Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - FS KKR Capital Corp | d704640dex991.htm |

| EX-99.2 - EX-99.2 - FS KKR Capital Corp | d704640dex992.htm |

| 8-K - FS INVESTMENT CORP--8-K - FS KKR Capital Corp | d704640d8k.htm |

April

1, 2014 INVESTOR PRESENTATION

LISTING UPDATE

FS Investment Corporation

Exhibit 99.3

Franklin Square Capital Partners is not affiliated with Franklin Resources/Franklin

Templeton Investments or the Franklin Funds.

|

Important

considerations 2

An investment in the common stock of FS Investment Corporation (FSIC, we or us) involves a high degree

of risk and may be considered speculative. The following are some of the risks an investment in

our common stock involves; however, you should carefully consider all of the

information

found

in

the

section

of

our

Forms

10-Q

and

10-K

filings

entitled

“Risk

Factors”

and

in

our

other

public

filings

before

deciding

to invest in shares of our common stock.

of offering proceeds or borrowings, which may constitute a return of capital and reduce the amount of

capital available to us for investment. This presentation is for informational purposes only and

is not an offer to buy or the solicitation of an offer to sell any securities of FSIC. The

tender offer will be made only pursuant to an offer to purchase, letter of transmittal and related materials (the Tender

Materials) that FSIC intends to distribute to its stockholders and file with the Securities and Exchange

Commission (SEC). The full details of the tender offer, including complete instructions on

how to tender shares of common stock, will be included in the Tender

Materials,

which

FSIC

will

distribute

to

stockholders

and

file

with

the

SEC

upon

the

commencement

of

the

tender

offer.

Stockholders are urged to carefully read the Tender Materials when they become available because they

will contain important information, including the terms and conditions of the tender offer.

Stockholders may obtain free copies of the Tender Materials that

FSIC

files

with

the

SEC

at

the

SEC’s

website

at:

www.sec.gov

or

by

calling

the

information

agent

who

will

be

identified

in

the

Tender Materials. In addition, stockholders may obtain free copies of FSIC’s filings with the

SEC from FSIC’s website at: www.fsinvestmentcorp.com

or

by

contacting

FSIC

at

Cira

Centre,

2929

Arch

Street,

Suite

675,

Philadelphia,

PA

19104

or

by

phone

at (877) 628-8575.

An

investment

strategy

focused

primarily

on

privately

held

companies

presents

certain

challenges,

including

the

lack

of

available

information

about

these

companies.

Investing

in

middle-market

companies

involves

a

number

of

significant

risks,

any

one

of

which

could

have

a

material

adverse

effect

on

our

operating

results.

A

lack

of

liquidity

in

certain

of

our

investments

may

adversely

affect

our

business.

We

are

subject

to

financial

market

risks,

including

changes

in

interest

rates,

which

may

have

a

substantial

negative

impact

on

our

investments.

We

have

borrowed

funds

to

make

investments,

which

increases

the

volatility

of

our

investments

and

may

increase

the

risks

of

investing

in

our

securities.

We

have

limited

operating

history

and

are

subject

to

the

business

risks

and

uncertainties

associated

with

any

new

business.

Our

distributions

may

be

funded

from

unlimited

amounts

of

offering

proceeds

or

borrowings,

which

may

constitute

a

return

of

capital

and

reduce

the

amount

of

capital

available

to

us

for

investment. |

Forward-Looking

Statements Some of the statements in this presentation constitute forward-looking statements

because they relate to future events or the future performance or financial condition of FSIC.

The forward-looking statements contained in this presentation may include statements as to: our future operating results; our business

prospects

and

the

prospects

of

our

portfolio

companies;

the

impact

of

the

investments

that

we

expect

to

make;

the

ability

of

our

portfolio

companies

to

achieve their objectives; our current and expected financings and investments; the adequacy of our

cash resources, financing sources and working capital; the timing and amount of cash flows,

distributions and dividends, if any, from our portfolio companies; our contractual arrangements and relationships with

third parties; actual and potential conflicts of interest with FB Income Advisor, LLC (FB Advisor), FS

Investment Advisor, LLC, FS Energy and Power Fund, FSIC II Advisor, LLC, FS Investment

