Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Unilife Corp | d636924d8k.htm |

Annual General

Meeting of Stockholders November 21, 2013

1

Exhibit 99.1 |

Chairman’s

Welcome. Mr. Jim Bosnjak.

2 |

Introducing our

Board of Directors In Attendance

John Lund, CPA

Non-Executive Director

since 2009

Chair of Audit

Committee

Alan Shortall

CEO

Executive Director

since 2002

Mary Kate Wold, J.D.

Non-Executive

Director since 2010

Chair of Strategic

Partnerships

Committee

William Galle

Non-Executive

Director since 2008 |

Introducing our

Board of Directors Apologies

Jeff Carter MApp. BFin

Non-Executive Director

since 2006

Based in Australia

November 21, 2013 |

Agenda

1.

Confirmation of Quorum

2.

Resolutions

3.

Presentation from the CEO

4.

Questions

5.

Confirmation of Results

6.

Other Business |

Resolutions

1.

Election of six directors

2.

Ratify KPMG as independent registered public accounting firm

3.

Ratify compensation paid to certain directors

4. –

8.

Approve grant of securities to non-employee directors

9.

Approve special grant of securities to William Galle

10.

Ratify common stock issue under Controlled Equity Sales

Agreement with Cantor Fitzgerald

November 21, 2013 |

Confirmation of

Quorum Unilife’s

quorum

requirement

is

one-third

of

outstanding

shares

being

represented

either

in

person

or

by

proxy

At

least

59.72%

of

the

total

outstanding

shares

entitled

to

vote

have

been

received

and

are

represented

by

person

or

proxy |

Unilife Business

Update Unilife CEO. Mr. Alan Shortall.

8 |

An Innovative,

Differentiated and Customizable Portfolio of Product Platforms 9

Confidential

–

Unilife

Corporation

Auto-

Injectors

Ocular

Systems

Wearable

Injectors

Reconstitution

Systems

Prefilled

Syringes

Novel

Systems |

10

Platform of Prefilled Syringes

Unifill®

Unifill Finesse™

Unifill Select™

Unifill Allure™

Unifill Nexus™

Fully Integrated. Highly Differentiated.

|

Sanofi Supply

Contract for Lovenox® Unilife Product:

Unifill Finesse -

customized product from Unifill platform

Sanofi Drug:

Enoxaparin Sodium (Lovenox®

/ Clexane®)

Drug Area:

Anti-thrombotics (low molecular weight heparin)

Geographic Territory:

Global

Contract Period:

Can extend up to 2024

Exclusivity:

Use of Unifill Finesse with anti-thrombotic drugs

Minimum Volumes:

Minimum of 150MM units per year (after four-year

high-volume ramp period) to maintain exclusivity

Additional Payments:

Up to $15MM ($5MM received, next $5MM during FY14)

Other Terms:

Replaces and supersedes previously signed agreements

Non-exclusive use to Unifill Finesse for biologic drugs

11

“Currently

Sanofi

provides

Clexane

/

Lovenox

with

different

devices

coming

therefore

from

different

facilities.

The

deal

with

Unilife

will

bring

added

value

to

our

customers,

reinforcing

the

safety

aspects

of

a

performing

device

looking

at

reducing

the

risk

of

needlestick

injuries.

Sanofi

has

kept

evolving

with

cutting

edge

technology

for

delivering

its

products”…and

this

deal

demonstrates

“an

evolution

in

safety

device

syringes”

-

Sanofi

spokesman

Frederic

Lemonde*

*

Sep

11,

2013

http://www.in-pharmatechnologist.com/Drug-Delivery/Sanofi-Inks-Deal-for-Prefilled-Syringes-with-Unilife

|

Market for

Generic Injectables $11 B global market for global generic injectables (13% CAGR to

2017) The U.S. accounts for $7 B (60%) of the global market

1.5 B doses of generic injectable drugs used in the U.S. every year

About 70% of U.S. hospital patients receive a generic injectable

drug

Rapid conversion of generic injectables from vials to prefilled syringes

Benefits include fewer steps of use, time savings, dose accuracy

and less inventory

FDA

cites

patient

safety

concerns

with

prefilled

drugs

used

for

IV

infusion

Spontaneous disconnection, leakage or occlusion of medication and breakage

No universal attachment with any ISO standard needle hub or IV connector

12 |

The Unifill

Nexus™ 13

Universal Connectivity. No Clogging. No Breakage.

