Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TIPTREE INC. | a8-kpresentation.htm |

COMPANY OVERVIEW March 2014 TIPTREE FINANCIAL INC. TIPTREE FINANCIAL INC. NASDAQ: TIPT

DISCLAIMER 1 TIPTREE FINANCIAL INC. LIMITATIONS ON THE USE OF INFORMATION This presentation has been prepared by Tiptree Financial Inc. (the “Company” or “Tiptree”) solely for informational purposes, and not for the purpose of updating any information or forecast with respect to the Company, its subsidiaries or any of its affiliates or any other purpose. This information is subject to change without notice and should not be relied upon for any purpose. Neither the Company nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and no such party shall have any liability for such information. In furnishing this information and making any oral statements, neither the Company, its subsidiaries nor any of its affiliates undertakes any obligation to provide the recipient with access to any additional information or to update or correct such information. The information herein or in any oral statements (if any) are prepared as of the date hereof or as of such earlier dates as presented herein; neither the delivery of this document nor any other oral statements regarding the affairs of the Company or its affiliates shall create any implication that the information contained herein or the affairs of the Company, its subsidiaries or its affiliates have not changed since the date hereof or after the dates presented herein (as applicable); that such information is correct as of any time subsequent to its date; or that such information is an indication regarding the performance of the Company or any of its affiliates since the time of the Company’s latest public filings or disclosure. These materials and any related oral statements are not all-inclusive and shall not be construed as legal, tax, investment or any other advice. You should consult your own counsel, accountant or business advisors. Tiptree files public reports with the Securities and Exchange Commission (“SEC”) on EDGAR. The information contained herein should be read in conjunction with and is qualified by Tiptree’s public filings. Performance information is historical and is not indicative of, nor does it guarantee future results. There can be no assurance that similar performance may be experienced in the future. Any comparisons in this presentation to the S&P Index or any other index are for illustrative purposes only and are not intended to imply that the Company manages businesses that were similar to the index in comparison or risk. SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS This document contains "forward-looking statements" which involve risks, uncertainties and contingencies, many of which are beyond Tiptree's control, which may cause actual results, performance, or achievements to differ materially from anticipated results, performance, or achievements. All statements contained herein that are not clearly historical in nature are forward-looking, and the words "anticipate," "believe," "estimate," "expect," "plan," "target," and similar expressions are generally intended to identify forward-looking statements. Such forward-looking statements include, but are not limited to, statements about Tiptree's plans, objectives, expectations and intentions. There are various factors that could cause actual results to differ materially from those in any such forward-looking statements, many of which are beyond Tiptree's control, including economic, business, funding market, competitive and/or regulatory factors. Factors such as these are set forth under the captions "Forward-Looking Statements" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" (or similar captions) in Tiptree's most recent Annual Report on Form 10-K and its quarterly reports on Form 10-Q, and as described in Tiptree's other filings with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as to the date of this release. We cannot guarantee the accuracy of any such forward-looking statements contained herein, and Tiptree is under no obligation (and expressly disclaims any such obligation) to update or alter its forward-looking statements, whether as a result of new information, future events or otherwise. NOT AN OFFER OR A SOLICITATION This document does not constitute an offer or invitation for the sale or purchase of securities or to engage in any other transaction with the Company, its subsidiaries or its affiliates. The information in this document is not targeted at the residents of any particular country or jurisdiction and is not intended for distribution to, or use by, any person in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. NON-U.S. GAAP MEASURES Management believes that certain non-U.S. GAAP financial measures may be useful in certain instances to provide additional meaningful comparisons between current results and results in prior operating periods. Economic Book Value (“EBV”) is a non-GAAP financial measure which Tiptree uses to evaluate the performance of its core business. Management believes that EBV provides greater transparency and enhanced visibility into the underlying profitability drivers of our business and provides a useful, alternative view of the economic results of Tiptree’s businesses. EBV includes the following adjustments: (i) reversal of GAAP value for Tiptree Asset Management Company, LLC and variable interest entities and replacement with fair value, (ii) addition of life to date AFFO adjustments for real estate operations, (iii) reclassification of convertible preferred distributions to expense, and (iv) foreign exchange timing adjustment. Reconciliation of EBV to the most comparable GAAP measure is presented in the appendix of this presentation. EBV as used by Tiptree may not be comparable to similar measures presented by other companies as it is a non-GAAP financial measure that is not based on a comprehensive set of accounting rules or principles and therefore may be defined differently by other companies. EBV should be considered in addition to, not as a substitute for, financial measures determined in accordance with GAAP. By accepting this document, each recipient agrees to and acknowledges the foregoing terms and conditions.