Corporation II, GSO / Blackstone Debt Funds Management LLC or any of their respective affiliates; the dependence of

our future success on the general economy and its effect on the industries in which we may invest; our

use of financial leverage; the ability of FB Advisor to locate

suitable

investments

for

us

and

to

monitor

and

administer

our

investments;

the

ability

of

FB

Advisor

or

its

affiliates

to

attract

and

retain

highly

talented

professionals; our ability to maintain our qualification as a regulated investment company (RIC) and

as a business development company (BDC); the impact on our business of the Dodd-Frank Wall

Street Reform and Consumer Protection Act and the rules and regulations issued thereunder; the effect of changes

to tax legislation and our tax position; the tax status of the enterprises in which we invest; our

ability to complete the listing of our shares of common stock on the New York Stock Exchange

LLC (NYSE); our ability to complete the related tender offer; and the price at which shares of our common stock may

trade on the NYSE, which may be higher or lower than the purchase price in the tender offer.

In addition, words such as “anticipate,”

“believe,”

“expect”

and “intend”

indicate a forward-looking statement, although not all forward-looking statements

include these words. The forward-looking statements contained in this presentation involve risks

and uncertainties. Our actual results could differ materially from those implied or expressed

in the forward-looking statements for any reason. Factors that could cause actual results to differ materially include:

changes

in

the

economy;

risks

associated

with

possible

disruption

in

our

operations

or

the

economy

generally

due

to

terrorism

or

natural

disasters;

and

future changes in laws or regulations and conditions in our operating areas.

We have based the forward-looking statements included in this presentation on information

available to us on the date of this presentation. Except as required by the federal securities

laws, we undertake no obligation to revise or update any forward-looking statements, whether as a result of new

information, future events or otherwise. You are advised to consult any additional disclosures that we

may make directly to stockholders or through reports that

we

have

filed

and

may

file

in

the

future

with

the

Securities

and

Exchange

Commission

(SEC),

including

annual

reports

on

Form

10-K,

quarterly

reports

on Form

10-Q and current reports on Form

8-K. In addition, information related to past performance, while helpful as an evaluative tool,

is not necessarily indicative

of

future

results,

the

achievement

of

which

cannot

be

assured.

Investors

should

not

view

the

past

performance

of

FSIC,

or

information

about

the

market, as indicative of FSIC’s future results.

Credit ratings may not reflect the potential impact of risks relating to the structure or trading of

FSIC’s common stock and are provided solely for informational purposes. Credit ratings are

not recommendations to buy, sell or hold any security, and may be revised or withdrawn at any time by the

issuing organization in its sole discretion. FSIC does not undertake any obligation to maintain the

ratings or to advise of any change in ratings. Each agency’s rating should be evaluated

independently of any other agency’s rating. An explanation of the significance of the ratings may be obtained from each

of the rating agencies.

