Attached files

| file | filename |

|---|---|

| 8-K - PPBI 8-K INVESTOR PRESENTATION 2013-Q3 - PACIFIC PREMIER BANCORP INC | ppbi_8k-2013q3invpresa.htm |

Exhibit 99.1

Pacific Premier Bancorp, Inc.

Investor Presentation

Third Quarter 2013

Steven R. Gardner

President & Chief Executive Officer

2

Forward-Looking Statements and

Where to Find Additional Information

Where to Find Additional Information

The statements contained in this presentation that are not historical facts are forward-looking statements based on management’s current

expectations and beliefs concerning future developments and their potential effects on Pacific Premier Bancorp, Inc. (the “Company”). Such

statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond the control of the Company.

There can be no assurance that future developments affecting the Company will be the same as those anticipated by management. The Company

cautions readers that a number of important factors could cause actual results to differ materially from those expressed in, or implied or projected

by, such forward-looking statements. These risks and uncertainties include, but are not limited to, the following: the strength of the United States

economy in general and the strength of the local economies in which the Company conducts operations; the effects of, and changes in, trade,

monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; inflation, interest rate,

market and monetary fluctuations; the timely development of competitive new products and services and the acceptance of these products and

services by new and existing customers; the willingness of users to substitute competitors’ products and services for the Company’s products and

services; the impact of changes in financial services policies, laws and regulations (including the Dodd-Frank Wall Street Reform and Consumer

Protection Act) and of governmental efforts to restructure the U.S. financial regulatory system; technological changes; the effect of acquisitions that

the Company has made or may make; changes in the level of the Company’s nonperforming assets and charge-offs; oversupply of inventory and

continued deterioration in values of California real estate, both residential and commercial; the effect of changes in accounting policies and practices,

as may be adopted from time-to-time by bank regulatory agencies, the Securities and Exchange Commission (“SEC”), the Public Company Accounting

Oversight Board, the Financial Accounting Standards Board or other accounting standards setters; possible other-than-temporary impairments of

securities held by the Company; changes in consumer spending, borrowing and savings habits; the effects of the Company’s lack of a diversified loan

portfolio, including the risks of geographic and industry concentrations; ability to attract deposits and other sources of liquidity; changes in the

financial performance and/or condition of the Company’s borrowers; changes in the competitive environment among financial and bank holding

companies and other financial service providers; unanticipated regulatory or judicial proceedings; and the Company’s ability to manage the risks

involved in the foregoing.

expectations and beliefs concerning future developments and their potential effects on Pacific Premier Bancorp, Inc. (the “Company”). Such

statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond the control of the Company.

There can be no assurance that future developments affecting the Company will be the same as those anticipated by management. The Company

cautions readers that a number of important factors could cause actual results to differ materially from those expressed in, or implied or projected

by, such forward-looking statements. These risks and uncertainties include, but are not limited to, the following: the strength of the United States

economy in general and the strength of the local economies in which the Company conducts operations; the effects of, and changes in, trade,

monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; inflation, interest rate,

market and monetary fluctuations; the timely development of competitive new products and services and the acceptance of these products and

services by new and existing customers; the willingness of users to substitute competitors’ products and services for the Company’s products and

services; the impact of changes in financial services policies, laws and regulations (including the Dodd-Frank Wall Street Reform and Consumer

Protection Act) and of governmental efforts to restructure the U.S. financial regulatory system; technological changes; the effect of acquisitions that

the Company has made or may make; changes in the level of the Company’s nonperforming assets and charge-offs; oversupply of inventory and

continued deterioration in values of California real estate, both residential and commercial; the effect of changes in accounting policies and practices,

as may be adopted from time-to-time by bank regulatory agencies, the Securities and Exchange Commission (“SEC”), the Public Company Accounting

Oversight Board, the Financial Accounting Standards Board or other accounting standards setters; possible other-than-temporary impairments of

securities held by the Company; changes in consumer spending, borrowing and savings habits; the effects of the Company’s lack of a diversified loan

portfolio, including the risks of geographic and industry concentrations; ability to attract deposits and other sources of liquidity; changes in the

financial performance and/or condition of the Company’s borrowers; changes in the competitive environment among financial and bank holding

companies and other financial service providers; unanticipated regulatory or judicial proceedings; and the Company’s ability to manage the risks

involved in the foregoing.

Additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in the

Company’s 2012 Annual Report on Form 10-K, as amended, filed with the SEC and other filings made by the Company with the SEC. The Company

specifically disclaims any obligation to update any factors or to publicly announce the result of revisions to any of the forward-looking statements

included herein to reflect future events or developments.

Company’s 2012 Annual Report on Form 10-K, as amended, filed with the SEC and other filings made by the Company with the SEC. The Company

specifically disclaims any obligation to update any factors or to publicly announce the result of revisions to any of the forward-looking statements

included herein to reflect future events or developments.

