Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Genpact LTD | d623280d8k.htm |

| EX-99.1 - EX-99.1 - Genpact LTD | d623280dex991.htm |

Genpact

Q3 2013 Earnings Presentation

November 6, 2013

Ticker (NYSE: G)

Exhibit 99.2 |

Forward

Looking Statements These

materials

contain

certain

statements

concerning

our

future

growth

prospects

and

forward-looking

statements, as defined in the safe harbor provisions of the U.S.

Private Securities Litigation Reform Act of

1995. These statements are based on Genpact’s current expectations and

beliefs, as well as a number of assumptions

concerning

future

events.

These

statements

involve

a

number

of

risks,

uncertainties

and

other

factors that could cause actual results to differ materially from those in such

forward-looking statements. These risks and uncertainties include but

are not limited to a slowdown in the economies and sectors in which

our

clients

operate,

a

slowdown

in

the

BPM

and

IT

Services

sectors,

the

risks

and

uncertainties

arising from our past and future acquisitions, our ability to manage growth,

factors which may impact our cost advantage, wage increases, our ability to

attract and retain skilled professionals, risks and uncertainties regarding

fluctuations in our earnings, general economic conditions affecting our industry as

well as other risks detailed in our reports filed with the U.S. Securities and

Exchange Commission (the “SEC”),

including

the

Company's

Annual

Report

on

Form

10-K.

These

filings

are

available

at

www.sec.gov

or on the investor relations section of our website, www.genpact.com. Genpact may

from time to time make additional written and oral forward-looking

statements, including statements contained in our filings with the SEC. The

Company does not undertake to update any forward-looking statements that may be made from

time to time by or on behalf of the Company.

These materials also include measures defined by the SEC as non-GAAP financial

measures. Genpact believes that these non-GAAP measures can provide

useful supplemental information to investors regarding financial and

business trends relating to its financial condition and results of operations when

read in conjunction with the company’s reported results. Reconciliations of

these non-GAAP measures to GAAP are available in this presentation and

in our earnings release dated November 6, 2013. Non-GAAP Financial

Measures |

3

Q3 2013 -

Highlights

Revenues, adjusted income from operations, margins and cash flows from

operations all increased year-over-year

Q3

‘13

versus

Q3

‘12

performance:

Total Revenue:

+9%

Revenue from Global Clients:

+13%

GE Revenue:

-3%

Adjusted

Income

from

Operations

:

+19%

Cash from Operations

+62%

Revenue growth impacted by delayed large deal decisions, mortgage business

and FX

Strong

Adjusted

Income

from

Operations

margin

(1)

of

17.8%

Increasing interest in large transformational deals, reflected in our

pipeline (1)

Adjusted Income from Operations is a Non-GAAP Measure. GAAP Income from Operations increased 22.9%

and GAAP Operating Margin was 16.1%.

Notes:

1)

|

4

Our Growth Strategy

Lead

Guide global enterprises to best-in-class through our

proprietary SEP

framework

Expand

Invest in targeted industry verticals and domain expertise

Allocate

Allocate capital and resources to support sustainable,

profitable growth and shareholder value

Deliver

Execute seamlessly for clients across service lines and

geographies

We are actively driving change to our growth strategy to expand and capture a

bigger set of market opportunities:

Increasing focus on specific industry verticals, service lines and

geographies Redirecting management resources and investments to the best

opportunities SM |

5

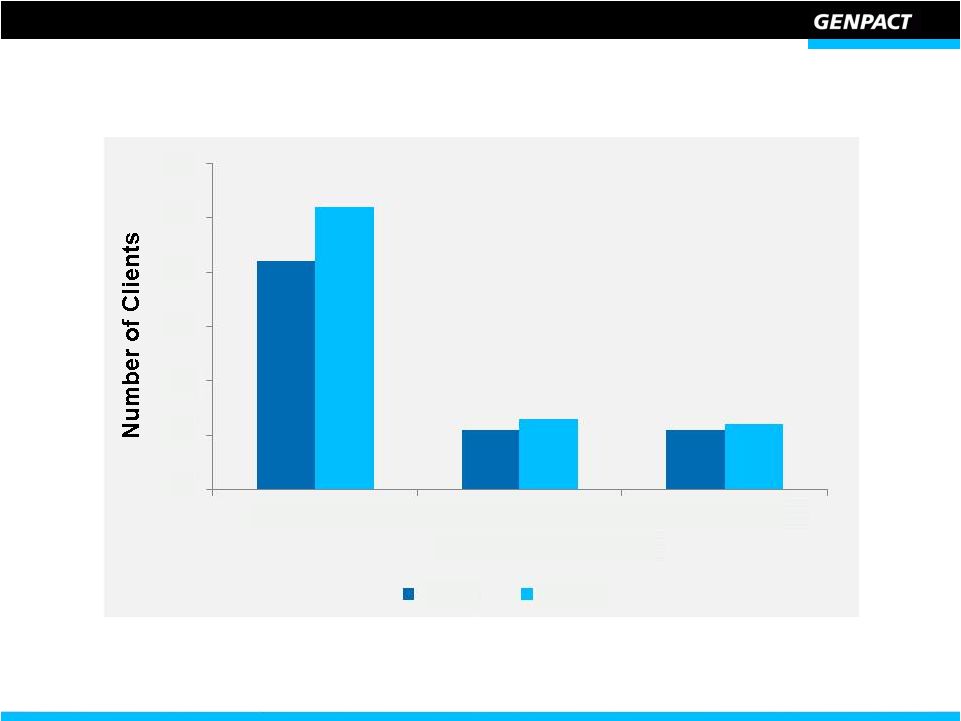

Continue to Expand Client Relationships

Notes:

1) Relationship size = Clients representing annual revenues based on rolling

four quarters 42

11

11

52

13

12

0

10

20

30

40

50

60

$5 to $15 MM

$15 to $25 MM

>$25 MM

Relationship Size

(1)