3 |

Phase 1

Phase 2

Phase 3

The Franklin Square BDC model

4

FSIC

LAUNCHES

2009

2010

2011

2012

2013

April 2014

COMPLETES

OFFERING

POTENTIAL

LISTING

Build portfolio

•

Raised $2.6 billion in equity capital

•

Advantageously used continuous offering model

to deploy capital over multi-year period

•

Continued transition to

direct originations

•

Optimized portfolio and

leverage facilities

•

Increased distribution

rate

•

List when market

conditions are

favorable

•

Provide new

investors access to

FSIC’s scale and

origination platform

Maximize value

Prepare for listing |

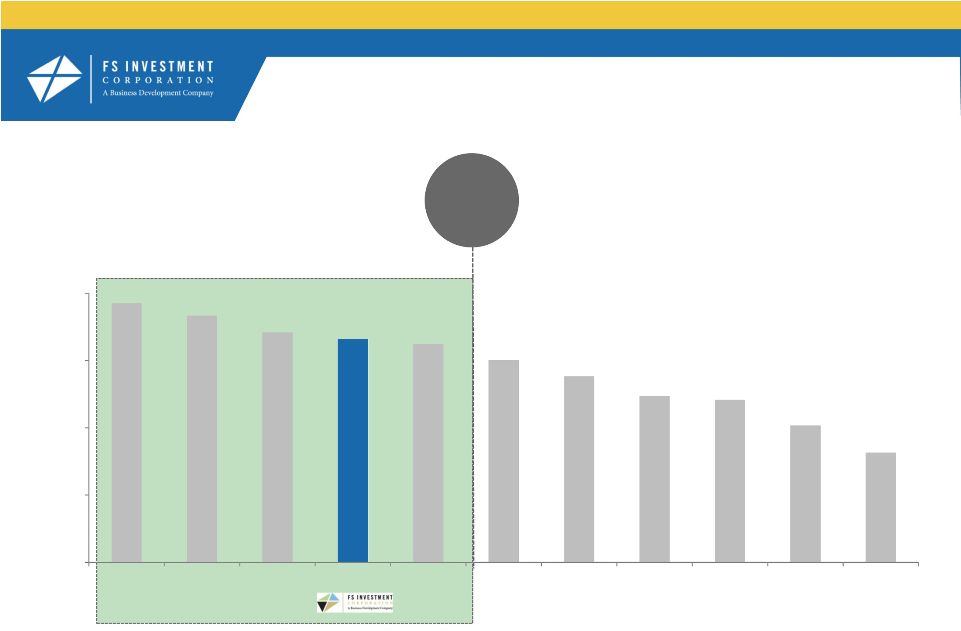

Why

Franklin Square’s model is unique 5

INITIAL

PORTFOLIO

SIZES

OF

RECENT

BDC

IPOs

AND

THE

PROPOSED

FSIC

LISTING

1

1

Source: Public filings. Dollar amounts shown are in millions. The initial portfolio for

FSIC is based on the fair value of investments as of February 28, 2014. The initial portfolio for the other BDCs shown based on the

respective fair values of investments pro forma for the respective BDC’s initial

public offering. •

Scale provides competitive advantage for originations

•

Experienced management team

•

Fully-invested portfolio

$378.9

$67.5

$194.4

$187.8

$198.1

$210.5

$41.5

$0.0

$326.3

$197.4

$132.9

$123.6

$4,141.8

TCP Capital

Monroe

Capital

Corp.

Stellus

Capital

Investment

Corp.

OFS Capital

Corp.

WhiteHorse

Finance, Inc.

Garrison

Capital

Harvest

Capital

Credit Corp.

Fifth Street

Senior

Floating

Rate Corp.

Capitala

Finance

Corp.

American

Capital

Senior

Floating, Ltd.

CM Finance

Inc.

TriplePoint

Venture

Growth

FS

Investment

Corp.

4/4/2012

10/24/2012

11/7/2012

11/7/2012

12/4/2012

3/26/2013

5/2/2013

7/11/2013

9/25/2013

1/15/2014

2/5/2014

3/6/2014

Apr-14 |

•

LEADING MANAGER OF

ALTERNATIVE INVESTMENTS

•

LEADING FRANCHISES

in credit,

private equity, real estate, hedge fund

solutions and financial advisory

•

BRAND AND SCALE

provides

exceptional access

•

BLACKSTONE’S GROUP

PURCHASING ORGANIZATION

available to FSIC portfolio companies

•

LEADING MANAGER OF

ALTERNATIVE CREDIT

focused on

non-investment grade corporate debt

•

GLOBAL PRESENCE

with over 250

employees

•

INVESTMENTS IN MORE THAN

1,100

corporate credits

•

$17.9 BILLION

in directly originated

transactions

•

LARGEST MANAGER OF BDCs

•

60 BDC PROFESSIONALS

•

SCALE

allows for one-stop financing

solutions and low cost structure

•

310 PORTFOLIO COMPANIES

across entire BDC platform

Platform provides a competitive advantage

SCALE

BRAND

INVESTMENT

EXPERTISE

COMPETITIVE

ADVANTAGE

6

1

2

3

2

2

2

Based on total balance sheet assets as of December 31, 2013. Includes the assets of

FSIC, FS Investment Corporation II (FSIC II) and FS Energy & Power Fund (FSEP).

As of December 31, 2013.

Includes portfolio companies of FSIC, FSIC II and FSEP as of December 31, 2013.

