Attached files

| file | filename |

|---|---|

| EX-31.1 - RULE 13A - 14(A) CERTIFICATION OF USG CORPORATION'S CHIEF EXECUTIVE OFFICER - USG CORP | usg_ex311x0331201810-q.htm |

| EX-95 - MINE SAFETY DISCLOSURES - USG CORP | usg_ex95x0331201810-q.htm |

| EX-32.2 - SECTION 1350 CERTIFICATION OF USG CORPORATION'S CHIEF FINANCIAL OFFICER - USG CORP | usg_ex322x0331201810-q.htm |

| EX-32.1 - SECTION 1350 CERTIFICATION OF USG CORPORATION'S CHIEF EXECUTIVE OFFICER - USG CORP | usg_ex321x0331201810-q.htm |

| EX-31.2 - RULE 13A - 14(A) CERTIFICATION OF USG CORPORATION'S CHIEF FINANCIAL OFFICER - USG CORP | usg_ex312x0331201810-q.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the quarterly period ended March 31, 2018

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to

Commission File Number 1-8864

USG CORPORATION |

(Exact name of registrant as specified in its charter)

Delaware | 36-3329400 | |

(State or other jurisdiction of | (I.R.S. Employer | |

incorporation or organization) | Identification No.) | |

550 West Adams Street, Chicago, Illinois | 60661-3676 | |

(Address of principal executive offices) | (Zip code) | |

Registrant’s telephone number, including area code (312) 436-4000

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of large accelerated filer, accelerated filer, smaller reporting company, and emerging growth company in Rule 12b-2 of the Exchange Act.

Large accelerated filer | þ | Accelerated filer | ¨ |

Non-accelerated filer | ¨ | (Do not check if a smaller reporting company) | |

Smaller reporting company | ¨ | ||

Emerging growth company | ¨ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

The number of shares of the registrant’s common stock outstanding as of March 31, 2018 was 139,652,659.

Table of Contents

Page | ||

2

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

USG CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

(millions, except per-share and share data) | Three months ended March 31, | |||||||

2018 | 2017 | |||||||

Net sales | $ | 786 | $ | 767 | ||||

Cost of products sold | 647 | 608 | ||||||

Gross profit | 139 | 159 | ||||||

Selling and administrative expenses | 93 | 75 | ||||||

Operating profit | 46 | 84 | ||||||

Income from equity method investments | 9 | 13 | ||||||

Interest expense | (14 | ) | (20 | ) | ||||

Interest income | 1 | 1 | ||||||

Other income, net | 3 | 6 | ||||||

Income from continuing operations before income taxes | 45 | 84 | ||||||

Income tax expense | (9 | ) | (29 | ) | ||||

Income from continuing operations | 36 | 55 | ||||||

Income from discontinued operations, net of tax | 1 | — | ||||||

Net income | $ | 37 | $ | 55 | ||||

Basic earnings per average common share | $ | 0.26 | $ | 0.38 | ||||

Diluted earnings per average common share | $ | 0.25 | $ | 0.37 | ||||

Average common shares | 141,105,228 | 146,309,994 | ||||||

Dilutive awards under long-term incentive plan | 2,703,126 | 2,420,360 | ||||||

Average diluted common shares | 143,808,354 | 148,730,354 | ||||||

See accompanying Notes to Condensed Consolidated Financial Statements.

3

USG CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

Three months ended March 31, | ||||||||

(millions) | ||||||||

2018 | 2017 | |||||||

Net income | $ | 37 | $ | 55 | ||||

Other comprehensive income (loss), net of tax: | ||||||||

Derivatives qualifying as cash flow hedges: | ||||||||

Income (loss) on derivatives qualifying as cash flow hedges, net of tax of $0 and $3, respectively | — | (6 | ) | |||||

Less: Reclassification adjustment for income (loss) on derivatives included in net income, net of tax of $0 in all periods | — | — | ||||||

Net derivatives qualifying as cash flow hedges | — | (6 | ) | |||||

Pension and postretirement benefits: | ||||||||

Changes in pension and postretirement benefits, net of tax of $0 in all periods | 2 | (1 | ) | |||||

Less: Amortization of prior service cost included in net periodic pension cost, net of tax (benefit) of ($1) and $0, respectively | (1 | ) | — | |||||

Net pension and postretirement benefits | 3 | (1 | ) | |||||

Foreign currency translation: | ||||||||

Changes in foreign currency translation, net of tax of $0 in all periods | 12 | 40 | ||||||

Other comprehensive income, net of tax | $ | 15 | $ | 33 | ||||

Comprehensive income | $ | 52 | $ | 88 | ||||

See accompanying Notes to Condensed Consolidated Financial Statements.

4

USG CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(millions, except share data) | March 31, 2018 | December 31, 2017 | |||||

Assets | |||||||

Cash and cash equivalents | $ | 261 | $ | 394 | |||

Short-term marketable securities | 62 | 62 | |||||

Receivables (net of reserves 2018 - $10 and 2017 - $9) | 332 | 233 | |||||

Inventories | 255 | 252 | |||||

Income taxes receivable | 16 | 15 | |||||

Other current assets | 30 | 35 | |||||

Total current assets | 956 | 991 | |||||

Long-term marketable securities | 33 | 37 | |||||

Property, plant and equipment (net of accumulated depreciation and depletion - 2018 - $2,082 and 2017 - $2,053) | 1,778 | 1,762 | |||||

Deferred income taxes | 280 | 287 | |||||

Equity method investments | 699 | 686 | |||||

Goodwill and intangible assets | 39 | 43 | |||||

Other assets | 46 | 45 | |||||

Total assets | $ | 3,831 | $ | 3,851 | |||

Liabilities and Stockholders’ Equity | |||||||

Accounts payable | $ | 269 | $ | 280 | |||

Accrued expenses | 131 | 135 | |||||

Total current liabilities | 400 | 415 | |||||

Long-term debt | 1,078 | 1,078 | |||||

Deferred income taxes | 5 | 4 | |||||

Pension and other postretirement benefits | 326 | 326 | |||||

Other liabilities | 183 | 183 | |||||

Total liabilities | 1,992 | 2,006 | |||||

Stockholders' Equity: | |||||||

Preferred stock | — | — | |||||

Common stock | 15 | 15 | |||||

Treasury stock at cost | (212 | ) | (169 | ) | |||

Additional paid-in capital | 3,040 | 3,057 | |||||

Accumulated other comprehensive loss | (374 | ) | (389 | ) | |||

Retained earnings (accumulated deficit) | (630 | ) | (669 | ) | |||

Total stockholders’ equity | 1,839 | 1,845 | |||||

Total liabilities and stockholders’ equity | $ | 3,831 | $ | 3,851 | |||

See accompanying Notes to Condensed Consolidated Financial Statements.

5

(millions) | Three months ended March 31, | ||||||

2018 | 2017 | ||||||

Operating Activities | |||||||

Net income | $ | 37 | $ | 55 | |||

Less: Income from discontinued operations, net of tax | 1 | — | |||||

Income from continuing operations | 36 | 55 | |||||

Adjustments to reconcile net income from continuing operations to net cash: | |||||||

Depreciation, depletion and amortization | 36 | 33 | |||||

Share-based compensation expense | 4 | 4 | |||||

Deferred income taxes | 7 | 29 | |||||

Income from equity method investments | (9 | ) | (13 | ) | |||

Change in operating assets and liabilities | (99 | ) | (138 | ) | |||

Other, net | 9 | 1 | |||||

Net cash used for operating activities of continuing operations | (16 | ) | (29 | ) | |||

Net cash provided by (used for) operating activities of discontinued operations | 1 | (1 | ) | ||||

Net cash used for operating activities | (15 | ) | (30 | ) | |||

Investing Activities | |||||||

Purchases of marketable securities | (26 | ) | (24 | ) | |||

Sales or maturities of marketable securities | 28 | 22 | |||||

Capital expenditures | (52 | ) | (39 | ) | |||

Working capital adjustment from acquisition of business | 2 | — | |||||

Net cash used for investing activities of continuing operations | (48 | ) | (41 | ) | |||

Net cash provided by investing activities of discontinued operations | — | 6 | |||||

Net cash used for investing activities | (48 | ) | (35 | ) | |||

Financing Activities | |||||||

Issuance of common stock | 4 | 3 | |||||

Repurchase of common stock | (62 | ) | (25 | ) | |||

Repurchases of common stock to satisfy employee tax withholding obligations | (7 | ) | (3 | ) | |||

Net cash used for financing activities of continuing operations | (65 | ) | (25 | ) | |||

Effect of exchange rate changes on cash from continuing operations | (5 | ) | 4 | ||||

Net decrease in cash and cash equivalents from continuing operations | (134 | ) | (91 | ) | |||

Net increase in cash and cash equivalents from discontinued operations | 1 | 5 | |||||

Net decrease in cash and cash equivalents | (133 | ) | (86 | ) | |||

Cash and cash equivalents at beginning of period | 394 | 427 | |||||

Cash and cash equivalents at end of period | $ | 261 | $ | 341 | |||

Supplemental Cash Flow Disclosures: | |||||||

Interest paid, net of capitalized interest | $ | 12 | $ | 35 | |||

Income taxes paid, net of refunds received | 2 | 2 | |||||

Noncash Investing and Financing Activities: | |||||||

Amount in accounts payable for capital expenditures | 13 | 9 | |||||

6

USG CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

In the following Notes to Condensed Consolidated Financial Statements, “USG,” “we,” “our” and “us” refer to USG Corporation, a Delaware corporation, and its subsidiaries included in the condensed consolidated financial statements, except as otherwise indicated or as the context otherwise requires.