3

13 Full-Service

Branch Locations

Company Profile

Exchange / Listing

NASDAQ: PPBI

Focus

Small & Mid-Market

Businesses

Businesses

Total Assets

$1.6 Billion

Branch Network

Note: Financial information as of the quarter ending 9/30/2013

Note: Market data as of 12/2/13

Pacific Premier Footprint

Headquarters

Irvine, CA

# of Research Analysts

5 Analysts

Market Cap

$242.2 Million

Avg. Daily Volume

50,309 Shares

4

Where We’ve Been and Where We’re Going

Strategic Plan -

Pre 2008 Stage

§ Conversion from a thrift to a commercial banking platform

§ Improve deposit base - diversify loan portfolio

§ Regimented approach to credit management

Strategic Plan -

Current Stage

§ Organic growth driven by high performing sales culture

§ Geographic and product expansion through disciplined acquisitions

§ Canyon National Bank (CNB) - $209 million in assets at closing on 2/11/2011 (FDIC-Assisted)

§ Palm Desert National Bank (PDNB) - $121 million in assets at closing on 4/27/2012 (FDIC-Assisted)

§ First Associations Bank (FAB) - $394 million in assets at closing on 3/15/2013 (Whole Bank)

§ San Diego Trust Bank (SDTB) - $201 million in assets at closing on 6/25/2013 (Whole Bank)

§ Infinity Franchise Holdings (IFH) - $75 million in assets, pending (Specialty Finance Lender)

