Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Arbutus Biopharma Corp | f8k_040814.htm |

| EX-99.4 - EXHIBIT 99.4 - Arbutus Biopharma Corp | exh_994.htm |

| EX-99.2 - EXHIBIT 99.2 - Arbutus Biopharma Corp | exh_992.htm |

| EX-99.3 - EXHIBIT 99.3 - Arbutus Biopharma Corp | exh_993.htm |

EXHIBIT 99.1

TEKMIRA PHARMACEUTICALS CORPORATION

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

AND

MANAGEMENT PROXY CIRCULAR AND PROXY STATEMENT

March 26, 2014

TEKMIRA PHARMACEUTICALS CORPORATION

100-8900 Glenlyon Parkway

Burnaby, British Columbia V5J 5J8

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 8, 2014

Dear Shareholders of Tekmira Pharmaceuticals Corporation:

NOTICE IS HEREBY GIVEN that the 2014 annual general and special meeting (the “Meeting”) of the shareholders (“Shareholders”) of Tekmira Pharmaceuticals Corporation, a British Columbia corporation (“Tekmira”) will be held on Thursday, May 8, 2014 at 2:00 p.m. (Pacific Daylight Time) at the Terminal City Club at 837 West Hastings Street, Vancouver, British Columbia in Vancouver, British Columbia, for the following purposes:

|

|

•

|

to receive the audited consolidated financial statements of Tekmira for the year ended December 31, 2013 and the report of the independent auditor thereon;

|

|

|

•

|

to elect six directors of Tekmira to serve for the ensuing year;

|

|

|

•

|

to appoint KPMG LLP as our independent auditor to hold office for the ensuing year;

|

|

|

•

|

to consider, and if thought advisable, approve an ordinary resolution authorizing an amendment of Tekmira’s omnibus share compensation plan to increase, by 800,000 common shares, the number of common shares in respect of which awards may be granted thereunder; and

|

|

|

•

|

to transact such other business as may properly come before the Meeting, or at any adjournments or postponements thereof.

|

Further information regarding the matters to be considered at the Meeting is set out in the accompanying Management Proxy Circular and Proxy Statement.

Tekmira is sending meeting materials for the Meeting to Shareholders using the “notice and access” provisions of National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer. Pursuant to such Provisions Tekmira provides Shareholders with a notice on how they may access the Management Proxy Circular and Proxy Statement electronically instead of providing a paper copy.

Our Board of Directors has fixed the close of business on Monday, March 31, 2014 as the record date for determining Shareholders entitled to receive notice of and to vote at the Meeting in person or by proxy. Only our Registered Shareholders as of Monday, March 31, 2014 will be entitled to vote, in person or by proxy, at the Meeting.

Regardless of whether or not a Shareholder plans to attend the Meeting in person, please complete, date and sign the enclosed form of proxy and deliver it by hand, mail or facsimile in accordance with the instructions set out in the form of proxy and in the Management Proxy Circular and Proxy Statement.

|

BY ORDER OF THE BOARD OF DIRECTORS

-s- Dr. Daniel Kisner

Dr. Daniel Kisner

Chairman of the Board

|

Dated: Vancouver, British Columbia March 26, 2014.

TEKMIRA PHARMACEUTICALS CORPORATION

100-8900 Glenlyon Parkway

Burnaby, British Columbia V5J 5J8

MANAGEMENT PROXY CIRCULAR AND PROXY STATEMENT

2014 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 8, 2014

This management proxy circular and proxy statement (“Proxy Statement”) is furnished in connection with the solicitation of proxies by the management of Tekmira Pharmaceuticals Corporation, a British Columbia corporation (“Tekmira” or the “Company”), for use at the annual general and special meeting (the “Meeting”), or at any adjournments or postponements thereof, of its shareholders to be held on May 8, 2014 at the time and place and for the purposes set forth in the accompanying notice of the Meeting.

In this Proxy Statement, references to “the Company,” “Tekmira,” “we,” and “our” refer to Tekmira Pharmaceuticals Corporation. “Common Shares” means common shares without par value in the capital of the Company; “Shareholders” means holders of Common Shares; “Beneficial Shareholders” means Shareholders who do not hold Common Shares registered in their own name; “Registered Shareholders” means Shareholders which are registered holders of Common Shares; and “Intermediaries” refers to brokers, investment firms, clearing houses and similar entities that own securities on behalf of Beneficial Shareholders. Unless otherwise indicated, the statistical and financial data contained in this Proxy Statement are as of March 26, 2014.

Tekmira’s functional currency is the Canadian dollar. However, most of the Company’s competitors, and a large proportion of its investors, are based in the United States. To achieve greater comparability with its competitors’ financial information and improve the understandability of its financial information for its U.S. investors, effective October 1, 2013, Tekmira is using United States dollars as its reporting currency. The information provided in this Proxy Statement is provided in United States dollars unless otherwise stated.

Whether or not you plan to attend the Meeting, please promptly provide your voting instructions. Your promptness in voting will assist in the expeditious and orderly processing of the proxies and in ensuring that a quorum is present. If you vote your proxy, you may nevertheless attend the Meeting and vote your Common Shares in person if you wish. Please note, however, that if your Common Shares are held of record by an Intermediary or other nominee and you wish to vote in person at the Meeting, you must follow the instructions provided to you by your Intermediary or such other nominee. If you want to revoke your instructions at a later time prior to the vote for any reason, you may do so in the manner described in this Proxy Statement.

QUESTIONS ABOUT VOTING

Why did I receive this Proxy Statement?

Tekmira has sent this Notice of Annual General and Special Meeting and Proxy Statement, together with the enclosed paper proxy, because our management is soliciting your proxy to vote at the Meeting. This Proxy Statement contains information about the matters to be voted on at the Meeting and important information about Tekmira. As many of our Shareholders are expected to be unable to attend the Meeting in person, proxies are solicited to give each Shareholder an opportunity to vote on all matters that will properly come before the Meeting. References in this Proxy Statement to the Meeting include any adjournments or postponements of the Meeting.

We intend to deliver this Proxy Statement and accompanying paper proxy on or about April 8, 2014 to all of our Shareholders entitled to receive notice of and vote at the Meeting.

What is the date, time and place of the Meeting?

The Meeting will be held at the Terminal City Club at 837 West Hastings Street, Vancouver, British Columbia, on Thursday, May 8, 2014, at 2:00 p.m. (Pacific Daylight Time).

Who can vote at the Meeting?

The record date for determining persons entitled to receive notice of and vote at the Meeting is March 31, 2014. Only Shareholders as of the close of business on March 31, 2014 are entitled to receive notice of and vote at the Meeting, or any adjournment or postponement thereof, in the manner and subject to the procedures described in this Proxy Statement and the accompanying proxy.

At the close of business on March 26, 2014, 21,982,088 Common Shares of Tekmira were issued and outstanding.

Each Shareholder is entitled to one vote per Common Share held on all matters to come before the Meeting. Common Shares of Tekmira are the only securities of Tekmira which will have voting rights at the Meeting.

What is the quorum for the Meeting?

To transact business at the Meeting, a quorum of Shareholders must be present at the commencement of the Meeting, either in person or by proxy. Under Tekmira’s articles, the quorum for the transaction of business at the Meeting is at least two people who are, or who represent by proxy, one or more Shareholders who, in the aggregate, hold at least 5% of the issued Common Shares of Tekmira. Tekmira has received a waiver of Rule 4350(f) from the NASDAQ which would otherwise require a quorum of holders of not less than 33 1/3% of our Common Shares.

How do I Vote?