Standard Fill Finish

Luer collar fits any standard

needle or connector

No Clogging or Breakage

Safe, Intuitive, One-Handed |

Commercial

Supply Contract with Hikma Hikma

is

3

rd

largest

by

volume

in

the

US

generic

injectables

market

15 Year supply agreement to launch 20 generic injectable drugs in

syringes from Unifill platform including Unifill and Unifill Nexus

Hikma to receive exclusivity for use of Unilife devices with target

drugs

Additional drugs may be added to exclusivity list if agreed by both parties

Unilife to receive $40MM in upfront and milestone payments

Minimum unit volumes of 175MM Unifill products a year after high-

volume commercial ramp program

Actual unit volumes expected to reach 250 million units or more per year

Unilife to also customize and supply other products from its portfolio

14 |

Platform of

Reconstitution Systems 15

One-Step Reconstitution. A World of Differentiation.

AutoMix Presto™

EZMix Genesis™

EZMix Engage™

EZMix Prodigy™ |

The EZMix

Prodigy™ Compact, integrated single-barrel design for doses between

1-50mL Intuitive single-step reconstitution for liquid or dry drug combinations

Being pursued by multiple pharmaceutical and biotech customers

16 |

Platform of

Auto-Injectors 17

LISA™

smart reusable

auto-injector

RITA™

disposable

auto-injector

Self-Injection. Simplified.

Multiple programs underway that are

aligned with Unifill syringe products |

The Market for

Wearable Injectors Around 250 high viscous, large volume

biologics targeted for wearable injectors

Multiple therapy areas targeted including cancer

and auto-immune diseases

List includes 100+ pharma and biotech companies

Estimated 350 million wearable injectors to

be sold annually by 2024

Average selling price of $20 -

$35 a unit

Market size of USD $8.8 billion by 2024

CAGR of 138% from 2015 -

2020

CAGR of 48% from 2020 –

2024

18

Reference

Source

for

Slide

Information:

Bolus

Injectors

Market

2014

-

2024.

2013

Roots

Analysis. |

Platform of

Wearable Injectors 19

Pre-Filled. Pre-Assembled.

Ready-to-Inject.

Precision-Therapy™

Flex-Therapy™

For long-duration therapies that require

delivery of large dose volumes

For long-duration therapies that require delivery of

large dose volumes with a specific rate profile |

A Typical

Customer Partnership 20

Average number of drugs being targeted

3 –

8

Average phase of drugs being targeted

Late-stage

Average unit volume range per molecule

2 -

5MM units

Average customization program length

18 -

36 months

Average size of customization program per drug per year

$3 -

6MM*

Average duration of customer commitment

15 -

20 years

* does not include high-cost

device sales during customization

and clinical trial programs |

Customization

and Supply Contract with MedImmune 21

MedImmune is the global biologics R&D arm of AstraZeneca

One of the richest biologic portfolios in the industry

120 large molecule drugs in R&D (half of AstraZeneca’s total clinical pipeline)

Under this agreement, Unilife will customize and supply devices

from

its platform of wearable injectors for use with target molecules.

