Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Star Mountain Resources, Inc. | Financial_Report.xls |

| EX-31.2 - EXHIBIT 31.2 - Star Mountain Resources, Inc. | ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Star Mountain Resources, Inc. | ex31-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Star Mountain Resources, Inc. | ex32-2.htm |

| EX-14.1 - EXHIBIT 14.1 - Star Mountain Resources, Inc. | ex14-1.htm |

| EX-32.1 - EXHIBIT 32.1 - Star Mountain Resources, Inc. | ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2013

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 000-54405

JAMESON STANFORD RESOURCES CORPORATION

(Exact name of registrant as specified in its charter)

| Nevada | 90-0963619 | |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification No.) |

| 2300 West Sahara Ave., Suite 800, Las Vegas, NV | 89102 | |

| (Address of principal executive offices) | (Zip Code) |

(702) 933-0808

(Registrant’s telephone number, including area code)

Not applicable.

(Former Name, former address and former fiscal year, if changed since last report)

Copies of Communications to:

Laura Anthony, Esq.

Legal& Compliance, LLC

330 Clematis Street, Suite 217

West Palm Beach, FL 33401

(561) 514-0936

Fax (561) 514-0832

Securities registered under Section 12(b) of the Act: None

Securities registered under Section 12(g) of the Act: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

The number of shares of Common Stock, $0.001 par value, issued and outstanding on April 11, 2014, was 39,442,758 shares.

At June 30, 2013, the aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates of the registrant was $5,576,000 based on the closing sale price on June 28, 2013 of $.85 per share.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Jameson Stanford Resources Corporation

Form 10-K

For the Year Ended December 31, 2013

Table of Contents

| 2 |

FORWARD-LOOKING STATEMENTS

This Annual Report includes forward-looking statements that relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Words such as, but not limited to, “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “targets,” “likely,” “aim,” “will,” “would,” “could,” and similar expressions or phrases identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and future events and financial trends that we believe may affect our financial condition, results of operation, business strategy and financial needs. Forward-looking statements include, but are not limited to, statements about:

| ● | our proposed mining business including estimates of minerals, operational costs and volatility of sales prices, | |

| ● | our needs for additional capital, | |

| ● | our history of losses, | |

| ● | our dependence on third party equipment and services to operate our business, | |

| ● | economic, legal, environmental restrictions and business conditions in the mining industry, | |

| ● | dependence on key personnel, | |

| ● | material weaknesses in our internal control over financial reporting, | |

| ● | the closely-held nature of our securities, | |

| ● | limited public market for our common stock, and | |

| ● | potential dilutive impact of future issuances. |

This Annual Report and the documents referred to herein should be read thoroughly with the understanding that our actual future results may be materially different from and/or worse than what we expect. We qualify all of our forward-looking statements by these cautionary statements including those made in Item A. Risk Factors. Other sections of this Annual Report include additional factors which could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Except for our ongoing obligations to disclose material information under the Federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements to report events or to report the occurrence of unanticipated events. These forward-looking statements speak only as of the date of this Annual Report, and the statements should not be relied on without also considering the risks and uncertainties associated with these statements and our business.

OTHER PERTINENT INFORMATION

Throughout this Annual Report references to “we”, “our”, “us”, “Jameson Stanford”, “the Company”, and similar terms refer to Jameson Stanford Resources Corporation and its wholly owned subsidiary Bolcán Mining Corporation.

CAUTIONARY STATEMENT REGARDING MINERALIZED MATERIAL

“Mineralized material” as used in this annual report on Form 10-K, although permissible under the United States Securities and Exchange Commission’s (“SEC”) Industry Guide 7, does not indicate “reserves” by SEC standards. We cannot be certain that any deposits from the Star Mountain/Chopar Mine, (b) Spor Mountain/Dugway Minerals Claim and Ogden Bay Wildlife Management Area in Weber County, Utah will ever be confirmed or converted into SEC Industry Guide 7 compliant “reserves”. Investors are cautioned not to assume that all or any part of the disclosed mineralized material estimates will ever be confirmed or converted into reserves or that mineralized material can be economically or legally extracted.

| 3 |

Business Development

We were originally incorporated under the laws of the state of Nevada in June 2009 as MyOtherCountryClub.com for the purpose of developing a website that would offer reciprocal golf privileges, and other related services, to members of private country clubs throughout the United States.

On May 2, 2012, we completed a 7-for-1 forward split of all outstanding shares of our common stock and a corresponding increase in our authorized common stock. The effect of the forward split was to increase the number of our common shares issued and outstanding from 8,400,000 to 58,800,000 and to increase our authorized common shares from 50,000,000 shares, par value $0.001, to 350,000,000 shares, par value $0.001.

On May 7, 2012, we entered into an Acquisition Agreement and Plan of Merger, as amended on July 24, 2012 and on October 24, 2012 (collectively referred to as the “Merger Agreement”), with our wholly-owned subsidiary, JSR Sub Co, a Nevada corporation (“Sub Co”), and Bolcán Mining Corporation, a Nevada corporation (“Bolcán Mining”). Pursuant to the Merger Agreement, we issued 25,000,000 shares of our Rule 144 restricted common stock in exchange for 100% of Bolcán Mining’s issued and outstanding capital stock.

Pursuant to the terms of the Merger Agreement, on October 29, 2012 Sub Co merged with and into Bolcán Mining (the “Merger”) with Bolcán Mining surviving the Merger as our wholly owned subsidiary. After the Merger, there were 31,300,000 shares of our common stock outstanding, of which approximately 80% were held by the former shareholders of Bolcán Mining. Prior to the Merger, we were a shell company with no business operations. As a result of the Merger, we are no longer considered a shell company.

Description of Bolcán Mining Corporation’s Business

Bolcán Mining was incorporated on April 11, 2012 to pursue the exploration of certain mining claims, mineral leases and excavation rights for mining projects located in (a) Star Mining District in Beaver County, Utah, (b) Spor Mountain Mining District in Juab County, Utah, and (c) Ogden Bay Wildlife Management Area in Weber County, Utah. On April 23, 2012, Bolcán Mining acquired certain lode mining claims and mineral leases related to the Star Mining District and Spor Mountain Mining District projects.

Effective as of June 30, 2012, pursuant to an Asset Purchase Agreement between Bolcán Mining and The Bolcán Group LLC (“Bolcán Group”) which was formed in October 12, 2010 by Mr. Michael Stanford, Bolcán Mining purchased all of the assets and assumed certain liabilities of Bolcán Group resulting in a combination of the two companies.

The operating activities of the Bolcán Group were inconsequential until October 2011 and consisted primarily of historical site research performed by Mr. Stanford. Mr. Stanford has other mining interests and provides services to the mining industry that are not part of Bolcán Mining.

Projects

Our current active projects include the following:

Star Mountain/Chopar Mine (Star Mining District)

On April 23, 2012, the Company paid and capitalized $22,113 to acquire 117 unpatented lode mining claims from the Bureau of Land Management related to the Star Mountain project near Milford, Utah. In addition, on May 1, 2012, the Company entered into a mineral lease agreement with the State of Utah for approximately 1,400 acres that are contiguous with the Star Mountain lode mining claims. The initial costs incurred and capitalized in connection with obtaining the lease was $1,599. Collectively, the Star Mountain claims and lease encompass a total area of approximately 3,740 acres.

The Star Mountain lease has an initial term of 10 years, subject to certain extension provisions. The future minimum annual rental commitment is $1.00 per acre (or $1,408). The lease also provides for a minimum annual royalty payment of $4,224 beginning in the 11th year of the lease (if extended), and requires contingent production royalty payments based on 4% to 8% of the gross value (as defined in the lease) of non-fissionable and fissionable metalifferous minerals, respectively, extracted from the leased area.

| 4 |

Spor Mountain/Dugway Minerals (Spor Mountain Mining District)

On May 1, 2012, the Company entered into a mineral lease agreement with the State of Utah for approximately 1,920 acres related to the Dugway Minerals project near Delta, Utah (the “Dugway Minerals Lease”). The initial costs incurred and capitalized in connection with obtaining the lease were $2,157. The lease has an initial term of 10 years, subject to certain extension provisions. The future minimum annual rental commitment is $1.00 per acre (or $1,918). The lease also provides for a minimum annual royalty payment of $5,754 beginning in the 11th year of the lease, and requires contingent production royalty payments based on 4% to 8% of the gross value (as defined in the lease) of non-fissionable and fissionable metalifferous minerals extracted from the leased area

Ogden Bay Minerals

The Company’s plans for the Ogden Bay Minerals project consists of developing a mineral exploration and possible excavation project on federal protected wetlands, canals and river systems across 25 square miles of land area known as North Delta located in West Ogden, Utah. Excavation and harvesting rights are maintained through easement rights obtained from Weber County and a special use river/stream alteration permit as part of a State of Utah/Weber County flood mitigation project. We intend to continue to explore for silica, zircon, silver and gold.

