Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CenterState Bank Corp | d660713d8k.htm |

Exhibit 99.1

| FOR IMMEDIATE RELEASE | ||

| January 21, 2014 |

CenterState Banks, Inc. Announces

Fourth Quarter 2013 Operating Results

(All dollar amounts are in thousands, except per share information)

(All earnings per share amounts are reported on a diluted basis unless otherwise noted)

DAVENPORT, FL. – January 21, 2014 - CenterState Banks, Inc. (NASDAQ: CSFL) reported earnings per share of $0.06 ($0.07 excluding merger expenses) on net income of $1,800 for the fourth quarter of 2013, compared to $0.10 per share on net income of $3,109 reported during the prior quarter. The primary differences between these two quarters are as follows.

| • | Net interest income before loan loss provision decreased $529 due primarily to the decrease in FDIC covered loan interest accretion. The NIM decreased from 4.96% to 4.65% due primarily to both a decrease in loan yields and a change in the mix of interest earning assets. There was no change in the 0.38% total cost of interest bearing liabilities between the two quarters. The cost of total deposits, including non-interest bearing checking accounts was 0.24% in the current quarter compared to 0.25% in the prior quarter. |

| • | The loan loss provision expense increased $1,456 between the two quarters from a negative expense of $1,273 in the prior quarter to a $183 expense in the current quarter. The general loan loss allowance (SFAS 5 factor) as a percentage of non-impaired loans continued to decrease from 1.57% at September 30, 2013 to 1.47% at December 31, 2013 as reflected by the improved real estate markets and improved credit trends. |

| • | The FDIC indemnification asset (“IA”) amortization expense increased by $664 between the two quarters due to continued improvement in the Company’s expected losses in its FDIC covered loan portfolio. |

| • | Total credit expenses decreased by $3,935 between the quarters, most of which related to FDIC covered assets. The related FDIC revenue decreased by $3,148 which is related to FDIC credit cost. Eighty percent of the cost is reimbursable from the FDIC. |

Announcement of efficiency and enhanced profitability initiatives

The Company reported restructuring and consolidation plans which are expected to reduce annual operating expenses by approximately $6 million.

Branch/ Retail Rationalization - $2.7 million annually

| • | The closing and consolidation of 13% of the Company’s retail branch network - 7 smaller branches and 1 standalone drive-thru facility. The branches will close effective mid-April. |

| • | Total loans and non-time deposits of the 7 branches are $89 million and $82 million respectively. Collectively, these smaller branches represent 6% of the Company’s total loans and 5% of the Company’s total non-time deposits as of December 31, 2013. |

| • | Loans and time deposits of the closed offices are expected to decline over the normal course of business. Two-thirds of non-time deposits and the corresponding fee income are expected to decline over a two-year period. The remaining one-third of the non-time deposits is expected to remain with the Company. |

| • | Restructuring residential lending and other retail platform staffing. |

4

Other Restructuring and Expense Reductions - $3.3 million annually

| • | Restructuring of credit administration and portfolio management divisions to streamline approval processes and to focus annual portfolio servicing on larger credits. |

| • | Other efficiency moves include savings in the correspondent unit, wealth management department, healthcare related costs, and communications expenses upon the maturity of existing contracts. |

| • | The total FTE reduction from the branch rationalization and other initiatives will be a net 57 FTE including positions consolidated from a January 10th announced reduction in force, retirements, and attrition. The baseline for the cost saves and reduction in FTEs is the third quarter of 2013 run rate. |

First Quarter Charge

| • | The Company expects to record a charge of approximately $2.8 million in the first quarter of 2014 for costs associated with these efficiency plans. The charge is expected to cover severance, real estate and lease write-downs, and other items associated with the plans. |

| • | In addition to the $2.8 million charge disclosed above, the Company also expects to record a charge for merger related expenses of approximately $2.3 million resulting in total one-time charges in the first quarter of 2014 of approximately $5.1 million. |

Timing of the Expense Saves and Revenue Reduction

| EXPENSE SAVES |

1Q14 | 2Q14 | 3Q14 | 4Q14 | 1Q15 | 2Q15 | ||||||||||||||||||

| Compensation related |

$ | 345 | $ | 575 | $ | 200 | $ | — | $ | — | $ | — | ||||||||||||

| Other non-interest expenses |

25 | 110 | 40 | 50 | 25 | 130 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Quarterly change |

$ | 370 | $ | 685 | $ | 240 | $ | 50 | $ | 25 | $ | 130 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Cumulative expense reduction per quarter |

$ | 370 | $ | 1,055 | $ | 1,295 | $ | 1,345 | $ | 1,370 | $ | 1,500 | * | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| REVENUE REDUCTION |

1Q14 | 2Q14 | 3Q14 | 4Q14 | 1Q15 | 2Q15 | ||||||||||||||||||

| Wealth management fees |

$ | — | $ | 140 | $ | 70 | $ | — | $ | — | $ | — | ||||||||||||

| Deposit related fees |

— | 5 | 5 | 5 | 5 | 5 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Quarterly change |

$ | — | $ | 145 | $ | 75 | $ | 5 | $ | 5 | $ | 5 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Cumulative |

$ | — | $ | 145 | $ | 220 | $ | 225 | $ | 230 | $ | 235 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| * | $1.5 million is the quarterly expected expense reduction fully phased-in at which point the Company expects annualized expense reduction of $6 million. |

All 7 of the branches are owned by the Company. The offsite drive-thru facility is leased. Two of the branch offices will be used as loan production offices by the Company and they also include tenants with leases. At its January board meeting, the Company’s directors authorized management to sell the remaining 5 offices after their scheduled closure date in April. Management expects to transfer these assets to held-for-sale during the first quarter of 2014 and they will be carried at net realizable value.

5

Gulfstream acquisition

On January 17, 2014, the Company announced that it has closed its merger with Gulfstream Bancshares, Inc. (“Gulfstream”) and it’s wholly owned subsidiary bank, Gulfstream Business Bank effective that day. Pursuant to this merger, the Company acquired $378 million of loans, $479 million of deposits and four branch banking offices in Palm Beach, Martin and St. Lucie Counties in southeast Florida. Loans and deposits reference above are not reflected at fair value. It is expected that Gulfstream will be converted to the Company’s core processing system on February 14, 2014. Total one-time merger and acquisition expenses related to this transaction are currently expected to be approximately $2.8 million of which approximately $0.5 million has been expensed during the fourth quarter of 2013. The remaining $2.3 million is expected to be a 1Q14 charge. The Company estimates that Gulfstream could add approximately $4.7 million to 2014 consolidated net income.

Loan growth

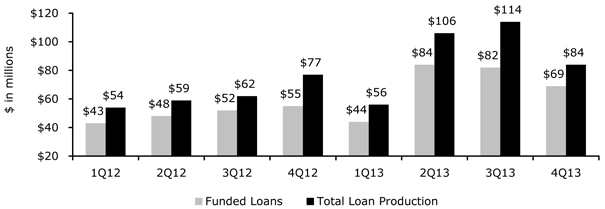

Non covered loans (i.e. loans not covered by FDIC loss share agreements) grew $28,225, or 9.3% annualized, during the three month period ending December 31, 2013. During the twelve months ending December 31, 2013, the annual growth rate was approximately 9.4%. Total new loans originated during the quarter approximated $83.5 million, of which $68.5 million were funded. The weighted average interest rate on funded loans was approximately 4.25%. About 35% of loan production was single family residential, 28% commercial real estate (“CRE”), 26% commercial and industrial (“C&I”) and 11% were all other. Approximately 56% of the current quarter production was fixed rate and 44% variable rate. The graph below summarizes total loan production and funded loan production over the past eight quarters.