Several drugs may be selected for use with Unilife's wearable injectors

Unilife selected after an extensive evaluation process

Revenue to begin being generated in the first quarter of fiscal 2014

|

Ocular Delivery

and Novel Device Platforms 22

Ocu-ject™

Micro-ject™

Beyond

Conventional Delivery Systems

Depot-ject™ |

Moving

Forward Revenue to grow sequentially each and every quarter in FY 2014

Significant annual revenue growth this fiscal year and beyond

Down the road, as contracts reach peak commercial sales, we will

attain a

position of global leadership for injectable drug delivery

Prefilled Syringes: Targeting production of 400MM units or more a year

Wearable Injectors: Taken leadership position in market worth $8B 2024

Together with revenue generated from other product platforms, Unilife on

way to generating future expected revenue in excess of $1 B a year

23 |

Annual General

Meeting of Stockholders November 21, 2013

Consider and Vote for Matters set forth in Proxy Statement

24 |

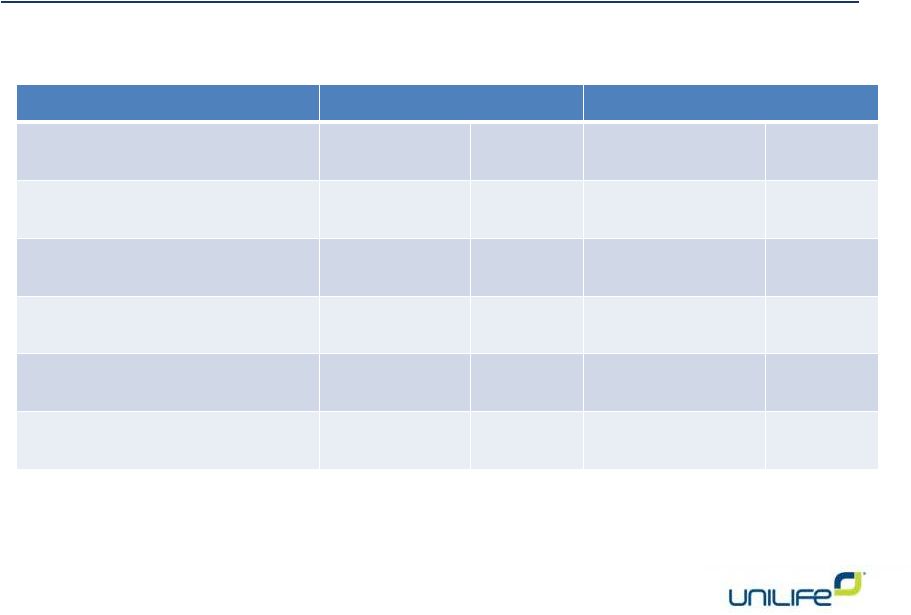

Election of Directors

Item 1. |

Election of Directors

Item 1.