The voting process is different depending on whether you are a Registered or Beneficial Shareholder:

|

·

|

You are a registered Shareholder if your Common Shares are registered in your name;

|

|

·

|

You are a Beneficial Shareholder if your shares are held on your behalf by an Intermediary. This means the shares are registered in your Intermediary’s name, and you are the beneficial owner.

|

Registered Shareholder: Common Shares Registered in Your Name

If you are a Registered Shareholder, you may vote in person at the Meeting or by proxy whether or not you attend the Meeting in person.

|

·

|

To vote in person at the Meeting, please come to the Meeting and we will give you an attendance card when you arrive.

|

|

·

|

To vote using the enclosed paper proxy, please complete, sign and return your proxy in accordance with the instructions on the proxy.

|

|

·

|

To vote by proxy over the Internet, go to www.cstvotemyproxy.com and follow the online voting instructions and refer to your holder account number and proxy access number provided on the enclosed paper proxy.

|

|

·

|

To vote by telephone, call 1-888-489-5760 (toll free in North America) and follow the instructions and refer to your holder account number and proxy access number provided on the enclosed paper proxy.

|

If you wish to submit a proxy, whether by paper, telephone or internet, you must complete and sign the Proxy, and then return it to Tekmira’s transfer agent, CST Trust Company Inc.: PO Box 721, Agincourt, ON M1S 0A1 (mail) or 1600-1066 West Hastings St., Vancouver, BC V6E 3X1; facsimile: 866-781-3111 (toll free in North America) or 416-368-2502; in each case, no later than 48 hours (excluding Saturdays, Sundays and holidays) prior to the time of the Meeting, or adjournment thereof. The chair of the Meeting may waive the proxy cut-off without notice. If the proxy is not dated, it will be deemed to be dated seven calendar days after the date on which it was mailed to you (the Registered Shareholder).

Beneficial Shareholder: Common Shares Registered in the Name of an Intermediary such as a Brokerage Firm, Bank, Dealer or other Similar Organization

-2-

The following information is of significant importance to Shareholders who do not hold Common Shares of Tekmira in their own name. Beneficial Shareholders should note that the only proxies that can be recognized and acted upon at the Meeting are those deposited by Registered Shareholders.

If your Common Shares are listed in an account statement provided to you by a broker, then in almost all cases your Common Shares will not be registered in your name on the records of Tekmira. In such circumstances your Common Shares will more likely be registered under the names of your broker or an agent of that broker. In the United States, the vast majority of such Common Shares of Tekmira are registered under the name of Cede & Co., as nominee for The Depository Trust Company (which acts as depositary for many U.S. brokerage firms and custodian banks), and in Canada, under the name of CDS & Co. (the registration name for CDS Clearing and Depository Services Inc., which acts as nominee for many Canadian brokerage firms).

Intermediaries are required to seek voting instructions from Beneficial Shareholders in advance of Shareholders’ meetings. Every Intermediary has its own mailing procedures and provides its own return instructions to clients.

The Proxy Statement is being sent to both Registered Shareholders and Beneficial Shareholders. There are two kinds of Beneficial Shareholders — those who object to their names being made known to the issuers of securities which they own (called OBOs for Objecting Beneficial Owners), and those who do not object (called NOBOs for Non-Objecting Beneficial Owners).

Tekmira is taking advantage of National Instrument 54-101 - Communications with Beneficial Owners of Securities of a Reporting Issuer, which permits it to deliver proxy-related materials indirectly to its NOBOs and OBOs. As a result, if you are a NOBO or OBO you can expect to receive Meeting materials from your Intermediary via Broadridge Financial Solutions Inc. (“Broadridge”), including a voting information form (“VIF”). If you receive a VIF, you should follow the instructions in the VIF to ensure that your Common Shares are voted at the Meeting. The VIF or form of proxy will name the same individuals as Tekmira’s proxy to represent you at the Meeting. You have the right to appoint a person (who need not be a Shareholder of Tekmira) other than the individuals designated in the VIF, to represent you at the Meeting. To exercise this right, you should insert the name of your desired representative in the blank space provided in the VIF. The completed VIF must then be returned in accordance with the instructions in the VIF. Broadridge then tabulates the results of all instructions received and completed in accordance with the instructions provided in the VIF and provides appropriate instructions respecting the voting of Common Shares to be represented at the Meeting. If you receive a VIF from Broadridge, you cannot use it to vote Common Shares directly at the Meeting – the VIF must be completed and returned in accordance with its instructions, well in advance of the Meeting in order to have your Common Shares voted.

Although as a Beneficial Shareholder you may not be recognized directly at the Meeting for the purposes of voting Common Shares registered in the name of your Intermediary, you, or a person designated by you, may attend at the Meeting as proxyholder for your Intermediary and vote your Common Shares in that capacity. If you wish to attend the Meeting and indirectly vote your Common Shares as proxyholder for your Intermediary, or to have a person designated by you do so, you should enter your own name, or the name of the person you wish to designate, in the blank space on the VIF provided to you and return the same in accordance with the instructions provided in the VIF, well in advance of the Meeting.

Alternatively, you can request in writing that your Intermediary send you a legal proxy which would enable you to attend the Meeting and vote your Common Shares.

These securityholder materials are being sent to both registered and Beneficial Shareholders. If you are a Beneficial Shareholder, and Tekmira or its agent has sent these materials to you, your name and address and information about your holdings of Common Shares have been obtained in accordance with applicable securities regulatory requirements from the Intermediary holding on your behalf.

Corporate Shareholders

In order to be entitled to vote or to have its shares voted at the Meeting, a Shareholder which is a corporation (a Corporate Shareholder”) must either (a) attach a certified copy of the directors’ resolution authorizing a representative to attend the Meeting on the Corporate Shareholder’s behalf, or (b) attach a certified copy of the directors’ resolution authorizing the completion and delivery of the proxy.

-3-

What am I voting on at the Meeting?

At the Meeting, you will be asked to vote on the following proposals:

|

·

|

to elect six directors of Tekmira to serve for the ensuing year (“Proposal No. 1”);

|

|

·

|

to appoint KPMG LLP as our independent auditor to hold office for the ensuing year (“Proposal No. 2”);

|

|

·

|

to consider, and if thought advisable, approve an ordinary resolution authorizing an amendment to Tekmira’s omnibus share compensation plan (the “2011 Plan”) to increase, by 800,000 Common Shares, the number of Common Shares in respect of which Awards (as defined below) may be granted thereunder (“Proposal No. 3”); and

|

|

·

|

to transact such other business as may properly come before the Meeting, or at any adjournments or postponements thereof (as of the date of this Proxy Statement, the Board of Directors of the Company (the “Board of Directors” or “Board”) is not aware of any such other matters.

|

How does the Board recommend that I vote?

Our Board of Directors believes that the election of its six nominees to our Board, the appointment of KPMG LLP as our independent auditor and the amendment of the 2011 Plan to increase, by 800,000 Common Shares, the number of Common Shares in respect of which Awards may be granted thereunder, are each in the best interests of Tekmira and our Shareholders and, accordingly, recommends that each Shareholder vote his or her shares “FOR” these proposals.

What vote is required in order to approve each proposal?

|

·

|

Proposal No. 1: Under Tekmira’s majority voting policy each director nominee must receive more “For” votes than “Withhold” votes in order for their appointment to be immediately approved. In an uncontested election, any nominee who receives a greater number of “Withheld” votes from his or her election than “For” such election is required to tender his or her resignation to the Board promptly following the vote. The Board (excluding any director that has tendered a resignation) will consider the director’s offer to resign and decide whether or not to accept it within 90 days of receiving the final voting results of the Meeting. Tekmira’s majority voting policy is more fully described below under “Statement on Corporate Governance – Director Election and Majority Voting Policy”.

|

|

·

|

Proposal No. 2: A simple majority of the votes cast by proxy or in person at the Meeting is required to approve Proposal No. 2.

|

|

·

|

Proposal No. 3: A simple majority of the votes cast by proxy or in person at the Meeting is required to approve Proposal No. 3.

|

Proxies returned by Intermediaries as “non-votes” because the Intermediary has not received instructions from the Beneficial Shareholder with respect to the voting of certain of Common Shares or, under applicable stock exchange or other rules, the Intermediary does not have the discretion to vote those Common Shares on one or more of the matters that come before the Meeting, will be treated as not entitled to vote on any such matter and will not be counted as having been voted in respect of any such matter. Common Shares represented by such broker “non-votes” will, however, be counted in determining whether there is a quorum for the Meeting.

