Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - TETRALOGIC PHARMACEUTICALS Corp | a2218960zex-32_1.htm |

| EX-23.1 - EX-23.1 - TETRALOGIC PHARMACEUTICALS Corp | a2218960zex-23_1.htm |

| EX-31.2 - EX-31.2 - TETRALOGIC PHARMACEUTICALS Corp | a2218960zex-31_2.htm |

| EX-31.1 - EX-31.1 - TETRALOGIC PHARMACEUTICALS Corp | a2218960zex-31_1.htm |

| EX-32.2 - EX-32.2 - TETRALOGIC PHARMACEUTICALS Corp | a2218960zex-32_2.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

TETRALOGIC PHARMACEUTICALS CORPORATION INDEX TO FINANCIAL STATEMENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2013 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission File Number 001-36208

TetraLogic Pharmaceuticals Corporation

(Exact Name of Registrant as Specified in Its Charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

42-1604756 (I.R.S. Employer Identification No.) |

|

343 Phoenixville Pike Malvern, Pennsylvania (Address of Principal Executive Offices) |

19355 (Zip Code) |

Registrant's telephone number, including area code: (610) 889-9900

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Common Stock, par value $0.0001 per share | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

| |

(Title of Class) | |

|---|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.:

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company ý |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the voting stock held by non-affiliates of the registrant, as of March 11, 2014, was approximately $91 million. Such aggregate market value was computed by reference to the closing price of the common stock as reported on the NASDAQ Global Market on March 11, 2014. The registrant has elected to use March 11, 2014 as the calculation date, as on June 28, 2013 (the last business day of the most recently completed fiscal quarter) the registrant was a privately-held concern. For purposes of making this calculation only, the registrant has defined affiliates as including only directors and executive officers and stockholders holding greater than 10% of the voting common stock of the registrant as of March 11, 2014.

The number of shares of the registrant's common stock outstanding as of March 11, 2014 was 22,275,194.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive proxy statement for its 2014 annual meeting of stockholders are incorporated by reference into Items 10, 11, 12, 13, and 14 of Part III of this Form 10-K.

i

Cautionary Note Regarding Forward-Looking Statements and Industry Data

In addition to historical facts or statements of current condition, this annual report and the documents into which this annual report is and will be incorporated contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. We may, in some cases, use terms such as "believes," "estimates," "anticipates," "expects," "plans," "projects," "intends," "potential," "may," "could," "might," "will," "should," "approximately" or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. Forward-looking statements appear in a number of places throughout this annual report and include statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things, our ability to develop and commercialize birinapant; status, timing and results of pre-clinical studies and clinical trials; the potential benefits of birinapant; the timing of seeking regulatory approval of birinapant; our ability to obtain and maintain regulatory approval; our estimates of expenses and future revenues and profitability; our estimates regarding our capital requirements and our needs for additional financing, including with respect to our colorectal cancer, or CRC program; our plans to develop and market birinapant and the timing of our development programs; our estimates of the size of the potential markets for birinapant; our selection and licensing of birinapant; our ability to attract collaborators with acceptable development, regulatory and commercial expertise; the benefits to be derived from corporate collaborations, license agreements, and other collaborative or acquisition efforts, including those relating to the development and commercialization of birinapant; sources of revenues and anticipated revenues, including contributions from corporate collaborations, license agreements, and other collaborative efforts for the development and commercialization of products; our ability to create an effective sales and marketing infrastructure if we elect to market and sell birinapant directly; the rate and degree of market acceptance of birinapant; the timing and amount or reimbursement for birinapant; the success of other competing therapies that may become available; the manufacturing capacity for birinapant; our intellectual property position; our ability to maintain and protect our intellectual property rights; our results of operations; financial condition, liquidity, prospects, and growth and strategies; the industry in which we operate; the trends that may affect the industry or us; the market price of our stock; and our potential obligation to repurchase certain shares of common stock.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events, competitive dynamics and industry change, and depend on the economic circumstances that may or may not occur in the future or may occur on longer or shorter timelines than anticipated. Although we believe that we have a reasonable basis for each forward-looking statement contained in this annual report, we caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate may differ materially from the forward-looking statements contained in this annual report. In addition, even if our results of operations, financial condition and liquidity, and events in the industry in which we operate are consistent with the forward-looking statements contained in this annual report, they may not be predictive of results or developments in future periods.

Actual results could differ materially from our forward-looking statements due to a number of factors, including risks related to:

- •

- our estimates regarding expenses, future revenues, capital requirements and needs for additional financing;

- •

- the success and timing of our pre-clinical studies and clinical trials;

- •

- the potential that results of pre-clinical studies and clinical trials indicate birinapant is unsafe or ineffective;

1

- •

- our exposure to business disruptions;

- •

- our dependence on third parties in the conduct of our pre-clinical studies and clinical trials;

- •

- the difficulties and expenses associated with obtaining and maintaining regulatory approval of birinapant, and the

labeling under any approval we may obtain;

- •

- our plans and ability to develop and commercialize birinapant;

- •

- our ability to acquire or license additional product candidates;

- •

- our failure to recruit or retain key scientific or management personnel or to retain our executive officers;

- •

- the size and growth of the potential markets for birinapant, market acceptance of birinapant and our ability to serve

those markets;

- •

- legal and regulatory developments in the U.S. and foreign countries;

- •

- our ability to limit our exposure to product liability lawsuits;

- •

- our exposure to scrutiny and increased expenses as a result of being a public company;

- •

- the rate and degree of market acceptance of birinapant;

- •

- obtaining and maintaining intellectual property protection for birinapant and our proprietary technology;

- •

- the successful development of our commercialization capabilities, including sales and marketing capabilities;

- •

- recently enacted and future legislation regarding the healthcare system;

- •

- the success of competing therapies and products that are or become available;

- •

- our ability to acquire products or product candidates with acceptable economics; and

- •

- our ability to raise additional capital.

Birinapant is an investigational drug undergoing clinical development and has not been approved by the U.S. Food and Drug Administration, or FDA, nor submitted to the FDA for approval. Birinapant has not been, nor may never be approved by any regulatory agency nor marketed anywhere in the world. Statements contained in this annual report should not be deemed to be promotional.

Any forward-looking statements that we make in this annual report speak only as of the date of such statement, and we undertake no obligation to update such statements to reflect events or circumstances after the date of this annual report or to reflect the occurrence of unanticipated events. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data.

You should also read carefully the factors described in the "Risk Factors" section of this annual report and elsewhere to better understand the risks and uncertainties inherent in our business and underlying any forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this annual report will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified timeframe, or at all.

We obtained the industry, market and competitive position data in this annual report from our own internal estimates and research as well as from industry and general publications and research surveys and studies conducted by third parties. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. We believe this data is accurate in all material respects as of the date of this annual report.

2

Overview

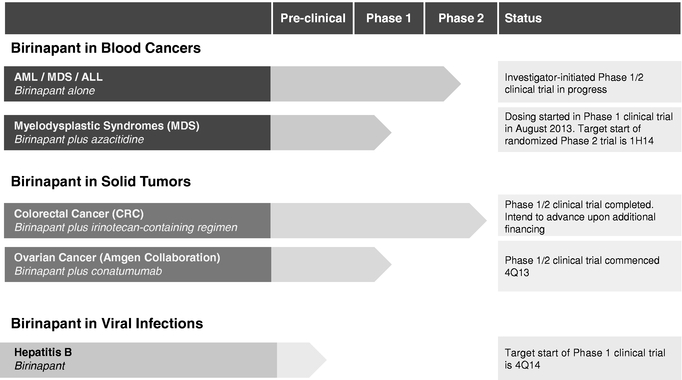

We are a clinical-stage biopharmaceutical company focused on discovering and developing novel SMAC-mimetics that are designed to cause or enable abnormal cells that are resistant to the body's immune system to self-destruct. Birinapant, our clinical-stage product candidate, is currently being tested in Phase 1 and Phase 2 oncology clinical trials for multiple solid tumors and hematological malignancies. Our clinical trials of birinapant have enrolled over 275 subjects.

