Attached files

| file | filename |

|---|---|

| EX-31.1 - Star Mountain Resources, Inc. | ex31-1.htm |

| EX-32.2 - Star Mountain Resources, Inc. | ex32-2.htm |

| EX-31.2 - Star Mountain Resources, Inc. | ex31-2.htm |

| EX-21 - Star Mountain Resources, Inc. | ex21.htm |

| EX-23.1 - Star Mountain Resources, Inc. | ex23-1.htm |

| EX-32.1 - Star Mountain Resources, Inc. | ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 000-54405

STAR MOUNTAIN RESOURCES, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 90-0963619 | |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification No.) |

| 8307 Shaffer Parkway, Suite 102, Littleton, Colorado | 80127 | |

| (Address of principal executive offices) | (Zip Code) |

(844) 443-7677

(Registrant’s telephone number, including area code)

605 W. Knox Rd, Suite 202, Tempe, AZ 85284

(Former Name, former address and former fiscal year, if changed since last report)

Copies of Communications to:

Laura Anthony, Esq.

Legal & Compliance, LLC

330 Clematis Street, Suite 217

West Palm Beach, FL 33401

(561) 514-0936

Fax (561) 514-0832

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes [ ] No [X]

At June 30, 2015, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $11,343,946 based on the closing sale price of the registrant’s common stock on June 30, 2015 of $1.05 per share.

As of April 11, 2016, 38,301,229 shares of the registrant’s common stock, par value $0.001, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Star Mountain Resources, Inc.

Form 10-K

For the Year Ended December 31, 2015

Table of Contents

| 2 |

Throughout this Annual Report on Form 10-K (“Annual Report”), references to “we”, “our”, “us”, “Star Mountain”, “the Company”, and similar terms refer to Star Mountain Resources, Inc. and its wholly owned subsidiaries: Bolcán Mining Corporation, Northern Zinc LLC, Balmat Holdings Corporation and St. Lawrence Zinc LLC.

Financial information in this Annual Report is presented in accordance with generally accepted accounting principles (“GAAP”) in the United States (“U.S. GAAP”), and unless otherwise specified, all dollar amounts are expressed in thousands of United States Dollars (“$” or “US$”).

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report includes forward-looking statements that relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Words such as, but not limited to, “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “targets,” “likely,” “aim,” “will,” “would,” “could,” and similar expressions or phrases identify forward-looking statements. We have based these forward-looking statements largely on our current expectations of future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Forward-looking statements include, but are not limited to, statements about:

| ● | the insufficiency of our existing cash resources and working capital to enable us to continue our operations for the next twelve months as a going concern; | |

| ● | future financial or operating performance of the Company or its subsidiaries and its projects; | |

| ● | the availability of, and terms and costs related to, potential future borrowing, debt repayment and financing; | |

| ● | future inventory, production, sales, payments from customers, cash costs, capital expenditures and exploration expenditures; | |

| ● | expected mining and concentrate grades and recoveries; | |

| ● | estimates of mineral reserves and resources, including estimated mine life and annual production; | |

| ● | projected timing to ramp-up of planned production levels at our Balmat Zinc Mine; | |

| ● | the projected development of our exploration properties and future exploration at our operations; | |

| ● | future concentrate shipment dates and shipment sizes; | |

| ● | future operating plans and goals, including our planned re-start activities for the Balmat Zinc Mine; | |

| ● | expected costs, including projected capital and operating costs; and | |

| ● | expectations regarding the global supply and demand and pricing of zinc. |

Forward-looking statements are based on current expectations and assumptions that are subject to a variety of known and unknown risks and uncertainties that may cause actual results to differ materially from the forward-looking statements. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in Item 1A, “Risk Factors” and elsewhere in this report. Except as required by law, we disclaim any obligation to update or revise publicly any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

CAUTIONARY STATEMENT REGARDING MINERALIZED MATERIAL

“Mineralized material” as used in this Annual Report, although permissible under the United States Securities and Exchange Commission’s (“SEC”) Industry Guide 7, does not indicate “reserves” by SEC standards. We cannot be certain that any mineralized materials will ever be converted into SEC Industry Guide 7-compliant “reserves”. Investors are cautioned not to assume that all or any part of the disclosed mineralized material estimates will ever be confirmed or converted into reserves or that mineralized material can be economically or legally extracted.

| 3 |

Corporate Background

The Company was incorporated in Nevada on September 2, 2009; initially as MyOtherCountryClub.com for the purpose of developing a website that would offer reciprocal golf privileges, and other related services, to members of private country clubs throughout the United States. We subsequently changed our name to the Jameson Stanford Resources Corporation in April 2012 and on October 29, 2012, merged with Bolcán Mining Corporation (“Bolcán Mining”) with Bolcán Mining becoming a wholly owned subsidiary of the Company. Prior to the merger, Jameson Stanford Resources Corporation was a publicly traded shell company with no business operations.

On December 15, 2014, the Company changed its name from Jameson Stanford Resources Corporation to Star Mountain Resources, Inc. to better reflect its primary focus of exploring and conducting pre-extraction activities on the mineral rights it held in the Star Mining District in Beaver County, Utah.

On November 2, 2015, we entered into three-way definitive agreements with Northern Zinc, LLC (“Northern Zinc”) and HudBay Minerals, Inc. (“Hudbay”) that resulted in the Company acquiring Northern Zinc, Balmat Holding Corporation (“Balmat Holdings”) and St. Lawrence Zinc Company, LLC (“SLZ”), including SLZ’s wholly owned interest in the Balmat mining and milling operations located in St. Lawrence County, New York (the “Balmat Mine”).

Subsidiaries

With the completion of our November 2, 2015 acquisition of Northern Zinc, a Nevada limited liability company, Northern Zinc joined Bolcán Mining, a Nevada corporation, as direct and wholly owned subsidiaries of Star Mountain, the parent company. Northern Zinc, in-turn, holds a 100% ownership interest in Balmat Holdings, a Delaware corporation, with SLZ, a Delaware limited liability company, being a direct and wholly owned subsidiary of Balmat Holdings. SLZ, in-turn, is the sole owner of the Balmat zinc mine and milling complex located in upstate New York while our Bolcán Mining subsidiary holds our mineral rights in the Star Mining district of southern Utah.

Description of Business

Our focus is the acquisition of mineral properties and their development into producing mines, with our primary focus currently being the re-start of mining operations at our Balmat Mine in upstate New York. When complete, we expect that this re-start will transition the Company from a junior exploration company to a mining company capable of generating a consistent revenue stream through the production of a salable concentrate material grading approximately 57% zinc.

The Balmat Mine was last in production during the latter part of 2008 when the mine’s previous owner, in response to depressed zinc prices, placed the mine on care and maintenance. Since that time, the mine and mill workings have been well cared for, the mine has been kept pumped dry and all permits and mineral rights have been maintained. Currently, the mine is readily accessible, the mill is in good condition and all required equipment and infrastructure is in place to allow for the mine’s re-start following a refurbishment period, which we estimate to be approximately six to nine months after securing necessary financing.

