Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - SEACOAST BANKING CORP OF FLORIDA | v367039_8k.htm |

| EX-99.2 - EXHIBIT 99.2 - SEACOAST BANKING CORP OF FLORIDA | v367039_ex99-2.htm |

| EX-99.1 - EXHIBIT 99.1 - SEACOAST BANKING CORP OF FLORIDA | v367039_ex99-1.htm |

Fourth Quarter 2013 January 30, 2014

2 Cautionary Notice Regarding Forward - Looking Statements This press release contains “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 and Section 21 E of the Securities Exchange Act of 1934 , including, without limitation, statements about future financial and operating results, ability to realized deferred tax assets, cost savings, enhanced revenues, economic and seasonal conditions in our markets, and improvements to reported earnings that may be realized from cost controls and for integration of banks that we have acquired, as well as statements with respect to Seacoast’s objectives, expectations and intentions and other statements that are not historical facts . Actual results may differ from those set forth in the forward - looking statements . Forward - looking statements include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, and involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the actual results, performance or achievements of Seacoast to be materially different from future results, performance or achievements expressed or implied by such forward - looking statements . You should not expect us to update any forward - looking statements . You can identify these forward - looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “support”, “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “further”, “point to,” “project,” “could,” “intend” or other similar words and expressions of the future . These forward - looking statements may not be realized due to a variety of factors, including, without limitation : the effects of future economic and market conditions, including seasonality ; governmental monetary and fiscal policies, as well as legislative, tax and regulatory changes ; changes in accounting policies, rules and practices ; the risks of changes in interest rates on the level and composition of deposits, loan demand, liquidity and the values of loan collateral, securities, and interest sensitive assets and liabilities ; interest rate risks, sensitivities and the shape of the yield curve ; the effects of competition from other commercial banks, thrifts, mortgage banking firms, consumer finance companies, credit unions, securities brokerage firms, insurance companies, money market and other mutual funds and other financial institutions operating in our market areas and elsewhere, including institutions operating regionally, nationally and internationally, together with such competitors offering banking products and services by mail, telephone, computer and the Internet ; and the failure of assumptions underlying the establishment of reserves for possible loan losses . The risks of mergers and acquisitions, include, without limitation : unexpected transaction costs, including the costs of integrating operations ; the risks that the businesses will not be integrated successfully or that such integration may be more difficult, time - consuming or costly than expected ; the potential failure to fully or timely realize expected revenues and revenue synergies, including as the result of revenues following the merger being lower than expected ; the risk of deposit and customer attrition ; any changes in deposit mix ; unexpected operating and other costs, which may differ or change from expectations ; the risks of customer and employee loss and business disruption, including, without limitation, as the result of difficulties in maintaining relationships with employees ; increased competitive pressures and solicitations of customers by competitors ; as well as the difficulties and risks inherent with entering new markets . All written or oral forward - looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, including, without limitation, those risks and uncertainties described in our annual report on Form 10 - K for the year ended December 31 , 2012 under “Special Cautionary Notice Regarding Forward - Looking Statements” and “Risk Factors”, and otherwise in our SEC reports and filings . Such reports are available upon request from the Company, or from the Securities and Exchange Commission, including through the SEC’s Internet website at http : //www . sec . gov .

3 Generating Momentum – 2013 Highlights Building Shareholder Value • Reversal of the valuation allowance on deferred tax assets • Successfully raised $75 million in common equity capital • Redemption of $50 million in Series A Preferred Stock • Pretax income totaled $11.6 million in 2013, up $12.3 million compared to 2012 • Loan originations totaled $563 million, up 18.8% compared to 2012 • Noninterest income excluding security gains increased 13.4% over prior year, the result of better performance in deposit interchange and service charges, mortgage banking fees, and wealth management revenue • Noninterest expense reduction of 9 % or $7.4 million compared to 2012, while continuing investment in growth and revenue producing opportunities Growing Our Franchise • Customer demand deposits increased $41.2 million or 9 .7%, year over year • Commercial loan originations increased $89 million or 80% compared to 2012 • I ntroduced digital deposit capture on smart phones for consumer and business banking, launched consumer and business tablet and mobile platforms, rebranded website, and enhanced ATM capabilities Reducing our Risk Posture • Termination of formalized regulatory agreements • Net charge - offs of $5.2 million or 0.41% of average loans in 2013, compared to $14.3 million or 1.16% one year prior • Nonperforming loans declined by $13.3 million, or 32.4% year over year • Accruing restructured loans reduced by $16.8 million, or 40.1% year over year • Nonperforming assets to total assets of 1.52%, compared to 2.43% at December 31, 2012