1

2

3 |

FSIC’s Size Makes

It an Immediately Relevant BDC TOTAL ASSETS AND BOOK EQUITY OF SELECT BDCs

3rd largest

EXTERNALLY MANAGED BDC

2

7

2

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

ARCC

PSEC

FSIC

AINV

FSC

SLRC

BKCC

GBDC

PNNT

NMFC

TICC

1

Total assets and book equity of the ten largest externally managed BDCs by total

assets. ARCC: Ares Capital Corporation; PSEC: Prospect Capital Corporation; FSIC: FS Investment Corporation; AINV: Apollo

Investment Corporation; FSC: Fifth Street Finance Corp.; SLRC: Solar Capital Ltd.;

BKCC: BlackRock Kelso Capital Corp.; GBDC: Golub Capital BDC, Inc.; PNNT: PennantPark Investment Corporation; NMFC: New Mountain

Finance Corporation; TICC: TICC Capital Corp. 2 Total assets and book equity shown in millions as of

February 28, 2014 for FSIC. Total assets and book equity shown in millions as of December 31, 2013 for ARCC, PSEC, AINV, FSC, SLRC, BKCC, GBDC, PNNT, NMFC and

TICC.

1

Total Assets (in millions)

Total Book Equity (in millions) |

GREATER THAN 80% SENIOR DEBT:

Average distribution rate : 8.93%

Average premium to NAV

:

5%

LESS THAN 80% SENIOR DEBT: Average

distribution rate : 10.43%

Average discount to NAV : 1%

Senior debt = premium pricing

%

SENIOR

DEBT

8

80%

96%

92%

85%

83%

81%

75%

69%

62%

60%

51%

41%

0%

25%

50%

75%

100%

GBDC

NMFC

ARCC

FSIC

FSC

PSEC

TICC

BKCC

PNNT

AINV

SLRC

1

2

3

2

3

1

Senior debt includes first lien senior secured loans, second lien senior secured loans

and senior secured bonds. ARCC senior debt includes Subordinated Certificates of the Senior Secured Loan Program. GBDC senior

debt includes GBDC’s Senior Loan Facility. Senior debt based on fair value as of

February 28, 2014 for FSIC. Senior debt based on fair value as of December 31, 2013 for GBDC, NMFC, ARCC, FSC, PSEC, TICC,

BKCC, PNNT, AINV and SLRC. Sourced from public filings. 2 Distributions rates based on each BDC’s last declared

regular cash distribution and share price data as of March 31, 2014.

3

Average premium and discount to NAV based on each BDC’s last declared NAV and

share price data as of March 31, 2014. There can be no assurance that FSIC will trade at a premium to NAV if FSIC lists its shares.

FSIC’s actual share price upon any listing could be significantly higher or lower

than values shown.

|

BDC

valuations and implied FSIC share price PREMIUM TO NAV

3

1

Premiums of the ten largest externally managed BDCs based on total assets. Share price

data as of March 31, 2014 and each BDC’s last reported NAV as reported in public filings. There can be no assurance that FSIC

will trade at a premium to NAV if FSIC lists its shares. FSIC’s actual share

price upon any listing could be significantly higher or lower than values shown.

2

Based on FSIC’s last reported NAV per share of $10.27 as of February 28,

2014. 3

Peer group includes GBDC, ARCC, NMFC and FSC.

9

Implied FSIC

share price

PEER AVERAGE

AVERAGE

FSC

BKCC

SLRC

AINV

TICC

PSEC

NMFC

PNNT

ARCC

GBDC

1.05x

1.01x

0.96x

0.96x

0.97x

0.97x

0.99x

1.01x

1.01x

1.02x

1.07x

1.17x

0.90x

0.95x

1.00x

1.05x

1.10x

1.15x

1.20x

1.25x

1.30x

$12.02

$10.99

$10.48

$10.37

$10.37

$10.17

$9.96

$9.96

$9.86

$9.86

$10.78

$10.37

(as

of

March

31,

2014)

1

2 |

How FSIC continues to

add value 10

8.25%

target annualized

distribution rate

At listing

After listing

+

$0.20

special cash

distributions

1

Target annualized distribution rate based on FSIC’s monthly distribution per share

of $0.07425 declared in April 2014 and an assumed FSIC listing price of $10.80 per share. This assumed listing price of $10.80 per share

is hypothetical and is not intended to be indicative of the current or future value of

the shares of FSIC’s common stock at or following the time of listing. There can be no assurance a listing will occur. If a listing occurs, the

actual listing share price may be significantly higher or lower. Distributions

are not guaranteed and are subject to the discretion of the board of directors of FSIC.

