Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EXOPACK HOLDING CORP | d611403d8k.htm |

| EX-99.1 - EX-99.1 - EXOPACK HOLDING CORP | d611403dex991.htm |

Exhibit 99.2

| This announcement is for information only and does not constitute an offer to sell or issue or the solicitation of an offer to buy or subscribe for securities in the United States or any other jurisdiction. This announcement is not a public offering in the Grand Duchy of Luxembourg or an offer of securities to the public in any European Economic Area member state that has implemented directive 2003/71/EC (together with any applicable implementing measures in any member state, the “Prospectus Directive”). This press release is not a solicitation of consents to the Proposed Amendments (as defined below). |

Forward-looking Statements

This report includes forward-looking statements, which are based on our current expectations and projections about future events. All statements other than statements of historical facts included in this report including, without limitation, statements regarding our future financial position, risks and uncertainties related to our business, strategy, capital expenditures, projected costs and our plans and objectives for future operations, including our plans for future costs savings and synergies, may be deemed to be forward-looking statements. Words such as “believe,” “expect,” “anticipate,” “may,” “assume,” “plan,” “intend,” “will,” “should,” “could,” “estimate,” “risk” and similar expressions or the negatives of these expressions are intended to identify forward-looking statements. By their nature, forward-looking statements involve known and unknown risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. Forward-looking statements are not guarantees of future performance. You should not place undue reliance on these forward-looking statements. In addition any forward-looking statements are made only as of the date of this report, and we do not intend and do not assume any obligation to update any statements set forth in this report. Many factors may cause our results of operations, financial condition, liquidity and the development of the industry in which we compete to differ materially from those expressed or implied by the forward-looking statements contained in this report.

CERTAIN DEFINITIONS

Unless otherwise specified or the context requires otherwise, the following terms have the meaning assigned to them below:

| “Additional Guarantees” |

the guarantees of the Notes made by the Additional Guarantors pursuant to the Supplemental Indenture; | |

| “Additional Guarantors” |

Exopack Holdings S.A. and certain of its subsidiaries that will provide guarantees pursuant to the Supplemental Indenture on the Completion Date. | |

| “Britton Business” |

the business of Copper International Holdings S.à r.l. and its subsidiaries, a provider of flexible plastic packaging, operating primarily in the United Kingdom, France and Germany; | |

| “Combination” |

the contribution by Sun Capital of the Exopack Business and the Fund V Companies to the Exopack Holdings S.A. in exchange for 100% of the share capital of a parent of Exopack Topco, completed on May 31, 2013; | |

| “Combined Businesses” |

the Fund V Companies and the Exopack Business, on an individual basis; | |

| “Completion Date” |

the date of completion of the Transactions; | |

| “Consent Solicitation” |

the solicitation of consents from certain holders of the Notes to amend the Indenture; | |

| “Continuing Credit Arrangements” |

the existing credit facilities, capital/finance lease arrangements and factoring arrangements that will remain outstanding following the completion of the Transactions, as described in “Description of Certain Indebtedness—Continuing Credit Arrangements”; | |

| “EU” |

the European Union; | |

| “euro” or “€” |

the lawful currency of the European Monetary Union; | |

| “European ABL Facilities” |

the new receivables and inventory facilities established under the European ABL Facilities Agreement, consisting of an £89.0 million UK asset-backed revolving facility, a €48.0 million French accounts receivable facility and a $25.0 million German accounts receivable facility; | |

| “European ABL Facilities Agreements” |

the pan-European receivables and inventory facility arrangements to be entered into among (i) GE Capital Bank Limited, Kobusch UK Limited, Paragon Labels Limited, Paragon Flexible Packaging Limited, Britton Taco Limited, Britton Decoflex Limited and Britton Merlin Limited (the “GE UK Facility”), (ii) GE Factofrance, Cofacredit, Paccor France SAS, Paccor Packaging France SA, Britton Decorative SAS, Britton Flexibles France SA and Britton Reuther GmbH & Co KG (the “French Facilities”) and (iii) (A) GE Capital Bank AG and Kobusch-Sengewald GmbH; (B) GE Capital Bank AG and Paccor Deutschland GmbH; and (C) GE Capital Bank AG and Paccor Packaging Deutschland GmbH (the “GE Germany Facilities”), in each case as further amended, restated, supplemented, refinanced, reviewed or replaced from time to time; | |

| “Exopack” |

Exopack Holding Corp.; | |

| “Exopack Term Loan Facility” |

the $350.0 million senior secured term loan B facility agreement, dated as of May 31, 2011, by and among Exopack Key Holdings, LLC, Exopack, LLC and Cello-Foil Products, Inc. as borrowers, and certain subsidiaries of Exopack Key Holdings, LLC, which will be repaid in full upon completion of the Transactions; | |

| “Exopack Topco” |

SCPack Holdings Management S.á r.l. & Partners S.C.A., incorporated as a Corporate partnership limited by shares (société en commandite par actions) under the laws of the Grand Duchy of Luxembourg, with registered office at 5, rue Guillaume Kroll, L-1882 Luxembourg, Grand Duchy of Luxembourg, registered with the Luxembourg Register of Commerce and Companies (R.C.S. Luxembourg) under number B-167051; | |

| “Former Fund V Credit Facilities” |

collectively, the revolving credit facility indebtedness and factoring facility indebtedness of the Fund V Companies that will be repaid in connection with the completion of the Transactions. The outstanding balances as of June 30, 2013 were $596.9 million (equivalent); | |

| “Fund V Companies” |

collectively, the Britton Business, the Kobusch Business, the Paccor Business and the Paragon Business and the Exopack Business as of June 30, 2013 and, in the case of the Exopack Business, for the period May 31, 2013 through June 30, 2013; | |

| “GPPI” |

Global Packaging Procurement, Inc., a global purchasing consortium; | |

| “Group”, “us,” “our” and “we” |

collectively, Exopack Holdings S.A. and its subsidiaries; | |

| “Guarantees” |

the guarantees of the Notes by the Guarantors following the completion of the Transactions; | |

| “Guarantors” |

Exopack Holdings S.A. and substantially all of its subsidiaries organized in the United States, the United Kingdom, Austria, Germany, Finland, Luxembourg and Poland, other than the subsidiaries of Exopack organized outside the United States. | |

| “IFRS” |

International Financial Reporting Standards, as adopted by the European Union; | |

| “Indenture” |

the indenture dated May 31, 2011 governing the Notes, as amended, restated, supplemented, refinanced, reviewed or replaced or otherwise modified from time to time; | |

| “Kobusch Business” |

the business of Eifel Holdings S.à r.l., a Luxembourg private limited liability company (société à responsabilité limitée), with registered office at 5, rue Guillaume Kroll, L-1882 Luxembourg, registered with the Luxembourg Register of Commerce and Companies (R.C.S. Luxembourg) under number B 163855, and its subsidiaries, a provider of flexible and rigid packaging solutions, operating in Europe, the Middle East and Asia; | |

| “New Indebtedness” |

the new indebtedness incurred in connection with the Refinancing; | |

| “New Debt Guarantors” |

the subsidiaries of Exopack Holdings S.A. that will guarantee the New Indebtedness; | |

| “Non-Guarantor Subsidiaries” |

the subsidiaries of the Exopack Holdings S.A. that will not guarantee the New Indebtedness; | |

| “North American ABL Facility” |

the $75.0 million asset-based revolving credit facility and a $25.0 million committed accordion facility established under the North American ABL Facility Agreement, as such facilities may be increased or decreased from time to time in accordance with the North American ABL Facility Agreement and the North American ABL Facility Intercreditor Agreement. The outstanding balance as of June 30, 2013 was $28.8 million, which will be repaid in connection with the completion of the Transactions. The North American ABL Facility will remain available for future drawings; | |

| “North American ABL Facility Agreement” |

the third amended and restated Credit Agreement, dated as of May 31, 2011 which is to be further amended and restated in connection with the Transactions, by and among Exopack, LLC, Cello-Foil Products, Inc., Exopack Performance Films Inc., and Exopack-Newmarket, Ltd. as borrowers, and the other persons party thereto that are designated as credit parties and General Electric Capital Corporation, as U.S. agent, U.S. L/C issuer and U.S. lender, and GE Canada Finance Holding Company, as Canadian agent, Canadian L/C issuer and Canadian lender, and the other financial institutions party thereto, as lenders; | |