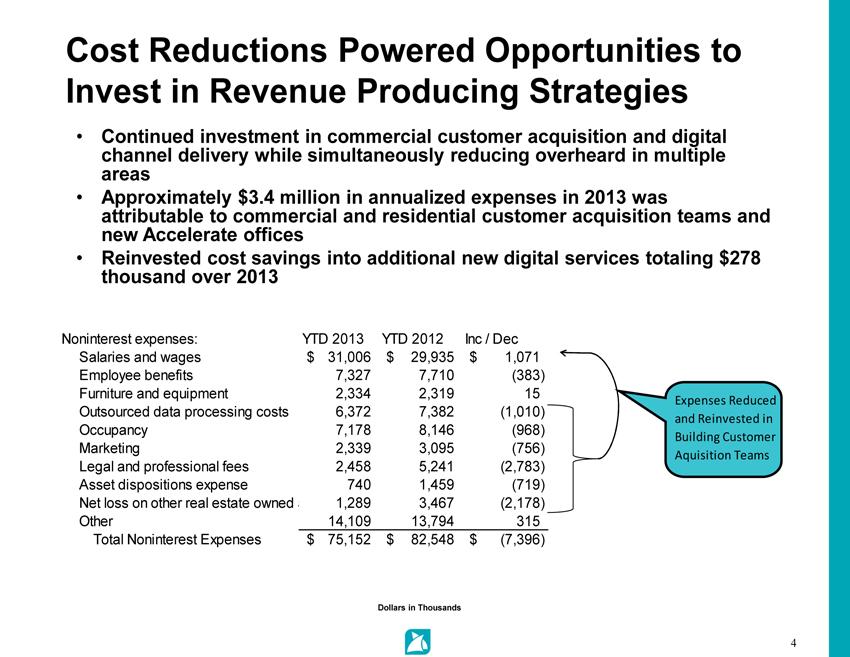

4 Cost Reductions Powered Opportunities to Invest in Revenue Producing Strategies • Continued investment in commercial customer acquisition and digital channel delivery while simultaneously reducing overheard in multiple areas • Approximately $3.4 million in annualized expenses in 2013 was attributable to commercial and residential customer acquisition teams and new Accelerate offices • Reinvested cost savings into additional new digital services totaling $278 thousand over 2013 Dollars in Thousands Noninterest expenses: YTD 2013 YTD 2012 Inc / Dec Salaries and wages 31,006$ 29,935$ 1,071$ Employee benefits 7,327 7,710 (383) Furniture and equipment 2,334 2,319 15 Outsourced data processing costs 6,372 7,382 (1,010) Occupancy 7,178 8,146 (968) Marketing 2,339 3,095 (756) Legal and professional fees 2,458 5,241 (2,783) Asset dispositions expense 740 1,459 (719) Net loss on other real estate owned and repossessed assets1,289 3,467 (2,178) Other 14,109 13,794 315 Total Noninterest Expenses 75,152$ 82,548$ (7,396)$ Expenses Reduced and Reinvested in Building Customer Aquisition Teams