In February 2016, we completed a reserve study at the Balmat Mine confirming the existence of proven and probable reserves as defined in SEC Industry Guide 7 (“IG7 Report”). The IG7 Report confirmed 585,000 tons of proven and probable reserves based on a 9.2% fully diluted zinc grade capable of generating estimated revenues of $80.8 million over the initial 2.5 year mine plan.

The IG7 Report also estimated the initial capital needed for Balmat’s re-start at $14.7 million, including pre-mining activities such as development drifting, re-engineering of underground infrastructure and essential upgrades to the ventilation, mobile equipment, crusher and hoisting systems. Subject to our ability to raise these funds, we plan to return the Balmat Mine to production following the completion of these refurbishment activities.

| 4 |

A summary of the economic analysis from the IG7 Report follows:

| Ore Mined for Processing | 585 | Kt | ||||

| Zinc Grade | 9.2 | % | ||||

| Contained Zinc | 53.8 | kt | ||||

| Capital Development | 9,067 | feet | ||||

| Mill Recovery | 96 | % | ||||

| Zinc Recovered in Concentrate | 51.7 | kt | ||||

| Zinc Price | $ | 0.92 | /pound | |||

| Smelter Deduction | 15 | % | ||||

| Smelter Treatment Charges | $ | 187.51 | /ton concentrate | |||

| Transportation Charges | $ | 21.51 | /ton concentrate | |||

| Penalty Charges | $ | 20.00 | /ton concentrate | |||

| Revenue | $ | 80,788 | (000’s) | |||

| Operating Costs (Includes 15% Contingency | $ | (39,533 | ) | (000’s) | ||

| Smelter Charges | $ | (21,313 | ) | (000’s) | ||

| Royalty 0.3% | $ | (178 | ) | (000’s) | ||

| EBITA | $ | 19,764 | (000’s) | |||

| Capital | $ | (14,745 | ) | (000’s) | ||

| Income Tax | $ | (590 | ) | (000’s) | ||

| Net Income | $ | 4,427 | (000’s) | |||

| Discounted Cash Flow @ 5% | $ | 3,165 | (000’s) | |||

| Payback Period | 2.5 | years | ||||

| Profitability Index | 1.2 | |||||

| Internal Rate of Return | 25 | % |

In addition to our Balmat Mine, we hold mining claims and mineral leases on exploration properties in the Star Mining district of southern Utah (“the Chopar Project”). These holdings are comprised of 115 unpatented mining claims, fee-simple, patented mining claims and mineral leases on State of Utah lands.

Further information on our Balmat Mine and Chopar Project is included under the section heading “Item 2. Properties” in this Annual Report.

Products

As a pre-production company, none of our properties or projects has yet reached the production stage. However, with our recent acquisition of the Balmat Mine and our plan to return the mine to production following a short refurbishment period, once back in production we expect that the Balmat Mine will produce a zinc concentrate material containing approximately 57% zinc.

According to current statistics published by the USGS, zinc is the fourth most widely consumed metal in the world after iron, aluminum, and copper. It has strong anticorrosive properties and bonds well with other metals. Consequently, about three-fourths of the zinc produced is used in zinc galvanizing, which is the process of adding thin layers of zinc to iron or steel to prevent corrosion and as an alloy combined with copper for production of brass and also with other metals to form materials that are used in automobiles, electrical components, and household fixtures. A third significant use of zinc is in the production of zinc oxide (the most important zinc chemical by production volume), which is used in rubber manufacturing and as a protective skin ointment.

Zinc is also important for health. It is a necessary element for the proper growth and development of humans, animals, and plants. The adult human body contains between 2 and 3 grams of zinc, which is the amount needed for the body’s enzymes and immune system to function properly. It is also important for taste, smell, and to heal wounds. Trace amounts of zinc occur in many foods, such as oysters, beef, and peanuts.

Customers

As a pre-production company, we have not generated any revenues since inception. However, if our plans to resume production at our Balmat Mine are successful, the zinc concentrate produced at the Balmat Mine will be sold to a zinc smelter for further processing. There are currently a number of zinc smelters located throughout the world, and with the Balmat Mine’s proximity to the St. Lawrence Seaway, we expect that the zinc concentrates produced by the Balmat Mine could be transported to and sold to any smelter in the world.

Environmental Regulation

Our exploration and planned development and mining activities are subject to extensive and costly environmental laws and regulations under various federal, state, county and local laws relating to the protection of the environment, which generally includes air and water quality, hazardous waste management, radionuclide handling and reclamation. Failure to comply with these requirements can result in civil and/or criminal liability for noncompliance, fines and penalties, clean-up costs and other environmental damages. It is also possible that unanticipated developments or changes in the law could require us to make environmental expenditures significantly greater than those we currently expect. Environmental legislation is evolving in a manner that will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. Current and future laws, regulations and permits will impose significant costs, liabilities or obligations or could limit or prevent our ability to continue operations or undertake new operations. Environmental hazards may exist on the properties in which we hold interests that are unknown to us at present and that have been caused by previous owners of the properties.

| 5 |

Our Balmat Mine in New York is subject to federal and state environmental laws, regulations and permits. The federal agency responsible for regulatory jurisdiction is the Environmental Protection Agency. The state agency with regulatory jurisdiction is the New York State Department of Environmental Conservation. We operate under approvals and permits granted by both agencies. As of December 31, 2015, the Company had posted a cash surety bond with the state of New York totaling $1,664. We also have in place a reclamation plan that we believe meets all legal and regulatory requirements. At December 31, 2015, $17,906 was accrued for estimated future reclamation activities at our Balmat Mine site.

Our Chopar Project in the Star Mining district of southern Utah is also subject to federal and state environmental laws, regulations and permits. The governmental agencies and regulators tasked with implementing and enforcing these laws and regulations include the Bureau of Land Management, the Mine Safety and Health Administration, the Utah Department of Natural Resources, the Utah State Institutional Trust Lands Administration, the Utah Department of Environmental Quality, the Environmental Protection Agency, and the Bureau of Alcohol, Tobacco, Firearms and Explosives. As of December 31, 2015, the Company had a surety bond with the State of Utah totaling $24 to ensure environmental reclamation of disturbed areas.

We are committed to fulfilling or exceeding our requirements under applicable environmental laws and regulations and it is our policy to conduct our business in a way that safeguards public health and the environment. We believe that our operations are in compliance with applicable environmental laws and regulations in all material respects. Such compliance requires significant expenditures and increases mine development and operating costs. Mining is subject to potential risks and liabilities associated with pollution of the environment and the disposal of waste products occurring as a result of mineral exploration and production. Environmental liability may result from mining activities conducted by others prior to our ownership of a property. To the extent we are subject to uninsured environmental liabilities, the payment of such liabilities would reduce our otherwise available earnings and could have a material adverse effect on our business plan.

Licenses and Permits

Our operations require licenses and permits from various governmental authorities. We believe we hold all material licenses and permits required under applicable laws and regulations and believe we are presently complying in all material respects with the terms of such licenses and permits. However, such licenses and permits are subject to change in various circumstances. There can be no guarantee that we will be able to obtain or maintain all necessary licenses and permits that may be required to explore and develop our properties, to commence construction or operation of mining facilities and properties under exploration or development or to maintain continued operations that economically justify the cost. Notwithstanding, other than those permits and licenses currently held, we are not aware of any other permits or licenses that are required for the resumption of mining and milling operations at our Balmat Mine.

