Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - SAJAN INC | v356758_8k.htm |

Page 1 Investor Presentation

Page 2 From the Lawyers… The Private Securities Litigation Reform Act of 1995 provides a safe harbor for certain forward - looking statements. The Company's Annual Report on Form 10 - K, its Quarterly Reports on Form 10 - Q and other filings with the Securities and Exchange Commission, the Company's press releases and oral statements made with the approval of an authorized executive officer contain forward - looking statements that reflect the Company's current views with respect to future events and financial performance. These forward - looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or those anticipated. The words "aim," "believe," "expect," "anticipate," "intend," "estimate" and other expressions that indicate future events and trends identify forward - looking statements. Actual future results and trends may differ materially from historical results or those anticipated depending on a variety of factors, including, but not limited to those set forth in the Company's Annual Report on Form 10 - K for the year ended December 31, 2012 filed with the Securities and Exchange Commission on March 29, 2013, under the heading "Item 1A. Risk Factors". The Company does not undertake any obligation to publicly update or revise any forward - looking statement, whether as a result of new information, future events or otherwise.

Page 3 Opportunity Market Sajan Summary • Founded in 1997 • A recognized leader in language technology • ISO 9001 & 13485 Certified • Over 1 billion words translated • Public through reverse merger in 2010 • 7 th largest LSP in US and 40 th in world Sajan: A translation services company that stands apart. We are built on advanced technology and outstanding customer service, a combination that produces long - term client relationships.

Page 4 Opportunity Market Sajan Summary Global customer support to serve some of the world’s leading brands. Sajan Headquarters River Falls, WI Sajan Ireland Sajan Spain Sajan Singapore Sajan Worldwide Locations

Page 5 Trusted. Experienced. Opportunity Market Sajan Summary Value speaks. In all languages.

Page 6 The Sajan Opportunity • Translation is a massive market at $35B and growing • Top 100 providers hold approximately 12% market share • Pressures from service - centric market driving innovation in technology. Providers are limited • Consolidation opportunity exists on a grand scale • Sajan is well positioned to lead such an endeavor Opportunity Market Sajan Summary

Page 7 Global Matters. Language Matters. Language fact: 3M derives well over 60% of its revenue from outside North America Opportunity Market Sajan Summary

Page 8 Global Matters. Language Matters. Consumers want instant access to information, both in the format desired and language desired. • 72% of customers say they are more likely to buy a product if it is in their language • Nearly 60% of consumers say that the ability to obtain information in their language is more important than price Source: Common Sense Advisory Opportunity Market Sajan Summary

Page 9 Global Matters. Language Matters. Life Sciences Consumer Brands E - Commerce Technology Manufacturing Legal The opportunity spans all business verticals. Complexities abound. It is truly a serious problem and a serious opportunity. Opportunity Market Sajan Summary Global demand Instant Information W eb Smart Phones Speed Price Enterprise Business Asia Big data Big language Social media Europe Brazil Global trade Regulatory Interpretation

Page 10 $35B Market and Growing Opportunity Market Sajan Summary

Page 11 Highly Fragmented Market Language translation has been historically dominated by service - centric providers. Opportunity Market Sajan Summary • Over 27,000 known providers • Top 100 covers 12% of market • In Top 100, 95% privately held • 98% generate less than $ 1M • Sajan ranks 7 th in the US and 40 th in the world

Page 12 Top 10 U.S. LSPs Opportunity Market Sajan Summary

Page 13 Highly Fragmented Market • Sajan employs 101 people worldwide • Sajan is in the 99 th percentile, in terms of employees Opportunity Market Sajan Summary

Page 14 Product and Service Offerings What exactly do these thousands of providers offer and how do they differentiate themselves? • They offer language translation (and related services) • They compete on price, quality and service • The model is human - centric; efficiency and disruptive change capability evades them • A very small number of firms offer technology solutions Opportunity Market Sajan Summary

Page 15 The Opportunity Technology is changing the translation industry. • The human function can only be optimized so far, technology must provide future gains • Translation Management Systems have been developed that are changing the industry, utilizing sophisticated multilingual storage and search, with integrated quality metrics • Adoption of technology has advanced slowly due to the complex and integrated nature of translation Opportunity Market Sajan Summary

Page 16 The Opportunity What exactly does technology bring? • Cost reduction derived from content reuse • Business process automation to reduce human labor • Language quality improvement by making translation more scientific • Scale. Integration to business systems supports growth • Speed becomes an overriding benefit from technology Opportunity Market Sajan Summary