Products

We intend to develop our project mining claims, mineral leases and excavation rights to produce the following specialized mining products:

| ● | Copper Ore with Precious Metals Component — Hard rock mineralized material will be drilled, blasted, excavated and hauled, then crushed and classified to customer specifications. We will deliver this product on-demand or just in time to customers on a 24/7 schedule, utilizing truck and pup combos for local deliveries and rail for regional deliveries. The Union Pacific Railroad main line from Los Angeles to Ogden, Utah, is routed through Milford, Utah, approximately five miles east of our Star Mountain project site. | |

| ● | Mined Mineral Concentrates — Finely divided particles from hard rock mining and recovery operations containing significant enrichments of silver and gold will be upgraded by gravity concentrating methods to contain a minimum 3,000 grams of precious metals per ton of concentrate. Mineral concentrate products are dried, bagged and shipped to customers. | |

| ● | Refined Precious Metals — During 2014–2015, we plan to develop a refining capacity for up to two tons per day of selected precious metals concentrates from our mining and recovery operations. Precious metals concentrates containing greater than 50% combined silver/gold mixture will be further concentrated, refined, separated and manufactured into bar and ingot product. |

Our Industry

Copper is the world’s third most widely used metal, after iron and aluminum, and an important component in the world’s infrastructure. Copper has unique chemical and physical properties including high ductility, malleability, thermal and electrical conductivity, and resistance to corrosion that has made it a superior material for use in electrical and electronic products including power transmission and generation, which accounts for about three quarters of the global copper use, telecommunications, building construction, transportation and industrial machinery businesses. Copper is also an important metal in non-electrical applications such as plumbing and roofing and, when alloyed with zinc to form brass, in many industrial and consumer applications.

Copper is an internationally traded commodity with prices principally determined by the major metal exchanges, the New York Commodities Exchange or “COMEX” and the London Metal Exchange or “LME”. Copper is usually found in association with sulfur. Pure copper metal is generally produced during a multistage process beginning with the mining and concentrating of low-grade ores containing copper sulfide minerals followed by smelting and electrolytic refining to produce a pure copper cathode. An increasing share of copper is produced from acid leaching of oxidized ores. Copper is one of the oldest metals ever used and has been one of the important materials in the development of civilization.

| 5 |

Copper Market. Copper is an important industrial metal with significant demand for fabrication of electrical wires, plumbing and industrial machinery. Most copper is mined or extracted as copper sulfides from large open pit mines in porphyry copper deposits that contain 0.4% to 1.0% copper. Copper is 100% recyclable with no quality degradation and is the third most recycled metal. It is estimated that 80% of the copper ever mined is still in use today.

Gold Market. The global market for gold is large and highly liquid. Primary demand for gold is associated with a safe haven investment with additional demand for jewelry, industrial and health science applications. Gold is also considered a hedge against inflation and a commodity of refuge from concerns with fiat currencies and corresponding risks related to economic, political and social uncertainties.

The World Gold Council, a leading international gold industry research organization, published on its website that total gold demand for 2013 decreased 2% to 3,756 metric tons (a metric ton is equal to 2,204.6 pounds) year-over-year. Of this decrease, investment demand posted the largest segment decrease offsetting the increase in gold jewelry demand.

Silver Market. Demand for silver is predominantly for industrial applications, especially electronics and jewelry, with investment making up only a small portion of total annual demand.

Government and Environmental Regulation

Our mining, processing operations and exploration activities are subject to various laws and regulations governing: (i) the protection of the environment; (ii) exploration; (iii) mine safety, development and production; (iv) exports, (v) taxes, (vi) labor standards, (vii) occupational health, (viii) waste disposal, (ix) hazardous substances, (x) water rights; (xi) explosives; (xii) land reclamation and (xiii) other matters. New laws and regulations, amendments to existing laws and regulations or more stringent implementation of existing laws and regulations could have a material adverse impact on us, increase costs, cause a reduction in levels of, or suspension of, production and/or delay or prevent the development of new mining properties.

The governmental agencies and regulators tasked with implementing and enforcing the above laws and regulations include Beaver County (Utah), the Bureau of Land Management, the Mine Safety and Health Administration, the Utah Department of Natural Resources, the Utah State Institutional Trust Lands Administration, the Utah Department of Environmental Quality, the Environmental Protection Agency, and the Bureau of Alcohol, Tobacco, Firearms and Explosives.

We believe we are currently in compliance in all material respects with all applicable environmental laws and regulations. Such compliance requires significant expenditures and increases mine development and operating costs. Mining is subject to potential risks and liabilities associated with pollution of the environment and the disposal of waste products occurring as a result of mineral exploration and production. Environmental liability may result from mining activities conducted by others prior to our ownership of a property. To the extent we are subject to uninsured environmental liabilities, the payment of such liabilities would reduce our otherwise available earnings and could have a material adverse effect on our business plan.

Licenses and Permits

Our operations require licenses and permits from various governmental authorities. We believe we hold all material licenses and permits required under applicable laws and regulations and believe we are presently complying in all material respects with the terms of such licenses and permits. However, such licenses and permits are subject to change in various circumstances. There can be no guarantee that we will be able to obtain or maintain all necessary licenses and permits that may be required to explore and develop our properties, to commence construction or operation of mining facilities and properties under exploration or development or to maintain continued operations that economically justify the cost.

| 6 |

Mine Safety and Health Administration Regulations

Pursuant to Section 1503(a) of the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act, issuers that are operators, or that have a subsidiary that is an operator, of a coal or other mine in the United States are required to disclose in their periodic reports filed with the SEC information regarding specified health and safety violations, orders and citations, related assessments and legal actions and mining-related fatalities. At this time, we have no safety violations, orders, citations, related assessments or legal actions or mining-related fatalities to report.

Competition

Because the life of a mine is limited by its mineral reserves, we plan to continually seek to replace and expand our reserves through the exploration of existing properties as well as through acquisitions of interests in new properties or of interests in companies which own such properties. We encounter competition from other mining companies in connection with the acquisition of properties and with the engaging and maintaining of qualified industry experienced personnel. This competition may increase the cost of acquiring suitable properties and retaining qualified industry experienced personnel.

Employees

For the years ended December 31, 2013 and 2012, we had no employees. We utilize the services of independent contractors.

An investment in our common stock involves a high degree of risk. Investors should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and investors may lose all or part of their investment. Investors should read the section entitled “Special Note Regarding Forward Looking Statements” above for a discussion of what types of statements are forward-looking statements as well as the significance of such statements in the context of this Annual report.

Risks Related To Our Business And Financial Condition

Estimates of mineralized material are based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated.

There are numerous uncertainties inherent in estimating quantities of mineralized material such as copper, gold and silver including many factors beyond our control and no assurance can be given that the recovery of mineralized material will be realized. In general, estimates of mineralized material are based upon a number of factors and assumptions made as of the date on which the estimates are determined, including:

| ● | the geological and engineering estimates that have inherent uncertainties and the assumed effects of regulation by governmental agencies; | |

| ● | the judgment of the engineers preparing the estimates; | |

| ● | the estimates of future metals prices and operating costs; | |

| ● | the quality and quantity of available data; | |

| ● | the interpretation of that data; and | |

| ● | the accuracy of various mandated economic assumptions all of which may vary considerably from actual results. |

Until mineralized material is actually mined and processed, it must be considered an estimate only. These estimates are imprecise and depend on geological interpretation and statistical inferences drawn from drilling and sampling analysis which may prove to be unreliable. We cannot assure that these mineralized material estimates will be accurate or that this mineralized material can be mined or processed profitably. Any material changes in estimates of mineralized material will affect the economic viability of placing a property into production and such property’s return on capital. There can be no assurance that minerals recovered in small-scale metallurgical tests will be recovered at production scale.

| 7 |

We may have difficulty meeting our current and future capital requirements.