6

FDIC covered loans and the related indemnification asset

Purchased credit impaired loans acquired pursuant to FDIC assisted transactions of failed financial institutions have been performing better than previously estimated. To the extent future estimated cash flows have improved (i.e. future estimated losses have decreased), the additional amount of future estimated cash flows are accreted into interest income over the remaining life of the related loan pool(s), thereby increasing the pool’s yield. The yields on the aggregate covered loan portfolio have been trending upward as a result of a decrease in the estimate of future losses. During the past nine quarters, the yields on the covered loan portfolio were as follows:

| (unaudited) |

4Q13 | 3Q13 | 2Q13 | 1Q13 | 4Q12 | 3Q12 | 2Q12 | 1Q12 | 4Q11 | |||||||||||||||||||||||||||

| FDIC covered loan portfolio |

12.91 | % | 14.15 | % | 12.03 | % | 11.06 | % | 7.71 | % | 7.03 | % | 7.51 | % | 6.69 | % | 6.80 | % | ||||||||||||||||||

The IA represents the amount that is expected to be collected from the FDIC for reimbursement of 80% of the estimated losses in the covered pools. When the Company decreases its estimate of future losses, the expected reimbursement from the FDIC, or IA, is decreased by 80% of this amount. The decrease in estimated reimbursements is expensed (negative accretion) over the lesser of the remaining expected life of the related loan pool(s) or the remaining term of the related loss share agreement(s), and is included in the Company’s non-interest income as a negative amount.

At December 31, 2013, the total IA on the Company’s balance sheet was $73,433. Of this amount, the Company expects to receive reimbursements from the FDIC of approximately $39,513 related to future estimated losses, and expects to expense approximately $33,920 for previously estimated losses that are no longer expected. The $33,920 is now expected to be paid by the borrower (or realized upon the sale of OREO) instead of a reimbursement from the FDIC. At December 31, 2013, the $33,920 previously estimated reimbursements from the FDIC will be written off as expense (negative accretion) in the Company’s non-interest income as summarized below.

| Year |

Year |

|||||||||||

| 2014 |

46.3 | % | 2018 |

5.2 | % | |||||||

| 2015 |

20.5 | % | 2019 |

4.5 | % | |||||||

| 2016 |

13.2 | % | 2020 thru 2022 |

3.9 | % | |||||||

|

|

|

|||||||||||

| 2017 |

6.4 | % | Total |

100.0 | % | |||||||

|

|

|

|||||||||||

7

Quarterly condensed consolidated income statements (unaudited) are shown below for the periods indicated. See notes 1 and 2 below for a discussion related to FDIC revenue and amortization (negative accretion) included in non-interest income.

Quarterly Condensed Consolidated Statements of Operations (unaudited)

| For the quarter ended: |

12/31/13 | 9/30/13 | 6/30/13 | 3/31/13 | 12/31/12 | |||||||||||||||

| Interest income |

$ | 25,479 | $ | 26,034 | $ | 24,487 | $ | 24,378 | $ | 23,265 | ||||||||||

| Interest expense |

1,398 | 1,424 | 1,507 | 1,556 | 1,726 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income |

24,081 | 24,610 | 22,980 | 22,822 | 21,539 | |||||||||||||||

| Recovery (provision) for loan losses |

(183 | ) | 1,273 | (1,374 | ) | 360 | (2,169 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income after loan loss provision |

23,898 | 25,883 | 21,606 | 23,182 | 19,370 | |||||||||||||||

| Income from correspondent banking and bond sales division |

3,070 | 2,909 | 4,904 | 6,140 | 6,450 | |||||||||||||||

| Gain on sale of securities available for sale |

22 | — | 1,008 | 30 | 420 | |||||||||||||||

| FDIC-IA amortization (negative accretion) (note 1) |

(4,500 | ) | (3,836 | ) | (3,272 | ) | (2,199 | ) | (1,540 | ) | ||||||||||

| FDIC-revenue (note 2) |

185 | 3,333 | 1,396 | 628 | 2,025 | |||||||||||||||

| All other non-interest income |

6,420 | 6,201 | 5,827 | 5,680 | 5,385 | |||||||||||||||

| Credit related expenses |

(1,820 | ) | (5,755 | ) | (3,134 | ) | (2,021 | ) | (3,573 | ) | ||||||||||

| Acquisition and conversion related expenses |

(539 | ) | (183 | ) | — | — | (55 | ) | ||||||||||||

| Correspondent banking division expenses |

(4,683 | ) | (4,377 | ) | (5,363 | ) | (6,075 | ) | (6,069 | ) | ||||||||||

| All other non-interest expense |

(19,407 | ) | (19,535 | ) | (18,876 | ) | (18,994 | ) | (18,833 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before income tax |

2,646 | 4,640 | 4,096 | 6,371 | 3,580 | |||||||||||||||

| Income tax provision |

(846 | ) | (1,531 | ) | (1,338 | ) | (1,795 | ) | (1,344 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NET INCOME |

$ | 1,800 | $ | 3,109 | $ | 2,758 | $ | 4,576 | $ | 2,236 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Earnings per share (basic) |

$ | 0.06 | $ | 0.10 | $ | 0.09 | $ | 0.15 | $ | 0.07 | ||||||||||

| Earnings per share (diluted) |

$ | 0.06 | $ | 0.10 | $ | 0.09 | $ | 0.15 | $ | 0.07 | ||||||||||

| Average common shares outstanding (basic) |

30,112,475 | 30,109,728 | 30,098,853 | 30,089,726 | 30,079,767 | |||||||||||||||

| Average common shares outstanding (diluted) |

30,244,648 | 30,243,873 | 30,161,241 | 30,159,188 | 30,153,775 | |||||||||||||||

| Common shares outstanding at period end |

30,112,475 | 30,112,475 | 30,104,270 | 30,095,520 | 30,079,767 | |||||||||||||||

| PTPP earnings (note 3) |

$ | 4,981 | $ | 5,972 | $ | 6,200 | $ | 7,343 | $ | 6,932 | ||||||||||

| PTPP diluted earnings per share (note 4) |

$ | 0.16 | $ | 0.20 | $ | 0.21 | $ | 0.24 | $ | 0.23 | ||||||||||

| note 1: | On the date of an FDIC acquisition (with loss share), the Company estimates expected future losses and the timing of those losses by loan pool. The related reimbursements from the FDIC for approximately 80% of those losses are recorded as a receivable from the FDIC, referred to as indemnification asset or “IA.” The Company updates its estimate of future losses and the timing of the losses each quarter. To the extent management estimates that future losses are less than prior expected future losses, management adjusts its estimates of future expected cash flows and this increase is accreted to interest income over the remaining life of those specific loan pools, increasing the yield on loans. Because management no longer expects these incremental future losses on the loan pool(s), then the expected future reimbursements from the FDIC for approximately 80% of these losses are also reduced. Instead of immediately charging down the IA for expected future FDIC reimbursements, the IA is written down over the shorter of the loss share period or the life of the related loan pool(s) by negative accretion (amortization) in this line item. |

| note 2: | Two FDIC related revenue items are included in this line item. The first item is FDIC reimbursement income from the sale of OREO. When OREO (those covered by loss share agreements) is sold for a loss, approximately 80% of the loss is recognized as income and included in this line item. Second, when a loan pool (with loss share) is impaired, the impairment expense is included in provision for loan losses, and approximately 80% of that loss is recognized as income from FDIC reimbursement, and included in this line item. |

| note 3: | Pre-tax pre-provision earnings (“PTPP”) is a non-GAAP measure that is defined as income before income tax excluding the provision for loan losses and gain on sale of available for sale (“AFS”) securities. In addition, the Company also excludes other credit related costs including losses on repossessed real estate and other assets, and other foreclosure related expenses. It also excludes non-recurring items as listed in the following reconciliation table. |

| note 4: | PTPP earnings per share means, PTPP as defined in note 3 above divided by the average number of diluted common shares outstanding. |

8

A reconciliation of the quarterly condensed PTPP is presented below (unaudited):

| For the quarter ended: |

12/31/13 | 9/30/13 | 6/30/13 | 3/31/13 | 12/31/12 | |||||||||||||||

| Income before income tax (GAAP) |

$ | 2,646 | $ | 4,640 | $ | 4,096 | $ | 6,371 | $ | 3,580 | ||||||||||

| exclude provision for loan losses |

183 | (1,273 | ) | 1,374 | (360 | ) | 2,169 | |||||||||||||

| FDIC income from pool impairment |

450 | (28 | ) | 70 | 21 | (261 | ) | |||||||||||||

| exclude other credit related costs |

1,820 | 5,755 | 3,134 | 2,021 | 3,573 | |||||||||||||||

| OREO indemnification income from FDIC |

(635 | ) | (3,305 | ) | (1,466 | ) | (649 | ) | (1,764 | ) | ||||||||||

| exclude gain on sale of AFS securities |

(22 | ) | — | (1,008 | ) | (30 | ) | (420 | ) | |||||||||||

| exclude non-recurring items: |

||||||||||||||||||||

| gain on sale of bank owned property held for sale |

— | — | — | (31 | ) | — | ||||||||||||||

| acquisition and conversion related expenses |

539 | 183 | — | — | 55 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PTPP earnings |

$ | 4,981 | $ | 5,972 | $ | 6,200 | $ | 7,343 | $ | 6,932 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

The condensed quarterly results of the Company’s correspondent banking and bond sales segment are presented below.

