Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WEST CORP | d727801d8k.htm |

Annual Meeting

of Stockholders May 2014

Annual Meeting of Stockholders

May 2014

Exhibit 99.1 |

Forward Looking

Statements 2

This presentation contains forward-looking statements within the meaning

of the federal securities laws. As you consider this presentation, you

should understand that these statements are not guarantees of

performance or results, and they involve various risks, uncertainties

(some of which are beyond our control) and assumptions, including those

risks, uncertainties and assumptions set forth in our annual report on

Form 10-K and quarterly reports on Form 10-Q and other filings with the

U.S. Securities and Exchange Commission. Although we believe that

these forward-looking statements are based on reasonable assumptions,

you should be aware that many factors could affect our actual financial

results and cause them to differ materially from those anticipated in the

forward-looking statements. Any forward-looking statement

contained herein speaks only as of the date on which it is made, and except

as required by law, we have no duty to, and do not intend to, update or

revise the forward-looking statements in this presentation after the

date of this presentation.

West Confidential & Proprietary.

Copyright © 2014 West Corporation. All Rights Reserved.

|

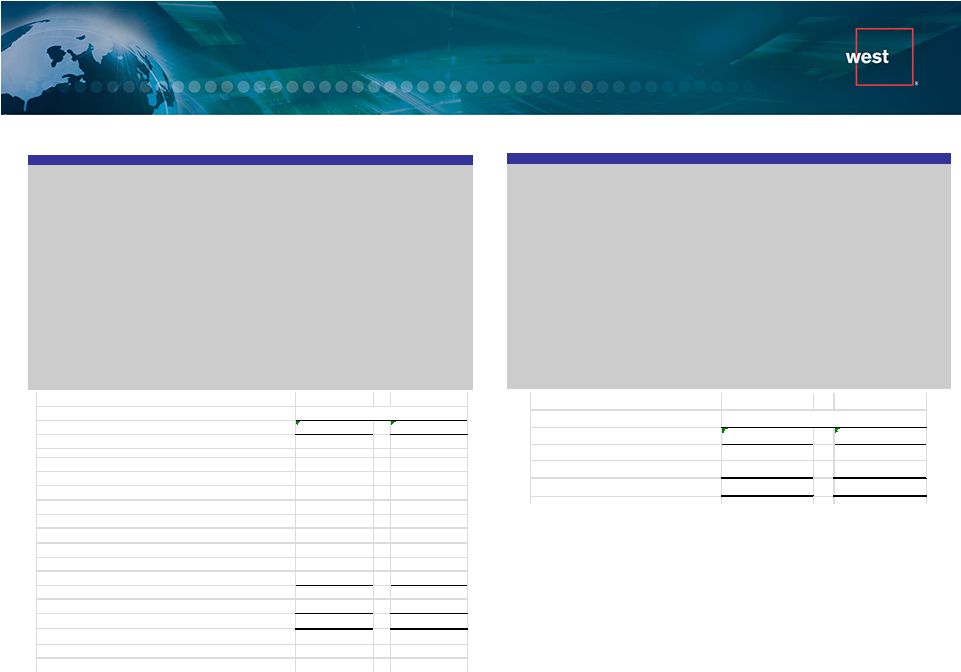

Non-GAAP

Reconciliation 3

Adjusted net income and adjusted earnings per share (EPS) are non-

GAAP measures. The Company believes these measures provide a

useful indication of profitability and basis for assessing the operations

of the Company without the impact of IPO-related expenses, expenses

terminated in connection with the IPO, bond redemption premiums,

M&A and acquisition related costs and certain non-cash items.

Adjusted net income should not be considered in isolation or as a

substitute for net income or other profitability metrics prepared in

accordance with GAAP. Adjusted net income, as presented, may not

be comparable to similarly titled measures of other companies. Set

forth below is a reconciliation of adjusted net income to net income.

