Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Poage Bankshares, Inc. | v357689_8k.htm |

| EX-2.1 - EXHIBIT 2.1 - Poage Bankshares, Inc. | v357689_ex2-1.htm |

| EX-99.1 - EXHIBIT 99.1 - Poage Bankshares, Inc. | v357689_ex99-1.htm |

Acquisition of Town Square Financial Corporation October 2013 Investor Presentation

2 General Information and Limitations Forward - Looking Statements Certain statements contained herein are “forward - looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward - looking statements may be identified by reference to a future period or period s, or by the use of forward - looking terminology, such as “may,” “will,” “believe,” “expect,” “estimate,” “anticipate,” “continue,” or similar terms or variations on those terms, or the negative of those terms. Forward - looking statements are subject to numerous risks and uncertainties, as described in our SEC filings. In addition to risk factors identified by the Company in its Annual Report on Form 10 - K, filed with the Securities and Exchange Commission on D ecember 19, 2012, the following factors could cause the actual results to differ materially from the Company’s expectations: failure to satisfy the co nditions to closing for the proposed merger in a timely manner or at all; failure of Town Square Financial Corporation’s stockholders to approve the prop ose d merger; failure to obtain the necessary governmental approvals for the proposed merger or adverse regulatory conditions in connection with such app rovals; disruption to the parties' businesses as a result of the announcement and pendency of the transaction; difficulties related to the integrat ion of the businesses following the merger; competitive pressures among depository and other financial institutions; changes in the interest rate environment ; a nd changes in economic conditions, either nationally or regionally. The Company wishes to caution readers not to place undue reliance on any such forward - looking statements, which speak only as of the date made. The Company wishes to advise readers that the factors listed above could affect the Company’s actual results for future periods t o d iffer materially from any opinions or statements expressed with respect to future periods in any current statements. The Company does not undertake and sp ecifically declines any obligation to publicly release the results of any revisions that may be made to any forward - looking statements to reflect ev ents or circumstances after the date of the release of this presentation or to reflect the occurrence of anticipated or unanticipated events.

• Creates significant operating scale within the Ashland, KY market area • Pro forma bank will have the largest deposit market share within Boyd county • In - market expansion maximizes opportunities in the local market area • Opportunity to grow in existing areas and expand presence within current branch footprint • Combines two strong management teams • Financially attractive deal pricing and structure with conservative modeling assumptions – Transaction priced at 104% of TBV and 13.3x LTM EPS (as of 9/30/13 ) – “Well capitalized” pro forma company with strong capital ratios of 13.5% TCE / TA and 18.7% Tier 1 capital ratio – Achievable cost savings of $519k in Year 1 (18% of estimated non - interest expense and 75% realized in Year 1) – Immediately EPS accretive (57% in 2014 and 78% in 2015) 3 Transaction Highlights