Mine Safety and Health Administration Regulations

Pursuant to Section 1503(a) of the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act, issuers that are operators, or that have a subsidiary that is an operator of a mine in the United States are required to disclose in their periodic reports filed with the SEC information regarding specified health and safety violations, orders and citations, related assessments and legal actions and mining-related fatalities. See Item 4: Mine Safety Disclosures.

Competition

The exploration for and acquisition of mineral properties is subject to intense competition. Identifying and evaluating potential mining prospects is a costly and time-consuming endeavor. Due to our limited capital and personnel, we are at a competitive disadvantage compared to many other companies with regard to exploration and, if warranted, advancement of mining properties. Our present limited capital means that our ability to compete for properties to be explored and developed is limited. We believe that competition for acquiring mineral prospects will continue to be intense in the future.

Employees

At December 31, 2015, we had 11 full-time employees of which seven were employed in care and maintenance activities at our Balmat Mine in New York. None of our employees are covered by collective bargaining agreements.

Available Information

We make available, free of charge, on or through our Internet website, at www.starmountainresources.com, our annual reports on Form 10-K, our quarterly reports on Form 10-Q and our current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. Our Internet website and the information contained therein or connected thereto are not intended to be, and are not, incorporated into this Annual Report.

| 6 |

Our filings can also be viewed at our corporate offices, located at 8307 Shaffer Parkway, Suite 102, Littleton, Colorado 80127. Our reports, registration statements and other information can be inspected on the SEC’s website at www.sec.gov and such information can also be inspected, and copies ordered, at the public reference facilities maintained by the SEC at the following location: 100 F Street NE, Washington, D.C. 20549. Information regarding the operation of the SEC’s public reference facilities may be obtained by calling the SEC at 1-800-SEC-0330.

An investment in our common stock involves a high degree of risk. Investors should carefully consider the risks described below, together with all of the other information included in this Annual Report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and investors may lose all or part of their investment. Investors should read the section entitled “Cautionary Note Regarding Forward-Looking Statements” above for a discussion of what types of statements are forward-looking statements as well as the significance of such statements in the context of this Annual Report.

Risks Related To Our Business and Financial Condition

There is substantial doubt as to our ability to continue as a going concern.

We have no historical revenues, have suffered recurring losses from operations and have a working capital deficit of $1,118 as of December 31, 2015. Further losses are anticipated in the development of our business. Therefore, our continuation as a going concern is dependent upon our completion of a future financing. However, there is no assurance that we will be successful in completing such a financing. If we are unable to fund future operations by way of financing, including public or private offerings of equity or debt securities, our business, financial condition and exploration activities will be adversely impacted. As a result, there is substantial doubt as to our ability to continue as a going concern.

The audit opinion and notes that accompany our consolidated financial statements for the year ended December 31, 2015, refer to the substantial doubt regarding our ability to continue as a going concern. The accompanying financial statements have been prepared assuming that we will continue as a going concern. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty. We do not have sufficient cash to fund planned operations or meet our obligations for the next 12 months without raising additional funds.

Difficult conditions in the global capital markets and the general economy may materially and adversely affect our business and results of operations, and we do not expect these conditions to improve in the near future.

Our results of operations are materially affected by conditions in the domestic capital markets and the general economy. Recent concerns over inflation, energy costs, geopolitical issues, the availability and cost of credit, the U.S. mortgage market and a declining real estate market in the U.S. have contributed to increased volatility and diminished expectation for the economy and the markets going forward. These factors, combined with volatile (and currently depressed) oil and gas prices, declining business and consumer confidence and increased unemployment, have precipitated an economic slowdown and fears of a continued recession. In addition, the fixed-income markets are experiencing a period of extreme volatility that has negatively impacted market liquidity conditions.

Because we have a very limited operating history, investors have little basis to evaluate our ability to operate.

Our activities to date have been focused on raising capital funds, exploring our properties and preparing those properties for production. Although some of our mine and concentrating facilities have previously operated, these operations were carried out under different ownership and, therefore, we face all of the risks commonly encountered by other businesses that lack an established operating history including the need for additional capital, personnel and intense competition. There is no assurance that our business plan will be successful.

Any future revenues and profits are uncertain.

Prior to completion of the development and pre-production stage, we will incur increased operating expenses without realizing any significant revenues. We expect to incur continued and significant losses until such time that we achieve commercial production levels and generate sufficient revenue to fund continuing operations. As a result of continuing losses, we may exhaust all of our resources and be unable to complete development of our planned mining operations. There is no certainty that we will produce revenue from any source, operate profitably or provide a return on investment in the future. If we are unable to generate revenues or profits, our shareholders might not be able to realize returns on their investment in our common shares.

| 7 |

Our ability to become and remain profitable over the long term will depend on our ability to identify, explore and develop our current and additional properties we may acquire in the future.

Zinc and other mineral properties are wasting assets. They eventually become depleted or uneconomical to continue mining. Our ability to become and remain profitable over the long term depends on our ability to finalize the design, permit, development and profitable extraction and recovery of mineral resources beyond our current planned mine life. If our ability to expand the operations beyond their current planned mined lives does not occur, we may seek to acquire other precious and base metals properties beyond our current properties. The acquisition of precious and base metals properties and their exploration and development are subject to intense competition. Companies with greater financial resources, larger staff, more experience and more equipment for exploration and development may be in a better position to compete for such mineral properties. If we are unable to find, develop and economically mine new properties, we most likely will not be profitable on a long-term basis and the price of our common stock may suffer.

The planned pre-mining activities and re-start of the Company’s Balmat Mine involves numerous uncertainties that could affect the feasibility or profitability of such plans.

Mine development projects, including re-starting a historically operating mining operation, require significant expenditures before production is possible. The completion and economic feasibility of such projects is based on many factors and includes risks such as potential delays, cost overruns, shortages of material or labor, construction defects, breakdowns and injuries to persons and property. We expect to engage self-employed personnel, subcontractors and material suppliers in connection with the refurbishment and development of our mine project. While we anticipate taking all measures that we deem reasonable and prudent in connection with refurbishment of the mine and the operation of the mill, there is no assurance that the risks described above will not cause delays or cost overruns in connection with such refurbishment or operation. Any delays would postpone our anticipated receipt of revenue and adversely affect our operations which in turn may adversely affect the price of our stock.

Future revenue is dependent upon our ability to secure a commercially viable sales outlet for our zinc concentrate.

We do not currently have any sales contracts in place and as we are currently pre-production, no potential customers have been able to test our product to ensure it meets desired specifications. Our business plans would be adversely affected in the event that our concentrates are not deemed saleable.

Increased costs could affect our ability to re-start the Balmat Mine and return it to production and, once in production, to be profitable.

We have estimated the initial capital costs required to re-start the Balmat Mine and return it to commercial production at approximately $14.7 million. The actual costs may be higher than we presently anticipate which could make it more difficult to finance such activities or to successfully establish mining operations.