Our clinical and pre-clinical programs are focused on:

- •

- myelodysplastic syndromes, or MDS

- •

- CRC

- •

- ovarian cancer

- •

- hepatitis B virus, or HBV

We have an ongoing Phase 1/2 clinical trial of birinapant as a single agent in various blood cancers. We have also started a Phase 1 clinical trial of birinapant administered with azacitidine in MDS and intend to start a randomized Phase 2 clinical trial of birinapant administered with azacitidine in MDS in the first half of 2014.

We completed a Phase 1/2 clinical trial of birinapant administered with irinotecan in CRC, and we intend to start a randomized clinical trial of birinapant administered with a chemotherapy regimen containing irinotecan in second-line CRC, subject to our ability to obtain additional financing.

We started a Phase 1/2 clinical trial of birinapant administered with conatumumab in ovarian cancer in the fourth quarter of 2013.

We intend to start a Phase 1 clinical trial in HBV in the fourth quarter of 2014.

Background of SMAC-Mimetics

Fundamentally important to maintaining human health is the mechanism in both normal and abnormal cells for controlling programmed cell death. This process of self-destruction of cells is known as apoptosis. There are multiple checks and balances within a cell to ensure that healthy cells do not undergo apoptosis by mistake and that abnormal cells, such as cancerous and virally infected cells, undergo apoptosis and are cleared from the body. Key molecules that protect cells from apoptosis are called Inhibitor of Apoptosis proteins, or IAPs. A key molecule that promotes apoptosis is Second Mitochondrial Activator of Caspases, or SMAC, a naturally occurring IAP inhibitor.

In many diseases, such as certain cancers and viral infections, abnormal cells that should be naturally cleared from the body manage to escape apoptosis. As a result, cells that should self-destruct actually survive and even proliferate or propagate infection, leading to multiple disease complications. In both cancer and viral infections, the abnormal cells typically use a similar escape pathway: the overexpression of proteins such as the IAPs resulting in the avoidance of the signals to undergo cell self-destruction.

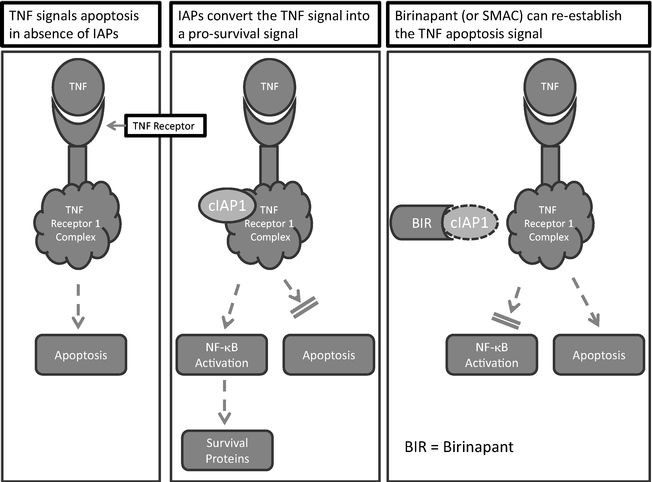

Tumor Necrosis Factor, or TNF, is an extracellular signaling molecule that induces apoptosis. Cancer cells and certain virally infected cells can use IAPs to convert a TNF-induced self-destruction signal into a pro-survival signal through a protein complex called NF-kB. While a number of cancer therapies induce TNF, the TNF self-destruction signal may be blocked by the IAPs. Normally, IAPs can

3

be disabled by their natural inhibitor SMAC, but this natural blocking mechanism is rendered ineffective in many cancers and certain viral infections due to the overexpression of IAPs. We believe that novel small molecule therapies that mimic SMAC, or SMAC-mimetics have the potential to inhibit the overexpressed IAPs and re-establish the TNF self-destruction signal. Our therapeutic focus is centered on the development of SMAC-mimetics that are designed to inhibit IAPs and re-establish the TNF self-destruction signal in order to overcome this "escape-from-apoptosis" in malignant or infected cells. A key element of our strategy is to administer a SMAC-mimetic with other therapies that induce TNF or related self-destruction signaling molecules. Examples of such other therapies are azacitidine, gemcitabine, granulocyte-macrophage colony-stimulating factor, or GM-CSF, interferon, or IFN, irinotecan and radiation therapy. There are no drugs currently on the market that specifically target the IAPs to re-establish apoptosis in abnormal cells.

Birinapant

Birinapant was selected from our chemical library of over 3,000 SMAC-mimetic compounds, has a strong intellectual property profile, and we believe has the potential to be broadly active across multiple tumor types and against virally-infected cells. Over 275 study participants with cancer have been treated with birinapant alone or administered with standard chemotherapies. In clinical trials, birinapant was generally well tolerated, meaning that treatment-related side effects were mild or moderate in severity in the majority of treated subjects, and showed signs of activity in subjects with cancer. In pre-clinical cancer studies, birinapant was synergistic (or super-additive) with agents that induce TNF, including established anti-cancer chemotherapies (such as azacitidine, gemcitabine and irinotecan), other anti-cancer therapies (such as radiotherapy), biological agents (such as GM-CSF and IFN), and with TNF and other members of the TNF superfamily including TNF-related apoptosis-inducing ligand, or TRAIL and TRAIL-Receptor 2 (also known as Death-Receptor 5, or DR5) agonists. In addition, birinapant reduced HBV levels in animal studies in a TNF-dependent manner. Our clinical strategy is to administer birinapant with therapies (for example, azacitidine or irinotecan) that induce the production of TNF or related molecules.

As shown in FIGURE 1, below, the principal target of birinapant is the IAP, cIAP1. A secondary target is the IAP, cIAP2 (not shown in FIGURE 1 below). Both are critical components of the TNF receptor 1 complex. It is this TNF receptor 1 complex that receives the TNF signal and then transmits it inside the cell, triggering a cascade of events that includes activation of NF-kB which delivers the pro-survival signal to a cancer (or virally infected) cell.

4

FIGURE 1. Birinapant is designed to mimic SMAC and enable TNF-activated apoptosis.

Activity in Clinical Trials

We believe that our pre-clinical and clinical data suggest that birinapant has potential for treating a wide spectrum of solid tumors, hematological malignancies and viral infections, and provide the rationale for further clinical development of birinapant. In clinical trials, birinapant has shown favorable pharmacokinetic, or PK properties, meaning how the subject's body handles birinapant, including the length of time birinapant remains in a subject's blood or tumor, with similar and predictable behavior among treated subjects. In addition, our clinical trials show evidence that birinapant is interacting with its intended target and that the activation of NF-kB was inhibited in subject tumor cells.

Birinapant has thus far shown clinical activity in both hematological malignancies and solid tumors, including acute myelogenous leukemia, or AML and CRC. Phase 1 and Phase 2 clinical trials have been completed or are ongoing with birinapant. Initial response and safety data from the Phase 1/2 solid tumor trial were reported at the 2013 Annual Meeting of the American Society of Clinical Oncology.

Our Phase 1 clinical trials are designed to define the maximum tolerated dose, or MTD of birinapant both as a single agent and when administered with other chemotherapies, to gather PK and safety data, and to determine the recommended Phase 2 dose. Phase 2 clinical trials are designed to determine the tolerability and magnitude of clinical benefit of birinapant both as a single agent and when administered with other chemotherapies, initially in a small number of subjects. Our Phase 1/2 clinical trials are designed to include both a dose escalation component and a fixed dose component to

5

gather safety data and measure any early signal of clinical benefit. Phase 3 clinical trials will be designed to confirm the tolerability and magnitude of clinical benefit in a larger number of subjects.

The following table sets forth our highest priority clinical programs:

Safety Studies

Birinapant was generally well tolerated both alone as a single agent, or administered with standard chemotherapies, in Phase 1 and Phase 2 clinical trials, which have collectively enrolled over 275 subjects. In these trials, side effects were predominantly dose-related, transient and mild or moderate in severity. Birinapant did not appear to substantially exacerbate any of the common toxicities associated with the administered chemotherapies.

Safety data from databases of our CROs are available in 226 subjects for studies of birinapant as a single agent or administered with standard chemotherapies. In single agent studies of birinapant, the most frequent treatment-related adverse events occurring in at least 10% of subjects were cytokine release syndrome, decreased appetite, diarrhea, fatigue, headache, hypotension, lymphocytopenia, nausea and vomiting. In clinical trials of birinapant administered with standard chemotherapies, the most frequent treatment-related adverse events, occurring in at least 10% of subjects, were decreased appetite, fatigue, nausea and vomiting. The majority of these treatment-related events were Grade 1 (mild) or 2 (moderate) severity, and reversible without clinical complications.