| “Notes” |

the $235.0 million aggregate principal amount of 10% Senior Notes due 2018, issued by Exopack on May 31, 2011, as amended; | |

| “Paccor Business” |

the business of Paccor International Holding S.à r.l., a Luxembourg private limited liability company (société à responsabilité limitée), with registered office at 1B Heienhaff, L-1736 Senningerberg, registered with the Luxembourg Register of Commerce and Companies (R.C.S. Luxembourg) under number B- 161812, and its subsidiaries, a provider of rigid plastic and paper packaging, operating across Europe; | |

| “Paragon Business” |

the business of Paragon Management S.à r.l. and its subsidiaries, a provider of labels, films and boards, operating primarily in the United Kingdom; | |

| “Pannunion” |

Pannunion Packaging plc, incorporated as a public limited company under the laws of Hungary; | |

| “Pro Forma” |

the information qualified by this term gives pro forma effect to the Transactions as if they had occurred as of: (i) January 1, 2012 (as it relates to income statement information for the twelve-month period ended June 30, 2013, the six month periods ended June 30, 2013 and 2012, respectively, and the year ended December 31, 2012), (ii) January 1, 2011 (as it relates to income statement information for the year ended December 31, 2011) and (iii) June 30, 2013 (as it relates to balance sheet information as of June 30, 2013); | |

| “Refinancing” |

the incurrence of the New Indebtedness and the use of the proceeds therefrom, together with available cash reserves, to refinance certain existing indebtedness of the Group and to pay fees and expenses incurred in connection with the Transactions; | |

| “Reuther” |

Britton Reuther GmbH & Co. KG, a limited partnership established under the laws of Germany; | |

| “Sun Capital” or “Sponsor” |

Sun Capital Partners, Inc. and, where applicable, the funds and limited partnerships owned or advised by it or its affiliates; | |

| “Transactions” |

collectively, (i) the Combination, (ii) the Refinancing, (iii) the amendment of the Indenture to reflect the Proposed Amendments and (iv) our entry into the European ABL Facilities and certain amendments to the North American ABL Facility. | |

| “U.K. GAAP” |

the generally accepted accounting principles in the United Kingdom; | |

| “Unterland” |

Britton Unterland GmbH, a limited liability company incorporated under the laws of Austria; | |

| “U.S. dollars,” “USD,” “US$” or “$” |

the lawful currency of the United States; | |

| “U.S. GAAP” |

the generally accepted accounting principles in the United States; and | |

| “Veriplast” |

Acorn (Netherlands) Z B.V. | |

THE NEWLY-FORMED EXOPACK HOLDINGS S.A. GROUP

Overview

We are among the largest manufacturers of plastic packaging products in the world based on net sales during 2012. We offer a broad range of value-added flexible and rigid plastic and paper packaging products that include primary packaging (such as bags, pouches, cups, lids and trays), films, laminates, sleeves and labels. We produce our products in 64 production facilities primarily located in North America and Europe, and have strategically located facilities in Asia and the Middle East. Our broad product offering and geographic reach allow us to serve as a “one-stop-shop” for our customers who increasingly demand a single source of supply that can be reliably and consistently delivered throughout the world. Our products are used in a diverse range of growing and resilient end markets, including the food, industrial, beverage, pet and household care and medical end markets. We have benefitted from significant plastic packaging growth in our main end markets in North America and Europe, which has on average over the last ten years exceeded gross domestic product growth due in part to resilient demand for consumer goods and a shift from metal, paper and glass packaging to plastic packaging. During the past two years, we have taken significant steps to integrate our various businesses with the aim of creating a global packaging company with a diverse manufacturing, development and sales platform to leverage customer relationships, product lines, manufacturing technologies and purchasing scale.

We currently have a diversified base of over 3,000 customers, ranging from leading international blue-chip customers to smaller regional businesses, who we believe look to us for packaging solutions that have high consumer impact in terms of form, function and branding. Our diverse customer base includes some of the largest consumer products companies in the world such as Procter & Gamble, Coca-Cola, Kellogg, Kraft Foods, Mondelēz, Nestle, Mars, Pepsi and Unilever. We have developed longstanding relationships with our customers spanning, in many cases, over 15 years. In both Pro Forma 2012 and the six months ended June 30, 2013 on a Pro Forma basis, no single customer represented more than 7% of net sales, and our top ten customers represented 21% and 28% of net sales, respectively. Effective packaging is key to the success of our customers’ products, and we work closely with these customers to design value-added packaging that complements and enhances the functionality and shelf-appeal of their product line. We have product innovation teams located throughout our markets that enable us to serve our customers locally, and we solidify our relationships with our customers by working with them to develop, commercialize and efficiently produce innovative new product packaging. We believe that the Combination enables us to expand our business by cross-selling to our large existing customer base and by offering new customers broad distribution of technically advanced products with consistent quality that cover a broad range of our customers’ value chain.

We operate 64 production facilities worldwide which allow us to supply global customers reliably, quickly and efficiently across multiple regions. We operate 16 production facilities in North America, 45 production facilities across Europe, as well as three strategically located facilities in the Middle East and China. We believe this provides us with a competitive advantage over most of our competitors, which in general are smaller and only offer regional distribution. Our manufacturing platform benefits from several years of facility upgrades and footprint rationalization. In 2012, on a Pro Forma basis, we made $50.4 million of strategic capital investments across our manufacturing platform, and our investments have provided us with a modern and efficient portfolio of facilities to produce our products. We have also benefited from sharing and implementation of best practices and procedures across our businesses in order to leverage our technological expertise and improve efficiency throughout our group.

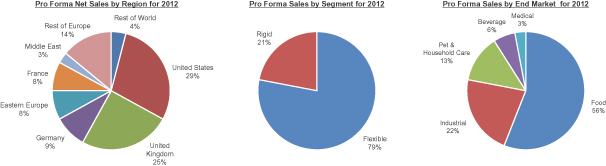

We conduct our business principally through two operating segments: Flexible and Rigid. In our Flexible packaging segment we manufacture a variety of flexible and semi-rigid plastic and paper products, including bags, pouches, roll stocks, films, laminates, sleeves and labels. We sell these products primarily in North America and Europe. In our Rigid packaging segment we manufacture thermoformed and decorated rigid plastic and paper packaging solutions, including bowls, cups, lids and trays. We sell these products primarily in Europe. The following charts present our net sales to our customers by geographic region, operating segment and end market on a Pro Forma basis for the year ended December 31, 2012.

Our net sales net loss and Pro Forma Adjusted EBITDA including synergies for the Pro Forma twelve months ended June 30, 2013 was $2,688.4 million, $69.2 million and $313.2 million, respectively.

Our Strengths

We believe our key competitive strengths are:

Leading Positions in Attractive End Markets. We are among the largest manufacturers of flexible and rigid plastic packaging in the world by net sales during 2012 and are one of the leading producers of flexible and rigid plastic packaging in both the North American and European markets. We hold strong leadership positions in attractive end markets and product types across our portfolio. For example, we believe that we are the second largest provider of pet food and cheese packaging in North America, a leader in the printed beverage shrink market in North America, a leading provider of unit dose laundry detergent packaging in North America and a leading provider of private labels in the United Kingdom, each based on net sales during 2012, as well as a major player in the thin wall rigid packaging market segment by volume in Eastern Europe and the largest thin wall rigid packaging producer by volume in Europe as a whole. We hold these leading positions in some of the most favorable segments and geographies in terms of market size and expected demand growth in the global packaging market. During the last ten years, plastic packaging has been the fastest growing segment of the packaging market, and sales growth in our markets during the last ten years has exceeded gross domestic product growth, due in part to increasing demand for consumer goods and a shift from metal, paper and glass containers to plastics. According to Pira International, the global flexible and rigid plastic packaging industry is expected to grow at a compound annual growth rate of 3.5% and 4.2%, respectively, between 2011 and 2016. Furthermore, our customer network is primarily involved in growing consumer-oriented end markets such as food, beverage and pet food. Global volumes in these end markets have increased at a compound annual growth rate of 3.4%, 1.5% and 3.3%, respectively between 2006 and 2012.