Strategic Plan -

Next Stage

§ Focus on producing quality EPS growth

§ Increase revenue from recurring fee income - SBA lending

§ Increase non-interest bearing deposit accounts to over 35% of deposit base

5

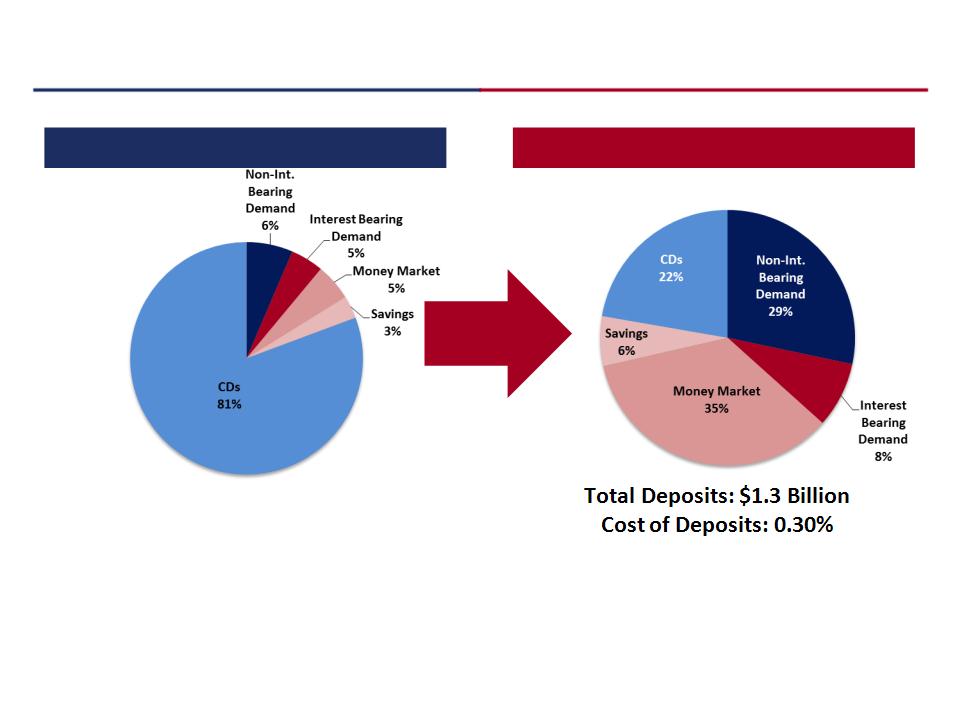

Commercial Bank Transformation - Deposit Composition

Deposit Composition - 12/31/2008

Deposit Composition - 9/30/2013

§ 78% of deposits are non-CD deposits

§ 29% of deposit balances are non-interest bearing deposits

Total Deposits: $457.1 Million

Cost of Deposits: 3.51%

6

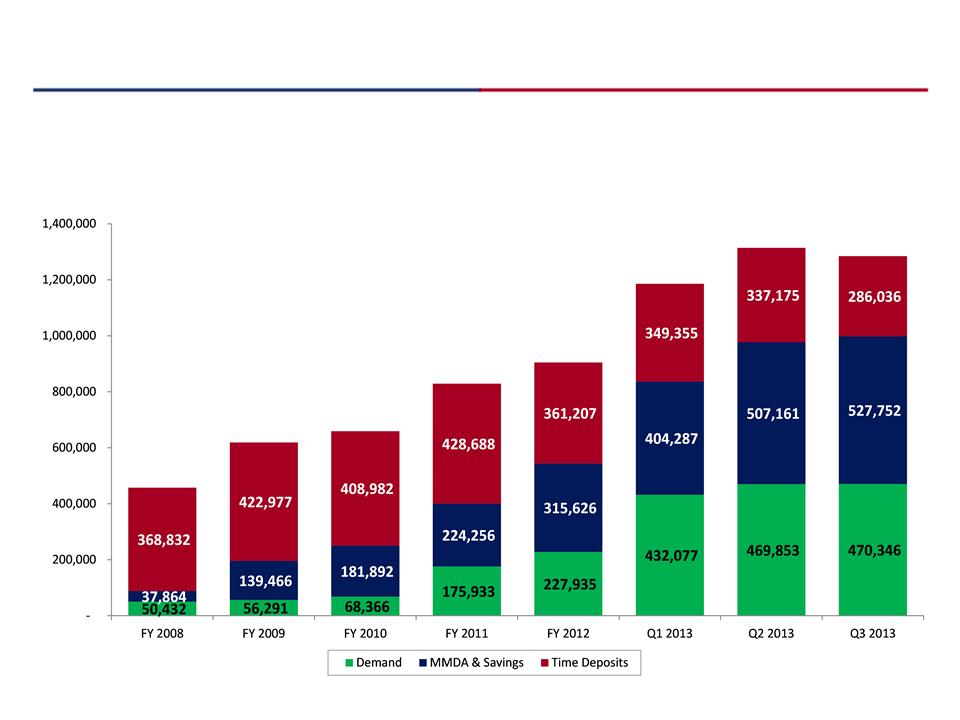

Deposit Franchise Value Creation

§ Transformation from a high-cost, thrift-like deposit base to a low-cost commercial banking deposit base

- cost of deposits of 0.30% at the end of Q3 2013

- cost of deposits of 0.30% at the end of Q3 2013

§ Demand deposits have grown from $50.4 million in 2008 to $470.3 million as of Q3 2013

7

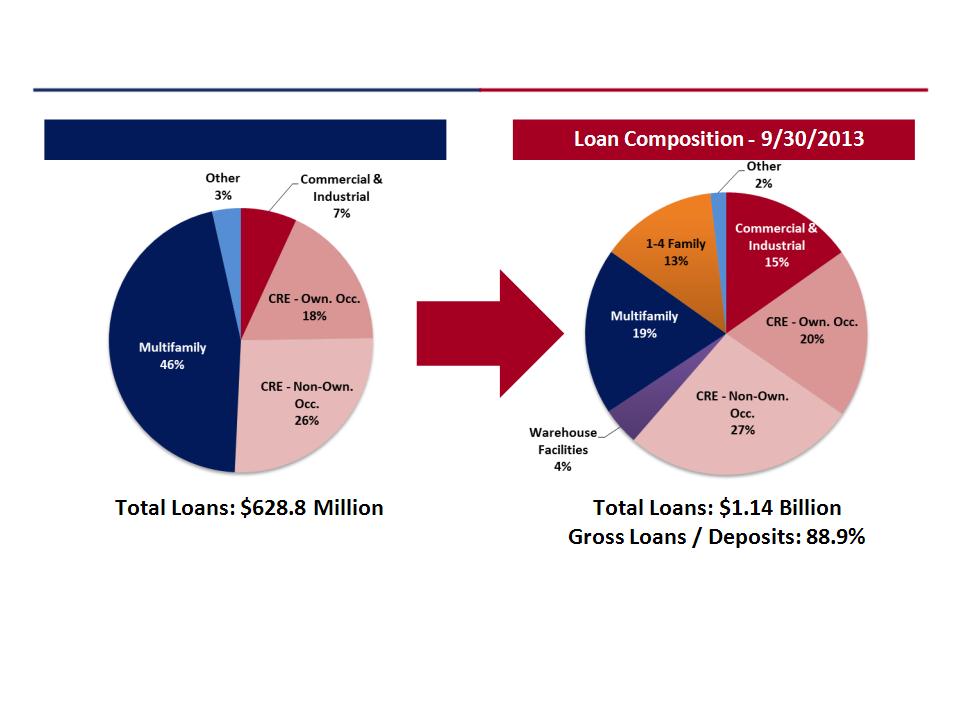

Commercial Bank Transformation - Loan Composition

Loan Composition - 12/31/2008

§ Management has significantly transformed the loan portfolio from one with significant real estate