In the single agent dose-escalation clinical trial that deliberately sought to define the dose-limiting toxicities and thus the MTD, the birinapant-related adverse events that were Grade 3 (severe to life-threatening) or greater in severity occurred in 9 of 50 (18%) subjects and included fatigue, headache, hypophosphatemia, increased serum amylase, increased serum lipase, lymphocytopenia, nausea, thrombocytopenia and vomiting. In the clinical trials of birinapant administered with standard chemotherapies, the treatment-related adverse events that were Grade 3 or greater in severity occurred in 32 of 176 (18%) subjects and included but were not limited to fatigue, neutropenia, thrombocytopenia and vomiting. In the clinical trial of birinapant administered with azacitidine, the

6

treatment related adverse events that were grade 3 or higher were abdominal cellulitis at the site of subcutaneous injection of azacitidine and asymptomatic increases in serum lipase.

In clinical trials, birinapant was associated with the onset of cranial nerve palsies, meaning a complete or partial weakness or paralysis of the areas served by the affected nerve, of mild to moderate severity. A palsy of the seventh cranial nerve resulted in a Grade 2 Bell's Palsy, or weakness or inability to control facial muscles on one side of the face, in 11 subjects among all treated subjects. Some of these events were considered dose-limiting toxicities and improved to Grade 1 or full recovery within two to four weeks. Most subjects elected to continue birinapant treatment and none had a recurrent event of Bell's Palsy.

Overview of Clinical and Pre-clinical Programs

Our most advanced clinical programs are in MDS and CRC. The proceeds we raised in our initial public offering will be used to advance the MDS program and our earlier-stage programs in ovarian cancer and HBV. Advancing the CRC program will require additional financing. We incurred research and development expenses of $15.3 million, $12.1 million and $9.5 million during the years ended December 31, 2011, 2012 and 2013, respectively.

Myelodysplastic Syndromes (MDS)

A Phase 1/2 investigator-initiated clinical trial in AML, MDS and acute lymphoblastic leukemia, or ALL, is ongoing at the University of Pennsylvania and 23 study subjects have been treated with birinapant as the sole agent or administered with hydroxyurea (if deemed necessary by the treating physician). The majority of subjects enrolled are elderly (over 70 years) with AML secondary to MDS and have received multiple prior treatments. In preliminary data, the treatment-related adverse events included Grade 3 and Grade 4 increases in serum levels of the digestive enzymes amylase and lipase, as determined by laboratory testing, with no subject-reported symptoms of abdominal pain. The preliminary data also shows reductions in leukemic blasts (tumor bulk) in some subjects. There were increases in neutrophils with the first birinapant dose in some subjects. One subject continued on treatment with birinapant as sole agent for approximately 10 months. Based on the synergy we observed in pre-clinical studies between birinapant and azacitidine, the current standard of care for MDS, and the action of birinapant in subjects with AML secondary to MDS, in August 2013, we initiated a Phase 1 clinical trial of birinapant administered with azacitidine in higher-risk MDS subjects who have relapsed or are refractory to azacitidine. We expanded this clinical trial to include subjects who have not been previously treated with, or are naïve to, azacitidine. We plan to enroll 15 to 30 subjects in a dose escalation phase to determine the recommended dose of birinapant administered with azacitidine for further trials. Subject enrollment is expected to be completed in the first half of 2014. We also intend to commence a randomized Phase 2 clinical trial in the first half of 2014 of birinapant administered with azacitidine versus azacitidine alone in first-line higher-risk MDS subjects.

Colorectal Cancer (CRC)

We have results of a Phase 1/2 clinical trial of birinapant administered with irinotecan in 71 CRC subjects who had previously failed standard chemotherapies. The clinical trial showed activity, with six subjects (8%) showing partial responses, or PRs, defined as at least a 30% decrease in the sum of all measurable tumor lesions by Response Evaluation Criteria in Solid Tumors, or RECIST. RECIST is a set of published rules that define when cancer patients improve (or respond), stay the same (or stabilize), or worsen (or progress) during treatment. The median progression-free survival, or PFS, was 2.2 months. Thirty-four percent of study subjects were alive without progression of their tumor at four months and 21% were alive without progression of their tumor at six months. The combination of birinapant administered with irinotecan was generally well tolerated. Compared to treatment with irinotecan alone, birinapant administered with irinotecan led to a modest increase in anemia (or a

7

decrease in red blood cells) and a modest increase in thrombocytopenia (or a decrease in platelets). As noted above, irinotecan is one of the chemotherapies that induces TNF. As the majority of subjects had disease progression on prior irinotecan treatment (65 of 71, or 92%), we believe that this data supports the view that the activity seen in this study is being driven by the synergistic effect of birinapant and irinotecan. Based on the clinical data that has emerged from the study of birinapant, a randomized clinical trial is planned in second-line CRC subjects, meaning those who have already failed a prior treatment regimen for advanced disease to commence enrollment, subject to our ability to obtain additional financing.

Ovarian Cancer

In pre-clinical studies, we observed synergy between birinapant and TRAIL receptor agonist antibodies. In collaboration with Amgen, Inc., or Amgen, we are exploring the combination of birinapant administered with Amgen's TRAIL receptor agonist antibody, conatumumab. We began dosing subjects in December 2013 in a Phase 1/2 ovarian cancer trial.

Hepatitis B Virus (HBV)

Hepatitis B is a liver disease that results from infection with HBV. In pre-clinical studies, birinapant significantly reduced HBV. The clearance was additive when given in combination with entecavir, the standard of care therapy for HBV. We intend to continue pre-clinical studies and regulatory activities and intend to start a Phase 1 clinical trial in the fourth quarter of 2014.

Biomarkers

In connection with our clinical programs, we are conducting research to uncover biomarkers, or biological parameters that can be measured to characterize a disease state or the effect of therapy, that can be used to identify subjects most likely to respond to birinapant. These studies are focused on detecting IAP gene amplification in different tumor types, on examining the expression of genes important in the TNF/IAP/NF-kB pathway and on examining the activation status of NF-kB itself.

Our Strategy

Our goal is to maximize the potential value of birinapant as a first-in-class and best-in-class SMAC-mimetic. The key elements of our strategy to achieve this goal include:

- •

- pursuing regulatory approval for birinapant administered with other therapies for the treatment of first-line higher-risk

MDS. We intend to initiate a randomized Phase 2 clinical trial in the first half of 2014. The data from the randomized Phase 2 clinical trial will determine the size of the treatment

effect of birinapant administered with azacitidine versus azacitidine alone and will form the basis of a Phase 3 clinical trial in first-line higher-risk MDS;

- •

- pursuing regulatory approval for birinapant for treatment of second-line CRC. We plan to initiate a randomized clinical

trial upon the availability of additional financing;

- •

- continuing a Phase 1/2 clinical trial started in December 2013 with birinapant administered with conatumumab in ovarian

cancer;

- •

- continuing our pre-clinical studies of birinapant as a potential antiviral therapeutic agent, with the intent of starting

an antiviral clinical program in the fourth quarter of 2014;

- •

- considering collaborations to accelerate development of our clinical programs outside of the U.S.; and

- •

- in-licensing or acquisitions of assets and companies to expand our existing technologies and operations.

8

Other elements of our business strategy include exploiting our understanding of the role of SMAC-mimetics more broadly in infectious disease, leveraging our library of SMAC-mimetic compounds to develop novel molecules to expand the utility of this developing class and pursuing potential collaborations.

Birinapant—Inhibitor of IAPs

Birinapant Inhibits IAPs to Overcome a Cancer Cell's "Escape from Apoptosis"

Birinapant is a bivalent investigational SMAC-mimetic designed to bind to a greater or lesser extent with multiple IAPs. IAPs, including cIAP1, cIAP2, XIAP, and ML-IAP, are a group of structurally-related proteins that can suppress apoptosis. Based on our pre-clinical studies and clinical trials, we believe that birinapant's potential ability to inhibit the IAPs will block this suppression across multiple cancers and virally infected cells.