Broad Geographic Reach. Our industry is driven by large, global customers who require that their suppliers are able to deliver products globally in a timely manner based on defined product specifications. We have an extensive manufacturing base in North America and Europe and strategically located production facilities in Asia and the Middle East, which allow us to supply global customers quickly and efficiently across multiple regions. The flexible packaging market is highly fragmented both in North America and Europe, and we believe that large, global customers have historically been underserved by smaller manufacturers that can only provide products on a regional basis. We are able to produce products in various regions of the world that have the same quality and appearance, which helps our customers to provide a consistent product and brand throughout their markets. Moreover, customers desire a packaging provider certified and able to meet applicable government food and safety standards, which we believe gives larger market participants, such as us, an advantage over small market participants. Our strategically located manufacturing bases allow us to manufacture products in close proximity to our customers’ facilities, reducing supply chain complexity, minimizing shipping costs and allowing for just-in-time delivery. Our broad geographic reach also exposes us to a wide variety of products and technologies, which we can introduce quickly throughout all of our markets.

Resilient and Diversified Business Model. We offer a diverse range of flexible and rigid plastic and paper packaging solutions for use in consumer staples such as foods and beverages, other consumer staples, including detergent and pet food, household care and hygiene products, medical devices and other construction and electronics products. We also produce packaging labels and can provide customized printing services for our customers’ products. We believe that we have one of the broadest product portfolios in the plastic packaging industry, which reduces our exposure to changes in consumer preferences for particular packaging solutions. Further, demand for consumer staples, and by extension demand for our products, is generally more resilient across economic cycles than other discretionary consumer or industrial products. We generated 74% and 72% of our net sales for Pro Forma 2012 and for the six months ended June 30, 2013 on a Pro Forma basis, respectively, from sales of packaging for food, pet and household care and beverages. Each of these end markets has exhibited resilience during recent adverse economic conditions. For example, according to MarketLine, global volumes of packaged food, pet food and beverages increased 3.5%, 3.2% and 1.6%, respectively, from 2008 to 2009. We also sell our products in over 60 countries, which reduces our exposure to individual geographic regions. Our customer base is well diversified with no individual customer representing more than 5% of sales and with the top ten customers only representing a combined 21% of sales during Pro Forma 2012. We believe that our broad product portfolio and diverse end markets, customer base and geographic markets make us less susceptible to regional economic shocks, changing demand dynamics or shifting customer preferences.

Established Relationships with Blue-Chip Customers. We have a large and expanding customer base of over 3,000 customers that includes some of the largest consumer products companies in the world, including Procter & Gamble, Coca-Cola, Kellogg, Kraft Foods, Mondelēz, Nestle, Mars, Pepsi and Unilever. In addition, many of the world’s largest retailers, including Tesco, Walmart (Asda), Marks & Spencer and J Sainsbury’s, use our packaging and labels for their store-brand products. We have long-standing relationships with many of these customers. For example, approximately 80% of our top 50 customers by net sales have been our customers for over 10 years. Our technology and design teams work closely with our customers to design packaging that complements and enhances the functionality and shelf-appeal of their product line, and our production teams also work closely with our customers, including in many cases at the customers’ production facility, to produce and deliver products according to their specifications and to ensure that our products are integrated into their assembly line. We believe that our record for reliably providing high quality products has created customer trust and loyalty. In addition, we believe that we benefit from high switching costs due to our knowledge of our customers’ products and processes, the costs involved with certifying facilities and developing packaging that complies with specific product requirements, in particular with food and healthcare packaging and the significant set-up time required to install production capacity for customized products. As a result, we are a preferred supplier to many of our customers. We believe that the Combination provides us the opportunity to increase sales by continuing to cross-sell across our product lines and geographic production capabilities to our existing customer base.

Proven Capabilities in Developing and Commercializing New Technologies. We seek to develop innovative, sustainable and value-added products that improve the shelf-appeal of our customers’ products and enhance product functionality by delivering unique performance characteristics. We focus our research efforts on projects with the potential to command a sustainable price premium, develop customer loyalty and support our overall profitability. We believe we have a track record of commercializing new products that generate incremental organic profitability. Recent product innovations include our RAVETM brand of plastic-laminated and converted plastic bags with easy to open and reclose features for the pet food and lawn and garden end markets, eXpress pvTM two-ply cement bags for cement and packaged concrete and DuoSmart products, which combine the appearance of paper packaging with the barrier properties of plastic. We have also been awarded the Flexible Packaging Association’s 2013 Highest Achievement Award for our development of the Kraft YES® Pack, a four corner sealed pouch with a pourable fitment and two handles, which we developed jointly with Kraft to provide customers with an attractive flexible packaging solution that decreases food waste and is functional and environmentally friendly. We own 163 patents and have 69 patent applications pending. We believe that the Combination provides us with a broad set of production technologies and dedicated personnel that will help drive our growth and enable us to increase the speed at which we can invest in new, successful technologies and innovative personnel and introduce those technologies across each of our markets.

Large Scale Provides Opportunities for Cost Savings. We benefit from economies of scale in raw material procurement, manufacturing and distribution. We are one of the largest purchasers of plastic resins globally at approximately 476,000 tons per year, which provides us with considerable purchasing power. We are also part of the Global Packaging Procurement, Inc., a raw materials cost saving initiative with several other businesses owned by Sun Capital, through which we are able to leverage the combined purchasing power of these packaging companies (who, for example, purchased an aggregate of 476,000 tons of plastic resin in 2012) to leverage our scale to achieve more favorable raw materials pricing. We estimate that in 2012 and the six months ended June 30, 2013 we realized approximately $31.0 million and $8.7 million, respectively of cost savings as a result of purchasing raw materials through contracts sourced through GPPI. In addition, in 2012 and the six months ended June 30, 2013 we saved approximately $14.8 million and $11.2 million respectively, through other integration measures, which primarily relate to the initial stages of certain back office integration programs and manufacturing rationalization. We believe that our combined scale provides significant opportunities to realize further savings in procurement, manufacturing and overhead costs. Our large manufacturing base also allows us to enhance capacity utilization, optimize transportation costs and realize distribution efficiencies. We constantly review and optimize our manufacturing footprint. Currently, we have identified an additional $29.6 million of annual costs savings through further consolidating our manufacturing base, which we expect to complete by the end of 2014. Our large scale provides us with significant free cash flow that has allowed us to make improvements in our production capabilities, and we have significantly reduced our per unit production costs as a result of recent manufacturing rationalization programs and capital investment in high volume equipment, longer production runs and flexible, cross-facility manufacturing capabilities. The Combination will also allow us to continue to eliminate operational redundancies by reducing headcount, consolidating our management and back office functions, restructuring certain facilities and consolidating information technology programs.

Stable Earnings and Strong Free Cash Flow Generation. Our diversified product portfolio, resilient end markets and focus on cost savings initiatives has allowed us to generate stable adjusted EBITDA margins and strong free cash flows despite challenging macroeconomic conditions and significant resin price changes in recent years. We have benefitted from strong plastic packaging industry growth in North America and Europe, our main geographic markets and continued growth in the end markets for our products such as packaging for foods and beverages, which have been resilient during periods of adverse economic conditions. We seek to stabilize our earnings by managing our exposure to fluctuations in raw material prices through long-term arrangements with preferred suppliers, with various raw material pass-through mechanisms and by managing our mix of contracted and spot sales. A significant portion of our net sales are made pursuant to agreements indexed to raw material prices with escalator and de-escalator mechanisms, which typically adjust plastic packaging raw material prices within 30 to 90 days and paper raw material prices within 90 to 120 days. During the Pro Forma six months ended June 30, 2013, contracts that contained raw material price increase pass-through mechanisms generated approximately 55% of net sales in our Flexible business segment and approximately 75% of net sales in our Rigid business segment. Our rationalization efforts have contributed to our ability to make significant capital investment in our production facilities and machinery, which we believe will help reduce our future maintenance capital expenditure requirements, allowing us to produce products more efficiently and enhance future free cash flows.

