Attached files

| file | filename |

|---|---|

| EX-4.04 - EX-4.04 - WEST CORP | d34480dex404.htm |

| EX-10.48 - EX-10.48 - WEST CORP | d34480dex1048.htm |

| EX-32.01 - EX-32.01 - WEST CORP | d34480dex3201.htm |

| EX-32.02 - EX-32.02 - WEST CORP | d34480dex3202.htm |

| EX-10.52 - EX-10.52 - WEST CORP | d34480dex1052.htm |

| EX-10.50 - EX-10.50 - WEST CORP | d34480dex1050.htm |

| EX-21.01 - EX-21.01 - WEST CORP | d34480dex2101.htm |

| EX-10.56 - EX-10.56 - WEST CORP | d34480dex1056.htm |

| EX-23.01 - EX-23.01 - WEST CORP | d34480dex2301.htm |

| EX-10.35 - EX-10.35 - WEST CORP | d34480dex1035.htm |

| EX-10.36 - EX-10.36 - WEST CORP | d34480dex1036.htm |

| EX-31.01 - EX-31.01 - WEST CORP | d34480dex3101.htm |

| EX-10.54 - EX-10.54 - WEST CORP | d34480dex1054.htm |

| EX-31.02 - EX-31.02 - WEST CORP | d34480dex3102.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For The Fiscal Year Ended December 31, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-35846

West Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 47-0777362 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 11808 Miracle Hills Drive, Omaha, Nebraska | 68154 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (402) 963-1200

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of exchange on which registered | |

| Common Stock ($0.001 par value) | NASDAQ |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Act.

Large accelerated filer þ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of the common equity held by non-affiliates (computed by reference to the average bid and asked price of such common equity) as of June 30, 2015, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $1,322.5 million. At February 12, 2016, 83,440,447 shares of the registrant’s common stock were outstanding.

Documents incorporated by reference

Applicable portions of the proxy statement for the 2016 annual meeting of stockholders are incorporated by reference in Part III of this Annual Report.

Table of Contents

| PART I | ||||||

| Page | ||||||

| ITEM 1. |

BUSINESS | 1 | ||||

| ITEM 1A. |

RISK FACTORS | 21 | ||||

| ITEM 1B. |

UNRESOLVED STAFF COMMENTS | 32 | ||||

| ITEM 2. |

PROPERTIES | 33 | ||||

| ITEM 3. |

LEGAL PROCEEDINGS | 33 | ||||

| ITEM 4. |

MINE SAFETY DISCLOSURES | 33 | ||||

| PART II | ||||||

| ITEM 5. |

34 | |||||

| ITEM 6. |

38 | |||||

| ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

39 | ||||

| ITEM 7A. |

65 | |||||

| ITEM 8. |

66 | |||||

| ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

66 | ||||

| ITEM 9A. |

67 | |||||

| ITEM 9B. |

70 | |||||

| PART III | ||||||

| ITEM 10. |

74 | |||||

| ITEM 11. |

75 | |||||

| ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

75 | ||||

| ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE |

75 | ||||

| ITEM 14. |

76 | |||||

| PART IV | ||||||

| ITEM 15. |

77 | |||||

| 83 | ||||||

Table of Contents

FORWARD-LOOKING STATEMENTS

This report contains “forward-looking statements” within the meaning of the federal securities laws. All statements other than statements of historical facts contained in this report, including statements regarding our future results of operations and financial position, business strategy and plans and objectives of management for future operations, are forward-looking statements. In many cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or other similar words.

These forward-looking statements are only predictions. These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other important factors that may cause our actual results, levels of activity, performance or achievements to materially differ from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. We have described in the “Risk Factors” section and elsewhere in this report the principal risks and uncertainties that we believe could cause actual results to differ from these forward-looking statements. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward-looking statements as guarantees of future events.

The forward-looking statements in this report represent our views as of the date of this report. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this report.

PART I.

| ITEM 1. | BUSINESS |

Overview

West Corporation (the “Company” or “West”) is a global provider of technology-enabled communication services. “We,” “us” and “our” also refer to West and its consolidated subsidiaries, as applicable. We offer a broad range of communication and network infrastructure solutions that help manage or support essential communications. These solutions include unified communications services, safety services, interactive services such as automated notifications, specialized agent services and telecom services.

The scale and processing capacity of our technology platforms, combined with our expertise in managing multichannel interactions, enable us to provide reliable, high-quality, mission-critical communications designed to maximize return on investment for our clients and help them build smarter, more meaningful connections. We are dedicated to delivering and improving upon new channels, new capabilities and new choices for how businesses and consumers collaborate, connect and transact.

Our clients include Fortune 1000 companies, along with small and medium enterprises in a variety of industries, including telecommunications, retail, financial services, public safety, education, technology and healthcare. We have sales and/or operations in the United States, Canada, Europe, the Middle East, Asia-Pacific, Latin America and South America.

Our focus on large addressable markets with attractive growth characteristics has allowed us to deliver steady, profitable growth. For the fiscal year ended December 31, 2015, we generated revenue from continuing operations of $2,280.3 million, Adjusted EBITDA from continuing operations of $676.1 million, or 29.7% Adjusted EBITDA margin, $190.9 million in income from continuing operations and $410.8 million in net cash flows from continuing operating activities. See “Management’s Discussion and Analysis of Financial Condition

1

Table of Contents

and Results of Operations—Liquidity and Capital Resources—Adjusted EBITDA” for a definition of EBITDA, Adjusted EBITDA and Free Cash Flows, which are non-GAAP measures, and a reconciliation of net income to EBITDA, cash flows from continuing operations to EBITDA and Adjusted EBITDA and cash flows from continuing operations to free cash flows.

The following summaries further highlight the steps we have taken to evolve and improve our business:

— Evolution to a Predominantly Technology-Based Solutions Business. Since our founding in 1986, we have invested significantly to expand our technology platforms and develop our operational processes to meet the complex communications needs of our clients. We have evolved our business mix from labor-intensive communication services to predominantly diversified technology-driven services. We have also invested approximately $2.9 billion in strategic acquisitions. We have increased our penetration into international unified communications markets, strengthened our interactive services business and established a leadership position in safety services and healthcare advocacy services. As we continue to increase the variety of services we provide, we intend to pursue opportunities in markets where we are able to leverage our technological capabilities and industry expertise.

On March 3, 2015, we divested several of our agent-based businesses. Businesses sold included our consumer-facing customer sales and lifecycle management, account services and receivables management businesses. The divestiture is consistent with the Company’s stated objective of focusing on faster growing, more profitable lines of business. As a result of this transaction, our employee count decreased from approximately 35,000 to 10,600, making us a significantly less labor-intensive company.

— Well Positioned for Emerging Technologies and Societal Trends. We operate at the scale and speed necessary to capitalize on emerging technologies and the advantages they will provide. We have reoriented our business to address the emergence of fast-growing markets such as healthcare, as well as emerging technology, industry and societal trends such as Internet Protocol (“IP”) infrastructure, unified communications as a service (“UCaaS”), migration to cloud-based solutions, mobility, Internet of Things (“IoT”), consumer’s desire for personalized experiences, analytics or “Big Data,” globalization, remote workforce and video-based collaboration.

