Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - USG CORP | d612900d8k.htm |

| EX-10.1 - EX-10.1 - USG CORP | d612900dex101.htm |

| EX-2.2 - EX-2.2 - USG CORP | d612900dex22.htm |

| EX-2.1 - EX-2.1 - USG CORP | d612900dex21.htm |

| EX-99.1 - EX-99.1 - USG CORP | d612900dex991.htm |

| EX-99.2 - EX-99.2 - USG CORP | d612900dex992.htm |

16

October 2013 Jim Metcalf

Chairman, President & CEO

Mike Kane

CEO & Managing Director

Creating a World Leading Joint Venture

Asia –

Australasia –

Middle East

Exhibit 99.3

® |

2

USG Cautionary Statements

This presentation contains forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995 related to management’s expectations about future

conditions. Actual business, market or other conditions may differ materially from

management’s expectations and, accordingly, may affect our sales and profitability or

other results and liquidity. Actual results may differ materially due to various other factors, including:

economic conditions, such as the levels of new home and other construction activity, employment

levels, the availability of mortgage, construction and other financing, mortgage and other

interest rates, housing affordability and supply, the levels of foreclosures and home resales,

currency exchange rates and consumer confidence; capital markets conditions and the

availability of borrowings under our credit agreement or other financings; our substantial

indebtedness and our ability to incur substantial additional indebtedness; competitive conditions,

such as price, service and product competition; shortages in raw materials; changes in raw

material and energy costs; volatility in the assumptions used to determine the funded status of

our pension plans; the loss of one or more major customers and our customers’ ability to

meet their financial obligations to us; capacity utilization rates for us and the industry; our

ability to expand into new geographic markets and the stability of such markets; our ability to

successfully enter into and operate the joint venture with Boral Limited, including risks that

our joint venture partner, Boral Limited, may not fulfill its obligations as an investor or may

take actions that are inconsistent with our objectives; our ability to protect our intellectual

property and other proprietary rights; changes in laws or regulations, including environmental and

safety regulations; the satisfactory performance of certain business functions by third party service

providers; our ability to achieve anticipated savings from cost reduction programs; the outcome

in contested litigation matters; the effects of acts of terrorism or war upon domestic and

international economies and financial markets; and acts of God. We assume no obligation to

update any forward-looking information contained in this presentation. Additional

information concerning these and other factors may be found in our filings with the Securities and

Exchange Commission, including the “Risk Factors” in our most recent Annual Report on

Form 10-K. |

3

Content

1.

Overview of the transaction / strategic rationale

2.

USG’s IP / Technology and adjacent products

3.

JV’s combined footprint and markets

4.

Synergies

5.

Key transaction terms

6.

Company specific factors

7.

Summary

Appendix |

Boral and USG are forming a US $1.6 billion

1

plasterboard and

ceilings joint venture, USG Boral Building Products, bringing together

Boral’s leading plasterboard manufacturing and distribution footprint

in Asia and Australia with USG’s world-leading building products

technologies and strategic assets in Asia and the Middle East.

1.

Asset value of US$1.6bn subject to finalisation of fair valuation, completion

adjustments and final foreign exchange rates at the date of completion

® |

5

1.

US$1.6bn asset valuation subject to finalisation of fair valuation, completion

adjustments and final foreign exchange rates at the date of completion

2.

Middle East joint venture refers to assets held in Saudi Arabia

Overview of the transaction

50:50 US$1.6bn plasterboard and ceilings joint venture, USG Boral Building

Products, will encompass the following assets:

-

Boral’s Gypsum operations in Asia and Australia, including its holdings in,

or portions of, Gypsum Resources Australia (GRA) and Rondo joint ventures

with CSR -

USG’s

wholly

owned

operations

in

Asia,

New

Zealand,

and

its

holdings

in,

or

portions

of,

current

joint

ventures

in

the

Middle

East²,

Oman

and

China

-

Exclusive rights to use USG’s intellectual property including its

world-leading plasterboard, joint compound and ceilings

technologies To achieve 50% ownership interest, USG will make a US$500m

upfront cash payment to Boral

-

Boral will also have the potential to receive earn out payments of up to US$75m,

based on three-

and five-year earnings targets

1 |

6

Creating a leading building products partnership

in Asia, Australasia and the Middle East

1.

Includes Asia, Australasia and the Middle East

The joint venture will be the market leader in its Territory

in sales, scale, distribution,

coverage (product and geography) and technology

USG

is a world leader in building products technologies with strategic assets in the

Middle East, New Zealand and Asia

BORAL

has a leading plasterboard manufacturing and distribution footprint in Asia and

Australia

Combined

business

delivers:

#1 or #2 position in most markets served

Sustainable long-term competitive advantage through game-changing

technologies Substantial synergies, expected from

-

Roll-out of USG technology across Boral’s Gypsum operations

-

Leveraging Boral’s distribution network to offer USG’s adjacent

products Capability to pursue and self-fund new opportunities

Over 150 years of combined industry leadership and experience

1

|

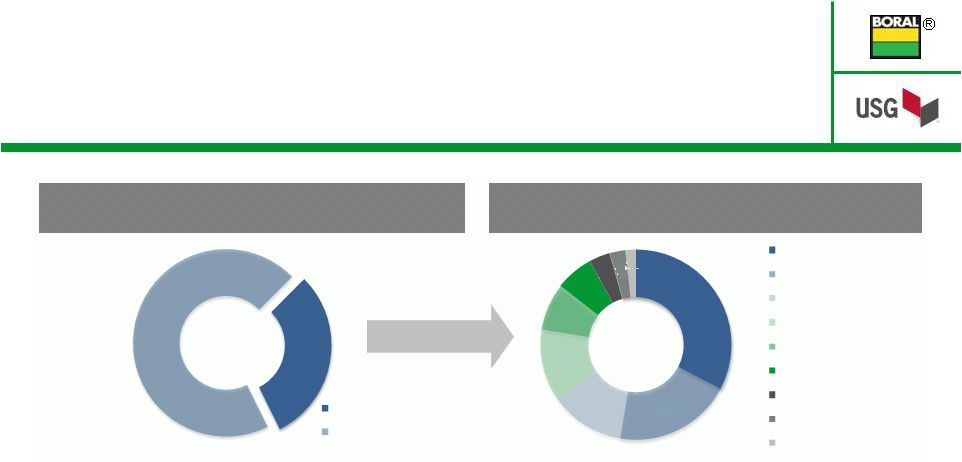

7

Building

Products

11%

Overview of BORAL

(ASX: BLD)