Experienced Management Team with Successful Track Record of Integrating New Businesses. Our senior management team has extensive experience in the packaging industry and a track record of successfully integrating acquisitions. Our senior management team is led by our Chief Executive Officer, Jack Knott, who has over 30 years of experience in the packaging industry, including serving in numerous senior management positions. Prior to the Combination, Mr. Knott was Chairman of the Board of Directors and Chief Executive Officer of the Exopack Business, where he managed the integration into the Exopack Business of several Sun Capital portfolio companies and other acquisitions. Prior to that, Mr. Knott was Chief Executive Officer of Huntsman Packaging / Pliant Corporation, where he successfully consolidated 15 acquisitions over six years. Mike Alger, our Chief Financial Officer, who has over 30 years of experience in senior finance and operations roles, previously served as Director of Exopack Holding Corp. and Group Chief Financial Officer of a diverse group of Sun Capital portfolio companies. Mr. Alger has significant acquisition and integration experience from prior business ventures. Mr. Knott, Mr. Alger and several other members of our current management team led the integration of the Sun Capital portfolio companies that comprised the Exopack Business and increased the EBITDA margin of Exopack Holding Corp. from 8.4% for the year ended 2006 to 11.9% in 2012, primarily through integration and cost-savings initiatives. Dieter Bergner, Chief Executive Officer of our Rigid Segment, who has over 15 years of experience in the packaging industry, was previously Chief Executive Officer of the Paccor Business. Michael Cronin, Chief Executive Officer of our Flexible Segment, who has over 30 years of experience in the packaging industry joined us in 2013 and was previously President of SCA Packaging since 2010 and, prior to that was President of Alcan Packaging Europe, where he managed the integration and restructuring of several large European packaging companies. We also continue to benefit from the extensive experience of Sun Capital, our shareholder, who has acquired 25 packaging companies since 2005.

Our Strategy

We intend to continue developing our business through continued investment in world-class technologies and people with the vision to become the global leader for innovative and sustainable packing solutions and are striving for excellence in safety, product quality, customer service and operations. Building upon our core strengths, we pursue the following strategies:

Leverage Our Customer Relationships to Organically Grow Our Business. We enjoy long-standing relationships with many of our customers. We work closely with these customers to design packaging that complements and enhances the functionality, product quality and shelf-appeal of their product lines. We seek to continue to offer enhanced service and support to customers, anticipating their needs and providing value-added solutions to their problems. We intend to continue to focus on delivering high quality customer service and value-added products and seek to leverage the long-standing customer relationships of our businesses to increase sales to our largest customers. Approximately 54% of our Pro Forma 2012 sales were to customers of only one of the Combined Businesses, and we believe that the Combination provides us the opportunity to cross-sell our complete product line to customers in all of our markets, and thus expand our share of the value chain with our existing customers. For example, we intend to leverage our leading market positions and technological expertise in rigid packaging and labels in Europe to build market share for these products in North America. For example, the Combination provides the Britton Business and the Exopack Business with an opportunity to establish global specifications for printed shrink film products. This ensures consistency of product and the ability to have a targeted color management specification for branded graphics. Where currently both the Exopack Business and the Britton Business are seeking to supply printed shrink film to certain global customers, we believe the customers recognize the advantages of our global scale and the opportunity to use technology exchange and best practices to deliver the highest quality and most consistent packaging. In addition, leveraging relationships across the Group have allowed us to capture new technology and market opportunities. For example, Perfotec, a supplier of patented produce respiration technology, has an existing relationship with the Kobusch Business, which the Exopack Business has now been able to leverage to generate further such opportunities.

Achieve Further Integration and Cost Savings from the Combination. We intend to continue to integrate all organizational and operational functions across our businesses. We intend to leverage our management’s collective experience in business integration and knowledge of each of our businesses to effectively bring our businesses constituting the Group into a single operating group. We believe the Combination and our increased scale allows us to secure improved volume pricing from our suppliers and continue to streamline procurement. We plan to continue to develop our company-wide purchasing programs to enhance our pricing capabilities, including approved GPPI supplier lists and programs to allow global purchasing from preferred suppliers. We plan to expand the role of GPPI in our raw materials procurement in order to continue to expand upon the $31.0 million and $8.5 million in procurement savings that we realized in 2012 and the six months ended June 30, 2013 as a result of GPPI’s activities. We also intend to continue to rationalize our manufacturing footprint where opportunities exist to streamline production and utilize more efficient sites, and to institute company-wide operational and manufacturing best practices. Finally, we intend to consolidate our management and back office functions by establishing a single management and back office team. We have targeted the achievement of annualized synergies and cost savings of $53.1 million by 2014 in connection with these integration programs (net of estimated costs associated with the implementation of these programs), based on the assumptions and actions more specifically discussed in.

Continue to Enhance our Products Through Advanced Technology. We intend to continue developing innovative products to further enhance the value we provide our customers, and we are focused on working together with our customers to increase the functionality, product quality and shelf-appeal of our products by developing and applying innovative new technologies. To enhance the convenience of our products, we intend to continue to develop complementary product features such as high definition graphics, fitments, easy open and advanced package re-closure systems. We believe that the integration of the Group improves our positioning in this regard, and we intend to utilize our 197-person graphics and technical team in various locations throughout North America and Europe to further accelerate the development of new products and the related commercialization. Our combined scale exposes us to a wide variety of products and technologies, and we intend to leverage this experience to introduce new products quickly throughout all of our markets maintaining our focus on safety, product quality, customer service and operations.

Increase Share of the Value Chain. We intend to leverage our global manufacturing capabilities, broad product portfolio and advanced packaging technologies to continue to expand our share of the value chain with our existing customers and to increase our market share in select product categories for which we believe we can offer the greatest range of value-added services. We currently provide products and services that cover a wide range of the value chain, ranging from converting raw materials into packaging products to printing and labeling those products. For instance, our plastic quad sealed bags used for the packaging of pet food cover the full packaging value chain: we form the basis of the product by extruding cast nylon and film, followed by lamination, printing and the addition of a slider zipper, as well as comprehensive field technical support to the pet food manufacturer. We believe that we are well-positioned following the Combination to increase our overall market share in attractive product categories by leveraging the leadership positions of our businesses at different points in the value chain. We intend to continue to focus our research and development and coordinated sales efforts on select products in which we believe we can offer the greatest range of value-added services.

Selectively Pursue Strategic Acquisition Opportunities. In addition to the growth in net sales, operating income and cash flow that we are targeting through organic sales volume growth and cost savings, we believe that we are well positioned as a platform for additional acquisition opportunities. We believe that our increased size resulting from the Combination creates an opportunity for us to consider a wider range of potential targets as a result of our greater resources and increased geographic reach. In addition, our broad geographic reach allows us to selectively expand into adjacent markets that we believe can be managed from and integrated with our existing operations, including high growth markets such as Russia. We believe that we have demonstrated the ability to successfully integrate acquisitions and achieve operating efficiencies. We intend to pursue a selective and disciplined acquisition strategy to expand into new markets to serve demand from our existing customer base.

History

Following the completion of the Combination, the Group has been combined into a single operating business. We intend to continue to leverage our experience acquiring and integrating packaging businesses to integrate all functions of the Group, including product line, procurement, manufacturing, technology and management. We believe that the businesses constituting the Group are complementary and that there are significant additional opportunities for us to achieve further growth and cost savings by fully integrating all aspects of these businesses.

During the past two years, we have taken significant steps to integrate the Group’s businesses in order to leverage their complementary product lines, customer bases, procurement requirements, technologies and geographic reach. For example, we have focused on coordinating product development and sales efforts across the businesses to leverage our combined product line and integrate new product technologies throughout our group. We have also instituted cost savings initiatives across the Group, including group-wide procurement initiatives and manufacturing rationalizations. We estimate that our integration programs during 2012 resulted in annualized cost savings of approximately $45.8 million, which primarily relate to initial stages of procurement integration and certain back office integration programs and manufacturing rationalization. In particular, Sun Capital has established GPPI, a global purchasing consortium among Sun Capital packaging companies. Through GPPI, Sun Capital packaging companies, including Albéa, PaperWorks Industries, Inc., Polestar and the Combined Businesses, are able to leverage their combined scale to negotiate more favorable raw materials pricing and other commercial terms from suppliers than each member company could individually secure. In addition, Sun Capital has taken steps to apply best practices in manufacturing, technology and sales across its portfolio companies.

