Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ESSA Bancorp, Inc. | d688875d8k.htm |

Exhibit 99.1 |

Forward Looking

Statements Building on Tradition

Certain statements contained herein are “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. Such forward-looking statements may be identified

by reference to a future period or periods, or by the use of forward-looking terminology, such as “may”,

“will”, “believe”, “expect”, “estimate”,

“anticipate”, “continue”, or similar terms or variations on those terms, or the

negative of those terms. Forward-looking statements are subject to numerous risks

and uncertainties, including, but not limited to, those related to the economic

environment, particularly in the market areas in which ESSA Bancorp, Inc. (the

“Company”) operates, competitive products and pricing, fiscal and monetary policies of the U.S.

Government, changes in government regulations affecting financial institutions, including

regulatory fees and capital requirements, changes in prevailing interest rates,

acquisitions and the integration of acquired businesses, credit risk management,

asset-liability management, the financial and securities markets and the availability of and costs

associated with sources of liquidity. The Company wishes to caution readers not to place

undue reliance on any such forward-looking statements, which speak only as of the

date made. The Company wishes to advise readers that the factors listed above

could affect the company’s financial performance and could cause the Company’s actual results

for future periods to differ materially from any opinions or statements expressed with respect

to future periods in any current statements. The Company does not undertake and

specifically declines any obligation to publicly release the result of any revisions

which may be made to any forward-looking statements to reflect events or circumstances after

the date of such statements or to reflect the occurrence of anticipated or unanticipated

event. |

FY

2013– Building Financial Performance

•

Record net income of $8.8 million.

•

EPS of $0.76 per diluted share, exceeding our pre-acquisition projections of

$0.68.

•

Net

interest

income

up

37%:

net

interest

spread

up

from

2.42%

in

2012

to

2.97% in 2013, interest expense management.

•

$180 million in total new loans originated:

o

Mortgages -

839 loans for $133.48 million

o

Consumer -

289 loans for $10.59 million

o

Commercial -

77 loans for $37.25 million

•

Deposits

up

4.56%

to

$1.0

billion,

reflecting

$14

million

growth

in

commercial

checking accounts from expanded client relationships and increased use of

lower cost brokered certificates as part of interest expense management.

Building on Tradition |

FY 2013

– Building on Financial Strength

•

Credit Quality:

o

Continue to utilize our prudent underwriting guidelines

o

Combined two companies; credit risk profile remained stable

o

Nonperforming assets/total assets of 1.89%

•

Capital strength above accepted regulatory standards for a well capitalized

institution.

Building on Tradition

9/30/2013 Actual

To Be Well Capitalized

Tot. Cap./Risk Weighted Assets

20.4%

10.0%

Tier 1 Cap./Risk Weighted Assets

19.4%

6.0%

Tier 1 Cap./Adjusted Assets

11.2%

5.0% |

Building Value,

Building for the Future •

Return on average assets (ROAA) of 0.64% and return on average equity (ROAE) of

5.12%.

o

Out-performed Mid-Atlantic thrift peer group median ROAA of 0.48% and ROAE of

3.70%

•

Focus on building shareholder value:

o

Repurchased 1.26 million shares of ESSA common stock at a weighted average purchase price

of $11.07

o

Tangible book value increased to $12.99 per share from $12.37 per share

o

23 consecutive quarters of cash dividend on common stock

o

Recently announced $0.02 per share quarterly dividend increase to $0.07 per share; 2.6%

yield at announcement date

•

Continued acquisitive growth, new markets and expansion:

o

Announced Franklin Security Bancorp acquisition in FY 2014 to open new markets in

Wilkes- Barre and Scranton

o

Acquired loans and deposits and attractive branch facility from First National Community