We anticipate that our future operating costs will vary from year to year due to a number of factors, such as changing ore grade, metallurgy and revisions to mine plans in response to the physical shape and location of the ore body. In addition, costs are affected by the price of commodities such as oil, gas, reagents/chemicals, steel, rubber and electricity. Such commodities are at times subject to volatile price movements, including increases that could make production less profitable or not profitable at all. A material increase in costs could also impact our ability to commence or maintain future development or mining operations.

Estimates of mineralized material are based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated.

There are numerous uncertainties inherent in estimating quantities of mineralized material including many factors beyond our control and no assurance can be given that the recovery of mineralized material will be realized. In general, estimates of mineralized material are based upon a number of factors and assumptions made as of the date on which the estimates are determined, including:

| ● | the geological and engineering estimates that have inherent uncertainties and the assumed effects of regulation by governmental agencies; | |

| ● | the judgment of the engineers preparing the estimates; | |

| ● | the estimates of future metals prices and operating costs; | |

| ● | the quality and quantity of available data; | |

| ● | the interpretation of that data; and | |

| ● | the accuracy of various mandated economic assumptions all of which may vary considerably from actual results. |

| 8 |

Until mineralized material is actually mined and processed, it must be considered an estimate only. These estimates are imprecise and depend on geological interpretation and statistical inferences drawn from drilling and sampling analysis which may prove to be unreliable. We cannot assure that these mineralized material estimates will be accurate or that this mineralized material can be mined or processed profitably. Any material changes in estimates of mineralized material will affect the economic viability of placing a property into production and such property’s return on capital. There can be no assurance that minerals recovered in small-scale metallurgical tests will be recovered at production scale.

The volatility of zinc prices could adversely affect our future operations and, if warranted, our ability to develop our properties.

The potential for profitability of our operations, the value of our properties and our ability to raise funding to conduct continued exploration and development, if warranted, are directly related to the market prices of zinc. Zinc prices can fluctuate widely and are affected by numerous factors beyond our control including interest rates, expectations for inflation, speculation, currency values, global and regional demand, the political and economic conditions of major zinc producing/consuming countries throughout the world, and production costs in major metal producing regions of the world. The price of zinc may also have a significant influence on the market price of our common stock and the value of our properties. A decrease in zinc prices may prevent our property from being economically mined or result in the write-off of assets whose value is impaired as a result of lower zinc prices.

The nature of mineral exploration and production activities involves a high degree of risk and the possibility of uninsured losses.

Exploration for and the production of minerals is highly speculative and involves greater risk than many other businesses. Many exploration programs do not result in the discovery of mineralization and any mineralization discovered may not be of sufficient quantity or quality to be profitably mined. Our operations are, and any future development or mining operations we may conduct will be, subject to all of the operating hazards and risks normally incident to exploring for and development of mineral properties, such as, but not limited to:

| ● | economically insufficient mineralized material; | |

| ● | fluctuation in production costs that make mining uneconomical; | |

| ● | labor disputes; | |

| ● | unanticipated variations in grade and other geologic problems; | |

| ● | environmental hazards; | |

| ● | water conditions; | |

| ● | difficult surface or underground conditions; | |

| ● | industrial accidents; | |

| ● | metallurgic and other processing problems; | |

| ● | regulatory curtailments or shutdowns; | |

| ● | mechanical and equipment performance problems; | |

| ● | failure of pit walls or dams; | |

| ● | unusual or unexpected rock formations; | |

| ● | personal injury, fire, flooding, cave-ins, earthquakes, landslides and rock-bursts; and | |

| ● | decrease in the value of mineralized material due to lower zinc prices. |

Any of these risks can materially and adversely affect, among other things, the development of properties, production quantities and rates, costs and expenditures, potential revenues and production dates. We currently have limited insurance to guard against some of these risks. If we determine that capitalized costs associated with any of our mineral interests are not likely to be recovered, we would incur a write down of our investment in these interests. All of these factors may result in losses in relation to amounts spent which are not recoverable or result in additional expenses.

Additionally, as a result of some or a combination of any of the above conditions, access to our mineral properties may be restricted during parts of the year. During the winter months, heavy snowfall can make it difficult to undertake work programs. Frequent inclement weather in the winter months can make development and mining activities difficult for short periods of time.

Title to our properties may be challenged or defective.

Our planned future operations and exploration activities may require amendments to our currently approved permits from various governmental authorities. Our operations are and will continue to be governed by laws and regulations governing prospecting, mineral exploration, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety, mining royalties and other matters. There can be no assurance that we will be able to acquire all required licenses, permits, amendments or property rights on reasonable terms in a timely manner, or at all, and that such terms will not be adversely changed, that required extensions will be granted or that the issuance of such licenses, permits or property rights will not be challenged by third parties.

| 9 |

We attempt to confirm the validity of our rights of title to, or contract rights with respect to, each mineral property in which we have a material interest. However, we cannot guarantee that title to our properties will not be challenged. Our mineral properties may be subject to prior unregistered agreements, interests or native land claims, and title may be affected by undetected defects. There may be valid challenges to the title of any of the claims comprising our mineral properties that, if successful, could impair possible development and/or operations with respect to such properties in the future. Challenges to permits or property rights, whether successful or unsuccessful; changes to the terms of permits or property rights or a failure to comply with the terms of any permits or property rights that have been obtained could have a material adverse effect on our business by delaying, preventing or making continued operations economically unfeasible.

We are subject to complex environmental and other regulatory risks, which could expose us to significant liability and delay, and potentially the suspension or termination of our operations and/or our development efforts.

Compliance with environmental quality requirements and reclamation laws imposed by federal, state, provincial and local governmental authorities may:

| ● | require significant capital outlays; | |

| ● | materially affect the economics of a given property; | |

| ● | cause material changes or delays in our intended activities; and | |

| ● | expose us to lawsuits. |

These regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation. They also set limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Applicable authorities may require us to prepare and present data pertaining to the effect or impact that any proposed exploration for or production of minerals may have upon the environment. The requirements imposed by any such authorities may be costly, time consuming, and delay operations. Future legislation and regulations designed to protect the environment, as well as future interpretations of existing laws and regulations, may require substantial increases in equipment and operating costs and delays, interruptions, or a termination of operations. We cannot accurately predict or estimate the impact of any such future laws or regulations, or future interpretations of existing laws and regulations, on our operations.

Historic mining activities have occurred on certain areas of our properties by unrelated parties prior to the general mining law of 1872, prior to the Federal Land Policy and Management Act of 1976, prior to the Resources Conservation & Recovery Act of October 21, 1978, and subsequent other Federal/State regulatory acts and statutes. If such historic activities have resulted in releases or threatened releases of regulated substances to the environment, potential for liability, however unlikely, may exist under federal or state remediation statutes. Such liability would include remediating any damage that we may have caused including costs for removing or remediating the release and damage to natural resources, including ground water, as well as the payment of fines and penalties. We are not aware of any such claims under these statutes at this time and cannot predict whether any such claims will be asserted in the future.

We may produce air emissions and pollutions that could fall under the jurisdiction of U.S. federal laws.