-4-

What impact does a “Withhold” vote have?

|

·

|

Proposal No. 1: With respect to each nominee, you may either vote “For” the election of such nominee or “Withhold” your vote with respect to the election of such nominee. If you vote “For” the election of a nominee, your Common Shares will be voted accordingly. If you select “Withhold” with respect to the election of a nominee, your vote will not be counted as a vote cast for the purposes of electing such nominee but will be considered in the application of our majority voting policy which is described below under “Statement on Corporate Governance – Director Election and Majority Voting Policy”.

|

|

·

|

Proposal No. 2: With respect to the appointment of the proposed independent auditors, you may either vote “For” such appointment or “Withhold” your vote with respect to such appointment. If you vote “For” the appointment of the proposed independent auditors, your Common Shares will be voted accordingly. If you select “Withhold” with respect to the appointment of the proposed independent auditors, your vote will not be counted as a vote cast for the purposes of appointing the proposed independent auditors.

|

|

·

|

Proposal No. 3. With respect to the amendment of the 2011 Plan to increase, by 800,000 Common Shares, the number of Common Shares in respect of which Awards may be granted thereunder, you may select “For” or “Against” with respect to such proposal. The proxy does not provide “Withhold” as a possible selection for Shareholders with respect to Proposal No. 3.

|

What is the effect if I do not cast my vote?

If a Registered Shareholder does not cast its vote by proxy or in any other permitted fashion, no votes will be cast on its behalf on any of the items of business at the Meeting. If a Beneficial Shareholder does not instruct its Intermediary on how to vote on any of the items of business at the Meeting and the Intermediary does not have discretionary authority to vote the Beneficial Shareholder’s shares on the matter, or elects not to vote in the absence of instructions from the Beneficial Shareholder, no votes will be cast on behalf of such Beneficial Shareholder with respect to such item. If you have further questions on this issue, please contact your Intermediary or Tekmira (as provide below).

How will proxies be exercised?

The Common Shares represented by the proxy will be voted or withheld from voting in accordance with your instructions on any ballot of a resolution that may be called for and, if you specify a choice with respect to any matter to be acted upon, the Common Shares will be voted accordingly. With respect to any amendments or variations in any of the resolutions shown on the proxy, or any other matters which may properly come before the Meeting, the Common Shares will be voted by the appointed nominee as he or she in their sole discretion sees fit.

Where you do not specify a choice on a resolution shown on the proxy, a nominee of management acting as proxyholder will vote the Common Shares as if you had specified an affirmative vote.

What does it mean if I receive more than one set of proxy materials?

This means that you own Common Shares that are registered under different names. For example, you may own some Common Shares directly as a Registered Shareholder and other Common Shares as a Beneficial Shareholder through an Intermediary, or you may own Common Shares through more than one such organization. In these situations, you will receive multiple sets of proxy materials. It is necessary for you to complete and return all paper proxies, or vote by proxy over the Internet, and complete and return all voting instruction forms in order to vote all of the Common Shares you own. Each paper proxy you receive will come with its own return envelope. If you vote by mail, please make sure you return each paper proxy in the return envelope that accompanies that proxy.

How do I appoint a proxyholder?

The individuals named in the accompanying form of proxy are directors or officers of Tekmira. If you are a Shareholder entitled to vote at the Meeting, you have the right to appoint a person or company other than the designees of management named in the proxy, who need not be a Shareholder of the Company, to vote according to your instructions. To appoint someone other than the designees of management named, please insert your appointed proxyholder’s name in the space provided in the proxy, sign and date and return the proxy in accordance with the instructions set out in the Proxy.

-5-

The only methods by which you may appoint a person as proxy are submitting a proxy by mail, hand delivery or fax.

Can I revoke my proxy?

In addition to revocation in any other manner permitted by law, if you are a Registered Shareholder and you wish to revoke your proxy, you may do so by depositing a written instrument to that effect and delivering it to CST Trust Company PO Box 721, Agincourt, ON M1S 0A1, or by hand to 1600-1066 West Hastings St., Vancouver, BC V6E 3X1 (hand delivery) or to the address of the registered office of Tekmira at Farris, Vaughan, Wills & Murphy LLP, 25th Floor, 700 West Georgia Street, Vancouver, British Columbia, V7Y 1B3, attention: R. Hector MacKay-Dunn, Q.C., at any time up to and including the last business day preceding the day of the Meeting, or any adjournment thereof, or to the Chairman of the Meeting on the day of the Meeting before any vote in respect of which the proxy has been give has been taken.

If you are a Registered Shareholder and you wish to revoke your proxy by providing a written instrument to such effect, such written instrument must be executed in writing by you or your legal personal representative or trustee in bankruptcy, or, if you are a corporation that is a Registered Shareholder, by the corporation or a representative of the corporation appointed in accordance with Tekmira’s articles.

Beneficial Shareholders who wish to change their vote must, in sufficient time in advance of the Meeting, arrange for their Intermediaries to change the vote and, if necessary, revoke their proxy.

How will proxies be solicited and who will pay the cost of the proxy solicitation?

The solicitation of proxies will be primarily by mail, but Tekmira’s directors, officers and regular employees may also solicit proxies personally or by telephone. Tekmira will bear all costs of the solicitation, including the printing, handling and mailing of the Meeting materials. Tekmira has arranged for Intermediaries to forward the Meeting materials to Beneficial Shareholders of Tekmira held of record by those Intermediaries and Tekmira may reimburse the Intermediaries for their reasonable fees and disbursements in that regard.

Are Meeting materials being provided by way of notice-and-access?

Tekmira is sending meeting materials for the Meeting to Shareholders using the “notice and access” provisions of National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer. Pursuant to such provisions, the Company provides Shareholders with a notice on how they may access the Information Circular electronically instead of providing a paper copy.

How can I make a Shareholder proposal for the 2015 Annual General Meeting?

If you want to propose a matter for consideration at our 2015 annual general meeting, then that proposal must be received at our registered office at 25th Floor, Toronto Dominion Bank Tower, 700 West Georgia Street, Vancouver, British Columbia, V7Y 1B3 by March 20, 2015. For a proposal to be valid, it must, subject to the Business Corporations Act (British Columbia), be in writing, accompanied by the requisite declarations and signed by the submitter and qualified Shareholders who at the time of signing are the registered or beneficial owners of shares that, in the aggregate: (a) constitute at least 1% of our issued Common Shares that have the right to vote at general meetings; or (b) have a fair market value in excess of C$2,000. For the submitter or a qualified Shareholder to be eligible to sign the proposal, that Shareholder must have been the registered or beneficial owner of our Common Shares that carry the right to vote at general meetings for an uninterrupted period of at least two years before the date the proposal is signed.

-6-

What if amendments are made to these proposals or if other matters are brought before the Meeting?

With respect to any amendments or variations in any of the resolutions shown on the proxy, or any other matters which may properly come before the Meeting, the Common Shares will be voted by the appointed nominee as he or she in their sole discretion sees fit.

As of the date of this Proxy Statement, the Board is not aware of any such amendments, variations or other matters to come before the Meeting. However, if any such changes that are not currently known to the Board should properly come before the Meeting, the Common Shares represented by your proxyholders will be voted in accordance with the best judgment of the proxyholders.

How can I find out the results of the voting at the Meeting?

Preliminary voting results will be announced at the Meeting. After the Meeting, Tekmira will promptly issue a news release providing detailed disclosure of the voting results for the election of directors. In addition, final voting results will be filed with the Canadian provincial securities regulatory authorities on SEDAR at www.sedar.com, and will also be published in our Quarterly Report on Form 10-Q for the second quarter of 2014, and filed with the SEC on EDGAR at www.sec.gov/edgar.shmtl and filed with the Canadian provincial securities regulatory authorities on SEDAR as noted above.

Whom should I contact if I have questions concerning the Proxy Statement or the Proxy?

If you have questions concerning the information contained in this Proxy Statement or require assistance in

completing the proxy, you may contact Tekmira by letter, phone, fax or through our website as follows:

Tekmira Pharmaceuticals Corporation

Attn: Bruce Cousins

Executive Vice President and Chief Financial Officer

100-9800 Glenlyon Parkway

Burnaby, British Columbia, Canada

V5J 5J8

Phone: 604-419-3200

Fax: 604-419-3201

Website: www.tekmirapharm.com

NOTICE TO SHAREHOLDERS IN THE UNITED STATES

The solicitation of proxies involve securities of an issuer located in Canada and are being effected in accordance with the corporate laws of the Province of British Columbia, Canada and securities laws of the provinces of Canada. As a “foreign private issuer”, Tekmira is exempt from the United States Securities and Exchange Commission (“SEC”) rules regarding proxy solicitations (and certain related matters) and therefore are not subject to the procedural requirements of Rule 14a-5(e) of the United States Securities Exchange Act of 1934, as amended. Shareholders should be aware that disclosure requirements under the securities laws of the provinces of Canada differ from the disclosure requirements under United States securities laws.