Quarterly Condensed Segment Information - Correspondent banking and bond sales division (unaudited)

| For the quarter ended: |

12/31/13 | 9/30/13 | 6/30/13 | 3/31/13 | 12/31/12 | |||||||||||||||

| Net interest income |

$ | 748 | $ | 725 | $ | 607 | $ | 774 | $ | 878 | ||||||||||

| Total non-interest income (note 1) |

4,025 | 3,771 | 5,609 | 7,005 | 7,193 | |||||||||||||||

| Total non-interest expense (note 2) |

(4,683 | ) | (4,377 | ) | (5,363 | ) | (6,075 | ) | (6,069 | ) | ||||||||||

| Income tax provision |

(35 | ) | (46 | ) | (329 | ) | (657 | ) | (753 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 55 | $ | 73 | $ | 524 | $ | 1,047 | $ | 1,249 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Contribution to diluted earnings per share |

$ | — | $ | — | $ | 0.02 | $ | 0.03 | $ | 0.04 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Allocation of indirect expenses net of income tax benefit (note 3) |

$ | (353 | ) | $ | (303 | ) | $ | (283 | ) | $ | (286 | ) | $ | (369 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Contribution to diluted earnings per share after deduction of allocated indirect expenses |

$ | (0.01 | ) | $ | (0.01 | ) | $ | 0.01 | $ | 0.03 | $ | 0.03 | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| note 1: | The primary component in this line item is gross commissions earned on bond sales (“income from correspondent banking and bond sales division”) which was $3,070, $2,909, $4,904, $6,140 and $6,450 for 4Q13, 3Q13, 2Q13, 1Q13 and 4Q12 respectively. The remaining non interest income items in this category include fees from safe-keeping activities, bond accounting services, asset/liability consulting related activities, international wires, clearing and corporate checking account services, and other correspondent banking related revenue and fees. |

| note 2: | A significant portion of these expenses are variable in nature and are a derivative of the income from correspondent banking and bond sales division. The amounts do not include any indirect support allocation costs. |

| note 3: | A portion of the cost of the Company’s indirect departments such as human resources, accounting, deposit operations, item processing, information technology, compliance and others have been allocated to the correspondent banking and bond sales division based on management’s estimates. |

Net Interest Margin (“NIM”)

The primary reason for the decrease in NIM between sequential quarters was the decrease in yields on loans and change in the mix of interest earning assets (“IEA”). The yields on the non covered loans continue to decrease quarter to quarter as the average approaches the average yields of the Company’s new loan production. The average yield on FDIC covered loans (accounted for pursuant to ASC 310-30) decreased in 4Q compared to 3Q due primarily to collections in excess of certain pool balances during 3Q resulting in additional interest accretion during that quarter. As indicated in the above discussion relating to the Company’s IA, the covered purchased loans are performing better than previously expected and as such future loss estimates continue to be revised downward causing additional amounts to be accreted into future interest income. At this time the Company expects the yield on covered loans in 1Q14 to be no less than 4Q13.

9

Although total average loans, the highest yielding component in the IEA portfolio, increased quarter to quarter, total average loans as a percentage of total IEAs decreased quarter to quarter. The lowest yielding asset, federal funds sold and other, increased significantly between quarters. This was the other primary factor contributing to the decrease in NIM between sequential quarters.

The table below summarizes yields and costs by various interest earning asset and interest bearing liability account types for the current quarter, the previous calendar quarter and the same quarter last year.

Yield and cost table (unaudited)

| 4Q13 | 3Q13 | 4Q12 | ||||||||||||||||||||||||||||||||||

| average | interest | avg | average | interest | avg | average | interest | avg | ||||||||||||||||||||||||||||

| balance | inc/exp | rate | balance | inc/exp | rate | balance | inc/exp | rate | ||||||||||||||||||||||||||||

| Loans (TEY)* (note 1) |

$ | 1,231,052 | $ | 14,479 | 4.67 | % | $ | 1,195,105 | $ | 14,243 | 4.73 | % | $ | 1,138,127 | $ | 14,640 | 5.12 | % | ||||||||||||||||||

| Covered loans (note 2) |

239,620 | 7,799 | 12.91 | % | 249,154 | 8,886 | 14.15 | % | 309,502 | 6,001 | 7.71 | % | ||||||||||||||||||||||||

| Taxable securities |

414,107 | 2,843 | 2.72 | % | 430,995 | 2,560 | 2.36 | % | 393,362 | 2,211 | 2.24 | % | ||||||||||||||||||||||||

| Tax -exempt securities (TEY) |

39,551 | 516 | 5.18 | % | 40,119 | 550 | 5.44 | % | 40,697 | 539 | 5.27 | % | ||||||||||||||||||||||||

| Fed funds sold and other |

161,270 | 210 | 0.52 | % | 80,346 | 149 | 0.74 | % | 138,236 | 194 | 0.56 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Tot. interest earning assets(TEY) |

$ | 2,085,600 | $ | 25,847 | 4.92 | % | $ | 1,995,719 | $ | 26,388 | 5.25 | % | $ | 2,019,924 | $ | 23,585 | 4.65 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Interest bearing deposits |

$ | 1,405,244 | $ | 1,225 | 0.35 | % | $ | 1,402,753 | $ | 1,246 | 0.35 | % | $ | 1,490,327 | $ | 1,545 | 0.41 | % | ||||||||||||||||||

| Fed funds purchased |

34,782 | 5 | 0.06 | % | 36,823 | 5 | 0.05 | % | 44,520 | 6 | 0.05 | % | ||||||||||||||||||||||||

| Other borrowings |

19,729 | 18 | 0.36 | % | 22,847 | 21 | 0.36 | % | 20,004 | 19 | 0.38 | % | ||||||||||||||||||||||||

| Corporate debentures |

16,994 | 150 | 3.50 | % | 16,987 | 152 | 3.55 | % | 16,968 | 156 | 3.66 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total interest bearing liabilities |

$ | 1,476,749 | $ | 1,398 | 0.38 | % | $ | 1,479,410 | $ | 1,424 | 0.38 | % | $ | 1,571,819 | $ | 1,726 | 0.44 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net Interest Spread (TEY) |

4.54 | % | 4.87 | % | 4.21 | % | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Net Interest Margin (TEY) |

4.65 | % | 4.96 | % | 4.31 | % | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| * | TEY = tax equivalent yield |

| note 1: | loans not covered by FDIC loss share agreements |

| note 2: | loans covered by FDIC loss share agreements, and accounted for pursuant to ASC Topic 310-30. |

The table below summarizes the Company’s yields on interest earning assets and costs of interest bearing liabilities over the prior five quarters.