exposure to a more balanced and well-diversified portfolio

exposure to a more balanced and well-diversified portfolio

§ Total business loans represent 40% of total loans

Gross Loans / Deposits: 137.5%

8

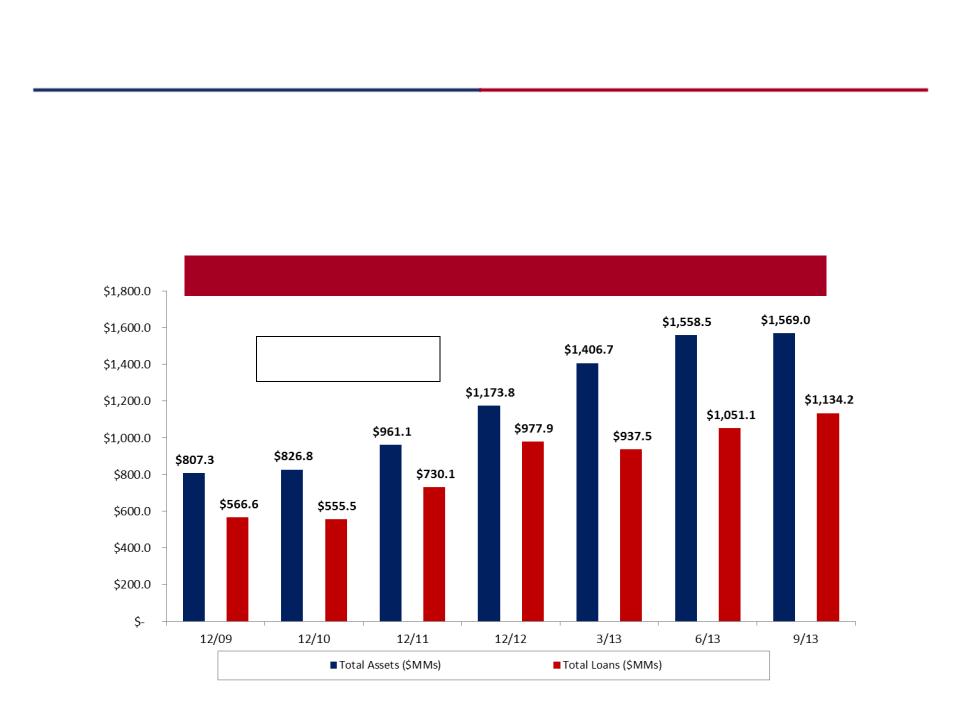

Asset Growth

Total Assets & Total Loans

§ The Company has grown from $807.3 million assets at the end of 2009 to

approximately $1.57 billion as of Q3 2013

approximately $1.57 billion as of Q3 2013

§ Total assets compound annual growth rate of above 19% since 2009

§ Results driven by focus on both organic and acquisitive growth

*CAGR since 12/31/2009

Total Assets CAGR*: 19.4%

Total Loans CAGR*: 20.3%

9

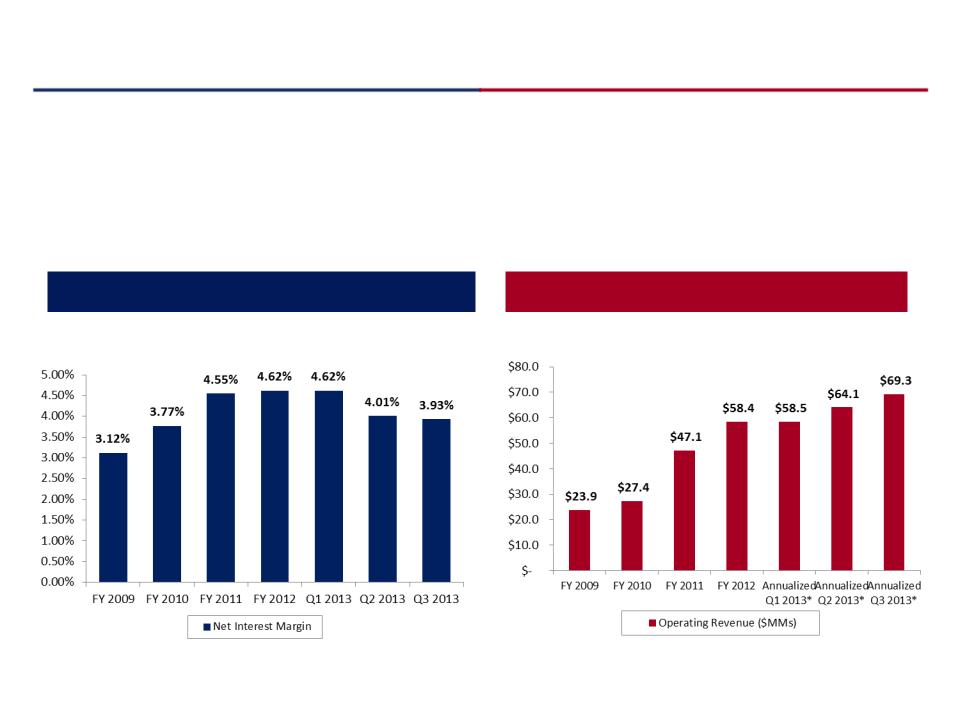

Net Interest Margin & Revenue Growth

Net Interest Margin

Operating Revenue

§ Strength in net interest margin as the Company continues to shift from a legacy thrift to a

commercial banking balance sheet mix

commercial banking balance sheet mix

§ The Company has consistently delivered meaningful operating revenue growth in each of the

