Attached files

| file | filename |

|---|---|

| 8-K - KBR, INC. | form8k.htm |

Exhibit 99.1

FOR IMMEDIATE RELEASE Contact: Zac Nagle

October 24, 2013 Vice President,

Investor Relations and Communications

713-753-5082

Rob Kukla, Jr.

Director, Investor Relations

713-753-5082

KBR ANNOUNCES EARNINGS PER DILUTED SHARE

OF $0.16 FOR THIRD QUARTER 2013

|

§

|

Backlog at $14.2 billion with book-to-bill of 1.2x

|

|

§

|

Total cash provided by operations of $178 million in the third quarter of 2013

|

|

§

|

Operating income of $166 million, up 35% from the second quarter of 2013

|

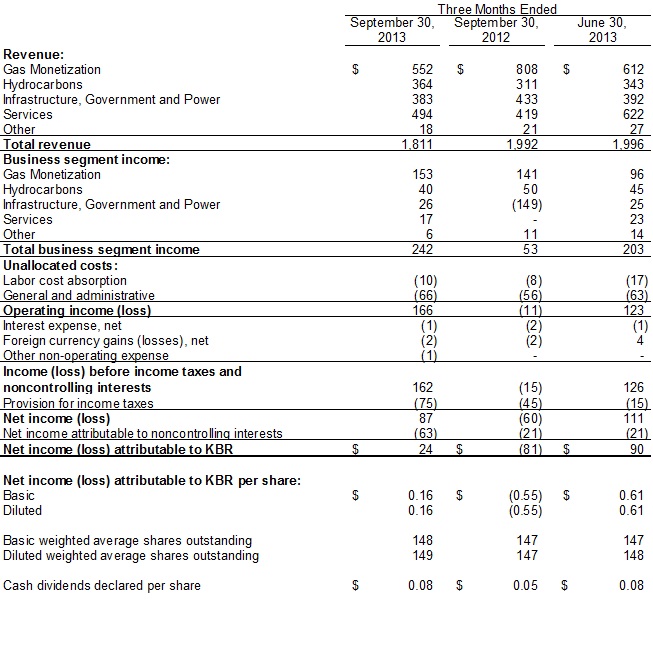

HOUSTON, Texas – KBR (NYSE:KBR) announced today that third quarter 2013 net income attributable to KBR was $24 million, or $0.16 per diluted share, compared to a net loss attributable to KBR of $81 million, or $0.55 per diluted share, in the third quarter of 2012.

Consolidated revenue in the third quarter of 2013 was $1.8 billion compared to $2.0 billion in the third quarter of 2012. Operating income in the third quarter of 2013 was $166 million compared to an operating loss of $11 million in the prior year third quarter. The third quarter of 2012 included a non-cash goodwill impairment charge of $178 million related to a market assessment of the minerals business.

“The third quarter was highlighted by a strong, 1.2x book-to-bill ratio and cash flow from operations of $178 million. The quarter was unfavorably impacted by the adverse tax ruling related to the separation from our prior parent, several non-operational discrete tax items and the delay of key project close-out items originally forecast in the quarter,” said Bill Utt, Chairman, President, and Chief Executive Officer of KBR. “Looking forward, we continue to see a strong opportunity set of major projects across all of our businesses; however, we expect the near term competitive environment for new awards to continue.”

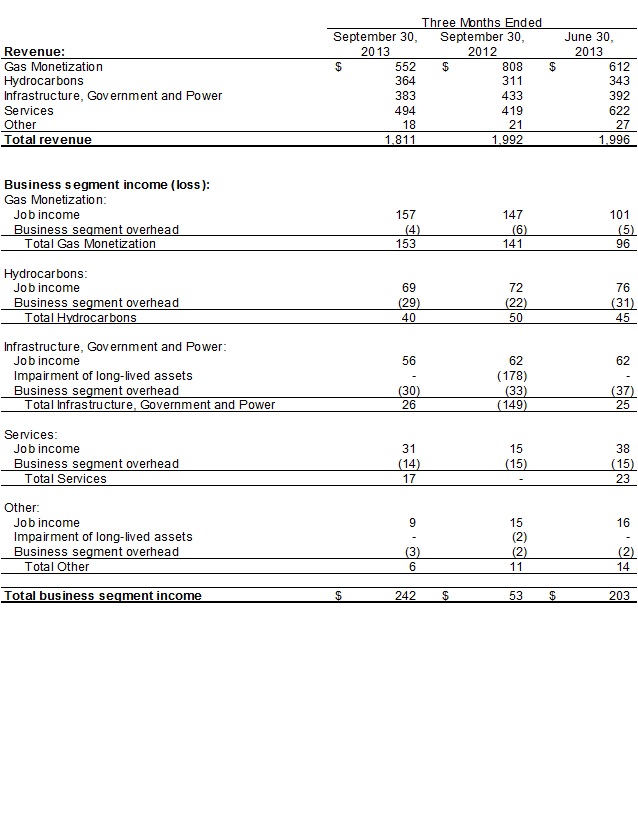

Business Discussion (All comparisons are third quarter 2013 versus third quarter 2012, unless otherwise noted).