Five quarter trend of yields and costs (unaudited)

| For the quarter ended: |

12/31/13 | 9/30/13 | 6/30/13 | 3/31/13 | 12/31/12 | |||||||||||||||

| Yield on loans (TEY)* |

4.67 | % | 4.73 | % | 4.86 | % | 4.92 | % | 5.12 | % | ||||||||||

| Yield on FDIC covered loans |

12.91 | % | 14.15 | % | 12.03 | % | 11.06 | % | 7.71 | % | ||||||||||

| Yield on securities (TEY) |

2.94 | % | 2.62 | % | 2.44 | % | 2.57 | % | 2.52 | % | ||||||||||

| Yield on fed funds sold and other |

0.52 | % | 0.74 | % | 0.51 | % | 0.58 | % | 0.56 | % | ||||||||||

| Yield on total interest earning assets |

4.85 | % | 5.18 | % | 4.82 | % | 4.90 | % | 4.58 | % | ||||||||||

| Yield on total interest earning assets (TEY) |

4.92 | % | 5.25 | % | 4.89 | % | 4.96 | % | 4.65 | % | ||||||||||

| Cost of interest bearing deposits |

0.35 | % | 0.35 | % | 0.37 | % | 0.38 | % | 0.41 | % | ||||||||||

| Cost of fed funds purchased |

0.06 | % | 0.05 | % | 0.07 | % | 0.05 | % | 0.05 | % | ||||||||||

| Cost of other borrowings |

0.36 | % | 0.36 | % | 0.35 | % | 0.36 | % | 0.38 | % | ||||||||||

| Cost of corporate debentures |

3.50 | % | 3.55 | % | 3.54 | % | 3.58 | % | 3.66 | % | ||||||||||

| Cost of interest bearing liabilities |

0.38 | % | 0.38 | % | 0.40 | % | 0.41 | % | 0.44 | % | ||||||||||

| Net interest margin (TEY) |

4.65 | % | 4.96 | % | 4.59 | % | 4.64 | % | 4.31 | % | ||||||||||

| Cost of total deposits |

0.24 | % | 0.25 | % | 0.27 | % | 0.28 | % | 0.31 | % | ||||||||||

| * | TEY = tax equivalent yield |

10

The table below summarizes selected financial ratios over the prior five quarters.

Selected financial ratios (unaudited)

| As of or for the quarter ended: |

12/31/13 | 9/30/13 | 6/30/13 | 3/31/13 | 12/31/12 | |||||||||||||||

| Return on average assets (annualized) |

0.30 | % | 0.53 | % | 0.46 | % | 0.78 | % | 0.37 | % | ||||||||||

| Return on average equity (annualized) |

2.60 | % | 4.56 | % | 4.00 | % | 6.76 | % | 3.25 | % | ||||||||||

| Loan / deposit ratio |

71.7 | % | 74.3 | % | 72.6 | % | 70.3 | % | 71.9 | % | ||||||||||

| Stockholders’ equity (to total assets) |

11.3 | % | 11.7 | % | 11.5 | % | 11.6 | % | 11.6 | % | ||||||||||

| Common tangible equity (to total tangible assets) |

9.4 | % | 9.7 | % | 9.5 | % | 9.6 | % | 9.6 | % | ||||||||||

| Tier 1 capital (to average assets) |

10.4 | % | 10.6 | % | 10.3 | % | 10.1 | % | 9.9 | % | ||||||||||

| Efficiency ratio, including correspondent banking (note 1) |

80.9 | % | 78.1 | % | 77.8 | % | 75.6 | % | 76.4 | % | ||||||||||

| Efficiency ratio, excluding correspondent banking (note 2) |

75.2 | % | 72.8 | % | 73.7 | % | 73.0 | % | 74.3 | % | ||||||||||

| Common equity per common share |

$ | 9.08 | $ | 9.06 | $ | 9.02 | $ | 9.18 | $ | 9.09 | ||||||||||

| Common tangible equity per common share |

$ | 7.38 | $ | 7.35 | $ | 7.30 | $ | 7.45 | $ | 7.36 | ||||||||||

| note 1: | Numerator equals non-interest expense less non-recurring expenses (e.g. merger costs, bank property impairment, etc.) less intangible amortization (both CDI and Trust intangible) less credit related expenses. Denominator equals net interest income on a taxable equivalent yield basis (“TEY”) before the provision for loan losses plus non-interest income less non-recurring income (e.g. gain on sale of securities available for sale, etc.) less FDIC income related to losses on the sales of covered OREO properties and impairment of loan pool(s) covered by FDIC loss share arrangements. |

| note 2: | Numerator starts with the same numerator as in “note 1”, less correspondent bank non-interest expense, including indirect expense allocations. Denominator starts with the same denominator as in “note 1”, less correspondent bank net interest income and less correspondent bank non-interest income. |

11

Loan portfolio mix and covered loans

Approximately 15.6% of the Company’s loans, or $230,273, are covered by FDIC loss sharing agreements related to the acquisition of three failed financial institutions during the third quarter of 2010 and two during the first quarter of 2012. Pursuant to the terms of the loss sharing agreements, the FDIC is obligated to reimburse the Company for 80% of losses with respect to the covered loans beginning with the first dollar of loss incurred, subject to the terms of the agreements. The Company will reimburse the FDIC for its share of recoveries with respect to the covered loans. The loss sharing agreements applicable to single family residential mortgage loans provide for FDIC loss sharing and the Company reimbursement to the FDIC for recoveries for ten years. The loss sharing agreements applicable to commercial loans provides for FDIC loss sharing for five years and Company reimbursement to the FDIC for a total of eight years for recoveries. All of the covered loans acquired are accounted for pursuant to ASC Topic 310-30.

The table below summarizes the Company’s loan mix over the most recent five quarter ends.

Loan mix (unaudited)

| At quarter ended: |

12/31/13 | 9/30/13 | 6/30/13 | 3/31/13 | 12/31/12 | |||||||||||||||

| Loans not covered by FDIC loss share agreements |

||||||||||||||||||||

| Real estate loans |

||||||||||||||||||||

| Residential |

$ | 458,331 | $ | 449,224 | $ | 437,946 | $ | 432,892 | $ | 428,554 | ||||||||||

| Commercial |

528,710 | 529,172 | 504,487 | 478,790 | 480,494 | |||||||||||||||

| Land, development and construction loans |

62,503 | 60,375 | 60,928 | 59,524 | 55,474 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total real estate loans |

1,049,544 | 1,038,771 | 1,003,361 | 971,206 | 964,522 | |||||||||||||||

| Commercial loans |

143,263 | 126,451 | 124,465 | 115,217 | 124,225 | |||||||||||||||

| Consumer and other loans, (note 1) |

1,148 | 1,259 | 2,851 | 2,818 | 2,732 | |||||||||||||||

| Consumer and other loans |

49,547 | 49,065 | 48,084 | 47,991 | 48,547 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total loans before unearned fees and costs |

1,243,502 | 1,215,546 | 1,178,761 | 1,137,232 | 1,140,026 | |||||||||||||||

| Unearned fees and costs |

404 | 135 | (2 | ) | (217 | ) | (458 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total loans not covered by FDIC loss share agreements |

1,243,906 | 1,215,681 | 1,178,759 | 1,137,015 | 1,139,568 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loans covered by FDIC loss share agreements |

||||||||||||||||||||

| Real estate loans |

||||||||||||||||||||

| Residential |

120,030 | 124,027 | 128,930 | 135,068 | 142,480 | |||||||||||||||

| Commercial |

100,012 | 109,285 | 118,999 | 130,549 | 134,413 | |||||||||||||||

| Land, development and construction loans |

6,381 | 5,673 | 4,897 | 7,777 | 13,259 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total real estate loans |

226,423 | 238,985 | 252,826 | 273,394 | 290,152 | |||||||||||||||

| Commercial loans |

3,850 | 3,906 | 4,002 | 4,577 | 6,143 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total loans covered by FDIC loss share agreements |

230,273 | 242,891 | 256,828 | 277,971 | 296,295 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Loans |

$ | 1,474,179 | $ | 1,458,572 | $ | 1,435,587 | $ | 1,414,986 | $ | 1,435,863 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| note 1: | Consumer loans acquired pursuant to five FDIC assisted transactions of failed financial institutions during the third quarter of 2010 and first quarter of 2012. These loans are not covered by an FDIC loss share agreement and are being accounted for pursuant to ASC Topic 310-30. |

12

Credit quality and allowance for loan losses

During the quarter, excluding loans covered by FDIC loss share agreements, the Company recorded a loan loss provision expense of $746 and charge-offs net of recoveries of $317, resulting in an increase in the allowance for loan losses (excluding covered loans) of $429 as shown in the table below.

With regard to loans covered by FDIC loss share agreements, the Company recorded a negative loan loss provision expense of $563 and charge-offs of $733, resulting in a decrease in the allowance for loan losses on covered loans of $1,296. See the table “Allowance for loan losses” for additional information.

