Attached files

| file | filename |

|---|---|

| 8-K - FORM 8K - CenterState Bank Corp | d725088d8k.htm |

Gulf South Bank

Conference

New Orleans

May 12, 2014

Ernest S. Pinner, Chairman & CEO

James J. Antal, Chief Financial Officer

Stephen D. Young, Treasurer (and

chief operating officer of subsidiary

bank)

Exhibit 99.1 |

This

presentation

contains

forward-looking

statements,

as

defined

by

Federal

Securities

Laws,

relating

to

present

or

future

trends

or

factors

affecting

the

operations,

markets

and

products

of

CenterState

Banks,

Inc.

(CSFL).

These

statements

are

provided

to

assist

in

the

understanding

of

future

financial

performance.

Any

such

statements

are

based

on

current

expectations

and

involve

a

number

of

risks

and

uncertainties.

For

a

discussion

of

factors

that

may

cause

such

forward-looking

statements

to

differ

materially

from

actual

results,

please

refer

to

CSFL’s

most

recent

Form

10-Q

and

Form

10-K

filed

with

the

Securities

Exchange

Commission.

CSFL

undertakes

no

obligation

to

release

revisions

to

these

forward-looking

statements

or

reflect

events

or

circumstances

after

the

date

of

this

presentation.

Forward Looking Statement

2

2 |

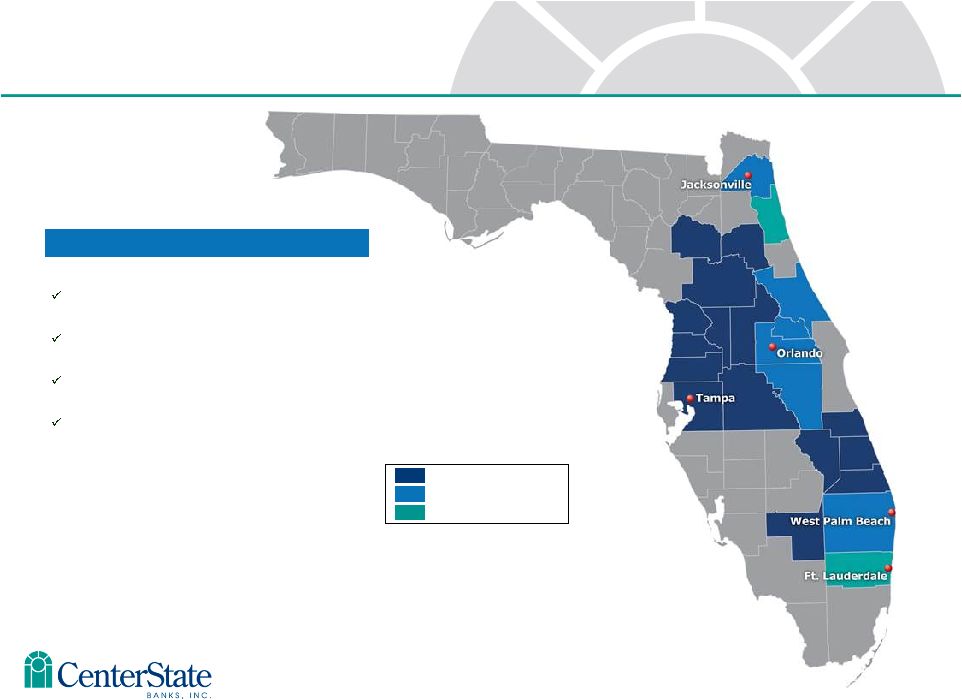

Company Overview |

Correspondent

Banking Market As of 3/31/14

•

Headquartered in Davenport, FL

$3.0 billion in assets

$1.8 billion in loans

$2.6 billion in deposits

•

Company formed: June 2000

1 Subsidiary Bank

51 Branch banking offices

Correspondent Segment

Corporate Overview

4 |

18

CSFL –

Best Positioned Florida Consolidator

Source: SNL Financial

Data as of MRQ available

5

Ocala National Bank (Jan 2009)

Olde Cypress Community Bank (July 2010)

Independent National Bank of Ocala (Aug 2010)

Community National Bank of Bartow (Aug 2010)

Central Florida State Bank (Jan 2012)