Q3 12

Q3 13 |

6

Increased Pipeline Across Core Markets

Macro-environment continues to be mixed

Clients’ continued focus on improving business models to adapt to a

continuously challenging environment

Increasing interest in longer term, transformative engagements

Pipeline at historically high levels

Significantly bigger value and proportion of larger, transformative deals in the

pipeline, involving complex transformational changes

These larger deals take longer to convert to revenues

Win rates steady; pricing competitive but stable |

7

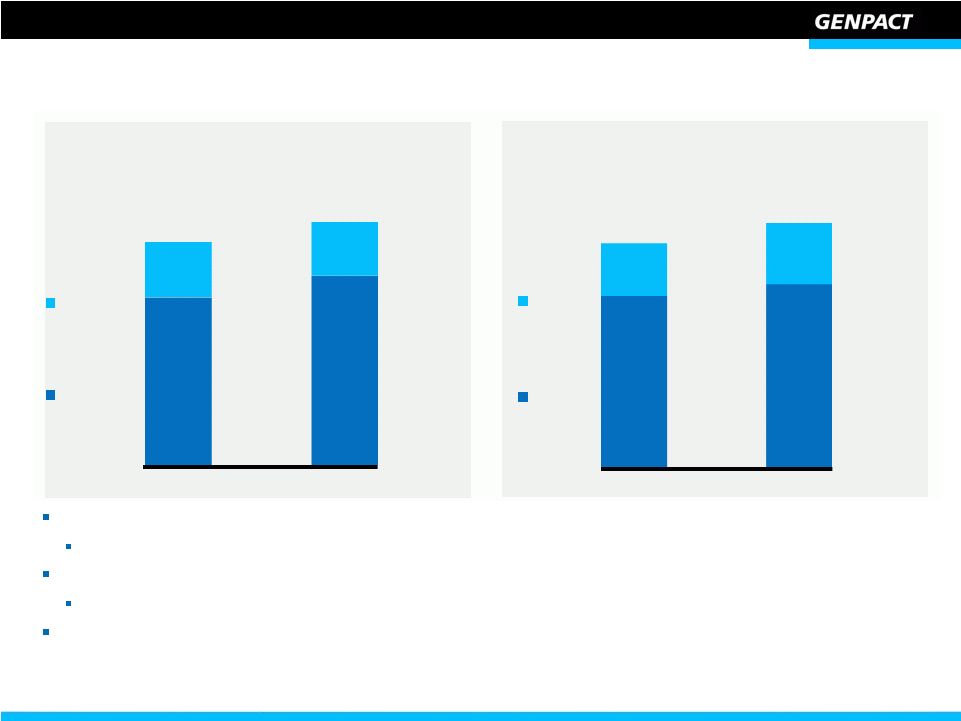

Revenue Growth of 8.9% Driven by Global Clients

Q3 2013 Global Clients

Business Process Management revenues increased 10% while ITO revenues increased

20% Q3 2013 GE

Decline

in

Business

Process

Management

partly

offset

by

growth

in

ITO

Year To Date 2013 revenue at $1.574 billion; up 12.9% year over year

Global

Clients

(1)

GE

(1)

BPM

ITO

8.9%

YoY

Growth%

12.7%

(2.7)%

8.9%

15.5%

6.9%

YoY

Growth%

$491.2

$534.9

Q3 ‘12

Q3 ‘13

Q3 ‘12

Q3 ‘13

($ in millions)

Notes:

1) Data adjusted for divestitures from GE

($ in millions)

369.9

416.9

121.3

118.0

376.1

401.9

115.1

133.0

$491.2

$534.9 |

8

Adjusted Income From Operations Growth of 19.2%

Q3‘12

Q3‘13

YoY Growth

Revenue

$491.2

$534.9

8.9%

Cost Of Revenue

297.3

329.3

10.8%

Gross Profit

193.9

205.6

6.0%

Gross Profit % of Revenue

39.5%

38.4%

(110)bps

Selling, general and administrative expenses

118.5

117.0

(1.3)%

SG&A % of Revenue

24.1%

21.9%

(220)bps

Adjusted Income From Operations

(1)

79.7

95.0

19.2%

Adjusted Income From Operations Margin %

16.2%

17.8%

160 bps

Notes:

1) Adjusted Income from Operations is a Non-GAAP Measure. Income from

Operations was $70.0 million in Q3 ‘12 and $86.0 million in Q3 ’13

($ millions)

Strong Q3 2013 Adjusted Income from Operations margin driven by:

Continued efficiencies

Slower than expected ramps in front-end and domain expert hiring, and delays in

large deals that typically need upfront investments

|

9

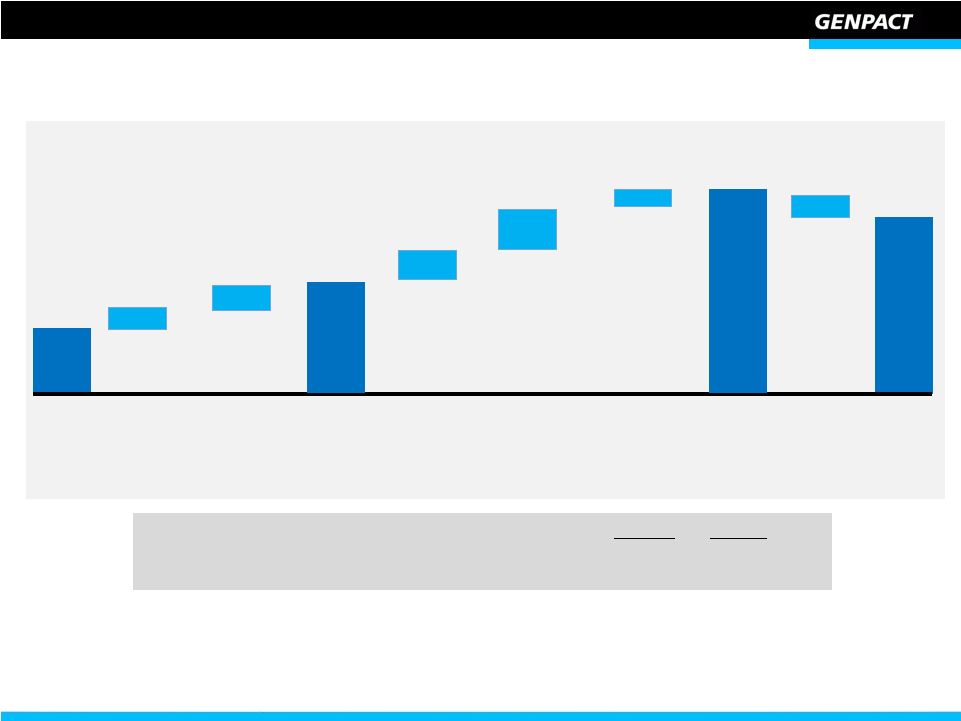

EPS Bridge

11

5

Adjusted

Income from

Operations

Q3 ‘12

GAAP

EPS

Q3 ‘12

Q3 ‘13

Adjusted Net Income ($ millions)

41.7

77.3

Diluted

Shares

Outstanding

(millions)

(2)

230

236

2

30

Fx

Re-measurement

Gains

(Cents per share)

Net

other

Adjustments

(1)

18

33

3

Net

other

Adjustments

(1)

Q3 ‘12

Adjusted

EPS

Q3 ‘13

Adjusted

EPS

Q3 ‘13

GAAP

EPS

Notes:

-

The above bridge reflects only significant variance items year over year

-

EPS = Diluted earnings per share

1)

Adjustments primarily include amortization of intangibles relating to acquisitions,

share-based compensation expenses and acquisition related expenses

2)