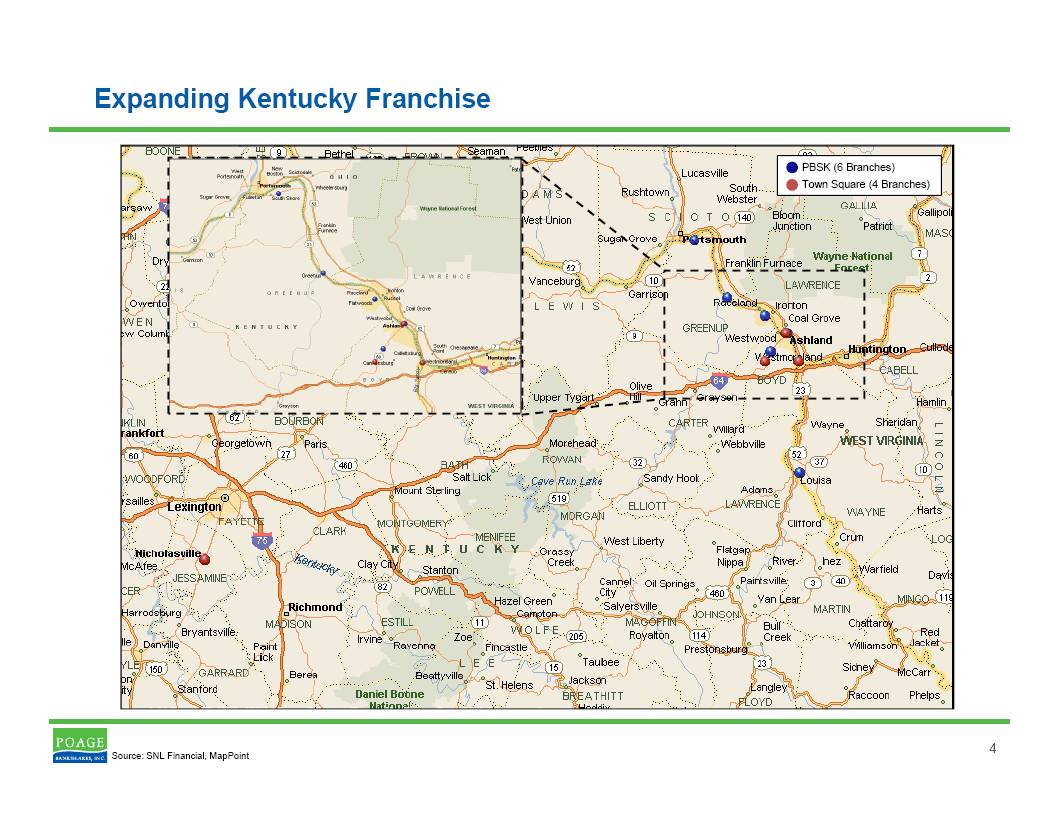

Source: SNL Financial, MapPoint 4 Expanding Kentucky Franchise PBSK (6 Branches) Town Square (4 Branches)

Approximately $14.7 million 5 Transaction Overview $33.86 Price per Share: Transaction Value: 55% stock consideration, 45% cash consideration Consideration Mix: PBSK is offering two board seats to existing Town Square board members Board Representation: Fixed exchange ratio of 2.3289x Exchange Ratio: First trigger: PBSK average closing price is down by more than 15% from $13.65; and Second trigger: PBSK average closing price is down by more than 20% from SNL Thrift Index Double Trigger / Walkaway : PBSK ownership: 86% Town Square Financial ownership: 14% Ownership Detail: $600,000 Termination Fee: Shareholder approval for Town Square and customary regulatory approvals Required Approvals: Transaction close 3/31/2014 Targeted Closing:

(1) Year 1 defined as the remaining 2 quarters in 2014 after transaction close (2) Incremental tangible book value earnback represents the number of years to eliminate tangible book value dilution at closing utilizing the incremental earnings realiz ed through the merger 6 Transaction Financial Impact Key Transaction Assumptions : • 7.0% credit mark on Town Square’s gross loans (approximately $8.9 million) • Estimated cost savings of 18% of Town Square’s annual operating expenses – Year 1 cost savings of $519k (75% phased - in) – Year 2 cost savings of $713k (100% phased - in) • Transaction expenses of approximately $1.5 million after - tax Pro Forma Financial Impact : • Year 1 EPS accretion of 57% (1) • Year 2 EPS accretion of 78% • IRR greater than 17% • Tangible book value earnback of less than 4 years (2) Pro Forma Capital Ratios : • TCE / TA of 13.5% • Leverage ratio of 11.1% • Total risk - based capital ratio of 19.5%