last several years

last several years

Note: Operating revenue = net interest income + non-interest income

10

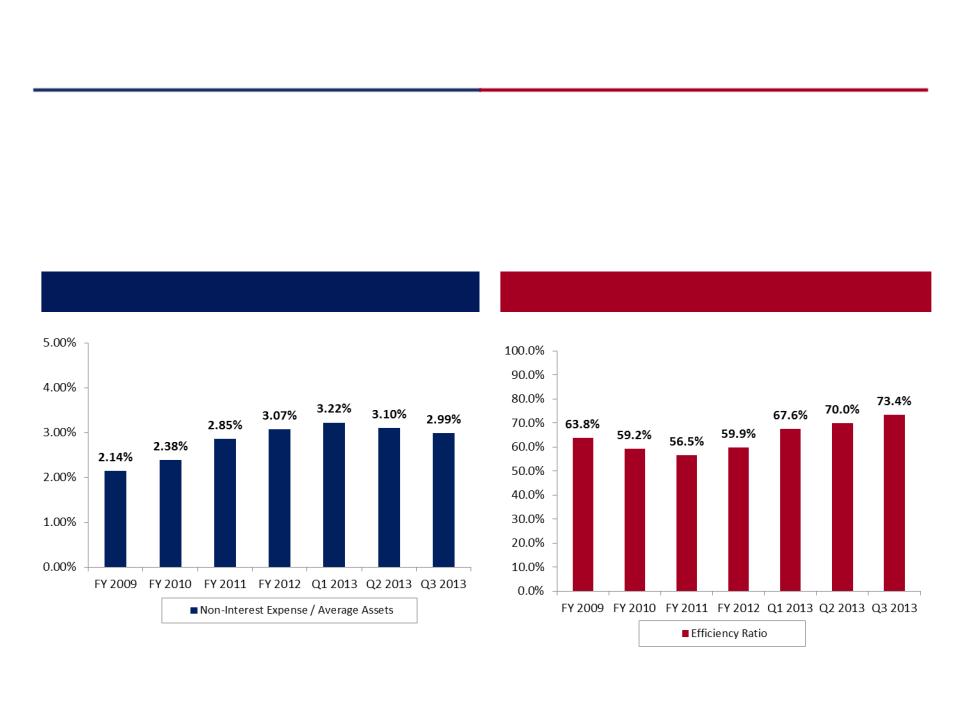

Expenses & Efficiency

Non-Interest Expense / Avg. Assets

Efficiency Ratio

§ The Company continues to support its growth efforts by making significant

investments and hiring talented producers

investments and hiring talented producers

§ The Company will realize benefits from economies of scale as it continues to grow

Note: Exclude s impact from non-recurring merger expense s related to the Company’s

recent acquisitions in Q1 and Q2

recent acquisitions in Q1 and Q2

11

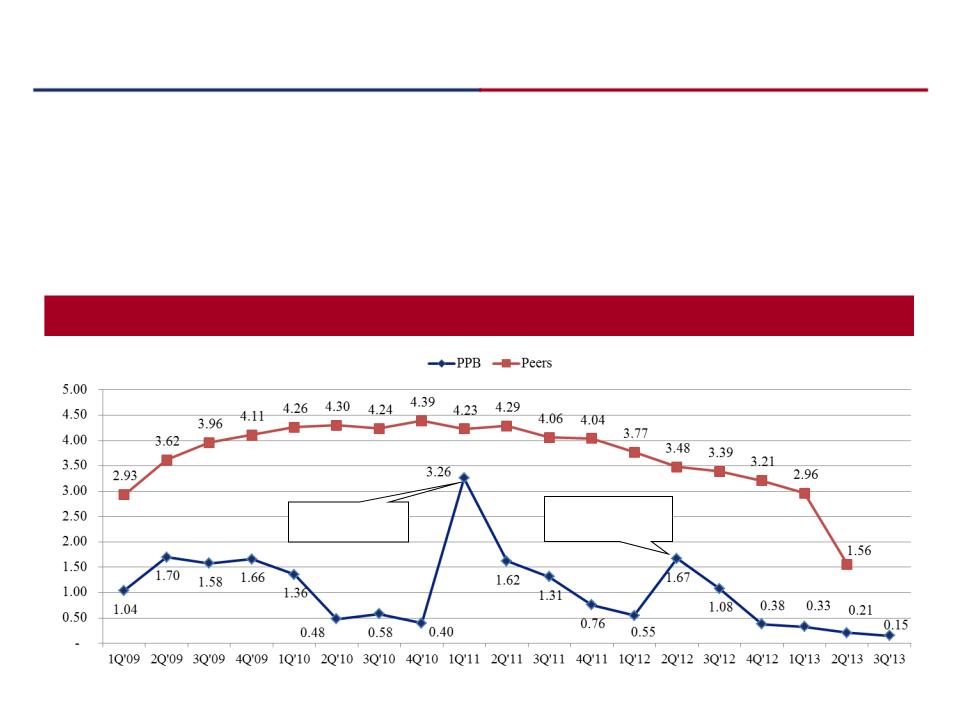

Conservative Credit Culture

Nonperforming Assets to Total Assets

§ The Company has a history of pro-actively addressing credit issues through aggressive problem-asset

resolution, which is demonstrated by its significant outperformance of peers over the last several years

resolution, which is demonstrated by its significant outperformance of peers over the last several years

§ No troubled debt restructurings (“TDRs”)

§ Loan sales utilized strategically to manage risk

CNB Acquisition

2/11/11

PDNB Acquisition

4/27/12

* California peer group consists of all insured California institutions, from SNL Financial.