A$3.7bn

market

cap

(US$3.5bn)

1

A$5.3bn

(US$5.4bn)

2

revenue

in

FY2013

3

12,610 employees as of 30 June 2013

Construction Materials, Building Products

and Gypsum

Australia, Asia and US

Overview of USG

(NYSE: USG)

US$3.0bn

market

cap

1

US$3.2bn

revenue

in

FY2012

3

8,500 employees as of 31 December 2012

Gypsum, Ceilings and Product Distribution

North America, South America, Asia and

Middle East

Geographic revenue –

FY2012

Segment revenue –

FY2012

Segment revenue –

FY2013

Geographic revenue –

FY2013

Construction

Materials &

Cement 60%

Boral USA 11%

Boral

Gypsum

18%

Australia

78%

Asia

11%

USA

11%

Product

distribution

4

31%

The joint venture partners

Gypsum

53%

Ceilings

16%

United

States

80%

Other

8%

Canada

12%

1.

Source: Company reports. Share price from IRESS and Factset as at 10 October 2013. Based on A$/US$

exchange rate of 0.95 as at 10 October 2013

2.

Based on average A$/US$ exchange rate of 1.02 for the year ended 30 June 2013 3.

Boral’s financial year ended 30 June 2013; USG’s financial year ended 31 December 2012 4.

USG’s Product Distribution business outside Asia and the Middle East and Boral’s Building

Products division (which includes Bricks, Roofing, Timber & Windows) are not a part of the

Joint Venture transaction |

8

USG

BLD

50%

50%

Korea

Thailand/

Philippines

Aus/NZ

India

Middle East

86m m²

(0.9 BSF)

capacity & Boral

sales presence in

Australia

50% Rondo metal

products

50% GRA gypsum

mine

USG NZ grid

manufacturing

USG sales

presence

105m m²

(1.1 BSF)

capacity in

Thailand &

Boral sales

presence (71%

interest)

Gypsum mine

Boral metal

products

USG sales

presence

65m m²

(0.7 BSF)

capacity &

Boral sales

presence

Boral metal

products

USG sales

presence

10m

m²

(0.1 BSF)

capacity in

Malaysia &

Boral sales

presence

50% Rondo

metal products

USG joint

compound

manufacturing

USG sales

presence

155m m²

(1.7 BSF)

capacity³

&

Boral sales

presence

Boral metal

products

50% interest in

USG ceiling

tile, metal

ceiling grid &

mineral wool

manufacturing

9m

m²

(0.1 BSF)

capacity &

Boral sales

presence

Boral metal

products

50% Rondo

metal

products

USG Joint

Compound

USG sales

presence

Boral sales

presence

50% interest in

8m m² (0.1 BSF)

plant in Oman³

55% interest in

Oman gypsum

mine

45% interest in

ceiling, metal

ceiling grid,

metal stud, and

joint compound

plant in Saudi

Arabia

Vietnam

USG TECHNOLOGY

153m m²

(1.6 BSF)²

capacity &

Boral sales

presence

USG sales

presence

42m m²

(0.5 BSF)

capacity³

&

Boral sales

presence

Boral metal

products

USG sales

presence

Boral operations

USG operations

Indonesia

China

Malaysia/

Singapore

1.

Actual structure will be via two JV legal entities

2.

m m² refers to million square metres; BSF refers to

billion square feet 3.

Post completion of capacity expansion at Ho Chi Minh City (Vietnam) and Chongqing

(China) in financial year ending 30 June 2014 and construction of new plant

in Oman in calendar year 2014 (CY2014) 4.

Post completion of manufacturing facility expected in 1Q CY2014

Overview of joint venture operations in

Asia, Australasia and the Middle East

USG Boral Building

Products¹

Plant

4 |

9

Content

1.

Overview of the transaction / strategic rationale

2.

USG’s IP / Technology and adjacent products

3.

JV’s combined footprint and markets

4.

Synergies

5.

Key transaction terms

6.

Company specific factors

7.

Summary

Appendix |

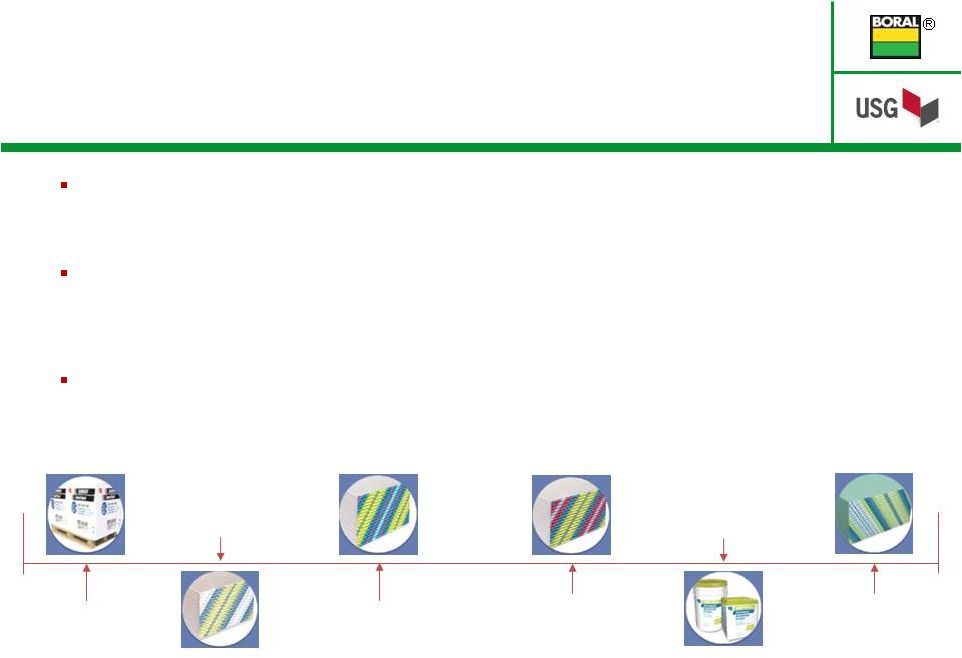

10

2009:

Durock

®

Cement Board

Next-Gen up to

25% lighter

2010:

SHEETROCK

®

Brand

UltraLight Panels up to 30%

lighter

2011:

SHEETROCK

®

Brand

UltraLight Panels

FIRECODE

®

30 up to

30% lighter

2011:

SHEETROCK

®

Brand

UltraLight Panels

FIRECODE

®

X

up to

15% lighter

2012:

SHEETROCK

®

Brand

UltraLightWeight

All Purpose Joint Compound up to

40% lighter

2013:

SHEETROCK

®

Brand

UltraLight Panels Mold

Tough

®

up to 20%

lighter

1.