— Developed and Enhanced Large Scale Technology Platforms. Investing in technology and developing specialized expertise in the industries we serve are critical components to our strategy of enhancing our services and delivering operational excellence. The scale of our technology platforms is a competitive advantage in many of the markets we serve. Our open standards-based platform allows for the flexibility to add new capabilities as our clients demand. In addition, we have integrated mobile, social media and cloud computing capabilities into our platforms and offer those services to our clients.

— Expanded Safety Services. We have invested significant resources into our safety services line of business. Since 2006, we have made several strategic acquisitions, including Intrado Inc. (“Intrado”), Positron Public Safety Systems and the 911 Enable business of Connexon Group, Inc. (“911 Enable”). This combination of acquisitions has provided us with a leading platform in safety communication and infrastructure services. Today, we believe we are one of the largest providers of safety services to telecommunications service providers, government agencies and public safety organizations, based on the number of 9-1-1 calls that we and other participants in the industry facilitate and the percentage of the U.S. population covered by our services. Our presence in this market has steadily increased through substantial investments in proprietary systems, such as our Emergency Services IP Network (ESInet), call handling product suite, and geographic information system (“GIS”) offerings and programs designed to upgrade the capabilities of 9-1-1 centers by delivering a broader set of features and functionality. We provide a comprehensive hosted platform that seamlessly integrates handset and network-based mobile location technologies. Our location determination services automatically apply precise locating methods to deliver accurate results. We plan to continue to develop our presence in the mobility industry in support of wireless carriers, Voice over IP (“VoIP”) providers, telematics and cable companies, enterprises and alarm/security companies.

2

Table of Contents

— Expanded Interactive Services. We have grown our interactive services line of business organically and through acquisitions. We provide automated notification services across several industries, including healthcare, utilities, financial services, telecommunications, transportation, government and public safety. Additionally, with the acquisitions in 2014 and 2015 of Reliance Holding, Inc., doing business through its wholly owned subsidiary Reliance Communications, LLC as SchoolMessenger (“SchoolMessenger”), the assets of GroupCast, LLC, doing business as SchoolReach (“SchoolReach”), and substantially all of the assets of Intrafinity, Inc., doing business as SharpSchool (“SharpSchool”), we expanded our interactive services into a leadership position in the K-12 education market in the U.S.

— “One West” Initiative. Our history of acquisitions provided us with industry-leading brands such as Intrado, InterCall, TeleVox, and many more. These brands are well known in their respective markets. However, many of our clients were not aware of the breadth of our offerings sold under different brand names. We believe that unifying our offerings under the “West” name will allow us to leverage one brand in our marketing efforts and drive additional cross-selling opportunities.

This initiative is not limited to the branding of our services. Our management team is focused on internal programs that are intended to leverage the existing assets and expertise of our employees across all of our lines of business. We will focus on several efforts to transform the Company’s operations to be more efficient. These efforts include collaboration between employees in different lines of business, simplification and automation of certain processes, leveraging existing technology infrastructure and consolidating efforts across the Company in each of our procurement, capital expenditure and carrier management functions.

The primary goal of these initiatives is to become a more responsive organization, delivering faster innovation to satisfy our clients’ needs, and to develop the ability to offer clients solutions for their communications needs that combine services across our lines of business.

Corporate Information

Our business was founded in 1986 through a predecessor company, and West Corporation was incorporated in 1994. On October 24, 2006, we completed a recapitalization (the “Recapitalization”) of the company in a transaction sponsored by an investor group led by Thomas H. Lee Partners, LP and Quadrangle Group LLC (the “Sponsors”). Pursuant to the Recapitalization, a merger subsidiary was merged with and into West Corporation, with West Corporation continuing as the surviving corporation, and our publicly traded securities were cancelled in exchange for cash.

We financed the Recapitalization with equity contributions from the Sponsors and the rollover of a portion of our equity interests held by Gary and Mary West, the founders of the Company, and certain members of management, along with a senior secured term loan facility, a senior secured revolving credit facility and the private placement of senior notes and senior subordinated notes.

On December 30, 2011, we completed the conversion of our outstanding Class L Common Stock into shares of Class A Common Stock (the “Conversion”) and thereafter the reclassification (the “Reclassification”) of all of our Class A Common Stock as a single class of Common Stock by filing amendments to our amended and restated certificate of incorporation (the “Charter Amendments”) with the Delaware Secretary of State. Upon the effectiveness of the filing of the Charter Amendments, each share of our outstanding Class L Common Stock was converted into 40.29 shares of Class A Common Stock pursuant to the Conversion, and all of the outstanding shares of Class A Common Stock were reclassified as shares of Common Stock pursuant to the Reclassification. Following the Conversion and Reclassification, all shares of Common Stock share proportionately in dividends. On March 8, 2013, we completed a 1-for-8 reverse stock split.

On March 27, 2013, we completed our initial public offering by selling an aggregate of 21,275,000 shares of our common stock at a price to the public of $20.00 per share. The initial public offering resulted in net proceeds to us of $398.1 million after deducting underwriting discounts and commissions of approximately $24.5 million and other offering expenses of approximately $3.0 million.

3

Table of Contents

Our principal executive offices are located at 11808 Miracle Hills Drive, Omaha, Nebraska 68154, and our telephone number at that address is (402) 963-1200. Our website is www.west.com where our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports are available without charge as soon as reasonably practicable following the time they are filed with or furnished to the Securities and Exchange Commission. None of the information on our website or any other website identified herein is part of this report. All websites in this report are intended to be inactive textual references only.

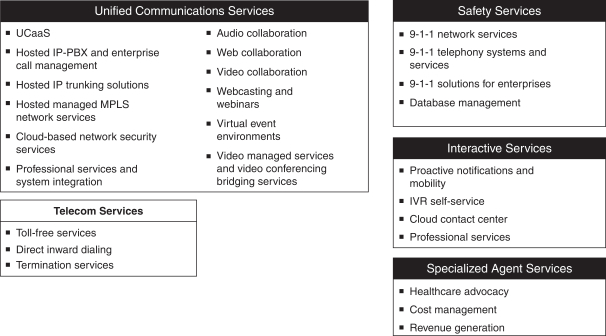

During 2015, we implemented a revised organizational structure under which our five operating segments (Unified Communications Services, Telecom Services, Safety Services, Interactive Services and Specialized Agent Services) are aggregated into four reportable segments as follows:

| • | Unified Communications Services, including collaboration services, UCasS and telecom services; |

| • | Safety Services, including 9-1-1 network services, 9-1-1 telephony systems and services, 9-1-1 solutions for enterprises and database management; |

| • | Interactive Services, including proactive notifications and mobility, interactive voice response (“IVR”) self-service, cloud contact center and professional services; and |

| • | Specialized Agent Services including healthcare advocacy services, cost management services and revenue generation. |

Beginning in 2015, all prior period comparative information has been recast to reflect this change as if it had taken place in all periods presented.