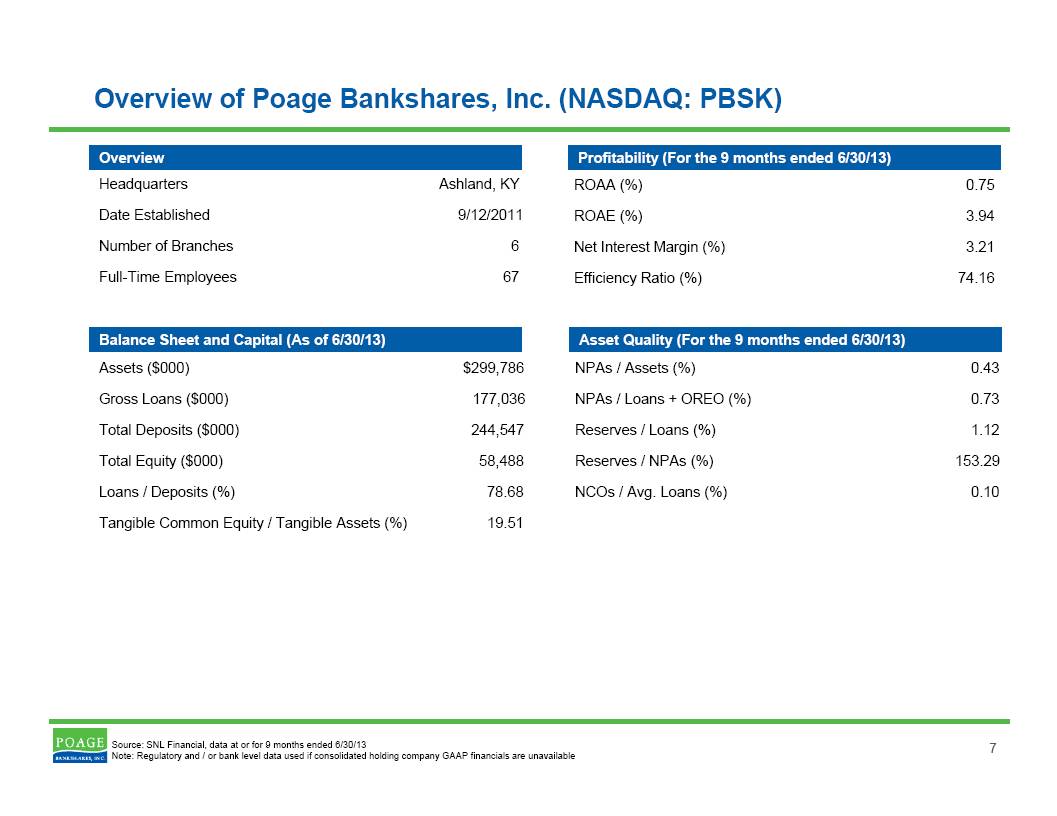

Source: SNL Financial, data at or for 9 months ended 6/30/13 Note: Regulatory and / or bank level data used if consolidated holding company GAAP financials are unavailable 7 Overview of Poage Bankshares , Inc. (NASDAQ: PBSK) Overview Balance Sheet and Capital (As of 6/30/13) Headquarters Ashland, KY Date Established 9/12/2011 Number of Branches 6 Full - Time Employees 67 Assets ($000) $299,786 Gross Loans ($000) 177,036 Total Deposits ($000) 244,547 Total Equity ($000) 58,488 Loans / Deposits (%) 78.68 Tangible Common Equity / Tangible Assets (%) 19.51 Profitability (For the 9 months ended 6/30/13) Asset Quality (For the 9 months ended 6/30/13) ROAA (%) 0.75 ROAE (%) 3.94 Net Interest Margin (%) 3.21 Efficiency Ratio (%) 74.16 NPAs / Assets (%) 0.43 NPAs / Loans + OREO (%) 0.73 Reserves / Loans (%) 1.12 Reserves / NPAs (%) 153.29 NCOs / Avg. Loans (%) 0.10

Source: SNL Financial, data at or for 6 months ended 6/30/13 Note: Financials are at the consolidated holding company level. Earnings have been tax - effected 35% to convert S - Corp status to C - Corp status 8 Overview of Town Square Financial Corporation Overview Balance Sheet and Capital (As of 6/30/13) Headquarters Ashland, KY Date Established 2/18/2000 Number of Branches 4 Full - Time Employees 49 Assets ($000) $154,908 Gross Loans ($000) 126,446 Total Deposits ($000) 133,024 Total Equity ($000) 13,631 Loans / Deposits (%) 95.06 Tangible Common Equity / Tangible Assets (%) 8.80 Profitability (For 6 months ended 6/30/13) Asset Quality (For 6 months ended 6/30/13) ROAA (%) 0.50 ROAE (%) 6.10 Net Interest Margin (%) 4.45 Efficiency Ratio (%) 65.98 NPAs / Assets (%) 5.07 NPAs / Loans + OREO (%) 6.20 Reserves / Loans (%) 1.09 Reserves / NPAs (%) 17.56 NCOs / Avg. Loans (%) 0.65