Our management and Board of Directors monitor overall costs and expenses and, if necessary, adjust programs and planned expenditures in an attempt to ensure sufficient operating capital. We continue to evaluate costs and planned expenditures for on-going development, care and maintenance efforts at our mineral properties. The continued development, care and maintenance of our mineral properties will require significant amounts of additional capital. As a result, we likely will need to explore raising additional capital during fiscal 2014 and beyond so that we can continue to fully fund our planned activities. Our ability to obtain this financing will depend upon, among other things, the price of minerals and the industry’s perception of its future price. The extraordinary conditions in the global financial and capital markets have currently limited the availability of this funding. Therefore, availability of funding is dependent largely upon factors outside of our control and cannot be accurately predicted. If the disruptions in the global financial and capital markets continue, debt or equity financing may not be available to us on acceptable terms, if at all. If we are unable to fund future operations by way of financing, including public or private offerings of equity or debt securities, our business, financial condition and exploration activities will be adversely impacted.

The volatility of the price of gold or silver and other precious metals could adversely affect our future operations and, if warranted, our ability to develop our properties.

The potential for profitability of our operations, the value of our properties and our ability to raise funding to conduct continued exploration and development, if warranted, are directly related to the market prices of gold, silver and other precious metals. The prices of such metals fluctuate widely and are affected by numerous factors beyond our control including interest rates, expectations for inflation, speculation, currency values (in particular the strength of the U.S. dollar), global and regional demand, political and economic conditions, global and regional demand, the sale of gold and silver by central banks, the political and economic conditions of major gold and silver producing countries throughout the world, and production costs in major metal producing regions of the world. The price of gold may also have a significant influence on the market price of our common stock and the value of our properties. Our decision to put a mine into production and to commit the funds necessary for that purpose must be made long before the first revenue from production would be received. A decrease in the prices of gold or silver may prevent our property from being economically mined or result in the write-off of assets whose value is impaired as a result of lower gold, zinc, lead, copper or silver prices.

The nature of mineral exploration and production activities involves a high degree of risk and the possibility of uninsured losses.

Exploration for and the production of minerals is highly speculative and involves greater risk than many other businesses. Many exploration programs do not result in the discovery of mineralization and any mineralization discovered may not be of sufficient quantity or quality to be profitably mined. Our operations are, and any future development or mining operations we may conduct will be, subject to all of the operating hazards and risks normally incident to exploring for and development of mineral properties, such as, but not limited to:

| ● | economically insufficient mineralized material; | |

| ● | fluctuation in production costs that make mining uneconomical; | |

| ● | labor disputes; | |

| ● | unanticipated variations in grade and other geologic problems; | |

| ● | environmental hazards; | |

| ● | water conditions; | |

| ● | difficult surface or underground conditions; | |

| ● | industrial accidents; | |

| ● | metallurgic and other processing problems; | |

| ● | mechanical and equipment performance problems; | |

| ● | failure of pit walls or dams; | |

| ● | unusual or unexpected rock formations; | |

| ● | personal injury, fire, flooding, cave-ins and landslides; and | |

| ● | decrease in the value of mineralized material due to lower gold or silver prices. |

| 8 |

Any of these risks can materially and adversely affect, among other things, the development of properties, production quantities and rates, costs and expenditures, potential revenues and production dates. We currently have limited insurance to guard against some of these risks. If we determine that capitalized costs associated with any of our mineral interests are not likely to be recovered, we would incur a write down of our investment in these interests. All of these factors may result in losses in relation to amounts spent which are not recoverable or result in additional expenses.

Difficult conditions in the global capital markets and the economy generally may materially and adversely affect our business and results of operations, and we do not expect these conditions to improve in the near future.

Our results of operations are materially affected by conditions in the domestic capital markets and the economy generally. The stress experienced by domestic capital markets that began in the second half of 2007 has continued and substantially increased into the present. Recently, concerns over inflation, energy costs, geopolitical issues, the availability and cost of credit, the U.S. mortgage market and a declining real estate market in the U.S. have contributed to increased volatility and diminished expectation for the economy and the markets going forward. These factors, combined with volatile oil and gas prices, declining business and consumer confidence and increased unemployment, have precipitated an economic slowdown and fears of a continued recession. In addition, the fixed-income markets are experiencing a period of extreme volatility that has negatively impacted market liquidity conditions.

Title to our properties may be challenged or defective.

Our planned future operations and exploration activities may require amendments to our currently approved permits from various governmental authorities. Our operations are and will continue to be governed by laws and regulations governing prospecting, mineral exploration, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety, mining royalties and other matters. There can be no assurance that we will be able to acquire all required licenses, permits, amendments or property rights on reasonable terms in a timely manner, or at all, and that such terms will not be adversely changed, that required extensions will be granted or that the issuance of such licenses, permits or property rights will not be challenged by third parties.

We attempt to confirm the validity of our rights of title to, or contract rights with respect to, each mineral property in which we have a material interest. However, we cannot guarantee that title to our properties will not be challenged. Our mineral properties may be subject to prior unregistered agreements, interests or native land claims, and title may be affected by undetected defects. There may be valid challenges to the title of any of the claims comprising our mineral properties that, if successful, could impair possible development and/or operations with respect to such properties in the future. Challenges to permits or property rights, whether successful or unsuccessful; changes to the terms of permits or property rights or a failure to comply with the terms of any permits or property rights that have been obtained could have a material adverse effect on our business by delaying, preventing or making continued operations economically unfeasible.

We are subject to complex environmental and other regulatory risks, which could expose us to significant liability and delay, and potentially the suspension or termination of our development efforts.

Compliance with environmental quality requirements and reclamation laws imposed by federal, state, provincial and local governmental authorities may:

| ● | require significant capital outlays; | |

| ● | materially affect the economics of a given property; | |

| ● | cause material changes or delays in our intended activities; and | |

| ● | expose us to lawsuits. |

These regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation. They also set limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Applicable authorities may require us to prepare and present data pertaining to the effect or impact that any proposed exploration for or production of minerals may have upon the environment. The requirements imposed by any such authorities may be costly, time consuming, and delay operations. Future legislation and regulations designed to protect the environment, as well as future interpretations of existing laws and regulations, may require substantial increases in equipment and operating costs and delays, interruptions, or a termination of operations. We cannot accurately predict or estimate the impact of any such future laws or regulations, or future interpretations of existing laws and regulations, on our operations.

| 9 |

Historic mining activities have occurred on certain areas of our properties by unrelated parties prior to the general mining law of 1872, prior to the Federal Land Policy and Management Act of 1976, prior to the Resources Conservation & Recovery Act of October 21, 1978, and subsequent other Federal/State regulatory acts and statutes. If such historic activities have resulted in releases or threatened releases of regulated substances to the environment, potential for liability, however unlikely, may exist under federal or state remediation statutes. Such liability would include remediating any damage that we may have caused including costs for removing or remediating the release and damage to natural resources, including ground water, as well as the payment of fines and penalties. We are not aware of any such claims under these statutes at this time and cannot predict whether any such claims will be asserted in the future.

We may produce air emissions and pollutions that could fall under the jurisdiction of U.S. federal laws.

Under the U.S. Resource Conservation and Recovery Act, mining companies may incur costs for generating, transporting, treating, storing or disposing of hazardous waste, as well as for closure and post-closure maintenance once they have completed mining activities on a property. Our mining operations may produce air emissions, including fugitive dust and other air pollutants, from stationary equipment, storage facilities and the use of mobile sources such as trucks and heavy construction equipment which are subject to review, monitoring and/or control requirements under the Federal Clean Air Act and state air quality laws. Permitting rules may impose limitations on our production levels or create additional capital expenditures in order to comply with the rules.

Legislation has been proposed that would significantly affect the mining industry.