The allowance for loan losses (“ALLL”) was $20,454 at December 31, 2013 compared to $21,321 at September 30, 2013, a decrease of $867. This decrease is the result of the aggregate effect of a $598 decrease in general loan loss allowance, a $1,027 increase in the specific loan loss allowance related to impaired loans and a $1,296 decrease in the loan loss allowance related to certain impaired loan pools of FDIC covered loans accounted for pursuant to ASC Topic 310-30. The changes in the Company’s ALLL components between December 31, 2013 and September 30, 2013 are summarized in the table below.

| Dec 31, 2013 | Sept 30, 2013 | increase (decrease) | ||||||||||||||||||||||||||||||||||

| loan | ALLL | loan | ALLL | loan | ALLL | |||||||||||||||||||||||||||||||

| balance | balance | % | balance | balance | % | balance | balance |

|

||||||||||||||||||||||||||||

| Non impaired loans |

$ | 1,219,796 | $ | 17,883 | 1.47 | % | $ | 1,175,801 | $ | 18,481 | 1.57 | % | $ | 43,995 | $ | (598 | ) | -10 bps | ||||||||||||||||||

| Impaired loans |

24,110 | 1,811 | 7.51 | % | 39,880 | 784 | 1.97 | % | (15,770 | ) | 1,027 | 554 bps | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Loans (note 1) |

1,243,906 | 19,694 | 1.58 | % | 1,215,681 | 19,265 | 1.58 | % | 28,225 | 429 | — bps | |||||||||||||||||||||||||

| Covered loans (note 2) |

230,273 | 760 | 242,891 | 2,056 | (12,618 | ) | (1,296 | ) | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total loans |

$ | 1,474,179 | $ | 20,454 | 1.39 | % | $ | 1,458,572 | $ | 21,321 | 1.46 | % | $ | 15,607 | $ | (867 | ) | -7 bps | ||||||||||||||||||

| note 1: | Total loans not covered by FDIC loss share agreements. |

| note 2: | Loans covered by FDIC loss share agreements. Eighty percent of any losses in this portfolio will be reimbursed by the FDIC and recognized as FDIC indemnification income and included in non-interest income within the Company’s condensed consolidated statement of operations. Four loan pools with an aggregate carrying value of $8,005 are impaired at December 31, 2013, and have a specific allowance of $760. The aggregate carrying value of $8,005 represents approximately 77% of the underlying loan balances outstanding. |

The general loan loss allowance (non-impaired loans) decreased by a net amount of $598. This decrease was primarily due to the Company’s continued improvement in its credit metrics, as evidenced by the continued decline in the Company’s two year charge-off history, partially offset by the growth in its non-impaired loan portfolio.

The specific loan loss allowance (impaired loans) is the aggregate of the results of individual analyses prepared for each one of the impaired loans not covered by an FDIC loss share agreement. The Company recorded partial charge offs in lieu of specific allowance for a number of the impaired loans. The Company’s impaired loans have been written down by $2,772 to $24,110 ($22,299 when the $1,811 specific allowance is considered) from their legal unpaid principal balance outstanding of $26,882. In the aggregate, total impaired loans have been written down to approximately 83% of their legal unpaid principal balance, and non-performing impaired loans have been written down to approximately 75% of their legal unpaid principal balance. The Company’s total non-performing loans (non-accrual loans plus loans past due greater than 90 days and still accruing, $27,107 at December 31, 2013) have been written down to approximately 77% of their legal unpaid principal balance.

13

Approximately $10,763 of the Company’s impaired loans (45%) are accruing performing loans. This group of impaired loans is not included in the Company’s non-performing loans or non-performing assets categories.

Any losses in loans covered by FDIC loss share agreements, as described in note 2 above, are reimbursable from the FDIC to the extent of 80% of such losses. These loans are being accounted for pursuant to ASC Topic 310-30. Loan pools in this portfolio are evaluated for impairment each quarter. If a pool is impaired, an allowance for loan loss is recorded.

Management believes the Company’s allowance for loan losses is adequate at December 31, 2013. However, management recognizes that many factors can adversely impact various segments of the Company’s market and customers, and therefore there is no assurance as to the amount of losses or probable losses which may develop in the future. The table below summarizes the changes in allowance for loan losses during the previous five quarters.

Allowance for loan losses (unaudited)

| as of or for the quarter ending |

12/31/13 | 9/30/13 | 6/30/13 | 3/31/13 | 12/31/12 | |||||||||||||||

| Loans not covered by FDIC loss share agreements |

||||||||||||||||||||

| Allowance at beginning of period |

$ | 19,265 | $ | 21,800 | $ | 22,631 | $ | 24,033 | $ | 24,019 | ||||||||||

| Charge-offs |

(774 | ) | (1,570 | ) | (2,603 | ) | (1,231 | ) | (2,121 | ) | ||||||||||

| Recoveries |

457 | 344 | 310 | 163 | 293 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net charge-offs |

(317 | ) | (1,226 | ) | (2,293 | ) | (1,068 | ) | (1,828 | ) | ||||||||||

| Provision for loan losses |

746 | (1,309 | ) | 1,462 | (334 | ) | 1,842 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Allowance at end of period for loans not covered by FDIC loss share agreements |

$ | 19,694 | $ | 19,265 | $ | 21,800 | $ | 22,631 | $ | 24,033 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loans covered by FDIC loss share agreements |

||||||||||||||||||||

| Allowance at beginning of period |

$ | 2,056 | $ | 2,020 | $ | 2,623 | $ | 2,649 | $ | 2,322 | ||||||||||

| Charge-offs |

(733 | ) | — | (515 | ) | — | — | |||||||||||||

| Recoveries |

— | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net charge-offs |

(733 | ) | — | (515 | ) | — | — | |||||||||||||

| Provision for loan losses |

(563 | ) | 36 | (88 | ) | (26 | ) | 327 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Allowance at end of period for loans covered by FDIC loss share agreements |

$ | 760 | $ | 2,056 | $ | 2,020 | $ | 2,623 | $ | 2,649 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total allowance at end of period |

$ | 20,454 | $ | 21,321 | $ | 23,820 | $ | 25,254 | $ | 26,682 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

The Company defines non-performing loans (“NPLs”) as non-accrual loans plus loans past due 90 days or more and still accruing interest. NPLs do not include loans covered by FDIC loss share agreements, which are accounted for pursuant to ASC Topic 310-30. NPLs as a percentage of total loans not covered by FDIC loss share agreements were 2.18% at December 31, 2013 compared to 1.74% at September 30, 2013.

Non-performing assets (“NPAs”) (which the Company defines as NPLs, as defined above, plus (a) OREO (i.e. real estate acquired through foreclosure, in-substance foreclosure, or deed in lieu of foreclosure), excluding OREO covered by FDIC loss share agreement; and (b) other repossessed assets that are not real estate, and are not covered by FDIC loss share agreement), were $33,666 at December 31, 2013, compared to $26,084 at September 30, 2013. NPAs as a percentage of total assets was 1.39% at December 31, 2013 compared to 1.12% at September 30, 2013. NPAs as a percentage of loans plus OREO and other repossessed assets, excluding loans and OREO covered by FDIC loss share agreements, was 2.69% at December 31, 2013 compared to 2.14% at September 30, 2013.

14

The table below summarizes selected credit quality data for the periods indicated.