See slide in appendix for an overview of USG’s technology journey and leading

innovations 2.

Equivalent cost compared to USG’s previous generation technology plasterboard,

but at a lower cost relative to industry standard / Boral Gypsum plasterboard

USG: A history of differentiating

through innovation

USG

has

led

every

major

industry

innovation

1

-

US$170m invested in R&D since 2003 with 2,000+ patents received

-

Dedicated research & development facility in Libertyville, Illinois, US

Significant recognition received for innovations

-

2011 –

Global Gypsum Magazine’s Product of the Year Award and The Home Depot’s

Product Innovation of the Year Award (SHEETROCK®

Brand UltraLight Panels)

-

2013 –

Ranked a Top Innovator in the Industrial Materials Sector by the Patent

Board Superior performing, lower weight products in plasterboard, cement

board and joint compound -

UltraLight

products

command

a

price

premium,

can

be

produced

at

equivalent

cost

2

and reduce freight

-

Better score and snap, superior sag resistance, and lighter weight characteristics

improve contractor and distributor productivities

|

11

Strong market response and rapid

adoption of UltraLight technology

US: Total Board Volumes

1.

Classic volume refers to USG’s technologies preceding UltraLight third

generation technology Mexico

Improved performance attributes speeds adoption in emerging market

Lighter weight generates freight savings and improved profitability

Positioned as a premium price, superior performance product

Canada

Strong conversion rate attributed to performance characteristics

Lighter weight increases contractor productivity and profitability

High adoption rates in all end use markets

50% conversion across full USG plasterboard portfolio in 3

years ~80% of ½” wallboard converted to SHEETROCK®

Brand UltraLight Panels

Side by side comparison drives rapid adoption in the retail

channel Superior performance attributes encourage residential

adoption

Productivity enhancements yield strong

commercial conversion

United States

UltraLight Volume

USG Classic Volume

¹ |

12

Customer testimonials illustrate the strong

value proposition of USG’s UltraLight portfolio

“When we started tracking board counts on this product we began seeing

production rate increases”

–

Commercial Contractor, US

“We will use the product whenever possible”

–

Residential Contractor, US

“I could do easily 5-10 more sheets”

–

Installer, US

“All attributes are excellent, I prefer this board”

–

Contractor, Mexico

“Lighter, easier to screw, easier to install, and has no difficulty

cutting” –

Contractor, Mexico

"Panel weight makes it easier to install & work with”

–

Contractor, Mexico

“It just flows onto the walls”

–

Contractor,

US

regarding

SHEETROCK®

Brand

UltraLightweight

Joint

Compound

For additional information :

www.theweighthasbeenlifted.com |

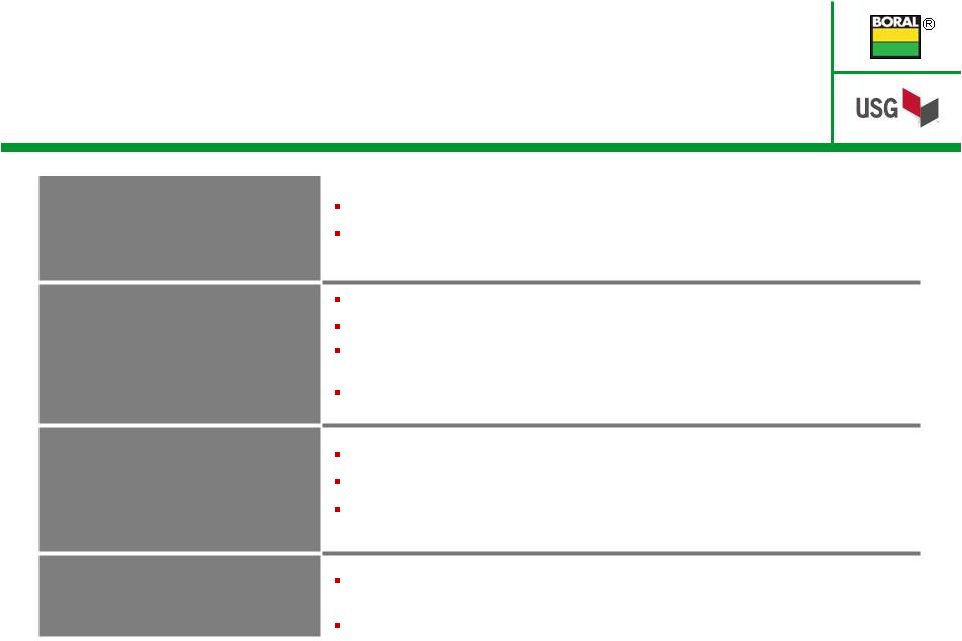

High-performance ceilings business provides

a strong, complementary adjacency that further

differentiates the joint venture

Acoustical Tile

Full-line high performance

offering

Sustainable solutions

Architectural specification

focused

Specialty Solutions

Innovator

Leading brands

Enhances the aesthetics of

finished space

Creates a basis of design for the

specifier

Suspension Systems

Globally recognised DONN®

grid

World class manufacturing

Complete code approvals

Partnered with GE for

integrated LED lighting solution

Commercial Segments

Extends the portfolio for

commercial projects

Strong in all commercial

segments

Broadens the portfolio of

product solutions for commercial

projects

#2 USG global share in the industry with leading brands

International manufacturing and market coverage

Profitable business with stable margins through the US cycle

Solutions focused on performance, sustainability and aesthetics

13 |

14

Content

1.