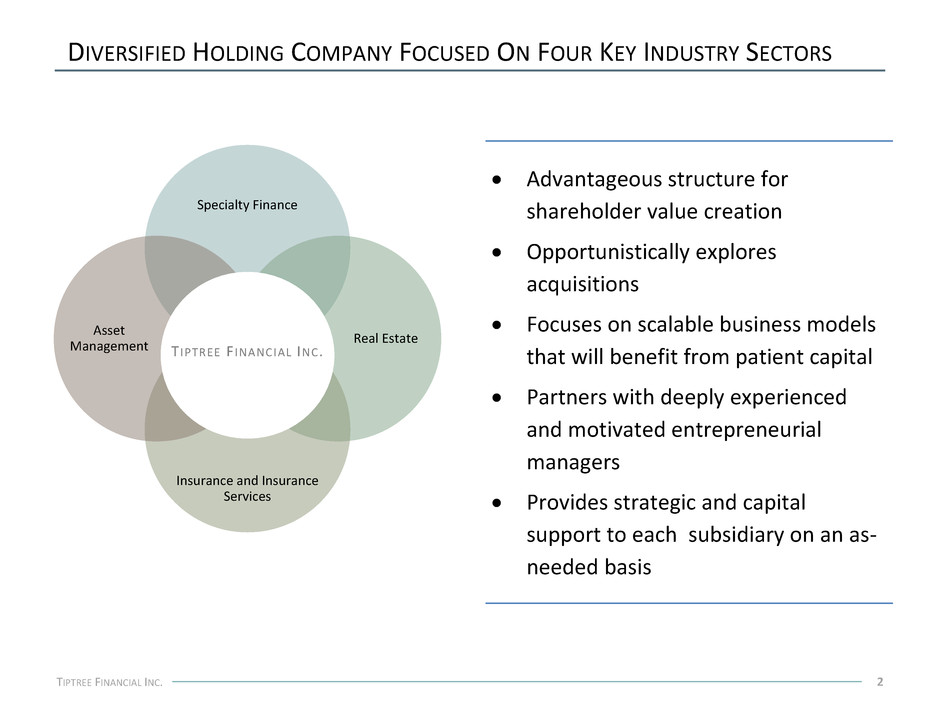

DIVERSIFIED HOLDING COMPANY FOCUSED ON FOUR KEY INDUSTRY SECTORS 2 Advantageous structure for shareholder value creation Opportunistically explores acquisitions Focuses on scalable business models that will benefit from patient capital Partners with deeply experienced and motivated entrepreneurial managers Provides strategic and capital support to each subsidiary on an as- needed basis TIPTREE FINANCIAL INC. Specialty Finance Real Estate Insurance and Insurance Services Asset Management T IPTREE F INANCIAL INC.

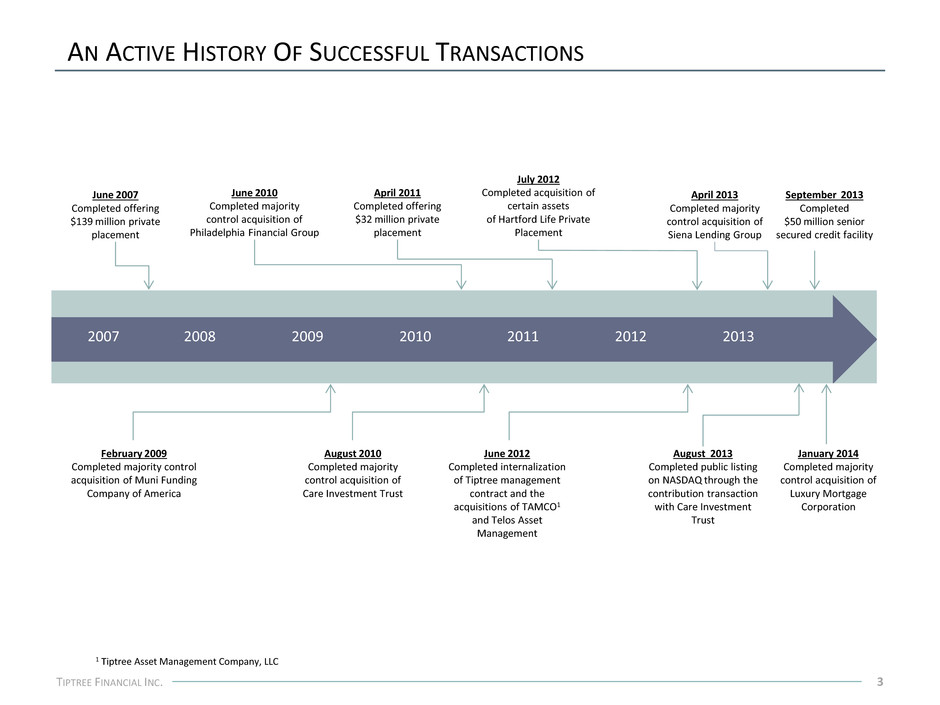

August 2010 Completed majority control acquisition of Care Investment Trust AN ACTIVE HISTORY OF SUCCESSFUL TRANSACTIONS 3 February 2009 Completed majority control acquisition of Muni Funding Company of America June 2010 Completed majority control acquisition of Philadelphia Financial Group April 2011 Completed offering $32 million private placement June 2007 Completed offering $139 million private placement July 2012 Completed acquisition of certain assets of Hartford Life Private Placement TIPTREE FINANCIAL INC. 2013 2012 2011 2010 2009 2008 2007 June 2012 Completed internalization of Tiptree management contract and the acquisitions of TAMCO1 and Telos Asset Management April 2013 Completed majority control acquisition of Siena Lending Group August 2013 Completed public listing on NASDAQ through the contribution transaction with Care Investment Trust September 2013 Completed $50 million senior secured credit facility January 2014 Completed majority control acquisition of Luxury Mortgage Corporation 1 Tiptree Asset Management Company, LLC