Weighted average number of diluted shares outstanding

4

‘12 one time

costs related to

recapitalization

8

Lower effective

tax rate

-3 |

10

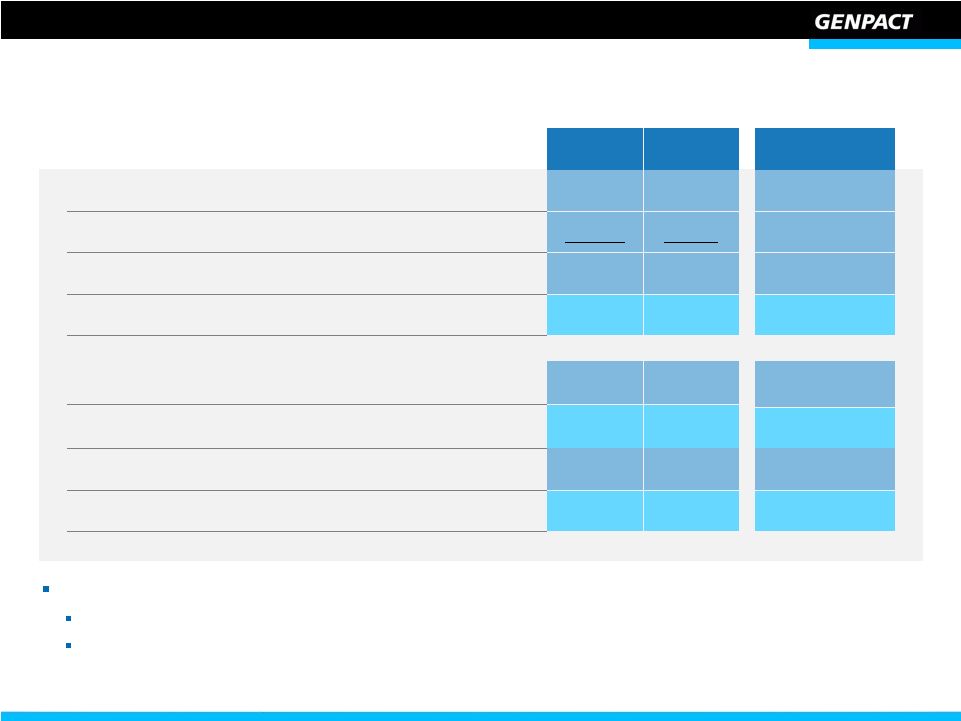

Strong Cash From Operations

Q3 2013 cash from operations increased 62% due to:

Higher Operating Margin

Lower working capital driven by improved Days Sales Outstanding

Q3 ‘12

Q3 ‘13

62%

$77

$126

YTD ‘12

YTD ‘13

$233

11%

42%

YoY

Growth%

YoY

Growth%

($ in millions)

Q3 ‘12

Q3 ‘13

Days Sales Outstanding

84

80

Cash

and

Liquid

Assets

($

millions)

(1)

395

499

Notes:

1) Cash and Liquid Assets = Cash and Cash equivalents and short-term

deposits ($ in millions)

Operating

Performance

Upfront Client

Payment

(One-time)

164

233

45

$209 |

11

Full Year 2013 Outlook

FY 2013

Revenues ($B)

$2.12 -

$2.13

Adjusted Income from Operations -

Margin

16.5% -

16.8%

Other Metrics

Cash Flow From Operations

Decline < 5% YoY

Effective Tax Rate

24% -

26%

Capital Expenditure (% of revenue)

2.0% -

2.3% |

Q&A |

Annexure

1: Reconciliation of Adjusted Income from Operations

(USD, In Thousands)

September 30

2012

2013

Income from operations as per GAAP

$

69,952

$

85,957

Add: Amortization of acquired intangible assets resulting from

Formation Accounting

1,621

711

Add: Amortization of acquired intangible assets relating to

acquisitions

2,694

3,857

Add: Acquisition related expenses

298

-

Add: Consultancy and legal fees relating to change of shareholding

and capital restructuring (excluding expenses related to the credit

facility)

7,318

-

Add: Stock based compensation

5,613

5,312

Less: Provision (created) reversed for loss on divestitures

-

141

Add: Other income (expense)

(6,365)

184

Add: Gain on Equity-method investment activity, net

50

32

Less: Net income attributable to noncontrolling interest

(1,436)

(1,169)

Adjusted income from operations

$

79,745

$

95,025

Three

months

ended

13 |

Annexure

2: Reconciliation of Adjusted Net Income (USD, In Thousands, except per share

data) Three

months

ended

September 30

2012

2013

Net income as per GAAP

$

25,175

$

70,262

Add: Amortization of acquired intangible assets resulting from

Formation Accounting

1,621

711

Add: Amortization of acquired intangible assets relating to

acquisitions

2,694

3,857

Add: Consultancy and legal fees relating to change of shareholding

and capital restructuring (excluding expenses related to the credit

facility)

7,318

-

Add: Stock based compensation

5,613

5,312

Add: Acquisition related expenses

298

-

Add:

Withholding

taxes

relating

to

remittance

of

funds

between

subsidiaries to partly fund the payment of special cash dividend in

respect of capital restructuring

2,300

-

Less: Tax impact on amortization of acquired intangibles resulting

from Formation Accounting

(357)

(114)

Less: Tax impact on amortization of acquired intangibles relating

from acquisitions

(893)

(1,319)

Less: Tax Impact on acquisition related expenses

(75)

-

Less: Tax Impact on stock based compensation

(1,971)

(1,458)

Adjusted net income

$

41,723

$

77,251

Adjusted diluted earnings per share

$

0.18

$

0.33

14 |

Thank

You |