Selected credit quality ratios (unaudited)

| As of or for the quarter ended: |

12/31/13 | 9/30/13 | 6/30/13 | 3/31/13 | 12/31/12 | |||||||||||||||

| Non-accrual loans (note 1) |

$ | 27,077 | $ | 21,104 | $ | 24,219 | $ | 24,456 | $ | 25,448 | ||||||||||

| Past due loans 90 days or more and still accruing interest (note 1) |

30 | 35 | 615 | 316 | 293 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total non-performing loans (“NPLs”) (note 1) |

27,107 | 21,139 | 24,834 | 24,772 | 25,741 | |||||||||||||||

| Other real estate owned (OREO) (note 1) |

6,409 | 4,804 | 5,469 | 6,186 | 6,875 | |||||||||||||||

| Repossessed assets other than real estate (note 1) |

150 | 141 | 223 | 380 | 770 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total non-performing assets (“NPAs”) (note 1) |

$ | 33,666 | $ | 26,084 | $ | 30,526 | $ | 31,338 | $ | 33,386 | ||||||||||

| Non-performing loans as percentage of total loans not covered by FDIC loss share agreements |

2.18 | % | 1.74 | % | 2.11 | % | 2.18 | % | 2.26 | % | ||||||||||

| Non-performing assets as percentage of total assets |

1.39 | % | 1.12 | % | 1.30 | % | 1.31 | % | 1.41 | % | ||||||||||

| Non-performing assets as percentage of loans and OREO plus other repossessed assets (note 1) |

2.69 | % | 2.14 | % | 2.58 | % | 2.74 | % | 2.91 | % | ||||||||||

| Net charge-offs (note 1) |

$ | 317 | $ | 1,226 | $ | 2,293 | $ | 1,068 | $ | 1,828 | ||||||||||

| Net charge-offs as a percentage of average loans for the period (note 1) |

0.03 | % | 0.10 | % | 0.20 | % | 0.09 | % | 0.16 | % | ||||||||||

| Net charge-offs as a percentage of average loans for the period on an annualized basis (note 1) |

0.12 | % | 0.40 | % | 0.80 | % | 0.36 | % | 0.64 | % | ||||||||||

| Loans past due 30 thru 89 days and accruing interest as a percentage of total loans (note 1) |

0.85 | % | 0.75 | % | 0.99 | % | 1.06 | % | 0.65 | % | ||||||||||

| Allowance for loan losses as percentage of NPLs (note 1) |

73 | % | 91 | % | 88 | % | 91 | % | 93 | % | ||||||||||

| Troubled debt restructure (“TDRs”) (note 2) |

$ | 15,447 | $ | 15,811 | $ | 13,103 | $ | 14,073 | $ | 14,660 | ||||||||||

| Impaired loans that were not TDRs |

8,663 | 24,069 | 25,590 | 26,031 | 33,519 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total impaired loans |

24,110 | 39,880 | 38,693 | 40,104 | 48,179 | |||||||||||||||

| Non impaired loans |

1,219,796 | 1,175,801 | 1,140,066 | 1,096,911 | 1,091,389 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total loans not covered by FDIC loss share agreements |

1,243,906 | 1,215,681 | 1,178,759 | 1,137,015 | 1,139,568 | |||||||||||||||

| Total loans covered by FDIC loss share agreements |

230,273 | 242,891 | 256,828 | 277,971 | 296,295 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total loans |

$ | 1,474,179 | $ | 1,458,572 | $ | 1,435,587 | $ | 1,414,986 | $ | 1,435,863 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| As of or for the quarter ended: |

12/31/13 | 9/30/13 | 6/30/13 | 3/31/13 | 12/31/12 | |||||||||||||||

| Allowance for loan losses for loans not covered by FDIC loss share agreements |

||||||||||||||||||||

| Specific loan loss allowance- impaired loans |

$ | 1,811 | $ | 784 | $ | 600 | $ | 990 | $ | 1,022 | ||||||||||

| General loan loss allowance- non impaired |

17,883 | 18,481 | 21,200 | 21,641 | 23,011 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total allowance for loan losses |

$ | 19,694 | $ | 19,265 | $ | 21,800 | $ | 22,631 | $ | 24,033 | ||||||||||

| Allowance for loan loss percentage of period end loans: |

||||||||||||||||||||

| Impaired loans (note 1) |

7.51 | % | 1.97 | % | 1.55 | % | 2.47 | % | 2.12 | % | ||||||||||

| All other non impaired loans (note 1) |

1.47 | % | 1.57 | % | 1.86 | % | 1.97 | % | 2.11 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total loans (note 1) |

1.58 | % | 1.58 | % | 1.85 | % | 1.99 | % | 2.11 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Note 1: | Excludes loans, OREO and other repossessed assets covered by FDIC loss share agreements. |

| Note 2: | The Company has approximately $15,447 of TDRs. Of this amount $10,763 are performing pursuant to their modified terms, and $4,684 are not performing and have been placed on non-accrual status and included in non performing loans (“NPLs”). Current accounting standards require TDRs to be included in our impaired loans, whether they are performing or not performing. Only non performing TDRs are included in our NPLs. |

15

Deposit activity

During the quarter, total deposits increased by $94,276 (time deposits decreased by $15,333 and non-time deposits increased by $109,609). Most of the increase came from commercial checking account balances. The loan to deposit ratio was approximately 71.7% at quarter end. The cost of interest bearing deposits in the current quarter remained approximately the same compared to the prior quarter. The overall cost of total deposits (i.e. includes non-interest bearing checking accounts) decreased by 1 bps to 0.24% in the current quarter compared to 0.25% in the prior quarter. The table below summarizes the Company’s deposit mix over the periods indicated.

Deposit mix (unaudited)

| For the quarter ended: |

12/31/13 | 9/30/13 | 6/30/13 | 3/31/13 | 12/31/12 | |||||||||||||||

| Checking accounts |

||||||||||||||||||||

| Non-interest bearing |

$ | 644,915 | $ | 562,027 | $ | 555,721 | $ | 565,404 | $ | 519,510 | ||||||||||

| Interest bearing |

483,842 | 452,583 | 456,660 | 459,528 | 452,961 | |||||||||||||||

| Savings deposits |

232,942 | 240,431 | 241,609 | 239,127 | 238,216 | |||||||||||||||

| Money market accounts |

309,657 | 306,706 | 312,891 | 316,785 | 311,241 | |||||||||||||||

| Time deposits |

384,875 | 400,208 | 409,811 | 432,752 | 475,304 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total deposits |

$ | 2,056,231 | $ | 1,961,955 | $ | 1,976,692 | $ | 2,013,596 | $ | 1,997,232 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Non time deposits as percentage of total deposits |

81 | % | 80 | % | 79 | % | 79 | % | 76 | % | ||||||||||

| Time deposits as percentage of total deposits |

19 | % | 20 | % | 21 | % | 21 | % | 24 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total deposits |

100 | % | 100 | % | 100 | % | 100 | % | 100 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

16

Presented below are condensed consolidated balance sheets and average balance sheets for the periods indicated.

Condensed Consolidated Balance Sheets (unaudited)

| For the quarter ended: |

12/31/13 | 9/30/13 | 6/30/13 | 3/31/13 | 12/31/12 | |||||||||||||||

| Cash and due from banks |

$ | 21,581 | $ | 21,216 | $ | 21,160 | $ | 20,823 | $ | 19,160 | ||||||||||

| Fed funds sold and Fed Res Bank deposits |

153,308 | 85,600 | 82,395 | 155,872 | 117,588 | |||||||||||||||

| Trading securities |

— | 398 | — | — | 5,048 | |||||||||||||||

| Investments securities, available for sale |

457,086 | 456,555 | 492,087 | 460,534 | 425,758 | |||||||||||||||

| Loans held for sale |

1,010 | 1,317 | 1,760 | 2,131 | 2,709 | |||||||||||||||

| Loans covered by FDIC loss share agreements |

230,273 | 242,891 | 256,828 | 277,971 | 296,295 | |||||||||||||||

| Loans not covered by FDIC loss share agreements |

1,243,906 | 1,215,681 | 1,178,759 | 1,137,015 | 1,139,568 | |||||||||||||||

| Allowance for loan losses |

(20,454 | ) | (21,321 | ) | (23,820 | ) | (25,254 | ) | (26,682 | ) | ||||||||||

| FDIC indemnification assets |

73,433 | 81,603 | 88,716 | 97,958 | 119,289 | |||||||||||||||

| Premises and equipment, net |

96,619 | 97,289 | 96,506 | 96,946 | 97,954 | |||||||||||||||

| Goodwill |

44,924 | 44,924 | 44,924 | 44,924 | 44,924 | |||||||||||||||

| Core deposit intangible |

4,958 | 5,196 | 5,441 | 5,691 | 5,944 | |||||||||||||||

| Bank owned life insurance |

49,285 | 48,961 | 48,634 | 48,296 | 47,957 | |||||||||||||||

| OREO covered by FDIC loss share agreements |

19,111 | 21,633 | 28,532 | 29,434 | 26,783 | |||||||||||||||

| OREO not covered by FDIC loss share agreements |

6,409 | 4,804 | 5,469 | 6,186 | 6,875 | |||||||||||||||

| Other assets |

34,118 | 29,274 | 27,962 | 30,712 | 34,070 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| TOTAL ASSETS |

$ | 2,415,567 | $ | 2,336,021 | $ | 2,355,353 | $ | 2,389,239 | $ | 2,363,240 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Deposits |