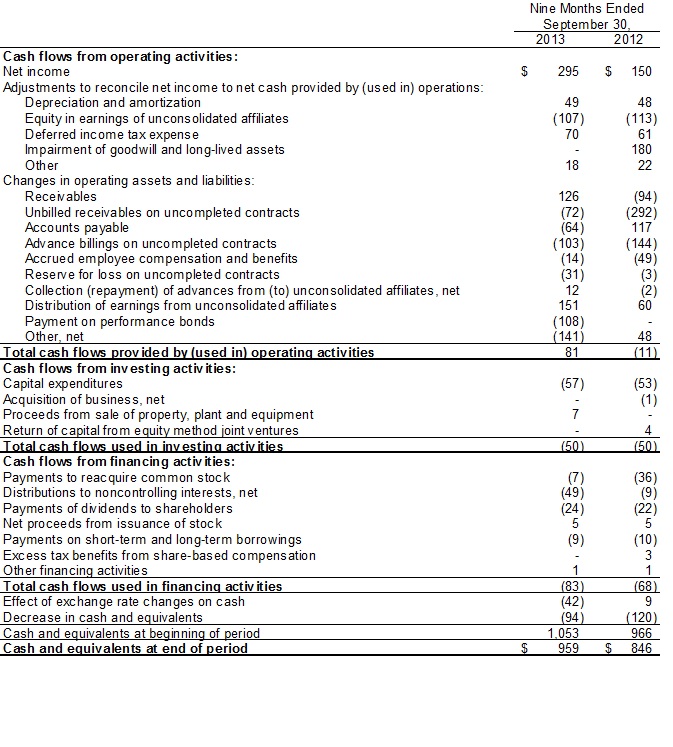

Gas Monetization Results

Gas Monetization revenue was $552 million, down $256 million, or 32% primarily related to completed construction on the Skikda LNG and Escravos GTL projects. Gas Monetization job income was $157 million, up $10 million, or 7%, primarily related to the recognition of a change order executed on the Gorgon LNG project as well as increased activity on the Ichthys LNG EPC and other active FEED projects. Partially offsetting the increase was lower income related to the Skikda LNG project in Algeria.

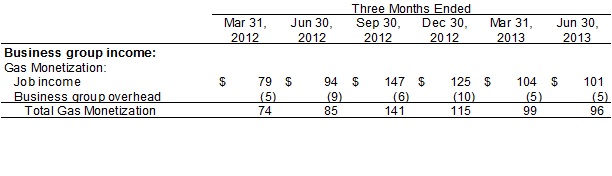

A supplemental table outlining Gas Monetization’s historical job income and business group overhead for the new reporting structure is attached.

Hydrocarbons Results

Hydrocarbons revenue was $364 million, up $53 million, or 17%. Hydrocarbons job income was $69 million, down $3 million, or 4%. An $8 million gain in the third quarter of 2012 from the completion of an ammonia project in Venezuela, which did not recur in the third quarter of 2013, was partially offset by a $5 million gain in the third quarter of 2013 due to a favorable arbitration award on a previously completed Egyptian project. Income from new ammonia and ethylene EPC projects and related technology awards in North America were offset by the completion or near completion of several offshore engineering projects.

Infrastructure, Government and Power (IGP) Results

IGP revenue was $383 million, down $50 million, or 12%. IGP job income was $56 million, down $6 million, or 10%, primarily related to lower work volumes for infrastructure-related projects, reduced activity on the LogCAP IV contract, and lower construction volumes on the Allenby & Connaught project. Partially offsetting the decrease was $6 million in cost reductions on a project in Indonesia as well as a third quarter 2012 charge of $8 million on a project in Indonesia that did not recur in the third quarter of 2013.