Unaudited, in thousands except per share

2013

2012

Net income

143,202

$

125,541

$

Amortization of acquired intangible assets

55,338

65,848

Amortization of deferred financing costs

18,246

14,606

Accelerated amortization of deferred financing costs

6,603

2,715

Share-based compensation

10,555

25,849

Sponsor management/termination fee

25,000

4,123

IPO bonus

2,975

-

Subordinated debt call premium

16,502

-

M&A and acquisition related costs

1,172

1,652

Acquisition earnout reversal

-

(7,887)

Pre-tax total

136,391

106,906

Income tax expense on adjustments

50,260

42,228

Adjusted net income

229,333

$

190,219

$

Diluted shares outstanding

80,318

63,523

Adjusted EPS - diluted

2.86

$

2.99

$

Twelve Months Ended Dec. 31,

Adjusted Net Income and Adjusted EPS

Free Cash Flow

Unaudited, in thousands

2013

2012

Cash flows from operations

384,087

$

318,916

$

Cash capital expenditures

128,398

125,489

Free cash flow

255,689

$

193,427

$

Twelve Months Ended Dec. 31,

West Confidential & Proprietary.

Copyright © 2014 West Corporation. All Rights Reserved.

The Company believes free cash flow provides a relevant measure of

liquidity and a useful basis for assessing the Company’s ability to

fund its activities, including the financing of acquisitions, debt service,

stock repurchases and distribution of earnings to shareholders. Free

cash flow is calculated as cash flows from operations less cash

capital expenditures. Free cash flow is not a measure of financial

performance under GAAP. Free cash flow should not be considered

in isolation or as a substitute for cash flows from operations or other

liquidity measures prepared in accordance with GAAP. Free cash

flow, as presented, may not be comparable to similarly titled

measures of other companies. Set forth below is a reconciliation of

free cash flow to cash flows from operations.

|

IP

Communications

Interactive Services

Agent Services

Public Safety

Services

Telecom Services

Conferencing and

Collaboration

West Corporation, through our 32,600 employees, manages and processes

large-scale, complex, mission-critical transactions

that help our clients communicate more effectively with their customers.

Largest conferencing

provider in the world

148 million conference calls

managed in 2013

Fast growing business

within West

Positioned as a Gartner

Magic Quadrant Leader

Backbone of 9-1-1 system

in US

290 million 9-1-1 calls

facilitated in 2013

1.4 billion notification calls

and data messages

delivered in 2013

Primarily serves

telecommunication

carriers –

an

important vertical

market for West

58 billion telephony

minutes managed in

2013

Agents in the US,

Jamaica, Mexico

and Philippines

Nearly 5,000 agents

working from home

West Overview

West Confidential & Proprietary.

Copyright © 2014 West Corporation. All Rights Reserved.

|

Revenue

5

$2,700-

$2,755

This page contains forward looking statements. Please see page 2.

2013 Consolidated

Revenue over 2012

1.8%

GROWTH

Platform Revenue

3.6%

GROWTH

Agent Services Revenue

2.6%

DECLINE

$2,638

$2,686

2012

2013

2014 Guidance

West Confidential & Proprietary.

Copyright © 2014 West Corporation. All Rights Reserved.

|

Adjusted Net

Income 6

$232 -

$247

Adjusted Net Income excludes costs related to the IPO and acquisitions. See

page 3 for a reconciliation of Adjusted Net Income to Net Income. This page

contains forward looking statements. Please see page 2. 2013 Adjusted

Net Income grew over 2012

20.6%

GROWTH

Growth was a result of paying

off debt with IPO proceeds and

negotiating lower interest rates

on $2.4B of term debt

$190

$229

2012

2013

2014

Guidance

West Confidential & Proprietary.

Copyright © 2014 West Corporation. All Rights Reserved.

|

Cash Flows from

Operations 7

$375 -

$400

This page contains forward looking statements. Please see page 2.

2013 Cash Flows from

Operations grew over 2012

20.4%

GROWTH

$319

$384

2012

2013

2014

Guidance

West Confidential & Proprietary.