Our Services

We believe we have built our reputation as a best-in-class service provider by delivering differentiated, high-quality services for our clients. Our portfolio of technology-driven, communication services includes:

4

Table of Contents

Unified Communications Services

We provide our clients with a range of integrated unified communications (“UC”) services. We combine reliable, world-class technologies with deep experience and flexibility to provide solutions that are easy to use and scalable for every client’s specific needs. Our products and services can improve many aspects of business by enabling personalized engagement, meetings anywhere, enhanced productivity and immersive communication experiences.

UC is commonly defined as the integration of real-time enterprise communication services with non-real-time communication services like unified messaging (email, integrated voicemail, short message service (“SMS”) and fax). We focus specifically on midmarket and large enterprise clients with a complete unified communications cloud-based solution which consists of enterprise voice, conferencing and collaboration, network management, unified messaging and presence, contact center and client application integration. In addition, we continue to expand our broad communications services with support for high-end videoconferencing, Skype for Business integration, webcasts and other digital media services.

Utilizing UC services allows our clients to replace their on-premise private branch exchange (“PBX”) infrastructure with a cloud-based, hosted UC service and derive the benefits of moving from a capital expenditure investment model to a more flexible, scalable and responsive operating expense model. It also allows clients to focus their limited resources on their core business and benefit from the support, reliability and efficiency of West as their service provider. Our Unified Communications Services reportable segment includes the following:

UCaaS

| • | Unified Communications as a Service. The delivery of unified communications technology is provided as a hosted, or cloud-based, service commonly referred to as Unified Communications as a Service (“UCaaS”). Our Company has extensive experience in designing, deploying and managing UCaaS solutions as well as the ability to provide superior long-term support to our clients. Gartner, Inc. a leading research and advisory firm has positioned West in the “Leaders” quadrant of its “Magic Quadrant for UCaaS, Multiregional” report for each of the past four years. The recognition is based on West’s ability to execute and its completeness of vision in the UCaaS space. As one of 20 UCaaS providers assessed by Gartner for the 2015 report, West is one of three to be positioned within the “Leaders” quadrant. |

In its November 2015 “Critical Capabilities for Unified Communications as a Service, Global 2015” report, Gartner rated West as the strongest provider of UCaaS services in its two use cases centered on the needs of the large enterprise. West also received the second highest score for clients with a multinational unified communications requirement.

West delivers solutions that include technology from leading providers such as Cisco and Microsoft, while adding our own technology to bring together a complete UC solution for clients. West holds Cisco Gold Partner, Cisco Cloud Provider and Cisco Managed Services Channel Program Master certifications and was named the 2014 Cisco Cloud Partner of the Year U.S./Canada.

Managed Voice Services

| • | Hosted IP-PBX and Enterprise Call Management allows an enterprise to upgrade its communications technology with cloud-based, on–demand services including full PBX functionality, advanced enterprise and personal call management tools, contact center solution and leading edge unified communications features. These services can be fully integrated with a client’s existing IP or legacy time-division multiplexing (“TDM”) infrastructure where required, leveraging investments already made in telephony infrastructure and providing a seamless enterprise-wide solution. On October 31, |

5

Table of Contents

| 2015, we completed the acquisition of Magnetic North Software, Ltd., (“Magnetic North”), a leading U.K.-based provider of hosted customer contact center and unified communications solutions to enterprises. This acquisition provides us with an expanded presence in Europe, the Middle East and Africa (“EMEA”), strong partner relationships and an integrated UC contact center platform that we expect to use across our lines of business to provide clients with the capability to deliver seamless and contextual multichannel consumer experiences. |

| • | Hosted IP Trunking Solutions provide enterprise clients with carrier–grade service, along with the benefits of next–generation IP–based service that allows their business to run more efficiently. These solutions deliver a consistent set of voice services across an enterprise’s infrastructure, with flexible IP and TDM trunking options for clients’ on–site PBX. |

Network Services

| • | Hosted Managed Multiprotocol Label Switching (“MPLS”) Network Services provide enterprise clients with a mechanism for transporting data and voice content along with other real-time business applications. Centralized management services provide continuous network monitoring and management. |

| • | Cloud-Based Network Security Services aggregate a set of technologies into one simple and scalable cloud–based solution that provides clients of our MPLS network services with network protection. This service can help protect the client’s network from spam and viruses, unauthorized intrusions and inappropriate web content, while providing simplicity and consistency of security policy management and eliminating single points of failure and bottlenecks that can occur with premise-based security solutions. |

| • | Professional Services and System Integration provide our clients with advice and solutions to integrate their unified communication systems. We offer consulting, design, integration, and implementation of voice, video, messaging, and collaboration systems and services. |

Collaboration Services. We are the largest conferencing services provider in the world based on conferencing revenue according to Wainhouse Research. We have maintained our industry leadership position over the past seven years by adapting to changing client demands and technology. Frost & Sullivan awarded us with the 2015 “Global Conferencing Services Market Leadership” Award based on our vision, early recognition of evolving customer demands, focus on technology innovation, service quality, customer value and superior customer service. In 2015, for the second consecutive year, Gartner positioned the Company in the “Visionaries” quadrant of its “Magic Quadrant for Web Conferencing.”

We managed approximately 167 million conference calls in 2015, a 5 percent increase over 2014. Our collaboration solutions include the following:

| • | Audio Collaboration includes our global conferencing service that allows clients to initiate an audio conference at any time, on-demand or by appointment, self-service or with support from event professionals. Our on-demand audio conferencing solutions are available in over 180 countries and our global operator-assisted conferencing solutions are offered in 32 languages. MobileMeet is our mobile application that lets users start, join or schedule meetings from their smartphone or tablet for a seamless meeting experience. MobileMeet features include native calendar integration, push notifications and chat. |

| • | Web Collaboration allows clients to connect remote parties and bolster collaboration among groups. These web-based tools provide clients with the capability to make presentations and share applications and documents over the Internet. These services are offered through our proprietary product, InterCall Unified Meeting®, as well as through the resale of Cisco, Microsoft and Adobe products. Web conferencing services can be customized to each client’s individual needs, and are integrated with our |

6

Table of Contents

| on-demand audio conferencing platform. Tools that support mobile devices are available to address the growing business demand for wider accessibility. |

| • | Video Collaboration gives users the ability to create a virtual face-to-face experience with customers, prospects, partners and colleagues without the time commitment and expense of travel. |

Digital Media Services

| • | Webcasting and Webinars allow users to stream small or large digital media presentations over the Internet. We offer our clients the flexibility of streaming any combination of audio, video (desktop or high-end) or slides using any operating system. |

| • | Virtual Event Environments deliver targeted content directly to our clients’ audience in a fully-branded, interactive online environment. Clients are able to provide large, global audiences easy and instant access to content, experts and peers live or on demand. Examples of virtual events include trade shows, product launches, job fairs and employee town hall meetings. We offer clients consulting, project management and implementation of these virtual event environment solutions. West was named the 2014 winner of the Best Virtual Learning Environment by Elearning! and Government Elearning! Magazines. |

| • | Video Managed Services and Video Bridging Services provides clients with the ability to fully outsource the management and support of video conferencing to an experienced and trained staff. |