The dysregulation of apoptosis is recognized as a fundamental defect in the pathogenesis of cancer. Apoptosis is a highly regulated process that enables cells to respond to either extracellular or intracellular signals in order to rapidly eliminate damaged cells. In many tumors, the ability to undergo apoptosis is impaired and the transformed cell is able to remain in a viable, pro-survival state, even in the presence of strong pro-apoptotic signals. Therefore, dysregulation of apoptosis in tumors contributes to the malignant phenotype and is associated with resistance to certain chemotherapeutics and biological therapies. The IAP genes are frequently amplified (for example, the cancer cells contain extra copies of such genes beyond the normal two copies per cell) in cancer, which can contribute to resistance to apoptosis in response to certain biological and conventional cytotoxic drug therapies.

The IAPs have multiple and distinct domains that are responsible for different functions of the protein. A critical functional domain of both cIAP1 and cIAP2 is called the E3 ubiquitin ligase domain, or E3 domain, which acts to "tag" proteins for degradation. Two IAP E3 domains must interact with each other to be functional. Thus when two IAPs come together to form a "homodimer," allowing the two E3 domains to interact, it can result in their self-degradation. This self-degradation of two IAP molecules as a result of coming together and interacting with each other through their E3 domains is critically important to the action of all SMAC-mimetics.

The endogenous SMAC protein interacts with the IAP homodimer, that is, it interacts with two IAP molecules. Product candidates under development which interact with the IAPs fall into two classes: a "monovalent" compound that interacts with a single IAP molecule or a "bivalent" compound that interacts with two IAP molecules. Birinapant is a bivalent compound that mimics the activity of endogenous SMAC. Based upon pre-clinical studies, we believe that, bivalent SMAC-mimetics are more potent inhibitors of TNF induced NF-kB activation than monovalent IAP inhibitors.

In pre-clinical studies, birinapant was synergistic with agents that induce TNF, including anti-cancer chemotherapies (such as azacitidine, gemcitabine and irinotecan), other anti-cancer therapies (such as radiotherapy), biological agents (such as GM-CSF and IFN) and with members of the TNF superfamily that include TNF itself, TRAIL, and TRAIL-Receptor 2 (also known as DR5) agonists.

In pre-clinical studies, a significant number of tumor types resistant to single agent treatment with either TNF or TRAIL became sensitive in the presence of low concentrations of birinapant. The requirement for TNF underpins our clinical program: while birinapant is anticipated to have some activity when administered as the sole therapy, we believe its maximum anti-cancer activity will occur when administered with chemotherapies that further induce TNF.

We believe that birinapant has the potential to be superior to other IAP inhibitors for two reasons. First, birinapant is a bivalent molecule similar to endogenous SMAC and allows for direct engagement of two IAP molecules. Our pre-clinical studies suggest that bivalent SMAC-mimetics are more potent inhibitors of TNF induced NF-kB activation than monovalent IAP inhibitors. To our knowledge,

9

birinapant is the only bivalent SMAC-mimetic in clinical development in the United States. Second, based on our pre-clinical studies, birinapant inhibits cIAP1 more than cIAP2. Complete degradation of cIAP2 is associated with increased toxicities. We believe that this is the basis for the pre-clinical data suggesting that birinapant will be better tolerated than SMAC-mimetics that are less selective. Consistent with these pre-clinical studies, birinapant was generally well tolerated in our clinical trials.

Clinical Programs

Myelodysplastic Syndromes (MDS)

Background

MDS is a form of cancer of bone-marrow stem cells resulting in fewer than normal mature blood cells in the circulation. In MDS, bone marrow becomes dysplastic, or defective. The blood cells produced do not develop normally, such that too few healthy blood cells are released into the blood stream, which leads to cytopenias. Thus, many patients with MDS require frequent blood transfusions. In most cases, the disease worsens and the patient develops progressive bone marrow failure. In advanced stages of the disease, blasts leave the bone marrow and enter the blood stream, leading to AML, which occurs in approximately one-third of patients with MDS. We believe that there is a medical need for a treatment option that improves outcomes of standard of care regimens for patients with MDS.

According to the American Cancer Society, MDS is diagnosed in approximately 12,000 people in the U.S. annually, for an age-adjusted incidence rate of approximately 4.4 to 4.6 cases per 100,000 people. MDS occurs predominantly in older patients (usually those older than 60 years). The median age at diagnosis is approximately 70 years. MDS may arise de novo or secondarily after treatment with chemotherapy and/or radiation therapy for other cancers or, rarely, after environmental exposures.

Two standard classification systems, the French-American-British, or FAB, morphological classification system, and the International Prognostic Scoring System, or IPSS, are used for defining MDS subtypes and risk categories, respectively. Standard treatment approaches for MDS depend on the patient's FAB subtype and IPSS risk category: Low/Intermediate, or lower-risk, and Intermediate-2/High, or higher-risk. Approximately 25%-30% of MDS patients are diagnosed as having higher-risk MDS, although many lower-risk MDS patients eventually progress to higher-risk MDS.

The vast majority of lower-risk MDS patients are clinically managed with supportive care: broad-spectrum antibiotics and red blood cell, or RBC, platelet transfusions. MDS patients who require repeated RBC transfusions may be treated with an iron chelating agent to prevent or reduce iron overload. Recombinant human erythropoietin, or EPO, is used to treat the defective development of RBCs in MDS patients with symptomatic anemia, specifically those with serum EPO <500 U/L and limited transfusion requirement. This may be combined with granulocyte colony-stimulating factor, or G-CSF, to improve the neutrophil count. Lenalidomide (Revlimid) is approved for transfusion-dependent lower-risk MDS patients with deletion of part of chromosome 5.

Azacitidine was initially approved in the U.S. in 2004 for the treatment of patients with MDS. Azacitidine is a pyrimidine nucleoside analog of cytidine and is believed to exert antineoplastic effect by causing hypomethylation of DNA (deoxyribonucleic acid) and direct cytotoxicity on abnormal hematopoietic cells in the bone marrow. Clinical trials that supported approval of azacitidine demonstrated that treatment could yield response in approximately 50% of subjects, that these responses can be prolonged, and that there is a survival benefit in patients with MDS.

There continues to be a significant unmet need among MDS patients for more effective initial therapy and therapies for refractory and relapsed disease. While azacitidine has become a standard of care for first-line therapy for higher-risk MDS, 40%-50% of patients are refractory to treatment and responders typically demonstrate progressive disease within 2 years, often progressing to AML. Other

10

than palliative care, patients with relapsed or refractory MDS have no currently effective anti-tumor therapies after initial treatment with azacitidine. For patients who progress after azacitidine, the median overall survival is 5.6 months and two-year survival probability is 15%. Many patients progress to AML, emphasizing the commonality of the underlying biological mechanism between MDS and AML.

Rationale

Dysregulation of IAPs may be critical for the development and progression of hematological malignancies, including AML and MDS. Although classified as distinct disease entities, MDS and AML are closely related diseases. In a number of third-party studies, the over-expression of IAPs has been associated with "escape-from-apoptosis" and poor prognosis in AML. Consistent with these third-party findings suggesting that IAPs exert adverse effects on the outcome of AML, in other third-party studies, SMAC over-expression has been associated with improved prognosis in AML. The natural evolution of MDS involves molecular changes that make those cells increasingly dependent on anti-apoptotic pathways, the same pathways that birinapant interdicts.

In other third-party studies of MDS, dysregulated expression of IAPs was observed, with overexpression of IAPs in MDS bone marrow cells, which we believe has a potential role in transformation to overt leukemia. We believe that these studies demonstrate that the IAPs represent targets for therapy and thus the potential therapeutic opportunity for SMAC-mimetics in MDS and AML.

Pre-clinical Studies

In vitro studies of both established AML cell lines and freshly-derived AML blast cells, single agent birinapant demonstrated activity at clinically achievable study drug exposures. This was evident in assays of unfractionated AML cells, and in studies of AML "stem/progenitor" cells (CD34+, CD38 negative cells). In these studies, we observed increased apoptosis after 48 hours of in vitro culture. An independent study by a separate investigator observed clonal suppression of AML-derived colonies in 14 day cultures by birinapant, with sparing of normal progenitor cells. Studies of human ALL cells in tumor models have demonstrated cytotoxic activity in in vitro and in vivo studies.