1. | Organization, Consolidation and Presentation of Financial Statements |

PREPARATION OF FINANCIAL STATEMENTS

We prepared the accompanying unaudited condensed consolidated financial statements of USG Corporation in accordance with applicable United States Securities and Exchange Commission, or SEC, guidelines pertaining to interim financial information. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses. Actual results could differ materially from those estimates. In the opinion of our management, the financial statements reflect all adjustments, which are of a normal recurring nature, necessary for a fair presentation of our financial results for the interim periods. The results of operations for the three months ended March 31, 2018 are not necessarily indicative of the results of operations to be expected for the entire year.

SEGMENTS

Our reportable segments are determined considering both qualitative and quantitative metrics for aggregation of the product type within geographies for which discrete financial information is available. We have five reportable segments: U.S. Wallboard and Surfaces, U.S. Performance Materials, U.S. Ceilings, Canada, and USG Boral Building Products, or UBBP. Our U.S. Wallboard and Surfaces, U.S. Performance Materials and U.S. Ceilings reportable segments are identified based on products manufactured and marketed. Our Canada segment is a separately reportable segment, as while it has similar qualitative factors to U.S. operations, it has different quantitative metrics and, therefore, cannot be aggregated. Our operating segments in Mexico and Latin America are included in Other as reconciling items to our consolidated segments. This segment structure was effective for the quarter ended December 31, 2017. Our prior period results have been recast to reflect these changes and present comparative year over year information by segment. See Note 4, Segments.

These condensed consolidated financial statements and notes are to be read in conjunction with the financial statements and notes included in USG’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017, which we filed with the SEC on February 14, 2018.

RECENTLY ADOPTED ACCOUNTING PRONOUNCEMENTS

We adopted Accounting Standard Update, or ASU, 2018-02, "Income Statement - Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income," in the first quarter of 2018. The ASU allows for the reclassification of stranded tax effects on items resulting from the Tax Cuts and Jobs Act, or the 2017 Tax Act, from accumulated other comprehensive income, or AOCI, to retained earnings. Tax effects unrelated to the 2017 Tax Act are released from AOCI using either the specific identification approach or the portfolio approach based on the nature of the underlying item. We elected not to reclassify the income tax effects of the 2017 Tax Act.

We adopted ASU 2017-07, “Compensation - Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost,” on January 1, 2018 using the practical expedient. This ASU required us to disaggregate and present current service cost along with other current compensation costs for employees while presenting other net benefit cost components below operating profit. In addition, only the service cost component of net benefit cost is eligible for capitalization in our inventory and fixed assets. We retrospectively adopted the presentation of service cost and prospectively adopted the capitalization of only service cost into inventory and fixed assets.

7

The effect of the adoption of ASU 2017-07 on our condensed consolidated statements of income for the three months ended March 31, 2017 was as follows.

(millions) | Three months ended March 31, 2017 | ||||||||||

As Restated | Adjustment for Adoption of ASU 2017-07 | As Previously Reported | |||||||||

Gross profit | $ | 159 | $ | (5 | ) | $ | 164 | ||||

Operating profit | 84 | (7 | ) | 91 | |||||||

Other income, net | 6 | 7 | (1 | ) | |||||||

Net income | 55 | — | 55 | ||||||||

We adopted ASU 2014-09, “Revenue from Contracts with Customers (Topic 606),” and all related amendments on January 1, 2018 using the modified retrospective method using practical expedients. Topic 606 supersedes the revenue recognition requirements in "Revenue Recognition (Topic 605)" and requires entities to recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services.

Upon adoption, we recorded an increase of $2 million to our opening balance of retained earnings for the cumulative effect of adopting Topic 606. The adjustment related to a change to the point in time at which we record revenue for most customers. Prior period amounts have not been restated and continue to be reported under the legacy accounting guidance of Topic 605. As of and for the three months ended March 31, 2018, the impact of applying Topic 606 as compared to applying Topic 605 is immaterial to our financial statements.

In addition to our cumulative effect adjustment, our adoption of Topic 606 resulted in additional quantitative disclosure of revenue by product and in the modification of certain significant accounting policies. See Note 4, Segments, for our revenue disaggregated by product and the revised polices below.

Revenue Recognition

We recognize revenue upon transfer of control of our products to the customer which generally occurs upon shipment. We enter into agreements with customers to offer rebates, generally based on achievement of specified sales levels and various marketing allowances that are common industry practice. Reductions to revenue for customer programs and incentive offerings, including promotions and other volume-based incentives, are estimated using the most likely amount method and recorded in the period in which the sale occurs. Provisions for early payment discounts are accrued in the same period in which the sale occurs. We do not have any material payment terms as payment is received shortly after the point of sale. We pay commissions to third parties to obtain contracts. As these contracts are less than one year, these costs are expensed as incurred.

Shipping and Handling Costs

We include shipping and handling costs billed to customers in net sales. We account for related costs as fulfillment activities and present the costs in cost of products sold when control of our products transfers to the customer.

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

In February 2016, the FASB issued ASU 2016-02, “Leases (Topic 842),” which supersedes existing lease guidance to require lessees to recognize assets and liabilities on the balance sheet for the rights and obligations created by long-term leases and to disclose additional quantitative and qualitative information about leasing arrangements. Subsequently, the FASB has issued various ASUs to provide further clarification around certain aspects of Topic 842. We will adopt the new standard on January 1, 2019 using the modified retrospective approach. As a result of the new standard, we will implement a new lease accounting system, new processes and accounting policies. Further, we anticipate the adoption of ASU 2016-02 will have a significant impact to our condensed consolidated balance sheets and disclosures. We are currently finalizing our accounting policies and verifying the completeness of our lease population and, thus, we are unable to quantify the financial statement impact at this time.

8

2. Acquisitions and Dispositions

Acquisition of Ceilings Plus

On November 30, 2017, we completed our acquisition of Ceilings Plus for $50 million, net of a working capital adjustment received in the first quarter of 2018. The addition of Ceilings Plus to our U.S. Ceilings segment expands our operations in the specialty ceilings markets. The preliminary fair value of tangible assets acquired, less liabilities assumed, in connection with the Ceilings Plus acquisition was $18 million. The preliminary fair value of intangible assets acquired, which included customer relationships and trade names, totaled $20 million. The resulting preliminary goodwill recorded was $12 million and all is expected to be deductible for tax purposes. The goodwill resulting from this acquisition consists largely of the company’s expected future product sales and synergies with the existing U.S. Ceilings product offerings. The primary area of the preliminary purchase price allocation remaining to be valued is the fair value of acquired contracts. We will complete the fair value assessment within the one year measurement period.

Discontinued Operations

On October 31, 2016, we completed the sale of our L&W Supply, or L&W, distribution business to ABC Supply. Upon the close of the sale, we entered into a supply agreement with L&W, and for the three months ended March 31, 2018 and 2017, we recorded sales of $95 million and $131 million, respectively, and cash inflows related to payments on trade receivables during those same periods of $104 million and $109 million, respectively.

3. Equity Method Investments

Equity method investments as of March 31, 2018 and December 31, 2017, were as follows:

March 31, 2018 | December 31, 2017 | |||||||||||

(dollars in millions) | Carrying Value | Ownership Percentage | Carrying Value | Ownership Percentage | ||||||||

USG Boral Building Products | $ | 692 | 50% | $ | 679 | 50% | ||||||

Other equity method investments | 7 | 33% - 50% | 7 | 33% - 50% | ||||||||

Total equity method investments | $ | 699 | $ | 686 | ||||||||

Investment in USG Boral Building Products

UBBP is our 50/50 joint ventures with Boral Limited, or Boral. We account for our investment in UBBP using the equity method of accounting. As of March 31, 2018, the amount of our consolidated retained earnings which represents undistributed earnings from UBBP is $70 million.