Periodically, members of the U.S. Congress have introduced bills which would supplant or alter the provisions of the General Mining Law of 1872 which governs the unpatented claims that we control with respect to our U.S. properties. One such amendment has become law and has imposed a moratorium on the patenting of mining claims which reduced the security of title provided by unpatented claims such as those on our properties. If additional legislation is enacted, it could substantially increase the cost of holding unpatented mining claims by requiring payment of royalties and could significantly impair our ability to develop mineral estimates on unpatented mining claims. Such bills have proposed, among other things, to make permanent the patent moratorium, to impose a federal royalty on production from unpatented mining claims and to declare certain lands as unsuitable for mining. Although it is impossible to predict at this time what royalties may be imposed in the future, the imposition of such royalties could adversely affect the potential for development of such mining claims and the economics of existing operating mines on federal unpatented mining claims. Passage of such legislation could adversely affect our business.

Our operations are subject to permitting requirements which could require us to delay, suspend or terminate our operations on our mining properties.

Our operations, including ongoing exploration drilling programs, require permits from state and federal governments including permits for the use of water and for drilling wells for water. We may be unable to obtain these permits in a timely manner, on reasonable terms, on terms that provide us sufficient resources to develop our properties or at all. Even if we are able to obtain such permits, the time required by the permitting process can be significant. If we cannot obtain or maintain the necessary permits, or if there is a delay in receiving these permits, our timetable and business plan for exploration of our properties will be adversely affected which may in turn adversely affect our results of operations, financial condition and cash flows.

We may face a shortage of water.

Water is essential in all phases of the exploration, development and operation of mineral properties. The nature of our operations requires water to be used in such processes as exploration, drilling, testing, dust suppression, milling and tailings disposal. The lack of available water and the cost of acquisition may make an otherwise viable project economically impossible to complete.

| 10 |

Global climate change is an international concern and could impact our ability to conduct future operations.

Global climate change is an international issue and receives an enormous amount of publicity. We would expect that the imposition of international treaties or federal, state or local laws or regulations pertaining to mandatory reductions in energy consumption or emissions of greenhouse gasses could affect the feasibility of our mining projects and increase our operating costs.

Because access to the mineral property may be restricted by inclement weather or other hazards, we may be delayed in our development efforts.

We are subject to risks and hazards including environmental hazards, the existence of unusual or unexpected geological formations and the occurrence of cave-ins, flooding, earthquakes and periodic interruptions due to inclement or hazardous weather conditions. As a result, access to our mineral properties may be restricted during parts of the year. During the winter months, heavy snowfall can make it difficult to undertake work programs. Frequent inclement weather in the winter months can make development and mining activities difficult for short periods of time.

We may face a shortage of supplies, equipment and materials.

The mineral industry has experienced from time to time shortages of certain supplies, equipment and materials necessary in the exploration, evaluation, development and production of mineral deposits. The prices at which such supplies and materials are available have also greatly increased. Our planned operations could be subject to delays due to such shortages and further price escalations could increase our costs for such supplies, equipment and materials. Our experience and that of others in the industry is that suppliers are often unable to meet contractual obligations for supplies, equipment, materials and services and that alternate sources of supply do not exist.

The market for obtaining desirable properties, investment capital, and outside engineers and consultants is highly competitive.

Presently, we utilize outside consultants, and in large part rely on the personal efforts of our officers and director. Our success will depend, in part, upon the ability to attract and retain qualified outside engineers and other professionals to develop and operate our mineral properties in addition to obtaining investment capital to conduct our mining operations. We believe that we will be able to attract competent employees and consultants but no assurance can be given that we will be successful in this regard as competition for these professionals is highly competitive. If we are unable to engage and retain the necessary personnel, our business would be materially and adversely affected.

We depend upon a limited number of personnel and the loss of any of these individuals could adversely affect our business.

If any of our current executive employees were to die, become disabled or leave our company, we would be forced to identify and retain individuals to replace them. Mr. Michael Stanford is our CEO, President, Chairman and Sole Director and our critical employee at this time. There is no assurance that we can find suitable individuals to replace him or to add to our employee base if that becomes necessary. We are entirely dependent on Mr. Stanford as our critical personnel at this time. We have no life insurance on Mr. Stanford.

Our Chairman and CEO own 63.4% of the issued and outstanding Common Stock and thereby acting alone he has the ability to choose management or impact operations, which will limit your ability to influence the outcome of important transactions, including a change in control.

Our Chairman and CEO, Michael Stanford, owns 63.4% of the outstanding Common Stock and has voting power of 63.4% of our issued and outstanding Common Stock as of December 31, 2013. Consequently, Mr. Stanford has the ability to influence control of our operations and, acting alone, has the ability to influence or control substantially all matters submitted to stockholders for approval, including:

| ● | Election of the Board of Directors; | |

| ● | Removal of directors; and | |

| ● | Amendment to the our certificate of incorporation or bylaws; |

| 11 |

Mr. Stanford thus has substantial influence over our management and affairs and other stockholders possess no practical ability to remove management or effect the operations of our business. Accordingly, this concentration of ownership by itself may have the effect of impeding a merger, consolidation, takeover or other business consolidation, or discouraging a potential acquirer from making a tender offer for the Common Stock, and could deprive our stockholders of an opportunity to receive a premium for their Common Stock as part of a sale of our Company and might ultimately affect the market price of our Common Stock.

We have incurred substantial losses since our inception and may never be profitable.

We have incurred losses since inception resulting in an accumulated stockholders’ equity deficit of $523,982 as of December 31, 2013, and further losses have continued through the first quarter of 2014 and are anticipated in the development of our business. As a development stage enterprise, there exists substantial doubt regarding our ability to continue as a going concern. The ability to continue as a going concern is dependent upon generating profitable operations in the future and/or to obtain the necessary financing to meet our obligations and repay our liabilities arising from normal business operations. Management intends to finance operating costs over the next twelve months with existing cash on hand, loans from stockholders and directors and the private placement of common stock.

We currently have not entered into forward sales, commodity, derivatives or hedging arrangements with respect to our mineral production and as a result we are exposed to the impact of any significant decrease in mineral prices.

We expect to sell the minerals we produce at prevailing market prices. Currently, we have not entered into forward sales, commodity, derivative or hedging arrangements to establish a price in advance for the sale of future production although we may do so in the future. As a result, we may realize the benefit of any short-term increase in prices but we are not protected against decreases; and if prices decrease significantly, our expected future revenues may be materially and adversely affected.

Our ability to become and remain profitable over the long term will depend on our ability to identify, explore and develop our current and additional properties.

Gold, silver, and other mineral properties are wasting assets. They eventually become depleted or uneconomical to continue mining. Our ability to become and remain profitable over the long term depends on our ability to finalize the design, permit, development and profitable extraction and recovery of mineral resources beyond our current planned mine life. If our ability to expand the operations beyond their current planned mined lives does not occur, we may seek to acquire other precious and base metals properties beyond our current properties. The acquisition of precious and base metals properties and their exploration and development are subject to intense competition. Companies with greater financial resources, larger staff, more experience and more equipment for exploration and development may be in a better position to compete for such mineral properties. If we are unable to find, develop and economically mine new properties, we most likely will not be profitable on a long-term basis and the price of our common stock may suffer.

Because we have a very limited operating history, investors have little basis to evaluate our ability to operate.

Our activities to date have been focused on raising capital funds, exploring our properties and preparing those properties for production. Although some of our mine and concentrating facilities have previously operated, these operations were carried out under different ownership and, therefore, we face all of the risks commonly encountered by other businesses that lack an established operating history including the need for additional capital personnel and intense competition. There is no assurance that our business plan will be successful.

| 12 |

The construction of our mines and our mills are subject to all of the risks inherent in construction, start-up and operations.

These risks include potential delays, cost overruns, shortages of material or labor, construction defects, breakdowns and injuries to persons and property. We expect to engage self-employed personnel, subcontractors and material suppliers in connection with the construction and development of our mine projects. While we anticipate taking all measures that we deem reasonable and prudent in connection with construction of the mines and the operation of the mills, there is no assurance that the risks described above will not cause delays or cost overruns in connection with such construction or operation. Any delays would postpone our anticipated receipt of revenue and adversely affect our operations which in turn may adversely affect the price of our stock.

We do not insure against all of the risks to which we may be subject in our operations.