2

On March 31, 2014, FSIC’s board of directors expressed its intent to declare two

special cash distributions, each in the amount of $0.10 per share, that will be paid on August 15, 2014 and November 14, 2014 to

stockholders of record as of July 31, 2014 and October 31, 2014, respectively. 1

2 |

FSIC is an income

solution 11

DISTRIBUTION YIELDS ACROSS ASSET CLASSES

1

Target annualized distribution rate based on FSIC’s monthly distribution per share

of $0.07425 declared in April 2014 and an assumed FSIC listing price of $10.80 per share. This assumed listing price of $10.80 per share

is hypothetical and is not intended to be indicative of the current or future value of

the shares of FSIC’s common stock at or following the time of listing. There can be no assurance a listing will occur. If a listing occurs, the

actual listing share price may be significantly higher or lower. Distributions

are not guaranteed and are subject to the discretion of the board of directors of FSIC.

2

Dow Jones Dividend Index represented by the iShares Dow Jones Select Dividend ETF

(DVY), Treasury Inflation Protected Securities represented by the iShares Barclays TIPS Bond ETF (TIP), High Yield Bonds

represented by the iShares iBoxx $ High Yield Corporate Bond ETF (HYG), Syndicated Bank

Loans represented by the PowerShares Senior Loan Portfolio ETF (BKLN), Investment Grade Bonds represented by the

iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD), MLPs represented by the ALPS

Alerian MLP ETF (AMLP) and REITs represented by the Vanguard REIT Index ETF (VNQ). Distribution yields as of

March 31, 2014. This data is for illustrative purposes only. FSIC

Traditional

investment

options

Fixed income

options

Other income

alternatives

8.25%

3.29%

1.13%

5.89%

3.99%

3.55%

6.30%

2.57%

FSIC

Dow Jones

Dividend Index

Treasury

Inflation

Protected

Securities

High-yield

bonds

Syndicated

bank loans

Investment

grade bonds

MLPs

REITs

1

2

2

2 |

FSIC's value proposition

12

PROVEN

STRATEGY

PROVEN

PORTFOLIO

PROVEN

PERFORMANCE

110%

cumulative

total

return

8.25%

target annualized

distribution

rate

16.0%

average annual

GAAP

return

•

Direct originations

•

Distributions

paid

from

net

investment

income

and

capital

gains

•

Fully

ramped

portfolio

•

Invest primarily in senior secured, floating rate loans of U.S. private companies

•

Generate income and capital appreciation

PROVEN

MANAGEMENT

1

2

2

3

3

1

Target annualized distribution rate based on FSIC’s monthly distribution of

$0.07425 per share declared in April 2014 and an assumed FSIC listing price of $10.80 per share. This assumed listing price of $10.80 per share is

hypothetical and is not intended to be indicative of the current or future value of the

shares of FSIC’s common stock at or following the time of listing. There can be no assurance a listing will occur. If a listing occurs, the

actual listing share price may be significantly higher or lower. Distributions

are not guaranteed and are subject to the discretion of the board of directors of FSIC.

2

Cumulative and average annual GAAP returns since inception through the quarter ended

December 31, 2013. These returns are calculated in accordance with GAAP using NAV performance and cash distributions declared

during the relevant period and represent the return on the fund’s investment

portfolio rather than an actual return to stockholders. Past performance is not indicative of future results.

3

As of December 31, 2013. |

FSIC listing

details 13

TICKER

FSIC

EVENT

Listing shares on the NYSE

ANTICIPATED

TIMING

April 16, 2014

STOCKHOLDER LOCK-

UP

None; fully tradable at listing

MANAGEMENT LOCK-

UP

Expected for 180 days post listing

POST-LISTING

TENDER

Up to $250 million tender at expected listing

POTENTIAL POST-

TENDER SHARE

PURCHASES

CURRENT ANNUALIZED

DISTRIBUTION

$0.891 per share

SPECIAL CASH

DISTRIBUTIONS

$0.10 per share that may be paid on 8/15/14

$0.10 per share that may be paid on 11/14/14

•

An innovative offering model

•

Publicly-traded BDC premiums suggest potential for

share price appreciation

•

Potential special cash distributions

•

No longer an illiquid alternative

•

Compares well to other income-producing investments

•

Sets precedent for the BDC industry

•

Continued sponsor commitment

LISTING CONSIDERATIONS

2

3

5

4

1

1

There can be no assurance FSIC will list in this time frame or at all.