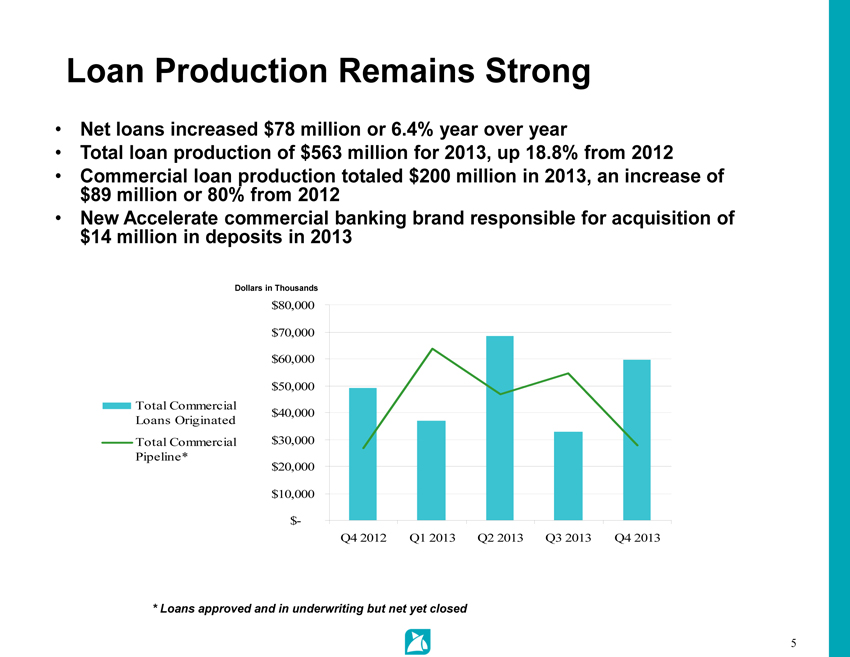

5 Loan Production Remains Strong • Net loans increased $78 million or 6.4% year over year • Total loan production of $563 million for 2013, up 18.8% from 2012 • Commercial loan production totaled $200 million in 2013, an increase of $89 million or 80% from 2012 • New Accelerate commercial banking brand responsible for acquisition of $14 million in deposits in 2013 * * Loans approved and in underwriting but net yet closed Dollars in Thousands $- $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Total Commercial Loans Originated Total Commercial Pipeline*

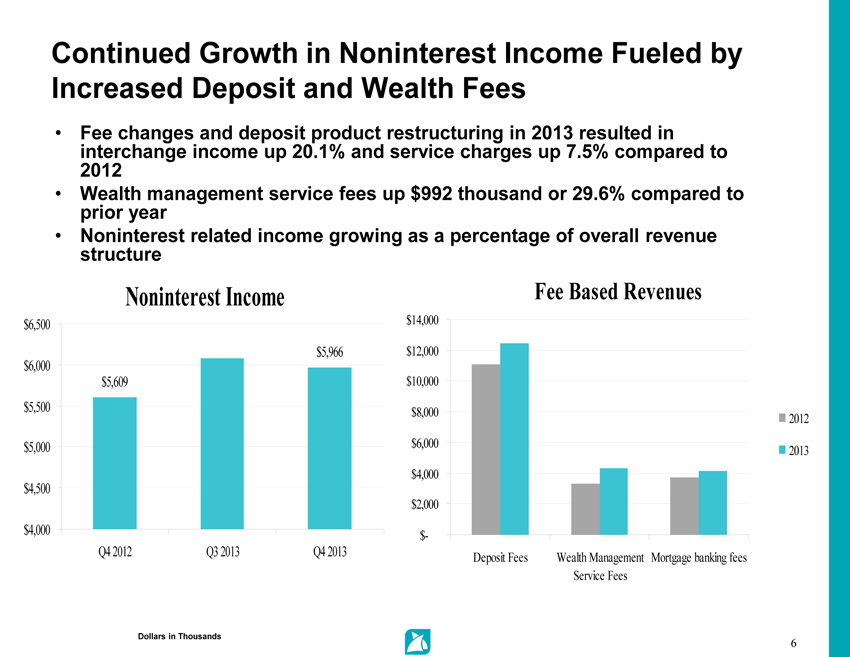

6 Continued Growth in Noninterest Income Fueled by Increased Deposit and Wealth Fees • Fee changes and deposit product restructuring in 2013 resulted in interchange income up 20.1% and service charges up 7.5% compared to 2012 • Wealth management service fees up $992 thousand or 29.6% compared to prior year • Noninterest related income growing as a percentage of overall revenue structure 21% Dollars in Thousands Fee Based Revenues $- $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 Deposit Fees Wealth Management Service Fees Mortgage banking fees 2012 2013 Noninterest Income $5,609 $5,966 $4,000 $4,500 $5,000 $5,500 $6,000 $6,500 Q4 2012 Q3 2013 Q4 2013