Overview of the transaction / strategic rationale

2.

USG’s IP / Technology and adjacent products

3.

JV’

combined footprint and markets

4.

Synergies

5.

Key transaction terms

6.

Company specific factors

7.

Summary

Appendix |

15

1.

Production either online or expected to be online in CY2014

2.

Production may be at the same physical location. Other production includes

ceiling tile, metal ceiling grid, metal products, joint compounds, mineral wool and cornice production

3.

Certain manufacturing facilities and gypsum quarries held in joint venture with

third parties (refer to page 8 of this presentation) CHINA

THAILAND

VIETNAM

MALAYSIA

INDONESIA

PHILIPPINES

SOUTH KOREA

AUSTRALIA

NEW ZEALAND

INDIA

SAUDI ARABIA

USG/ Boral

JV

Capacity

(m m²)1

633

Capacity

(BSF)1

6.8

Manufacturing footprint

(number of operations)

Boral plasterboard plant

Boral gypsum mine

³

Boral other production

2,3

USG plasterboard plant

1,3

USG gypsum mine

³

USG other production

1,2,3

18

2

28

3

1

4

2

3

1

3

1

3

2

1

3

1

3

3

5

6

1

2

OMAN

1

1

1

1

3

3

1

1

1

9

Joint venture has leading positions

across Asia, Australasia and the Middle East |

16

JV plasterboard market share 2013

5

Country

Board Capacity

Board

lines

Non-board

production

Sales

offices

Gypsum

mine

(m m

2

)

(BSF)

China

155

1.7

7

9

7

-

Korea

153

1.6

4

3

6

-

Thailand

105

1.1

3

3

3

1

Australia

86

0.9

3

4

9

1

Indonesia

65

0.7

3

3

5

-

Vietnam

42

0.5

2

3

5

-

Malaysia/

Singapore

10

0.1

1

4

4

-

India

9

0.1

1

3

7

-

Other

4

-

-

-

1

8

-

New Zealand

-

-

-

1

1

-

Saudi Arabia

-

-

-

3

3

-

Oman

8

0.1

1

-

-

1

Total

633

6.8

25

37

58

3

Revenue contribution from largest to smallest

Joint venture market positions

37%

43%

54%

6%

41%

58%

48%

16%

55%

13%

1.

Production either online or expected to be online in CY2014 2.

Includes metal stud, metal ceiling grid, joint compound, ceiling tile, cornice and/or mineral wool

facilities

3.

Certain manufacturing facilities and gypsum mines held in joint venture with third parties (refer to

page 8 of this presentation)

4.

Other includes metal plant in the Philippines and export business in UAE, Philippines, and Hong Kong 5.

Source: management estimates based on plasterboard sales volume, excluding ceiling tiles

3

2

1

1

3

1

1

1

3

2

3

3

3

1

1

1 |

17

2013

Market

size

in

JV

region

-

except

China

1

(million m²)

2013

Market

size

in

JV

region

1

(million m²)

Total

682

Total

2,262

1.

USG and Boral estimates for plasterboard market (excluding ceiling tiles)

2.

Middle East defined as including UAE, Oman and Saudi Arabia

Asian markets represent strong growth

potential for JV building products

2

Non-China

China

223

136

87

83

55

44

24

18

12

Korea

Australia

Indonesia

Thailand

India

Vietnam

Malaysia & Singapore

Philippines

Middle East

Market Highlights

Korea:

Australia:

Indonesia:

Thailand:

China:

India:

Middle East:

mature market with appetite for high performance and high quality products

strong growth in third most populated country in Asia, with large consumer

market solid growth with opportunity to increase plasterboard

penetration largest market with continued growth due to government

limitations on brick and clay demand for faster building construction is

accelerating modern product usage steady growth resulting from strong

government investment in numerous markets mature market with strong

potential in residential wall penetration |

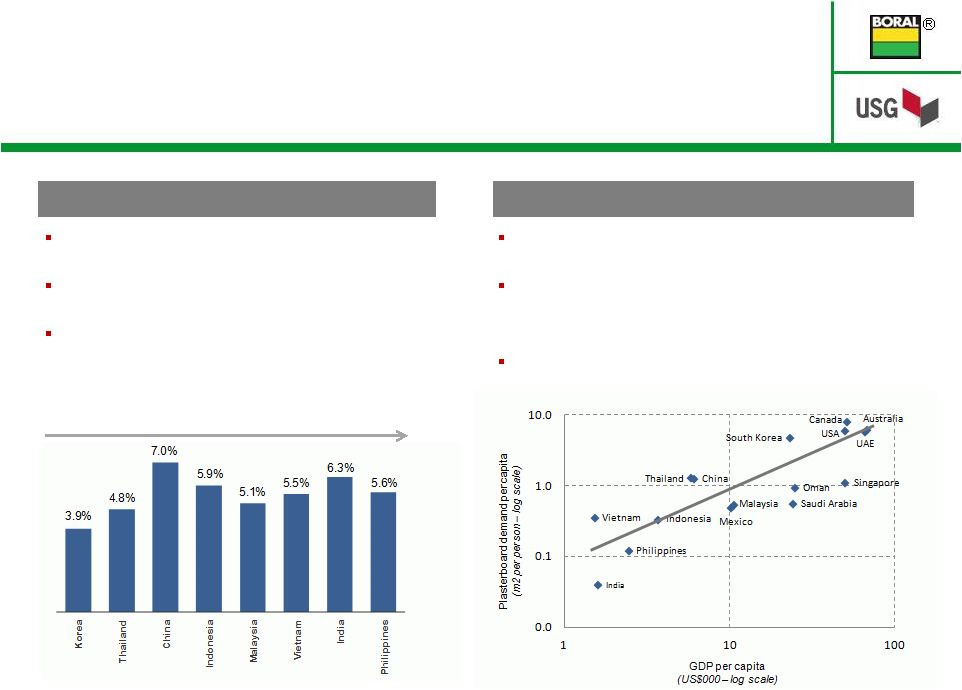

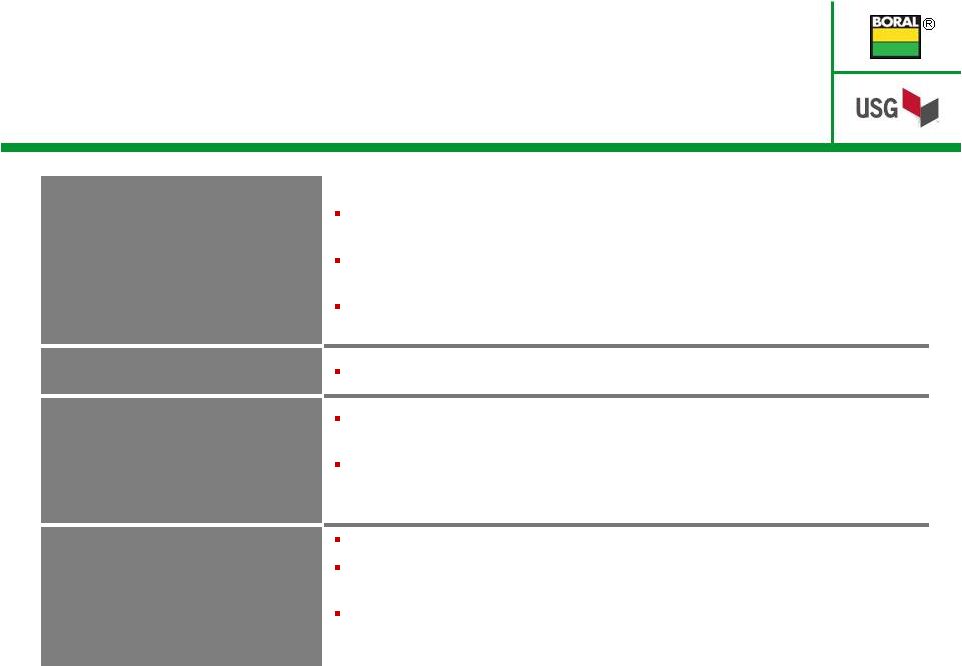

18

Strong economic growth forecast across most

Asian markets

Increasing commercial projects expected to drive

growth in non-residential construction

Increasing urbanisation will drive growth in

residential new build

1.

Source: IMF data at October 2013

2.

Boral management estimates for plasterboard demand. GDP per capital and population

based on IMF 2013 forecast data. Real GDP growth –

Asian countries

Plasterboard demand/GDP per capita

Historically plasterboard use starts in ceilings then moves

to walls, and starts in commercial then moves to housing

Lightweight, flexible and easy to install characteristics

make plasterboard the interior lining product of choice

-

USG technology expected to enhance this attribute

Asia expected to become the world’s largest plasterboard

market by 2015

Forecast real GDP growth –

5 year CAGR to 2018

Revenue contribution from largest to smallest

Strong macro fundamentals driving

growing market demand

1

1

1 |

19

Content

1.

Overview of the transaction / strategic rationale

2.

USG’s IP / Technology and adjacent products

3.

JV’s combined footprint and markets

4.

Synergies

5.

Key transaction terms

6.

Company specific factors

7.