Telecom Services. We provide local and national tandem switching services that facilitate an efficient exchange of network traffic between originating and terminating networks throughout the U.S. We connect people and unite networks by delivering interconnection services for all types of providers, including wireless, wireline, cable and VoIP. We operate a next-generation technology-agnostic national network providing a cost effective means for TDM to IP conversion for IP networks that require access to the Public Switched Telephone Network (PSTN). We provide carrier-grade interconnections that reduce cost and merge traditional telecom, mobile and IP technologies onto a common, efficient backbone. Telecom Services also provides much of the telecommunications network infrastructure that supports our conferencing business. We offer the following telecom services:

| • | Toll-Free Services. We provide toll-free origination and termination services to wireless carriers, cable operators, Competitive Local Exchange Carriers (“CLECs”) and VoIP service providers. Our solutions provide a more scalable and efficient way for service providers to route toll-free calls. Through an extensive network of interconnections, proprietary reporting and flexible online management tools, service providers can achieve optimal network operating efficiencies. |

| • | Direct Inward Dialing. We are a licensed CLEC with our own telephone number ranges and network infrastructure. Our wholesale Direct Inward Dial service is ideal for resellers, voice service providers or calling card services who need a simple solution backed by a secure network. Our application programming interface (API) and customer portal provides clients with access to our back office tools. |

| • | Termination Services. We provide high-quality, low-cost termination service throughout the entire North American dialing plan using our soft switch platform and direct network interconnections. |

Safety Services

We provide technology solutions for wireline and wireless carriers; satellite, telematics and cable operators; VoIP providers; alarm/security companies; as well as public safety organizations, government agencies and enterprises. West services the entire public and personal safety ecosystem with reliable networks and a deep understanding of safety needs. We continue to innovate and develop next generation industry solutions that match new technologies.

7

Table of Contents

We connect people to first responders—firefighters, law enforcement, ambulance services, and the telecommunicators answering calls in public safety answering points (“PSAPs”). Our seamless, reliable, and fault tolerant infrastructure along with our data management experience and expertise are the underpinning for individuals’ requests for assistance that require the ability to be located, and have calls routed and delivered to the correct public safety agency. We provide 9-1-1 call routing, call location creation and delivery, and call delivery and accuracy compliance tools to the majority of U.S.-based telecommunications service providers including all major Incumbent Local Exchange Carriers (“ILECs”), most CLECs, as well as wireless carriers, VoIP service providers and telematics providers. We believe we are the leading database management provider in the industry, managing over 213 million ILEC, CLEC and VoIP records. We continue to develop and support new technologies for existing providers as well as support new entrants such as Over the Top (“OTT”) providers. OTT29-1-1® was successfully introduced to the market in 2015, offering a complete solution for OTT service providers to transport emergency caller requests for assistance to the appropriate agency.

We believe we are one of the largest providers of safety services based on the number of 9-1-1 calls that we and other participants in the industry facilitate and the percentage of the population served by our desktop communication technology. In 2015, we facilitated approximately 290 million 9-1-1 calls including an estimated 109 million transactions in support of our clients’ Enhanced 9-1-1 (“E9-1-1”) mobile routing and location requests.

The Company provides 9-1-1 voice and data services and/or call handling equipment to over 6,000 PSAPs across the U.S. and Canada. With nearly 15 years of running IP networks for 9-1-1 call delivery, we are uniquely positioned to help both PSAPs and telecommunications carriers meet the ever-increasing demand of emerging IP-based technologies.

We offer the following safety services:

| • | 9-1-1 Network Services are the systems that enable the routing and delivery of emergency calls to the appropriate PSAP. Wireline and wireless carriers, VoIP service providers, telematics and cable operators, alarm companies and satellite phone providers depend on West for location determination and routing and delivery services to support 9-1-1 operations and meet emergency communications requirements. |

Our i3-compliant Emergency Services IP Network (“ESInet”) provides the interoperability and advanced routing options that PSAPs need to meet standards requirements and move to the future of Next Generation 9-1-1 (NG9-1-1). Emerging technologies based on i3-compliant architecture provide increased flexibility and reliability in the delivery of 9-1-1 calls.

| • | 9-1-1 Telephony Systems and Services include our fully-integrated desktop communications technology solutions that public safety agencies use to enable E9-1-1 call handling. Our next generation 9-1-1 call handling solution is an IP-based system designed to significantly improve the information available to first responders by integrating capabilities such as the ability to send text messages, photos or video to PSAPs. |

Utilizing VoIP technology, our VIPER® system provides PSAPs with enhanced call taking efficiencies, high availability, automatic call distribution and remote deployment capabilities. VIPER has been successfully installed in thousands of call taking positions across North America.

According to Frost & Sullivan, West is the market leader, based on customer premise equipment (“CPE”) revenue, and is expected to maintain this leadership position for the entirety of Frost & Sullivan’s forecast period (2012-2020). Frost & Sullivan called West a “full end-to-end solution provider” offering “all ESInet components, systems integration, IP network, GIS and CPE.”

| • | 9-1-1 Solutions for Enterprises help organizations of all types and sizes meet their E9-1-1 obligations by routing 9-1-1 calls and detailed location information to the appropriate PSAP. We support all subscriber endpoint types, including IP phones, soft phones, and wireless phones connected to various |

8

Table of Contents

| voice platforms. The acquisition of 911 Enable in September 2014 allows us to build on our expertise in the enterprise VoIP market to deliver improved emergency response for IP-based enterprise clients across the U.S. and Canada. |

| • | Database Management. The Company manages the 9-1-1 location data for over 213 million ILEC, CLEC, and VoIP records. |

Interactive Services

We design, integrate, deliver, manage and optimize applications, services, platforms and networks that aim to create a better customer experience, strengthen customer engagement and drive efficiencies for our clients. We specialize in cloud-based communication solutions that drive a smart, personalized and convenient customer experience, including IVR self-service, proactive notifications and mobility, cloud contact center and comprehensive professional services. Our technology uses an omni-channel approach that brings together voice, text, email, push notification, fax, video, web, social media, hosted contact center and mobile to create a connected customer experience across channels. Our high-capacity and high-availability platform can be deployed in a number of ways and integrated with other inbound and outbound communication channels. In most cases, our technology also directly interfaces with our client’s internal systems, including customer relationship management, PBX and enterprise reporting platforms. In 2015, our IVR, contact center, and alerts and notifications platforms received or delivered over 6.5 billion multichannel messages on behalf of our clients. We offer the following interactive services:

| • | Proactive Notifications and Mobility empower enterprises to reach out in real time, generate stronger engagement and improve the customer experience. By learning, storing and using user preferences and behaviors, our clients can personalize automated notifications to deliver exactly what their customers want in their preferred channel. We provide customized voice, email, SMS messages and push notifications sent on behalf of our clients, delivered with personalized and contextual information directly to mobile devices, wireless phones or email inboxes. We are a leading provider of these services in the utility, healthcare, retail pharmacy and K-12 education markets in the U.S. |

| • | IVR Self Service includes integrated hosted routing, natural language speech/IVR, mobile, email and SMS solutions. Examples of self-service applications used by our clients include answer supervision and routing, accessing account balances, activation of credit cards, placing orders, answering frequently asked questions and stop/start service. In addition to providing information and enabling transactions, our solutions enable clients to track their customers’ interactions across channels and devices in order to provide a more efficient interaction. |

| • | Cloud Contact Center allows our clients to coordinate and more efficiently manage agents in multiple call centers with greater control, flexibility and cost-effectiveness. Our system allows for easy orchestration of new and existing communication channels to route conversations to skilled representatives anywhere in the world, with the context and customer information that today’s consumer expects. Our solution integrates within a client’s current technology environment, eliminating the expense and effort of replacing existing technologies. |

| • | Professional Services includes network management, application design, speech science and usability testing, customer journey mapping, strategic account support and complex business intelligence and data analytics. |