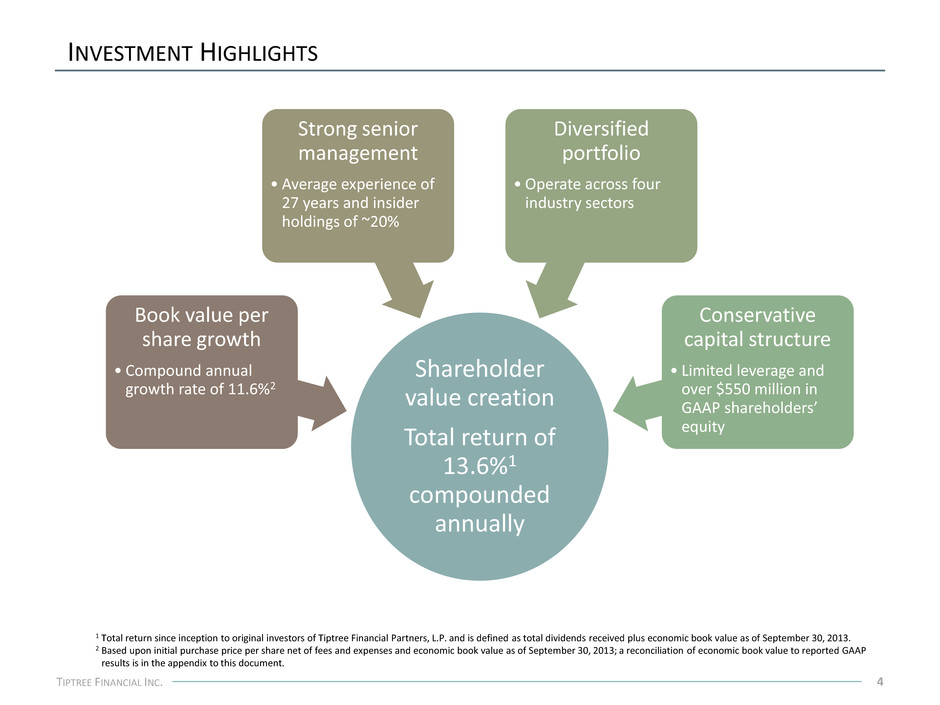

INVESTMENT HIGHLIGHTS 4 TIPTREE FINANCIAL INC. 1 Total return since inception to original investors of Tiptree Financial Partners, L.P. and is defined as total dividends received plus economic book value as of September 30, 2013. 2 Based upon initial purchase price per share net of fees and expenses and economic book value as of September 30, 2013; a reconciliation of economic book value to reported GAAP results is in the appendix to this document. Shareholder value creation Total return of 13.6%1 compounded annually Book value per share growth • Compound annual growth rate of 11.6%2 Strong senior management • Average experience of 27 years and insider holdings of ~20% Diversified portfolio •Operate across four industry sectors Conservative capital structure • Limited leverage and over $550 million in GAAP shareholders’ equity

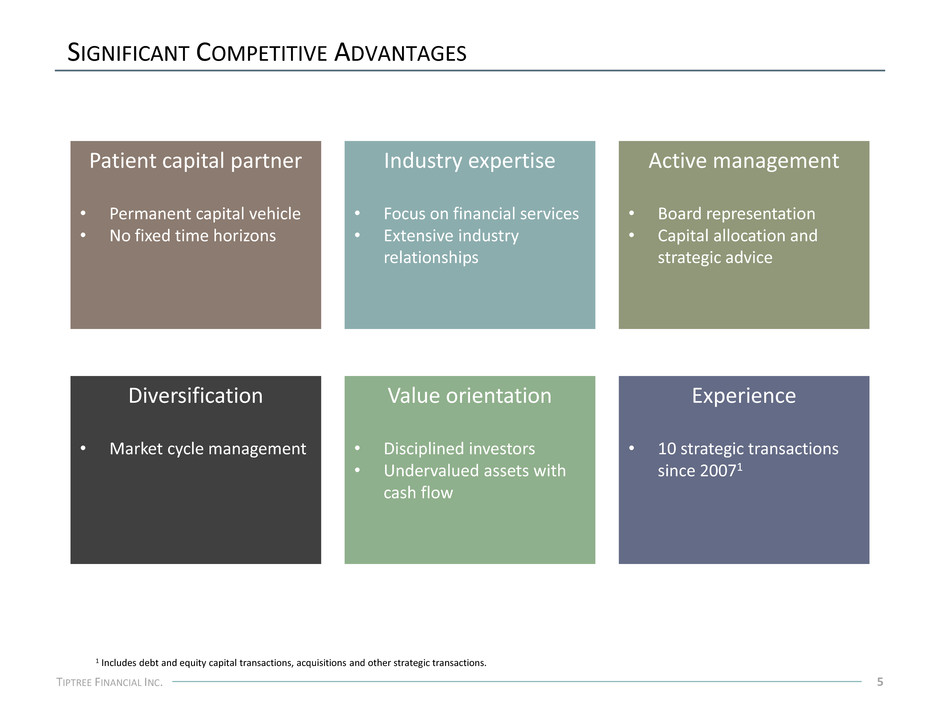

Patient capital partner • Permanent capital vehicle • No fixed time horizons SIGNIFICANT COMPETITIVE ADVANTAGES 5 TIPTREE FINANCIAL INC. 1 Includes debt and equity capital transactions, acquisitions and other strategic transactions. Industry expertise • Focus on financial services • Extensive industry relationships Active management • Board representation • Capital allocation and strategic advice Diversification • Market cycle management Value orientation • Disciplined investors • Undervalued assets with cash flow Experience • 10 strategic transactions since 20071