Under the U.S. Resource Conservation and Recovery Act, mining companies may incur costs for generating, transporting, treating, storing or disposing of hazardous waste, as well as for closure and post-closure maintenance once they have completed mining activities on a property. Our mining operations may produce air emissions, including fugitive dust and other air pollutants, from stationary equipment, storage facilities and the use of mobile sources such as trucks and heavy construction equipment which are subject to review, monitoring and/or control requirements under the Federal Clean Air Act and state air quality laws. Permitting rules may impose limitations on our production levels or create additional capital expenditures in order to comply with the rules.

Legislation has been proposed that would significantly affect the mining industry.

Periodically, members of the U.S. Congress have introduced bills which would supplant or alter the provisions of the General Mining Law of 1872 which governs the unpatented claims that we control with respect to our U.S. properties. One such amendment has become law and has imposed a moratorium on the patenting of mining claims which reduced the security of title provided by unpatented claims such as those on our properties. If additional legislation is enacted, it could substantially increase the cost of holding unpatented mining claims by requiring payment of royalties and could significantly impair our ability to develop mineral estimates on unpatented mining claims. Such bills have proposed, among other things, to make permanent the patent moratorium, to impose a federal royalty on production from unpatented mining claims and to declare certain lands as unsuitable for mining. Although it is impossible to predict at this time what royalties may be imposed in the future, the imposition of such royalties could adversely affect the potential for development of such mining claims and the economics of existing operating mines on federal unpatented mining claims. Passage of such legislation could adversely affect our business.

| 10 |

Our operations are subject to permitting requirements which could require us to delay, suspend or terminate our operations on our mining properties.

Our operations, including ongoing exploration drilling programs, require permits from state and federal governments including permits for the use of water and for drilling wells for water. We may be unable to obtain these permits in a timely manner, on reasonable terms, on terms that provide us sufficient resources to develop or operate our properties or at all. Even if we are able to obtain such permits, the time required by the permitting process can be significant. If we cannot obtain or maintain the necessary permits, or if there is a delay in receiving these permits, our timetable and business plan for exploration and operation of our properties will be adversely affected which may in turn adversely affect our results of operations, financial condition and cash flows.

Land reclamation requirements for our properties may be burdensome or too expensive.

Although variable depending on location and the governing authority, land or other reclamation requirements are generally imposed on mineral exploration companies as well as companies with mining operations to minimize the long-term effects of land or other disturbance. To carry out reclamation obligations imposed on us in connection with the potential development and production activities at the Balmat Mine and other properties, we must allocate financial resources that might otherwise be spent on further exploration and future development programs. We have set up a provision for reclamation obligations as currently anticipated for disturbance associated with the Balmat Mine and Chopar Property, as appropriate, but this provision may not be adequate. If we are required to carry out unanticipated reclamation work, our financial position could be adversely affected.

Global climate change is an international concern and could impact our ability to conduct future operations.

Global climate change is an international issue and receives an enormous amount of publicity. We would expect that the imposition of international treaties or federal, state or local laws or regulations pertaining to mandatory reductions in energy consumption or emissions of greenhouse gases could affect the feasibility of our mining projects and increase our operating costs.

Additionally, legislation and increased regulation regarding climate change could impose significant costs on us and/or our suppliers, including costs related to increased energy requirements, capital equipment, environmental monitoring and reporting and/or other costs to comply with such regulations. Any adopted future climate change regulations could also negatively impact our ability to compete with companies situated in areas not subject to such regulations. Given the political significance and uncertainty around the impact of climate change and how it should be dealt with, we cannot predict how legislation and regulation will affect our financial condition, operating performance or ability to compete.

We may face a shortage of supplies, equipment and materials.

The mineral industry has experienced from time to time shortages of certain supplies, equipment and materials necessary in the exploration, evaluation, development and production of mineral deposits. The prices at which such supplies and materials are available have also increased. Our planned operations could be subject to delays due to such shortages and further price escalations could increase our costs for such supplies, equipment and materials. Our experience and that of others in the industry is that suppliers are often unable to meet contractual obligations for supplies, equipment, materials and services and that alternate sources of supply do not exist.

We may face a shortage of water.

Water is essential in all phases of the exploration, development and operation of mineral properties. The nature of our operations requires water to be used in such processes as exploration, drilling, testing, dust suppression, milling and tailings disposal. The lack of available water and the cost of acquisition may make an otherwise viable project economically impossible to complete.

We depend upon a limited number of personnel and the loss of any of these individuals could adversely affect our business.

Our success is currently largely dependent on the performance, retention and abilities of our directors, officers, employees and contractors. The loss of the services of these persons could have a material adverse effect on our business and prospects. There is no assurance that we can maintain the services of our directors, officers, employees, contractors or other qualified personnel required to operate our business. Failure to do so could have a material adverse effect on us and our prospects. We do not maintain “key man” life insurance policies on any of our officers or employees.

| 11 |

Our directors and senior management may be engaged in other businesses. Potential conflicts of interest or other obligations of management could interfere with corporate operations.

Some of our directors, officers and key contractors may be engaged in additional businesses, or situations may arise where our directors, officers and contractors could be in direct competition with us. Conflicts, if any, will be dealt with in accordance with the relevant provisions of applicable policies, regulations and legislation. Some of our directors and officers are or may become directors or officers of other entities engaged in other business ventures. As a result of their other business endeavors, our directors, officers and contractors may not be able to devote sufficient time to our business affairs, which may negatively affect our ability to conduct ongoing operations or to generate revenues.

We do not insure against all of the risks to which we may be subject in our operations.

While we currently maintain insurance against general commercial liability claims, we have not purchased property insurance and do not maintain insurance to cover all of the potential risks associated with our operations. We might be subject to liability for environmental, pollution or other hazards associated with mineral production, exploration and development which risks may not be insured against, which may exceed the limits of our insurance coverage or which we may elect not to insure against because of premium costs or other reasons. We may also not be insured against interruptions to our operations. Losses from these or other events may cause us to incur significant costs which could materially and adversely affect our financial condition and our ability to fund activities on our property. A significant loss could force us to reduce or terminate our operations.

We are subject to the risk of litigation, the causes and costs of which are not always known.

We are subject to litigation arising in the normal course of business and may be involved in disputes that may result in litigation. Although we are not aware of any material pending or threatened litigation or of any legal proceedings known to be contemplated which are, or would be, likely to have a material adverse effect upon us or our operations, taken as a whole, the causes of potential future litigation cannot be known and may arise from, among other things, business activities, environmental and health and safety concerns, share price volatility or failure to comply with disclosure obligations. The results of litigation cannot be predicted with certainty but could include, among other things, costly damage awards or settlements, fines, and the loss of licenses, concessions or rights. If we are unable to resolve a dispute favorably, either by judicial determination or settlement, it may have a material adverse effect on our financial condition, cash flow or results of operations.

We depend upon information technology systems, which are subject to disruption, damage, or failure and have risks associated with implementation and integration.

We depend upon information technology systems in the conduct of our operations. Our information technology systems are subject to disruption, damage or failure from a variety of sources, including, without limitation, computer viruses, security breaches, cyber-attacks, natural disasters and defects in design. Cybersecurity incidents, in particular, are evolving and include, but are not limited to, malicious software, attempts to gain unauthorized access to data and other electronic security breaches that could lead to disruptions in systems, unauthorized release of confidential or otherwise protected information or the corruption of data. Various measures have been implemented to manage our risks related to the information technology systems and network disruptions. However, given the unpredictability of the timing, nature and scope of information technology disruptions, we could potentially be subject to downtimes, operational delays, the compromising of confidential or otherwise protected information, destruction or corruption of data, security breaches, other manipulation or improper use of our systems and networks or financial losses from remedial actions, any of which could have a material adverse effect on our cash flows, competitive position, financial condition or results of operations.