Services Results

Services revenue was $494 million, up $75 million, or 18%. Services job income was $31 million, up $16 million, or 107%, primarily related to $21 million in charges in the third quarter of 2012 due to increased cost estimates to complete two construction projects in the United States that did not recur in the third quarter of 2013, as well as increased activity on several module fabrication projects in Canada. Partially offsetting the increase was lower income related to a contract expiration and dry-docking of a vessel in the MMM joint venture.

Other Results

Other revenue was $18 million, down $3 million, or 14%. Other job income was $9 million, down $6 million, or 40%, primarily related to lower gas supply availabilities as well as lower ammonia prices at the EBIC ammonia plant in Egypt and increased maintenance costs at a project in the United Kingdom.

Corporate

Corporate general and administrative expense, including $14 million related to the company’s ERP implementation, was $66 million, up $10 million, or 18%.

Third quarter of 2013 labor cost absorption expense was $10 million, a $7 million improvement from the second quarter of 2013.

The effective tax rate for the third quarter 2013 was approximately 46% primarily due to a $38 million, or $0.26 per diluted share, tax expense related to an unfavorable accounting referee report for a tax dispute with KBR’s former parent as outlined in a KBR Form 8-K filed on October 11, 2013.

Noncontrolling interest was $63 million in the third quarter of 2013, which includes approximately $50 million related to a change order executed on the Gorgon LNG project.

Total cash provided by operating activities in the third quarter of 2013 was $178 million.

During the third quarter of 2013, KBR had capital expenditures of $17 million and quarterly dividend payments of $12 million for total cash deployment of $29 million.

KBR expects 2013 EPS to be at the low end of the previous guidance range of between $2.55 and $2.90, excluding charges related to the tax dispute with KBR’s former parent.

Significant Achievements and Awards

|

§

|

KBR was awarded a five year extension to provide contracted construction and maintenance services to DuPont. KBR’s contract renewal includes an expansion of services from 17 sites to 26 DuPont sites across the northeast U.S. and gulf coast regions.

|

|

§

|

KBR was awarded an approximately $300 million EPC contract by an undisclosed client for a urea plant to be constructed in North America.

|

|

§

|

KBR was selected to execute a front-end engineering and design (FEED) contract for a crude oil refinery revamp project for one of the oldest operating refineries in the U.S. During the feasibility phase, KBR’s expertise will focus on determining the optimum economic configuration to increase overall heavy crude processing capability and flexibility.

|

|

§

|

KBR was awarded a FEED contract by INEOS Olefins & Polymers USA for one of the largest grassroots high-density polyethylene plants to be built in the Americas. KBR’s scope of work includes the FEED for the inside and outside battery limit facilities, development of an appropriation grade cost estimate, and order of long lead equipment for the project.

|

|

§

|

KBR was awarded a contract to provide materials management services at a major steam-assisted gravity drainage operation southeast of Fort McMurray, Alberta, Canada. KBR will supply the equipment and experienced materials handling personnel to facilitate the offloading and loading of equipment, as well as material and inventory control.

|

|

§

|

KBR, along with three other firms, was awarded a contract under the Navy’s Global Contingency Construction Multiple Award Contract valued at up to $800 million over five years and provides immediate response for civilian construction contract capability in the event of natural disasters, humanitarian assistance, conflict or projects with similar characteristics.

|

|

§

|

KBR was awarded a contract by International Paper to provide total maintenance services for one of Russia’s most productive paper mills located in Svetogorsk, Russia. This contract is for three years with the option to renegotiate commercial terms after the first year.

|

KBR is a global engineering, construction and services company supporting the energy, hydrocarbons, power, industrial, civil infrastructure, minerals, government services and commercial markets. For more information, visit www.kbr.com.

NOTE: The statements in this press release that are not historical statements, including statements regarding future financial performance and backlog information, are forward-looking statements within the meaning of the federal securities laws. These statements are subject to numerous risks and uncertainties, many of which are beyond the company’s control that could cause actual results to differ materially from the results expressed or implied by the statements. These risks and uncertainties include, but are not limited to: the outcome of and the publicity surrounding audits and investigations by domestic and foreign government agencies and legislative bodies; potential adverse proceedings by such agencies and potential adverse results and consequences from such proceedings; the scope and enforceability of the company’s indemnities from Halliburton Company; changes in capital spending by the company’s customers; the company’s ability to obtain contracts from existing and new customers and perform under those contracts; structural changes in the industries in which the company operates, escalating costs associated with and the performance of fixed-fee projects and the company’s ability to control its cost under its contracts; claims negotiations and contract disputes with the company’s customers; changes in the demand for or price of oil and/or natural gas; protection of intellectual property rights; compliance with environmental laws; changes in government regulations and regulatory requirements; compliance with laws related to income taxes; unsettled political conditions, war and the effects of terrorism; foreign operations and foreign exchange rates and controls; the development and installation of financial systems; increased competition for employees; the ability to successfully complete and integrate acquisitions; and operations of joint ventures, including joint ventures that are not controlled by the company.