Specialized Agent Services

We provide our clients a combination of highly skilled subject matter experts with proven analytics and technology to provide solutions for the fast-growing healthcare market. We believe we are the leading provider of healthcare advocacy products and services to employees of large organizations. We also help health insurance payers, third-part administrators and self-insured employers improve cash flow and reduce healthcare costs by

9

Table of Contents

identifying and recovering overpaid and third-party liability claims. Additionally, we offer business-to-business sales across multiple vertical markets with a focus on increasing our clients’ market share and improving customer relationships. We offer the following specialized agent services:

| • | Healthcare Advocacy. We serve over 40 million Americans through more than 10,000 client relationships, including many of the nation’s largest companies. By helping members personally maneuver healthcare issues, we save our clients time and money. Our leading-edge technology platform combined with clinical experts can support consumers with any healthcare issue. We leverage the power of data analytics with pricing transparency and personalized health communications to help members make better-informed decisions and get more value from the healthcare system. Additional services include wellness coaching, Employee Assistance Programs, nurse line, biometrics screenings and chronic care solutions. We entered this market through the acquisition of Health Advocate™, Inc. (“Health Advocate”) in June 2014. |

| • | Cost Management. As a leading national provider of healthcare cost containment solutions, we help health insurance payers, third-party administrators and self-insured organizations improve cash flow and claims payment accuracy while reducing medical and administrative expenses. We do this by providing a number of solutions across the claims payment continuum, including pre-payment claims integrity (or claims accuracy) services, post-payment claims integrity services, subrogation/third-party liability identification and recovery services, and survey services. Our investigative and survey services gather information so payers/administrators have the information they need to pay claims accurately the first time. Our data analytics expertise, long-standing client partnerships and innovative solutions allow for increased dollars saved and recovered, which we believe drives down the overall cost of healthcare. |

| • | Revenue Generation. We are one of the nation’s leading providers of business-to-business sales and account management services. Leveraging our three decades of experience, we use a consultative, analytically driven approach to design and implement customized sales solutions for each partner. Our associates follow a sophisticated sales methodology and use a tailored, multichannel approach to effectively engage with customers in multiple business markets. From working as a team with our partners’ outside sales teams, to delivering revenue in assigned accounts, our revenue generation solutions help our clients drive incremental sales, increase market share and strengthen relationships with their customers. |

Market Opportunity

Consistent with our investment strategy, we have and will continue to target new and complementary markets that leverage our depth of expertise in technology-enabled communication services. As we continue to increase the variety of services we provide, we intend to pursue opportunities in markets where we are able to leverage our technology capabilities and industry expertise. We believe our strongest growth opportunities will come from UCaaS, safety services and interactive services. These businesses serve large, fast-growing markets with relatively predictable and steady growth, and are characterized by recurring, valuable transactions and strong margin profiles.

Unified Communications Services

The market for cloud-based UCaaS worldwide was approximately $10.5 billion in 2015 and is expected to grow at a compound annual growth rate (“CAGR”) of 12% through 2019 according to Gartner, Inc.

The market for worldwide audio, web and video conferencing is large and mature. The conferencing market was approximately $6.9 billion in 2015 and is expected to grow at a CAGR of 4% through 2019 according to Wainhouse Research. Through organic growth and multiple strategic acquisitions, we have become the leading global provider of conferencing services since 2008 based on revenue, according to Wainhouse Research.

10

Table of Contents

Safety Services

The market for safety services represents a highly attractive opportunity. According to Compass Intelligence, approximately $2.9 billion of government-sponsored funds were estimated to be available for 9-1-1 and next generation 9-1-1 applications, hardware and systems expenditures in 2015, and such funds are expected to grow at a 3.6% CAGR through 2019. Given the critical nature of these systems and services, government agencies and other public safety organizations prioritize funding for such services to ensure dependable delivery. Further, as communities across the U.S. upgrade outdated 9-1-1 systems to next generation 9-1-1 platforms, we believe our suite of services is best suited to capture the demand.

Interactive Services

According to Gartner, the market for SMS/mobile apps in North America will be approximately $2.7 billion in 2016 and is expected to grow at a CAGR of 26% through 2018. Gartner industry analysts believe this growth is being driven by a number of factors, including the accelerating product and technology innovation cycles leading to greater adoption of customer data analytics, self-service functions and multichannel interaction across services and consumer devices.

Technology, Industry and Societal Trends

We also believe that we are well positioned to take advantage of rapidly growing markets such as healthcare, as well as emerging technology, industry and societal trends such as IP infrastructure, unified communications, migration to cloud-based solutions, mobility, Internet of Things (“IoT”), consumer’s desire for personalized experiences, analytics or “Big Data,” globalization, a growing remote workforce and video.

Enterprises continue to shift business applications to the cloud. According to Gartner: “As premise-based telephony infrastructure reaches end of life, organizations of all sizes will increasingly evaluate cloud telephony solutions as a preferred option to purchasing another premise-based platform.” Gartner also predicts that by 2020 over 90% of enterprise voice calls in the digital workplace will originate from collaboration applications, up from less than 30% today.

Continued focus by companies on meeting the needs of more demanding consumers who want self-service and a better customer experience is propelling growth in our cloud-based customer engagement solutions like those offered by our interactive services line of business. Mobile location-based services and marketing continue to grow rapidly. We believe this “mobile-centric” mindset and the use of contextual mobile advertising and customer service will drive additional growth opportunities.

The IoT is expected to grow rapidly over the next several years. Cisco estimates that more than 50 billion devices will be connected to the Internet by 2020. Gartner believes the IoT connectivity services spending was approximately $10 billion in 2015 and will grow to $31 billion by 2020. They also estimate IoT consumer services spending was approximately $5 billion in 2015 and will grow to $39 billion by 2020. Gartner also estimates end-user spending on professional IoT services was approximately $178 billion in 2015 and will be approximately $412 billion in 2020. We see opportunities to leverage our technology to take advantage of this growth with our Safety Services and Interactive Services reportable segments.

We believe the healthcare market provides us with opportunities to leverage our technology capabilities across our lines of business. We currently serve every sector of healthcare including providers/health systems/Accountable Care Organizations, health plans/payers, self-insured employers, pharmaceutical companies and retail pharmacies. Each of these healthcare sectors is seeking new ways to serve consumers. Healthcare consumers are being compelled to take a more active role in managing their health and healthcare spend. Expanded use of communication tools and technologies that cater to consumer needs are expected to continue to grow. We have communication technologies, clinical agent support services and analytics to deliver a better, more efficient healthcare consumer experience. The initial focus of our new healthcare practice is to provide

11

Table of Contents

healthcare organizations with patient-centered communication solutions including automated communications using voice, text, email and mobile technologies along with providing clinical agents who can speak with patients on more complex health matters.