Risks Related To Our Common Stock

There currently is only a minimal public market for our common stock. Failure to develop or maintain a trading market could negatively affect the value of our common stock and make it difficult or impossible for investors to sell shares.

There currently is only a minimal public market for shares of our common stock and an active market may never develop. Our common stock is quoted on the OTC Pink tier of the OTC Markets Group Inc. under the symbol “SMRS.” We may not ever be able to satisfy the listing requirements for our common stock to be listed on a national exchange which are often a more widely-traded and liquid market. Some, but not all, of the factors that may delay or prevent the listing of our common stock on a more widely-traded and liquid market includes the following:

| ● | our stockholders’ equity may be insufficient; | |

| ● | the market value of our outstanding securities may be too low; | |

| ● | our net income from operations may be too low; | |

| ● | our common stock may not be sufficiently widely held; |

| 12 |

| ● | our inability to secure market makers for our common stock; and | |

| ● | our inability to meet the rules and requirements mandated by the several exchanges and markets. |

If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results, which could lead to a restatement of our financial statements. As a result, current and potential shareholders could lose confidence in our financial reporting which would harm our business.

Our management determined in prior years, including for the year ended December 31, 2014, that we did not maintain effective internal controls over financial reporting as a result of identified material weaknesses in our internal control over financial reporting. While we have taken steps to remediate these control deficiencies, there are no assurances that any future deficiencies will not result in errors in our financial statements in future periods. If we are required to restate our financial statements, we will incur additional costs and could be subject to litigation.

We cannot assure investors that the common stock will become liquid or that it will be listed on a national securities exchange.

Until our common stock is listed on a national securities exchange such as the New York Stock Exchange or the Nasdaq Stock Market, we expect our common stock to remain eligible for quotation on the OTC Pink or other over-the-counter quotation systems. In such venues, however, an investor may find it difficult to obtain accurate quotations as to the market value of our common stock. In addition, if we fail to meet the criteria set forth in SEC regulations, various requirements would be imposed by law on brokers or dealers who sell our securities to persons other than established customers and accredited investors. Consequently, such regulations may deter brokers or dealers from recommending or selling our common stock which may further affect the liquidity of the common stock. This would also make it more difficult for us to raise capital.

The application of the “penny stock” rules could adversely affect the market price of our common stock and increase transaction costs to sell those such stock.

The SEC has adopted rule 3a51-1 that establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share subject to certain exceptions. For any transaction involving a penny stock, unless exempt, Rule 15g-9 requires that a broker or dealer needs to:

| ● | approve a person’s account for transactions in penny stocks, and | |

| ● | receive from the investor a written agreement to the transaction setting forth the identity and quantity of the penny stock to be purchased. |

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

| ● | obtain financial information and investment experience objectives of the person and | |

| ● | make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. |

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market which, in highlight form:

| ● | sets forth the basis on which the broker or dealer made the suitability determination and | |

| ● | declares that the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our common stock.

| 13 |

The market price for our common stock is particularly volatile given our status as a relatively unknown company with a small and thinly traded public float, limited operating history and lack of profits. Investors may be unable to sell our common stock at or above the original purchase price, which may result in substantial losses.

The market for our common stock is characterized by significant price volatility when compared to seasoned issuers, and we expect that our stock price will continue to be more volatile than a seasoned issuer for the indefinite future. The volatility in our stock price is attributable to a number of factors. First, as noted above, our common stock is sporadically and thinly traded. As a consequence of this lack of liquidity, the trading of relatively small quantities of shares by our shareholders may disproportionately influence the price of those shares in either direction. The price for our stock could, for example, decline precipitously in the event that a large number of our common shares are sold on the market without commensurate demand as compared to a seasoned issuer which could better absorb those sales without adverse impact on its share price. Secondly, we are a speculative or “risky” investment due to our limited operating history and lack of profits to date and uncertainty of future market acceptance for our potential products and services. As a consequence of this enhanced risk, more risk-adverse investors may, under the fear of losing all or most of their investment in the event of negative news or lack of progress, be more inclined to sell their shares on the market more quickly and at greater discounts than would be the case with the stock of a seasoned issuer. Many of these factors are beyond our control and may decrease the market price of our common stock regardless of our operating performance. We cannot make any predictions or projections as to what the prevailing market price for our common stock will be at any time including as to whether our common stock will sustain their current market prices or as to what effect that the sale of shares or the availability of common stock for sale at any time will have on the prevailing market price.

We do not pay dividends on our common stock.

We have not paid any dividends on our common stock and do not anticipate paying dividends in the foreseeable future. We plan to retain earnings, if any, to finance the development and expansion of our business. In the absence of dividends, investors will only see a return on their investment if the value of our common shares appreciates.

Dilution through outstanding common share options and warrants could adversely affect the trading price of our common shares. Future common share issuances or conversions of preferred shares could also lead to dilution.

We have issued common stock warrants as part of various investments made to date. Additionally, we have issued common shares as well as options to purchase common shares to various employees, consultants and third parties. To the extent that significant numbers of options or warrants may be granted and exercised, the interests of the other shareholders may be diluted. As of December 31, 2015, there were 9,197,500 warrants and 250,000 common share purchase options outstanding, which, if exercised, would result in an additional 9,447,500 common shares being issued and outstanding, which equals approximately 24.9% of our common shares outstanding as of December 31, 2015.

In addition, the Company has outstanding preferred stock that was convertible into a total of 2,065,000 common shares as of December 31, 2015, which equals approximately 5.4% of our common stock outstanding as of December 31, 2015.

Finally, as of December 31, 2015, the Company has outstanding convertible notes that were convertible into a total of 962,500 common shares, which equals approximately 2.5% of our common stock outstanding as of December 31, 2015.

Rule 144 related risk.

The SEC adopted amendments to Rule 144 which became effective on February 15, 2008 that apply to securities acquired both before and after that date. Under these amendments, a person who has beneficially owned restricted shares of our common stock for at least six months would be entitled to sell their securities provided that: (i) such person is not deemed to have been one of our affiliates at the time of or at any time during the three months preceding a sale, (ii) we are subject to the periodic reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) for at least 90 days before the sale and (iii) if the sale occurs prior to satisfaction of a one-year holding period, we provide current information at the time of sale.

Persons who have beneficially owned restricted shares of our common stock for at least six months but who are our affiliates at the time of, or at any time during the three months preceding a sale, would be subject to additional restrictions by which such person would be entitled to sell within any three-month period only a number of securities that does not exceed the greater of either of the following:

| ● | 1% of the total number of securities of the same class then outstanding; or | |

| ● | the average weekly trading volume of such securities during the four calendar weeks preceding the filing of a notice on Form 144 with respect to the sale; |

provided, in each case, that we are subject to the Exchange Act periodic reporting requirements for at least three months before the sale. Such sales by affiliates must also comply with the manner of sale, current public information and notice provisions of Rule 144.

| 14 |

Restrictions on the reliance of Rule 144 by shell companies or former shell companies.