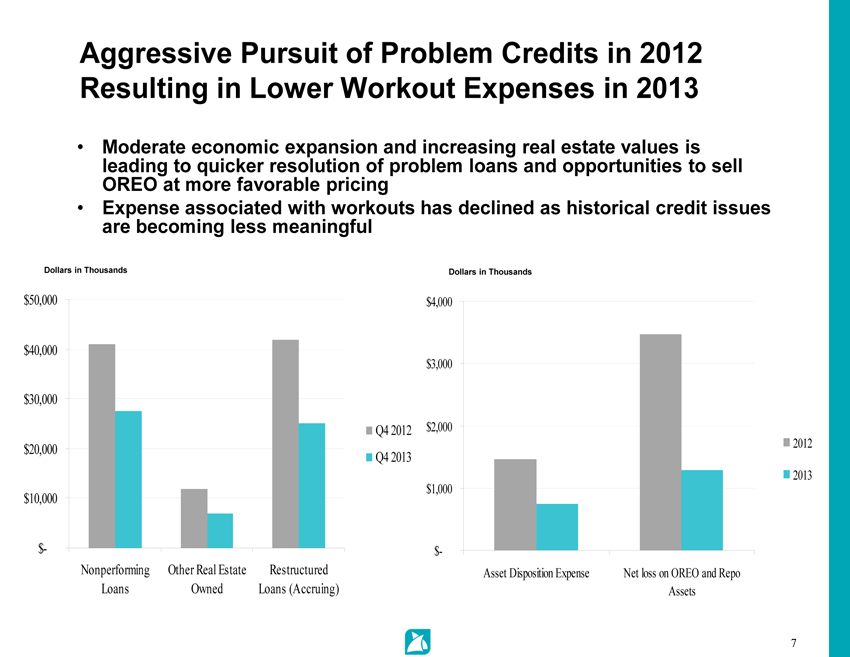

7 Aggressive Pursuit of Problem Credits in 2012 Resulting in Lower Workout Expenses in 2013 • Moderate economic expansion and increasing real estate values is leading to quicker resolution of problem loans and opportunities to sell OREO at more favorable pricing • Expense associated with workouts has declined as historical credit issues are becoming less meaningful Dollars in Thousands Dollars in Thousands $- $1,000 $2,000 $3,000 $4,000 Asset Disposition Expense Net loss on OREO and Repo Assets 2012 2013 $- $10,000 $20,000 $30,000 $40,000 $50,000 Nonperforming Loans Other Real Estate Owned Restructured Loans (Accruing) Q4 2012 Q4 2013