In the event certain U.S. Dollar denominated performance targets are satisfied by UBBP, we will be obligated to pay Boral an earnout payment of up to $50 million based on performance through 2019. We have not recorded a liability for this earnout payment as we have concluded that it is currently not probable that the five-year performance target will be achieved. If our conclusion on the probability of achievement changes, we will record a liability representing the present value of the earnout payment with a corresponding increase to our investment.

Our underlying net assets in our investments are denominated in a foreign currency, and translation gains or losses will impact the recorded value of our investments. Translation gains or losses recorded in other comprehensive income were as follows:

Three months ended March 31, | ||||||||

(millions) | 2018 | 2017 | ||||||

Translation gain | $ | 3 | $ | 24 | ||||

9

Summarized financial information for UBBP is as follows:

Three months ended March 31, | ||||||||

(millions) | 2018 | 2017 | ||||||

USG Boral Building Products | ||||||||

Net sales | $ | 287 | $ | 276 | ||||

Gross profit | 79 | 86 | ||||||

Operating profit | 28 | 35 | ||||||

Income from continuing operations before income taxes | 32 | 38 | ||||||

Net income | 20 | 26 | ||||||

Net income attributable to USG Boral Building Products | 19 | 25 | ||||||

USG share of income from investment accounted for using the equity method | 9 | 13 | ||||||

TRANSACTIONS WITH UBBP

Our U.S. Wallboard and Surfaces and U.S. Performance Materials segments sell products to UBBP. Total sales to UBBP for the three months ended March 31, 2018 and 2017 were immaterial.

In 2014, in connection with the formation of UBBP, we contributed our ownership interest in a joint venture in China to UBBP, but retained our loan receivable from this joint venture. As of March 31, 2018 and December 31, 2017, the loan receivable, including interest, totaled $13 million and is included in "Other assets" on our accompanying condensed consolidated balance sheets.

4. Segments

During the fourth quarter of 2017, as part of the realignment of our operating structure, we changed the composition of our reportable segments, effective for the quarter ended December 31, 2017. See Note 1, Organization, Consolidation and Presentation of Financial Statements, for additional information regarding our five reportable segments. See Note 3 for segment results for UBBP. Segment results for our U.S. Wallboard and Surfaces, U.S. Performance Materials, U.S. Ceilings and Canada segments were as follows:

Three months ended March 31, | ||||||||

(millions) | 2018 | 2017 | ||||||

Net Sales: | ||||||||

U.S. Wallboard and Surfaces | $ | 441 | $ | 469 | ||||

U.S. Performance Materials | 92 | 86 | ||||||

U.S. Ceilings | 138 | 112 | ||||||

Canada | 111 | 96 | ||||||

Other | 60 | 56 | ||||||

Eliminations | (56 | ) | (52 | ) | ||||

Total | $ | 786 | $ | 767 | ||||

Operating Profit (Loss): | ||||||||

U.S. Wallboard and Surfaces | $ | 49 | $ | 79 | ||||

U.S. Performance Materials | 1 | 6 | ||||||

U.S. Ceilings | 19 | 20 | ||||||

Canada | 2 | 2 | ||||||

Other | 4 | 1 | ||||||

Corporate | (29 | ) | (24 | ) | ||||

Total | $ | 46 | $ | 84 | ||||

10

Net sales disaggregated by product type were as follows:

Three months ended March 31, 2018 | |||||||||||||||||||||||

(millions) | U.S. Wallboard and Surfaces | U.S. Performance Materials | U.S. Ceilings | Canada | Other | Total | |||||||||||||||||

Wallboard | $ | 220 | $ | — | $ | — | $ | 63 | $ | 18 | $ | 301 | |||||||||||

Surfaces and industrial products | 145 | — | — | 23 | 7 | 175 | |||||||||||||||||

Underlayment | — | 65 | — | 2 | 9 | 76 | |||||||||||||||||

Building envelope and structural | — | 18 | — | — | — | 18 | |||||||||||||||||

Ceiling tile and grid | — | — | 116 | 12 | 9 | 137 | |||||||||||||||||

Specialty ceilings | — | — | 16 | 2 | — | 18 | |||||||||||||||||

Other products | 24 | — | — | 3 | 16 | 43 | |||||||||||||||||

Total product sales | 389 | 83 | 132 | 105 | 59 | 768 | |||||||||||||||||

Other miscellaneous sales (a) | 52 | 9 | 6 | 6 | 1 | 74 | |||||||||||||||||

Total sales before eliminations | 441 | 92 | 138 | 111 | 60 | 842 | |||||||||||||||||

Eliminations | (31 | ) | (6 | ) | (12 | ) | (7 | ) | — | (56 | ) | ||||||||||||

Total net sales | $ | 410 | $ | 86 | $ | 126 | $ | 104 | $ | 60 | $ | 786 | |||||||||||

(a) | Other miscellaneous sales primarily includes shipping and handling costs billed to customers. |

5. | Marketable Securities |

Marketable securities are classified as available-for-sale securities and reported at fair value, with unrealized gains and losses excluded from earnings and reported in AOCI on our accompanying condensed consolidated balance sheets.

Our investments in marketable securities consisted of the following:

As of March 31, 2018 | As of December 31, 2017 | ||||||||||||||

(millions) | Amortized Cost | Fair Value | Amortized Cost | Fair Value | |||||||||||

Corporate debt securities | $ | 67 | $ | 67 | $ | 68 | $ | 68 | |||||||

U.S. government and agency debt securities | 4 | 4 | 6 | 6 | |||||||||||

Asset-backed debt securities | 13 | 13 | 11 | 11 | |||||||||||

Certificates of deposit | 11 | 11 | 13 | 13 | |||||||||||

Municipal debt securities | — | — | 1 | 1 | |||||||||||

Total marketable securities | $ | 95 | $ | 95 | $ | 99 | $ | 99 | |||||||

The realized and unrealized gains and losses for the three months ended March 31, 2018 and 2017 were immaterial. Cost basis for securities sold are determined on a first-in-first-out basis.

Contractual maturities of marketable securities as of March 31, 2018 were as follows:

(millions) | Amortized Cost | Fair Value | |||||

Due in 1 year or less | $ | 62 | $ | 62 | |||

Due in 1-5 years | 33 | 33 | |||||

Total marketable securities | $ | 95 | $ | 95 | |||

Actual maturities may differ from the contractual maturities because issuers of the securities may have the right to prepay them.

11

6. Debt

Total debt consisted of the following:

(millions) | March 31, 2018 | December 31, 2017 | |||||

4.875% senior notes due 2027 | $ | 500 | $ | 500 | |||

5.5% senior notes due 2025 | 350 | 350 | |||||

Industrial revenue bonds (due 2028 through 2034) | 239 | 239 | |||||

Total | 1,089 | 1,089 | |||||

Less: Unamortized debt issuance costs | 11 | 11 | |||||

Total | $ | 1,078 | $ | 1,078 | |||

CREDIT FACILITY

Our credit facility agreement has a maximum borrowing limit of $220 million and requires us to maintain a minimum fixed charge coverage ratio in the event excess availability falls below a minimum threshold. Our excess borrowing availability as of March 31, 2018 of $192 million exceeds this threshold, thus the requirement to maintain the minimum fixed charge coverage ratio is not applicable. As of March 31, 2018, we were in compliance with the covenants contained in our credit facility.

As of March 31, 2018 and during the quarter then-ended, there were no borrowings under the facility. Outstanding letters of credit totaled $28 million as of March 31, 2018.

OTHER INFORMATION

(millions) | March 31, 2018 | December 31, 2017 | |||||

Fair value of debt | $ | 1,111 | $ | 1,134 | |||

Accrued interest | 13 | 12 | |||||

The fair values of our debt were determined utilizing unadjusted prices from independent pricing services and are classified as Level 2. See Note 8, Fair Value Measurements, for further discussion on fair value measurements. The vendors’ methodologies utilize various forms of market data, including but not limited to, trade data, yield, spreads, bids and offers. We review the values provided by the independent pricing service for reasonableness by comparing the valuations received from the independent pricing service to valuations from at least one other observable source.

12

7. | Derivative Instruments |

We use derivative instruments to manage selected commodity price and foreign currency exposures as described below. We do not use derivative instruments for speculative trading purposes, and we typically do not hedge beyond five years. Cash flows from derivative instruments are included in operating activities in our condensed consolidated statements of cash flows. Gains and losses on contracts designated as cash flow hedges are reclassified into earnings when the underlying forecasted transactions affect earnings. For contracts designated as cash flow hedges, we reassess the probability of the underlying forecasted transactions occurring on a quarterly basis.