Historically, the SEC staff has taken the position that Rule 144 is not available for the resale of securities initially issued by companies that are, or previously were, blank check companies like us. The SEC has codified and expanded this position in the amendments discussed above by prohibiting the use of Rule 144 for resale of securities issued by any shell companies (other than business combination related shell companies) or any issuer that has been at any time previously a shell company. The SEC has provided an important exception to this prohibition, however, if the following conditions are met:

| ● | the issuer of the securities that was formerly a shell company has ceased to be a shell company; | |

| ● | the issuer of the securities is subject to the reporting requirements of Section 14 or 15(d) of the Exchange Act; | |

| ● | the issuer of the securities has filed all Exchange Act reports and material required to be filed, as applicable, during the preceding 12 months (or such shorter period that the issuer was required to file such reports and materials), other than Current Reports on Form 8-K; and | |

| ● | at least one year has elapsed from the time that the issuer filed current comprehensive disclosure with the SEC reflecting its status as an entity that is not a shell company. |

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

We currently have an interest in one early stage exploration property and one near production zinc mine. Our early stage exploration property, which we refer to as our Chopar Project, is located in the Star Mountain district of Utah while our near production zinc mine, which we refer to as our Balmat Mine, is located in upper New York State.

During 2014, we discontinued efforts to explore for minerals at the Spor Mountain/Dugway Minerals project which consisted of nine mining claims and three metalliferous mineral lease sections located in Juab County, Utah. At that time, we recorded a $2 impairment charge against mineral rights related to this discontinued project.

During 2015, we relinquished our easement rights for excavation and harvesting as part of to the Ogden Bay Minerals project in West Ogden, Utah. The Ogden Bay Minerals project was a mineral excavation project commissioned by various State and federal agencies to restore habitat, repair damage, dredge silt and sand and remove debris from the Weber River. Since no amounts related to this project had been capitalized, relinquishing our rights to this project did not result in the recognition of any impairment charge.

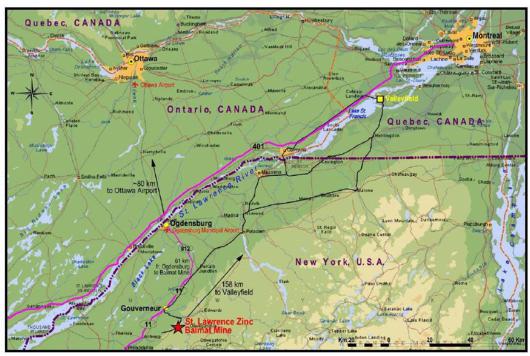

Balmat Mine (Zinc)

In November 2015, we acquired the Balmat Mine as part of our acquisition of Northern Zinc and Balmat Holding. The Balmat Mine is located in northern New York State, approximately 7 miles southeast of Gouverneur, New York, 100 miles northeast of Syracuse, New York and 38 miles via State Road #812 from the St. Lawrence Seaway at Ogdensburg, NY. While currently on care and maintenance, the Balmat Mine has been well maintained and is fully permitted and, based on our assessment, can be returned to production following a short refurbishment period.

| 15 |

The Balmat Mine is located in the historic Balmat Zinc District that has been the home to zinc mining operations for more than 85 years. From initial discovery in the early 1900’s, several zinc mines in the district have produced a cumulative 43 million tons of ore grading 9.5% zinc. The mine site is surrounded by heavily treed bedrock ridges with interspersed low-lying marsh areas. The area is covered by gravel and clay overburden. The Gouverneur area has a typical mid-continental climate with warm summers and cold winters moderated by proximity to the Great Lakes. The average annual temperatures range from 53oF to 38oF with the summer temperatures ranging between 60oF to 80oF and the winter temperatures between 30oF to -13oF. The area averages 115 frost-free days per year and 40 inches of precipitation, 70% as snow. The town of Gouverneur has a population of approximately 6,000 and services an outlying rural population of 35,000. The town is well serviced with hospital and railway.

The historic Balmat Zinc District consists of four mines: the Edwards mine produced from 1915 to 1980, the Balmat mine from 1930 to 2008, the Pierrepont mine from 1982 to 2001 and the Hyatt mine from 1974 to 1998, on an intermittent basis. The Balmat mine operated continuously from 1930 to 2001 when production ceased due to depressed zinc prices. Production resumed in 2006 until the mine was placed on care and maintenance in the fall of 2008.

The assets of the Balmat Mine include 2,699 acres of fee simple surface rights, 51,428 acres of mineral rights, an underground zinc mine and primary crusher, a 4,000 ton per day production hoist, a 5,000 ton per day mill and concentrator, a 12,000 ton concentrate storage shed, tailings storage area and containment dam, rail access, underground equipment, support facilities and infrastructure and a full complement of mobile mining equipment.

The majority of the fee simple surface rights consist of the 1,754 acres in the town of Fowler where the Balmat mine, mill, and tailings disposal facility are located. Nine parcels totaling 703 acres are owned in the town of Edwards, which includes the Edwards mine. The remaining 242 acres include the Pierrepont mine, which is located on four owned parcels.

In addition to the 51,428 acres of owned mineral rights, which are located in St. Lawrence and Franklin Counties, Balmat controls another 4,774 acres of mineral rights through leases and options. The leases have an initial 20-year term, are renewable for an additional 20 years and are subject to a 4% net smelter return royalty while the optioned mineral rights have an initial 5-year term, are renewable and are subject to a $4 per acre annual option payment. Average royalties covering all of Balmat’s mineral holdings are estimated at 0.3% over Balmat’s future production. Approximately 2,500 acres of the mineral rights are controlled under a reciprocal lease agreement with the Gouverneur Talc Company.

The tailings disposal facility covers approximately 200 acres. Water from the tailings flows through a series of retention ponds before being discharged into Turnpike Creek. Discharge is regulated by state permit. The remaining tailings capacity is estimated to be 9 million tons, or 20 to 25 years of production based on current planned production rates.

The Balmat Mine contains 14 known zones of zinc mineralization. The deposits tend to occur in clusters. Three clusters have been defined consisting of three to five orebodies each. Geometry of mineralization varies, ranging from tabular to podiform and from shallow to steeply dipping. Areas defined to date contain tonnages ranging from roughly 0.5 million tons to over 10 million tons. Typical thickness ranges from two feet to 12 feet thick. Mineralization tends to be very continuous along strike, ranging from 50 feet to 800 feet. Plunge-lengths may exceed 6,000 feet.

| 16 |

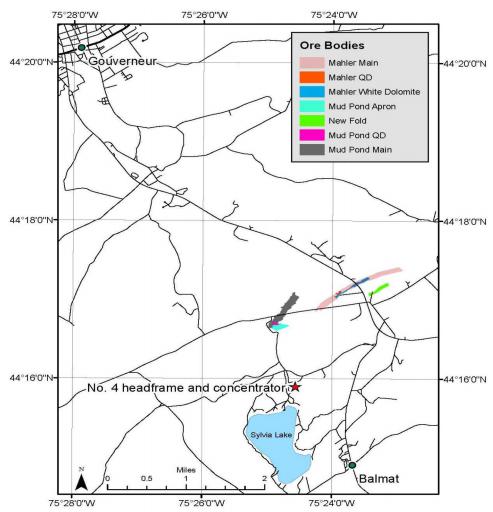

The following map shows the locations of the Balmat zinc orebodies currently being considered for further production:

We have not yet conducted any of our own exploration work on the Balmat Mine property. Notwithstanding, the property is at an advanced stage of development with a calculated mineral reserve supporting a 2.5-year mine plan. We have also identified mineralized material adjacent to the current reserves of similar grade that we believe have the potential to be reclassified to reserve status as mining progresses and additional exploration work is performed. We plan to resume exploration activities at the Balmat Mine once production has been reestablished.