Source: SNL Financial, data as of the most recent quarter ended 6/30/13 Note: Regulatory financials used for comparative purposes 9 Pro Forma Loan Composition Loan Portfolio ($000) Amount % of Total Loan Portfolio ($000) Amount % of Total Loan Portfolio ($000) Amount % of Total Const. & Land 4,136$ 2.3% Const. & Land 10,056$ 8.0% Const. & Land 14,192$ 4.7% 1-4 Family RE 131,740 74.4% 1-4 Family RE 43,092 34.1% 1-4 Family RE 174,832 57.6% Multifamily 970 0.5% Multifamily 4,192 3.3% Multifamily 5,162 1.7% CRE 17,050 9.6% CRE 35,067 27.7% CRE 52,117 17.2% C&I / Ag 6,333 3.6% C&I / Ag 26,194 20.7% C&I / Ag 32,527 10.7% Cons. & Home Equity 16,775 9.5% Cons. & Home Equity 7,334 5.8% Cons. & Home Equity 24,109 7.9% Other 32 0.0% Other 511 0.4% Other 543 0.2% Gross Loans & Leases 177,036 100.0% Gross Loans & Leases 126,446 100.0% Gross Loans & Leases 303,482 100.0% Yield on Loans and Leases: 5.53% Yield on Loans and Leases: 5.75% Yield on Loans and Leases: 5.62% PBSK Town Square Financial Corporation Pro Forma Const. & Land 2.3% 1 - 4 Family RE 74.4% Multifamily 0.5% CRE 9.6% C&I / Ag 3.6% Cons. & Home Equity 9.5% Const. & Land 8.0% 1 - 4 Family RE 34.1% Multifamily 3.3% CRE 27.7% C&I / Ag 20.7% Cons. & Home Equity 5.8% Other 0.4% Const. & Land 4.7% 1 - 4 Family RE 57.6% Multifamily 1.7% CRE 17.2% C&I / Ag 10.7% Cons. & Home Equity 7.9% Other 0.2%

Source: SNL Financial, data as of the most recent quarter ended 6/30/13 Note: Regulatory financials used for comparative purposes 10 Pro Forma Deposit Composition Deposit Portfolio ($000) Amount % of Total Deposit Portfolio ($000) Amount % of Total Deposit Portfolio ($000) Amount % of Total Trans. 38,713$ 16.5% Trans. 45,925$ 34.5% Trans. 84,638$ 23.0% Savings & MMDAs 65,488 28.0% Savings & MMDAs 28,062 21.1% Savings & MMDAs 93,550 25.5% Retail CDs 120,142 51.3% Retail CDs 52,274 39.3% Retail CDs 172,416 46.9% Jumbo CDs 9,888 4.2% Jumbo CDs 6,763 5.1% Jumbo CDs 16,651 4.5% Total Deposits 234,231 100.0% Total Deposits 133,024$ 100.0% Total Deposits 367,255$ 100.0% Cost of Total Deposits: 0.72% Cost of Total Deposits: 0.63% Cost of Total Deposits: 0.69% PBSK Town Square Financial Corporation Pro Forma Trans. 16.5% Savings & MMDAs 28.0% Retail CDs 51.3% Jumbo CDs 4.2% Trans. 34.5% Savings & MMDAs 21.1% Retail CDs 39.3% Jumbo CDs 5.1% Trans. 23.0% Savings & MMDAs 25.5% Retail CDs 46.9% Jumbo CDs 4.5%

