Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GLOBE SPECIALTY METALS INC | form8k3q2014.htm |

| EX-99.1 - PRESS RELEASE Q3 FY14 - GLOBE SPECIALTY METALS INC | pressrelease3q2014.htm |

3rd Quarter 2014 Earnings Call May 9, 2014

* Disclaimer This presentation may contain statements that relate to future events and expectations and, as such, constitute "forward-looking statements" within the meaning of the federal securities laws. These statements can be identified by the use of words such as “believes,” “expects,” “may,” “will,” “intends,” “plans,” “estimates” or “anticipates,” or other comparable terminology, or by discussions of strategy, plans or intentions. These statements are based on management’s current expectations and assumptions about the industries in which Globe operates. Globe disclaims any intention or obligation to update publicly any forward-looking statements, whether in response to new information, future events or otherwise, except as required by applicable law. Forward-looking statements are not guarantees of future performance and are subject to significant risks and uncertainties that may cause actual results or achievements to be materially different from the future results or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, those risks and uncertainties described in Globe’s most recent Annual Report on Form 10-K, including under “Special Note Regarding Forward-Looking Statements” and “Risk Factors” and Globe’s quarterly reports on Form 10-Q. These reports can be accessed through the “Investors” section of Globe’s website at www.glbsm.com. EBITDA, adjusted EBITDA and adjusted diluted earnings per share are non-GAAP measures. Reconciliations of these measures to the comparable GAAP financial measures are provided in the financial statements included in Globe’s most recent earnings press release, available through the “Investors” section of Globe’s website at www.glbsm.com. All references to “MT” or “tons” mean metric tons, each of which equals 2,204.6 pounds.

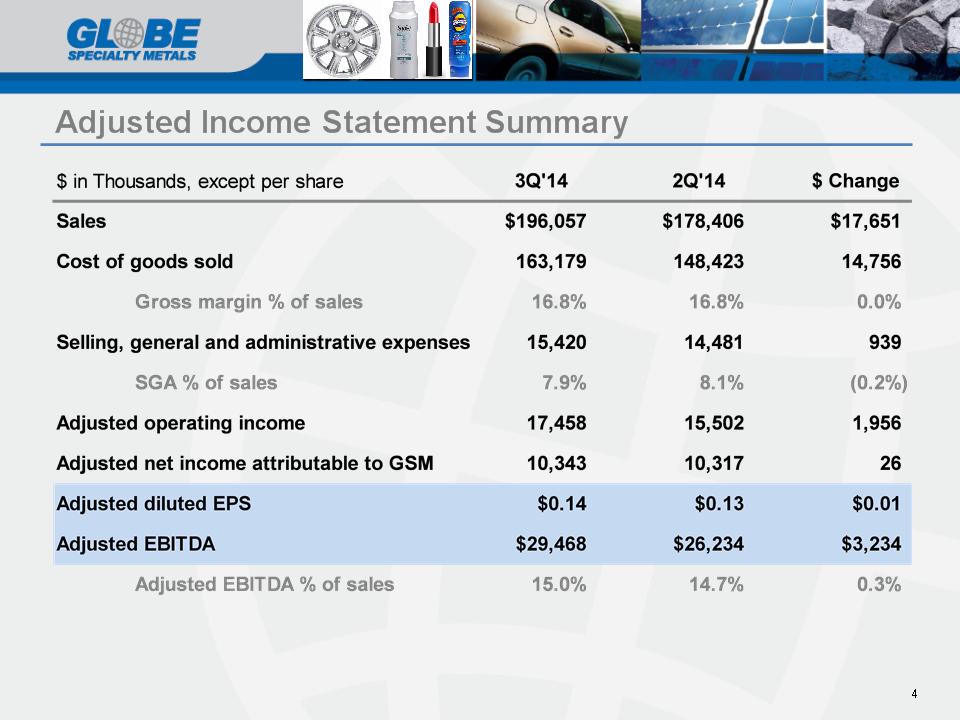

* Sales volume of 73,926 MT in the third quarter, up 11% from the prior quarter. Sales of $196.1 million in the third quarter, up 10% from the prior quarter. Adjusted EBITDA for the third quarter was $29.5 million, up 12% from the prior quarter. Adjusted diluted earnings per share attributable to GSM for the third quarter was $0.14, an increase of 8% from the prior quarter. Volumes and pricing increased providing Adjusted EBITDA margin expansion, and cash flow to execute our share repurchases during the quarter. 3rd Quarter 2014 Financial Highlights

* Adjusted Income Statement Summary

* 3rd Quarter 2014 Special Items

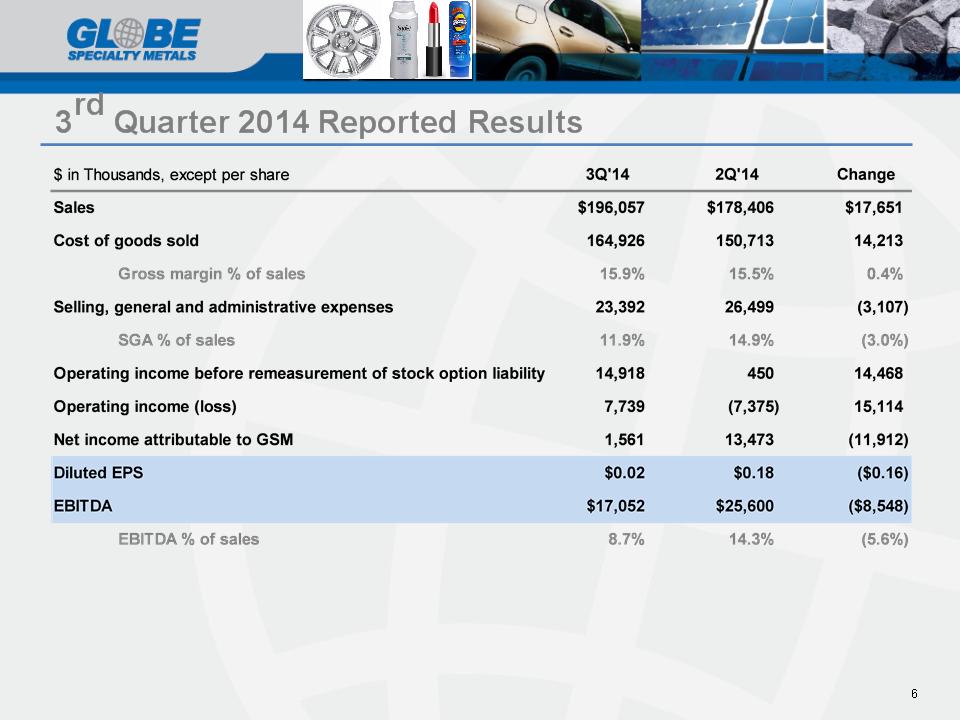

* 3rd Quarter 2014 Reported Results

* Sequential Quarter Adjusted EBITDA Bridge Sequential Adj. EBITDA Bridge, $m

* Cash Flow Overview – Net Cash Bridge Cash Flow Bridge, $m

May 9, 2014 3rd Quarter 2014 Earnings Call