12

§ Ranked #2 in SNL Financial’s Top Performing Banks of 2012 ($500MM - $5.0B Assets)

§ Raymond James Community Bankers Cup Winner (2012)

§ Top 10% of banks based on profitability, operational efficiency and balance sheet metrics ($500MM - $10.0B Assets)

§ Ranked #52 in American Banker’s Top 200 Community Banks (2012)

§ Based on average ROAE over the last 3 years

§ Ranked #7 top performer by Independent Community Bankers of America (“ICBA”)

§ Performance measured by return on average equity for banks with assets > $1.0B

§ Sandler O’Neill + Partners “Sm-All” Star - Class of 2011

§ Top 25 bank & thrifts with a market capitalization < $2.0B

§ BauerFinancial 5-Star rating - recognition as a “Superior Bank” by the nation’s leading independent bank rating

service (2011)

service (2011)

Pacific Premier Bancorp, Inc. has received industry recognition and numerous

awards for its outstanding client service and performance

awards for its outstanding client service and performance

Award Winning Performance

COMMUNITY BANKERS CUP

13

Superior Market Performance (PPBI)

Source: SNL Financial, market information as of 9/30/2013

§ The Company has significantly outperformed its publicly traded bank peers (SNL Bank Index / NASDAQ Bank Index) in the

market over the last 3 years

market over the last 3 years

§ Since September 2010, PPBI’s stock price is up 202% versus the SNL Bank at 39% and NASDAQ bank indices at 41%

+202%

+39%

+41%

14

Overview of Q3 2013 Results

§ Third Quarter 2013 Shareholder Highlights

§ Diluted earnings per share of $0.18

§ Return on average assets of 0.78%

§ Return on average equity of 7.29%

§ Tangible book value per share increases $0.20 to $8.82

§ Third Quarter 2013 Performance

§ Total assets of approximately $1.6 billion, up 33.7% since December 31, 2012

§ Cost of deposits dropped five basis point to 0.30%

§ Non-interest bearing deposits increase by 5% to $364 million, or 28% of total deposits

§ Net Interest margin of 3.93% (reflects excess liquidity following acquisitions)

§ Pristine credit quality - nonperforming assets / total assets of 0.15%

§ Other Highlights

§ Significant business development momentum

§ Total loans increased 8% to $1.1 billion as excess liquidity was deployed

§ System conversions completed for both FAB and SDTB

(1) Adjusted excludes merger related expenses

15

Scarcity Value - Public Banks in Southern CA*

*Southern CA includes Los Angeles, Orange, Imperial, Riverside ,

San Bernardino and San Diego counties

§ 15th largest exchange listed banks by total assets in Southern California* (top 20

shown below)

shown below)

Source: SNL Financial, as of 6/30/2013, PPBI as of 9/30/13

Note: Includes banks listed on NASDAQ/NYSE/OTCB

16

Keys to Building Out the Franchise

§ Relationship Banking Model - Strong Sales Culture

§ Growing Low-Cost Core Deposit Base - Increasing Franchise Value

§ Robust Earnings Stream - Building Book Value

§ Disciplined Approach to Acquisitive Growth and Integration

§ Strong Capital Management - Leveraging Capital Base

§ Diligent Credit Underwriting and Excellent Asset Quality

17

High Performing Sales Culture Drives Organic Growth

§ Business development team consists of early career sales executives

with real estate or financial services experience

with real estate or financial services experience

§ Consistent calling effort identifies prospects

§ Diligent monitoring and management of quantity and quality of lead

generation

generation

§ Senior commercial bankers utilized to close new relationships

Business

Development /

Sales Infrastructure

Development /

Sales Infrastructure

Consistent

Contact

Contact

Lead

Generation

Management

Generation

Management

Senior Commercial

Bankers Close New

Relationships

Bankers Close New

Relationships

18

§ Small and middle market business banking focus

§ Full suite of business banking services, including: cash

management, payroll and merchant card services

management, payroll and merchant card services

§ Customized C&I and commercial real estate loans

Commercial Banking Business Units

Business Banking

SBA Lending

HOA Banking & Lending

Warehouse Lending

Income Property Lending

§ Small Business Administration (“SBA”) Loans

§ California Capital Access Program (“Cal CAP”) Loans

§ United State Department of Agriculture (“USDA”) Loans

§ Bureau of Indian Affairs (“BIA”) Loans

§ Nationwide leader of customized cash management,

electronic banking services and credit facilities for:

electronic banking services and credit facilities for:

§ Home Owner Association (“HOA”) Companies

§ HOA Management Companies

§ Property Management Firms

§ Credit facilities and electronic banking services

exclusively designed for large and small mortgage

banking concerns

exclusively designed for large and small mortgage

banking concerns

§ Credit facilities and banking services for commercial

real estate (“CRE”) investors

real estate (“CRE”) investors

§ Structured CRE and bridge loan flexibility

Construction Lending

§ Construction loans for developers and owner users on

residential and CRE properties

residential and CRE properties

§ New team assembled in first half of 2013

19

Acquisition & Integration Strategy

General Acquisition Criteria

Integration Strategy

§ Look for strategic, financially compelling and

culturally compatible organizations

culturally compatible organizations

§ Favorable markets / demographics

§ Business line diversification / cross-sell

opportunity

opportunity

§ Disciplined approach to analysis, pricing and

structuring of each transaction

structuring of each transaction

§ Realistic cost savings assumptions

§ Core customer retention

§ Keeping franchise value intact

§ Immediately accretive to EPS

§ Minimum 15% internal rate of return

§ Maximum 10% dilution to tangible book value

per share (Earn-back period of 4 years or less)

per share (Earn-back period of 4 years or less)