First Guaranty Bank & Trust Co. (Jan 2012)

Federal Trust Acquisition

from

The Hartford Insurance Company (Nov 2011)

TD Bank divesture in Putnam (Jan 2011)

Gulfstream Business Bank in Stuart (Jan 2014)

First Southern Bancorp (Pending)

FDIC Acquisitions

Non-FDIC Acquisitions |

Gulfstream

Business Bank – Closed January 17, 2014

Offices:

4

Assets:

$545 million

Deposits:

$467 million

Loans:

$376 million

Gulfstream

Highlights

(1)

(1) Financial data as of 12/31/13

Gulfstream (4 branches)

CSFL (55 branches)

6

Port St. Lucie

Stuart

Jupiter

Delray Beach

Lake

Okeechobee

Vero Beach

Fort Pierce |

7

Efficiency Initiatives

Total fully phased-in expense

reduction –

$6 million annually

Branch closures –

$2.7 million annually

Other restructuring and expense

reductions –

$3.3 million annually

8 branch closings in April 2014 |

(1)

Based on financial data as of December 31, 2013

Source: CSFL Management, FSOF Management

First Southern Highlights

(1)

Offices:

17

Assets:

$1,093 million

Deposits:

$883 million

Loans:

$635 million

CSFL Branches

CSFL & FSOF Branches

FSOF Branches

First Southern Bancorp, Inc. –

Expected to close June 2014

8 |

Florida

Trends 9

Source: U.S. Census Bureau and Bureau of Labor Statistics |

10

Source:

Florida

Realtors

Monthly

Market

Detail

(March

2014)