We believe our pre-clinical studies of birinapant administered with azacitidine support a distinct mechanism of anti-tumor synergy that may provide clinical benefit compared to individual agents alone. Birinapant administered with azacitidine demonstrated anti-tumor activity compared to single agent azacitidine in primary AML blast cells. In our in vivo studies of AML cells, we also observed activity for birinapant as either a single agent or administered with azacitidine. We have observed similar pre-clinical activity when birinapant is administered with two other AML/MDS therapies, cytosine arabinoside and decitabine.

In our in vitro studies, we observed that azacitidine leads to TNF induction, which we believe supports the rationale that the administration of birinapant with azacitidine may have additive activity over azacitidine treatment alone for MDS subjects. Additionally, we believe these studies support the rationale that administration of birinapant with azacitidine offers possible therapeutic benefit to subjects who relapse following, or are refractory to, azacitidine therapy. We believe that clinical evidence to support this potential for retreatment efficacy has been demonstrated for CRC subjects who obtained clinical benefit for the administration of birinapant with TNF-inducing chemotherapies after previously progressing on these same chemotherapy agents.

11

Clinical Trials

An investigator-initiated Phase 1/2 clinical trial is ongoing at the University of Pennsylvania to assess the safety and efficacy of single agent birinapant in AML, MDS and ALL. An investigator-initiated clinical trial is one in which the sponsor is not a commercial entity. The sponsor is responsible for conducting the study and reporting safety data to the FDA. The majority of subjects enrolled are elderly (over 70 years) with AML secondary to MDS and have received multiple prior treatments. To date, 23 AML subjects have been treated with birinapant as the sole agent or administered with hydroxyurea (if deemed necessary by the treating physician). Currently, 10 subjects have received concurrent hydroxyurea during treatment with birinapant. Subjects receive birinapant administered as a 30-minute IV infusion weekly or biweekly for three weeks, per repeated cycle of four weeks. As the study is ongoing, the data and analyses are preliminary and incomplete. However, we have the following preliminary data:

- •

- some subjects experienced a decrease in the leukemic blast cells;

- •

- some subjects showed an increase in neutrophils with the first birinapant dose;

- •

- PK measurements indicated that birinapant had comparable plasma and tumor drug exposure in subjects with AML compared to

subjects with solid tumors;

- •

- pharmacodynamic, or PD, measurements of several subjects showed cIAP1 and NF-kB

target suppression in peripheral blood AML blast cells;

- •

- one subject with AML who had progressed from MDS and had progressive disease after prior cytotoxic regimens, had stable

disease and no cumulative toxicities with 10 months of therapy; and

- •

- one other subject experienced a decrease from 60% to 10% in bone marrow blast count.

Safety data is available from 16 AML subjects who received birinapant as a single agent in the Phase 1/2 clinical trial. In this clinical trial, treatment-related adverse events were neutropenia (low blood levels of neutrophils), leukopenia (low blood levels of leukocytes), oral pain (mouth sores), fatigue, fever, increased serum amylase (protein in multiple organs, including pancreas), increased serum lipase (protein in multiple organs, including pancreas), increased aspartate aminotransferase (an enzyme in multiple organs, including the liver), increased alkaline phosphatase (an enzyme in multiple organs, including the liver), dysesthesia (abnormal sensation), dysgeusia (abnormal taste), headaches and sweating. Eight serious adverse events, or SAEs (adverse events that may result in a hospitalization, are life-threatening or cause death), that were considered related to birinapant treatment, as determined by the clinical investigator, included febrile neutropenia (fever with low blood levels of neutrophils), fever, increased serum amylase and increased serum lipase.

12

The following table sets forth the adverse events occurring during treatment of AML, MDS and ALL subjects who received birinapant and are considered to be related to such treatment as determined by the principal investigator as of October 26, 2012:

Adverse Event

|

No. of Grade 1 Adverse Events |

No. of Grade 2 Adverse Events |

No. of Grade 3 Adverse Events |

No. of Grade 4 Adverse Events |

Total No. of Adverse Events(1) |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Dysethesia |

1 | — | — | 1 | ||||||||||||

Dysgeusia |

— | 1 | — | — | 1 | |||||||||||

Fatigue |

1 | 1 | — | — | 2 | |||||||||||

Fever |

2 | — | — | — | 2 | |||||||||||

Headache |

2 | 1 | — | — | 3 | |||||||||||

Increased alkaline phosphatase |

— | 1 | — | — | 1 | |||||||||||

Increased aspartate aminotransferase (AST) |

1 | — | — | — | 1 | |||||||||||

Increased serum amylase |

2 | — | 2 | — | 4 | |||||||||||

Increased serum lipase |

1 | — | 1 | 1 | 3 | |||||||||||

Leukopenia |

1 | — | — | — | 1 | |||||||||||

Neutropenia |

— | — | — | 2 | 2 | |||||||||||

Oral pain (mouth sores) |

1 | — | — | — | 1 | |||||||||||

Sweating |

1 | — | — | — | 1 | |||||||||||

- (1)

- There were no Grade 5 (death) adverse events.

While the preliminary data showed hematologic activity of single agent birinapant in AML in this trial, we anticipate greater activity may be seen when used in administration with agents that induce TNF (such as azacitidine) as enhanced activity has been seen both in pre-clinical studies and in clinical trials of solid tumors when there has been administration of a chemotherapeutic agent that increases TNF. We are currently investigating this activity in a clinical trial of birinapant administered with hypomethylating agents in higher-risk MDS.

In April 2013, we filed an IND with the FDA for birinapant administered with azacitidine in MDS subjects and have begun enrolling subjects at five sites, including Mayo Clinic-Jacksonville (MS), Mayo Clinic-Scottsdale (AZ), MD Anderson Cancer Center in Houston, TX, Roswell Park Cancer Institute (NY), and the University of Pennsylvania. We have added two more translational research management sites in California. This is a Phase 1, open-label, non-randomized clinical trial in subjects with higher-risk MDS who are refractory to or have relapsed following azacitidine therapy. We expanded this clinical trial to include subjects who have not been previously treated with, or are naïve to, azacitidine.

The primary objective of this clinical trial is to determine the MTD, recommended Phase 2 dose, and PDs of birinapant when administered with azacitidine in the subject population. The secondary objectives of this trial are the following: to determine the clinical activity of birinapant administered with azacitidine; to determine the PKs of birinapant when administered with azacitidine, and to explore biomarkers of anti-tumor activity of birinapant.

In August 2013, we initiated a Phase 1 clinical trial of birinapant administered with subcutaneous azacitidine in higher-risk MDS subjects who have relapsed or are refractory to azacitidine. We expanded this clinical trial to include subjects who have not been previously treated with, or are naïve to, azacitidine. It is planned that approximately 15 to 30 subjects with higher-risk MDS will be enrolled in the Phase 1 clinical trial by the first half of 2014 and will receive birinapant administered with azacitidine in dose-escalation cohorts to determine the recommended dose for further trials. We intend to commence a randomized Phase 2 clinical trial in the first half of 2014 of birinapant administered with azacitidine versus azacitidine alone in first-line higher-risk MDS subjects.

13

Biomarker Studies

A secondary objective of the Phase 1 clinical trial of birinapant administered with azacitidine in MDS is to assess biomarkers of anti-tumor activity. In studies of subjects with AML, we believe there is preliminary evidence to suggest that the assessment of NF-kB activity at baseline using a flow-cytometry based assay may have the potential to select for subjects more likely to respond to treatment.

Some of the available baseline AML samples had activation of NF-kB and some did not. While sample numbers are small, a reduction in blast count after birinapant treatment was observed only in subjects with activation of NF-kB in the leukemic samples at baseline. We believe this has the potential to provide an assay that could identify subjects most likely to respond to birinapant. Experiments are being performed to validate these findings and to develop a diagnostic assay for NF-kB. Using NF-kB as a biomarker could be particularly relevant in MDS as there are third-party studies in which NF-kB activation has been shown in subjects with higher-risk MDS and, furthermore, NF-kB activation appeared to correlate with disease progression.