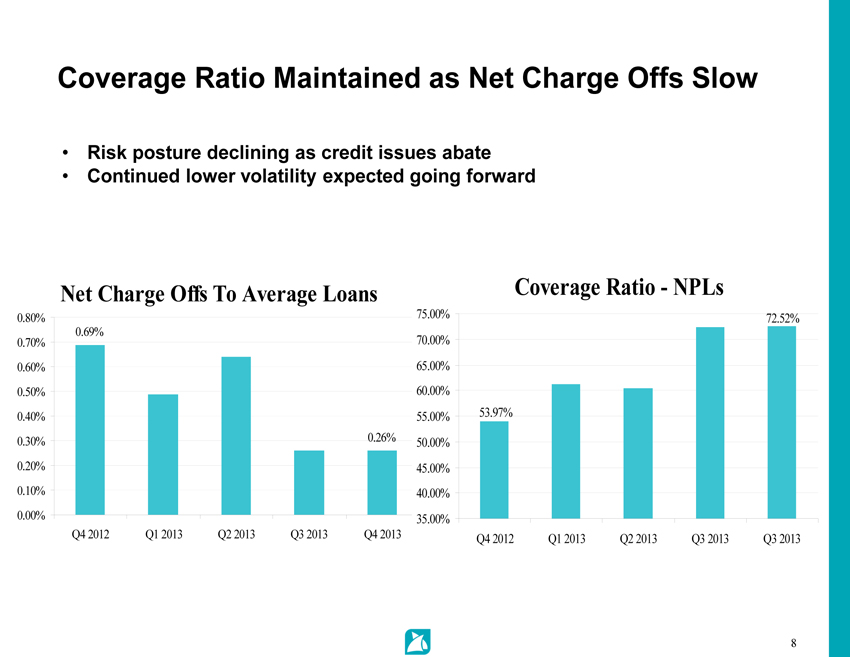

8 Coverage Ratio Maintained as Net Charge Offs Slow • Risk posture declining as credit issues abate • Continued lower volatility expected going forward Net Charge Offs To Average Loans 0.69% 0.26% 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 0.70% 0.80% Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Coverage Ratio - NPLs 72.52% 53.97% 35.00% 40.00% 45.00% 50.00% 55.00% 60.00% 65.00% 70.00% 75.00% Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q3 2013

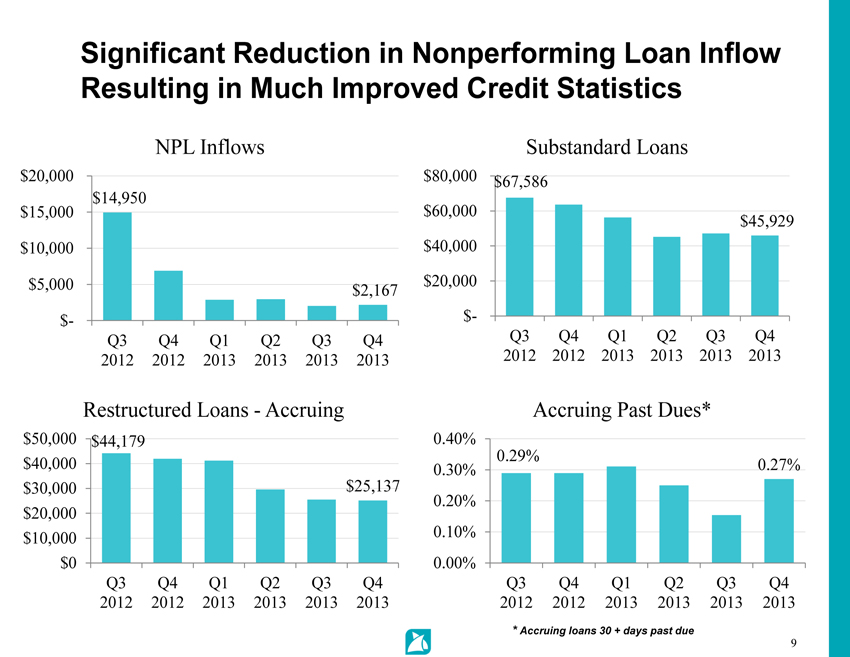

9 Significant Reduction in Nonperforming Loan Inflow Resulting in Much Improved Credit Statistics * Accruing loans 30 + days past due $14,950 $2,167 $- $5,000 $10,000 $15,000 $20,000 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 NPL Inflows $44,179 $25,137 $0 $10,000 $20,000 $30,000 $40,000 $50,000 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Restructured Loans - Accruing $67,586 $45,929 $- $20,000 $40,000 $60,000 $80,000 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Substandard Loans 0.29% 0.27% 0.00% 0.10% 0.20% 0.30% 0.40% Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Accruing Past Dues*