Section 16(a) of the Securities Exchange Act of 1934 requires a registrant’s directors and executive officers, and persons who own more than 10% of a registered class of a registrants’ securities, to file with the SEC initial reports of ownership and reports of changes in ownership of Common Shares and other equity securities of the registrant. As we are a “foreign private issuer” pursuant to Rule 3a12-3 of the Securities Exchange Act of 1934, Tekmira and the persons referred to below are exempt from the reporting and liability provisions of Section 16(a). However, under Canadian provincial securities laws, the persons referred to below are required to file reports in electronic format through the System for Electronic Disclosure by Insiders, or SEDI, disclosing changes in beneficial ownership of, or control or direction over, our Common Shares and other securities. Our Shareholders can access such reports at www.sedi.ca.

-7-

The enforcement by Shareholders of civil liabilities under United States federal securities laws may be affected adversely by the fact that Tekmira is incorporated under the Business Corporations Act (British Columbia), as amended, certain of its directors and its executive officers are residents of Canada and a substantial portion of its assets and the assets of such persons are located outside the United States. Shareholders may not be able to sue a foreign company or its officers or directors in a foreign court for violations of United States federal securities laws. It may be difficult to compel a foreign company and its officers and directors to subject themselves to a judgment by a United States court.

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

BACKGROUND

The size of the Board of Directors of the Company has been fixed at six. The term of office of each of the current directors will end immediately before the election of directors at the Meeting. Unless the director’s office is earlier vacated in accordance with the provisions of the Business Corporations Act (British Columbia) and the articles of Tekmira, each director elected will hold office until immediately before the election of new directors at the next annual general meeting of Tekmira or, if no director is then elected, until a successor is elected or appointed.

Pursuant to Section 13.9 of the Articles of the Company (the “Articles”), a shareholder of the Company wishing to nominate an individual to be a director, other than pursuant to a requisition of a meeting made pursuant to the Business Corporations Act (British Columbia) (the “BCBCA”) or a shareholder proposal made pursuant to the provisions of the BCBCA, is required to comply with Section 13.9 of the Articles. Section 13.9 of the Articles provides, inter alia, that proper written notice of any such director nomination (the “Nomination Notice”) for an annual general meeting of shareholders must be provided to the Secretary of the Company not less than 30 nor more than 65 days prior to the date of the annual general meeting of shareholders; provided, however, that in the event that the annual general meeting of shareholders is to be held on a date that is less than 50 days after the date (the “Notice Date”) on which the first public announcement of the date of the annual general meeting was made, the Nomination Notice must be provided no later than the close of business on the tenth day following the Notice Date. The foregoing is merely a summary of provisions contained in Section 13.9 of the Articles, and is not comprehensive and is qualified by the full text of such provisions. The full text of such provisions is set out in Section 13.9 of the Articles, a copy of which is attached as Exhibit B to the March 27, 2013 management information circular of the Company which can be found under the Company’s profile at www.sedar.com or www.sec.gov. As of the date of this Circular, the Company has not received a Nomination Notice in compliance with Section 13.9 of the Articles.

Under Tekmira’s majority voting policy each director nominee must receive more “For” votes than “Withhold” votes in order for their appointment to be immediately approved. In an uncontested election, any nominee who receives a greater number of “Withheld” votes from his or her election than “For” such election is required to tender his or her resignation to the Board promptly following the vote. The Board (excluding any director that has tendered a resignation) will consider the director’s offer to resign and decide whether or not to accept it within 90 days of receiving the final voting results of the Meeting. Tekmira’s majority voting policy is more fully described below under “Statement on Corporate Governance – Director Election and Majority Voting Policy”.

Unless otherwise instructed, the designated proxyholders intend to vote “FOR” the election of the six Director nominees proposed by the Board in this Proxy Statement. We are not aware that any of our nominees will be unable or unwilling to serve as a director of Tekmira; however, should we become aware of such an occurrence before the election of directors takes place at the Meeting, if the persons named in the accompanying proxy are appointed as proxyholder, it is intended that the discretionary power granted under such proxy will be used by the proxyholders to vote in their discretion for a substitute nominee or nominees.

Our Board of Directors recommends a vote of “FOR” each named nominee.

-8-

INFORMATION ON NOMINEES FOR DIRECTORS

The following table sets out the names of management’s nominees for election as directors, all major offices and positions with the Company and any of its significant affiliates each nominee now holds, each nominee’s principal occupation, business or employment, the period of time during which each has been a director of the Company and the number of Common Shares of Tekmira beneficially owned, controlled or directed by each, directly or indirectly, as at March 26, 2014.

|

Nominee Name,

Position with

the Company and

Residency

|

Principal Occupation

for the Past Five Years

|

Other Public Company

Directorships for the

Past Five Years

|

Period as a

Director of the

Company

|

Common Shares of

Tekmira

Beneficially Owned,

Controlled or

Directed(1)

|

|

Kenneth Galbraith (8)(10)

Director

British Columbia, Canada

|

Five Corners Capital (Sept. 2013 – present)

General Partner at Ventures West (Feb. 2007 – Sept. 2013)

|

n/a

|

Since January 28, 2010

|

15,240 (2)

|

|

Donald Jewell (8)(9)

Director

British Columbia, Canada

|

Managing Partner, RIO Industrial (financial management services) (Aug. 1995-present)

|

Rogers Sugar/Lantic

(Sept. 2003 – Jan. 2013)

|

Since May 30, 2008

|

479,755 (3)

|

|

Frank Karbe (8)

Director

California, U.S.A.

|

Chief Financial Officer of Exelixis, Inc. (Jan. 2004-present)

|

n/a

|

Since January 28, 2010

|

5,000 (4)

|

|

Daniel Kisner (9)(10)

Director and Board Chair

California, U.S.A.

|

Independent Consultant

(Sept. 2010 to present)

Partner at Aberdare Ventures (2003-September 2010)

|

Dynavax Technologies Corporation

(Jul. 2010 – present)

Lpath Incorporated

(Jun. 2012 - present)

Conatus Pharmaceuticals

(Feb. 2014 - present)

|

Since January 28, 2010

|

12,500 (5)

|

|

Mark Murray (6)

Director, President and CEO

Washington, U.S.A.

|

President, Chief Executive Officer and Director of Tekmira (May 2008 – present);

President and Chief Executive Officer of Protiva Biotherapeutics Inc. (2000-present)

|

n/a

|

Since May 30, 2008

|

64,961 (6)

|

|

Peggy Phillips (9)

Director

Washington, U.S.A.

|

Independent Consultant

(Previously Chief Operating Officer of Immunex Corporation)

|

Dynavax Technologies Corporation

(Aug. 2006 - present)

|

Since February 12, 2014

|

— (7)

|

Notes:

|

(1)

|

The number of Common Shares of Tekmira beneficially owned, controlled or directed, directly or indirectly, by the above nominees for directors, directly or indirectly, is based on information furnished by the nominees themselves and from the insider reports available at www.sedi.ca.

|

-9-

|

(2)

|

Mr. Galbraith also holds options to purchase 20,000 Common Shares of Tekmira at exercises prices ranging from C$1.70 to C$5.15 and expiry dates ranging from January 27, 2020 to December 9, 2022.

|

|

(3)

|

Mr. Jewell also holds options to purchase 25,000 Common Shares of Tekmira at exercises prices ranging from C$1.70 to C$5.15 and expiry dates ranging from December 18, 2018 to December 9, 2022. As a result of purchasing Units in Tekmira’s June 16, 2011 public share offering, Mr. Jewell also holds warrants to purchase 30,000 Common Shares of Tekmira at a price of C$3.35 and with an expiry date of June 15, 2016. As a result of purchasing Units in Tekmira’s February 29, 2012 private placement, Mr. Jewell also holds warrants to purchase 60,000 Common Shares of Tekmira at a price of C$2.60 and with an expiry date of February 28, 2017.