Derivative Instruments | Type | Hedged Item | Aggregate Notional Amount | Contracts Maturing Through |

Commodity | Natural gas swaps | Purchases of natural gas | 40 million mmBTUs* | December 31, 2022 |

Foreign Exchange | Forward contracts | Purchases of products and services denominated in a foreign currency | $107 million | December 31, 2019 |

Foreign Exchange | Forward contracts | Intercompany Loan | $16 million | April 27, 2018 |

* - millions of British Thermal Units

COUNTERPARTY RISK, MASTER NETTING ARRANGEMENTS AND BALANCE SHEET OFFSETTING

We are exposed to credit losses in the event of nonperformance by the counterparties to our derivative instruments. As of March 31, 2018, our derivatives were in a $15 million net liability position. All of our counterparties have investment grade credit ratings; accordingly, we anticipate that they will be able to fully satisfy their obligations under the contracts.

All of our derivative contracts are governed by master netting agreements negotiated between us and the counterparties that reduce our counterparty credit exposure. The agreements outline the conditions (such as credit ratings and net derivative fair values) upon which we, or the counterparties, are required to post collateral. As required by certain of our agreements, we had $14 million of collateral posted with our counterparties related to our derivatives as of March 31, 2018. Amounts paid as cash collateral are included in "Receivables" on our accompanying condensed consolidated balance sheets.

We have not adopted an accounting policy to offset fair value amounts related to derivative contracts under our master netting arrangements; therefore, individual derivative contracts are reflected on a gross basis, as either assets or liabilities, on our accompanying condensed consolidated balance sheets, based on their fair value as of the balance sheet date.

FINANCIAL STATEMENT INFORMATION

The following are the pre-tax effects of derivative instruments on the condensed consolidated statements of income and condensed consolidated statements of comprehensive income for the three months ended March 31, 2018 and 2017.

Amount of Gain or (Loss) Recognized in Other Comprehensive Income on Derivatives (Effective Portion) | Location of Gain or (Loss) Reclassified from AOCI into Income (Effective Portion) | Amount of Gain or (Loss) Reclassified from AOCI into Income (Effective Portion) | |||||||||||||||

(millions) | 2018 | 2017 | 2018 | 2017 | |||||||||||||

Derivatives in Cash Flow Hedging Relationships | |||||||||||||||||

Commodity contracts | $ | (3 | ) | $ | (9 | ) | Cost of products sold | $ | — | $ | — | ||||||

Foreign exchange contracts | 3 | — | Cost of products sold | — | — | ||||||||||||

Total | $ | — | $ | (9 | ) | $ | — | $ | — | ||||||||

Location of Gain or (Loss) Recognized in Income on Derivatives | Amount of Gain or (Loss) Recognized in Income on Derivatives | |||||||||

(millions) | 2018 | 2017 | ||||||||

Derivatives Not Designated as Hedging Instruments | ||||||||||

Commodity contracts | Cost of products sold | $ | — | $ | (1 | ) | ||||

Total | $ | — | $ | (1 | ) | |||||

For both commodity contracts and foreign exchange contracts, no ineffectiveness was recorded in the three months ended March 31, 2018 and 2017.

13

The following are the fair values of derivative instruments and the location on our accompanying condensed consolidated balance sheets and our condensed consolidated statements of comprehensive income as of March 31, 2018 and December 31, 2017.

Balance Sheet Location | Fair Value | Balance Sheet Location | Fair Value | ||||||||||||||

(millions) | 3/31/18 | 12/31/17 | 3/31/18 | 12/31/17 | |||||||||||||

Derivatives in Cash Flow Hedging Relationships | |||||||||||||||||

Commodity contracts | Other current assets | $ | 1 | $ | 1 | Accrued expenses | $ | 7 | $ | 6 | |||||||

Commodity contracts | Other assets | 1 | 1 | Other liabilities | 11 | 8 | |||||||||||

Foreign exchange contracts | Other current assets | 1 | — | Accrued expenses | 1 | 3 | |||||||||||

Foreign exchange contracts | Other assets | 1 | — | Other liabilities | — | — | |||||||||||

Total derivatives in cash flow hedging relationships | $ | 4 | $ | 2 | $ | 19 | $ | 17 | |||||||||

Derivatives Not Designated as Hedging Instruments | |||||||||||||||||

Commodity contracts | Other current assets | $ | — | $ | — | Accrued expenses | $ | — | $ | — | |||||||

Total derivatives not designated as hedging instruments | $ | — | $ | — | $ | — | $ | — | |||||||||

Total derivatives | Total assets | $ | 4 | $ | 2 | Total liabilities | $ | 19 | $ | 17 | |||||||

As of March 31, 2018, we had no derivatives designated as fair value hedges or net investment hedges.

8. Fair Value Measurements

Certain assets and liabilities are required to be recorded at fair value. There are three levels of inputs that may be used to measure fair value which are described below along with how USG derives fair value.

Level | Definition | USG Valuation Method |

Level 1 | Quoted prices for identical assets and liabilities in active markets | Cash equivalents and equity mutual funds consist of money market funds that are valued based on quoted prices in active markets. |

Level 2 | Quoted prices for similar assets and liabilities in active markets; quoted prices for identical or similar assets and liabilities in markets that are not active; and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets | Marketable securities, including certain cash equivalents, are valued using a "market value" approach. Values are based on quoted prices and other observable market inputs received from data providers. |

Derivatives are valued using the "income" approach such as discounted-cash-flow models and readily observable market data. The inputs for the valuation models are obtained from data providers and include end-of-period spot and forward natural gas prices, foreign currency exchange rates, natural gas price volatility and LIBOR and swap rates for discounting the cash flows implied from the derivative contracts. | ||

Level 3 | Valuations derived from valuation techniques in which one or more significant inputs or significant value drivers are unobservable | No level 3 investments. |

Our assets and liabilities measured at fair value on a recurring basis were as follows:

Level 1 | Level 2 | Level 3 | Total | ||||||||||||||||||||||||||||

(millions) | 3/31/18 | 12/31/17 | 3/31/18 | 12/31/17 | 3/31/18 | 12/31/17 | 3/31/18 | 12/31/17 | |||||||||||||||||||||||

Cash equivalents | $ | 3 | $ | 124 | $ | 37 | $ | 24 | $ | — | $ | — | $ | 40 | $ | 148 | |||||||||||||||

Equity mutual funds | 6 | 6 | — | — | — | — | 6 | 6 | |||||||||||||||||||||||

Marketable securities: | |||||||||||||||||||||||||||||||

Corporate debt securities | — | — | 67 | 68 | — | — | 67 | 68 | |||||||||||||||||||||||

U.S. government and agency debt securities | — | — | 4 | 6 | — | — | 4 | 6 | |||||||||||||||||||||||

Asset-backed debt securities | — | — | 13 | 11 | — | — | 13 | 11 | |||||||||||||||||||||||

Certificates of deposit | — | — | 11 | 13 | — | — | 11 | 13 | |||||||||||||||||||||||

Municipal debt securities | — | — | — | 1 | — | — | — | 1 | |||||||||||||||||||||||

Derivative assets | — | — | 4 | 2 | — | — | 4 | 2 | |||||||||||||||||||||||

Derivative liabilities | — | — | (19 | ) | (17 | ) | — | — | (19 | ) | (17 | ) | |||||||||||||||||||

14

9. Employee Retirement Plans

The components of net pension and postretirement benefit costs are summarized in the following table:

Three months ended March 31, | ||||||||

(millions) | 2018 | 2017 | ||||||

Pension: | ||||||||

Service cost of benefits earned | $ | 12 | $ | 10 | ||||

Interest cost on projected benefit obligation | 16 | 16 | ||||||

Expected return on plan assets | (24 | ) | (23 | ) | ||||

Net amortization | 8 | 5 | ||||||

Net pension cost | $ | 12 | $ | 8 | ||||

Postretirement: | ||||||||

Service cost of benefits earned | $ | 1 | $ | 1 | ||||

Interest cost on projected benefit obligation | 1 | 1 | ||||||

Net amortization | (6 | ) | (6 | ) | ||||

Net postretirement benefit | $ | (4 | ) | $ | (4 | ) | ||

Service cost of benefits earned is included in "Costs of products sold" and "Selling and administrative expenses" on our condensed consolidated statements of income. The other components of net pension and postretirement costs are included in "Other income, net".

During the first three months of 2018, we made cash contributions of $1 million to our domestic supplemental pension plan and $1 million to our pension plans in Canada. We expect to make total contributions to our pension plans in 2018 of approximately $60 million.