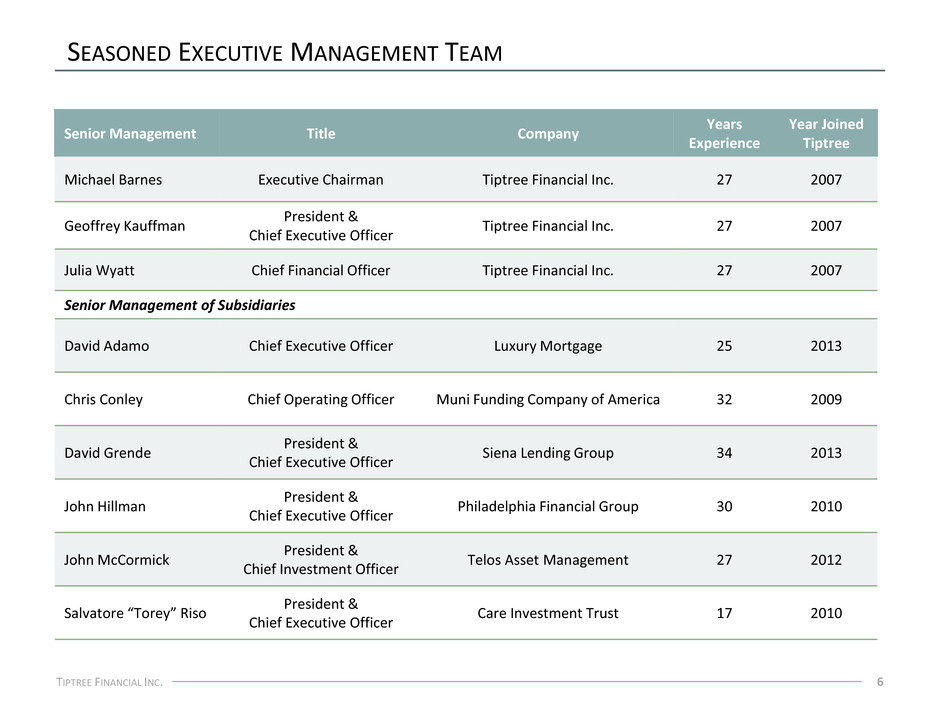

SEASONED EXECUTIVE MANAGEMENT TEAM 6 TIPTREE FINANCIAL INC. Senior Management Title Company Years Experience Year Joined Tiptree Michael Barnes Executive Chairman Tiptree Financial Inc. 27 2007 Geoffrey Kauffman President & Chief Executive Officer Tiptree Financial Inc. 27 2007 Julia Wyatt Chief Financial Officer Tiptree Financial Inc. 27 2007 Senior Management of Subsidiaries David Adamo Chief Executive Officer Luxury Mortgage 25 2013 Chris Conley Chief Operating Officer Muni Funding Company of America 32 2009 David Grende President & Chief Executive Officer Siena Lending Group 34 2013 John Hillman President & Chief Executive Officer Philadelphia Financial Group 30 2010 John McCormick President & Chief Investment Officer Telos Asset Management 27 2012 Salvatore “Torey” Riso President & Chief Executive Officer Care Investment Trust 17 2010

OUR OPERATING SUBSIDIARIES 7 TIPTREE FINANCIAL INC. Telos Asset Management Specialty finance company focused on tax-exempt lending Specialty life insurance company and third party administrator ` Healthcare focused real estate investment and finance company Asset management company primarily focused on senior secured credit Commercial finance company offering asset based loans Residential mortgage origination company