KBR’s Annual Report on Form 10-K dated February 20, 2013, recent Current Reports on Forms 8-K, and other Securities and Exchange Commission filings discuss some of the important risk factors that KBR has identified that may affect the business, results of operations and financial condition. KBR undertakes no obligation to revise or update publicly any forward-looking statements for any reason.

KBR, Inc.: Condensed Consolidated Statements of Income

(Millions, except per share data) (Unaudited)

KBR, Inc.: Condensed Consolidated Statements of Income

(Millions, except per share data) (Unaudited)

KBR, Inc.: Condensed Consolidated Balance Sheets

(Millions) (Unaudited)

KBR, Inc.: Condensed Consolidated Statements of Cash Flows

(Millions) (Unaudited)

KBR, Inc.: Revenue and Operating Results by Business Segment

(Millions)(Unaudited)

KBR, Inc.: Revenue and Operating Results by Business Segment

(Millions)(Unaudited)

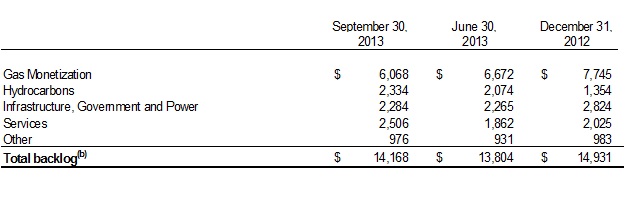

KBR, Inc.: Backlog Information (a)

(Millions)(Unaudited)

|

(a)

|

Backlog is presented differently depending on whether the contract is consolidated by KBR or is accounted for under the equity method of accounting. Backlog related to consolidated projects is presented as 100% of the expected revenue from the project. Backlog generally includes total expected revenue in backlog when a contract is awarded and/or the scope is definitized. Where contract duration is indefinite, projects included in backlog are limited to the estimated amount of expected revenue within the following twelve months. Certain contracts provide maximum dollar limits, with actual authorization to perform work under the contract being agreed upon on a periodic basis with the customer. In these arrangements, only the amounts authorized are included in backlog. For projects where KBR acts solely in a project management capacity, KBR only includes the management fee revenue of each project in backlog. For certain long-term service contracts with a defined contract term, such as those associated with privately financed projects, the amount included in backlog is limited to five years.

|

Backlog related to unconsolidated joint ventures is presented as KBR’s percentage ownership of the joint venture’s estimated revenue. However, because these projects are accounted for under the equity method, only KBR’s share of future earnings from these projects will be recorded in revenue. Our backlog for projects related to unconsolidated joint ventures totaled $5.2 billion, $5.3 billion and $5.8 billion at September 30, 2013, June 30, 2013, and December 31, 2012, respectively. Our backlog related to consolidated joint ventures with noncontrolling interest totaled $1.5 billion, $1.8 billion and $2.1 billion at September 30, 2013, June 30, 2013, and December 31, 2012, respectively.

As of September 30, 2013, 46% of our backlog was attributable to fixed-price contracts and 54% was attributable to cost-reimbursable contracts. For contracts that contain both fixed-price and cost-reimbursable components, we classify the components as either fixed-price or cost-reimbursable according to the composition of the contract except for smaller contracts where we characterize the entire contract based on the predominate component.

All backlog is attributable to firm orders as of September 30, 2013, June 30, 2013, and December 31, 2012.

|

(b)

|

Backlog attributable to unfunded government orders was $0.1 billion, $0.1 billion and $0.2 billion as of September 30, 2013, June 30, 2013, and December 31, 2012, respectively.

|

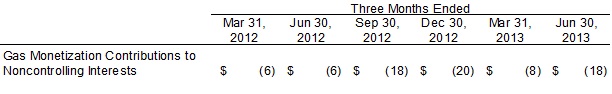

KBR, Inc.: Historical Gas Monetization Business Segment Income and Overheads

(Millions)(Unaudited)

KBR, Inc.: Historical Gas Monetization Business Segment Contributions to Noncontrolling Interests

(Millions)(Unaudited)