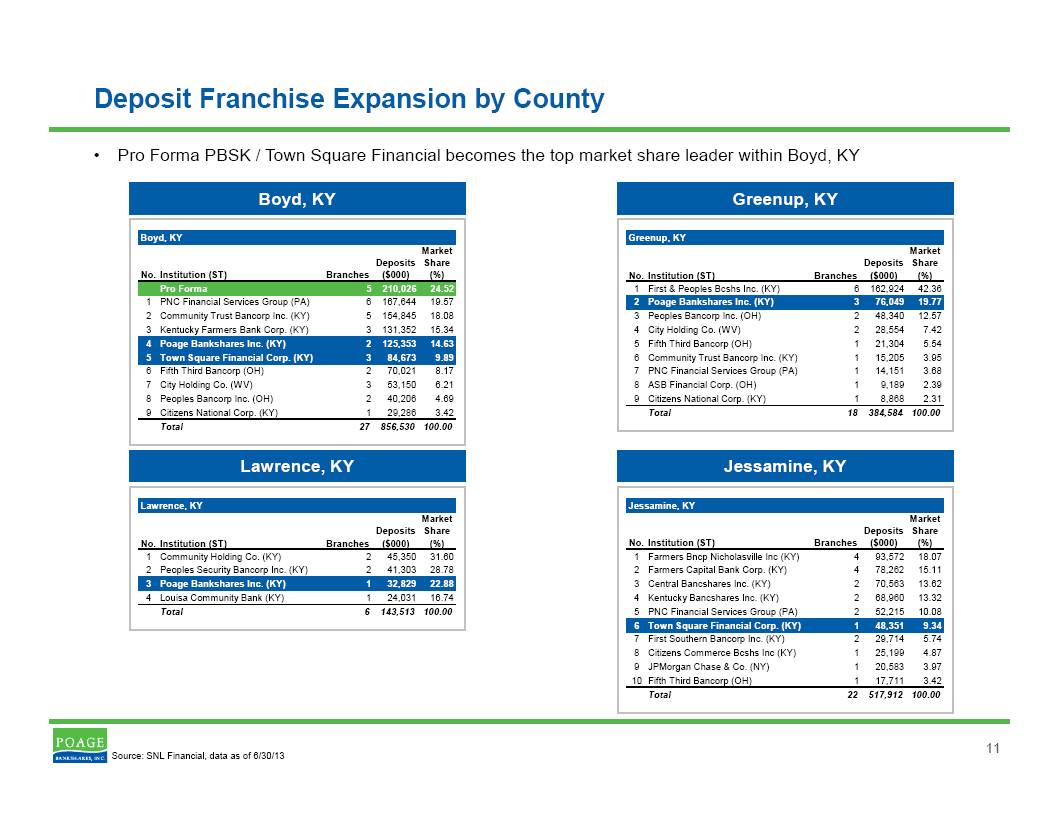

• Pro Forma PBSK / Town Square Financial becomes the top market share leader within Boyd, KY Source: SNL Financial, data as of 6/30/13 11 Deposit Franchise Expansion by County Boyd, KY Greenup, KY Lawrence, KY Jessamine, KY Boyd, KY No.Institution (ST) Branches Deposits ($000) Market Share (%) Pro Forma 5 210,026 24.52 1 PNC Financial Services Group (PA) 6 167,644 19.57 2 Community Trust Bancorp Inc. (KY) 5 154,845 18.08 3 Kentucky Farmers Bank Corp. (KY) 3 131,352 15.34 4 Poage Bankshares Inc. (KY) 2 125,353 14.63 5 Town Square Financial Corp. (KY) 3 84,673 9.89 6 Fifth Third Bancorp (OH) 2 70,021 8.17 7 City Holding Co. (WV) 3 53,150 6.21 8 Peoples Bancorp Inc. (OH) 2 40,206 4.69 9 Citizens National Corp. (KY) 1 29,286 3.42 Total 27 856,530 100.00 Greenup, KY No.Institution (ST) Branches Deposits ($000) Market Share (%) 1 First & Peoples Bcshs Inc. (KY) 6 162,924 42.36 2 Poage Bankshares Inc. (KY) 3 76,049 19.77 3 Peoples Bancorp Inc. (OH) 2 48,340 12.57 4 City Holding Co. (WV) 2 28,554 7.42 5 Fifth Third Bancorp (OH) 1 21,304 5.54 6 Community Trust Bancorp Inc. (KY) 1 15,205 3.95 7 PNC Financial Services Group (PA) 1 14,151 3.68 8 ASB Financial Corp. (OH) 1 9,189 2.39 9 Citizens National Corp. (KY) 1 8,868 2.31 Total 18 384,584 100.00 Lawrence, KY No.Institution (ST) Branches Deposits ($000) Market Share (%) 1 Community Holding Co. (KY) 2 45,350 31.60 2 Peoples Security Bancorp Inc. (KY) 2 41,303 28.78 3 Poage Bankshares Inc. (KY) 1 32,829 22.88 4 Louisa Community Bank (KY) 1 24,031 16.74 Total 6 143,513 100.00 Jessamine, KY No.Institution (ST) Branches Deposits ($000) Market Share (%) 1 Farmers Bncp Nicholasville Inc (KY) 4 93,572 18.07 2 Farmers Capital Bank Corp. (KY) 4 78,262 15.11 3 Central Bancshares Inc. (KY) 2 70,563 13.62 4 Kentucky Bancshares Inc. (KY) 2 68,960 13.32 5 PNC Financial Services Group (PA) 2 52,215 10.08 6 Town Square Financial Corp. (KY) 1 48,351 9.34 7 First Southern Bancorp Inc. (KY) 2 29,714 5.74 8 Citizens Commerce Bcshs Inc (KY) 1 25,199 4.87 9 JPMorgan Chase & Co. (NY) 1 20,583 3.97 10 Fifth Third Bancorp (OH) 1 17,711 3.42 Total 22 517,912 100.00

• Immediately accretive to earnings post - transaction close • Effective deployment of capital – P ro forma company remains “well - capitalized” post - transaction close • Achievable cost savings and complementary branch footprint drives growth, efficiency, and operating scale • Pro forma company will have the largest deposit market share within Boyd county • Strategic in - market acquisition favorably positions the pro forma company for further growth and efficiencies 12 Investment Highlights