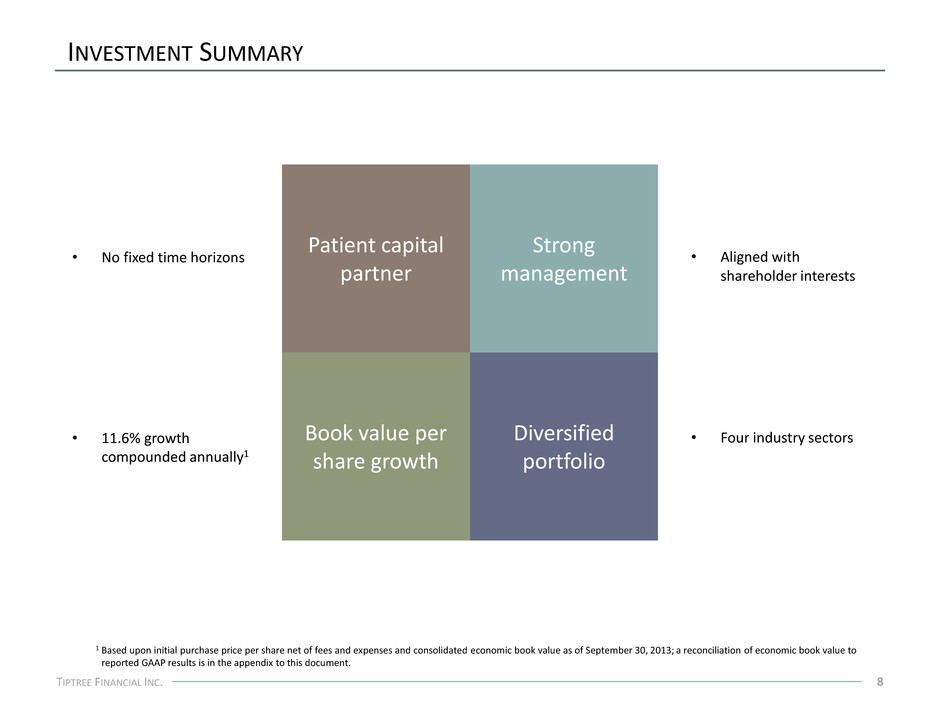

INVESTMENT SUMMARY 8 TIPTREE FINANCIAL INC. 1 Based upon initial purchase price per share net of fees and expenses and consolidated economic book value as of September 30, 2013; a reconciliation of economic book value to reported GAAP results is in the appendix to this document. Patient capital partner Strong management Book value per share growth Diversified portfolio • Aligned with shareholder interests • Four industry sectors • No fixed time horizons • 11.6% growth compounded annually1

9 APPENDIX TIPTREE FINANCIAL INC.

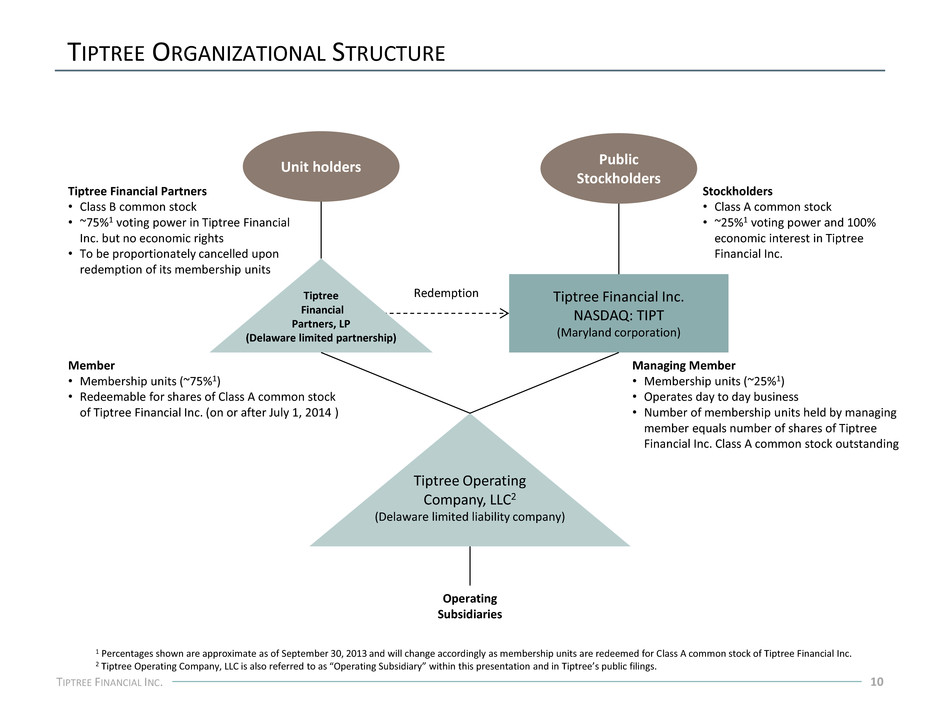

TIPTREE ORGANIZATIONAL STRUCTURE 10 Tiptree Financial Inc. NASDAQ: TIPT (Maryland corporation) Unit holders Public Stockholders Tiptree Operating Company, LLC2 (Delaware limited liability company) Operating Subsidiaries Member • Membership units (~75%1) • Redeemable for shares of Class A common stock of Tiptree Financial Inc. (on or after July 1, 2014 ) Managing Member • Membership units (~25%1) • Operates day to day business • Number of membership units held by managing member equals number of shares of Tiptree Financial Inc. Class A common stock outstanding Stockholders • Class A common stock • ~25%1 voting power and 100% economic interest in Tiptree Financial Inc. Tiptree Financial Partners • Class B common stock • ~75%1 voting power in Tiptree Financial Inc. but no economic rights • To be proportionately cancelled upon redemption of its membership units 1 Percentages shown are approximate as of September 30, 2013 and will change accordingly as membership units are redeemed for Class A common stock of Tiptree Financial Inc. 2 Tiptree Operating Company, LLC is also referred to as “Operating Subsidiary” within this presentation and in Tiptree’s public filings. TIPTREE FINANCIAL INC. Tiptree Financial Partners, LP (Delaware limited partnership) Redemption