Our Competitive Strengths

We have developed expertise to serve the needs of clients who place a premium both on the services we provide and our industry expertise. We believe the following strengths have helped us to establish a leading competitive position in the markets we serve and enable us to deliver operational excellence to clients.

— Broad Portfolio of Product Offerings. Our technology platforms combined with our experience and operational expertise allow us to provide a broad range of service offerings for our clients. Our ability to provide our clients with a reliable, efficient and cost-effective alternative to process high volume, complex voice and data transactions helps them to improve their business and serve their users and customers more effectively and efficiently.

— Innovative Application of Technology Enables Scalable Operating Model. Our strengths across technology and multiple channels allow us to efficiently process transactions for our clients. We cross-utilize our assets and shared service platforms across our businesses, providing scale and flexibility to handle greater transaction volume, offer superior service and develop new offerings more effectively and efficiently. We foster a culture of innovation and have been issued approximately 332 patents and have approximately 261 pending patent applications for technology and processes that we have developed. We continue to invest in new platform technologies and to enhance our portfolio with patented technologies, which allow us to deliver premium services to our clients.

— Strong Client and Partner Relationships. We have built long-lasting, integral relationships with our clients who operate in a broad range of industries, including telecommunications, retail, financial services, safety, technology and healthcare. Our top ten clients in 2015 had an average tenure with us of over 14 years. In 2015, our 100 largest clients represented approximately 44% of our revenue and approximately 35% of our revenue came from clients purchasing multiple service offerings. We also have strong relationships with partners in many of our lines of business that significantly enhance our go-to-market sales and distribution capability. Some of our partners provide complementary technology that we integrate with our core service offerings to deliver higher value to our clients. In many of these cases, we are also able to leverage our partners’ sales and distribution capabilities. Other partners resell our services, private label our services under their brand, or integrate our services into their core products.

— Operational and Service Excellence. We achieve the results our clients are seeking through increased productivity, reliability and scale. Our ability to improve upon our clients’ communications processes is an important aspect of our value proposition. We leverage our technology infrastructure and shared services platforms to manage higher value transactions and achieve cost savings for our clients and ourselves.

— Ability to Optimize Free Cash Flow. Our business generates significant free cash flow. In 2015, we generated $274.0 million in free cash flow. We used these funds, along with the proceeds of our divestiture, to repay $258.7 million of long-term debt, acquire three companies, repurchase two million shares of our common stock, pay a dividend to shareholders and reinvest in our business. In 2016, we expect to generate between $235 million and $265 million in free cash flow. We expect to use this cash for dividends, to pay down debt, make acquisitions and for stock buybacks.

— Experienced Management Team with Track Record of Growth. Our senior leadership has an average tenure of approximately 16 years with us and has delivered strong results through various market cycles, both as a public and a private company. As a group, this team has created a culture of superior client service and growth in revenue and profitability. Our team has also established a long track record of successfully acquiring and integrating companies to drive growth.

12

Table of Contents

As demand for outsourced services grows with greater adoption of our technologies and services, we believe our long history of delivering results for our clients combined with our scale and the investments we have made in our businesses provide us with a significant competitive advantage.

Our Business Strategy

Our strategy is to identify growing markets where we can deploy our existing assets, experience and expertise to strengthen our competitive position. Our strategy is supported by our commitment to superior client service, operational excellence and market leadership. Key aspects of our strategy include the following:

— Expand Relationships with Existing Clients. We are focused on deepening and expanding relationships with our existing clients by delivering value in the form of reduced costs, improved customer relationships and enhanced revenue opportunities. Approximately 35% of our revenue in 2015 came from clients purchasing multiple service offerings from us. We intend to leverage our large global sales team and diversified client base to continue to cross-sell our services. We seek out clients with plans for growth and expect to participate in that growth along with our clients. As we demonstrate the value that our services provide, often starting with a single service, we are frequently able to expand the size and scope of our client relationships.

— Develop New Client Relationships. We will continue to focus on building long-term client relationships across a wide range of industries to further diversify our revenue base. We target clients in industries in which we have expertise or other competitive advantages and an ability to deliver a wide range of solutions that have a meaningful impact on their business. By continuing to add new long-term client relationships in large and growing markets, we believe we enhance the stability and growth potential of our revenue base.

— Capitalize on Select Global Opportunities. In addition to expanding and enhancing our existing relationships domestically, we will selectively pursue new client opportunities globally. Our expertise in collaboration services has allowed us to penetrate substantial international markets. In 2015, approximately 21% of our consolidated revenue was generated outside of the U.S. We believe our distribution capabilities, including approximately 344 international sales personnel, provide us with the opportunity to drive incremental revenue. We anticipate that the 2015 acquisition of U.K.-based Magnetic North will drive additional opportunities internationally.

— Continue to Enhance Leading Technology Capabilities. We believe our service offerings are enhanced by our superior technology capabilities and track record of innovation, and we will continue to target services where our reliability, scale and efficiencies enable us to address our clients’ communication issues or enhance the results of their communications.

— Continue to Enhance Our Market Position Through Selective Acquisitions. Since 2000, we have completed 33 acquisitions of businesses and technologies with a total value of approximately $2.9 billion. We will continue to expand our suite of communication services across industries, geographies and end-markets. While we expect this will occur through organic growth, we expect to continue to acquire assets and businesses that strengthen our value proposition to clients and drive value to us. We have developed an internal capability to source, evaluate and integrate acquisitions that we believe has created value for shareholders.

Sales and Marketing

Generally, our sales personnel target growth-oriented clients and selectively pursue those with whom we have the greatest opportunity for long-term success. Their goals are both to maximize our current client relationships and expand our client base. To accomplish these goals, we attempt to sell additional services to existing clients and to develop new relationships. We generally pay commissions to sales professionals on both new sales and incremental revenue generated from existing clients.

13

Table of Contents

At December 31, 2015, we had approximately 804 sales and marketing personnel in our Unified Communications Services reportable segment, approximately 49 sales and marketing personnel in our Safety Services reportable segment, approximately 22 sales and marketing personnel in our Interactive Services reportable segment and approximately 98 sales and marketing personnel in our Specialized Agent Services reportable segment.

Competition

Unified Communications Services

The UCaaS market is a highly competitive and fast-growing market characterized by a large number of traditional carrier service providers entering the mid-market to enterprise market with proprietary versions of hosted or “cloud-based” unified communications service offerings, as well as SMB-targeting competitors who compete more aggressively on price. The principal competitive factors include, among others, experience in implementing and designing enterprise level networks, on-demand and integrated hosted communications and collaboration platforms and expertise in integration of a broad variety of unified communications applications both in implementation and professional services consultation. Our principal competitors in this industry at the enterprise level include Microsoft, AT&T, Verizon, BT, ShoreTel and Google for hosted services solutions and IBM, Hewlett-Packard, Verizon Business and regional integrated service vendors for professional services. We also face competition from clients who implement premise-based solutions from providers like Avaya, Cisco and ShoreTel. The small to medium sized business market has hundreds of regional competitors with a few, such as 8x8 and RingCentral that compete on a national scale.