Bank in FY 2014 to expand Monroe County presence, consolidate branches

Building on Tradition |

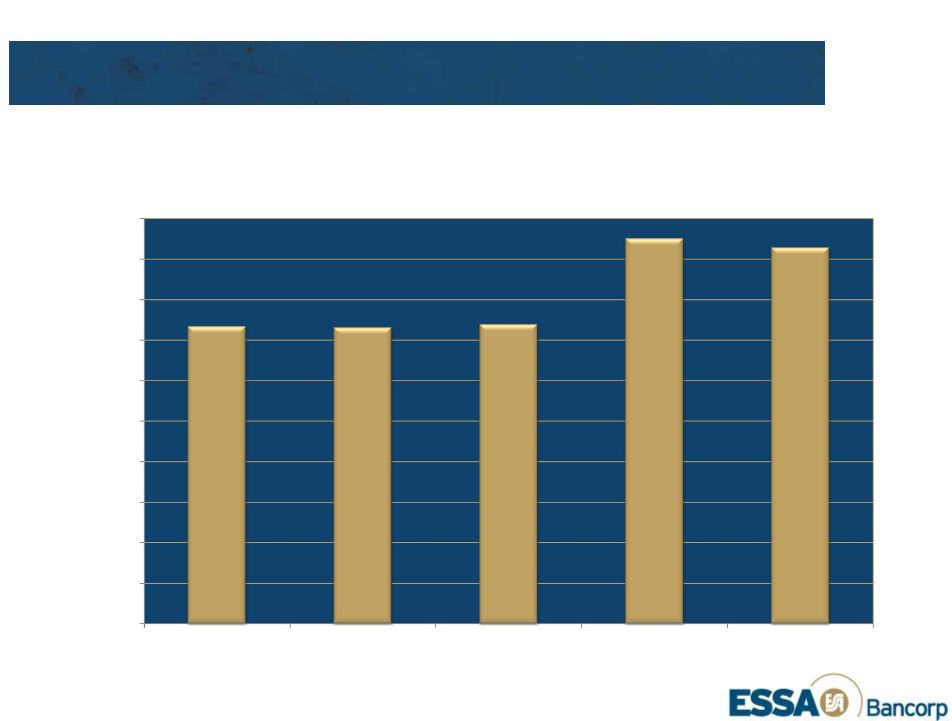

Total Assets ($

in thousands) Building on Tradition

1,042,119

1,071,997

1,097,480

1,418,786

1,372,315

0

200,000

400,000

600,000

800,000

1,000,000

1,200,000

1,400,000

1,600,000

9/30/09

9/30/10

9/30/11

9/30/12

09/30/13 |

Total Loans, Net

($ in thousands) Building on Tradition

733,580

730,842

738,619

950,355

928,230

0

100,000

200,000

300,000

400,000

500,000

600,000

700,000

800,000

900,000

1,000,000

9/30/09

9/30/10

9/30/11

9/30/12

9/30/2013 |

Commercial &

Municipal Loans ($ in thousands) Building on Tradition

84,340

94,488

119,997

206,746

203,039

0

50,000

100,000

150,000

200,000

250,000

9/30/09

9/30/10

9/30/11

9/30/12

9/30/2013 |

Total Deposits

($ in thousands) Building on Tradition

408,855

540,410

637,924

995,634

1,041,059

0

200,000

400,000

600,000

800,000

1,000,000

1,200,000

9/30/09

9/30/10

9/30/11

9/30/12

9/30/2013 |

Net Income ($

in thousands) Building on Tradition

6,556

4,512

5,258

215

8,823

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

9,000

10,000

9/30/09

9/30/10

9/30/11

9/30/12

9/30/2013

9/30/09

9/30/10

9/30/11

9/30/13

9/30/12 |

Stockholders’

Equity ($ in thousands)

Building on Tradition

9/30/09

9/30/10

9/30/11

9/30/12

9/30/13

185.5

171.6

161.7

175.4

166.4

145

150

155

160

165

170

175

180

185

190 |

Total Stock

Return – Value Opportunity

Source: SNL Financial LC, Charlottesville, NC

Building on Tradition

0.00

20.00

40.00

60.00

80.00

100.00

120.00

140.00

160.00

180.00

9/30/08

9/30/09

9/30/10

9/30/11

9/30/12

9/30/13

ESSA Bancorp, Inc.

SNL Thrift Index

Russell 2000 |

•

Offering superior service and products to a growing customer base

o

Meeting the needs of our customers. Satisfaction depends on providing

financial solutions and continual improvement of our service, products,

systems and operations.

•

Providing a positive and rewarding work experience for our employees

o

Our employees are ESSA’s most valuable asset. Our goal is to attract and

retain talented employees with the best work environment.

o

Enhancing the quality of life in our served communities through charitable

and civic contributions.

•

Enhancing value for our shareholders

o

Positive financial results contributed to higher ROAA and ROAE

o

Issued

our

23

consecutive

quarterly

cash

dividend

to

common

stockholders

o

Repurchased 1.26 million shares of ESSA common stock

rd

Building on Tradition |

Building on

Tradition Building Our Future: Key Objectives in 2014

•

Growing return on equity through leveraging capital profitably

o

Complete integration of Franklin Savings Bank

o

Build share in served and new markets

o

Consider strategic acquisition opportunities

•

Effective risk management

o

Maintain high credit quality

o

Manage interest rate risk and exposure

o

Keep pace with regulatory, compliance requirements |

Building on

Tradition Thank You! |