While we currently maintain insurance against general commercial liability claims and the physical assets at our projects, we do not maintain insurance to cover all of the potential risks associated with our operations. We might be subject to liability for environmental, pollution or other hazards associated with mineral exploration and development which risks may not be insured against, which may exceed the limits of our insurance coverage or which we may elect not to insure against because of premium costs or other reasons. We may also not be insured against interruptions to our operations. Losses from these or other events may cause us to incur significant costs which could materially and adversely affect our financial condition and our ability to fund activities on our property. A significant loss could force us to reduce or terminate our operations.

We may require significant additional capital to fund our business plan.

We will be required to expend significant funds to determine if proven and probable mineral reserves exist at some of our properties, to continue exploration, and if warranted, develop our existing properties and to identify and acquire additional properties to diversify our property portfolio. There can be no assurance that any of the development properties we now hold, or which we may acquire, will contain a commercial ore reserve, and therefore, there can be no assurance that we will ever generate a positive cash flow from the sale of production on such properties. In addition, once we decide to place a property into production, risks still exist that the amount and grade of the reserves may be significantly less than predicted in geological and geophysical reserve reports prepared for us by third party professionals. We have spent and will be required to continue to spend significant amounts of capital for drilling, geological and geochemical analysis, assaying and feasibility studies with regard to the results of our exploration. We may not benefit from these investments if we are unable to identify commercially exploitable mineralized material.

Our ability to obtain necessary funding for these purposes, in turn, depends upon a number of factors including the status of the national and worldwide economy and the prices of gold and other precious and base metals. Capital markets worldwide have been adversely affected by substantial losses by financial institutions in turn caused by investments in asset-backed securities. We may not be successful in obtaining the required financing, or if we can obtain such financing, such financing may not be on terms that are favorable to us. Failure to obtain such additional financing could result in delay or indefinite postponement of further mining operations or exploration and development and the possible partial or total loss of our potential interest in our properties.

If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results. As a result, current and potential shareholders could lose confidence in our financial reporting, which would harm our business and the trading price of our stock.

Our management has determined that as of December 31, 2013, we did not maintain effective internal controls over financial reporting based on criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) in Internal Control-Integrated Framework as a result of identified material weaknesses in our internal control over financial reporting related to the omission of (i) receipt of funds for purchases of our common stock in the first, second and third quarters of 2013, (ii) an issuance of 230,426 shares of our common stock in September 2013, and (iii) the issuance of 5,360,000 shares of our common stock in August 2013. Further, a lack of controls over the accounting for surety bond costs resulted in the reclassification of surety bond costs from an expense to mineral rights on our balance sheet. These errors will require us to restate our consolidated financial statements for the three months ended March 31, 2013, the six months ended June 30, 2013 and the nine months ended September 30, 2013 to correct these errors. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the company's annual or interim financial statements will not be prevented or detected on a timely basis. For a detailed description of these material weaknesses and our remediation efforts and plans, see “Part II — Item 9A) — Controls and Procedures.” If the result of our remediation of the identified material weaknesses is not successful, or if additional material weaknesses are identified in our internal control over financial reporting, our management will be unable to report favorably as to the effectiveness of our internal control over financial reporting and/or our disclosure controls and procedures, and we could be required to further implement expensive and time-consuming remedial measures and potentially lose investor confidence in the accuracy and completeness of our financial reports which could have an adverse effect on our stock price and potentially subject us to litigation.

Our operating costs could be adversely affected by inflationary pressures especially to labor and fuel costs.

The global economy is currently in a period of high commodity prices and, as a result, the mining industry is attempting to increase production. This has caused significant upward price pressures in the operating costs of mining companies especially in the area of skilled labor. The skilled labor needed by the mining industry is in tight supply and its cost is increasing. Many of our competitors have lower costs and their mines are located in better locations that may give them a competitive advantage in employee hiring and retention.

| 13 |

The cost of fuel to run machinery and generate electricity is closely correlated to the price of oil and energy. Over the past two years, the price of oil has risen significantly and has increased the operating cost of mines dependent on fuel to run their business. Continued upward price pressures in our operating costs may cause us to generate significantly less operating cash flows than expected which would have an adverse impact to our business.

We will continue to incur losses for the foreseeable future.

Prior to completion of the development and pre-production stage, we anticipate that we will incur increased operating expenses without realizing any significant revenues. We expect to incur continued and significant losses until such time that we achieve commercial production from our mining operations on our mineral claims. As a result of continuing losses, we may exhaust all of our resources and be unable to complete development of our planned mining operations. Our accumulated deficit will continue to increase as we continue to incur losses. We may not be able to generate profits or continue operations if we are unable to generate significant revenues from future mining of the mineral claims and our business will most likely fail.

Risks Related To Our Common Stock

There currently is only a minimal public market for our common stock. Failure to develop or maintain a trading market could negatively affect the value of our common stock and make it difficult or impossible for investors to sell shares.

There currently is only a minimal public market for shares of our common stock and an active market may never develop. Our common stock is quoted on the OTCQB tier of the OTC Markets Group Inc. under the symbol “JMSN”. We may not ever be able to satisfy the listing requirements for our common stock to be listed on a national exchange which are often a more widely-traded and liquid market. Some, but not all, of the factors that may delay or prevent the listing of our common stock on a more widely-traded and liquid market includes the following:

| ● | our stockholders’ equity may be insufficient; | |

| ● | the market value of our outstanding securities may be too low; | |

| ● | our net income from operations may be too low; | |

| ● | our common stock may not be sufficiently widely held; | |

| ● | our inability to secure market makers for our common stock; and | |

| ● | our inability to meet the rules and requirements mandated by the several exchanges and markets. |

If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results. As a result, current and potential shareholders could lose confidence in our financial reporting which would harm our business and result in a restatement of our financial statements.

Our management has determined that for the years ended December 31, 2013 and 2012, we did not maintain effective internal controls over financial reporting as a result of identified material weaknesses in our internal control over financial reporting described later in this report. There are no assurances that these material weaknesses will not result in errors in our financial statements in future periods. If we are required to restate our financial statements, we will incur additional costs and could be subject to litigation.

We cannot assure investors that the common stock will become liquid or that it will be listed on a national securities exchange.

Until our common stock is listed on a national securities exchange such as the New York Stock Exchange or the Nasdaq Stock Market, we expect our common stock to remain eligible for quotation on the OTCQB or other over-the-counter quotation systems. In such venues, however, an investor may find it difficult to obtain accurate quotations as to the market value of our common stock. In addition, if we fail to meet the criteria set forth in SEC regulations, various requirements would be imposed by law on brokers or dealers who sell our securities to persons other than established customers and accredited investors. Consequently, such regulations may deter brokers or dealers from recommending or selling our common stock which may further affect the liquidity of the common stock. This would also make it more difficult for us to raise capital.

| 14 |

The application of the “penny stock” rules could adversely affect the market price of our common stock and increase transaction costs to sell those such stock.

The SEC has adopted rule 3a51-1 that establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share subject to certain exceptions. For any transaction involving a penny stock, unless exempt, Rule 15g-9 requires that a broker or dealer needs to:

| ● | approve a person’s account for transactions in penny stocks, and | |

| ● | receive from the investor a written agreement to the transaction setting forth the identity and quantity of the penny stock to be purchased. |

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

| ● | obtain financial information and investment experience objectives of the person and | |

| ● | make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. |

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market which, in highlight form:

| ● | sets forth the basis on which the broker or dealer made the suitability determination and | |

| ● | declares that the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our common stock.

The market price for our common stock is particularly volatile given our status as a relatively unknown company with a small and thinly traded public float, limited operating history and lack of profits that could lead to wide fluctuations in our stock price. Investors may be unable to sell our common stock at or above the original purchase price, which may result in substantial losses.