§ Aggressive approach to timely and effective

integration

integration

§ Identify key players that fit into our culture

and who can add value to the organization

and who can add value to the organization

§ Immediately meet with new customer base to

begin cross-selling products and services

begin cross-selling products and services

§ Aggressive approach to disposition of any

problem assets inherited in a transaction

problem assets inherited in a transaction

§ Diligent approach to acquisitive growth and business integration

20

Infinity Franchise Holdings

|

Strategic

Rationale |

§ Expanding PPBI’s commercial banking franchise with acquisition of specialty finance lender

§ Lender to established franchisees of Quick Serve Restaurants “QSR” such as Dunkin’ Donuts, Burger King,

Wendy’s, Jack in the Box, Taco Bell, etc. § Further diversifies PPBI’s loan portfolio with C&I and Owner-Occupied CRE loans

§ Asset generating platform with attractive loan yields which will enhance PPBI’s net interest margin

|

|

Financially

Attractive |

§ Valuation multiples below other recent comparable specialty finance transactions

§ Limited credit risk due to clean loan portfolio, no delinquencies or classified assets

§ Combined company is better positioned to drive long-term EPS growth

|

|

Structure and

Team |

§ IFH will operate as a separate division of Pacific Premier Bank (“PPB”)

§ Management team has been together for nearly 20 years and originated over $1.7 billion in franchise loans

§ PPBI will retain most IFH employees

|

|

Transaction

Detail |

§ Deal consideration of approximately $16 million consisting of a 50/50 stock/cash mix (1)

§ Anticipated closing in early Q1 2014, subject to customary regulatory approvals

§ Due diligence included extensive review of loan portfolio and operations

§ Attractive economics for PPBI - Accretive to 2014 EPS, 1.4% dilutive to tangible book value per share, 1.2

year tangible book value payback and 20%+ IRR |

(1) Shares issued based on PPBI stock price of $13.94 subject to a 5% +/- collar. Total consideration will adjust based on the change in IFH’s Adjusted Net Asset Value

between 9/30/2013 and the closing date.

between 9/30/2013 and the closing date.

21

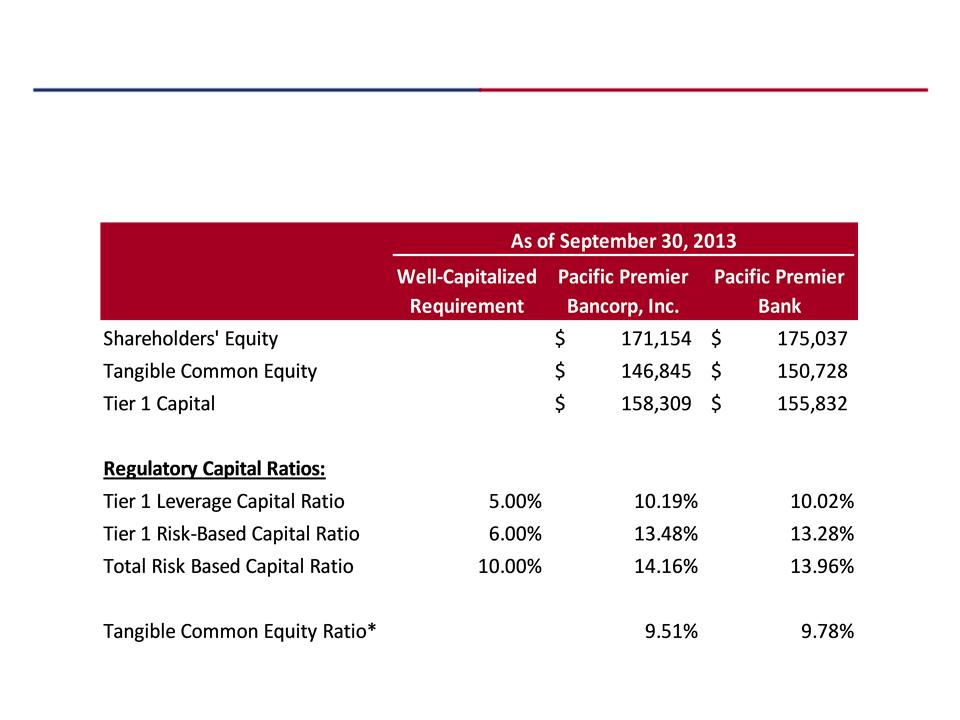

Capital Resources

§ Well capitalized and equipped with the necessary capital resources to continue to execute on

the Company’s growth strategy by pursuing organic and acquisitive growth opportunities

the Company’s growth strategy by pursuing organic and acquisitive growth opportunities

§ Pure common equity capital structure (no TARP / preferred equity)