Colorectal Cancer (CRC)

Background

CRC is the most deadly cancer in the U.S. among non-smokers and the second most deadly cancer overall. The American Cancer Society estimates that in the U.S. there will be approximately 142,000 new cases and approximately 51,000 deaths from CRC in 2013, accounting for 9% of all cancer deaths. Almost 50% of the patients with a new diagnosis of CRC will die within five years. According to the NCI, the prevalence of CRC in the U.S. in 2010 was estimated to be 1.2 million cases. CRC is the third most common cancer in both men and women. The risk of CRC increases with age; 90% of cases are diagnosed in individuals 50 years of age or older. Despite effective screening, leading to a reduction in the mortality from CRC, the number of cases remains high and is expected to increase worldwide to 2.2 million by the year 2030. We believe that there is a medical need for a treatment option that improves outcomes of standard of care regimens for patients with CRC.

Surgery is the first-line treatment for early stage CRC. When CRC is advanced or metastasizes (spreads to other parts of the body, such as the liver), chemotherapy alone or in combination with radiation is commonly used. FDA approved drugs for patients with advanced or metastatic CRC (mCRC) are: 5-fluorouracil, aflibercept (Zaltrap), bevacizumab (Avastin), capecitabine (Xeloda), cetuximab (Erbitux), irinotecan (Camptosar), leucovorin, oxaliplatin (Eloxatin), panitumumab (Vectibix) and regorafenib (Stivarga). Depending on the stage of the cancer, three or more of these drugs may be administered at the same time or used after one another. Chemotherapy regimens (such as FOLFOX (5-fluorouracil, leucovorin, and oxaliplatin) or FOLFIRI (5-fluorouracil, irinotecan, and leucovorin)), either with or without aflibercept or bevacizumab, have been shown to increase survival rates in patients with advanced/metastatic CRC and are among the leading first- and second-line treatments in the U.S. and Europe. Typically, patients who fail 5-fluorouracil, irinotecan, oxaliplatin, and bevacizumab- or aflibercept-containing therapies, and who have a wild-type, or normal KRAS gene in the tumor, receive treatment with an epidermal growth factor receptor, or EGFR, monoclonal antibody. This EGFR antibody therapy can be either cetuximab or panitumumab, alone or combined with chemotherapy. The protein product of the normal KRAS gene performs an essential function in normal tissue signaling, and the mutation of a KRAS gene is an essential step in the development of many cancers. The approximately 50% of CRC patients who have a KRAS mutant gene in the tumor do not respond to EGFR monoclonal antibody therapy. The classification of CRC tumors based on the presence of a normal or mutant KRAS gene has important implications therefore for therapy.

Patients who fail second-line treatment have limited treatment options. Retreatment with prior therapy is unlikely to produce benefits. Regorafenib is currently the third-line standard of care. In the clinical trial that led to its approval, regorafenib was evaluated versus a placebo. Published Phase 3

14

clinical trial results of regorafenib from this clinical trial are presented in FIGURE 2. The median PFS and objective response rate for the placebo and regorafenib arms were 1.7 and 1.9 months, and 0% and 1%, respectively. Objective response is defined as the sum of PRs and complete responses, or CRs, as defined by RECIST criteria. In addition, significant adverse events have been associated with regorafenib, including diarrhea, fatigue, hand-foot reaction, hyperbilirubinemia, hypertension, mucositis, rash or skin desquamation, and thrombocytopenia. Accordingly, we believe that an unmet medical need remains for patients who fail second-line treatment. There is also a clear unmet need in subjects with KRAS mutant CRC who fail first-line therapy and, because of their KRAS mutant status, are not eligible for EGFR antibody therapy.

FIGURE 2. Published Phase 3 Clinical Trial Regorafenib vs. Placebo Results.

Study Population

|

Placebo N= 255 |

Regorafenib N= 505 |

|||||

|---|---|---|---|---|---|---|---|

4 months PFS |

7 | % | 25 | % | |||

6 months PFS |

2 | % | 14 | % | |||

Median PFS (mo) |

1.7 | 1.9 | |||||

Median Overall Survival (mo) |

5.0 | 6.4 | |||||

Response Rate |

0 | % | 1 | % | |||

Disease Control Rate Stable Disease>6weeks |

15 | % | 41 | % | |||

Source: Grothey A, Van Cutsem E, Sobrero A, et al. Regorafenib monotherapy for previously treated metastatic (CORRECT); an international, multicenter, randomized, placebo-controlled, phase 3 trial. Lancet 2013; 381:303-12.

Rationale

In CRC, dysregulation of both cell growth and cell destruction (apoptosis) pathways are well established as fundamental causes of disease. Existing CRC therapies and newer, "targeted" agents like the EGFR antibodies (such as cetuximab and panitumumab) are anti-growth agents. As described above, birinapant is a targeted therapy that we believe has the potential to inhibit the IAPs and drive cell destruction or apoptosis.

Third party studies in gastrointestinal cancers, CRC in particular, support the hypothesis that alteration of IAPs and SMAC may be important for cancer development and therapeutic efficacy. Genetic abnormalities of IAPs are among the most common genomic alterations in CRC. Comprehensive genetic analyses of human CRC samples demonstrated chromosome regions containing cIAP1 and cIAP2 genes as among the most frequently amplified regions in CRC. Additionally, in studies of over 6,000 publicly-available human tumor samples in The Cancer Genome Atlas, the IAP genes were amplified across multiple tumor types. This included over 60% of the 500 CRC tumors in the database. Furthermore, in studies of rectal cancer, low levels of SMAC were correlated with poor outcomes for neoadjuvant therapy, or therapy given as a first step to shrink a tumor before the main treatment is administered, for locally advanced disease. In studies of 1,162 cases of gastric cancer, high expression of IAPs, or XIAP, and low expression of SMAC were correlated with poor prognosis.

In third-party clinical trials, NF-kB activation (dependent on cIAP1 and cIAP2) has been correlated with poor prognosis and resistance to cytotoxic therapies in multiple solid tumors, including CRC and esophageal cancer. NF-kB is an intracellular protein complex that is downstream of TNF and transmits the TNF-pro-survival signal. In our pre-clinical studies and clinical trials, signaling was inhibited by birinapant. Third-party pre-clinical studies demonstrated the potential that NF-kB activation leads to resistance to 5-FU, irinotecan, and other cytotoxic therapies while suppression of NF-kB has demonstrated the potential to lead to reversal of chemotherapy resistance. In a third-party clinical trial of irinotecan-refractory metastatic CRC, subjects with CRC tumors with activated NF-kB

15

had significantly less clinical benefit than subjects with CRC tumors that did not have activated NF-kB. This was true in terms of decreased response rate, decreased PFS and decreased overall survival.

Third-party clinical trials suggest that NF-kB activation is more prevalent in KRAS mutant CRC, and that increased NF-kB activity was correlated with worse prognosis and greater resistance to therapies. Birinapant's ability to inactivate the NF-kB pro-survival signal suggests a mechanism by which KRAS mutant CRC may be responsive to combination therapies that include birinapant.

Pre-clinical Studies

Pre-clinical studies have shown that administering birinapant with therapies that induce TNF and TRAIL results in synergistic anti-tumor activity. In our in vitro analyses of 12 CRC cancer cell lines, 75% demonstrated apoptosis-induction when birinapant was administered with TNF or TRAIL. Importantly, non-cancerous cell lines demonstrated no induction of cell death with administration of high doses of birinapant, TNF or TRAIL, or any combination thereof.

In vivo pre-clinical studies with xenografts of primary tumors from CRC subjects demonstrated that birinapant had single-agent activity in seven of 20 xenografts studied. This activity was observed for both KRAS mutant tumors and tumors with normal KRAS. Because the action of birinapant is dependent on TNF, we believe that the single agent activity in these studies reflects the production of TNF by the tumor cells themselves, or otherwise known as autocrine production of TNF.