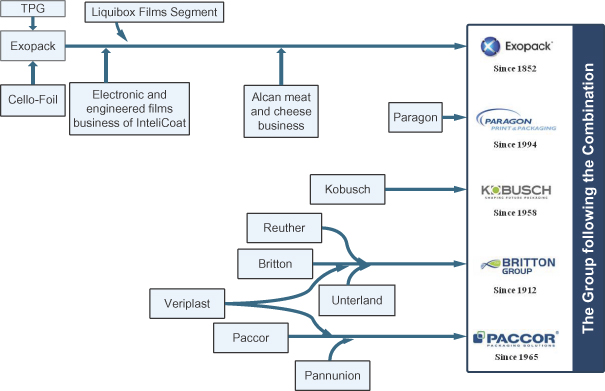

Our constituent businesses were added to Sun Capital’s portfolio since 2005, as displayed (in simplified form) in the following table and described below:

| • | Exopack Holding Corp., which is primarily engaged in the production of flexible packaging, film products and specialty substrates, primarily in North America but also in Europe. Exopack Holding Corp. and its consolidated subsidiaries are referred to as the “Exopack Business.” The Exopack Business was acquired by Sun Capital in 2005 in connection with the combination of the predecessor Exopack business, Cello-Foil Products, Inc. and The Packaging Group. In addition to integrating the businesses combined in 2005, the Exopack Business has acquired and successfully integrated Intellicoat Technologies EF Holdco, Ltd., a producer of precision coated films and specialty substrates for imaging, electronics, medical and optical technologies, DuPont Liquid Packaging System’s performance films business segment, and certain flexible packaging rollstock and flexible packaging shrink bag businesses previously operated by Bemis Company, Inc.; |

| • | Copper International Holdings S.à r.l., which primarily produces flexible packaging products serving a variety of end markets in Europe. Copper International Holdings S.à r.l. and its consolidated subsidiaries are referred to as the “Britton Business.” The Britton Business was formed on December 30, 2011 and holds the Reuther, Britton and Unterland businesses, as well as the flexible packaging business of Veriplast, each acquired by Sun Capital between January 2007 and October 2011.; |

| • | Paccor International Holdings S.à r.l., which produces rigid plastic products, primarily plastic cups, containers, lids and trays for the dairy, fresh food and edible fats industries primarily in Europe. Paccor International Holdings S.à r.l. and its consolidated subsidiaries are referred to as the “Paccor Business.” The Paccor Business was formed on June 20, 2011 and holds the Paccor and Pannunion businesses, as well as the rigid packaging business of Veriplast, each acquired by Sun Capital between January 2007 and October 2011; |

| • | Eifel Holdings S.à r.l., which primarily produces high-value, custom designed plastic-based flexible and semi-rigid and rigid packaging solutions. Eifel Holdings S.à r.l. and its consolidated subsidiaries are referred to as the “Kobusch Business.” The Kobusch Business was acquired by Sun Capital on December 31, 2011; and |

| • | Paragon Print and Packaging (Holdings) Limited, which primarily provides print and packaging services to the U.K. private label fresh and chilled food market. Paragon Print and Packaging (Holdings) Limited and its consolidated subsidiaries are referred to as the “Paragon Business.” The Paragon Business was acquired by Sun Capital on December 31, 2012. |

As a result of the Combination, the Exopack Holdings S.A. now indirectly owns all of the outstanding share capital of the members of the Group, and Exopack Holdings S.A. remains indirectly held by a combination of funds affiliated with Sun Capital.

Product Overview

For operational, management and financial reporting purposes, our business is divided into two operating segments, Flexible and Rigid, based on the type of products manufactured. Our Flexible segment generated sales of $2,115.2 million in the twelve months ended June 30, 2013 on a Pro Forma basis, and our Rigid segment generated sales of $573.2 million in the twelve months ended June 30, 2013 on a Pro Forma basis.

Our Flexible segment operates 42 production facilities: 14 in the United States, 24 in Europe, two in Canada, one in the Middle East and one in Asia, through which we manufacture and sell value-added flexible, plastic-based packaging and film products used in a wide variety of end markets, including food and beverage, healthcare and hygiene, pet food, agriculture and horticulture, electronics, building materials and chemicals, and banking and security. We offer a wide range of packaging styles, graphics, special features and coatings to suit particular customer needs. In addition to a complete existing product line, we have sophisticated in-house product development departments located throughout our markets, which allow us to integrate ourselves into, and, we believe, add significant value to, our customers’ packaging design processes. We continually develop our product portfolio in response to our customers’ changing needs and we believe that our product development capabilities help solidify our relationships with our customers.

Our Rigid segment operates 22 production facilities located in 14 countries in Europe, in close proximity to customers and in geographies with favorable underlying growth rates. Our Rigid segment produces thermoformed and decorated rigid plastic and plastic/paper packaging solutions for a variety of end-markets including food and foodservice, healthcare, home and personal care and hygiene. Our Rigid facilities have advanced technological capabilities, enabling us to concentrate on value-added packaging solutions including sophisticated decorating capabilities.

Customers

Our diversified customer base includes more than 3,000 customers. Our customers range in size from Fortune 100 companies to smaller regional businesses, and come from a variety of end markets, including food and beverages, chemical, agriculture, medical, pet food, building materials, electronics, lawn and garden and personal care and hygiene products. We have a blue-chip customer base and have strong longstanding relationships with our top clients, including Procter & Gamble, Coca-Cola, Kellogg, Kraft Foods, Mondelēz, Nestle, Mars, Pepsi, Unilever, Tesco, Walmart (Asda), Marks & Spencer and Sainsbury’s. Approximately 80% of our net sales in Pro Forma 2012 were to customers that have been customers of one or more members of the Group for over 15 years. In Pro Forma 2012, our top ten customers represented 28% of our net sales. We supply many customers across various geographic regions and have relationships with those customers across numerous product lines and types which helps strengthen the stability of our relationships with these customers.

In most of our product lines, we utilize our extensive manufacturing network to produce products in the same geographic region as our customers, which allows us to produce and deliver our products quickly in order to ensure a minimized lead time. We manufacture certain of our other products both at central locations and throughout our network of production facilities depending on the particular customer needs. We seek to manufacture our products as close as possible to our customers’ premises in order to streamline transportation costs and provide just-in-time delivery.

Manufacturing Operations, Production Facilities and Equipment

Our production facilities are located in 18 countries, including the United Kingdom, the United States, France, Germany, Hungary, Canada, Finland, Netherlands, Poland, Austria, Bulgaria, Egypt, Romania, Serbia, Spain, Turkey, China and Ukraine. Our Joint Venture with INDEVCO manufactures its products in Lebanon. Excluding the Joint Venture, we have 64 principal production facilities totaling approximately 680,000 square meters. We believe that our facilities are suitable and adequate for our business purposes for the foreseeable future.

We maintain an expansive array of packaging machinery and specialized equipment at our various facilities, which enables us to offer a wide variety of products and maintain a high degree of flexibility in meeting customer demands. Our diverse production capabilities allow us to serve a large portion of the packaging value chain and are a key element of our ability to serve as a “one-stop-shop” for our customers. Product conformance to customer standards is continually monitored and maintained by our supervisors and our key equipment and critical operations are administered by trained, experienced operators. Investments in equipment are driven by industry trends, developing technologies, customer needs and cost containment.

We use state of the art equipment at our production facilities to manufacture plastic products. Our key manufacturing technologies are known as “extrusion,” “lamination” and “coating.” In extrusion, plastic resins with various properties are blended with additives to create a specified performance compound, the nature of which is dependent on end-market use and customer preference. Blended resin compounds are then shaped under heat and pressure to create plastic sheet material or film. The manufacturing inputs and process, including the combination of resin and extrusion methods, may be varied to produce differences in color, clarity, tensile strength, toughness, thickness, shrinkability, surface friction, transparency, sealability and permeability. If a product needs the protection of more than a single plastic film, additional layers consisting of materials, such as oriented polyester or OPP, are bonded to it, in a lamination process. These materials are stiffer, harder to tear and heat sealable. The film layers are brought together by applying an adhesive or by extruding a layer of molten polymer to bind two film layers into one. Extruded plastic film, foil, and paper can be coated using slot die, direct gravure, reverse gravure and proprietary coating methods, using liquid crystal, exotic filled ceramics and polyamides, and some can be used over printed products for gloss, print protection or surface dynamic control. In most of our production facilities, we also have various types of printing capabilities that allows us to print directly on the products we produce, allowing us to provide an additional process in the value chain.