For

Withheld

Item 1.1 Jim Bosnjak

37,893,553

89.64%

4,381,120

10.36%

Item 1.2 Jeff Carter

38,248,088

90.48%

4,026,585

9.52%

Item 1.3 William Galle

39,975,506

94.56%

2,299,167

5.44%

Item 1.4 John Lund

39,968,156

94.54%

2,306,517

5.46%

Item 1.5 Mary Kate Wold

40,048,663

94.73%

2,226,010

5.27%

Item 1.6 Alan Shortall

39,480,958

93.39%

2,793,715

6.61% |

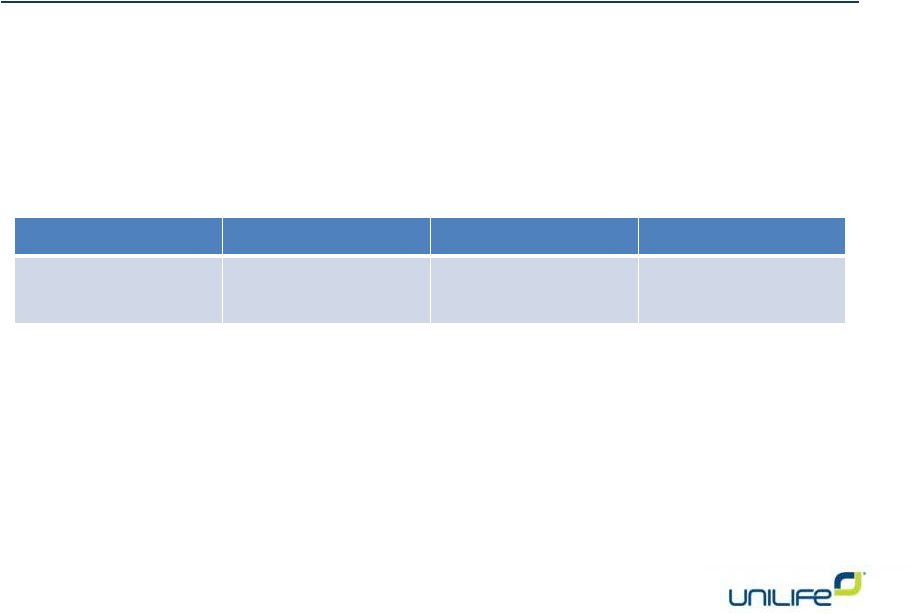

Item 2.

Ratification of the appointment of KPMG LLP as the

Corporation’s independent registered public

accounting firm for Fiscal Year 2014 |

Item 2.

Ratification of the appointment of KPMG LLP as the

Corporation’s independent registered public

accounting firm for Fiscal Year 2014

For

Against

Abstain

Item 2.

58,319,458

904,285

684,984 |

Item 3.

To consider and act on an advisory vote regarding

the approval and compensation paid to certain

executive officers |

Item 3.

For

Against

Abstain

Item 3.

36,033,719

5,784,484

456,470

To consider and act on an advisory vote regarding

the approval and compensation paid to certain

executive officers |

Items 4

- 8.

The approval of the grant of 105,000 securities to each

of the five non-employee Directors |

Items 4

- 8.

For

Against

Abstain

Item 4. Jim Bosnjak

30,270,781

11,676,609

327,283

Item 5. Jeff Carter

30,130,410

11,683,867

460,396

Item 6. William Galle

30,410,105

11,400,255

464,313

Item 7. John Lund

30,410,221

11,400,755

463,697

Item 8. Mary Kate Wold

30,433,812

11,382,098

458,763

The approval of the grant of 105,000 securities to each

of the five non-employee Directors |

33

Item 9.

To approve a special grant of 52,500 securities to

William Galle in the form of restricted stock units. |

34

Item 9.

For

Against

Abstain

Item 9.

30,306,626

11,483,493

484,554

To approve a special grant of 52,500 securities to

William Galle in the form of restricted stock units. |

To ratify the

issuance and sale of 3,512,153 shares of common stock (equivalent to 21,072,918 CHESS

Depositary Interests (“CDIs”)) under the Controlled Equity Offering Sales

Agreement we entered into with Cantor Fitzgerald & Co. dated October 3, 2012,

pursuant to a registration statement filed by us with the U.S. Securities and

Exchange Commission (“SEC”), and the accompanying prospectus

supplement that we filed with the SEC on October 4, 2012.

35

Item 10. |

To ratify the

issuance and sale of 3,512,153 shares of common stock (equivalent to 21,072,918 CHESS

Depositary Interests (“CDIs”)) under the Controlled Equity Offering Sales

Agreement we entered into with Cantor Fitzgerald & Co. dated October 3, 2012,

pursuant to a registration statement filed by us with the U.S. Securities and

Exchange Commission (“SEC”), and the accompanying prospectus

supplement that we filed with the SEC on October 4, 2012.

36

Item 10.

For

Against

Abstain

Item 10.

39,787,618

1,938,609

548,446 |

Annual General

Meeting of Stockholders November 21, 2013

Other Business

37 |

Annual General

Meeting of Stockholders November 21, 2013

Close of Meeting

38 |