*Please refer to non-GAAP reconciliation

22

§ New bankers positively impacting organic loan portfolio growth

§ SBA loan production generating meaningful non-interest income

§ Liquidity and deposit platform to fund future loan growth

§ California presents significant acquisition opportunities

§ Proven management team with a track record of executing on acquisitions

Outlook

Continued Focus on Building Long-term Franchise Value

23

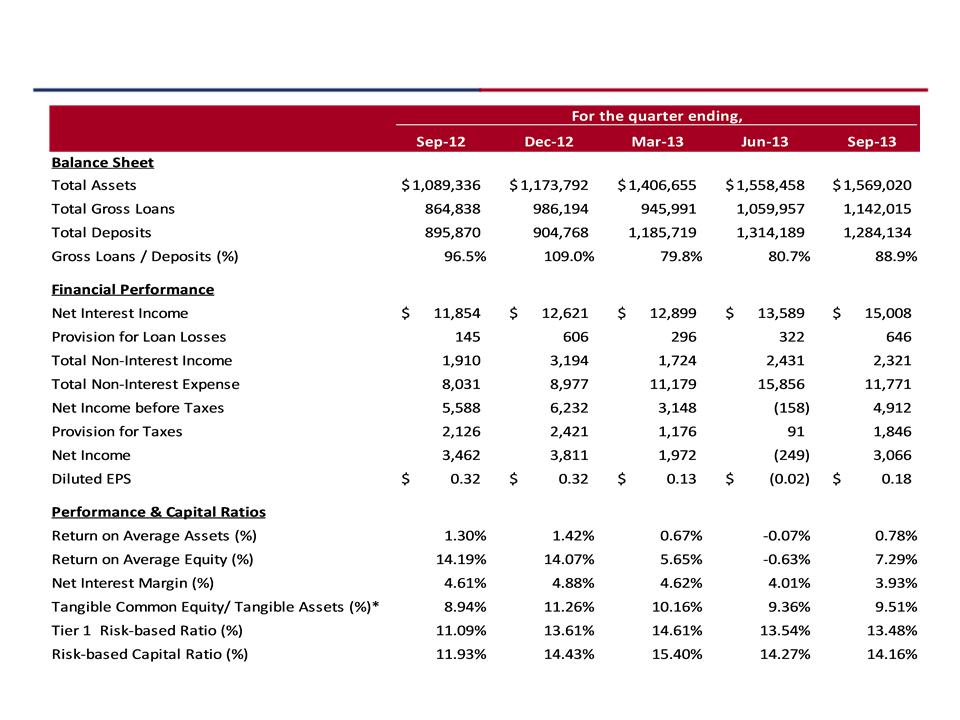

Financial Highlights

Note: All dollars in thousands, except per share

*Please refer to non-GAAP reconciliation

24

Non-GAAP Financial Measures

Tangible common equity and tangible book value per share are non-GAAP financial measures derived from GAAP-based amounts. We calculate tangible common equity by excluding

the balance of intangible assets from common stockholders’ equity. We calculate tangible book value per share by dividing tangible common equity by common shares outstanding,

as compared to book value per common share, which we calculate by dividing common stockholders’ equity by common shares outstanding. We believe that this is consistent with

the treatment by bank regulatory agencies, which exclude intangible assets from the calculation of risk-based capital ratios. Accordingly, we believe that these non-GAAP financial

measures provide information that is important to investors and that is useful in understanding our capital position and ratios. However, these non-GAAP financial measures are

supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for these measures, this presentation may not be

comparable to other similarly titled measures reported by other companies. A reconciliation of the non-GAAP measures of tangible common equity and tangible book value per

share to the GAAP measures of common stockholders’ equity and book value per share is set forth.

the balance of intangible assets from common stockholders’ equity. We calculate tangible book value per share by dividing tangible common equity by common shares outstanding,

as compared to book value per common share, which we calculate by dividing common stockholders’ equity by common shares outstanding. We believe that this is consistent with

the treatment by bank regulatory agencies, which exclude intangible assets from the calculation of risk-based capital ratios. Accordingly, we believe that these non-GAAP financial

measures provide information that is important to investors and that is useful in understanding our capital position and ratios. However, these non-GAAP financial measures are

supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for these measures, this presentation may not be

comparable to other similarly titled measures reported by other companies. A reconciliation of the non-GAAP measures of tangible common equity and tangible book value per

share to the GAAP measures of common stockholders’ equity and book value per share is set forth.

|

|

PPBI

|

PPB

|

|

|

9/30/2013

|

9/30/2013

|

|

Common Stockholders’ Equity

|

$171,154

|

$175,037

|

|

Less: Intangible Assets

|

(24,309)

|

(24,309)

|

|

Tangible Common Equity

|

$146,845

|

$150,728

|

|

Book Value per Share

|

$10.28

|

-

|

|

Less: Intangible Assets per Share

|

(1.46)

|

-

|

|

Tangible Book Value per Share

|

$8.82

|

-

|

|

Total Assets

|

$1,569,020

|

$1,565,002

|

|

Less: Intangible Assets

|

(24,309)

|

(24,309)

|

|

Tangible Assets

|

$1,544,711

|

$1,540,693

|

|

Tangible Common Equity Ratio

|

9.51%

|

9.78%

|