We use thermoforming, injection molding and blow molding techniques in the production of rigid plastic packaging. Thermoforming transforms thermoplastic sheet material into a new geometry using heat to soften the material and forcing it into or onto a mold where it is cooled and “frozen” into the new geometry. Injection molding is the technique of injecting molten plastic into a cold mold and forming a part. Blow molding is the technique of injecting plastic material into a tube and then using pressurized air to conform it to a required hollow shape.

We employ a wide variety of other production processes that allow us to meet a wide range of customer needs.

The table below lists certain information about our principal production facilities.

| Production |

Location |

Flexible/Rigid |

Employees |

Total sq. feet |

Leased/ | |||||

| 17 |

United Kingdom | 14/03 | 2,473 | 1,562 | 8/9 | |||||

| 14 |

United States | 14/– | 1,965 | 2,756 | 4/10 | |||||

| 7 |

France | 4/3 | 733 | 1,056 | 4/3 | |||||

| 6 |

Germany | 5/1 | 790 | 300 | 1/5 | |||||

| 3 |

Hungary | –/3 | 494 | 401 | 0/3 | |||||

| 2 |

Canada | 2/– | 169 | 328 | 1/1 | |||||

| 2 |

Finland | -/2 | 226 | 66 | 2/0 | |||||

| 2 |

Netherlands | -/2 | 110 | 12 | 0/2 | |||||

| 2 |

Poland | -/2 | 665 | 67 | 0/2 | |||||

| 1 |

Austria | 1/- | 312 | 517 | 1/0 | |||||

| 1 |

Bulgaria | -/1 | 100 | 46 | 0/1 | |||||

| 1 |

Egypt | 1/- | 339 | 293 | 0/1 | |||||

| 1 |

Romania | -/1 | 47 | 4 | 0/1 | |||||

| 1 |

Serbia | -/1 | 80 | 2 | 0/1 | |||||

| 1 |

Spain | -/1 | 51 | 11 | 0/1 | |||||

| 1 |

Turkey | -/1 | 138 | 66 | 0/1 | |||||

| 1 |

Ukraine | -/1 | 61 | 4 | 0/1 | |||||

| 1 |

China | 1/– | 8 | 10 | 1/0 |

In recent years as we have acquired the entities that comprise the Group, we have continuously expanded our manufacturing footprint and improved our operational efficiency and streamlined our broader business. We will continue to improve our manufacturing footprint now that we have integrated our businesses in the Combination. Our improvement plan includes evaluating the rationalization of our production facilities, capital investments to reduce production costs, manufacturing technology development, targeted sales growth projects and pricing-point improvements, with a focus on projects we believe would return our investment within three years or less. Also, we have upgraded the operating processes at each of our facilities, reducing our fixed costs and improving our profit margins. We plan to undertake similar upgrades at other facilities now that we have integrated our businesses following the Combination. In 2012, we made expenditures relating to production facility upgrades in an aggregate amount of $54.6 million.

We develop and maintain our facilities with modern equipment and extensive technical capabilities. Our production lines are developed with industry leading machine suppliers and assemblers, and in many cases, our own specialist engineers carry out extensive customization of the base equipment to create a proprietary manufacturing process. We perform on-going and regularly scheduled maintenance on each of our facilities and since being acquired by Sun Capital, we have not experienced any unplanned plant shut-down or material interruption in our operations due to equipment failures that affected our customers.

Our customers are increasingly expanding their global presence and rely on us to provide regional or local supply solutions, and as a result we believe the Combination allows us to solidify our position as a key supplier to those global customers. Our ability to manufacture products in various regions allows us to serve markets where delivery times and transportation and other costs such as import duties may be prohibitive. We believe that we have a flexible manufacturing base that allows us to effectively respond to changing customer needs, for example by modifying production lines in response to customer specifications.

The Transactions

The Combination

We effected the Combination in order to create a global packaging company with operations in over 18 countries that focuses on rigid and flexible plastic packaging. We believe we have created a company with a diverse plastic packaging manufacturing, development and sales platform by combining five rigid and flexible packaging assets that represent businesses that have been acquired by Sun Capital since 2005, certain of which have been partially integrated since 2011. We believe that the Combined Businesses have complementary product lines, customer bases, technologies and geographic reach. To effect the Combination, funds managed by Sun Capital transferred all ownership interests in the Combined Businesses to the Exopack Holdings S.A. in return for equity interests in a parent of Exopack Topco.

During the past two years, our businesses have been increasingly managed as a single unit and significant steps have been taken to consolidate our group-wide manufacturing footprint, rationalize our product lines, introduce group-wide purchasing initiatives and coordinate sales and marketing programs. For example, in 2012, we spent $50.4 million on manufacturing and restructuring initiatives designed to move or consolidate product lines at more efficient plants and close inefficient plants, reduce manufacturing headcount, eliminate product lines with lower margins and upgrade manufacturing facilities to make them more efficient. In 2012, on a Pro Forma basis, we realized $14.8 million of cost savings as a result of our manufacturing and restructuring measures implemented in 2011 and 2012. We have also focused on leveraging our scale in order to reduce procurement costs. In April 2012, Sun Capital established a global procurement team, Global Packaging Procurement, Inc., that focuses on achieving best in class sourcing across all of Sun Capital’s packaging investments. The Group spent $1.4 billion on direct and indirect materials in 2012, and there is significant overlap in both raw material and supplier types across the Group. Our procurement initiatives, including through GPPI, have sought to negotiate favorable prices for larger orders and eliminate duplicate suppliers, using central resources to provide additional support to local procurement teams and optimizing supplier performance through improved management and use of KPIs. We realized $31.0 million in procurement savings in 2012, of which $20.9 million was realized through improved resin pricing.

The Combination enables us to formally consolidate all operational and corporate functions of the Combined Businesses. We believe that operating as a single business positions us to achieve further growth in sales and profitability.

Our Group is managed by the board of directors of Exopack Holdings S.A. Procurement, finance, human resources and legal functions are being consolidated in functional clusters across our various geographies.

The Refinancing

In connection with the Combination, we expect to refinance a substantial portion of the existing indebtedness of the Group. We have taken the following steps and will enter into the following financing arrangements as part of the Transactions:

| • | Proposed Amendment of the Notes Indenture. Solicitation of approval of the Proposed Amendments pursuant to a consent solicitation statement. |

| • | Incurrence of New Indebtedness. Exopack Holdings S.A. will incur $1,000 million of New Indebtedness which will be guaranteed by substantially all of its subsidiaries and parts of which will be secured. |

| • | European ABL Facilities. The European ABL Facilities are receivables and inventory facilities, consisting of an £89.0 million UK asset-backed revolving credit facility, a €48.0 million French accounts receivable facilities and a €25.0 million German accounts receivable facility (the amounts drawn under which may not exceed $175.0 million (equivalent) in the aggregate at any one time), that we will use to fund our working capital needs in Europe, under which $175.0 million (equivalent) would have been available at June 30, 2013, after giving effect to the Transactions. |

| • | North American ABL Facility. The North American ABL Facility provides for a $75.0 million asset-based revolving credit facility, under which $75.0 million would have been available at June 30, 2013 after giving effect to the Refinancing. The North American ABL Facility Agreement will be amended effective as of the Completion Date, pursuant to which the lenders under the North American ABL Facility Agreement, among other things, consented to various transactions in connection with the incurrence of the New Indebtedness. Exopack, LLC and Cello-Foil Products, Inc. may also borrow up to an additional $25.0 million under the North American ABL Facility subject to certain conditions. |

| • | Continuing Credit Arrangements. We have sought consent as required to maintain the Continuing Credit Arrangements, which primarily consist of capital and finance lease arrangements and overdraft arrangements of the Fund V Companies that will remain outstanding following the Refinancing (as defined below). |