$ | 2,056,231 | $ | 1,961,955 | $ | 1,976,692 | $ | 2,013,596 | $ | 1,997,232 | ||||||||||

| Federal funds purchased |

29,909 | 45,356 | 53,274 | 45,130 | 38,932 | |||||||||||||||

| Other borrowings |

37,453 | 39,140 | 38,873 | 37,398 | 35,762 | |||||||||||||||

| Other liabilities |

18,595 | 16,829 | 15,098 | 16,890 | 17,783 | |||||||||||||||

| Common stockholders’ equity |

273,379 | 272,741 | 271,416 | 276,225 | 273,531 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

$ | 2,415,567 | $ | 2,336,021 | $ | 2,355,353 | $ | 2,389,239 | $ | 2,363,240 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Condensed Consolidated Average Balance Sheets (unaudited)

| For quarter ended: |

12/31/13 | 9/30/13 | 6/30/13 | 3/31/13 | 12/31/12 | |||||||||||||||

| Federal funds sold and other |

$ | 161,270 | $ | 80,346 | $ | 179,982 | $ | 137,776 | $ | 138,236 | ||||||||||

| Security investments |

453,658 | 471,114 | 437,815 | 460,228 | 434,059 | |||||||||||||||

| Loans covered by FDIC loss share agreements |

239,620 | 249,154 | 264,769 | 284,151 | 309,502 | |||||||||||||||

| Loans not covered by FDIC loss share agreements |

1,231,052 | 1,195,105 | 1,155,737 | 1,136,076 | 1,138,127 | |||||||||||||||

| Allowance for loan losses |

(21,438 | ) | (23,819 | ) | (23,962 | ) | (26,782 | ) | (26,930 | ) | ||||||||||

| All other assets |

341,437 | 377,072 | 367,969 | 398,334 | 395,267 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| TOTAL ASSETS |

$ | 2,405,599 | $ | 2,348,972 | $ | 2,382,310 | $ | 2,389,783 | $ | 2,388,261 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Deposits- interest bearing |

$ | 1,405,244 | $ | 1,402,753 | $ | 1,433,806 | $ | 1,462,511 | $ | 1,490,327 | ||||||||||

| Deposits- non interest bearing |

635,383 | 581,827 | 574,345 | 545,579 | 521,890 | |||||||||||||||

| Federal funds purchased |

34,782 | 36,823 | 35,619 | 44,662 | 44,520 | |||||||||||||||

| Other borrowings |

36,723 | 39,834 | 40,812 | 37,356 | 36,972 | |||||||||||||||

| Other liabilities |

18,516 | 17,315 | 22,135 | 25,200 | 20,860 | |||||||||||||||

| Stockholders’ equity |

274,951 | 270,420 | 275,593 | 274,475 | 273,692 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

$ | 2,405,599 | $ | 2,348,972 | $ | 2,382,310 | $ | 2,389,783 | $ | 2,388,261 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

17

Non interest income and non interest expense

The table below summarizes the Company’s non-interest income for the periods indicated.

Quarterly Condensed Consolidated Non Interest Income (unaudited)

| For the quarter ended: |

12/31/13 | 9/30/13 | 6/30/13 | 3/31/13 | 12/31/12 | |||||||||||||||

| Income from correspondent banking and bond sales division |

$ | 3,070 | $ | 2,909 | $ | 4,904 | $ | 6,140 | $ | 6,450 | ||||||||||

| Other correspondent banking related revenue |

955 | 862 | 705 | 865 | 743 | |||||||||||||||

| Wealth management related revenue |

1,172 | 1,179 | 1,130 | 1,070 | 942 | |||||||||||||||

| Service charges on deposit accounts |

2,313 | 2,244 | 2,081 | 1,819 | 1,825 | |||||||||||||||

| Debit, prepaid, ATM and merchant card related fees |

1,394 | 1,399 | 1,342 | 1,285 | 1,242 | |||||||||||||||

| BOLI income |

324 | 327 | 338 | 339 | 355 | |||||||||||||||

| Other service charges and fees |

262 | 190 | 231 | 302 | 278 | |||||||||||||||

| Gain on sale of securities available for sale |

22 | — | 1,008 | 30 | 420 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Subtotal |

$ | 9,512 | $ | 9,110 | $ | 11,739 | $ | 11,850 | $ | 12,255 | ||||||||||

| FDIC indemnification asset – amortization (see explanation below) |

(4,500 | ) | (3,836 | ) | (3,272 | ) | (2,199 | ) | (1,540 | ) | ||||||||||

| FDIC indemnification income |

185 | 3,333 | 1,396 | 628 | 2,025 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total non-interest income |

$ | 5,197 | $ | 8,607 | $ | 9,863 | $ | 10,279 | $ | 12,740 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

The FDIC indemnification asset (“IA”) is producing amortization (versus accretion) due to reductions in the estimated losses in the FDIC covered loan portfolio. To the extent current projected losses in the covered loan portfolio are less than originally projected losses, the related projected reimbursements from the FDIC contemplated in the IA are less, which produces a negative income accretion in non-interest income. This event corresponds to the increase in yields in the FDIC covered loan portfolio, although there is not perfect correlation. Higher expected cash flows (i.e. less expected future losses) on the loan side of the equation is accreted into interest income over the life of the related loan pool. The lower expected reimbursement from the FDIC (i.e. 80% of the lower expected future losses) is amortized over the lesser of the remaining life of the related loan pool(s) or the remaining term of the loss share period.

When a FDIC covered OREO property is sold at a loss, the loss is included in non-interest expense as loss on sale of OREO, and approximately eighty percent of the loss is recorded as FDIC indemnification income and included in non-interest income. In addition, eighty percent of any related loan pool impairments also are reflected in this non-interest income account.

18

The table below summarizes the Company’s non-interest expense for the periods indicated.

Quarterly Condensed Consolidated Non Interest Expense (unaudited)

| For the quarter ended: |

12/31/13 | 9/30/13 | 6/30/13 | 3/31/13 | 12/31/12 | |||||||||||||||

| Employee salaries and wages |

$ | 11,200 | $ | 11,168 | $ | 12,142 | $ | 12,665 | $ | 12,580 | ||||||||||

| Employee incentive/bonus compensation accrued |

1,375 | 1,325 | 1,171 | 1,094 | 1,032 | |||||||||||||||

| Employee stock based compensation expense |

173 | 147 | 143 | 146 | 153 | |||||||||||||||

| Deferred compensation expense |

147 | 147 | 134 | 141 | 124 | |||||||||||||||

| Health insurance and other employee benefits |

968 | 842 | 796 | 951 | 878 | |||||||||||||||

| Payroll taxes |

613 | 655 | 733 | 1,017 | 610 | |||||||||||||||

| 401K employer contributions |

268 | 276 | 308 | 367 | 236 | |||||||||||||||

| Other employee related expenses |

381 | 272 | 344 | 296 | 336 | |||||||||||||||

| Incremental direct cost of loan origination |

(575 | ) | (487 | ) | (537 | ) | (437 | ) | (228 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total salaries, wages and employee benefits |

14,550 | 14,345 | 15,234 | 16,240 | 15,721 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (Gain) loss on sale of OREO |

(93 | ) | 68 | 177 | 76 | (17 | ) | |||||||||||||

| Loss (gain) on sale of FDIC covered OREO |

801 | 1,784 | 386 | (77 | ) | 548 | ||||||||||||||

| Valuation write down of OREO |

110 | 338 | 295 | 342 | 287 | |||||||||||||||

| Valuation write down of FDIC covered OREO |

51 | 2,846 | 1,385 | 645 | 1,146 | |||||||||||||||

| Loss (gain) on repossessed assets other than real estate |

16 | 39 | 104 | 242 | (52 | ) | ||||||||||||||

| Loan put back expense |

— | — | — | 4 | 734 | |||||||||||||||

| Foreclosure and repossession related expenses |

477 | 376 | 438 | 441 | 355 | |||||||||||||||

| Foreclosure and repo expense, FDIC (note 1) |

458 | 304 | 349 | 348 | 572 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total credit related expenses |

1,820 | 5,755 | 3,134 | 2,021 | 3,573 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Occupancy expense |