–

Single

Family

Homes

Florida Real Estate –

Single Family Homes

10

24,000

22,000

20,000

18,000

16,000

14,000

12,000

10,000

$190K

$180K

$170K

$160K

$150K

$140K

$130K

$120K

$110K

190,000

170,000

150,000

130,000

110,000

90,000

70,000 |

1st

Quarter

Financial

Summary |

12

1st Quarter Summary of Financial Results

1Q14

4Q13

EPS

$0.03

$0.06

Operating EPS

$0.13

$0.07

•

Merger related expenses

Gulfstream $2,072

First Southern $275

•

Efficiency initiatives-

charges

Impairment charges $2,653

RIF severance $505

•

Efficiency improvements

•

GSB & Branch closures

•

NIM unchanged

•

4.65% vs. 4.65%

•

PCI loans and IA effect

•

ALLL

•

Credit issues in rear view mirror

•

Bond sales

•

First Southern effect

Current Qtr take-aways |

13

NIM Summary

1. Interest bearing deposits. Does not include non-interest bearing checking

accounts. 13

1Q14

4Q13

Average

Avg

Average

Avg

Balance

Rate

Balance

Rate

Loans

$1,513,060

4.75%

$1,229,868

4.64%

PCI loans

251,587

13.27%

240,804

13.00%

Securities

532,046

3.04%

453,658

2.94%

Fed funds sold and other

197,915

0.49%

161,270

0.52%

Total interest earning assets

$2,494,608

4.91%

$2,085,600

4.92%

Interest

bearing

deposits¹

$1,653,806

0.33%

$1,405,244

0.35%

All other

94,340

1.08%

71,505

0.96%

Total interest bearing liabilities

$1,748,146

0.37%

$1,476,749

0.38%

Net Interest Margin

4.65%

4.65% |

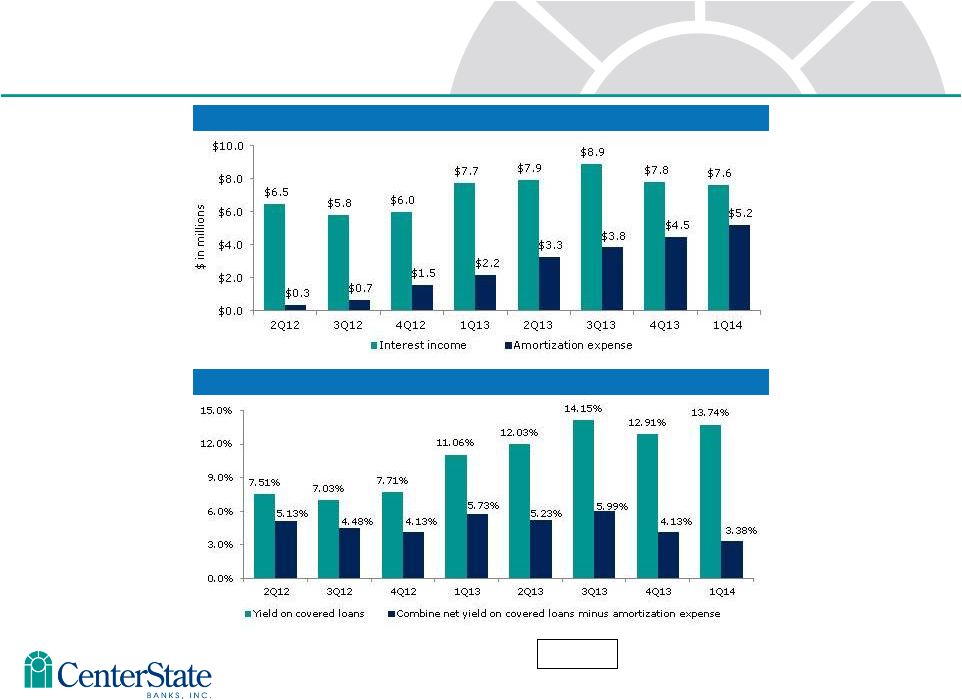

14

Relationship between Covered loans and FDIC indemnification asset (IA)

14

Covered Loans –

Average Yields*

* As adjusted, excludes accelerated accretion related to ASC 310-10 loans

IA Amortization Expense

At 3/31/14 remaining projected IA to be amortized ($34M) |

15

Loan Growth, excludes PCI loans

Loan Production by Quarter

•

Avg yld funded loans 4.54%

•

27% Resi

•

33% CRE

•

24% C&I

•

16% all other

•

Loan pipeline:

End of 1Q14: $140M

End of 4Q13: $114M

End of 3Q13: $124M

End of 2Q13: $150M

End of 1Q13: $175M

Current Quarter Loan Production |

16

16

ALLL –

excluding PCI Loans

FAS 5 Component (excluding Gulfstream)

Total ALLL (excluding PCI loans)

Loan Balance

ALLL

Loans (Fas 5)

$1,218,614

$16,994

1.39%

Gulfstream loans

319,665

---

---

Impaired Loans (Fas 114)

26,555

1,919

7.23%

Total Non-PCI Loans

$1,564,834

$18,913

1.21%

ALLL as a % of NPLs=

62% |

17

ALLL –

PCI loans

17

FDIC

Not

Total

% of

Covered

Covered

PCI Loans

Legal Bal

Legal Balance

$291,821

$41,540

$333,361

100%

Discount Balance

(72,088)

(10,473)

(82,561)

(25%)

Book Value

$219,733

$31,067

$250,800

75%

ALLL

(1,183)

---

(1,183)