We will use part of the proceeds from the New Indebtedness, together with available cash reserves, to refinance the following existing indebtedness of our subsidiaries (the “Refinancing”):

| • | Existing Exopack Term Loan Facility. We will repay the $350.0 million Exopack Term Loan Facility, of which $343.0 million remained outstanding as of June 30, 2013; |

| • | North American ABL Facility. We will repay drawings under the $75.0 million asset-based revolving North American ABL Facility, of which $28.8 million remained outstanding as of June 30, 2013. The North American ABL Facility will remain available for future drawings. |

| • | Former Fund V Credit Facilities. We will repay Former Fund V Credit Facilities, many of which were put in place in connection with the acquisition of those companies by Sun Capital. The outstanding balances as of June 30, 2013, were $596.9 million. |

The following table illustrates the estimated sources and uses of the funds necessary to complete the Refinancing, assuming it was completed as of June 30, 2013. Actual amounts may vary from estimated amounts depending on several factors, including differences from our estimates of available cash on hand, changes in the actual amount of the borrowings outstanding under the Former Fund V Credit Facilities and fees and expenses related to the Transactions.

| Sources of Funds | Uses of Funds | |||||||||

| (U.S. dollars in millions) | ||||||||||

| New Indebtedness |

1,000 | Repay Former Fund V Credit Facilities(3) |

598.7 | |||||||

| North American ABL Facility(1) |

— | Repay Exopack Term Loan Facility |

343.0 | |||||||

| European ABL Facilities(2) |

— | Repay North American ABL Facility(4) |

39.6 | |||||||

| Cash on balance sheet |

62.5 | Estimated fees and expenses(5) |

60.0 | |||||||

| Cash on balance sheet |

21.2 | |||||||||

|

|

|

|

|

|||||||

| Total sources |

1,062.5 | Total uses |

1,062.5 | |||||||

|

|

|

|

|

|||||||

| (1) | The North American ABL Facility is a $75.0 million asset-backed revolving credit facility, under which $75.0 million would have been available at June 30, 2013, after giving effect to the Transactions. Exopack, LLC and Cello-Foil Products, Inc. may also borrow up to an additional $25.0 million under the North American ABL Facility subject to certain conditions. |

| (2) | The European ABL Facilities are five-year receivable financing facilities that provide for aggregate borrowing of up to $175.0 million equivalent. As of June 30, 2013 on a Pro Forma basis, we would have had $175.0 million equivalent of available borrowings under the European ABL Facilities. |

| (3) | Includes outstanding revolving credit facility indebtedness and factoring arrangements of the Fund V Companies. The revolving credit facility and factoring arrangements will be repaid with a portion of the net proceeds of the New Indebtedness. These outstanding balances as of June 30, 2013 were $596.9 million. In addition, $1.8 million of overdraft facilities will be repaid with a portion of the net proceeds from the Transactions. |

| (4) | Reflects the repayment of $28.8 million that was outstanding under the North American ABL Facility as of June 30, 2013 and $10.8 million of borrowings made subsequent to June 30, 2013. |

| (5) | Includes estimated expenses in connection with the Transactions, including transaction fees paid to Sun Capital and the discounts and commissions paid in connection with the incurrence of the New Indebtedness. Actual transaction costs, fees and expenses may be higher than estimated. To the extent the fees and expenses exceed our estimates, we will use cash on hand to fund these expenses. |

Recent Developments

As of the date of this Consent Solicitation Statement we have completed trading for the three-month period ended September 30, 2013. Based on preliminary results from unaudited management accounts and information currently available, we estimate that during this period net sales increased by approximately 2% compared to the three-month period ended September 30, 2012 and this increase was primarily driven by increased pricing from the Rigid and Flexibles Industrial divisions, partially offset by reduced volumes from the Pet Food division. EBITDA increased by approximately 6% from the third quarter of 2012, which was primarily attributable to increased sales in our food, industrial and coatings businesses, and as a result of procurement and manufacturing synergies as well as other cost efficiency programs, primarily in our Rigid segment. This was partially offset by increased plastic resin pricing in September, and the usual lag in resulting price increases, and slight increases in labor costs.

This financial information is based on preliminary management accounts and has not been audited, reviewed or verified by our independent auditors and you should not place undue reliance on them. We cannot assure you that, upon completion of our financial statements for the three months ended September 30, 2013 and the review by our independent auditors of our results for the year ended December 31, 2013, we will not report materially different results than those indicated above.

Intelicoat Acquisition

On August 28, 2013, Exopack Advanced Coatings, LLC, an affiliate of EHC, purchased certain assets and assumed certain liabilities from Sun Capital portfolio companies Intelicoat Technologies Image Products S. Hadley LLC and Image Products Group LLC for a total purchase consideration of $8.0 million.

Corporate Information

Our principal executive offices are located at 3070 Southport Road, Spartanburg, South Carolina 29302, and our telephone number is (864) 596-7140. Our corporate website address is www.exopack.com. Except as otherwise explicitly stated herein, the information contained on or that can be accessed through our corporate website is not incorporated by reference herein.

The principal executive offices of Exopack Holdings S.A., which is our parent company, and which will be a guarantor of the Notes if the Proposed Amendments become operative, are located at 5, rue Guillaume Kroll, L-1882, Luxembourg.

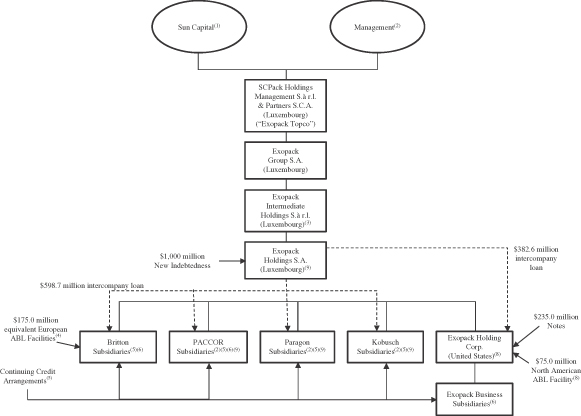

Summary Corporate and Financing Structure

The following diagram summarizes our corporate structure and principal outstanding financing arrangements after giving effect to the Transactions, which includes, among other things, the Combination and the Refinancing.

| (1) | In connection with the Combination, funds managed by Sun Capital transferred all of their ownership interests in the Group (other than certain interests currently held by management and other minority interests yet to be transferred into the Group) to Exopack Holdings S.A. in exchange for equity interests in a parent of Exopack Topco. |

| (2) | We currently have management equity programs in place at the Exopack Business, the Paccor Business and the Paragon Business. Other than for the Paragon Business, these programs generally intend to provide for each management team to receive between 5-7% of the equity of the applicable business. Certain members of management of the Paragon Business rolled over certain equity stakes in connection with Sun Capital’s acquisition of the Paragon Business and currently own 11.49% of the share capital of the Paragon Business (including 7% to be vested over five years). Following |

| completion of the Transactions we will seek to consolidate these equity arrangements so that management holders receive equity issued by Exopack Topco in exchange for their current equity stakes in the Group. We will also make our management equity pool available to certain managers of the Britton Business and the Kobusch Business. We currently anticipate that this equity pool will provide management with 5-7% of our equity. |

| (3) | The New Indebtedness is expected to amount to $1,000 million and is expected to be guaranteed on a senior basis by substantially all of the subsidiaries of Exopack S.A. and we expect that parts of the New Indebtedness will be secured by certain assets of Exopack Holdings S.A.’s and a pledge over the shares of Exopack Holdings S.A. |

| (4) | Certain of our subsidiaries will enter into the European ABL Facilities upon the completion of the Transactions, which consists of a five-year senior secured revolving credit facility that provides for aggregate borrowing of up to $175.0 million equivalent, subject to certain borrowing base limitations. As of June 30, 2013 on a Pro Forma basis, we would have had $175.0 million (equivalent) of available borrowings under the European ABL Facilities. |