1,944 | 1,924 | 1,942 | 1,892 | 1,909 | |||||||||||||||

| Depreciation of premises and equipment |

1,560 | 1,364 | 1,455 | 1,497 | 1,530 | |||||||||||||||

| Supplies, stationary and printing |

280 | 268 | 285 | 288 | 245 | |||||||||||||||

| Marketing expenses |

681 | 722 | 586 | 528 | 655 | |||||||||||||||

| Data processing expenses |

962 | 1,026 | 912 | 884 | 1,131 | |||||||||||||||

| Legal, auditing and other professional fees |

951 | 1,176 | 844 | 783 | 755 | |||||||||||||||

| Bank regulatory related expenses |

565 | 588 | 635 | 581 | 448 | |||||||||||||||

| Postage and delivery |

266 | 266 | 267 | 285 | 279 | |||||||||||||||

| ATM and debit card related expenses |

414 | 435 | 428 | 511 | 377 | |||||||||||||||

| Amortization of CDI |

237 | 246 | 250 | 253 | 284 | |||||||||||||||

| Internet and telephone banking |

334 | 286 | 239 | 224 | 235 | |||||||||||||||

| Put back option amortization expense |

— | — | — | 37 | 134 | |||||||||||||||

| Correspondent account and Federal Reserve charges |

116 | 114 | 120 | 109 | 115 | |||||||||||||||

| Conferences, seminars, education and training |

155 | 138 | 138 | 153 | 114 | |||||||||||||||

| Director fees |

102 | 99 | 102 | 102 | 103 | |||||||||||||||

| Travel expenses |

102 | 119 | 104 | 74 | 114 | |||||||||||||||

| Other expenses |

871 | 796 | 698 | 628 | 753 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Subtotal |

25,910 | 29,667 | 27,373 | 27,090 | 28,475 | |||||||||||||||

| Merger, acquisition and conversion related expenses |

539 | 183 | — | — | 55 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total non- interest expense |

$ | 26,449 | $ | 29,850 | $ | 27,373 | $ | 27,090 | $ | 28,530 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| note 1: | These are foreclosure and repossession related expenses related to FDIC covered assets, and are shown net of FDIC reimbursable amounts pursuant to FDIC loss share agreements. |

19

Explanation of Certain Unaudited Non-GAAP Financial Measures

This press release contains financial information determined by methods other than Generally Accepted Accounting Principles (“GAAP”). The financial highlights provide reconciliations between GAAP interest income, net interest income and tax equivalent basis interest income and net interest income, as well as total stockholders’ equity and tangible common equity. It also reconciles income before income taxes and Pre-tax Pre-Provision (“PTPP”) earnings. Management uses these non-GAAP financial measures in its analysis of the Company’s performance and believes these presentations provide useful supplemental information, and a clearer understanding of the Company’s performance. The Company believes the non-GAAP measures enhance investors’ understanding of the Company’s business and performance. These measures are also useful in understanding performance trends and facilitate comparisons with the performance of other financial institutions. The limitations associated with operating measures are the risk that persons might disagree as to the appropriateness of items comprising these measures and that different companies might calculate these measures differently. The Company provides reconciliations between GAAP and these non-GAAP measures. These disclosures should not be considered an alternative to GAAP.

Reconciliation of GAAP to non-GAAP Measures (unaudited):

| 4Q13 | 3Q13 | 4Q12 | ||||||||||

| Interest income, as reported (GAAP) |

$ | 25,479 | $ | 26,034 | $ | 23,265 | ||||||

| tax equivalent adjustments |

368 | 354 | 320 | |||||||||

|

|

|

|

|

|

|

|||||||

| Interest income (tax equivalent) |

$ | 25,847 | $ | 26,388 | $ | 23,585 | ||||||

|

|

|

|

|

|

|

|||||||

| Net interest income, as reported (GAAP) |

$ | 24,081 | $ | 24,610 | $ | 21,539 | ||||||

| tax equivalent adjustments |

368 | 354 | 320 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net interest income (tax equivalent) |

$ | 24,449 | $ | 24,964 | $ | 21,859 | ||||||

|

|

|

|

|

|

|

|||||||

| 12/31/13 | 9/30/13 | 6/30/13 | 3/31/13 | 12/31/12 | ||||||||||||||||

| Total stockholders’ equity (GAAP) |

$ | 273,379 | $ | 272,741 | $ | 271,416 | $ | 276,225 | $ | 273,531 | ||||||||||

| Goodwill |

(44,924 | ) | (44,924 | ) | (44,924 | ) | (44,924 | ) | (44,924 | ) | ||||||||||

| Core deposit intangible |

(4,958 | ) | (5,196 | ) | (5,441 | ) | (5,691 | ) | (5,944 | ) | ||||||||||

| Trust intangible |

(1,158 | ) | (1,209 | ) | (1,259 | ) | (1,309 | ) | (1,363 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Tangible common equity |

$ | 222,339 | $ | 221,412 | $ | 219,792 | $ | 224,301 | $ | 221,300 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 4Q13 | 3Q13 | 2Q13 | 1Q13 | 4Q12 | ||||||||||||||||

| Income before income tax (GAAP) |

$ | 2,646 | $ | 4,640 | $ | 4,096 | $ | 6,371 | $ | 3,580 | ||||||||||

| exclude provision for loan losses |

183 | (1,273 | ) | 1,374 | (360 | ) | 2,169 | |||||||||||||

| FDIC income from pool impairment |

450 | (28 | ) | 70 | 21 | (261 | ) | |||||||||||||

| exclude other credit related costs |

1,820 | 5,755 | 3,134 | 2,021 | 3,573 | |||||||||||||||

| OREO indemnification income from FDIC |

(635 | ) | (3,305 | ) | (1,466 | ) | (649 | ) | (1,764 | ) | ||||||||||

| exclude gain on sale of AFS securities |

(22 | ) | — | (1,008 | ) | (30 | ) | (420 | ) | |||||||||||

| exclude non-recurring items: |

||||||||||||||||||||

| gain on sale of bank owned property held for sale |

— | — | — | (31 | ) | — | ||||||||||||||

| acquisition and conversion related expenses |

539 | 183 | — | — | 55 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PTPP earnings |

$ | 4,981 | $ | 5,972 | $ | 6,200 | $ | 7,343 | $ | 6,932 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

20

About CenterState Banks, Inc.

The Company, headquartered in Davenport, Florida, between Orlando and Tampa, is a bank holding company that was formed in June 2000 as part of a merger of three independent commercial banks. Currently, the Company operates through one subsidiary bank with 59 full service branch banking locations in 20 counties throughout central Florida. Through its subsidiary bank the Company provides a range of consumer and commercial banking services to individuals, businesses and industries.

In addition to providing traditional deposit and lending products and services to its commercial and retail customers in central Florida, the Company also operates a correspondent banking and bond sales division. The division is integrated with and part of the Company’s subsidiary bank located in Winter Haven, Florida, although the majority of the bond salesmen, traders and operations personnel are physically housed in leased facilities located in Birmingham, Alabama, Atlanta, Georgia and Winston-Salem, North Carolina. The customer base includes small to medium size financial institutions primarily located in southeastern United States.

For additional information contact Ernest S. Pinner, CEO, John C. Corbett, EVP, or James J. Antal, CFO, at 863-419-7750.

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995:

Some of the statements in this report constitute forward-looking statements, within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. These statements related to future events, other future financial and operating performance, costs, revenues, economic conditions in our markets, loan performance, credit risks, collateral values and credit conditions, or business strategies, including expansion and acquisition activities and may be identified by terminology such as “may,” “will,” “should,” “expects,” “scheduled,” “plans,” “intends,” “anticipates,” “believes,” “estimates,” “potential,” or “continue” or the negative of such terms or other comparable terminology. Actual events or results may differ materially. In evaluating these statements, you should specifically consider the factors described throughout this report. We cannot assure you that future results, levels of activity, performance or goals will be achieved, and actual results may differ from those set forth in the forward looking statements.

Forward-looking statements, with respect to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the actual results, performance or achievements of the Company or the Bank to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. You should not expect us to update any forward-looking statements. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, including, without limitation, those risks and uncertainties described in our annual report on Form 10-K for the year ended December 31, 2012, and otherwise in our SEC reports and filings.

21