Clinical Trials

Prior to evaluating birinapant in any particular indication, we conducted a single agent Phase 1 clinical trial with birinapant in 50 subjects with multiple solid tumor cancer types to determine the MTD and gather PK and safety data. The IND was submitted in September 2009. The study began in December 2009 and was conducted at Fox Chase Cancer Center (PA) and the University of Pennsylvania in Philadelphia, PA and Roswell Park Cancer Institute in Buffalo, NY and included subjects who had received a median of four prior therapies for their cancers. Birinapant was generally well tolerated. There was evidence of anti-tumor activity or prolonged disease stabilization in two subjects with CRC, one subject with non-small cell lung cancer, or NSCLC, and one subject with liposarcoma. Methods for showing activity were a blood test measuring declines in carcinoembryonic antigen, or CEA, and computed tomography, or CT, scanning. The liposarcoma subject had disease stabilization for nine months despite progression on three prior therapies. This study was completed in March 2012.

Our second clinical trial was a Phase 1 clinical trial of birinapant administered with one of five different standard chemotherapy regimens, carboplatin, docetaxel, gemcitabine, irinotecan, or liposomal doxorubicin and paclitaxel. This trial included 124 subjects with multiple solid tumor cancer types to determine MTD, and gather PK and safety data. Secondary objectives were to assess anti-tumor activity, pharmacodynamics and potential translational biomarkers. This study began in October 2010 and was conducted at the three sites listed above as well as Barbara Ann Karmanos Cancer Institute in Detroit, MI, the Holy Cross Hospital Cancer Center in Fort Lauderdale, FL, the Mary Crowley Cancer Research Centers in Dallas, TX and START (South Texas Accelerated Research Therapeutics) in San Antonio, TX. Subjects treated had a variety of tumor types, the most common being CRC, ovarian cancer, lung cancer and melanoma. The subjects had failed a median of three prior chemotherapies. Birinapant did not appear to substantially exacerbate the toxicities commonly associated with any of these regimens. Fourteen subjects showed anti-tumor activity (as defined by RECIST). One NSCLC subject had a CR (defined as the disappearance of all lesions) and 13 subjects had PRs (defined as at least a 30% decrease in the sum of all lesions), including responses in anal cancer, CRC, gallbladder cancer, melanoma, NSCLC, ovarian cancer, and small-cell lung cancer.

16

Focus on CRC

In our single agent Phase 1 clinical trial, birinapant demonstrated anti-tumor activity in two study subjects with CRC who had failed all prior standard therapies. One subject with a KRAS mutant tumor had a CEA response and radiographic improvement of tumor lesions with stable disease for 5.1 months. A second subject with CRC and normal KRAS demonstrated anti-tumor response with development of a large area of tumor necrosis in the center of a prominent abdominal mass. Based upon the results of the prior Phase 1 clinical trials and pre-clinical studies in which we observed the synergy of birinapant administered with irinotecan, we decided to expand into a Phase 2 clinical trial in CRC with birinapant administered with irinotecan by adding 51 subjects to the 20 CRC subjects who were previously enrolled.

Results in Phase 1/2 clinical trial of CRC subjects treated with birinapant administered with irinotecan

In the Phase 1/2 clinical trial, 71 relapsed and/or refractory CRC subjects who had received a median of four prior therapies were treated with birinapant and irinotecan. A summary of the results are presented in FIGURE 3. In addition to presenting the results for all 71 subjects, we have provided summary data on two subject subsets. The first subset is the 22 subjects who failed a therapy that contained irinotecan immediately prior to entering the clinical trial. The second subset is the 37 subjects with a KRAS mutant tumor who failed irinotecan in a prior therapy.

FIGURE 3. Summary results of Phase 1/2 clinical trial of CRC subjects treated with birinapant administered with irinotecan.

Study Population

|

All Subjects N=71 |

Subjects Who Failed Immediately Prior Irinotecan Therapy N=22 |

KRAS Mutant Subjects Who Failed Prior Irinotecan N=37 |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

4 months PFS |

34 | % | 32 | % | 38 | % | ||||

6 months PFS |

21 | % | 18 | % | 24 | % | ||||

Median PFS (mo) |

2.2 | 3.0 | 3.0 | |||||||

Response Rate |

8 | % | 14 | % | 8 | % | ||||

Disease Control Rate [PR + Stable Disease] |

63 | % | 59 | % | 68 | % | ||||

In the Phase 1/2 clinical trial, 71 relapsed and/or refractory CRC subjects who had received a median of four prior therapies were treated with birinapant and irinotecan. There were signs of activity in subjects treated with birinapant and irinotecan as determined by objective responses and PFS. Six subjects showed PRs. Five of these six had previously failed prior irinotecan-based therapies, including three with KRAS mutant tumors. The median PFS for birinapant and irinotecan was 2.2 months, and 34% of subjects treated with birinapant and irinotecan were alive without disease progression at four months, or 4 mo PFS, and 21% were alive without disease progression at six months, or 6 mo PFS.

Of the 71 subjects in this Phase 1/2 clinical trial of birinapant administered with irinotecan, 22 CRC subjects had failed irinotecan therapy immediately prior to starting treatment with birinapant and re-treatment with irinotecan. It is generally not expected that subjects who fail a chemotherapy will respond to immediate re-treatment with the same therapy. Of these 22 subjects who previously failed irinotecan as their immediate prior therapy, there were three (13%) partial responders to treatment, seven subjects (32%) were alive without disease progression at four months and four subjects (18%) were alive without disease progression at six months.

In addition, of the 71 subjects in this Phase 1/2 clinical trial, 37 CRC subjects with KRAS mutant tumors who had previously failed an irinotecan-based therapy were treated with birinapant and irinotecan. Of these 37 subjects, three subjects (8%) demonstrated PRs, 38% of subjects were alive

17

without progression of their disease at four months, and 24% of subjects were alive without progression of disease at six months. We believe that this data may suggest activity from the combination of birinapant administered with irinotecan in a group of subjects where there is still a significant unmet need for treatment.

Safety data from databases of our CROs are available for subjects in the Phase 1 and Phase 2 clinical trials who received birinapant administered with irinotecan. The most frequent adverse events occurring during treatment in greater than 10% of subjects, related to birinapant or not, were abdominal pain, alopecia (hair loss), anemia (low blood levels of red blood cell), anorexia, arthralgia (pain in the joints), asthenia (whole body weakness), chills, constipation, cough, decreased appetite, decreased weight, decreased white blood cell count, dehydration, diarrhea, dizziness, dyspnea (breathing difficulty), elevated blood creatinine, fatigue, headache, hypoalbuminaemia (low blood levels of albumin), hypokalaemia (low blood levels of potassium), hyponatraemia (low blood levels of sodium), hypotension (low blood pressure), leukopenia (low blood levels of leukocytes), nausea, insomnia, neutropenia (low blood levels of neutrophils), peripheral edema (swelling of tissues due to fluid), peripheral motor neuropathy (damage to nerves outside of the brain or spinal cord that control muscle function), pyrexia (fever), rash, stomatitis (inflammation in the mouth), thrombocytopenia (low blood levels of platelets), urinary tract infection, vomiting and weakness. Compared to treatment with irinotecan alone, birinapant administered with irinotecan led to a modest increase in Grade 3 or greater anemia (4% versus 11%) and thrombocytopenia (1% versus 11%). This safety data suggests that birinapant administered with irinotecan has comparable tolerability to irinotecan administered as a single agent.