Copyright © 2014 West Corporation. All Rights Reserved.

|

WSTC vs. S&P

500 8

95.00

100.00

105.00

110.00

115.00

120.00

125.00

130.00

135.00

140.00

145.00

22-Mar-13

22-Apr-13

22-May-13

22-Jun-13

22-Jul-13

22-Aug-13

22-Sep-13

22-Oct-13

22-Nov-13

22-Dec-13

WSTC

S&P 500

WSTC finished 2013 at $25.71, an increase of

36.3% from the IPO closing price of $18.86

West Confidential & Proprietary.

Copyright © 2014 West Corporation. All Rights Reserved.

|

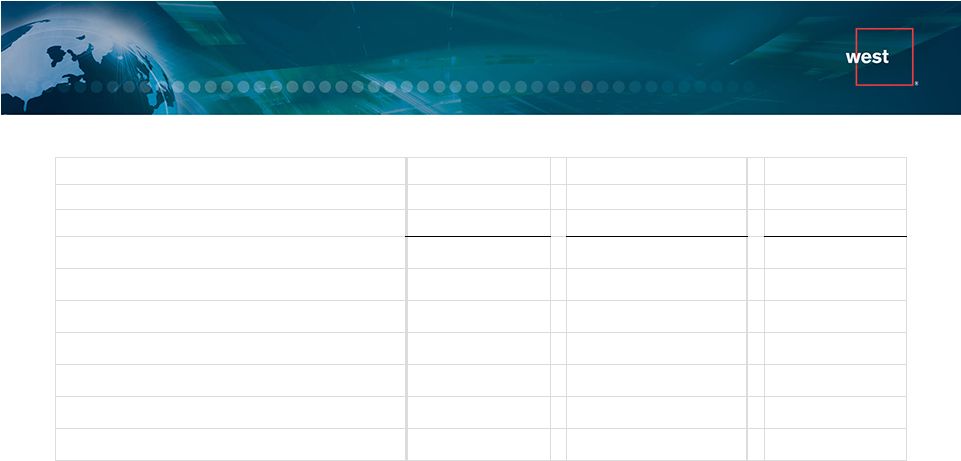

2014

Guidance 9

In millions except per share amounts.

This page contains forward looking statements. Please see page 2.

See reconciliation of non-GAAP financial measures on page 3.

Implied

Growth at

2013 Actual

2014 Guidance

Midpoint

Consolidated Revenue

$2,686

$2,700 - $2,755

1.5%

Platform-based Revenue

$1,955

$2,000 - $2,033

3.1%

Agent-based Revenue

$742

$710 - $730

-3.0%

Free Cash Flow

$256

$225 - $250

-7.1%

Cash Flows from Operations

$384

$375 - $400

0.9%

Adjusted Net Income

$229

$232 - $247

4.4%

Adjusted Earnings per Share - Diluted

$2.86

$2.72 - $2.89

-1.9%

West Confidential & Proprietary.

Copyright © 2014 West Corporation. All Rights Reserved.

|

Uses of

Cash 10

This page contains forward looking statements. Please see page 2.

2014 Guidance for

Cash Flows from

Operations of

$375M-$400M

•

$0.225 per share quarterly

•

Approximately 32% of expected free cash flow in 2014

DIVIDEND

•

$500M of 8.625% bonds callable 10/1/14

•

$650M of 7.875% bonds callable 11/15/14

REFINANCE DEBT

ACQUISITIONS

PAY DOWN DEBT

West Confidential & Proprietary.

Copyright © 2014 West Corporation. All Rights Reserved.

|

Recent

Acquisition: SchoolMessenger 11

•

Fast growing

notifications and

alerts business

for the K-12

education market

This page contains forward looking statements. Please see page 2.

•

Revenue of $27

million in 2013

with growth

expected in high

single digits

•

Strong profit

margins

•

Purchase price

was

approximately

$75 million

GROWTH

REVENUE

PROFITS

PRICE

West Confidential & Proprietary.

Copyright © 2014 West Corporation. All Rights Reserved.

|

Questions?

12 |