10. Share-Based Compensation

During the first three months of 2018, we granted share-based compensation in the form of market share units, or MSUs, performance shares, and restricted stock units, or RSUs, to eligible participants under our 2016 Long-Term Incentive Plan. We recognize expense on all share-based grants over the service period, which is the shorter of the period until the employees’ retirement eligibility dates and the service period of the award for awards expected to vest. We record forfeitures as they occur. Awards granted during the first three months of 2018, weighted average fair value, and assumptions used to determine fair value were as follows:

MSUs | Performance Shares | RSUs | |||||||||

Awards granted | 427,664 | 103,819 | 26,000 | ||||||||

Weighted average fair value (a) | $ | 34.22 | $ | 34.21 | $ | 33.88 | |||||

Expected volatility (b) | 32.62 | % | 32.61 | % | N/A | ||||||

Risk-free rate (c) | 2.37 | % | 2.37 | % | N/A | ||||||

Expected term (in years) (d) | 2.95 | 2.95 | N/A | ||||||||

Expected dividends | — | — | N/A | ||||||||

(a) | Fair value of MSUs and Performance Shares is estimated on the date of grant using the Monte Carlo simulation utilizing the assumptions outlined above. Fair value of RSUs is equal to the closing price of our common stock on the date of grant. |

(b) | The expected volatility rate is based on stock price history immediately prior to grant for a period commensurate with the expected term. |

(c) | The risk-free rate is based on zero coupon U.S. government issues at the time of grant. |

(d) | The expected term represents the period from the valuation date to the end of the performance period. |

15

Terms of the awards granted during the first three months of 2018 were as follows:

MSUs | Performance Shares | RSUs | |

Maximum shares/units earned | Varies from 0% to 150% of the number of MSUs awarded depending on the actual performance of our stock price | Varies from 0% to 200% of the number of performance shares awarded depending on the performance of our total stockholder return relative to the performance of the Dow Jones U.S. Construction and Materials Index (a) | 100% |

Vesting Provisions | Three-year performance period | Three-year performance period | Specified number of years from the grant date |

Vesting in the case of termination of employment due to death, disability, retirement or change in control during performance period (b) | Pro-rated based on the number of full months employed in 2018 with awards issued at the end of the three-year period | Pro-rated based on the number of full months employed during the performance period with awards issued at the end of the three-year period | Varies |

Settlement | Settled in common stock at the end of the performance or vesting period | ||

(a) | Adjustments to the performance of the Dow Jones U.S. Construction and Materials Index may be made to reflect changes in the companies included in the index during the performance period. |

(b) | Early vesting for MSUs, performance shares and RSUs in situations where there is a change in control also requires a related loss of employment or diminution of duties in certain circumstances. |

OTHER

MSUs, performance shares, RSUs, and stock options that were not included in the computation of diluted earnings per share for those periods because their inclusion would be anti-dilutive were as follows:

Three months ended March 31, | ||||||

(millions) | 2018 | 2017 | ||||

MSUs, performance shares, RSUs and stock options | — | 1.0 | ||||

11. Supplemental Balance Sheet Information

INVENTORIES

Total inventories consisted of the following:

(millions) | March 31, 2018 | December 31, 2017 | |||||

Finished goods | $ | 145 | $ | 140 | |||

Work in progress | 40 | 39 | |||||

Raw materials | 70 | 73 | |||||

Total | $ | 255 | $ | 252 | |||

ACCRUED EXPENSES

Accrued expenses consisted of the following:

(millions) | March 31, 2018 | December 31, 2017 | |||||

Self-insurance reserves | $ | 14 | $ | 12 | |||

Employee compensation | 13 | 17 | |||||

Interest | 13 | 12 | |||||

Derivatives | 8 | 9 | |||||

Pension and other postretirement benefits | 17 | 17 | |||||

Environmental | 16 | 17 | |||||

Other | 50 | 51 | |||||

Total | $ | 131 | $ | 135 | |||

16

ASSET RETIREMENT OBLIGATIONS

Changes in the liability for asset retirement obligations, which are included in "Other liabilities" on our condensed consolidated balance sheets, consisted of the following:

Three months ended March 31, | |||||||

(millions) | 2018 | 2017 | |||||

Balance as of January 1 | $ | 118 | $ | 113 | |||

Accretion expense | 2 | 1 | |||||

Foreign currency translation | (1 | ) | — | ||||

Balance as of March 31 | $ | 119 | $ | 114 | |||

12. Stockholders' Equity

TREASURY STOCK

Changes in treasury stock for the three months ended March 31, 2018 and 2017 were as follows:

2018 | 2017 | ||||||||||||

(millions, except share data) | Treasury Shares (000) | Treasury Stock | Treasury Shares (000) | Treasury Stock | |||||||||

Balance as of January 1 | (5,571 | ) | $ | (169 | ) | — | $ | — | |||||

Repurchase of common stock for tax withholdings related to stock-based compensation | (204 | ) | (7 | ) | (107 | ) | (3 | ) | |||||

Repurchase of common stock under share repurchase program | (1,812 | ) | (62 | ) | (764 | ) | (25 | ) | |||||

Stock reissuances | 740 | 26 | 150 | 4 | |||||||||

Balance as of March 31 | (6,847 | ) | $ | (212 | ) | (721 | ) | $ | (24 | ) | |||

ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)

Changes in the balances of each component of AOCI for the three months ended March 31, 2018 and 2017 were as follows:

Derivatives | Defined Benefit Plans | Foreign Currency Translation | AOCI | ||||||||||||||||||||||||||||

(millions) | 2018 | 2017 | 2018 | 2017 | 2018 | 2017 | 2018 | 2017 | |||||||||||||||||||||||

Balance as of January 1 | $ | 16 | $ | 27 | $ | (297 | ) | $ | (246 | ) | $ | (108 | ) | $ | (166 | ) | $ | (389 | ) | $ | (385 | ) | |||||||||

Other comprehensive income (loss) before reclassifications, net of tax | — | (6 | ) | 2 | (1 | ) | 12 | 40 | 14 | 33 | |||||||||||||||||||||

Less: Amounts reclassified from AOCI, net of tax | — | — | (1 | ) | — | — | — | (1 | ) | — | |||||||||||||||||||||

Net other comprehensive income (loss) | — | (6 | ) | 3 | (1 | ) | 12 | 40 | 15 | 33 | |||||||||||||||||||||

Balance as of March 31 | $ | 16 | $ | 21 | $ | (294 | ) | $ | (247 | ) | $ | (96 | ) | $ | (126 | ) | $ | (374 | ) | $ | (352 | ) | |||||||||

Amounts reclassified from AOCI, net of tax, for the three months ended March 31, 2018 and 2017, were as follows:

Three months ended March 31, | ||||||||

(millions) | 2018 | 2017 | ||||||

Derivatives | ||||||||

Net reclassification from AOCI for cash flow hedges included in cost of products sold | $ | — | $ | — | ||||

Less: Income tax benefit on reclassification from AOCI included in income tax expense | — | — | ||||||

Net amount reclassified from AOCI | $ | — | $ | — | ||||

Defined Benefit Plans | ||||||||

Net reclassification in AOCI for amortization of prior service cost included in other income, net | (2 | ) | — | |||||

Less: Income tax benefit on reclassification from AOCI included in income tax expense | (1 | ) | — | |||||

Net amount reclassified from AOCI | $ | (1 | ) | $ | — | |||

We estimate that we will reclassify a net $4 million after-tax loss on derivatives from AOCI to earnings within the next 12 months.

17

13. Income Taxes

Due to the timing of the enactment and the complexity involved in applying the provisions of the 2017 Tax Act, we made reasonable estimates of the effects and recorded provisional amounts in our financial statements as of December 31, 2017. The provisional effect on deferred tax assets and liabilities of the change in tax rates was recognized in earnings in the period ended December 31, 2017, which was when the change was enacted. As part of the 2017 Tax Act's change to a quasi-territorial system, a transition tax was imposed on our accumulated foreign earnings, partially offset by foreign tax credits, which was also recognized in the period ended December 31, 2017. The 2017 Tax Act made significant changes to how foreign tax credits may be realized to offset future tax liabilities. Further clarity may change our anticipated realization of our foreign tax credits. In addition, we may make an election to forgo the use of net operating losses, or NOLs, to offset the impact of the transition tax as allowed under the 2017 Tax Act.

The estimate recorded as of December 31, 2017 continues to be our best estimate as of March 31, 2018. As we collect and prepare necessary data and interpret the 2017 Tax Act and any additional guidance issued by the U.S. Treasury Department, the IRS, and other standard-setting bodies, we may make adjustments to the provisional amounts.

Our income tax expense and effective tax rate for the three months ended March 31 were as follows:

Three months ended March 31, | ||||||||

(dollars in millions) | 2018 | 2017 | ||||||

Income tax expense | $ | 9 | $ | 29 | ||||

Effective tax rate | 20.0 | % | 34.5 | % | ||||

The income tax expense for all periods presented reflects taxes from federal, foreign, state and local jurisdictions. Our effective tax rates were lower than the U.S. statutory rate primarily because of earnings realized in countries that had lower statutory tax rates and our equity method income, which is presented net of tax. Our effective tax rate in the future will depend on, among other things, the portion of our profits earned within and outside the United States.

