and amortization 25.8 24.1 100.5 EBITDA 29.7 28.3 112.0 Management, board & strategic fees 0.9 1.4 4.9 Loss on extinguishment of debt - 1.9 - Reorganization costs 1.3 0.1 1.4 Stock option expense 0.4 0.2 1.7 Adjusted EBITDA 32.3 $ 31.9 $ 120.0 $ 1st Quarter |

|

|

* Includes recall gains of $4.4, $15.4 and $18.6 for 2010, 2011, and 2012. ** Excludes recall gains of $4.4, $15.4 and $18.6 for 2010, 2011, and 2012 EBITDA Reconciliation: 2007 – 2013 LTM (In millions) 2007 2008 2009 2010 2011 2012 2013 2014 Net Loss attributable to UHS* (63.6) $ (23.5) $ (18.6) $ (29.1) $ (22.4) $ (35.2) $ (43.0) $ (42.3) $ Interest expense 40.2 46.9 46.5 46.5 55.0 55.7 55.0 54.5 Provision (benefit) for income taxes (9.7) (15.4) (11.5) 1.7 (8.2) (2.6) (0.2) (0.7) Depreciation and amortization 71.6 85.8 87.0 91.7 96.5 96.7 98.8 100.5 EBITDA* 38.5 93.8 103.4 110.8 120.9 114.6 110.6 112.0 Management, board & strategic fees 1.0 1.3 1.3 2.4 7.3 2.6 5.4 4.9 Loss on extinguishment of debt 23.4 - - - - 12.3 1.9 - Reorganization costs - - - - - 7.2 0.2 1.4 Stock option expense 3.7 2.5 1.3 7.3 4.3 4.0 1.5 1.7 ASC 805 impact 2.4 2.3 2.0 1.1 0.9 0.1 - - Recapitalization, company sale, stock compensation and severance expenses 27.2 - - - - - - - Other (0.7) 0.1 - - - - - - Adjusted EBITDA* 95.5 $ 100.0 $ 108.0 $ 121.6 $ 133.4 $ 140.8 $ 119.6 $ 120.0 $ Memo Total Revenue 264.0 $ 289.1 $ 297.2 $ 312.1 $ 355.2 $ 415.3 $ 428.4 $ 431.3 $ Total Debt & Accrued Int, Less Cash & Investments 501.1 $ 521.7 $ 522.3 $ 528.6 $ 674.8 $ 712.8 $ 717.0 $ 725.8 $ Leverage (Total Net Debt & Accrued Interest Less Cash & Investments/ LTM adj EBITDA)** 5.2 5.2 4.8 4.5 5.6 5.8 6.0 6.0 |

|

|

Selected Reconciliations (In millions) LTM 2014 2013 2014 Gross Margin ASC 805 Impact Depreciation - Surgical Services 0.2 $ 0.3 $ 0.9 $ Total Gross Margin ASC 805 Impact 0.2 0.3 0.9 SG&A per GAAP to Cash SG&A SG&A per GAAP 30.7 31.5 113.9 Management, Board, & Strategic Fees (0.9) (1.4) (4.9) Loss on extinguishment of debt - (1.9) - Reorganization costs (1.3) (0.1) (1.4) Stock Option Expense (0.4) (0.2) (1.7) Historical Depreciation & Amortization (1.6) (1.3) (6.0) ASC 805 Depreciation & Amortization (3.3) (3.5) (13.6) Adjusted Cash SG&A 23.2 $ 23.1 $ 86.3 $ 1st Quarter |

|

|

Depreciation & Amortization Reconciliations (In millions) LTM 2014 2013 2014 Historical Medical Equipment Solutions Depreciation 17.9 $ 17.6 $ 72.7 $ Asset Impairment Charge 1.2 - 1.2 $ Total Medical Equipment Solutions Depreciation 19.1 17.6 73.9 Historical Clinical Engineering Solutions Depreciation 0.2 0.2 0.8 Total Clinical Engineering Solutions Depreciation 0.2 0.2 0.8 Historical Surgical Services Depreciation 1.4 1.2 5.3 ASC 805 Surgical Services Depreciation 0.2 0.3 0.9 Total Surgical Services Depreciation 1.6 1.5 6.2 Historical Gross Margin Depreciation 19.5 19.0 78.8 Gross Margin ASC 805 Depreciation 0.2 0.3 0.9 Asset Impairment Charge 1.2 1.2 Total Gross Margin Depreciation 20.9 19.3 80.9 Historical Selling, General, and Admin Depreciation 1.6 1.3 6.0 Total Selling, General, and Admin Depreciation 1.6 1.3 6.0 Total ASC 805 Selling, General, and Admin Amortization 3.3 3.5 13.6 Total Depreciation and Amortization 25.8 $ 24.1 $ 100.5 $ 1st Quarter |

|

|

Other Reconciliations LTM (In millions) 2007 2008 2009 2010 2011 2012 2013 2014 Cash used in Investing Activities 418.9 $ 71.4 $ 50.6 $ 74.2 $ 153.2 $ 73.6 $ 56.4 $ 66.7 $ - Acquisitions (349.7) - - - (70.0) (14.4) - - - / + Other 1.4 - 1.5 3.3 - - - - - ME in A/P prior period (7.4) (9.0) (5.7) (4.7) (11.8) (8.8) (5.0) (11.1) + ME in A/P current period 9.0 5.7 4.7 11.8 8.8 5.0 13.7 9.3 Accrual CAPEX 72.2 $ 68.1 $ 51.1 $ 84.6 $ 80.2 $ 55.4 $ 65.1 $ 64.9 $ Certain Intellamed Assets (14.6) $ - $ - $ - $ - $ - $ - $ - $ UHS by Parent (335.1) - - - - - - - Other Acquisitions - - - - (70.0) (14.4) - - Total Acquisitions (349.7) $ - $ - $ - $ (70.0) $ (14.4) $ - $ - $ ACQUISITIONS ACCRUAL CAPEX RECONCILIATION |