The following table sets forth the adverse events occurring during treatment in greater than 10% of CRC subjects who received birinapant administered with irinotecan and are considered to be related to such treatment as determined by the principal investigator as of October 10, 2013:

Adverse Event

|

Subjects with Adverse Events*# |

Subjects with Birinapant- related Adverse Events# |

No. of Grade 1 Adverse Events |

No. of Grade 2 Adverse Events |

No. of Grade 3 Adverse Events |

No. of Grade 4 Adverse Events |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Abdominal pain |

11 | 2 | 6 | 4 | (1) | 1 | (1) | 0 | |||||||||||

Alopecia |

27 | 3 | 19 | (1) | 11 | (2) | 0 | 0 | |||||||||||

Anemia |

27 | 10 | 8 | (5) | 19 | (5) | 6 | (1) | 1 | (1) | |||||||||

Anorexia |

28 | 14 | 22 | (12) | 11 | (7) | 0 | 0 | |||||||||||

Dehydration |

21 | 2 | 2 | 13 | (1) | 10 | (1) | 0 | |||||||||||

Diarrhea |

55 | 6 | 46 | (4) | 25 | (4) | 8 | (2) | 0 | ||||||||||

Fatigue |

42 | 18 | 30 | (12) | 19 | (8) | 4 | (3) | 0 | ||||||||||

Leukopenia |

14 | 9 | 4 | (3) | 4 | (2) | 6 | (2) | 6 | (4) | |||||||||

Nausea |

51 | 25 | 42 | (19) | 19 | (11) | 2 | 0 | |||||||||||

Neutropenia |

22 | 8 | 1 | (1) | 9 | (2) | 12 | (3) | 14 | (5) | |||||||||

Peripheral motor neuropathy |

10 | 10 | 8 | (8) | 6 | (6) | 0 | 0 | |||||||||||

Rash |

13 | 13 | 13 | (13) | 2 | (2) | 0 | 0 | |||||||||||

Stomatitis |

12 | 0 | 12 | 0 | 1 | 0 | |||||||||||||

Thrombocytopenia |

25 | 10 | 18 | (8) | 14 | (6) | 7 | (3) | 3 | (1) | |||||||||

Vomiting |

37 | 13 | 25 | (11) | 18 | (3) | 4 | 0 | |||||||||||

Weakness |

17 | 0 | 15 | 3 | 0 | 0 | |||||||||||||

- (

- ) Denotes

number of subjects with birinapant-related adverse events.

- *

- Subjects

may have experienced more than one adverse event in this category.

- #

- There were no Grade 5 (death) adverse events.

18

We believe that the data from this Phase 1/2 clinical trial supports the view that the activity seen is being driven by the synergistic effect of birinapant administered with irinotecan. In addition, we believe the activity we observed in the KRAS mutant population provides a rationale for targeting this underserved group of patients. Based on this analysis, we intend to undertake a randomized clinical trial of birinapant administered with a chemotherapy regimen containing irinotecan in second-line CRC, pending our ability to obtain additional financing.

Ovarian Cancer

Background

Ovarian cancer is among the five most common cancers in women and ranks fifth as the cause of cancer death in the U.S. It is the leading cause of gynecologic mortality in the U.S. According to the SEER Cancer Statistics Review, it is estimated that 22,240 women will be diagnosed with and 14,030 women will die of ovarian cancer in 2013. Ovarian cancer accounts for 5% of cancer deaths among women and causes more deaths than any other cancer of the female reproductive system.

Although over 70% of women with advanced disease respond to optimal debulking surgery followed by platinum-taxane based chemotherapy, duration of response is short and relapse is common. Subsequent responses to salvage therapy regimens tend to be brief (less than six months) due to the tumors' progressive resistance to chemotherapy. Relapsed ovarian cancers represent a significant challenge. Objective response rates to second-line therapies (such as doxorubicin, gemcitabine, and topotecan) are in the range of 20% and median overall survival is less than 1 year. In a third-party Phase 2 clinical trial of docetaxel, clinical trial of docetaxel given every 21 days in paclitaxel-resistant ovarian and peritoneal carcinoma, the response rate (combined CR and PR) was 22.4%. A similar third-party study showed a response rate of 23%.

Rationale

As previously described, cancer cells use the IAPs to convert the TNF self-destruction signal into a pro-survival signal through a protein complex called NF-kB. Published third-party studies have shown that the NF-kB pathway may be over-activated in aggressive ovarian cancers as evidenced by intrinsic NF-kB activation in serous ovarian cancer, which is a form of aggressive ovarian cancer. Aberrant activation of NF-kB may influence outcomes in women who receive standard therapy for advanced ovarian cancer. Modification of the NF-kB pathway may present an opportunity to improve outcomes in the subset of women who have this pathway activity. The addition of a SMAC-mimetic such as birinapant has shown potential in pre-clinical studies to inhibit NF-kB activity, down-regulate cell survival pathways, and overcome blocks to the apoptotic pathway resulting in increased tumor cell destruction.

TRAIL is a member of the TNF super-family, and can induce apoptosis by binding to two cell surface receptors called death receptor 4, or DR4 (also known as TRAIL Receptor-1) and DR5 (also known as TRAIL Receptor-2), respectively. TRAIL binding to DR4 and DR5 initiates an intracellular cascade inducing apoptosis in many transformed cell lines but not non-cancerous cells.

Conatumumab (AMG 655), an investigational product candidate, owned by Amgen, is a fully-human monoclonal agonist antibody designed to partially mimic endogenous TRAIL by binding DR5, thereby inducing apoptosis in sensitive cells. Such a property of conatumumab, being a TRAIL agonist, may induce apoptosis selectively in cancer cells and enhance the activity of standard cancer therapy, molecularly targeted agents, or both. Approximately 985 subjects have been enrolled in 10 ongoing or completed clinical trials of conatumumab; 55 have received monotherapy and 930 have received conatumumab or placebo in combination with chemotherapy and/or other biologic agents.

19

We believe that birinapant may have the potential to remove blockades imposed by IAPs in the TRAIL-induced apoptotic pathway. Pre-clinical studies have evaluated birinapant's ability to convert TRAIL-resistant cells into TRAIL-responsive cells and demonstrated that administering birinapant with conatumumab may allow enhanced activation of DR5-induced apoptosis by removing IAP protein-mediated inhibition. There continues to be an unmet medical need for subjects with many kinds of solid tumors, including ovarian cancer. Ovarian cancer provides an opportunity for testing this novel combination. We believe that pre-clinical studies suggest that the clinical administration of birinapant with conatumumab in solid tumor malignancies may potentially result in greater clinical activity than either agent alone.

Pre-clinical studies

In pre-clinical studies, cancer cell lines that were resistant to either single agent birinapant or single agent TRAIL or DR5 agonists (such as conatumumab) can undergo cell destruction when these agents are administered together. Ovarian-derived tumor cell lines were one of the most responsive tumor cell types to treatment by either single agent birinapant or birinapant administered with TRAIL.

Clinical trials

Under a Cooperative Research and Development Agreement, or CRADA, with the NCI, the NCI initiated a Phase 2 clinical trial of birinapant in subjects with fallopian tube cancer, primary peritoneal cancer, or relapsed platinum resistant or refractory epithelial ovarian cancer. Epithelial ovarian cancer is a type of cancer that comes from the tissue that covers the ovary, and is the most common type (90%) of ovarian cancer. The first subject was enrolled in January 2013 and this trial is completed. The primary objectives of this trial are to determine the efficacy and tolerability of single-agent birinapant and correlative predictive biomarkers for clinical activity. Birinapant is being administered alone at the single-agent MTD dose weekly for three of four weeks. This study had enrolled 11 subjects. There were two SAEs, Bell's Palsy and abdominal pain, that were considered related to birinapant treatment as determined by the clinical investigator, and no objective responses.

As discussed previously, we believe that birinapant may have the most activity when given in combination with another therapeutic agent that induces the apoptosis signal. Accordingly, we have an open IND and started a Phase 1/2 open-label, non-randomized clinical trial of birinapant administered with conatumumab in subjects with relapsed epithelial ovarian cancer, fallopian tube cancer, or primary peritoneal cancer. Approximately 30 subjects (18 in the dose escalation and a further 12 in a dose expansion cohort) will be administered birinapant with conatumumab at approximately seven investigational sites in the U.S. The primary objectives of the proposed Phase 1 clinical trial are to determine the recommended Phase 2 dose of birinapant when administered with conatumumab in subjects who have relapsed after two prior standard therapies. The secondary objectives are to determine the clinical activity of birinapant administered with conatumumab, to determine the PK characteristics of birinapant and conatumumab in plasma and tumor, and to assess PD and predictive biomarkers. Depending on initial results of safety, PK, PD and clinical activity, further clinical trials may be planned to define clinical benefit.

Virology Pre-clinical Development Program

As with cancer cells, cells that are infected with certain viruses may escape apoptosis. We are conducting pre-clinical studies to evaluate the potential development of birinapant as an infectious disease therapeutic to overcome this "escape-from-apoptosis" in infected cells. We believe this is a novel approach. There are no drugs currently on the market that specifically target the IAPs and thereby induce apoptosis in virally infected cells as a strategy for therapy. Using a mouse model of HBV, birinapant was well tolerated and showed activity in the clearance of cells infected with HBV. In pre-clinical studies, birinapant administered with entecavir, the standard of care for HBV, cleared more

20