The market for our common stock is characterized by significant price volatility when compared to seasoned issuers, and we expect that our stock price will continue to be more volatile than a seasoned issuer for the indefinite future. The volatility in our stock price is attributable to a number of factors. First, as noted above, our common stock is sporadically and thinly traded. As a consequence of this lack of liquidity, the trading of relatively small quantities of shares by our shareholders may disproportionately influence the price of those shares in either direction. The price for our stock could, for example, decline precipitously in the event that a large number of our common shares are sold on the market without commensurate demand as compared to a seasoned issuer which could better absorb those sales without adverse impact on its share price. Secondly, we are a speculative or “risky” investment due to our limited operating history and lack of profits to date and uncertainty of future market acceptance for our potential products and services. As a consequence of this enhanced risk, more risk-adverse investors may, under the fear of losing all or most of their investment in the event of negative news or lack of progress, be more inclined to sell their shares on the market more quickly and at greater discounts than would be the case with the stock of a seasoned issuer. Many of these factors are beyond our control and may decrease the market price of our common stock regardless of our operating performance. We cannot make any predictions or projections as to what the prevailing market price for our common stock will be at any time including as to whether our common stock will sustain their current market prices or as to what effect that the sale of shares or the availability of common stock for sale at any time will have on the prevailing market price.

| 15 |

We do not pay dividends on our common stock.

We have not paid any dividends on our common stock and do not anticipate paying dividends in the foreseeable future. We plan to retain earnings, if any, to finance the development and expansion of our business.

Rule 144 related risk.

The SEC adopted amendments to Rule 144 which became effective on February 15, 2008 that apply to securities acquired both before and after that date. Under these amendments, a person who has beneficially owned restricted shares of our common stock for at least six months would be entitled to sell their securities provided that: (i) such person is not deemed to have been one of our affiliates at the time of or at any time during the three months preceding a sale, (ii) we are subject to the Exchange Act periodic reporting requirements for at least 90 days before the sale and (iii) if the sale occurs prior to satisfaction of a one-year holding period, we provide current information at the time of sale.

Persons who have beneficially owned restricted shares of our common stock for at least six months but who are our affiliates at the time of, or at any time during the three months preceding a sale, would be subject to additional restrictions by which such person would be entitled to sell within any three-month period only a number of securities that does not exceed the greater of either of the following:

| ● | 1% of the total number of securities of the same class then outstanding; or | |

| ● | the average weekly trading volume of such securities during the four calendar weeks preceding the filing of a notice on Form 144 with respect to the sale; |

provided, in each case, that we are subject to the Exchange Act periodic reporting requirements for at least three months before the sale. Such sales by affiliates must also comply with the manner of sale, current public information and notice provisions of Rule 144.

Restrictions on the reliance of Rule 144 by shell companies or former shell companies.

Historically, the SEC staff has taken the position that Rule 144 is not available for the resale of securities initially issued by companies that are, or previously were, blank check companies like us. The SEC has codified and expanded this position in the amendments discussed above by prohibiting the use of Rule 144 for resale of securities issued by any shell companies (other than business combination related shell companies) or any issuer that has been at any time previously a shell company. The SEC has provided an important exception to this prohibition, however, if the following conditions are met:

| ● | the issuer of the securities that was formerly a shell company has ceased to be a shell company;. | |

| ● | the issuer of the securities is subject to the reporting requirements of Section 14 or 15(d) of the Exchange Act;. | |

| ● | the issuer of the securities has filed all Exchange Act reports and material required to be filed, as applicable, during the preceding 12 months (or such shorter period that the issuer was required to file such reports and materials), other than Current Reports on Form 8-K; and | |

| ● | at least one year has elapsed from the time that the issuer filed current comprehensive disclosure with the SEC reflecting its status as an entity that is not a shell company. |

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable to a smaller reporting company.

| 16 |

Administrative Offices

Our primary business office is located at 2300 West Sahara Ave., Suite 800, Las Vegas, NV 89102. Our phone number is 702-933-0808. Our residential office is leased from an entity controlled by the majority shareholder.

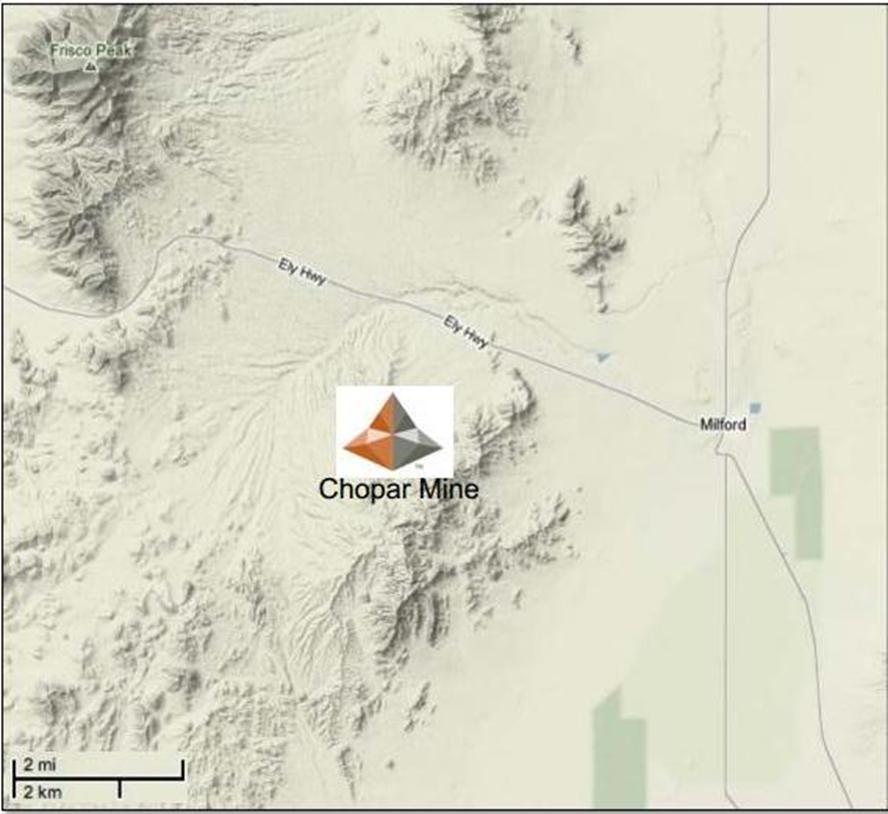

Star Mountain/Chopar Mine (Star Mining District)