Summary

Appendix |

®

Substantial synergies expected from both the application of

USG’s gypsum technologies (manufacturing and freight cost

savings plus revenue enhancements) and leveraging Boral’s

customer relationships and distribution platform

(USG’s adjacent products) |

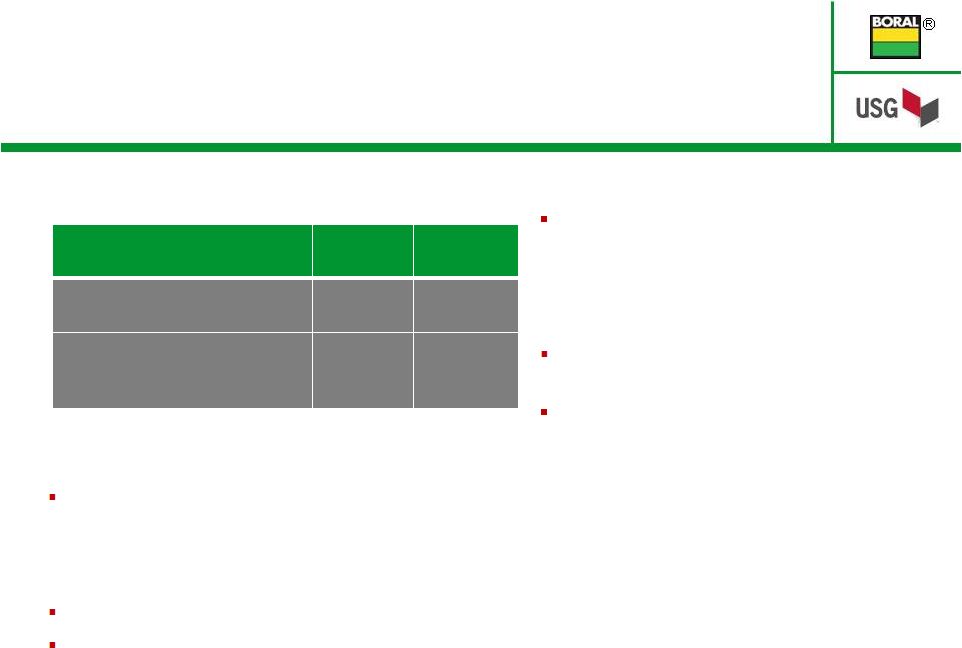

21

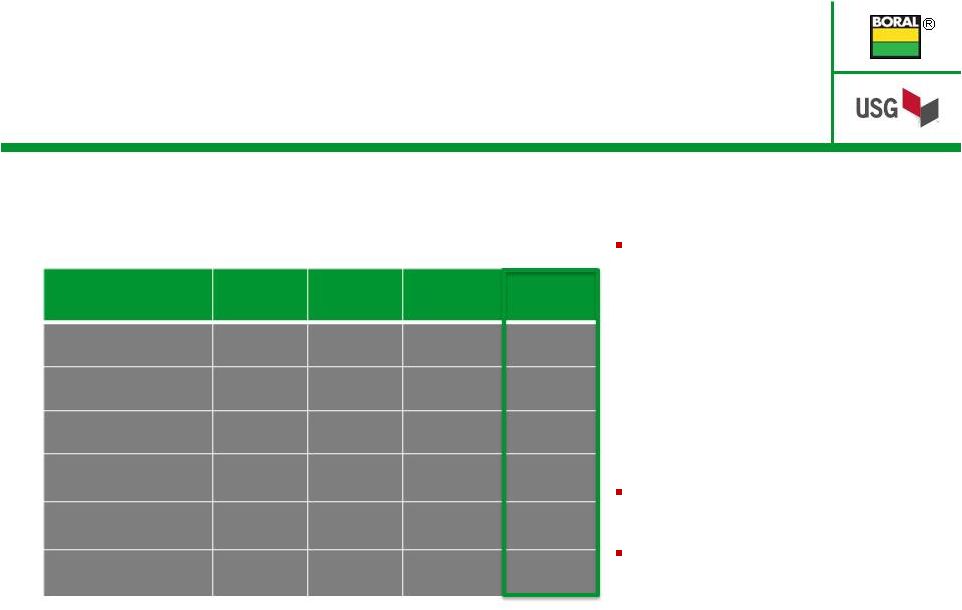

Targeted synergy breakdown

Manufacturing,

freight & other

cost savings

Adjacent products

through Boral

channels

Revenue

growth

Synergies -

geographic allocation

Australia

Korea

China

Thailand

Other

Anticipated synergies exceed US$50m per annum

within 3 years of completing technology roll-out

Synergies:

Adjacent product synergies to commence immediately

Other synergies to ramp up following 2 year phased

technology roll-out and as market penetration increases

Upfront operational expenditure will exceed synergies in first

two years

Based on extensive due diligence undertaken, including

product testing

Expect substantial synergies from:

Roll-out of USG’s technologies:

-

lower manufacturing & freight costs

-

enhanced revenues through price premium

Adjacent product sales through Boral market channels

-

ceiling products, metal products, cement and fibre board,

joint compounds |

22

Implementation of technology

expected to be self-funded

Targeted roll-out of technologies across all gypsum manufacturing lines

Phased over approximately 2 years

Approximately US$50m of capital expenditure expected to implement technology

upgrades

Includes equipment modification, staff training, secondment of USG technology team

and other upgrades

Expected to be funded through JV cash flows |

23

Content

1.

Overview of the transaction / strategic rationale

2.

USG’s IP / Technology and adjacent products

3.

JV’s combined footprint and markets

4.

Synergies

5.

Key transaction terms

6.

Company specific factors

7.

Summary

Appendix |

24

1.

Subject to finalisation of fair valuation, completion adjustments and final foreign

exchange rates at the date of completion Including USG’s and

Boral’s respective shares in non-controlling and controlled interests

2.

Subject to achieving three-

and five-year earnings targets

Estimated asset value of the joint venture is US$1.6bn¹

-

US$1.35bn for assets contributed by Boral; US$0.25bn for assets contributed by

USG USG’s contributed

assets include a perpetual licence in the JV’s Territory to USG’s

current plasterboard technology, and the ceilings, joint compound and grid

technologies currently used in the Territory (including improvements to

current technologies) Up to US$575m total payment from USG to Boral:

-

US$500m cash upfront

-

Earn out payments totalling up to US$75m² (net present

value of ~US$50m) Estimated transaction value¹ USD

BORAL

USG

Assets

$1,350m¹

$250m¹

Cash

($500m)

Balancing cash

payment

$500m

NPV of earn out

($50m)

²

From JV earnings

$50m

²

Net contribution to JV

$800m

$800m |

25

Key transaction terms

Structure

USG’s and Boral’s respective assets to be contributed into the joint

venture USG to make US$500m initial payment, then two potential earn outs:

US$25m after 3 years and US$50m after 5 years upon achieving earnings

targets Management

CEO will be Frederic de Rougemont, Boral Gypsum

CFO will be Paul Monzella, USG Corporation

Joe Holmes, Chief Technology Officer, and Bill Hogan, VP Product

Adjacencies, from USG Corporation will be executives

Finance and Technical Committees will provide oversight and assistance to

joint venture management

Governance

Chairman will be Jennifer Scanlon, USG Corporation (no casting vote)

Right to appoint chairman will rotate every two years

Board

will

consist

of

equal

nominee

directors

from

Boral

and

USG

for

as

long

as they hold 50:50 interests

Funding

Joint

venture

expected

to

be

self

funding

with

ability

to

borrow

in

its

own

right,

subject to JV

Board approval

Targeted dividend distribution of 50% of after-tax profit

|

26

Intellectual Property

Joint venture granted exclusive royalty-fee rights in the Territory to current

Boral IP and USG IP, including improvements to current technology

Exclusive

option

during

the

term

to

licence

future

“breakthrough

IP”

developed

by USG and Boral

Exclusive

option

during

the

term

to

licence

“adjacent

IP”

generated

by

USG

Distribution rights

Exclusive distribution rights for USG products in the JV Territory during the

term Non-compete

Joint venture

parties

will

not

compete

with

the

joint

venture

in

the

defined

Territory

Party who exits the joint venture will not compete until the later of the third

anniversary of their exit, or 10 years from the commencement of the joint

venture

Transfer of interest / change

of control

7 year standstill on transfer of interest in joint venture

Pre-emptive rights including

right

of

first

offer,

last

right

to

buy

and

tag-along

right for non-selling party

Change of control, which applies to any entity in the chain of ownership,

including the parent companies, triggers a call option for the other party at fair

market value

Key transaction terms |

27

Content

1.

Overview of the transaction / strategic rationale

2.

USG’s IP / Technology and adjacent products

3.

JV’s combined footprint and markets

4.

Synergies

5.

Key transaction terms

6.

Company specific factors

7.