|

|

(4)

|

Mr. Karbe also holds options to purchase 20,000 Common Shares of Tekmira at exercises prices ranging from C$1.70 to C$5.15 and expiry dates ranging from January 27, 2020 to December 9, 2022. As a result of purchasing Units in Tekmira’s February 29, 2012 private placement, Mr. Karbe also holds warrants to purchase 2,500 Common Shares of Tekmira at a price of C$2.60 and with an expiry date of February 28, 2017.

|

|

(5)

|

Dr. Kisner also holds options to purchase 25,000 Common Shares of Tekmira at exercises prices ranging from C$1.70 to C$5.15 and expiry dates ranging from January 27, 2020 to December 9, 2022. As a result of purchasing Units in Tekmira’s June 16, 2011 public share offering, Dr. Kisner also holds warrants to purchase 5,000 Common Shares of Tekmira at a price of C$3.35 and with an expiry date of June 15, 2016. As a result of purchasing Units in Tekmira’s February 29, 2012 private placement, Dr. Kisner also holds warrants to purchase 1,250 Common Shares of Tekmira at a price of C$2.60 and with an expiry date of February 28, 2017.

|

|

(6)

|

Dr. Murray became the President and Chief Executive Officer of Tekmira following the business combination with Protiva that was competed on May 30, 2008. Dr. Murray also has options to purchase 185,000 Common Shares of Tekmira at exercises prices ranging from C$1.70 to C$5.15 and expiry dates ranging from August 30, 2018 to December 9, 2022. In addition to these options, Dr. Murray holds options to purchase 365,000 common shares of Protiva, a wholly-owned subsidiary of Tekmira, with an exercise price of C$0.30 and expiry dates ranging from September 12, 2015 to March 1, 2018. As part of the business combination between Tekmira and Protiva, Tekmira agreed to issue 246,435 Common Shares of Tekmira on the exercise of these stock options. The shares reserved for issue on the exercise of these options is equal to the number of Tekmira Common Shares that would have been issued if the options had been exercised before the completion of the business combination and the shares issued on exercise of the options had then been exchanged for Tekmira Common Shares. See “Securities Authorized for Issuance Under Equity Compensation Plans – Additional Shares Subject to Issue”. As a result of purchasing Units in Tekmira’s June 16, 2011 public share offering, Dr. Murray also holds warrants to purchase 5,000 Common Shares of Tekmira at a price of C$3.35 and with an expiry date of June 15, 2016. As a result of purchasing Units in Tekmira’s February 29, 2012 private placement, Dr. Murray also holds warrants to purchase 5,000 Common Shares of Tekmira at a price of C$2.60 and with an expiry date of February 28, 2017.

|

|

(7)

|

Ms. Phillips holds options to purchase 15,000 Common Shares of Tekmira at a price of C$17.31 with an expiry date of February 11, 2024.

|

|

(8)

|

Member of the Audit Committee.

|

|

(9)

|

Member of the Executive Compensation and Human Resources Committee.

|

|

(10)

|

Member of the Corporate Governance and Nominating Committee.

|

As of March 26, 2014, the directors of the Company, as a group, beneficially owned, controlled or directed, directly or indirectly, an aggregate of 577,456 Common Shares of Tekmira (1,257,641 on a fully diluted basis), representing 2.6% (5.1% fully diluted) of the issued and outstanding Common Shares of Tekmira.

The following are brief biographies of nominees for the position of director. This information has been furnished by the respective nominees.

Mark Murray, Ph.D., President, Chief Executive Officer and Director. Dr. Murray has served as our President, Chief Executive Officer and Director since May 2008 when Tekmira and Protiva merged. Previously, he was the President and CEO and founder of Protiva since its inception in 2000. Dr. Murray has over 20 years of experience in both the R&D and business development and management facets of the biotechnology industry. Dr. Murray has held senior management positions at ZymoGenetics and Xcyte Therapies. Since entering the biotechnology industry Dr. Murray has successfully completed numerous and varied partnering deals, directed successful product development programs, been responsible for strategic planning programs, raised venture capital, and executed extensive business development initiatives in the U.S., Europe and Asia. Dr. Murray obtained his Ph.D. in Biochemistry from the University of Oregon Health Sciences University and was a Damon Runyon-Walter Winchell post-doctoral research fellow for three years at the Massachusetts Institute of Technology.

Daniel Kisner, M.D., Chairman. Dr. Kisner has served as the Chairman of our Board since January 2010. Dr. Kisner is currently an independent consultant. From 2003 until December 2010, Dr. Kisner was a Partner at Aberdare Ventures. Prior to Aberdare, Dr. Kisner served as President and CEO of Caliper Technologies, a leader in microfluidic lab-on-a-chip technology. He led Caliper from a technology-focused start up to a publicly traded, commercially oriented organization. Prior to Caliper, he was President and COO of Isis Pharmaceuticals, Inc. Previously, Dr. Kisner was Division VP of Pharmaceutical Development for Abbott Laboratories and VP of Clinical Research and Development at SmithKline Beckman Pharmaceuticals. In addition, he held a tenured position in the Division of Oncology at the University of Texas, San Antonio School of Medicine and is certified by the American Board of Internal Medicine in Internal Medicine and Medical Oncology. Dr. Kisner holds a B.A. from Rutgers University and an M.D. from Georgetown University.

-10-

Kenneth Galbraith, C.A., Director. Mr. Galbraith has served as our Director since January 2010. Since September 2013, Mr. Galbraith has held the position of Managing Director at Five Corners Capital. He previously was a General Partner at Ventures West, leading the firm’s biotechnology practice from 2007 to 2013. Prior to joining Ventures West, Mr. Galbraith was Chairman and Interim CEO of AnorMED, a biopharmaceutical company focused on new therapeutic products in hematology, HIV and oncology, until its sale to Genzyme Corp. in a cash transaction worth almost $600 million. Previously, Mr. Galbraith spent 13 years in senior management with QLT Inc., a global biopharmaceutical company specializing in developing treatments for eye diseases, retiring in 2000 from his position as Executive VP and CFO. Mr. Galbraith was a founding Director of the BC Biotechnology Alliance and served as Chairman of the Canadian Bacterial Diseases Network, one of Canada's federally-funded Networks for Centers of Excellence (NCE). He was also a Director of the Michael Smith Foundation for Health Research and the Fraser Health Authority. He currently serves on the Board of Directors of a number of private biotechnology companies as well as the Vancouver Aquarium Marine Science Centre, one of the world's leading aquariums and Genome BC and has previously served on the Board of Directors of a number of NASDAQ-listed biotechnology companies, including Cardiome Pharma Corporation and Angiotech Pharmaceuticals Inc. Mr. Galbraith earned a Bachelor of Commerce (Honours) degree from the University of British Columbia and is a Chartered Accountant.

Donald Jewell, C.A., Director. Mr. Jewell has served as our Director since May 2008. Mr. Jewell is a Chartered Accountant with over 35 years of business experience. Mr. Jewell spent 20 years with KPMG and at the time of his departure, he was the managing partner in charge of KPMG’s management consulting practice in British Columbia. Until March 2010, Mr. Jewell was Chairman of Cal Investments Limited, a London based hedge fund. Mr. Jewell is currently the managing director of a private Canadian holding company; a private equity investor and on the Board of three investee businesses; Trustee of a two substantial Canadian private trusts; and on the Board of the trusts’ major operating companies. He is also on the Board of Directors of Lantic Inc.

Frank Karbe, Director. Mr. Karbe has served as our Director since January 2010. Mr. Karbe is currently the Executive Vice President and Chief Financial Officer of Exelixis, Inc., a NASDAQ-listed biotechnology company. Prior to joining Exelixis in 2004, Mr. Karbe worked as an investment banker for Goldman Sachs & Co., where he served most recently as Vice President in the healthcare group focusing on corporate finance and mergers and acquisitions in the biotechnology industry. Prior to joining Goldman Sachs in 1997, Mr. Karbe held various positions in the finance department of The Royal Dutch/Shell Group in Europe. Mr. Karbe holds a Diplom-Kaufmann from the WHU—Otto Beisheim Graduate School of Management, Koblenz, Germany (equivalent to a U.S. Masters of Business Administration).