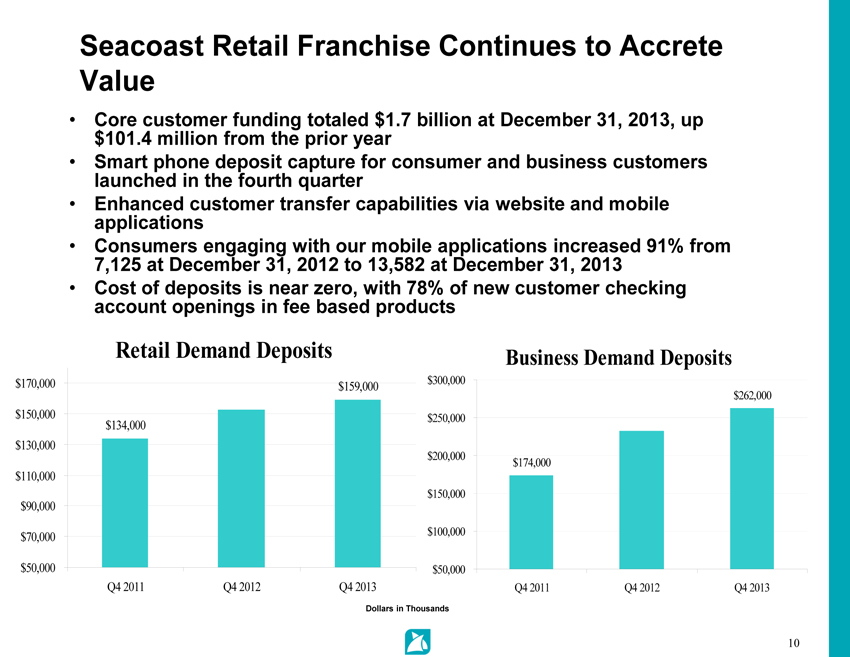

10 Seacoast Retail Franchise Continues to Accrete Value • Core customer funding totaled $1.7 billion at December 31, 2013, up $101.4 million from the prior year • Smart phone deposit capture for consumer and business customers launched in the fourth quarter • Enhanced customer transfer capabilities via website and mobile applications • Consumers engaging with our mobile applications increased 91% from 7,125 at December 31, 2012 to 13,582 at December 31, 2013 • Cost of deposits is near zero, with 78% of new customer checking account openings in fee based products Dollars in Thousands Retail Demand Deposits $134,000 $159,000 $50,000 $70,000 $90,000 $110,000 $130,000 $150,000 $170,000 Q4 2011 Q4 2012 Q4 2013 Business Demand Deposits $174,000 $262,000 $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 Q4 2011 Q4 2012 Q4 2013

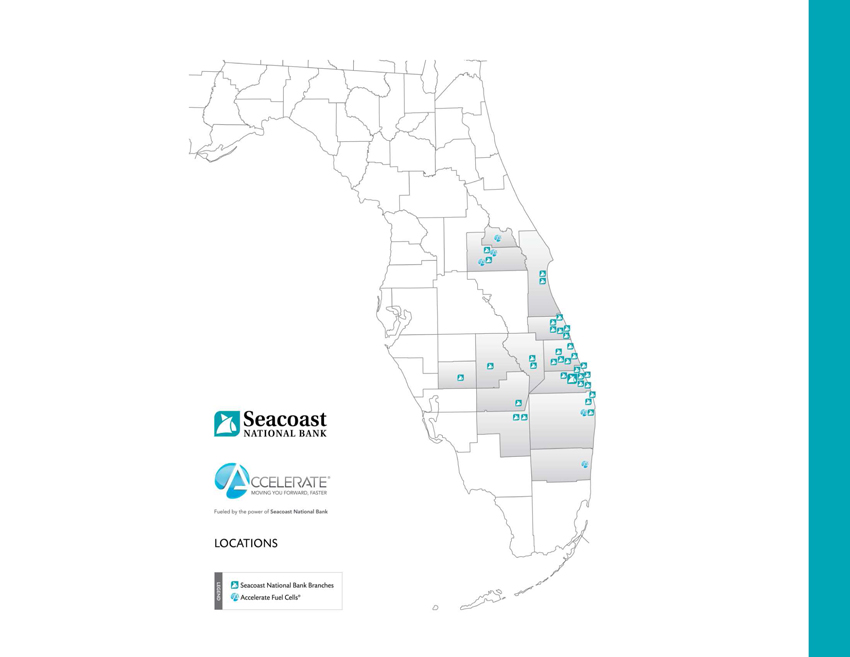

11 2014 Priorities Building Shareholder Value • After raising capital and redeeming our preferred stock we have taken an offensive position and shifted our focus to accelerating growth and acquisition opportunities • Moving into 2014 we will continue to invest in revenue growth while maintaining our focus on a prudent expense structure Growing Our Franchise • Examine branch network for opportunities for reinvestment and enhancements to the customer experience • Continued improvement on our value proposition with concentration on a robust customer engagement strategy and targeted customer acquisition utilizing numerous marketing channels • Refinement of our commercial and business banking strategy; continue development of our branding and presence in Orlando, Boca Raton and Ft. Lauderdale

12