| (5) | We will have various Continuing Credit Arrangements outstanding at the Fund V Companies following the completion of the Transactions, consisting primarily of capital and finance leases and overdraft facilities. As of June 30, 2013, on a Pro Forma basis, we had $48.2 million (equivalent) of indebtedness outstanding under the Continuing Credit Arrangements. |

| (6) | On the Completion Date, we expect that substantially all of Exopack Holdings S.A.’s subsidiaries organized in the United States, United Kingdom, Luxembourg, Austria, Canada, Finland, Germany and Poland will guarantee the New Indebtedness. On a Pro Forma basis, the New Debt Guarantors (other than the subsidiaries of Exopack organized outside of the United States) accounted for 78% of our combined net sales and approximately 78% of our combined EBITDA for the year ended December 31, 2012. The Non-Guarantor Subsidiaries include all of our subsidiaries organized in, among other jurisdictions, France, Hungary, The Netherlands, Spain, Bulgaria, Turkey and China. As of June 30, 2013, on a Pro Forma basis, our Non-Guarantor Subsidiaries would have had $5.2 million of total consolidated debt outstanding. |

| (7) | Exopack has issued the Notes which are guaranteed by all of Exopack’s subsidiaries incorporated in the United States. |

| (8) | The North American ABL Facility is a $75.0 million asset-based revolving credit facility, under which $75.0 million would have been available at June 30, 2013, after giving effect to the Transactions. Exopack, LLC and Cello-Foil Products, Inc. may also borrow up to an additional $25.0 million under the North American ABL Facility subject to certain conditions. |

| (9) | An affiliate of Exopack Holdings S.A. holds 10% of each of the holding companies of the Kobusch Business, Paccor Business and Britton Business (the “10% Stake”). Within thirty days from the Completion Date, such affiliate will transfer the 10% Stake to Exopack Holdings S.A. via share contributions down the structure. An affiliate of Exopack Holdings S.A. currently holds 6% of Paccor Packaging Deutschland GmbH (the “6% Stake”). Within thirty days from the Completion Date, such affiliate will transfer the 6% Stake to a group entity held directly or indirectly by Exopack Holdings S.A. at fair market value in exchange for a note (the “Paccor Note”). The Paccor Note will then be contributed down the structure to the future holder of the 6 % stake, where it will be extinguished. |

Summary Pro Forma Combined Financial Data

We have presented in the following table unaudited balance sheet and income statement data prepared on a Pro Forma basis for Exopack Holdings S.A. and its subsidiaries. This pro forma data reflects certain pro forma adjustments to give effect to the Transactions. We believe that presenting the results of operations in this manner provides useful data for comparison given the complexity involved with comparing periods that do not include all members of the Group for the full period and, in certain cases, are derived from financial statements of the Group that are prepared on different bases of accounting. The pro forma adjustments are based upon available information and certain assumptions that we believe are reasonable and does not purport to represent what our results of operations would have been had the Transactions occurred on the dates assumed, and do not purport to project our results of operations or financial condition for any future period. The pro forma adjustments give effect to the Transactions as though they had occurred on January 1, 2012, inclusive of the year ended December 31, 2012 and the six months ended June 30, 2012 and 2013, and January 1, 2011 in the case of the year ended December 31, 2011. These pro forma results are not directly comparable to the consolidated Fund V Company or Exopack audited financial information. In addition, the results presented for Pro Forma 2011 are not directly comparable to Pro Forma 2012 because Pro Forma 2011 does not include full year results from all of the Combined Businesses, and instead only includes a partial year (since the date of acquisition) for certain of the Combined Businesses.

The financial statements for the Fund V Companies used to describe the pro forma data for 2011 are not directly comparable to their financial statements for the Fund V Companies used to describe the pro forma data for 2012, because the entities included in the financial statements (and the duration that those entities are included in the financial statements) differs from period to period. Our unaudited pro forma combined statement of operations for the year ended December 31, 2011 does not give effect to the acquisition of the Britton Business, Veriplast, Unterland or Pannunion as if they had occurred on January 1, 2011, and only includes the results of operations directly attributable to these businesses as from the date of the applicable acquisition by Sun Capital Partners V, L.P. Our unaudited pro forma combined statement of operations for the year ended December 31, 2012, includes the results of operations of all members of the Group for the entire fiscal year, and as a result is not directly comparable to our unaudited pro forma combined income statement for the year ended December 31, 2011, which omits the results of operations of these businesses.

The unaudited financial information on a Pro Forma Basis for the twelve months ended June 30, 2013 presented herein has been derived by adding the pro forma financial information for the year ended December 31, 2012 to the pro forma financial information for the six months ended June 30, 2013 and subtracting the pro forma financial information for the six months ended June 30, 2012.

Exopack Holdings S.A. indirectly holds all of the outstanding shares of the Combined Businesses. Exopack Holdings S.A. has no material assets or liabilities, other than the capital stock of its subsidiaries, and it has not engaged in any activities other than those related to their formation in preparation for the Transactions and the Combination. Following the Completion Date, we will report the financial results of Exopack Holdings S.A. and its consolidated subsidiaries.

| Group Unaudited Pro Forma Financial Information |

||||||||||||||||||||

| Year ended December 31, |

Six months ended June 30, |

Twelve months ended June 30, 2013 |

||||||||||||||||||

| 2011 | 2012 | 2012 | 2013 | |||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| (U.S. dollars in millions) | ||||||||||||||||||||

| Combined Statement of Operations Data: |

||||||||||||||||||||

| Net Sales |

2,326.4 | 2,658.7 | 1,334.7 | 1,364.4 | 2,688.4 | |||||||||||||||

| Cost of sales |

(2,032.0 | ) | (2,327.5 | ) | (1,156.5 | ) | (1,182.3 | ) | (2,353.3 | ) | ||||||||||

| Gross margin |

294.4 | 331.2 | 178.2 | 182.1 | 335.1 | |||||||||||||||

| Selling general administrative expenses |

(265.9 | ) | (286.2 | ) | (153.2 | ) | (151.8 | ) | (284.8 | ) | ||||||||||

| Research and development |

(9.9 | ) | (10.6 | ) | (3.5 | ) | (4.5 | ) | (11.6 | ) | ||||||||||

| Operating income (loss) |

18.6 | 34.4 | 21.5 | 25.8 | 38.7 | |||||||||||||||

| Other income (expense): |

||||||||||||||||||||

| Bargain purchase on business combinations |

17.7 | — | — | — | — | |||||||||||||||

| Interest income |

0.3 | 0.5 | — | — | 0.5 | |||||||||||||||

| Interest expense |

(106.3 | ) | (108.5 | ) | (54.9 | ) | (61.7 | ) | (115.3 | ) | ||||||||||

| Other, net |

(0.2 | ) | 6.8 | 5.4 | 9.6 | 11.0 | ||||||||||||||

| Other income (expense), net |

(88.5 | ) | (101.2 | ) | (49.5 | ) | (52.1 | ) | (103.8 | ) | ||||||||||

| Loss before income tax and equity income in investee |

(69.9 | ) | (66.8 | ) | (28.0 | ) | (26.3 | ) | (65.1 | ) | ||||||||||

| (Provision)/benefit for income taxes |

(7.0 | ) | 0.2 | 3.9 | (0.4 | ) | (4.1 | ) | ||||||||||||

| Net loss |

(76.9 | ) | (66.6 | ) | (24.1 | ) | (26.7 | ) | (69.2 | ) | ||||||||||

| Group Pro Forma as of June 30, 2013 |

||||

| (unaudited) | ||||

| (U.S. dollars in millions) | ||||

| Combined Balance Sheet Data: |

||||

| Cash and cash equivalents |

33.8 | |||

| Trade accounts receivables, net |

417.8 | |||

| Inventories, net |

294.0 | |||

| Property and equipment, net |

731.1 | |||

| Intangible assets, net |

407.6 | |||

| Goodwill |

479.0 | |||

| Total assets |

2,539.0 | |||

| Accounts payable |

355.2 | |||

| Total current liabilities |

713.4 | |||

| Total non-current liabilities |

1,522.7 | |||

| Total liabilities |

2,236.1 | |||

| Group Pro Forma |

||||||||||||||||||||

| Year ended December 31, |