As of March 31, 2018, we had federal NOL carryforwards of approximately $458 million that are available to offset future federal taxable income and will expire in the years 2030 through 2032, none of which are currently subject to Internal Revenue Code limitations under Section 382. In addition, as of that date, we had federal alternative minimum tax credit carryforwards of approximately $19 million that are available to reduce future regular federal income taxes with the full benefit being realized by 2022 as described in the 2017 Tax Act. We have foreign tax credit carryforwards of $224 million that are available to offset future federal taxable income and expire in the years 2022 through 2027. In order to fully realize these U.S. federal net deferred tax assets, taxable income of approximately $1.617 billion would need to be generated during the period before their expiration based on our interpretation of the 2017 Tax Act.

As of March 31, 2018, we had a deferred tax asset of $169 million related to our state NOLs and tax credit carryforwards. The NOLs will expire if unused in years 2018 through 2034. To the extent that we do not generate sufficient state taxable income within the statutory carryforward periods to utilize the NOL and tax credit carryforwards in these states, they will expire unused.

As of March 31, 2018, the valuation allowance against our deferred tax assets was $175 million, which was unchanged from December 31, 2017.

The Internal Revenue Code imposes limitations on a corporation’s ability to utilize NOLs if it experiences an “ownership change” which can result from transactions increasing the ownership of certain stockholders in the stock of a corporation by more than 50 percentage points over a three-year period. If we were to experience an ownership change, utilization of our NOLs would be subject to an annual limitation that may be carried over to later years within the allowed NOL carryforward period. Over the entire carryforward period, we may not be able to use all our NOLs due to the aforementioned annual limitation. If an ownership change had occurred as of March 31, 2018, our annual U.S. federal NOL utilization would have been limited to approximately $123 million per year.

18

14. Litigation

WALLBOARD PRICING LAWSUITS

In 2015, USG, our subsidiary United States Gypsum Company, our former subsidiary L&W Supply Corporation, and seven other wallboard manufacturers were named as defendants in a lawsuit filed in federal court in California by twelve homebuilders alleging that since at least September 2011, U.S. wallboard manufacturers conspired to fix and raise the price of gypsum wallboard sold in the United States and to effectuate the alleged conspiracy by ending the practice of providing job quotes on wallboard. The lawsuit was transferred to the United States District Court for the Eastern District of Pennsylvania under the title In re: Domestic Drywall Antitrust Litigation, MDL No. 2437. In the second quarter of 2016, the Court dismissed with prejudice the portions of the homebuilders’ complaint alleging a conspiracy in 2014 and 2015, ruling that there were insufficient factual allegations to allow such a claim to go forward. The homebuilders' claims alleging a conspiracy prior to 2014 have not been dismissed, and the case proceeds as to those claims. USG has agreed to defend and indemnify L&W Supply Corporation with regard to this matter.

Beginning in the third quarter of 2013, class action lawsuits making similar allegations with regard to Canada were filed in Quebec, Ontario and British Columbia courts on behalf of purchasers of wallboard in Canada and naming USG, United States Gypsum Company, our Canadian subsidiary CGC Inc., or CGC, and other wallboard manufacturers as defendants.

We believe that the cost, if any, of resolving the homebuilders’ lawsuit and Canadian class action litigation will not have a material effect on our results of operations, financial position or cash flows.

ENVIRONMENTAL LITIGATION

We are involved in environmental cleanups of property that we own or have owned. In addition, we have previously been notified by state and federal environmental protection agencies of possible involvement as one of numerous “potentially responsible parties” in certain Superfund sites in the United States to pay for some part of the cleanup of hazardous waste. In most of these sites, our involvement is expected to be minimal. As of March 31, 2018 and December 31, 2017, we had accruals of $16 million and $17 million, respectively, for our probable and reasonably estimable liability in connection with these matters. Our accruals take into account all known or estimated undiscounted costs associated with these sites, including site investigations and feasibility costs, site cleanup and remediation, certain legal costs, and fines and penalties, if any. However, we continue to review these accruals as additional information becomes available and revise them as appropriate. Based on the information known to us, we believe these environmental matters will not have a material effect on our results of operations, financial position or cash flows.

15. Subsequent Events

In April 2018, we completed the sale of a surplus property with a gain of $13 million, or $9 million net of tax. The pre-tax gain will be recorded within our U.S. Wallboard and Surfaces segment. Additionally in April 2018, we entered into a definitive agreement to sell our 33% interest in a joint venture in South Africa for approximately $3 million. We will record a loss, net of tax, of $5 million on the sale. The loss is driven primarily by foreign currency losses included in equity that will be recognized upon disposition of the entity and will be recorded within Other in Note 4, Segments.

19

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

In the following Management’s Discussion and Analysis of Financial Condition and Results of Operations, “USG,” “we,” “our” and “us” refer to USG Corporation, a Delaware corporation, and its subsidiaries included in the condensed consolidated financial statements, except as otherwise indicated or as the context otherwise requires.

Overview

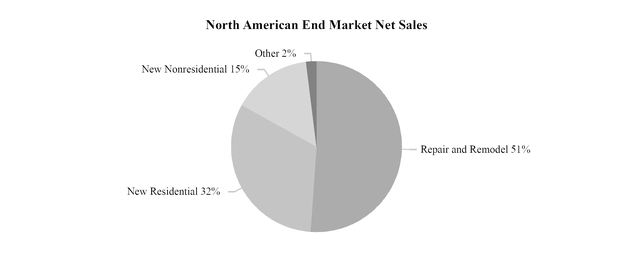

We are a leading manufacturer of building products and innovative building solutions. We produce a wide range of products for use in new residential, new nonresidential, and residential and nonresidential repair and remodel construction as well as products used in certain industrial processes. The following chart reflects our estimation of our North American net sales during the first three months of 2018.

SEGMENTS

During the fourth quarter of 2017, we realigned our organizational structure to reflect three divisions, in addition to UBBP: Gypsum, Performance Materials and Ceilings. As a result of our realigned operating structure, we changed the composition of our reportable segments effective for the quarter ended December 31, 2017 to align with how we manage our businesses, review operating performance and allocate resources considering the discrete information available for the geographies within those divisions. We now have five reportable segments: U.S. Wallboard and Surfaces, U.S. Performance Materials, U.S. Ceilings, Canada, and UBBP.

Gypsum: Our Gypsum division manufactures and markets gypsum wallboard and related products in the United States, Canada and Mexico. It is composed of our U.S. Wallboard and Surfaces segment, the gypsum operations of our Canada segment and our gypsum operations in Mexico, which are included in Other. Gypsum’s products are used in a variety of building applications to construct walls and ceilings of residential, nonresidential and institutional buildings, as well as in certain industrial applications. The major product lines within the Gypsum division are:

WALLBOARD | |

USG Sheetrock® brand gypsum wallboard and Securock® brand glass mat sheathing portfolios | Gypsum panels that provide aesthetic as well as sound-dampening, fire-retarding, abuse-resistance and moisture-control value |

SURFACES | |

USG Sheetrock® brand joint compound portfolio, as well as corner bead, joint tape, and plaster | Used for finishing wallboard joints |

Construction plaster products, sold under the brand names Red Top®, Imperial®, Diamond® and Supremo™ and industrial gypsum | Used to provide a custom finish for residential and nonresidential interiors and provide aesthetic, sound-dampening, fire-retarding and abuse-resistance value |

Performance Materials: Our Performance Materials division manufactures and markets a series of innovative products in the United States that provide solutions to our customers to help close the skilled labor gap and increase job site efficiency. It consists solely of our U.S. Performance Materials segment. Performance Materials products are used in a variety of interior and

20

exterior building applications of residential and nonresidential buildings throughout North America, as well as in certain industrial applications. These products can be grouped under three product categories of underlayment, building envelope and structural. The major products within these three categories are as follows:

UNDERLAYMENT | |

USG Durock® brand cement board | Provides water and fire-resistant assemblies for both interior and exterior applications |

Fiberock® brand backerboard | Includes abuse-resistant interior wall panels, tile backer boards, and flooring underlayments |

USG Durock™ brand shower systems | A fully bonded waterproofing system for tiled shower installations |

Levelrock® brand systems of poured gypsum flooring | Provides surface leveling, enhanced sound-dampening and fire-resistant performance for residential and nonresidential flooring applications |

BUILDING ENVELOPE | |

Securock® ExoAir® 430 air barrier system | Integrated gypsum sheathing panels with pre-applied fluid air barrier membrane that provides structural performance and moisture, mold and air control |

Securock® brand roof board portfolios | Roof boards for use in low-slope nonresidential roofing systems that provides moisture, mold and fire resistant value |

STRUCTURAL | |

USG Structural Panels | High-strength, reinforced factory made concrete panels for use in subfloor, roof deck, foundation walls and other noncombustible applications |