Prior to the Balmat Mine’s shut-down in August 2008, numerous capital improvements were made to the shaft workings and concentrator circuit, including the purchase of new equipment. During the seven years that the mine has been idle, regular inspections have been maintained on the hoist and headframe components as well as frequent examinations made of the underground workings. A fully equipped and functional mine rescue team has been retained as well. As a historic mining operation, all of the infrastructure required for the re-start of mining activities at the Balmat Mine is in place.

Electric power is provided to the site by National Grid through a 115 kV power line. Fresh water to the site is sourced from nearby Sylvia Lake. The Company applied for and has been awarded by the New York Power Authority a 4,000 kW allocation of low cost hydropower for a term of 7 years. The electricity provided under this low cost power grant will be priced at a 40% discount to the current wholesale market price.

We believe a skilled workforce is available in the area and we expect to be able to source the majority of our workforce from the local population. Moreover, many of the Balmat Mine’s former employees that were employed by the Mine when it was last in production still reside in the area and have expressed an interest in coming back to work at the Mine. We also expect to be able source most the mine’s consumables from local suppliers.

On February 1, 2016, we announced the completion of a reserve study at the Balmat Mine and issued a report with an effective date of November 2, 2015, confirming the existence of 585,000 tons of proven and probable reserves as defined by SEC Industry Guide 7 (“IG7 Report”) by Practical Mining, LLC.. The IG7 Report also estimated the initial capital needs for Balmat’s re-start at $14.7 million to cover such pre-mining activities as development drifting, re-engineering of underground infrastructure and essential upgrades to the ventilation, mobile equipment, crusher and hoisting systems.

| 17 |

| Reserve Class | Tons (000’s) | Zinc % | ||||||

| Proven | 152 | 9.0 | ||||||

| Probable | 434 | 9.2 | ||||||

| Total | 585 | 9.2 | ||||||

Key inputs to the IG7 Report included:

(stated in $US Dollars)

| NSR Royalty | 0.3 | % | ||||

| Concentrate Grade | 55.5 | % | Zn | |||

| Smelter Treatment Charges | $ | 187.51 | $/Ton | |||

| Transportation Charge | $ | 21.51 | $/Ton | |||

| Smelter Penalty | $ | 20.00 | $/Ton | |||

| Total Smelter Charges | $ | 229.02 | $/Ton | |||

| Smelting and Refining Cost | $ | 0.21 | $/lb. | |||

| Smelter Payment | 85 | % | ||||

| Metallurgical Recovery | 96.0 | % | ||||

| Direct Processing | $ | 9.05 | $/Ton | |||

| Ore Haulage/Hoisting Crushing | $ | 4.15 | $/Ton | |||

| Administration and Overhead | $ | 3.72 | $/Ton | |||

| 15% Contingency | $ | 8.69 | $/Ton | |||

| Total Processing Cost | $ | 25.61 | $/Ton | |||

| Unplanned Mining Dilution | 10.0 | % | ||||

| Direct Ore Mining Cost | $ | 41.83 | $/Ton | |||

| All in Cost | $ | 67.44 | $/Ton | |||

| Unplanned Dilution | 10 | % | ||||

| Cut Off Grades Zn% | ||||||

| Zinc Price | $/lb. | $ | 0.70 | $ | 0.80 | $ | 0.92 | $ | 1.00 | $ | 1.10 | |||||||||||

| Development Mining | 3.2 | % | 2.7 | % | 2.3 | % | 2.12 | % | 1.9 | % | ||||||||||||

| Production Mining | 8.5 | % | 7.2 | % | 6.1 | % | 5.5 | % | 4.9 | % | ||||||||||||

| Production Mining Design Limit | 9.3 | % | 7.9 | % | 6.7 | % | 6.1 | % | 5.4 | % |

Chopar Project: Star Mining District of Utah (Gold/Precious Metals)

Our Chopar Project is an “early stage” exploration project consisting of 115 lode-mining claims and four metalliferous mineral leases located in the Star Mountain range of the Star Mining District, in Beaver County, Utah, approximately five miles west of Milford, Utah. The Chopar Project area encompasses 3,730 acres in total; comprised of 1,408 acres of state mining claims and 2,322 acres of federal mining claims. The Chopar Project has no facilities or infrastructure and no proven or probable reserves as defined by SEC Industry Guide 7.

| 18 |

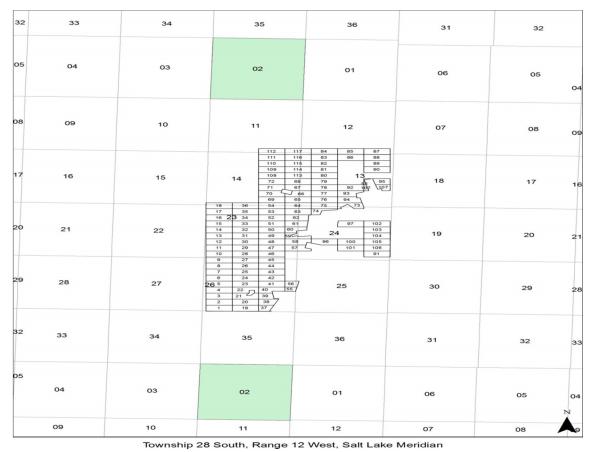

The following map showing the location of the Project’s lode-mining claims:

To date, the Company has conducted geological analysis, magnetic geophysical studies and a limited reverse circulation and core drilling exploration program. Based on the preliminary results achieved, we plan to engage in further substantive field evaluations, geophysical reviews and drilling in order to ascertain the nature and extent of the inferred mineralization, if any, at the Chopar Project. In October 2014, the Company’s third-party geology and geophysical consultants commenced on-site work in order to provide the data necessary to compile a preliminary metallogenic assessment study of our mineral rights in the Chopar Project area. Geological mapping delineated several areas of significant metasomatic alteration of surface rocks that are candidates for surface geochemical sampling programs and, if warranted, candidates for drilling campaigns. Subject to financing, a geochemical sampling program is tentatively planned for late spring 2016.

The 1,408 acres of state mining leases have an initial term of 10 years and require minimum annual rents of $1.00 per acre. The state leases also call for minimum annual royalty payments of $3.00 per acre beginning in the 11th year of the lease (if extended) as well as contingent production royalty payments ranging from 4% to 8% of the gross value (as defined in the lease) of any non-fissionable and fissionable metalliferous minerals extracted from the leased area.