Page 17 The Sajan Solution Sajan is a leader in technology - enabled language translation. • Sajan provides globalization and language translation solutions to its customers • Technology is an integrated differentiator for Sajan • Diverse client base validates innovative approach • Sajan has all the foundational elements to be the consolidator in this large, fragmented market Opportunity Market Sajan Summary

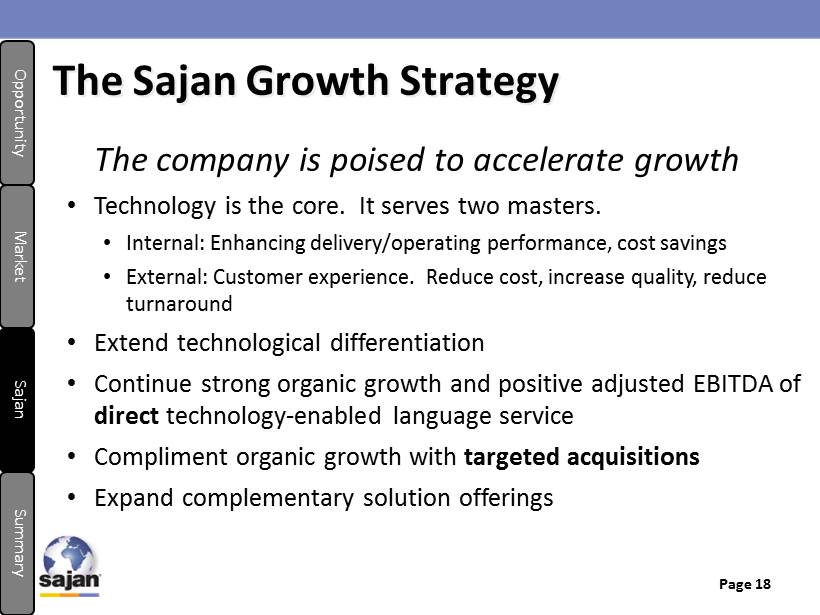

Page 18 The company is poised to accelerate growth • Technology is the core. It serves two masters. • Internal: Enhancing delivery/operating performance, cost savings • External: Customer experience. Reduce cost, increase quality, reduce turnaround • Extend technological differentiation • Continue strong organic growth and positive adjusted EBITDA of direct technology - enabled language service • Compliment organic growth with targeted acquisitions • Expand complementary solution offerings Opportunity Market Sajan Summary The Sajan Growth Strategy

Page 19 Sajan has the unique platform to build on. Organic and acquired volume can exponentially drive aggressive growth. • Maintain strong organic growth, positive earnings • Acquire opportune LSP’s, lean out, tuck in and leverage NOL as incremental benefit Opportunity Market Sajan Summary The Sajan Acquisition Strategy

Page 20 • Revenue $4 - 10M • EBITDA – at least 10% • Client base that • Is complementary to Sajan • Has more $$ to spend on translation • Can benefit from Technology • Cultural fit • Synergy opportunities to reduce expense • Immediately Accretive Opportunity Market Sajan Summary The Sajan Acquisition Target Profile:

Page 21 Opportunity Market Sajan Summary The Sajan Financial Profile

Page 22 Opportunity Market Sajan Summary The Sajan Financial Profile

Page 23 • We calculate Adjusted EBITDA by taking net income calculated in accordance with GAAP, and adding interest expense, income taxes, depreciation and amortization, and stock - based compensation. We believe that this non - GAAP measure of financial results provides useful information to management and investors regarding certain financial and business trends relating to our financial condition and results of operations. Our management uses this non - GAAP measure to compare our performance to that of prior periods for trend analyses and for budgeting and planning purposes. This measure is also used in financial reports prepared for management and our board of directors. We believe that the use of this non - GAAP financial measure provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing our financial measures with other companies, many of which present similar non - GAAP financial measures to investors . Opportunity Market Sajan Summary Non - GAAP Reconciliation

Page 24 • Our management does not consider this non - GAAP measure in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of this non - GAAP financial measure is that it excludes significant expenses and income that are required by GAAP to be recorded in our consolidated financial statements. In addition, it is subject to inherent limitations as it reflects the exercise of judgments by management about which expenses and income are excluded or included in determining this non - GAAP financial measure. In order to compensate for these limitations, management presents this non - GAAP financial measure in connection with GAAP results. We urge investors to review the reconciliation of our non - GAAP financial measures to the comparable GAAP financial measures and not to rely on any single financial measure to evaluate our business. Opportunity Market Sajan Summary Non - GAAP Reconciliation (cont.)

Page 25 In this large, fragmented and growing market, Sajan has the unique attributes to rapidly ascend. Tom Skiba, CFO tskiba@sajan.com www.sajan.com Opportunity Market Sajan Summary Opportunity Summary