2

Terms of the FSIC tender offer, including size thereof, are subject to the discretion

of FSIC’s board of directors. 3

Franklin Square Holdings, members of management of FSIC and Franklin Square Holdings

and GSO Capital Partners do not intend to participate in the tender offer. There can be no assurance that Franklin Square, any

member

of

management

of

FSIC

and

Franklin

Square

Holdings

or

GSO

Capital

Partners

will

purchase

any shares.

Any

such

purchases

may

be

conducted

in

open

market

transactions

(which

may

include

purchases

pursuant to 10b5-1

plans),

subject

to

restrictions

under

applicable

law.

4

On March 31, 2014, FSIC’s board of directors determined to increase the amount of

the regular monthly cash distribution payable to stockholders of record from $0.0720 per share to $0.07425 per share effective as of the

regular cash distribution payable for April 2014. Distributions are not guaranteed and

are subject to the discretion of the board of directors of FSIC. 5

On

March

31,

2014,

FSIC’s

board

of

directors

expressed

its

intent

to

declare

two

special

cash

distributions,

each

in

the

amount

of

$0.10

per

share,

that

will

be

paid

on

August

15,

2014

and

November

14,

2014

to

stockholders

of

record

as

of

July

31,

2014

and

October

31,

2014,

respectively.

Up to $175 million being considered:

–

$100 million by Franklin Square Holdings

–

$25 million by members of management of

FSIC and Franklin Square Holdings

–

$50 million by GSO Capital Partners |

FSIC listing operational review

14

ACCOUNT FREEZE

Expected to begin approximately two weeks prior to listing.

DISTRIBUTION

REINVESTMENT

PLAN (DRP)

Will be terminated shortly prior to listing subject to the occurrence of a

listing. After listing, a new DRP may be put into place so stockholders can

again reinvest monthly distributions in additional shares of FSIC. If the

current DRP is terminated, pending the adoption of a new DRP, stockholders that had elected to

participate in the current DRP will receive cash rather than shares in respect of

any cash distribution declared by FSIC.

FRACTIONAL

SHARES

The

mechanics

required

for

transferring

shares

in

order

for

FSIC

to

list

will

not

accept

fractional

shares.

If

an

investor

owns

any

fractional

shares

in

FSIC,

FSIC

expects

to

“round

up”

the

number

of

fractional

shares

held by stockholders immediately prior to a listing to the nearest whole number of

shares. |

What should you do to

prepare your clients for a listing? 2. Hold

3. Sell

15

1

FSIC and its advisors and representatives are not making any recommendation to you as to whether to

tender or refrain from tendering your shares or regarding price or prices at which you may

choose to tender your shares. You are urged to discuss your decision with your tax and financial advisor.

1. Buy

BUY MORE SHARES

HOLD SHARES

SELL

OR

TENDER

SHARES

Increases investment in FSIC without

an initial sales load

Same considerations as holding

•

•

Continued opportunity to receive

current income

Participate in potential special cash

distributions

•

•

Participate in potential market upside and

future growth of FSIC

Investment re-classified from alternative

to domestic equity

Ability to liquidate at time of your choosing

Not a taxable event

•

•

•

•

Loss of current income

Loss of opportunity to receive special cash

distributions

Loss of potential market upside and future

growth of FSIC

Open market sales subject to market volatility

Taxable event

•

•

•

•

•

•

If necessary, move shares to brokerage

account, at advisor and investor’s

convenience

Buy additional shares at market price at

time of your choosing

•

If necessary, move shares to brokerage

account, at advisor and investor’s

convenience

•

•

Consult tax advisor

The post-listing tender offer, if any, will be

made only pursuant to an offer to purchase,

letter of transmittal and related materials (the

Tender Materials) that FSIC intends to

distribute to its stockholders and file with the

SEC. The full details of the tender offer,

including complete instructions on how to

tender shares of common stock, will be

included in the Tender Materials, which FSIC

will distribute to stockholders and file with the

SEC upon the commencement of the tender

offer.

•

1 |

For additional

information 16

FOR GENERAL FSIC QUESTIONS, CONTACT FRANKLIN SQUARE AT

877-628-8575, option 2

FRANKLIN SQUARE CLIENT SERVICES AT

877-628-8575, option 3

EMAIL

ASKFSIC@franklinsquare.com

WEB

Consult www.FSIClist.com |