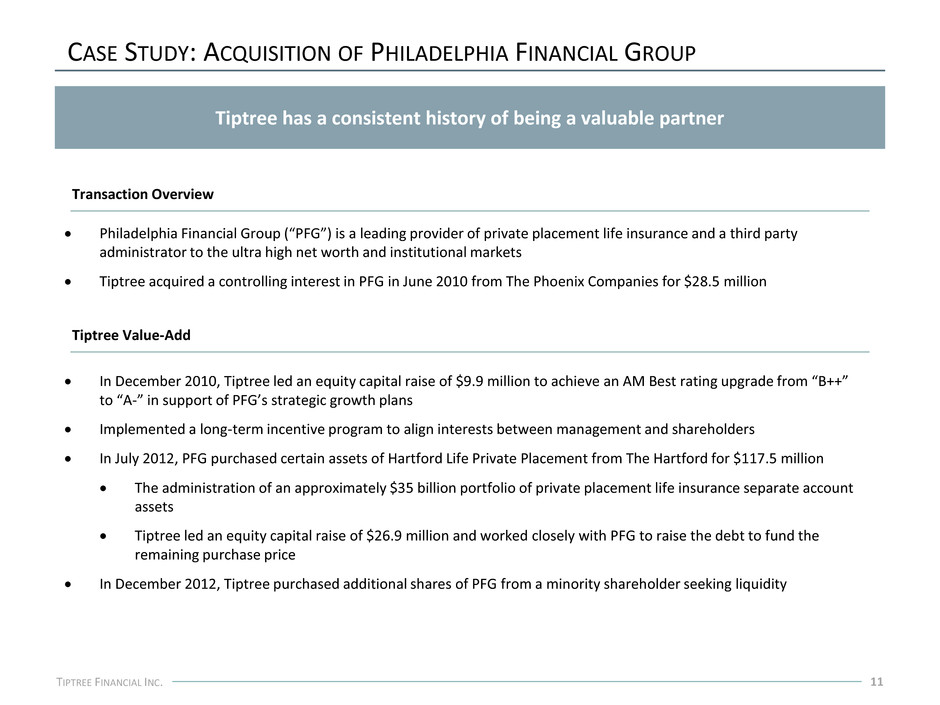

CASE STUDY: ACQUISITION OF PHILADELPHIA FINANCIAL GROUP 11 Tiptree has a consistent history of being a valuable partner Philadelphia Financial Group (“PFG”) is a leading provider of private placement life insurance and a third party administrator to the ultra high net worth and institutional markets Tiptree acquired a controlling interest in PFG in June 2010 from The Phoenix Companies for $28.5 million TIPTREE FINANCIAL INC. In December 2010, Tiptree led an equity capital raise of $9.9 million to achieve an AM Best rating upgrade from “B++” to “A-” in support of PFG’s strategic growth plans Implemented a long-term incentive program to align interests between management and shareholders In July 2012, PFG purchased certain assets of Hartford Life Private Placement from The Hartford for $117.5 million The administration of an approximately $35 billion portfolio of private placement life insurance separate account assets Tiptree led an equity capital raise of $26.9 million and worked closely with PFG to raise the debt to fund the remaining purchase price In December 2012, Tiptree purchased additional shares of PFG from a minority shareholder seeking liquidity Transaction Overview Tiptree Value-Add