Peggy Phillips, Director. Ms. Phillips has served as our Director since February 2014. Previously, Ms. Phillips was on the Board of Immunex and served as the Chief Operating Officer from 1999 until the company was acquired by Amgen in 2002. During her sixteen year career at Immunex, she held positions of increasing responsibility in research, development, manufacturing, sales, and marketing. As General Manager for Enbrel, she was responsible for clinical development, process development and regulatory affairs as well as the launch, sales and marketing of the product. Prior to joining Immunex, Ms. Phillips worked at Miles Laboratories for ten years. Ms. Phillips currently sits on the Board of Directors of Dynavax Technologies Corporation (NASDAQ: DVAX), a clinical stage biopharmaceutical company. Previously, Ms. Phillips served on the board of directors of Portola Pharmaceuticals, a biopharmaceutical company and on the board of Western Wireless, a cellular network operator, from 2004 until the acquisition of the company by Alltel in mid-2005. From 2003 until 2011, Ms. Phillips served on the Board of the Naval Academy Foundation. Ms. Phillips holds a B.S. and a M.S. in microbiology from the University of Idaho.

There are no family relationships between any of our executive officers and/or directors. None of the Directors or Director nominees were or are to be selected pursuant to an arrangement or understanding.

For more information regarding our Board of Directors and committees of our Board of Directors, as applicable, please see “Security Ownership of Certain Beneficial Owners and Management” and “Statement on Corporate Governance” below.

-11-

Bankruptcies and Cease Trade Orders

To the knowledge of management, no proposed director is, at the date hereof, or has been, within ten years before the date hereof, a director, chief executive officer or chief financial officer of any company that: (i) was subject to a cease trade order or similar order, or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days, that was issued while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer; or (ii) was subject to a cease trade or similar order, or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days, that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer.

Other than as disclosed below, to the knowledge of management, no proposed director or a holding company of such proposed director: (i) is, as at the date hereof, or has been within ten years before the date hereof, a director or executive officer of any company that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or (ii) has, within the ten years before the date hereof, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold assets of the proposed director. Certain of the investee companies that Dr. Daniel Kisner served on the board of directors in Dr. Kisner’s capacity as representative of Aberdare Ventures became bankrupt, made a proposal under legislation relating to bankruptcy or insolvency or were subject to or instituted proceedings, arrangements or compromises with creditors or had a receiver, receiver manager or trustee appointed to hold its assets.

To the knowledge of management, no proposed director or a holding company of such proposed director has been subject to: (i) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or (ii) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable security holder in deciding whether to vote for a proposed director.

Unless directed otherwise by a proxyholder, or such authority is withheld, the individuals named in the accompanying Proxy intend to vote the Common Shares represented by proxies for which either of them is appointed proxyholder “FOR” each named nominee whose names are set forth herein.

The Board of Tekmira recommends that the Shareholders vote FOR the election of the nominees whose names are set forth herein.

PROPOSAL NO. 2 — APPOINTMENT OF AUDITOR

KPMG LLP, P.O. Box 10426, 777 Dunsmuir Street, Vancouver, British Columbia, V7Y 1K3 will be nominated at the Meeting for re-appointment as independent auditor of Tekmira. KPMG LLP has been auditor of Tekmira since April 2007.

For more information concerning the Audit Committee and its members, see “Corporate Governance – Committees of our Board of Directors – Audit Committee” below.

Unless directed otherwise by a proxyholder, or such authority is withheld, management designees named in the accompanying proxy intend to vote the Common Shares represented by proxies for which either of them is appointed proxyholder “FOR” the re-appointment of KPMG LLP as independent auditor of Tekmira for the ensuing year.

The Board of the Tekmira recommends that the Shareholders vote FOR the re-appointment of KPMG LLP as independent auditor of Tekmira for the ensuing year.

-12-

PROPOSAL NO. 3 – APPROVAL OF INCREASE IN THE NUMBER OF COMMON SHARES IN RESPECT OF WHICH AWARDS MAY BE GRANTED UNDER THE 2011 PLAN

At Tekmira’s 2011 annual general and special meeting of Shareholders held on June 22, 2011, Shareholders approved the 2011 Plan and a 273,889 increase in the number of Common Shares in respect of which Awards may be granted under the 2011 Plan. Tekmira’s pre-existing option plan (the “2007 Plan”) was limited to the granting of stock options as equity incentive awards whereas the 2011 Plan also allows for the issuance of tandem stock appreciation rights, restricted stock units and deferred stock units (collectively, and including options, referred to as “Awards”). The 2011 Plan replaces the 2007 Plan (together “the Tekmira Plans”). The 2007 Plan will continue to govern the options granted thereunder. No further options will be granted under Tekmira’s 2007 Plan. At Tekmira’s annual general and special meeting of Shareholders held on June 20, 2012, Shareholders approved a 550,726 increase in the number Common Shares in respect of which Awards may be granted under the 2011 Plan.

Of the 2,193,870 Common Shares which Awards are subject to the 2011 Plan, we currently have 1,374,680 stock options that have been granted and are unexercised under the Tekmira Plans, representing 6.3% of our outstanding Common Shares as of March 26, 2014. There currently remains a balance of 97,398 Common Shares in respect of which Awards may be granted under the 2011 Plan, which represents 0.4% of our outstanding Common Shares as of March 26, 2014. For more information on the Tekmira Plans, see “Securities Authorized for Issuance Under Equity Compensation Plans”.

The objectives of our compensation policies and programs are to: (i) to recruit and subsequently retain highly qualified employees by offering overall compensation which is competitive with that offered for comparable positions in other biotechnology companies; (ii) to motivate employees to achieve important corporate performance objectives and reward them when such objectives are met; and (iii) to align the interests of employees with the long term interests of Shareholders through participation in our equity compensation plans. Equity compensation is an integral part of achieving these objectives as it provides our directors, officers, employees and consultants with the opportunity to participate in our growth and development.

In order to meet the objectives of our compensation program, we are proposing to amend the 2011 Plan to increase, by 800,000 Common Shares, the number Common Shares in which Awards may be granted under the 2011 Plan. This would increase the balance of Common Shares that remain to be granted under the 2011 Plan from 97,398 to 897,398, bringing the total of granted and unexercised Awards, together with unallocated Awards, to 2,272,078, representing 10.3% of our outstanding Common Shares as of March 26, 2014, and bringing the total Common Shares which Awards are subject to the 2011 Plan to 2,993,870 Common Shares, representing 13.6% of our outstanding Common Shares as of March 26, 2014.

Under the policies of the Toronto Stock Exchange, the proposed amendment must be approved by the Company’s Shareholders to be effective. Accordingly, at the Meeting, Shareholders will be asked to approve the following resolution:

“BE IT RESOLVED as an ordinary resolution THAT:

1. The Corporation’s 2011 omnibus share compensation plan be and is hereby amended to increase, by 800,000 common shares, the number of common shares in respect of which Awards may be granted thereunder;

2. Notwithstanding that this resolution has been passed by the shareholders of Tekmira, the Board of Directors may revoke such resolution at any time before it is effected without further action by the shareholders.

3. Any director or officer of Tekmira be and is hereby authorized, for and on behalf of Tekmira, to execute and deliver all documents and instruments and take such other actions, including making all necessary filings with applicable regulatory bodies and exchanges, as such director or officer may determine to be necessary or desirable to implement this ordinary resolution and the matter authorized hereby.”

-13-

Unless directed otherwise by a proxyholder, or such authority is withheld, management designees named in the accompanying proxy intend to vote the Common Shares represented by proxies for which either of them is appointed proxyholder “FOR” the amendment of the 2011 Plan to increase, by 800,000 Common Shares, the number of Common Shares in respect of which Awards may be granted thereunder.

The Board of Tekmira recommends that the Shareholders vote FOR the amendment of the 2011 Plan.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

To the knowledge of the directors and executive officers of the Company, no person or corporation owned, directly or indirectly, or exercised control or direction over, Common Shares carrying more than 10% of the voting rights attached to all outstanding Common Shares of Tekmira as at March 26, 2014. See “Proposal No. 1 –Election of Directors – Information on Nominees for Directors” for information regarding the Common Shares held by our Directors.

