Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CONVERGYS CORP | d653431d8k.htm |

| EX-99.2 - EX-99.2 - CONVERGYS CORP | d653431dex992.htm |

Convergys

Acquires Stream Global Services January 6, 2014

Exhibit 99.1 |

Forward Looking

Statements Statements about the expected timing, completion and effects of the proposed

transaction and all other statements in this report and the exhibits furnished or filed

herewith, other than historical facts,

constitute

“forward-looking

statements”

as

defined

under

U.S.

federal

securities

laws.

In

some

cases,

one

can

identify

forward

looking

statements

by

terminology

such

as

“will,”

“expect,”

“estimate,”

“think,”

“forecast,”

“guidance,

“outlook,”

“plan,”

“lead,”

“project”

or

other

comparable

terminology. Forward-looking statements are subject to certain risks and uncertainties that

could cause actual results to differ materially from our historical experience and our

present expectations or

projections.

These

risks

include,

but

are

not

limited

to:

(i)

the

ability

of

the

parties

to

satisfy

the

conditions precedent and consummate the proposed transaction; (ii) the timing of consummation

of the proposed transaction; (iii) the ability of the parties to secure regulatory

approvals in a timely manner or on the terms desired or anticipated; (iv) the ability of

Convergys to integrate the acquired operations, implement the anticipated business plans

of the combined company following closing and achieve anticipated benefits and cost

savings, (v) risks related to disruption of management’s attention from ongoing

business operations due to the pending transaction; (vi) the effect of the announcement

of the proposed transaction on either party’s relationships with its respective

customers, vendors, lenders, operating results and businesses generally; and (vii) those

factors contained

in

our

periodic

reports

filed

with

the

SEC,

including

in

the

“Risk

Factors”

section

of

our

most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q. The

forward-looking information in this document is given as of the date of the

particular statement and we assume no duty

to

update

this

information.

Our

filings

and

other

important

information

are

also

available

on

the

investor relations page of our web site at www.convergys.com.

2 |

Transaction

Summary 3

•

Convergys to acquire Stream for $820M in cash

Transaction

•

Combination creates $3 billion market leader

Combined

Company

•

$400M in cash (including $150M held offshore)

•

$420M in fully committed financing

Financing

•

Expect ~$0.35 incremental non-GAAP EPS first 12 months

•

Expect

$25M/yr

cost

synergies:

50%

1

st

year,

100%

year

2

•

$40M net cash tax benefit from NOLs and other attributes

Financial

Benefits

•

Expect to close by end of first quarter 2014

•

Conditional on customary regulatory filings

Conditions/

Timing |

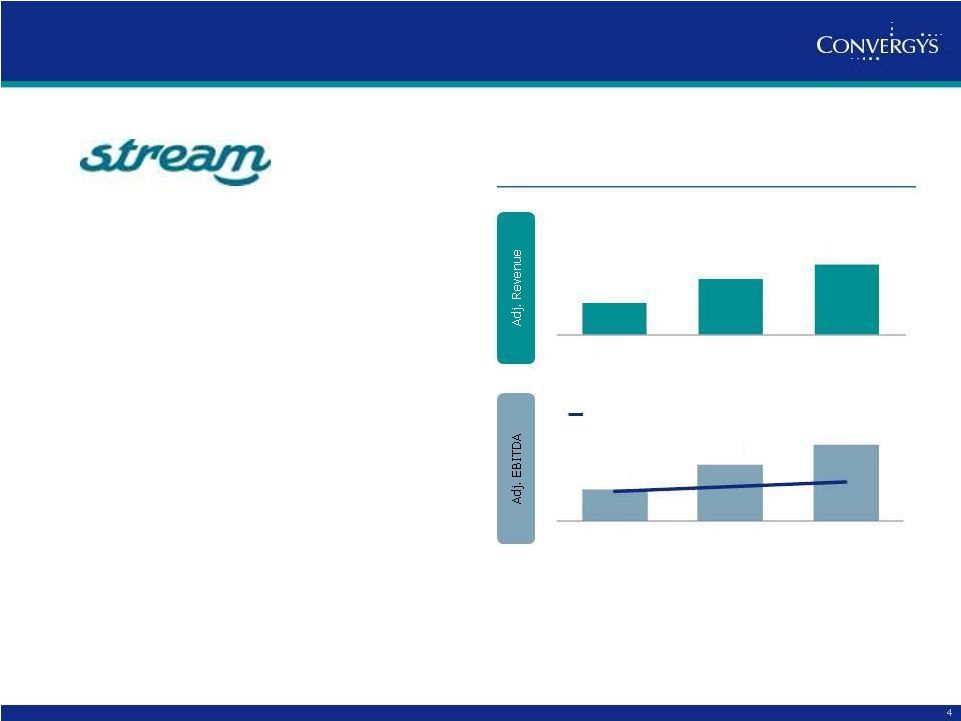

Stream: Premier

Global Services Provider •

Global service provider

–

40,000 employees, 56 contact centers, 35

languages, 22 countries

–

Americas, EMEA, Asia-Pacific, CALA

•

Serving marquee client base

–

leading companies in the Fortune 1000

•

Across wide breadth of industries

–

technology, computing, telecom, retail,

entertainment/media, financial services

•

Diverse service capabilities

–

technical support, customer care, sales

Margin

* Pro forma includes contribution from LBM

Overview

$865

$915

$943

2010

2011

2012

$75

$95

$111

9%

10%

12%

2010

2011

2012

Historical Adjusted Revenue and EBITDA* |

Stream Meets

Disciplined Selection Criteria Revenue trajectory

Organic growth

Organic growth

Complementary clients

Fortune 1000

marquee clients

Fortune 1000

marquee clients

EMEA/CALA

expansion

EMEA/CALA

expansion

Technical support

leader

Technical support

leader

Senior talent to

join Convergys

Senior talent to

join Convergys

Multiple in line

with precedents

Multiple in line

with precedents

Selection Criteria

Stream

Presence in desired geographies

Capabilities clients value

Strong management team

Valuation |

Strategic and

Financial Benefits of the Acquisition 6

Financial Benefits

Expands US and global presence

Combination creates #2 global service

provider by revenue

Cost synergy potential

Cost efficiencies from IT/IS infrastructure,

operations/support, executive and finance

Compatible business models, similar

structures and cultures ease integration

Strategic Benefits

More balanced revenue profile

More diversified client base, geographic

footprint and service capabilities

Enhances prospects for future revenue and

EPS growth

Preserves financial flexibility

Strong cash flow generation

Ample liquidity after close

Adds multi-shore delivery capacity

Provides new in-country language skills in

EMEA/CALA to serve multinational clients

Enhances geographic reach, breadth

of languages and service capabilities

Diversifies client portfolio

Highly accretive transaction

Reduces client concentration

Allows Convergys to apply its successful

business model across increased client base

Strengthens offering to technology clients

Leverages strong balance sheet

Tax efficient use of cash held offshore

Strong technical support expertise,

lead-generation solution offerings |

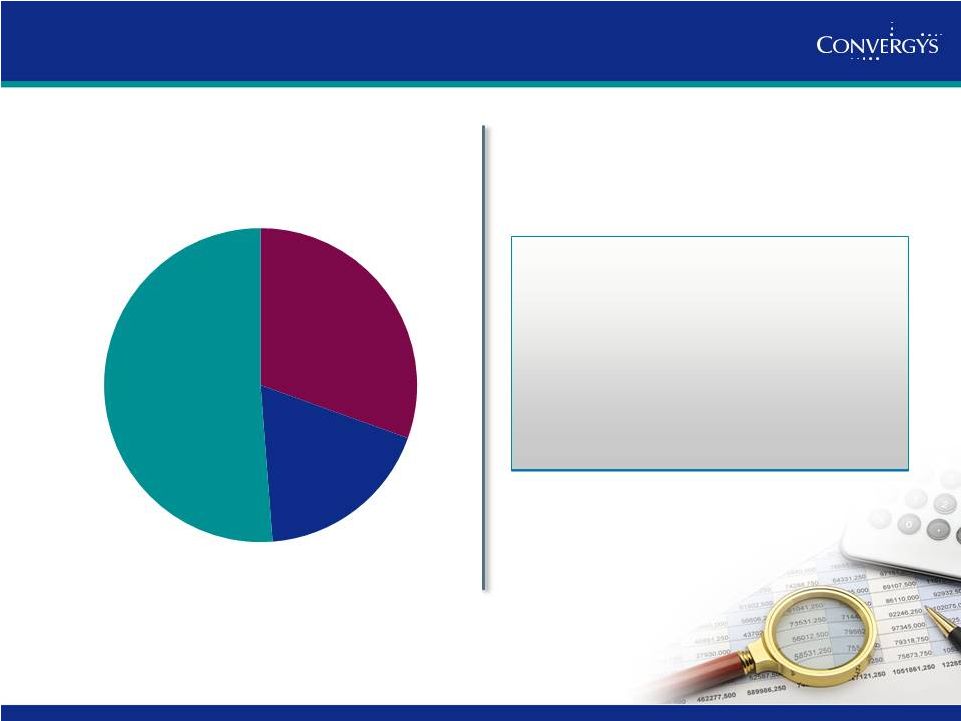

Today

7

RATIONALE #1:

Diversifies Base With Complementary Clients

Combined

(Pro Forma)

Reduces client concentration

Convergys Client Base Revenue Breakdown

Additional

Stream

clients

Top 3

clients

47%

Top 3

clients

33%

Rest of

clients

Rest of

clients |

RATIONALE #2:

Strengthens Services for Technology Industry

Technology Client Share

of Convergys Revenue

9%

2X

Combined Revenue by Vertical

(Pro Forma)

59%

Communications

6%

Financial

18%

Technology

17%

Other

Creates more balanced mix across industries

18%

Today

Combined |

RATIONALE #3:

Enhances Geographic Reach, Languages and Services

•

Adds European in-country

language support

•

Gain technical support services

expertise

•

LBM provides lead generation

services

9

Breadth of Languages and

Service Capabilities

Combined Revenue by Delivery Region

(Pro Forma)

47%

North America

20%

Rest of World

(EMEA/CALA)

34%

Asia

3X increase in EMEA/CALA share of revenue |

All Cash

Transaction, Ample Liquidity Post Close 10

100% Cash Funded

$820M Purchase Price

US Cash

$250

Offshore

Cash

$150

Fully

committed

debt

facilities

$420

*

Balance Sheet and Liquidity*

(Pro Forma $M)

Cash

~$200

Total debt/EBITDA ratio

1.6x

Debt

~$600

> $550

Available liquidity

Debt includes capital leases; available liquidity includes

undrawn revolver and A/R securitization

facilities, cash and short-term investments as of

transaction close. |

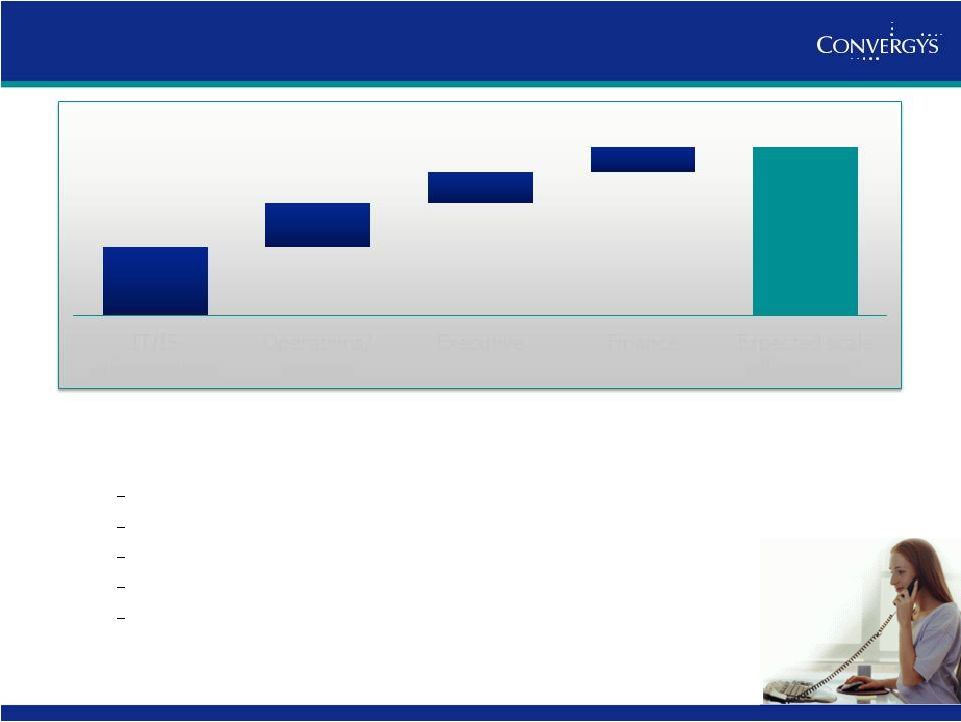

Complementary

Businesses Create Synergies 11

•

Planning to facilitate smooth integration into Convergys structure post close

significant diligence performed to identify synergies

combine all operations under global operating model

streamline IT/operations systems and tools

eliminate overlap job functions, standardize processes

Stream management augments operations and sales teams

* Expect to realize 50% first year, 100% within 24 months post close.

$25M

IT/IS

infrastructure

Operations/

support

Executive

Finance

Expected scale

efficiencies* |

Capital

Structure Principles Remain Intact Maintain Strong

Balance Sheet

12

Invest in Strategic

Growth

Return Capital to

Investors

•

Preserve strong balance sheet, liquidity

and credit rating

–

maintain flexibility to invest in organic and

strategic growth

–

leverage range within +/-

2x debt/EBITDA

•

Continue to return capital to investors

–

dividend

–

opportunistic share repurchase

•

Investment in organic growth

–

quality delivery, solutions and clients

•

Consider strategic tuck-in M&A

–

clients, capabilities and countries |

Convergys

2013

Business

Outlook

–

Reaffirmed

13

Not

included

in

this

guidance

is

the

impact

of

the

Stream

acquisition

or

share

repurchase activities. Also not included in this guidance are results

classified within

discontinued

operations

related

to

the

sale

of

Convergys’

Information

Management business as well as other impacts from corporate simplification

actions initiated in prior years such as non-cash pension settlement

charges. ($Million)

Reaffirmed 2013

Guidance

Revenue

~2,045

Adjusted EBITDA

>248

Adjusted EPS

~ $1.10 |

Summary

•

Combines two strong and well-

performing companies

•

Expands and diversifies client base

•

Adds global reach and service

capabilities

•

Highly accretive transaction

•

Leverages strong balance sheet

•

Enhances revenue, margin

improvement and EPS growth

14

Key Takeaways

A Powerful Combination |