Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Federal Home Loan Bank of Pittsburgh | d719168d8k.htm |

Member Audio/Web

Conference

May 2, 2014

Exhibit 99.1 |

Cautionary Statement Regarding Forward-

Looking Information

2

Statements contained in these slides, including statements describing the objectives, projections,

estimates, or predictions of the future of the Bank, may be “forward-looking

statements.” These statements may use forward-looking terms, such as “anticipates,”

“believes,” “could,” “estimates,” “may,” “should,”

“will,” or their negatives or other variations on these terms. The Federal Home Loan

Bank of Pittsburgh (the Bank) cautions that, by their nature, forward-looking statements involve

risk or uncertainty and that actual results could differ materially from those expressed or

implied in these forward-looking statements or could affect the extent to which a

particular objective, projection, estimate, or prediction is realized. These forward-looking statements involve risks and

uncertainties including, but not limited to, the following: economic and market conditions, including,

but not limited to, real estate, credit and mortgage markets; volatility of market prices,

rates, and indices related to financial instruments; political, legislative, regulatory,

litigation, or judicial events or actions; changes in assumptions used in the quarterly Other-Than-Temporary Impairment

(OTTI) process; risks related to mortgage-backed securities; changes in the assumptions used in

the allowance for credit losses; changes in the Bank’s capital structure; changes in the

Bank’s capital requirements; membership changes; changes in the demand by Bank members for

Bank advances; an increase in advances’ prepayments; competitive forces, including the availability of other

sources of funding for Bank members; changes in investor demand for consolidated obligations and/or

the terms of interest rate exchange agreements and similar agreements; changes in the FHLBank

System’s debt rating or the Bank’s rating; the ability of the Bank to introduce new

products and services to meet market demand and to manage successfully the risks associated with new

products and services; the ability of each of the other FHLBanks to repay the principal and interest

on consolidated obligations for which it is the primary obligor and with respect to which the

Bank has joint and several liability; applicable Bank policy requirements for retained earnings

and the ratio of the market value of equity to par value of capital stock; the Bank’s ability to maintain adequate

capital levels (including meeting applicable regulatory capital requirements); business and capital

plan adjustments and amendments; technology risks; and timing and volume of market activity. We

do not undertake to update any forward-looking information. Some of the data set forth

herein is unaudited. |

Over/

2014

2013

(Under)

Net interest income

62.3

$

45.4

$

16.9

$

Provision (benefit) for credit losses

(3.9)

(0.1)

(3.8)

Gain on litigation settlements, net

36.6

-

36.6

Other income

5.1

3.7

1.4

Other expenses

19.1

17.4

1.7

Income before assessment

88.8

31.8

57.0

AHP

8.9

3.2

5.7

Net income

79.9

$

28.6

$

51.3

$

Net interest margin (bps)

37

31

6

Earned dividend spread

10.90%

3.89%

7.01%

Three months ended March 31

Financial Highlights –

Statement of Income

(in millions)

3

, |

Quarterly Net Income

1Qtr 14

4Qtr 13

3Qtr 13

2Qtr 13

1Qtr 13

Net income

79.9

$

43.7

$

43.5

$

32.0

$

28.6

$

Derivative and hedging activity

(9.2)

$

16.1

$

5.4

$

7.1

$

1.6

$

Net gains (losses) on trading

securities

9.8

(5.1)

0.2

0.1

0.2

Gain on litigation

settlements, net

36.6

-

-

1.5

-

Net gains on early

extinguishment of debt

-

-

9.6

-

-

(in millions)

4 |

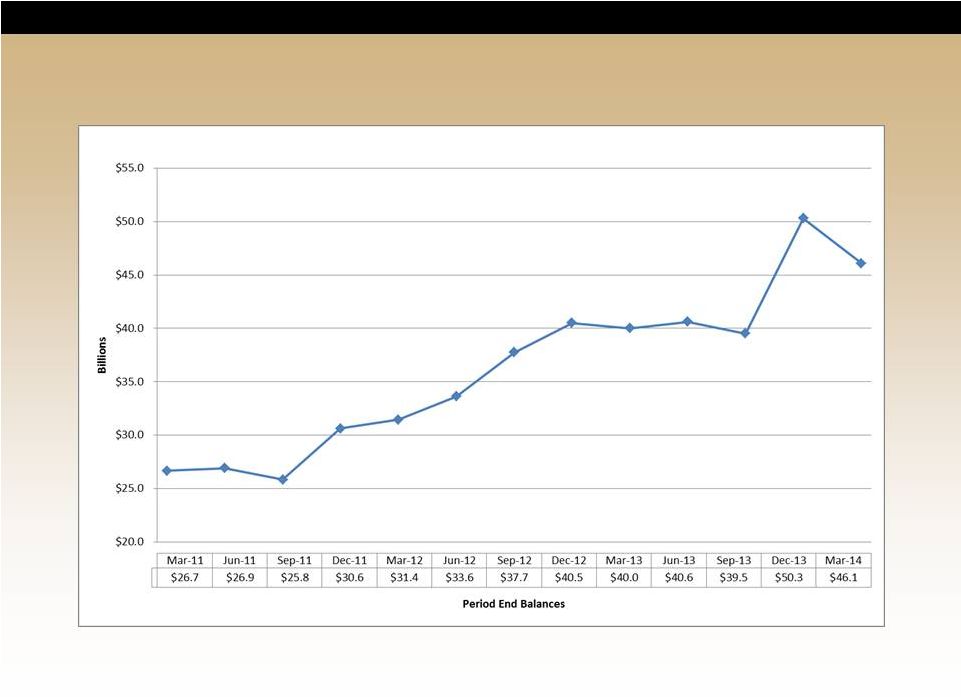

Quarterly Advance Trend

5 |

Financial Highlights –

Selected Balance Sheet

2014

2013

Amount

Average:

Total assets

68,085

$

59,297

$

8,788

$

15

%

Advances

47,320

36,380

10,940

30

Total investments

16,939

18,718

(1,779)

(10)

March 31,

Dec 31,

2014

2013

Amount

Spot:

Advances

46,064

$

50,248

$

(4,184)

$

(8)

%

PLMBS (par)

2,102

2,210

(108)

(5)

Capital stock

2,681

2,962

(281)

(9)

Retained earnings

749

686

63

9

Percent

Over/(Under)

Over/(Under)

Percent

Three months ended March 31,

(in millions)

(in millions)

6 |

(in millions)

March 31,

Dec 31,

2014

2013

Permanent capital

3,432

$

3,648

$

Excess permanent capital

over RBC requirement

2,447

$

2,595

$

Capital ratio (4% minimum)

5.3%

5.2%

Leverage ratio (5% minimum)

8.0%

7.7%

Market value/capital stock (MV/CS)

135.7%

128.0%

Capital Requirements

7 |

Member Audio/Web

Conference

May 2, 2014 |