EXECUTIVE COMPENSATION AND RELATED MATTERS

Named Executive Officers

For the purposes herein, our Named Executive Officers include our Chief Executive Officer, Mark Murray, Chief Financial Officer, Bruce Cousins (from October 2013, Ian Mortimer until October 2013), Chief Technical Officer, Ian MacLachlan, Chief Medical Officer, Mark Kowalski, and Senior Vice President of Pharmaceutical Development, Peter Lutwyche.

Compensation Discussion and Analysis

Compensation Principles, Components and Policies

The Executive Compensation and Human Resources Committee, or the Compensation Committee, is responsible for recommending the compensation of our executive officers to the Board of Directors. In establishing compensation levels for executive officers, the Compensation Committee seeks to accomplish the following goals:

|

•

|

to recruit and subsequently retain highly qualified executive officers by offering overall compensation which is competitive with that offered for comparable positions in other biotechnology companies;

|

|

•

|

to motivate executives to achieve important corporate performance objectives and reward them when such objectives are met; and

|

|

•

|

to align the interests of executive officers with the long-term interests of shareholders through participation in our stock-based compensation plan (the “2011 Plan”).

|

Benchmarking of Executive Compensation

In the fourth quarter of 2010, Lane Caputo Compensation Inc. was paid $30,000 to review Executive and Director Compensation and to benchmark against companies in the biotechnology industry. Lane Caputo benchmarked compensation against a group of relevant peer companies. The 16 companies selected in Tekmira’s peer group were:

|

Aeterna Zentaris Inc.

|

Neuralstem Inc

|

|

|

AVI Biopharma Inc.

|

NovaBay Pharmaceuticals Inc

|

|

|

Celldex Therapeutics Inc.

|

OncoGeneX Pharmaceuticals Inc.

|

|

|

Cleveland Biolabs Inc.

|

Peregrine Pharmaceuticals Inc

|

|

|

Curis Inc.

|

Rexahn Pharmaceuticals Inc

|

|

|

Idera Pharmaceuticals Inc

|

Sangamo BioSciences Inc

|

|

|

Inhibitex Inc

|

Transition Therapeutics Inc

|

|

|

Inovio Pharmaceuticals Inc

|

YM BioSciences Inc.

|

Based on the review of the Lane Caputo report, no changes were made to the base salaries of the Named Executive Officers except for Dr. Murray whose salary was increased from $338,100 (his salary was then denominated in Canadian dollars and was C$345,000) to $350,000 effective January 1, 2011.

-14-

During 2011 and 2012, given business conditions, no increases to executive compensation were considered.

During 2013, we participated in and purchased the Radford Global US Life Sciences Survey (US Edition). This survey is generally aimed at non-executive level staff. Tekmira considered 50th percentile data from the survey for companies with 50 to 149 employees in determining salaries for Dr. Kowalski and Mr. Cousins who were hired during 2013. 50th percentile market data was presented to the Compensation Committee by the CEO at the end of 2013 and was considered in the determination of executive salaries for 2014.

We intend to conduct a director and officer compensation benchmarking exercise in 2014.

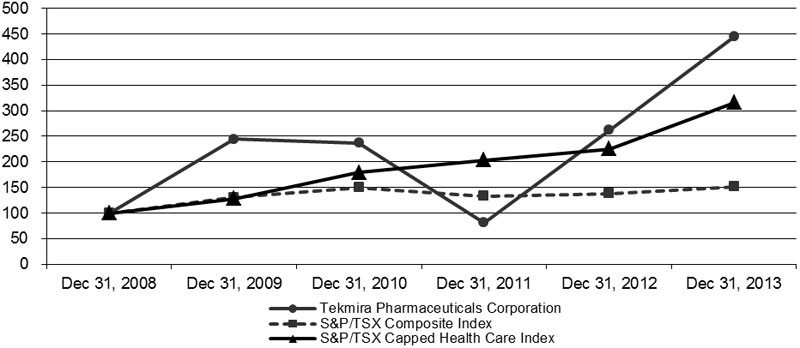

Performance Graph

The performance of our share price is one of the factors the Compensation Committee takes into account when considering executive compensation. The following graph compares the cumulative shareholder return on an investment of C$100 in the Common Shares of the Company on the TSX from December 31, 2008, with a cumulative total shareholder return on the S&P/TSX Composite Total Return and S&P/TSX Capped Health Care Indices.

Elements of Executive Compensation

Currently, our executive compensation package consists of the following components: base salary, discretionary annual incentive cash bonus, long-term incentives in the form of share options and health and retirement benefits generally available to all of our employees. We have not granted any share appreciation rights to our directors and officers. We have established the above components for our executive compensation package because we believe a competitive base salary and opportunity for annual cash bonuses are required to recruit and retain key executives. Our 2011 Plan enables our executive officers to participate in our long term success and aligns their interests with those of the shareholders. Additional details on the compensation package for Named Executive Officers are described in the following sections.

Base Salary

The Named Executive Officers are paid a base salary as an immediate means of rewarding the Named Executive Officer for efforts expended on our behalf. Base salaries for Named Executive Officers are evaluated against the responsibilities inherent in the position held, the individual’s experience and past performance and industry benchmarks.

-15-

Annual Incentive Cash Bonuses

Our policy is to pay bonuses at the end of our fiscal year, assuming that we have sufficient financial stability, based upon our level of achievement of major corporate objectives as determined by the Compensation Committee and the Board of Directors.

Long-Term Incentives—Share Options

Share options are granted to reward individuals for current performance, expected future performance and to align the long term interest of Named Executive Officers with shareholders. Share option grants are not based on pre-determined performance goals, either personal or corporate. Awards reflect the qualitative judgment of the Board of Directors as to whether a grant should be awarded for retention or incentive purposes and if so what the size and timing of such awards should be as well as taking into consideration the third party compensation survey completed for us in the third quarter of 2010.

Share options are generally awarded to executive officers at commencement of employment and periodically thereafter after taking into consideration the recommendations of the Lane Caputo compensation report completed in Q4 2010. Any special compensation other than cash bonuses is typically granted in the form of options. The exercise price for the options is the closing price of the Common Shares on the last trading day before the grant of the option.

Pension Plans or Similar Benefits for Named Executive Officers

We do not have any pension or deferred compensation plans for our Named Executive Officers. We do, however, have a Registered Retirement Savings Plan (“RRSP”) Matching Plan whereby the Company matches employee contributions to their RRSPs up to a certain percentage of each employee’s salary. The RRSP matching plan is available to all full-time employees of Tekmira. Each year the Compensation Committee will approve a matching percentage of up to 5% of the employee salaries. The matching percentage is the same for all employees and is not based on performance.

Health care plans

All Tekmira employees receive health care coverage as a benefit. In addition, Drs. Murray and MacLachlan are entitled to reimbursement of any health expenses incurred, including their families’ health expenses, that are not covered by our insurance, as part of their employment contracts.

Other compensation

As part of his employment contract, Dr. Murray’s compensation also includes reimbursement of personal tax filing service fees up to a maximum of $10,000 per year.

Named Executive Officer compensation for 2011, 2012 and 2013

Base salary

There were no changes to Named Executive Officer salaries from 2011 to 2012.

The salaries of Drs. Murray and Kowalski are denominated in US dollars. The salaries of the other Named Executive Officers are denominated in Canadian dollars.

Effective January 1, 2013, the base salary of Dr. Murray was increased by 8% to $377,500, the base salary of Dr. MacLachlan was increased by 7% to $305,851 (C$315,000), the base salary of Mr. Mortimer was increased by 7% to $296,141 (C$305,000) and the base salary of Dr. Lutwyche was increased by 7% to $233,029 (C$240,000) (Canadian dollar denominated salaries have been converted to US dollars at the 2013 average exchange rate of 0.9710). These increases reflect cost of living increases, performance and retention measures and take into consideration the lack of increases in 2012.