Total, net of ALLL

$218,550

$31,067

$249,617 |

18

Credit Metrics

Credit Related Expenses

Net Charge-offs

18 |

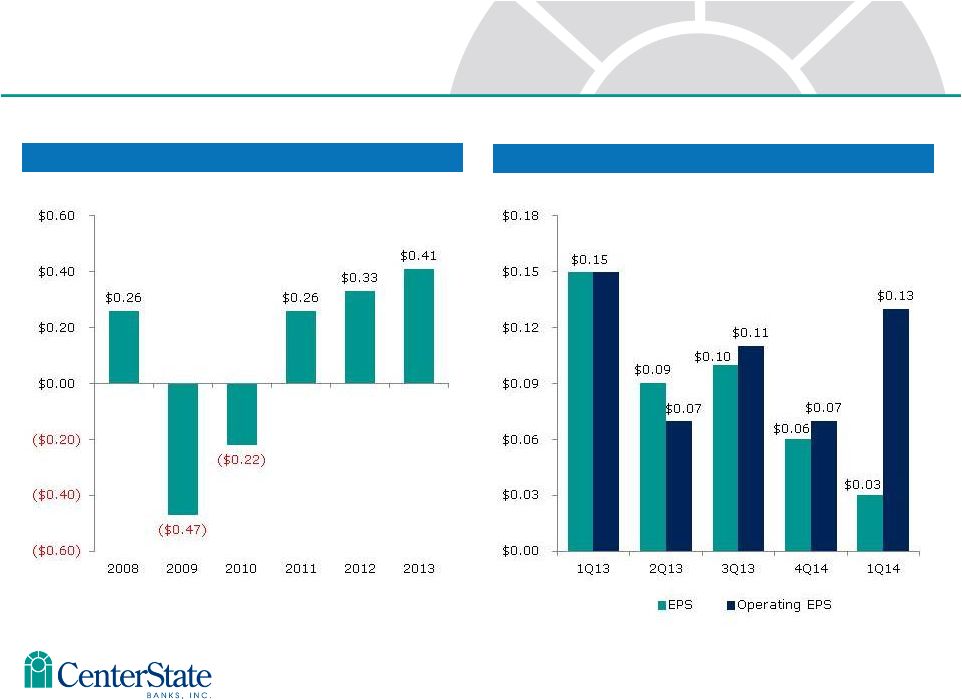

EPS

– 6 years

Profitability Metrics

19

EPS & Operating EPS -

5 quarters |

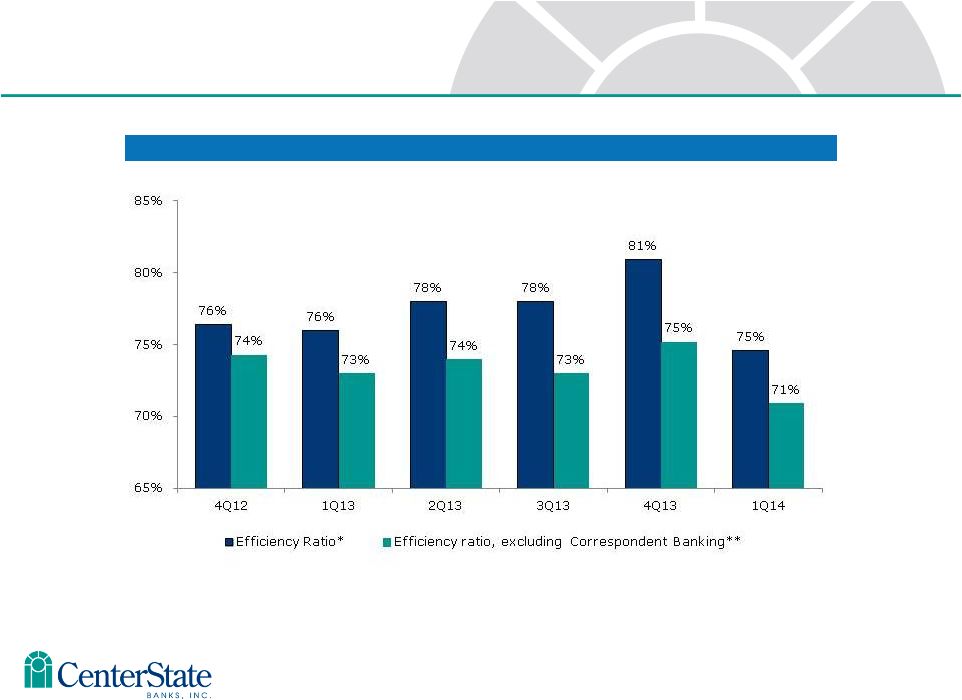

10

Efficiency Ratio

Operating Efficiencies

20

*

Efficiency

Ratio

is

defined

as

follows:

[non-interest

expense

–

intangible

amortization

–

credit

related

expenses

–

merger

related

expenses

–

other

nonrecurring

expense]

/

[net

interest

income

(fully

tax

equivalent)

+

non-interest

income

–

gain

on

sale

of

AFS

securities

–

FDIC

indemnification

revenue

–

nonrecurring

income]

**Efficiency

Ratio,

excluding

Correspondent

Banking

is

defined

as

follows:

[non-interest

expense

–

Correspondent

Banking

non-

interest

expense

–

intangible

amortization

–

credit

related

expenses

–

merger

related

expenses

–

other

nonrecurring

expense]

/

[net

interest

income

(fully

tax

equivalent)