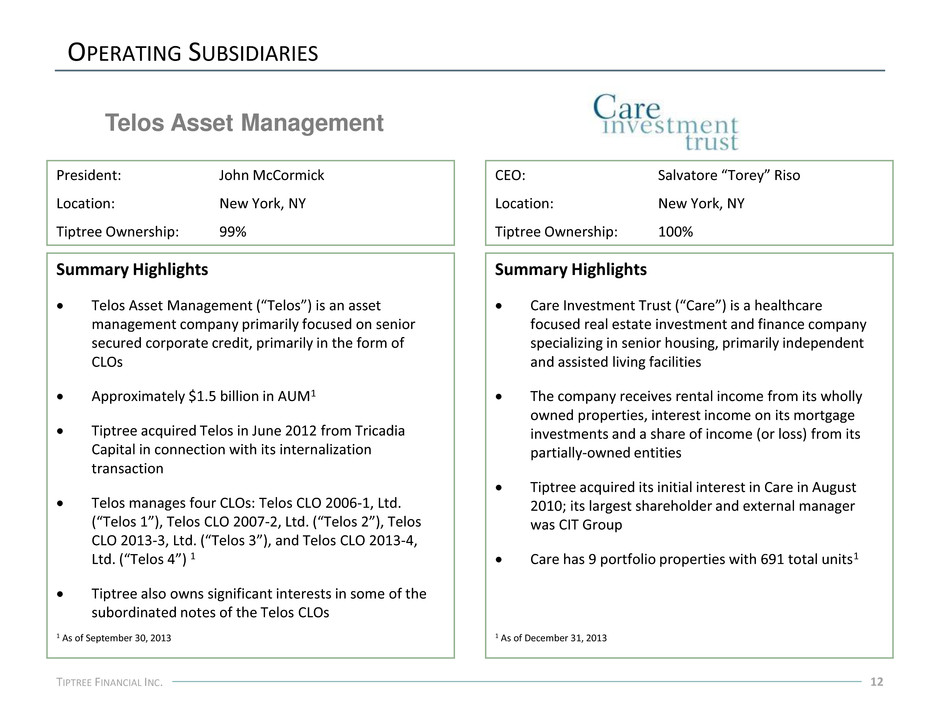

OPERATING SUBSIDIARIES 12 TIPTREE FINANCIAL INC. Summary Highlights Telos Asset Management (“Telos”) is an asset management company primarily focused on senior secured corporate credit, primarily in the form of CLOs Approximately $1.5 billion in AUM1 Tiptree acquired Telos in June 2012 from Tricadia Capital in connection with its internalization transaction Telos manages four CLOs: Telos CLO 2006-1, Ltd. (“Telos 1”), Telos CLO 2007-2, Ltd. (“Telos 2”), Telos CLO 2013-3, Ltd. (“Telos 3”), and Telos CLO 2013-4, Ltd. (“Telos 4”) 1 Tiptree also owns significant interests in some of the subordinated notes of the Telos CLOs President: John McCormick Location: New York, NY Tiptree Ownership: 99% Telos Asset Management Summary Highlights Care Investment Trust (“Care”) is a healthcare focused real estate investment and finance company specializing in senior housing, primarily independent and assisted living facilities The company receives rental income from its wholly owned properties, interest income on its mortgage investments and a share of income (or loss) from its partially-owned entities Tiptree acquired its initial interest in Care in August 2010; its largest shareholder and external manager was CIT Group Care has 9 portfolio properties with 691 total units1 CEO: Salvatore “Torey” Riso Location: New York, NY Tiptree Ownership: 100% 1 As of September 30, 2013 1 As of December 31, 2013

OPERATING SUBSIDIARIES 13 TIPTREE FINANCIAL INC. Summary Highlights Muni Funding Company of America (“MFCA”) is a specialty finance company focused on tax-exempt lending, primarily in the healthcare, educational and social services sectors Tiptree acquired its initial interest in MFCA in February 2009 from Institutional Financial Markets Inc. In addition to managing the MFCA portfolio, Muni Capital Management manages NPPF1, a $213 million Structured Tax-Exempt Partnership1 COO: Chris Conley Location: New York, NY Tiptree Ownership: 100% Summary Highlights Siena Lending Group (“Siena”) is a commercial finance company offering asset based loans to small and mid-sized companies Tiptree acquired its initial interest in Siena in April 2013 Siena originates, structures, underwrites and services senior, secured asset-based loans for companies with sales typically between $5 million and $50 million operating across a range of industry sectors Core financing solutions include revolving lines of credit and term loans, which may collectively be referred to as asset-based loans CEO: David Grende Location: Stamford, CT Tiptree Ownership: 67% 1 As of September 30, 2013

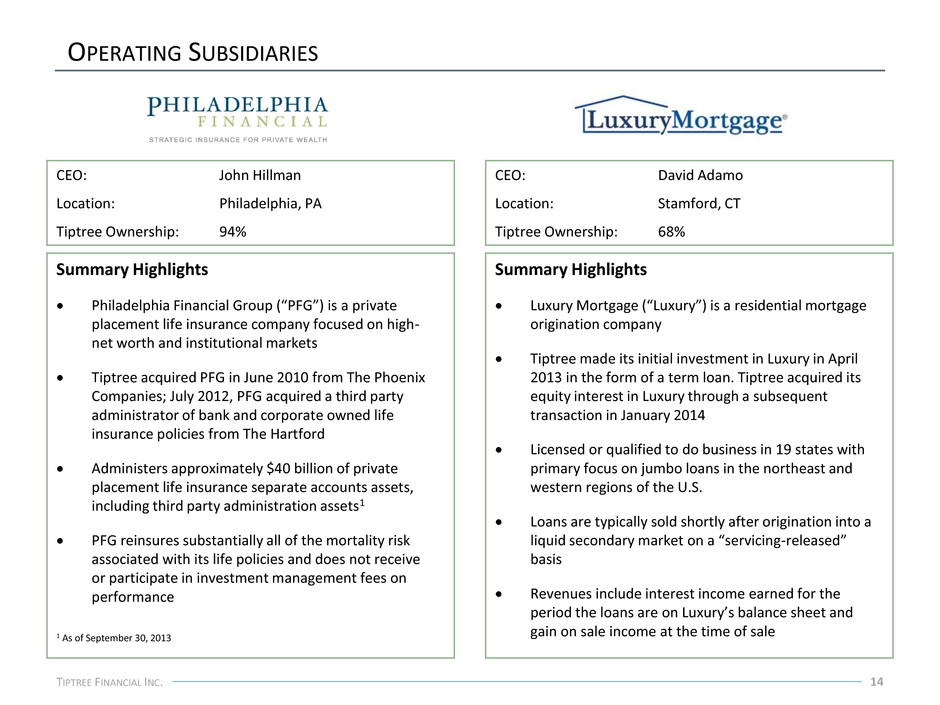

OPERATING SUBSIDIARIES 14 TIPTREE FINANCIAL INC. Summary Highlights Philadelphia Financial Group (“PFG”) is a private placement life insurance company focused on high- net worth and institutional markets Tiptree acquired PFG in June 2010 from The Phoenix Companies; July 2012, PFG acquired a third party administrator of bank and corporate owned life insurance policies from The Hartford Administers approximately $40 billion of private placement life insurance separate accounts assets, including third party administration assets1 PFG reinsures substantially all of the mortality risk associated with its life policies and does not receive or participate in investment management fees on performance CEO: John Hillman Location: Philadelphia, PA Tiptree Ownership: 94% Summary Highlights Luxury Mortgage (“Luxury”) is a residential mortgage origination company Tiptree made its initial investment in Luxury in April 2013 in the form of a term loan. Tiptree acquired its equity interest in Luxury through a subsequent transaction in January 2014 Licensed or qualified to do business in 19 states with primary focus on jumbo loans in the northeast and western regions of the U.S. Loans are typically sold shortly after origination into a liquid secondary market on a “servicing-released” basis Revenues include interest income earned for the period the loans are on Luxury’s balance sheet and gain on sale income at the time of sale CEO: David Adamo Location: Stamford, CT Tiptree Ownership: 68% 1 As of September 30, 2013