Effective January 1, 2014, the base salary of Dr. Murray was increased by 6% to $400,000, the base salary of Dr. MacLachlan was increased by 2.5% to $303,568 (C$322,875), the base salary of Mr. Cousins remained at $286,762 (C$305,000), the base salary of Dr. Lutwyche was increased by 3% to $232,418 (C$247,200), and the base salary of Dr. Kowalski was increased by 2.5% to $333,125 (Canadian dollar denominated salaries have been converted to US dollars at the December 31, 2013 exchange rate of 0.9402).

-16-

Annual Incentive Cash Bonuses

For 2011, Dr. Murray, Mr. Mortimer and Dr. MacLachlan were eligible to earn cash bonuses of up to a maximum of 50% and Dr. Lutwyche up to a maximum of 35% of their respective base salaries based on the Board of Directors determination of achievement of corporate goals. Our objectives for 2011, as established by the Board of Directors included: continued enrollment of patients in the Phase 1 clinical trial for TKM-PLK1; completion of pre-clinical toxicology studies for TKM-Ebola and filing of a TKM-Ebola Investigational New Drug application; continued execution of the TKM-Ebola contract including manufacturing scale-up and lyophilization of LNP technology; generate pre-clinical proof of concept for our next product candidate; and, maintain a strong cash position. Although good progress was made on the achievement of the 2011 objectives, given business conditions, no cash bonuses were paid.

For 2012, maximum percentage bonus potential for Drs. Murray, MacLachlan and Lutwyche was the same as for 2011. Our objectives for 2012, as established by the Board of Directors included: completing enrollment of patients in the Phase 1 clinical trial for TKM-PLK1; completion of a Phase 1 clinical trial for TKM-Ebola; continued execution of TKM-Ebola contract including manufacturing scale-up and lyophilization of LNP technology; and, complete an equity offering and maintain a strong cash position. At the end of 2012, the Compensation Committee recommended, and the Board of Directors approved, the payment of 200% of the maximum cash bonus for 2012 for Drs. Murray, MacLachlan, and Lutwyche. The bonus payments at the end of 2012 included the amounts the Named Executives had forgone in the 2011 and achievement against corporate objectives. The bonus was not based on any quantitative weighting of individual corporate performance goals or other formulaic process.

Maximum percentage bonus potential for Drs. Murray, MacLachlan and Lutwyche for 2013 was the same as for 2012. The maximum percentage bonus potential for Mr. Mortimer was 50%, for Mr. Cousins it was 40%, and for Dr. Kowalski it was 35%. Our objectives for 2013 were assigned quantitative weighting, and were established by the Board of Directors which included: initiating a TKM-PLK1 Phase 2 efficacy clinical trial (30%); file a TKM-ALDH2 IND (10%); treat first subject with new formulations of TKM-Ebola (10%); nominate a new product development candidate (20%); maintain cash runway into 2015 (10%); generate business development revenue (15%); and other organizational objectives (5%). At the end of 2013, the Compensation Committee recommended, and the Board of Directors approved, the payment of executive bonuses of up to 87.5% of the maximum. The maximum bonus level was based on the progress and achievement of the listed corporate objectives based on the indicated quantitative weighting.

The President and Chief Executive Officer reviewed the performance of Drs. MacLachlan, Lutwyche and Kowalski in light of their goals and achievements for 2013. Mr. Mortimer did not receive a performance bonus as he resigned from the Company. Dr. Murray’s bonus payout was based solely on the achievement of 2013 Corporate Goals. Mr. Cousin’s bonus was also based solely on achievement of corporate goals. The individual goals for Drs. MacLachlan, Lutwyche and Kowalski also contributed to determination of their bonus percentages.

The bonus percentages, as a percentage of annual salary, earned by the Named Executive Officers for 2013 were therefore:

|

Dr. Mark Murray

|

43.8%

|

|

Mr. Bruce Cousins

|

35.0%

|

|

Dr. Ian MacLachlan

|

37.2%

|

|

Dr. Mark Kowalski

|

30.6%

|

|

Dr. Peter Lutwyche

|

30.6%

|

Long-Term Incentives—Share Options

Share options are typically granted to employees, including executives, at the end of the year. At the end of 2010 there wasn’t enough room in our option pool to grant executive options. At our June 2011 Annual General Meeting our shareholders approved an increase to our available share option pool of 273,889. In August 2011 we granted 35,000 options to Dr. Murray, 25,000 options to Dr. MacLachlan, 25,000 options to Mr. Mortimer and 20,000 options to Dr. Lutwyche. These share option grants were recommended by the Compensation Committee and approved by independent Directors based on corporate and individual performance and vested upon the achievement of certain corporate goals.

-17-

In December 2011, as part of our annual compensation review, we granted 35,000 options to Dr. Murray, 25,000 options to Dr. MacLachlan, 25,000 options to Mr. Mortimer and 20,000 options to Dr. Lutwyche. These share option grants were recommended by the Compensation Committee and approved by independent Directors based on corporate and individual performance and our needs for fiscal 2012. These options vest one quarter immediately and one quarter on the next three anniversaries of their grant date.

In December 2012, as part of our annual compensation review, we granted 35,000 options to Dr. Murray, 25,000 options to Dr. MacLachlan, 25,000 options to Mr. Mortimer and 20,000 options to Dr. Lutwyche. These share option grants were recommended by the Compensation Committee and approved by independent Directors based on corporate and individual performance and our needs for fiscal 2013. These options vest one quarter immediately and one quarter on the next three anniversaries of their grant date.

In 2013, we granted 150,000 options to Mr. Cousins and 50,000 options to Dr. Kowalski in conjunction with their appointments as executive officers of Tekmira. These options vest one quarter immediately and one quarter on the next three anniversaries of their grant date.

In February 2014, as part of our annual compensation review, we granted 35,000 options to Dr. Murray, 25,000 options to each of Dr. MacLachlan and Dr. Kowalski, and 20,000 options to Dr. Lutwyche. These share option grants were recommended by the Compensation Committee and approved by independent Directors based on corporate and individual performance and our needs for fiscal 2014. Mr. Cousins did not receive any performance options in February 2014 as he was appointed in October 2013. These options vest one quarter immediately and one quarter on the next three anniversaries of their grant.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee during fiscal year 2013 served as one of our officers, former officers or employees nor received directly or indirectly compensation from the Company, other than in the capacity as a member of our Board and Compensation Committee. There was no direct or indirect control by the members of the Compensation Committee of the Company. No member of the Compensation Committee, directly or indirectly, is the beneficial owner of more than 10% of the Company’s equity, nor are they an executive officer, employee, director, general partner or a managing member of one or more entities that are together the beneficial owners of more than 10% of the Company’s equity. The Compensation Committee members are not aware of any business or personal relationship between (i) a member of the Compensation Committee and any person who has provided or is providing advice to the Compensation Committee; and (ii) an executive officer of the company and any firm or other person who is employed or is employing such person to provide advice to the Compensation Committee. During fiscal year 2013, none of our executive officers served as a director or member of the compensation committee of any other entity, one of whose executive officers served as a member of our Board of Directors or Compensation Committee, and none of our executive officers served as a member of the board of directors of any other entity, one of whose executive officers served as a member of our Compensation Committee.

Compensation Report from the Board of Directors

The Board of Directors has reviewed and discussed “Compensation Discussion and Analysis” required by Item 402(b) of Regulation S-K with management and, based on such review and discussions, has recommended that the “Compensation Discussion and Analysis” be included in this Information Circular.

BOARD OF DIRECTORS

Daniel Kisner, Board Chair

Franke Karbe

Kenneth Galbraith

Mark Murray

Peggy Phillips

Donald Jewell

-18-

Executive Compensation details

The following disclosure sets out the compensation for our Named Executive Officers and our directors for the financial year ended December 31, 2013.

Summary Compensation Table

The following table sets out the compensation paid, payable or otherwise provided to our Named Executive Officers during the our three most recently completed financial years ending on December 31. All amounts are expressed in US dollars unless otherwise noted. Amounts paid or denominated in Canadian dollars are converted to US dollars for presentation purposes at the average exchange rate for the year.

|

Name and principal position

|

Year

|

Salary

(US$)

|

Salary

(C$)

|

Options

(US$) (1)

|

Annual

incentive

cash bonus (US$)