Ceilings: Our Ceilings division manufactures and markets interior ceilings systems products in the United States, Canada, and Mexico. It consists of our U.S. Ceilings segment, the ceilings operations of our Canada segment, and our ceilings operations in Mexico, which are included in Other. Ceilings products include ceiling tile, ceiling grid, and specialty ceilings used primarily in nonresidential applications. In the fourth quarter of 2017, we acquired Ceilings Plus, a leader in the specialty ceilings market. The major product lines within the Ceilings division are:

CEILING TILE | |

Radar™, Eclipse™, Mars™ and Halcyon™ | Provides qualities such as sound absorption, fire retardation and convenient access to the space above the ceiling for electrical and mechanical systems, air distribution and maintenance |

CEILING GRID | |

Donn®, DX®, Fineline®, Centricitee™ and Identitee® DXI™ | Provides qualities such as fire retardation and convenient access to the space above the ceiling for electrical and mechanical systems, air distribution and maintenance |

SPECIALTY CEILINGS | |

Curvatura™, Compasso®, Radians®, Illusions™, Multiples™, Runways™, Barz™, Planx™, Mirra™, Corniche™,Wallforms™ and Parti™ | Provides qualities such as aesthetics, sound absorption, fire retardation and convenient access to the space above the ceiling for electrical and mechanical systems, air distribution and maintenance |

ENSEMBLETM | |

Ensemble™ Ceilings System | Provides a monolithic drywall look with acoustical performance |

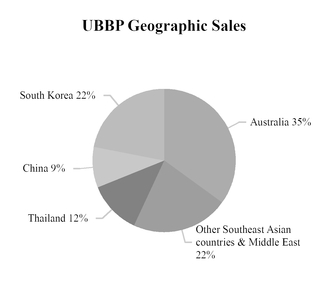

USG Boral Building Products: Our 50/50 joint ventures with Boral Limited, or Boral, are referred to as USG Boral Building Products, or UBBP. UBBP manufactures, distributes and sells certain building products, mines raw gypsum and sells natural and synthetic gypsum throughout Asia, Australasia and the Middle East. UBBP manufactures and distributes products for wall, ceiling, floor lining and exterior systems that utilize gypsum wallboard, referred to as plasterboard in the region in which UBBP operates, mineral fiber ceiling tiles, steel grid and joint compound.

21

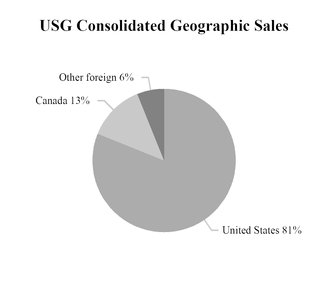

Geographic Information: For the first three months of 2018, we recorded $786 million of net sales in our condensed consolidated statements of income, and net sales for UBBP, which are not included in our condensed consolidated statements of income, were $287 million. The following charts reflect the geographic breakdown of net sales during the first three months of 2018.

MARKET CONDITIONS AND OUTLOOK

Our businesses are cyclical in nature and sensitive to changes in general economic conditions, including, in particular, conditions in the housing and construction-based markets in North America. Our business in the markets of Asia, Australasia, and the Middle East also significantly exposes us to the economic conditions in those areas. However, the UBBP joint ventures have helped diversify USG's overall exposure to changes in the North American economic conditions.

The following table summarizes the current market conditions and outlook for our primary end markets in North America.

End Market | Lead time | Metric | Source | Market Condition/Outlook |

New Residential | Installation of gypsum products(a) into a single family home typically follows a housing start by 90-120 days | Housing starts (seasonally adjusted) | U.S. Census Bureau | 3/31/2018 - 1.319 million Actual 2017 - 1.203 million |

Industry forecast (Blue Chip Economic Indicators) | 2018 - 1.25 million to 1.34 million (b) | |||

USG forecast | 2018 estimated - 1.25 million (c) | |||

New Nonresidential | Installation of gypsum(a) and ceilings products typically follows signing of construction contracts by about 12 to 18 months | Change in floor space for which contracts are signed | Dodge Data & Analytics | 2017 - 2% increase |

Industry forecast (Dodge Data & Analytics) (d) | 2018 - 3% increase | |||

USG forecast | 2018 estimated to increase by low to mid single digits | |||

Repair and Remodel (e) | Remodels typically begin within two years from purchase | Sales of existing homes (seasonally adjusted) | National Association of Realtors | 3/31/2018 - 5.60 million 3/31/2017 - 5.67 million Actual 2017 - 5.51 million |

Overall repair and remodel spending for gypsum products | USG forecast | 2018 spending estimated to increase by low to mid single digits | ||

(a) | Gypsum products include products manufactured and marketed by our U.S. Wallboard and Surfaces segment and Fiberock® brand gypsum fiber panels manufactured and marketed by our U.S. Performance Materials segment. |

(b) | Forecast based on the average of the bottom ten and top ten forecasts included in the report, respectively. |

(c) | USG estimate is based on the seasonally adjusted annual rate of housing starts. |

(d) | Dodge Data & Analytics' forecast includes several building types which do not generate significant demand for our products. |

(e) | The repair and remodel market includes renovation of both residential and nonresidential buildings. |

As indicated in the table above, we expect modest improvement in the U.S. construction markets over the next twelve months. However, while sales of our products in our U.S. Wallboard and Surfaces and U.S. Performance Materials segments have generally improved with the modest recovery in residential building, the segments continue to be adversely affected by the low level of residential and other construction activity compared to historical averages. The results of our U.S. Ceilings

22

segment, which primarily serves the nonresidential market, have shown some improvement over the longer term. However, the results also continue to be adversely affected by the low levels of new nonresidential construction activity as compared to historical averages. Our U.S. Ceilings segment is also adversely affected by changing construction preferences, such as the shift to open plenum and specialty ceilings. We acquired Ceilings Plus in 2017 to help address this trend.

We also expect modest improvement in the construction industry in Canada. Other international markets, including those that are within the UBBP territory, provide opportunities for our operations to serve the demand in these regions. Australia is expected to experience a decline in housing starts; however, these housing starts are expected to remain above the long-term average. The construction industry in South Korea has slowed, driven by increased government regulations. The construction industry in Thailand is showing slight improvement due to growth in the government infrastructure market. Several emerging markets which are within the UBBP territory are forecasted to experience growth. The international markets within the UBBP territory are beginning to adopt Western building practices, which provide more opportunities for our products. We anticipate that the performance of the UBBP joint ventures will partially offset some of the potential cyclicality in our North American businesses.

The following table summarizes the industry information on wallboard shipments and capacity.

U.S. Industry Information | Metric | Source | Market Condition/Outlook |

U.S. industry shipments of gypsum board (a) | Billion of square feet (bsf) | Gypsum Association | First three months 2018 - 5.8 bsf First three months 2017 - 6.0 bsf |

USG forecast | 2018 expected to increase low single digits from 25.7 bsf in 2017 | ||

U.S. wallboard capacity | Billion of square feet (bsf) | USG estimate | 1/1/2018 - 34.0 bsf |

U.S. industry capacity utilization rate | Annualized shipments as a percentage of industry capacity | USG estimate | First three months 2018 - 67% First three months 2017 - 71% |

(a) | Gypsum board include products manufactured and marketed by our U.S. Wallboard and Surfaces segment and Fiberock® brand gypsum fiber panels manufactured and marketed by our U.S. Performance Materials segment. |

Based on current industry trends and forecasts, demand for gypsum wallboard is expected to increase in 2018, but the magnitude of any increase will depend on the levels of housing starts and repair and remodel activity, among other factors. We project that the industry capacity utilization rate will increase modestly in 2018 compared to 2017.

We could experience pressure on gypsum wallboard selling prices and our gross margins at these levels of capacity utilization. Our U.S. Wallboard and Surfaces segment implemented a price increase for wallboard effective in January 2018. However, it is uncertain that we will be able to maintain the increase or obtain additional price increases in our selling prices. If we are unable to maintain our wallboard selling prices or implement additional price increases, our net sales, operating results and cash flows may be materially and adversely impacted.

CURRENCY IMPACT

Currency impact on consolidated and segment results has been derived by translating current period results at the quarter-to-date average foreign currency rates for the quarter ended March 31, 2017.