The principal competitive factors in the collaboration services market include range of service offerings, global capabilities, price and quality of service. Our principal competitors include AT&T, Verizon, PGi, BT Conferencing, Cisco Systems, Citrix, Adobe and other premise-based solution providers.

The principal competitive factors in the telecom services market include network performance, coverage, breadth of interconnections, pricing and the ability to support converging technologies (TDM or IP). Competitors in this market include Inteliquent, Peerless Network and a limited number of CLECs.

Safety Services

The market for safety services is competitive. The principal competitive factors in wireline and wireless safety services are the effectiveness of existing infrastructure, scalability, reliability, ease of use, price, technical features, scope of product offerings, customer service and support, ease of technical migration, useful life of new technology and wireless support. Competitors in the incumbent local exchange carrier and competitive local exchange carrier markets generally include internally developed solutions as well as TeleCommunications Systems. Competitors in the mobility (wireless, VoIP, OTT, cable, alarm) market include TeleCommunications Systems and competitors in the VoIP services market include Bandwidth.com, Inc. Competition in the public safety desktop market is driven by features, functionality, ease of use, price, reliability, upgradability, capital replacement and upgrade policies and customer service and support. Competitors in this market include Airbus DS Communications and EmergiTech.

Interactive Services

Within interactive services, the alerts and notifications market is highly competitive and fragmented, characterized by a large number of vertically focused competitors addressing specific industries, including healthcare, travel, education, credit collection and government. The principal competitive factors in this market are speed of delivery and implementation, the ability to deliver complex and integrated communications across multiple channels, the effective use of analytics, the capacity and scalability of processing those transactions reliably and the cost of delivering solutions.

14

Table of Contents

In the IVR self-service and hosted contact center market, competition ranges from large integrators and telecommunications companies to niche providers focused on singular products and software companies. Competitors in this market include Genesys, Interactive Intelligence, InContact, Nuance, AT&T and Verizon Business.

Specialized Agent Services

The principal competitive factors in the specialized agent services markets in which we participate include, among others, quality of service, industry-specific expertise and price. Competitors in the healthcare advocacy market include health insurance plan providers as well as companies that specialize in specific programs we offer, such as employee assistance plans or wellness programs. Competition in the business-to-business services market generally comes from companies that perform these activities in-house. Competitors in the cost management industry include a company’s internal operations, Cotiviti Corporation, The Rawlings Group and Optum.

Our Clients

Our clients vary by line of business and operate in a wide range of industries, including telecommunications, retail, financial services, government, education, utilities, technology and healthcare. We have tens of thousands of clients that use our services, ranging from small businesses to Fortune 100 clients.

Although we serve many clients, we derive a significant portion of our revenue from relatively few clients. In 2015, our 100 largest clients accounted for approximately 44% of our revenue. No client accounted for 10% or more of our revenue in 2015.

Our Personnel

As of December 31, 2015, we had approximately 10,630 total employees, of which approximately 4,180 were employed in the Unified Communications Services reportable segment, approximately 1,210 were employed in the Safety Services reportable segment, approximately 1,380 were employed in the Interactive Services reportable segment, approximately 3,340 were employed in the Specialized Agent Services reportable segment and approximately 520 were employed in corporate support functions. Of the total employees, approximately 2,160 were international employees.

Employees of our subsidiaries in France and Germany are represented by local works councils. Employees in France and certain other countries are also covered by the terms of industry-specific national collective agreements. Our employees are not represented by any labor organization in the United States. We believe that our relations with our employees and the labor organizations identified above are good.

Our Technology and Systems Development

Technology is critical to our business and we believe the scale and flexibility of our platforms is a competitive strength. Our software and hardware systems, as well as our network infrastructure, are designed to offer high-quality, integrated solutions. We have made significant investments in reliable hardware systems and integrated commercially available software when appropriate. Our technological platforms are designed to handle greater transaction volume than our competitors. Because our technology is client focused, we often rely on internally developed software systems to customize our services. As of December 31, 2015, we employed a staff of approximately 2,500 professionals in our technology departments.

We recognize the importance of providing uninterrupted service for our clients. We have invested significant resources to develop, install and maintain facilities and systems that are designed to be highly reliable and scalable. Our facilities and systems are designed to maximize system availability and minimize the possibility of service disruption.

15

Table of Contents

We have network operations centers that operate 24 hours a day, seven days a week and use both internal and external systems to effectively operate our equipment, people and sites. We interface directly with telecommunications providers and have the ability to manage capacity in real time. Our network operations centers monitor the status of elements of our network on a real-time basis. All functions of our network operations centers have the ability to be managed at backup centers.

We rely on a combination of copyright, patent, trademark and trade secret laws, as well as on confidentiality procedures and non-compete agreements, to establish and protect our proprietary rights in each of our segments. At December 31, 2015, we owned approximately 332 registered patents and approximately 313 registered trademarks including several patents and trademarks that we obtained as part of our past acquisitions. Certain of our patents will expire in 2018. From time to time, we may sell a portion of our patent portfolio, when we have concluded that the benefit of the sale outweighs the benefits to our business of continuing to maintain exclusive ownership of the applicable patents. We do not expect these patent expirations or sales to have a material adverse effect on our business. Trademarks continue as long as we actively use the mark. We have approximately 261 pending patent applications pertaining to technology relating to transaction processing, call center and specialized agent management, data collection, reporting and verification, collaboration and credit card processing. New patents that are issued have a life of 20 years from the date the patent application is initially filed. We believe the existence of these patents and trademarks, along with our ongoing processes to add additional patents and trademarks to our portfolio, may be a barrier to entry for specific products and services we provide and may also be used for defensive purposes in certain litigation.

Our International Operations

In 2015, revenue attributed to foreign countries was approximately 21% of our consolidated revenue and long-lived assets attributed to foreign countries were approximately 8% of our total consolidated long-lived assets.

In 2015, we operated out of facilities in the U.S. and approximately 20 foreign jurisdictions in North and South America, EMEA and Asia-Pacific (“APAC”).

For additional information regarding our domestic and international revenues, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Financial Statements included herewith.

Government Regulation

Privacy

We provide services to healthcare clients that, as providers of healthcare services, are considered “covered entities” under the Health Insurance Portability and Accountability Act of 1996 (“HIPAA”). As covered entities, our clients must comply with standards for privacy, transaction and code sets, and data security. Under HIPAA, we are sometimes considered a “business associate,” which requires that we protect the security and privacy of “protected health information” provided to us by our clients. We have implemented HIPAA and Health Information Technology for Economic and Clinical Health Act (“HITECH”) compliance training and awareness programs for our healthcare services employees. We also have undertaken an ongoing process to test data security at all relevant levels. In addition, we have reviewed physical security at all healthcare operation centers and have implemented systems to control access to all work areas.