Summary

Appendix |

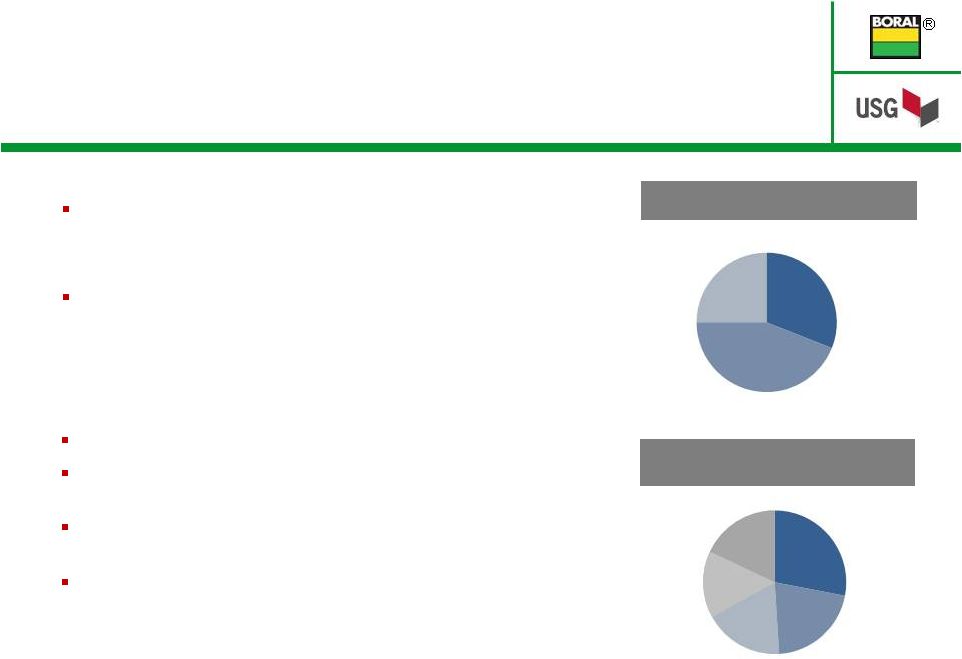

28

US$m

Projected JV earnings

$35 -

$45

Adjustment for USG’s contribution to the JV

($6 -

$8)

USG projected interest expense

($22 -

$25)

Total projected JV impact to USG’s net income

in CY2014

$7 -

$12

Calendar

year

2014

expected

impact

to

USG

earnings

¹

Accretive

–

US$7-$12m expected

contribution to USG bottom line in

CY2014

5

. Results are expected to

increase over time as technology is

propagated and capabilities are

optimised

NPV

positive

–

expected

future

returns exceed present value of cash

contributions as synergies are realised

Balance

Sheet

positive

–

expected EBITDA to offset additional

leverage, with higher cash contribution

and lower debt/EBITDA over time

USG expects to fund the joint venture

through US$350m in long-term debt

and US$150m of cash from its

balance sheet, with earn out payments

of up to US$75m

6

1.

Guidance will not be provided on a quarterly or annual basis

2.

JV

results

will

be

reflected

in

USG’s

Equity

Method

Income

on

its

Statement

of

Operations,

below

the

Operating

Profit

line

and may vary based on

finalization of fair valuation at the date of completion and foreign exchange

rates 3.

Represents full projected earnings contributions from USG’s contributed

entities in 2014 4.

Expected interest payment related to the long-term debt used to fund the joint

venture 5.

Expected contribution is based on 12 months of operations, results may vary based

on the actual commencement date of JV operations 6.

$75m

earn

out

payments

have

a

Net

Present

Value

of

$50m

based

on

the

three-

and

five-year

performance

targets

USG funding and earnings implications

4

5

3

2

|

29

US$500m upfront cash:

-

Majority of proceeds to be applied to

reducing Boral’s debt

-

May also consider capital management

initiatives, subject to market conditions

JV self funding

Strengthening BORAL’s Balance Sheet

Impact to financial statements

30 June

2013

Gearing

(Net debt / net debt + equity)

30%

22%

Gearing

(covenant calculation )

40%

29%

As at 30 June 2013 –

Proforma Gearing

Reduction in proforma gearing reflects

group net debt reducing to ~ A$0.9bn

Transaction will be reflected in Boral’s accounts as an equity accounted

interest (50%) in joint ventures following

Proforma

1

-

De-consolidation of existing Australian and Asian subsidiaries

-

Recognition of single balance sheet asset, equity accounted investment in joint

ventures, at fair value Final accounting impact will be finalised following

transaction completion Value accretive for Boral shareholders

1.

Illustrative impact on balance sheet ratios if the transaction had occurred on 30 June 2013. Unaudited

figures for illustrative purposes only, assumes FX AUD/ USD of 0.9257 |

30

Year ended 30 June 2013 –

Proforma Income Statement

Illustrative FY2013 Income Statement as if transaction had occurred

on 1 July 2012

FY2013 proforma assumptions:

-

Interest savings based on initial debt

repayment of A$250m

4

and A$250m

4

cash on deposit

-

Excludes: impact from USG

contributed operations

5

, benefits from

synergies, integration costs and any

gain/ loss on disposal at date of

transaction (after fair value

adjustments) –

will be treated as a

significant item

In FY2014, expect Boral’s NPAT

to reduce by around A$15m

Expect ~US$35-$45m as 50%

share of JV post-tax earnings in

first full year

1.

Excluding significant items

2.

Illustrative deconsolidation of Gypsum Australian and Asian entities

3.

Illustrative impact of equity accounted post-tax earnings and interest

savings (excludes earnings from USG entities and synergies) 4.

Initial proceeds of US$500m at July 2012 FX rate 1:1

5.

Net contribution from USG in FY2013 is negligible

6.

Assumes a negligible level of net debt within the JV

Figures may not add due to rounding.

BORAL –

impact on Income Statement

Group

Proforma

adj²

Proforma

adj³

Proforma

Group

Revenue

5,286

(919)

-

4,367

EBIT

¹

228

(83)

27

172

Net interest

(97)

4

20

(73)

Income tax

expense¹

(20)

16

(6)

(10)

Non-controlling

interest

(6)

8

-

2

Profit after tax¹

104

(55)

41

91 |

31

Content

1.

Overview of the transaction / strategic rationale

2.

USG’s IP / Technology and adjacent products

3.

JV’s combined footprint and markets

4.

Synergies

5.

Key transaction terms

6.

Company specific factors

7.