23

Consolidated Results of Operations

(dollars in millions, except per-share data) | 2018 | 2017 | $ Favorable (Unfavorable) | % Favorable (Unfavorable) | ||||||||||

Three months ended March 31: | ||||||||||||||

Net sales | $ | 786 | $ | 767 | $ | 19 | 2 | % | ||||||

Cost of products sold | 647 | 608 | (39 | ) | (6 | )% | ||||||||

Gross profit | 139 | 159 | (20 | ) | (13 | )% | ||||||||

Selling and administrative expenses | 93 | 75 | (18 | ) | (24 | )% | ||||||||

Operating profit | 46 | 84 | (38 | ) | (45 | )% | ||||||||

Income from equity method investments | 9 | 13 | (4 | ) | (31 | )% | ||||||||

Interest expense | (14 | ) | (20 | ) | 6 | 30 | % | |||||||

Interest income | 1 | 1 | — | — | % | |||||||||

Other income, net | 3 | 6 | (3 | ) | * | |||||||||

Income before continuing operations before income taxes | 45 | 84 | (39 | ) | (46 | )% | ||||||||

Income tax expense | (9 | ) | (29 | ) | 20 | 69 | % | |||||||

Income from continuing operations | 36 | 55 | (19 | ) | (35 | )% | ||||||||

Income from discontinued operations, net of tax | 1 | — | 1 | * | ||||||||||

Net income | $ | 37 | $ | 55 | $ | (18 | ) | (33 | )% | |||||

Diluted earnings per share - net income | $ | 0.25 | $ | 0.37 | $ | (0.12 | ) | (32 | )% | |||||

*not meaningful | ||||||||||||||

NET SALES

Consolidated net sales for the first quarter of 2018 increased $19 million, or 2%, compared with the first quarter of 2017, due to higher net sales for our U.S. Performance Materials, U.S. Ceilings and Canada segments driven by increased shipments and higher average selling prices, offset by lower net sales for our U.S. Wallboard and Surfaces segment as a result of lower volumes. On a consolidated basis for the comparative periods, we estimate that our net sales were impacted by a favorable foreign currency translation of $7 million.

GROSS PROFIT

Gross profit for the first quarter of 2018 decreased $20 million, or 13%, compared with the first quarter of 2017. Gross profit as a percentage of net sales was 17.7% for the first quarter of 2018, compared with 20.7% for the first quarter of 2017. The lower gross margin was driven primarily by increased costs per unit of products in our U.S. Wallboard and Surfaces, U.S. Performance Materials and U.S. Ceilings segments. Also contributing to the decrease in gross profit were costs incurred for the expansion of our Jacksonville and Delavan facilities offset by $3 million in savings driven by our Advanced Manufacturing initiatives.

SELLING AND ADMINISTRATIVE EXPENSES

Selling and administrative expenses totaled $93 million in the first quarter of 2018 compared to $75 million in the first quarter of 2017. As a percentage of net sales, selling and administrative expenses increased to 11.8% for the first quarter of 2018 from 9.8% for the first quarter of 2017. The increase reflected a $5 million charge for a legal judgment on a contract dispute from 2004, $4 million in costs associated with the integration of Ceilings Plus and our business unit realignment, and increased marketing and compensation expenses in support of our strategy.

INCOME FROM EQUITY METHOD INVESTMENTS

Income from equity method investments, primarily UBBP, in the first quarter of 2018 was $9 million, a decrease of $4 million, or 31%, from the first quarter of 2017. This reflected a decrease in income recorded by UBBP, due to lower margins in South Korea, Thailand and Indonesia partially offset by higher margins in Australia and China and higher selling and administrative expenses.

INTEREST EXPENSE

Interest expense was $14 million in the first quarter of 2018, down $6 million, or 30%, from the first quarter of 2017 reflecting lower interest rates on outstanding debt.

24

OTHER INCOME, NET

Other income, net, which consists primarily of the non-service cost components of our pension and postretirement plan benefits, was $3 million in the first quarter of 2018 as compared to $6 million for the first quarter of 2017. The decrease of $3 million primarily reflected an increase in the net amortization of unrecognized costs, which includes a credit related to our U.S. postretirement plan as a result of a subsidy provided to retirees eligible for Medicare. The subsidy will end December 31, 2019 at which time there will be no remaining credit to be amortized to the income statement.

INCOME TAX EXPENSE

We recorded income tax expense of $9 million in the first quarter of 2018 from federal, foreign, state and local jurisdictions reflecting an effective tax rate of 20%, compared to income tax expense of $29 million in the first quarter of 2017, reflecting an effective tax rate of 34.5%. The decline in the effective tax rate was primarily due to the federal rate reduction from 35% to 21% as part of the 2017 Tax Act.

Segment Results of Operations

Net sales and operating profit (loss) for our consolidated reportable segments were as follows:

Three months ended March 31, | ||||||||||||||

Favorable (Unfavorable) | ||||||||||||||

(millions) | 2018 | 2017 | $ | % | ||||||||||

Net sales | ||||||||||||||

U.S. Wallboard and Surfaces | $ | 441 | $ | 469 | $ | (28 | ) | (6 | )% | |||||

U.S. Performance Materials | 92 | 86 | 6 | 7 | % | |||||||||

U.S. Ceilings | 138 | 112 | 26 | 23 | % | |||||||||

Canada | 111 | 96 | 15 | 16 | % | |||||||||

Other | 60 | 56 | 4 | 7 | % | |||||||||

Eliminations | (56 | ) | (52 | ) | (4 | ) | (8 | )% | ||||||

Total | $ | 786 | $ | 767 | $ | 19 | 2 | % | ||||||

Operating profit (loss) | ||||||||||||||

U.S. Wallboard and Surfaces | $ | 49 | $ | 79 | $ | (30 | ) | (38 | )% | |||||

U.S. Performance Materials | 1 | 6 | (5 | ) | (83 | )% | ||||||||

U.S. Ceilings | 19 | 20 | (1 | ) | (5 | )% | ||||||||

Canada | 2 | 2 | — | — | % | |||||||||

Other | 4 | 1 | 3 | 300 | % | |||||||||

Corporate | (29 | ) | (24 | ) | (5 | ) | (21 | )% | ||||||

Total | $ | 46 | $ | 84 | $ | (38 | ) | (45 | )% | |||||

* Not meaningful | ||||||||||||||

U.S. Wallboard and Surfaces: Net sales in the first quarter of 2018 were $441 million, a decrease of $28 million, or 6%, compared with the first quarter of 2017. The decrease in net sales was due to the following:

Sales | Volume | Price | |||||||||||||||

(millions) | $ | % | $ | % | $ | % | |||||||||||

Change to Q1 2018 from Q1 2017 | |||||||||||||||||

USG Sheetrock® brand gypsum wallboard | $ | (29 | ) | (11 | )% | $ | (31 | ) | (12 | )% | $ | 2 | 1 | % | |||

USG Sheetrock® brand joint compound | (2 | ) | (2 | )% | (4 | ) | (4 | )% | 2 | 2 | % | ||||||

Other | 3 | ||||||||||||||||

Total decrease in net sales | $ | (28 | ) | ||||||||||||||

Sales for USG Sheetrock® brand gypsum wallboard decreased $29 million in the first quarter of 2018 compared to the first quarter of 2017 due to lower shipments partially offset by higher average selling price. The decreased volumes in the first quarter of 2018 primarily reflected higher volumes in the fourth quarter of 2017 in anticipation of the early January 2018 price increase, which was announced in the fourth quarter of 2017. In comparison, in the first quarter of 2017, sales reflected higher

25

volumes in early January 2017 in anticipation of the price increase in late January 2017. The increase in the average selling price in the first quarter of 2018 was driven by the January 2018 price increase.

Sales of USG Sheetrock® brand joint compound decreased $2 million on lower volumes offset by higher average selling price. The lower volume reflected delayed customer jobs due to unfavorable weather, primarily in the northeast. We also recorded higher royalties and sales of other products including glass-mat panels, paper and joint compound accessory products offset by lower freight due to lower sales.

Operating profit of $49 million was recorded in the first quarter of 2018 compared to $79 million recorded in the first quarter of 2017. The decrease of $30 million in operating profit reflected the following:

Operating Profit | Volume | Price | Cost | ||||||||||||

(millions) | $ | $ | $ | $ | |||||||||||

Change to Q1 2018 from Q1 2017 | |||||||||||||||

USG Sheetrock® brand gypsum wallboard | $ | (25 | ) | $ | (13 | ) | $ | 2 | $ | (14 | ) | ||||

USG Sheetrock® brand joint compound | (3 | ) | (1 | ) | 2 | (4 | ) | ||||||||

Other | (2 | ) | |||||||||||||

Total decrease in operating profit | $ | (30 | ) | ||||||||||||

The decrease in operating profit reflected lower gross profit for USG Sheetrock® brand gypsum wallboard and USG Sheetrock® brand joint compound. The decrease in gross profit for USG Sheetrock® brand gypsum wallboard reflected higher cost per unit and lower volumes slightly offset by higher average selling price. The higher per unit cost primarily reflected an increase in costs per unit of 29% for fixed costs and 11% for conversion costs driven by increased labor costs as a result of the decision to maintain staffing levels consistent with the fourth quarter despite lower volumes in order to be properly staffed throughout the remainder of 2018. The lower gross profit for USG Sheetrock® brand joint compound reflected a higher per unit cost and lower volumes offset by higher average selling price. The higher cost per unit for joint treatment reflected increased cost per unit for raw materials, primarily resin used for containers.