In addition to healthcare information, our databases contain personal data of our customers and clients’ customers, including credit card and other personal information. Federal law requires protection of customer proprietary network information (“CPNI”) applicable to our clients. Federal and state laws in the U.S. as well as those in the European Union require notification to consumers in the event of a security breach in or at our

16

Table of Contents

systems if the consumers’ personal information may have been compromised as a result of the breach. We have implemented processes and procedures to reduce the risk of security breaches, and have prepared plans to comply with these notification rules should a breach occur. Any failures in our security and privacy measures, however, could adversely affect our business, financial condition and results of operations. See the risk factors related to security breaches in “Risk Factors.”

Telecommunications

Our Safety Services, Unified Communications Services and Interactive Services reportable segments are subject to significant regulation by the Federal Communications Commission (“FCC”) and state utility commissions. For some services, we are required to maintain licenses with the FCC and/or state utility commissions.

With respect to Safety Services, our wholly-owned indirect subsidiary, Intrado Communications Inc. (“Intrado Communications”) is subject to various regulations as a result of its status as a regulated competitive local exchange carrier, and/or an emergency services provider, and/or an inter-exchange carrier, including state utility commissions’ regulations and FCC regulations adopted under the Telecommunications Act of 1996, as amended. Intrado Communications holds licenses from public utility commissions in 45 states and the District of Columbia. Its wholly owned affiliate, Intrado Communications of Virginia holds a license in Virginia. Also, under the New and Emerging Technologies 9-1-1 Improvement Act of 2008 (NET911 Act, P.L. 11-283, 47 U.S.C. 609) and its attendant FCC regulations (WC Docket No. 08-171, Report and Order dated October 21, 2008), West’s wholly owned subsidiary, Intrado Inc., is required to provide access to VoIP telephony providers certain 9-1-1 and E9-1-1 elements.

On December 12, 2013, the FCC released a Report and Order (“9-1-1 Order”), Improving 9-1-1 Reliability, Reliability and Continuity of Communications Networks, Including Broadband Technologies, FCC 13-158, requiring 9-1-1 Service Providers (as defined in the 9-1-1 Order), among other things, to certify that the 9-1-1 Service Provider has audited and identified critical 9-1-1 transmission and monitoring facilities and taken reasonable steps to ensure reliability. For the purpose of these certifications, Intrado Communications may need cooperation from third party providers of network services to obtain relevant data. The providers Intrado Communications relies on may not be able to provide the necessary data or may not agree to provide the necessary data at a reasonable commercial rate.

The market in which our Safety Services business unit operates may also be influenced by legislation, regulation, and judicial or administrative determinations which seek to promote a national broadband plan, a nationwide public safety network, next generation services, and/or competition in local telephone markets, including 9-1-1 service as a part of local exchange service, or seek to modify the Universal Service Fund (“USF”) program.

On November 11, 2014, the FCC issued a Policy Statement and Notice of Proposed Rulemaking (“NPRM”), FCC 14-186, proposing to add additional 9-1-1 reliability requirements and to expand the scope of 9-1-1 Service Providers to which the rules apply. The NPRM also proposes certification of new 9-1-1 Service Providers as well as notice and approval requirements when 9-1-1 Service Providers change network configuration or discontinue service. The FCC has taken comments on the NPRM, and we are analyzing any potential further impact to our Safety Services business unit. If the rules are adopted, they could impact business operations and require costs associated with compliance.

Through our wholly owned subsidiary West IP Communications, Inc. (“WIPC”), we provide interconnected VoIP services, which are subject to certain requirements imposed by the FCC, including without limitation, obligations to provide access to 9-1-1, pay federal universal service fees and protect CPNI, even though the FCC has not classified interconnected VoIP services as telecommunications services. The regulatory requirements applicable to WIPC’s VoIP services could change if the FCC determines the services to be telecommunications services regulated under Part II of the Communications Act.

17

Table of Contents

Federal laws regulating the provision of traditional telecommunications services may adversely impact our collaboration business. Our collaboration business has submitted forms to the Universal Service Administrative Company (“USAC”) and paid federal USF and similar fees since August 1, 2008 based on our good faith interpretation of the revenue reporting requirements and classification of our services. To the extent that USAC or the FCC disagrees with the methodology or classification of our services, we may be subject to additional costs and obligations applicable to more traditional telecommunications service providers.

Through our wholly owned indirect subsidiary, West Telecom Services, LLC (formerly HyperCube Telecom Services, LLC) (“West Telecom Services”), we act as a telecommunications carrier and provider of switching services throughout the United States. West Telecom Services routes communications traffic to all other carriers, including wireless, wireline, cable telephony and VoIP companies. West Telecom Services has obtained licenses to offer telecommunications services from the FCC and authorization to offer facilities-based and resold telecommunications services from state utility commissions in 47 states and the District of Columbia.

The FCC exercises regulatory authority over the pricing of the tandem transit and access services offered by West Telecom Services. On November 18, 2011, the FCC released a Report and Order and Further Notice of Proposed Rulemaking, FCC Release No. 11-161 (“FCC Order”) that comprehensively reforms the system under which regulated service providers compensate each other for the termination of interstate, intrastate, and local traffic. The FCC adopted bill-and-keep as the ultimate uniform, national methodology for all terminating telecommunications traffic exchanged with a local exchange carrier. Under bill-and-keep, the rate for exchanging terminating traffic is zero and terminating carriers look to their subscribers to cover the costs of providing termination services. The FCC Order did not address rate levels for tandem transit services.

The rules adopted by the FCC provide for a multi-year transition to a national uniform bill-and-keep framework. Carriers were required to cap most terminating interstate and intrastate intercarrier compensation rate elements as of December 29, 2011. To reduce the disparity between intrastate and interstate terminating end office rates, carriers were required to bring intrastate rates, where they were higher than interstate rates, to the level of interstate rates in two steps, the first by July 1, 2012, and the second by July 1, 2013. Thereafter, carriers such as West Telecom Services must reduce their interstate and intrastate termination and transport rates to bill-and-keep by July 2018.

As part of the transition of the intercarrier compensation system to bill-and-keep, the FCC also established in the FCC Order a prospective intercarrier compensation framework for traffic exchanged over public switched telephone network facilities that originates and/or terminates in IP format (“VoIP-PSTN traffic”). The FCC found that where a providers’ interconnection agreement does not address the appropriate rate for such traffic, the default intercarrier compensation rate for all toll terminating and originating VoIP-PSTN traffic would be equal to interstate access rates, while the default intercarrier compensation rate for other VoIP-PSTN traffic would be the otherwise-applicable reciprocal compensation rates. To collect the compensation for originating or terminating VoIP-PSTN traffic in IP traffic, a local exchange carrier, or its VoIP provider partner, must perform functions functionally equivalent to the switched access functions of non-VoIP-PSTN traffic performed by local exchange carriers. The FCC also addressed intercarrier compensation between wireline carriers and wireless providers in the FCC Order. Among other things, the FCC adopted bill-and-keep as the default methodology for all non-access traffic between wireless and wireline providers.

In the Further Notice of Proposed Rulemaking adopted as part of the FCC Order, the FCC sought comment on the appropriate transition and recovery mechanism for the rate elements not reduced as part of the FCC Order, including originating access (including originating charges for 8YY traffic) and certain common and dedicated transport. The FCC also sought comment on the appropriate policy framework for IP-to-IP interconnection. We cannot predict the timing or outcome of these proposals.