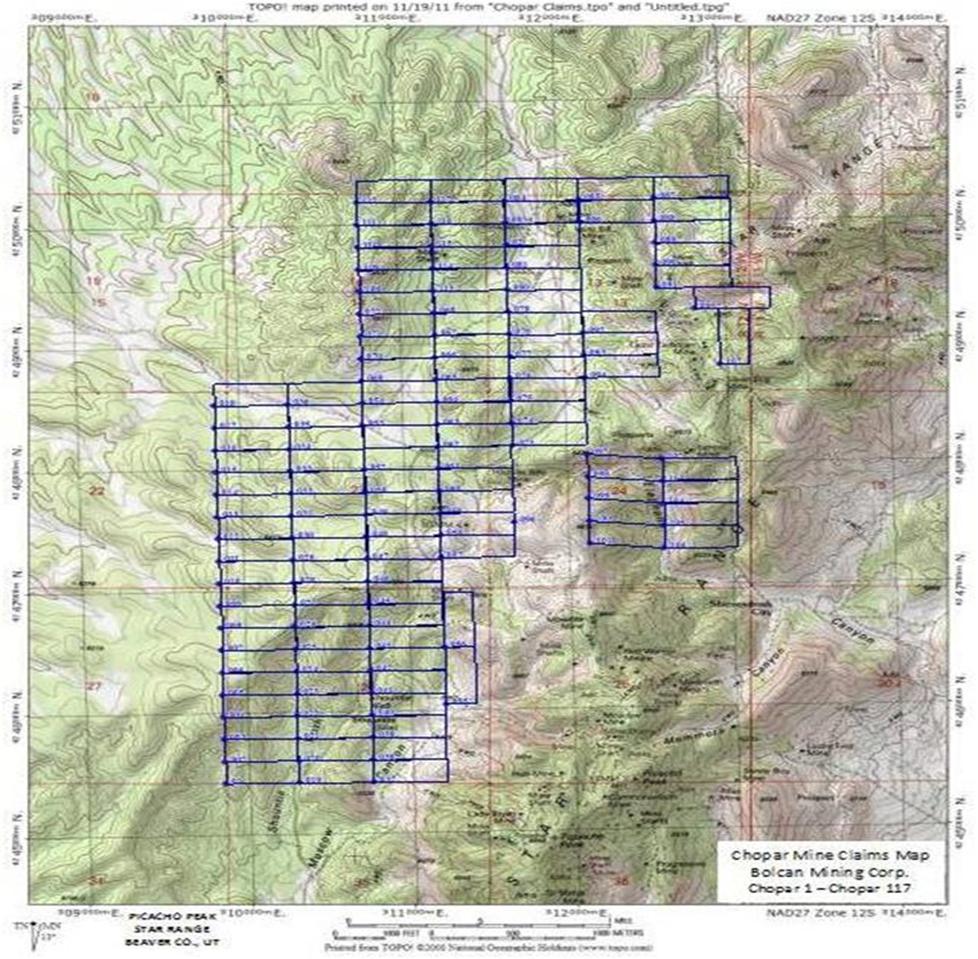

On April 23, 2012, the Company paid and capitalized $22,113 to acquire 117 unpatented lode mining claims from the Bureau of Land Management related to the Star Mountain project near Milford, Utah. In addition, on May 1, 2012, the Company entered into a mineral lease agreement with the State of Utah for approximately 1,400 acres that are contiguous with the Star Mountain lode mining claims. The initial costs incurred and capitalized in connection with obtaining the lease was $1,599. Collectively, the Star Mountain claims and lease encompass a total area of approximately 3,740 acres.

Star Mountain Mining District Chopar Claim Map: showing claim corners and boundaries.

| 17 |

Mineral Lease Tract Boundaries T28S, R12W, SLB&M, Sec. 2 [All], and T29S, R12W, SLB&M, Sec. 2 [All].

The Star Mountain lease has an initial term of 10 years, subject to certain extension provisions. The future minimum annual rental commitment is $1.00 per acre (or $1,408). The lease also provides for a minimum annual royalty payment of $4,224 beginning in the 11th year of the lease (if extended), and requires contingent production royalty payments based on 4% to 8% of the gross value (as defined in the lease) of non-fissionable and fissionable metalifferous minerals, respectively, extracted from the leased area.

The Company’s lode mining claim mineral rights on the Chopar Mine properties consist of lode mining claims on United States Forest Service land. The mineral rights were acquired by staking lode mining claims as per the Mining Law of 1872. Each lode mining claim in respect to the Chopar Mine project consists of Approx. 20 acres. All claims are subject to an annual maintenance fee of $140.00/claim due on or before September 1st each year. Mining claims are subject to the same risk of defective title that is common to all real property interests. Additionally, mining claims are self-initiated and self-maintained and therefore, possess some unique vulnerabilities not associated with other types of property interests. It is impossible to ascertain the validity of unpatented mining claims solely from an examination of public real estate records and, therefore, it can be difficult or impossible to confirm that all of the requisite steps have been followed for location and maintenance of a claim. Furthermore, as these interests are derived from multiple jurisdictions, the risk of a defective claim or other problems with ownership and development of the claim (including but not limited to the right of eminent domain) is compounded further. If the validity of a patented mining claim or mineral interest is challenged by an applicable governmental body on the grounds that mineralization has not been demonstrated, the claimant has the burden of proving the present economic feasibility of mining minerals located thereon. Such a challenge might be raised at any stage of development or at the commencement of production, or simply when the government seeks to include the land in an area to be dedicated to another use.

| 18 |

Star Mountain/Chopar Mine (Star Mining District) General Geology:

Stratigraphy. Rocks of the Star Range which encompass the Star Mining District include sedimentary, intrusive and extrusive igneous, metamorphosed sedimentary and igneous types. The intrusive igneous rocks are mostly quartz monzonite to granodiorite. A number of lamprophyre and aplite dikes cut the sedimentary and intrusives. Volcanic rocks are rhyolite, andesite, and basalt. Sedimentary and volcanic rocks have been contacted and hydrothermally metamorphosed. Contact metamorphic mineralization is also evident along the borders of the intrusives.

Geology General Statement. The area which encompasses the Star Mining District is located in a thrusted and fault-cut range about 13 km (8 miles) ESE from Milford, Utah. It hosts several distinct features that may be related to Tertiary-age plutons noted in the area. Field examination indicates Porphyry-epithermal gold-silver-copper system intruded into older Paleozoic and Mesozoic sedimentary units.

General Statement of Geophysical/Geochemical work completed. Recent field work completed on the property to date included ground magnetometer surveys, cross sectional modeling and deep penetrating 3D survey, geologic reconnaissance mapping, surface sampling and assaying, Reverse Circulation, Core Drilling, and assaying of selected targets, combined geophysical analysis, bulk sampling and bench scale testing for scale of economy for the beneficiation of Copper (Cu), Silver (Ag) and Gold (Au).

General Statement of Exploration Status. The company has been managing an ongoing diamond core drilling program within the Wild Bill area (approximately 900 acre area) at the northern most end of the Star Mountain, Chopar Mine. The company completed a reverse circulation (RC) drilling program of 15 drill holes to a depth of 500 feet each (7,500 feet drilled), then commenced diamond core drilling in August 2013.

Further Exploration. The diamond core drilling and analysis of the core and RC cuttings continued through the end of 2013. The company budgeted $1,200,000 for exploration expenses, and actually expensed $1,021,597 for exploration as of the year ended of December 31, 2013.

General Statement regarding Exploration and Mining Permits. The State of Utah, Division of Natural resources, Division of Oil, Gas, and Mining, Administrative Services, Minerals Program (the “Division”) which regulates all mining activities according to the Mined Land Reclamation Act, Title 40-8, Utah Code Annotated 1953, as amended in 1975, and the General Rules and Rules of Practice and Procedures, R647-1 through R647-5, required a Notice of Intent to conduct Exploration activities, and to place a Surety Reclamation Bond for exploration of $8,900/first acre and $4,900 each additional acre. Regarding drilling dry, and in addition to the above exploration costs the Division also requires a one-time mob/demob fee of $1,000 and $210 per each exploration hole drilled. Regarding drilling wet up to 7” diameter, and in addition to the above costs the Division requires $7,000 mod/demob charge for holes 800 feet or less plus $4.25/foot plus $210 for cap, $10,000 mob/demob charge for holes between 801 and 1,600 feet plus $210 for cap, $16,000 mob/demob for holes greater than 1,600 feet, and $5.44/foot plus $210 for cap. The Notices are amendable in time and scope and additional bonding may be assessed according to current or future plans, rules, and regulations.

The Chopar Mine property currently does not own a mine plant or mill or mining equipment, and is considered an “advanced stage” exploration project, and has no proven or probable reserves as defined by SEC Industry Guide 7.

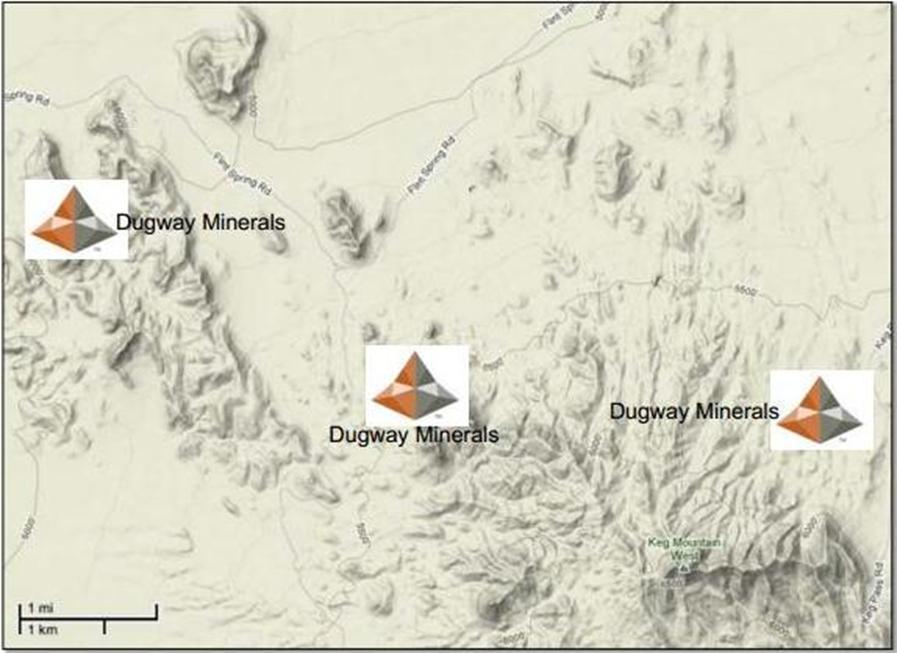

Spor Mountain/Dugway Minerals (Spor Mountain Mining District)