–

Correspondent

Banking

net

interest

income

+

non-interest

income

–

Correspondent

Banking

non-interest

income

–

gain

on

sale

of

AFS

securities

–

FDIC

indemnification

revenue

–

nonrecurring

income] |

Loan Portfolio |

Total Loans by

Type Total Loans Detail

Loan Type

No. of

Loans

Balance

Avg Loan

Balance

Residential Real

Estate

4,715

$ 495 MM

$105,000

CRE-Owner

Occupied

957

$ 387 MM

$404,400

CRE-Non Owner

Occupied

646

$ 349 MM

$540,200

Construction,

A&D, & Land

465

$ 61 MM

$131,200

Commercial &

Industrial

1,858

$ 218 MM

$117,300

Consumer & All

Other

2,874

$ 55 MM

$19,100

Total

11,515

$ 1,565 MM

$135,900

Total

Loan

Portfolio

as

of

March

31,

2014

Excluding purchased credit-impaired loans

22 |

Loans, excluding

PCI loans Yields (TEY)

Average Balances

23

New Loan Production –

Average Yields

New Loan Production |

Covered Loans

– Average Yields*

Covered Loans –

Average Balances

Covered Loans, included in total PCI loans

24

* Excluding accelerated accretion related to ASC 310-10 loans

|

25

25

FDIC Indemnification Asset

$34M

FDIC

Reimbursement

Write-Off

$43M

Collect from Borrower

(or sale of OREO)

$31M

Expected reimbursements from FDIC for 80% of expected losses

$34M

Previously expected reimbursements for previously expected losses no longer expected

$65M

Total indemnification assets

Written off over the lesser of the remaining expected life of the related loan pool(s) or the

remaining term of the related loss share agreement(s).

Amortization of Indemnification Asset ($34M)

as of March 31, 2014 |

26

Indemnification Asset (“IA”) amortization and its relationship

with FDIC covered loan interest income accretion

26

Interest Income and Amortization Expense

8 Quarter Average =

4.78%

Yields on Covered Loans and Indemnification Asset |

Credit Trends

27

NPAs / Loans & OREO (%)

Source: SNL Financial, MRQ presented if current quarter not yet available

Nonperforming assets include loans 90 days or more past due, nonaccrual loans, and

OREO/ORA; and exclude FDIC covered assets Southeastern peers include ABCB, PNFP, RNST,

SCBT, UBSH and UCBI. Florida peers include all banks headquartered in Florida with total

assets between $500 million and $5 billion. |

Deposit Portfolio |

Total

Deposits by Type Total Deposits Detail

23

Total

Deposit

Portfolio

as

of

March

31,

2014

Deposit Type

No. of

Deposits

Balance

Avg Deposit

Balance

Demand

Deposits

43,283

$ 839 MM

$19,400

Now Accounts

50,961

$ 559 MM

$11,000

Savings

Deposits

17,487

$ 235 MM

$13,400

Money Market

4,442

$ 482 MM

$108,600

Certificates of

Deposits

11,402

$ 444 MM

$38,900

Total

127,575

$ 2,559 MM

$20,100

29 |

Core deposits

defined as non-time deposits. Total Deposits

Number of Deposit Accounts (000’s)

Building Franchise Value with Core Deposits

30

Value of core deposits not fully

realized in this low rate environment.

Approximately 127,575 total accounts

-

$20,056 average balance per account

Cost of Deposits |

|

Appendix

|

1.

Assumes 8% capital allocation. Correspondent Analysis

33

Correspondent Earnings Ratios

2009

2010

2011

2012

2013

ROE

38.06%

59.07%

33.14%

58.80%

15.99%

ROA

3.04%

4.73%

2.65%

4.70%

1.28%

Net Capital Mkt Revenue

Fixed Non-Interest

Expense

Net Interest Income

Net Income

$0

$2,000,000

$4,000,000

$6,000,000

$8,000,000

$10,000,000

$12,000,000

$14,000,000

$16,000,000

$18,000,000

2009

2010

2011

2012

2013

Correspondent Income Analysis

1 |

Correspondent

Analysis 34

$0

$200,000

$400,000

$600,000

$800,000

$1,000,000

$1,200,000

2009

2010

2011

2012

2013

Recurring Revenue

International

Clearing/Fed Funds

BA / SK

Asset Liability |