Summary

Appendix |

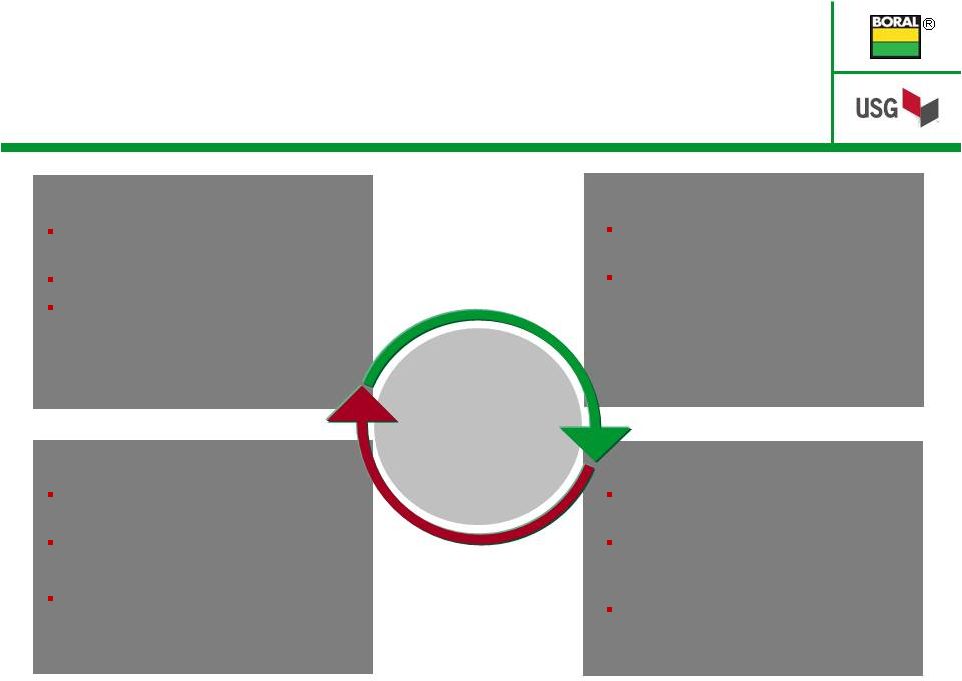

32

Combined

capability to

deliver significant

synergies

Strengthened

platform to drive

revenue and

margin growth

World class production capacity across

Asia, Australasia and the Middle East

Sales, marketing, and logistics

excellence and commercial leverage

World Class Capacity

World leading gypsum, ceilings, and joint

compound technologies

Market leader across Asia Pacific region

Experienced management and operating

team

Core Competitive Advantages

Strong Growth Potential

Strong underlying economic

growth forecast across key markets

Combined platform provides unrivalled

foundation for growth

Volume growth supported by >200m m²

currently unused capacity¹

Market Leading Positions

Strong brands respected for quality and

reliability

Extensive logistics and distribution

network in Asia, Australasia and the

Middle East

Deep customer relationships

1.

Based on 69% asset utilisation for year ended 30 June 2013 and includes capacity

expansion projects at Ho Chi Minh City (Vietnam) and Chongqing (China) and construction of

new plant in Oman to be completed in CY2014

Creating a world-leading plasterboard and ceiling

partnership in Asia, Australasia and the Middle East

BORAL asset

platform

+

USG technology

platform |

QUESTIONS

Transaction completion targeted for January 2014

It’s your world. Build it.

Build Something Great

® |

®

APPENDIX

Build Something Great

It’s your world. Build it. |

35

Sept 2013, USG ranked 9th in innovation

out of 112 companies in the Industrial

Materials Industry by the Patent Board

2000 –

2012

1,100+ US Patents

Sheetrock®

Brand

UltraLight Panels

Securock®

Glass-

Mat Roof Board

Durock®

Cement

Board Next-Gen

SHEETROCK®

Brand

UltraLightWeight

All Purpose Joint

Compound

Humitek®

Levelrock®

Next Generation Gypsum

Panels

Levelrock Floor

Underlayment System

USG™

Decorative Interior

Finish System

Geometrix™

Metal Ceiling

Panels

Astro™

ClimaPlus™

Ceiling

Panels

Translucents™

Luminous

Panels

Topo™

3-D Ceiling Panels

Humitek Gypsum Panels

Securock®

Roof Board

Sheetrock®

All Purpose Joint

Compound with Dust Control

Sheetrock®

Mold-Tough

panels

Zero-emitting ceiling tiles

High Recycled Content

Suspension Systems

True Wood Ceiling Panels

Securock®

Glass-Mat

Sheathing

Securock®

Glass-Mat Liner

Panels

Durock®

Fiberock®

Structocore Security

System

Durock Cement Board

Sheetrock Plus 3™

Joint

Compound

X-Technology Ceiling

Panels

Firecode®

Compound

3/4" Ultracode®

Core

Gypsum Panels

Compässo™

Suspension

Trim

Quick Release II Clip

Cuvatura™3-D System

Radar™

ClimaPlus™

Ceiling Panels

Fiberock Panels

USG Drywall Suspension

System

Ultrawall®

Structocore

Structocore™

Wall System

First Metal Stud Drywall

System

RC-1 Channel

Sheetrock WR Gypsum

Panels

Chemically Hardening Joint

Compound

SW Gypsum Panels

Blendtex Gypsum Panels

Exterior Ceiling Board

Ultrawall Relocatable Wall

System

USG Shaft Wall System

Textone SW Gypsum Panels

Area Separation Wall

System

Light Steel Framing

Pyrofill®

Firecode®

Structo-Gauge®

Gauging

Plaster

Pyrofill®

Poured Gypsum

Roof Deck

Water Repellent

Wallboard

Structo-Lite Perlited

Plaster

Sheetrock Firecode Core

(Type X)

Tapered Edge Panels

Ready-Mixed Joint

Compound

2" Solid Gypsum Wall

Board System

Acoustone®

Rocklath®

Gyplap®

Gypsum

Sheathing

Rocklath Gypsum Lath

Acoustone Ceiling Tiles

Perf-A-Tape®

Joint

Reinforcement

Sheetrock®

Sheetrock Gypsum

Panels

Pyrobar Gypsum

Partition Tile

Differentiate Through Innovation |