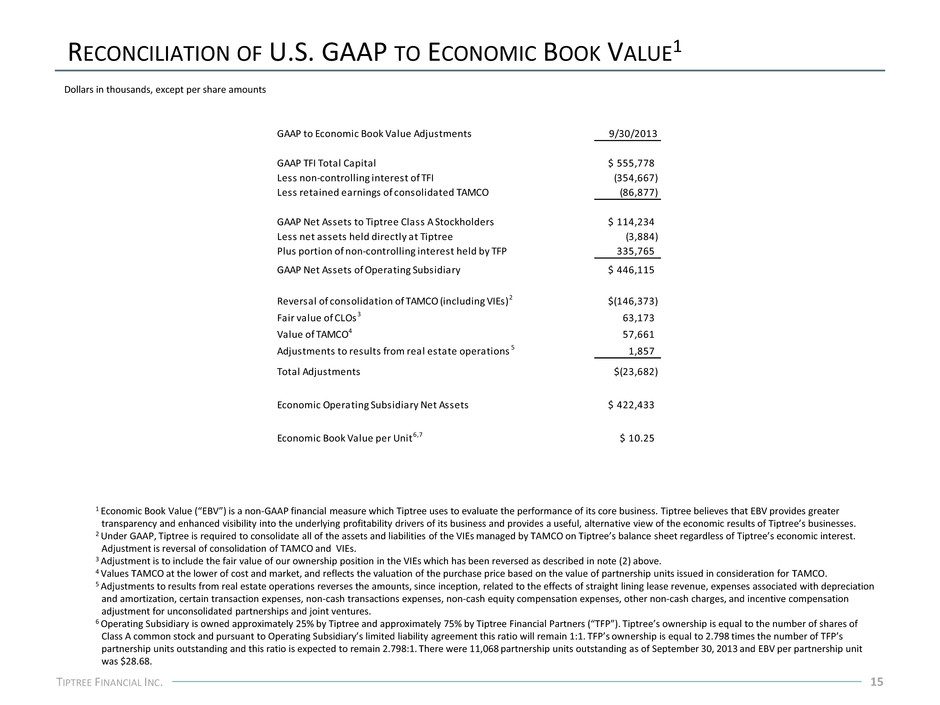

RECONCILIATION OF U.S. GAAP TO ECONOMIC BOOK VALUE1 15 TIPTREE FINANCIAL INC. 1 Economic Book Value (“EBV”) is a non-GAAP financial measure which Tiptree uses to evaluate the performance of its core business. Tiptree believes that EBV provides greater transparency and enhanced visibility into the underlying profitability drivers of its business and provides a useful, alternative view of the economic results of Tiptree’s businesses. 2 Under GAAP, Tiptree is required to consolidate all of the assets and liabilities of the VIEs managed by TAMCO on Tiptree’s balance sheet regardless of Tiptree’s economic interest. Adjustment is reversal of consolidation of TAMCO and VIEs. 3 Adjustment is to include the fair value of our ownership position in the VIEs which has been reversed as described in note (2) above. 4 Values TAMCO at the lower of cost and market, and reflects the valuation of the purchase price based on the value of partnership units issued in consideration for TAMCO. 5 Adjustments to results from real estate operations reverses the amounts, since inception, related to the effects of straight lining lease revenue, expenses associated with depreciation and amortization, certain transaction expenses, non-cash transactions expenses, non-cash equity compensation expenses, other non-cash charges, and incentive compensation adjustment for unconsolidated partnerships and joint ventures. 6 Operating Subsidiary is owned approximately 25% by Tiptree and approximately 75% by Tiptree Financial Partners (“TFP”). Tiptree’s ownership is equal to the number of shares of Class A common stock and pursuant to Operating Subsidiary’s limited liability agreement this ratio will remain 1:1. TFP’s ownership is equal to 2.798 times the number of TFP’s partnership units outstanding and this ratio is expected to remain 2.798:1. There were 11,068 partnership units outstanding as of September 30, 2013 and EBV per partnership unit was $28.68. Dollars in thousands, except per share amounts GAAP to Economic Book Value Adjustments 9/30/2013 GAAP TFI Total Capital $ 555,778 Less non-controlling interest of TFI (354,667) Less retained earnings of consolidated TAMCO (86,877) GAAP Net Assets to Tiptree Class A Stockholders $ 114,234 Less net assets held directly at Tiptree (3,884) Plus portion of non-controlling interest held by TFP 335,765 GAAP Net Assets of Operating Subsidiary $ 446,115 Reversal of consolidation of TAMCO (including VIEs)2 $(146,373) Fair value of CLOs3 63,173 Value of TAMCO4 57,661 Adjustments to results from real estate operations 5 1,857 Total Adjustments $(23,682) Economic Operating Subsidiary Net Assets $ 422,433 Economic Book Value per Unit6,7 $ 10.25