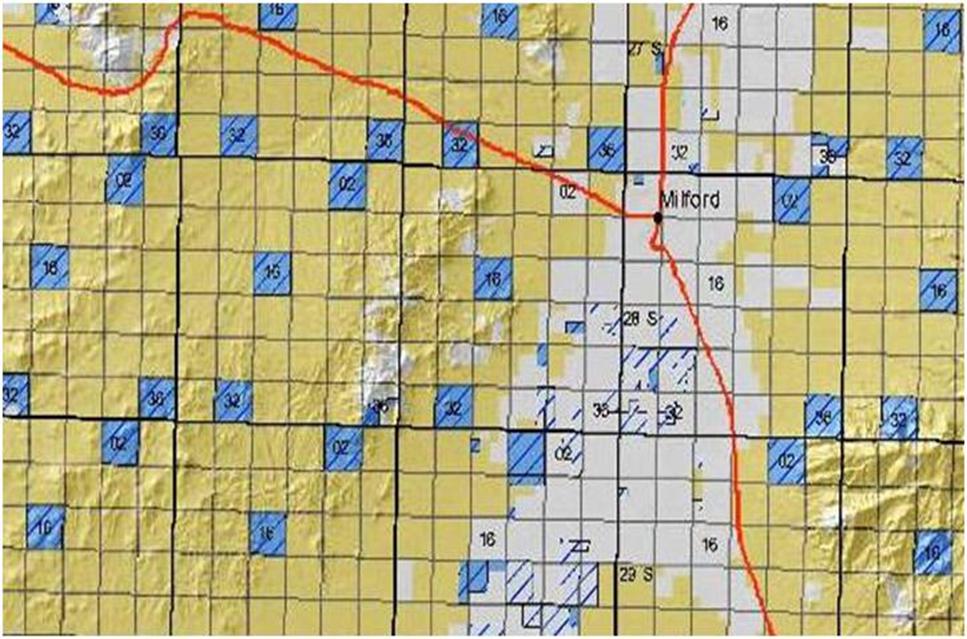

On May 1, 2012, the Company entered into a mineral lease agreement with the State of Utah for approximately 1,920 acres related to the Dugway Minerals project near Delta, Utah (the “Dugway Minerals Lease”). The initial costs incurred and capitalized in connection with obtaining the lease were $2,157. The lease has an initial term of 10 years, subject to certain extension provisions. The future minimum annual rental commitment is $1.00 per acre (or $1,918). The lease also provides for a minimum annual royalty payment of $5,754 beginning in the 11th year of the lease, and requires contingent production royalty payments based on 4% to 8% of the gross value (as defined in the lease) of non-fissionable and fissionable metalifferous minerals extracted from the leased area.

| 19 |

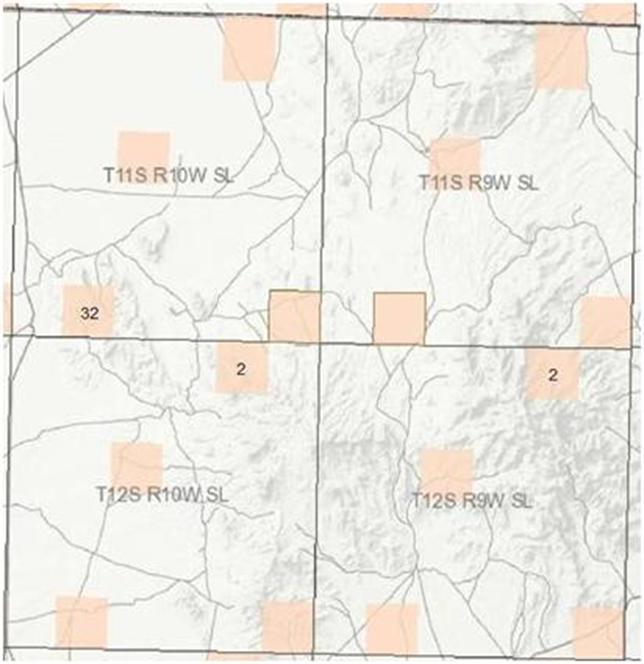

Mineral Lease Tract Boundaries T11S, R10W, SLB&M, Sec. 32 [All], T12S, R9W, SLB&M [All], T12S, R10W, SLB&M, Sec. 2 [All].

Spor Mountain/Dugway Minerals General Geology:

Stratigraphy General Statement. Paleozoic rocks, probably deformed during the Sevier orogeny, consist of Lower Cambrian Prospect Mountain Quartzite thrust over Middle Cambrian limestone. These rocks are unconformably overlain by Eocene andesite and latite. Subsidence of a newly recognized cauldron (approximately 5 km in diameter), between 39.4 and 36.2 million years ago, resulted in the formation of megabreccia. Eruption of a lithic-crystal ash-flow tuff may have accompanied subsidence and an inferred vent may mark the structural wall of the cauldron. Intrusion of several granodiorite stocks and plugs, about 36 million years ago, caused widespread alteration and mineralization. Later intrusions formed pebble dikes and granite plugs.

General Statement of Geophysical/Geochemical work completed. A joint Utah Geological and Mineral Survey (UGMS)-U. S. Geological Survey (USGS) investigation of the mineral potential began in the area covered by the Dugway Minerals Lease following the release of a report announcing the discovery of pyritized rocks with economic potential. Mapping in the area covered by this lease, in conjunction with the USGS Delta CUSMAP project, focused on the geologic setting of several little-explored occurrences of silver, lead, zinc, and copper mineralization. The company has performed grass roots prospecting, surface rock sampling, bulk sampling, and analysis of combined historical geophysical/geochemical data in the area covered by the Dugway Minerals Lease.

General Statement of Exploration Status. Exploration was limited to research and analysis of collected data, and geologic mapping through end of December 31, 2013.

Further Exploration. Mineralized rock in the area covered by the Dugway Minerals Lease consists of highly oxidized veins and stockwork zones containing potentially economic concentrations of silver, lead, copper, and bismuth as reported by the Utah Geological Survey. The company plans on performing further geophysical/geochemical work through a third party engineering firm on the properties beginning in the second quarter of 2014. Scope of work and associated costs will be based upon proposals and bids from several firms. The final budget and timeline are expected to be developed in 2014.

| 20 |

General Statement regarding Exploration and Mining Permits. The Dugway Minerals project currently does not have a mine plant, mill or mining equipment, and is considered an “early stage” exploration project, and has no proven or probable reserves as defined by SEC Industry Guide 7.

Ogden Bay Minerals

The Company’s plans for the Ogden Bay Minerals project consists of developing a mineral exploration and possible excavation project on federal protected wetlands, canals and river systems across 25 square miles of land area known as North Delta located in West Ogden, Utah. Excavation and harvesting rights are maintained through easement rights obtained from Weber County and a special use river/stream alteration permit as part of a State of Utah/Weber County flood mitigation project. We intend to continue to explore for silica, zircon, silver and gold.

Ogden Bay Minerals Exploration Base Map

Stratigraphy General Statement. The Ogden Bay site lies on an extensive lowland plain formed during the Quaternary Period by depositions of ancient Lake Bonneville and Great Salt Lake sediments, in combination with delta deposits, alluvial fans from the Weber River, and other siliceous mineral sands deposited from deep positive flow warm springs. Sand and soils consist of warm springs fine sandy loam, Lakeshore fine sand loam, Leland silt loam, and silica sand.

General Statement of Geophysical/Geochemical work completed. In 2010, the company completed augur soil sampling and assaying of mineralized zones of interest, analyzed combined historical geophysical/geochemical data located in the public realm for the Ogden Bay site. At year-end 2012 we had mined and stockpiled approximately 15,000 short tons of mineral sand for scale of economy and testing for the recovery of silica sand and other minerals of interest.