Attached files

| file | filename |

|---|---|

| EX-32 - SAJAN INC | v216368_ex32.htm |

| EX-31.1 - SAJAN INC | v216368_ex31-1.htm |

| EX-23.1 - SAJAN INC | v216368_ex23-1.htm |

| EX-31.2 - SAJAN INC | v216368_ex31-2.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2010

or

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from _______________________ to ___________________

Commission File Number: 000-51560

Sajan, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

41-1881957

|

|

(State of incorporation)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

625 Whitetail Blvd., River Falls, Wisconsin

|

54022

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (715) 426-9505

|

Securities registered pursuant to Section 12(b) of the Act:

|

||

|

Title of Each Class

|

|

Name of Each Exchange on which Registered

|

|

None

|

|

|

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.01 par value per share

Preferred Stock Purchase Rights

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer,” large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer ¨Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

¨ Yes x No

The aggregate market value of the outstanding common stock, other than shares held by persons who may be deemed affiliates of the registrant, as of the last day of the registrant’s most recently completed fiscal year end was approximately $10,146,573 based on the closing sales price of $0.95 per share as reported on the OTC.

BB market. As of March 15, 2011, there were 16,009,331 shares of our common stock, $0.01 par value per share, outstanding.

DOCUMENTS INCORPORATED IN PART BY REFERENCE

None.

2010 Annual Report on Form 10-K

Table of Contents

[Note: TOC will need to be updated after all revisions are made.]

|

Page

|

||

|

PART I

|

||

|

Item 1.

|

Business

|

3

|

|

Item 1A.

|

Risk Factors

|

11

|

|

Item 1B.

|

Unresolved Staff Comments

|

21

|

|

Item 2.

|

Properties

|

21

|

|

Item 3.

|

Legal Proceedings

|

22

|

|

Item 4.

|

Reserved

|

23

|

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

24

|

|

Item 6.

|

Selected Financial Data

|

24

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

24

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

32

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

33

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

58

|

|

Item 9A.

|

Controls and Procedures

|

58

|

|

Item 9B.

|

Other Information

|

61

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

62

|

|

Item 11.

|

Executive Compensation

|

66

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

69

|

|

Item 13.

|

Certain Relationships and Related Transactions and Director Independence

|

71

|

|

Item 14.

|

Principal Accountant Fees and Services

|

72

|

|

PART IV

|

||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

73

|

|

Signatures

|

76

|

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934 (“Securities Exchange Act”). Forward-looking statements reflect the current view about future events. When used in this Annual Report on Form 10-K, the words “anticipate,” “will,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan” and similar expressions or the negative of these terms as they relate to Sajan, Inc., its subsidiaries or its management identify forward-looking statements. Forward-looking statements are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that may cause our results, levels of activity, performance or achievements to be materially different from the information expressed or implied by the forward-looking statements. Such statements reflect the current view of the management of Sajan, Inc. with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this Annual Report on Form 10-K entitled “Risk Factors”) relating to Sajan, Inc.’s industry, its operations and results of operations, and any businesses that may be acquired by it. These factors include:

|

|

·

|

rate of growth in the global multi-lingual content delivery industry, especially for software-as-a-service solutions within this industry;

|

|

|

·

|

changes in the utilization of our software and services by our customers;

|

|

|

·

|

lack of acceptance of any existing or new solutions we offer;

|

|

|

·

|

our ability to continue increasing the number of our customers or the revenues we derive from our recurring revenue customers;

|

|

|

·

|

continued economic weakness and constrained globalization spending by businesses operating in international markets;

|

|

|

·

|

our ability to effectively develop new solutions that compete effectively with the solutions that our current and future competitors offer;

|

|

|

·

|

risk of increased regulation of the Internet and business conducted via the Internet;

|

|

|

·

|

our ability to identify attractive acquisition opportunities, successfully negotiate acquisition terms and effectively integrate any acquired companies or businesses;

|

|

|

·

|

our ability to effectively manage our growth;

|

|

|

·

|

availability of capital on acceptable terms to finance our continued growth;

|

|

|

·

|

risks of conducting international commerce, including foreign currency exchange rate fluctuations, changes in government policies or regulations, longer payment cycles, trade restrictions, economic or political instability in foreign countries where we may increase our business and reduced protection of our intellectual property;

|

|

|

·

|

our ability to add sales and marketing, research and development or other key personnel who are able to successfully sell or develop our solutions;

|

|

|

·

|

our ability to operate as a public company and comply with applicable disclosure and other requirements and to hire additional personnel with public company compliance experience; and

|

|

|

·

|

other risk factors included under “Risk Factors” in this Annual Report on Form 10-K.

|

Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned. Although the management of Sajan, Inc. believes that the expectations reflected in the forward-looking statements are reasonable, it cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, Sajan, Inc. does not intend to update any of the forward-looking statements to conform these statements to actual results. The following discussion should be read in conjunction with the financial statements and the related notes and the pro forma financial information included in this Annual Report on Form 10-K.

2

PART I

ITEM 1. BUSINESS

Sajan, Inc. provides language translation solutions to customers selling products into global markets or those customers otherwise requiring accurate language translation of many varieties of content. Sajan also offers its customers a robust Translation Management System (TMS) technology which is cloud-based to deliver business process automation, cost reduction and improve the quality of translated content. These customers use our solutions to translate product manuals, instructions, warnings, and other product information into numerous languages. We combine our internally developed proprietary technology and high quality translation services to provide language translation solutions that are fast, reliable, and user-friendly. By utilizing an integrated technology and a service-based approach to language translation, we offer a comprehensive solution that allow customers to rely upon a single provider to meet all of their language translation needs. For those customers requiring use of multiple service vendors, Sajan offers a complete Managed Service solution which provides the required flexibility, yet delivers the technology advantages. The overall solution can be described as modular and highly scalable, it extends from small workgroup environments to large enterprises.

We offer our customers the ability to utilize our solutions under two different models:

|

|

·

|

Technology Enabled Service Model: we provide all of the customer’s language translation requirements, and;

|

|

|

·

|

Managed Service Model: customers use our technology and operations staff to manage translators or other language service vendors.

|

Our solutions are used to manage the end-to-end process of content globalization, which is the project, process and delivery management of content translated and localized into multiple languages across the enterprise. Content is localized across the enterprise for a wide variety of high value-added purposes and uses, most notably, product sales and marketing, packaging, user manuals, technical support and training, as well as internal requirements.

Merger Transaction

On February 23, 2010, pursuant to the Merger Agreement, by and among MathStar, a Delaware corporation, and Sajan, a privately held Minnesota corporation whose business was providing language translation technology and service, Garuda, a wholly-owned subsidiary of MathStar, and Thomas Magne, solely in his capacity as agent for the holders of common stock of pre-Merger Sajan, pre-Merger Sajan was merged with and into Garuda. Garuda was the surviving entity in the Merger and subsequently changed its name to Sajan, LLC. As a result of the Merger, pre-Merger Sajan became a wholly-owned subsidiary of MathStar. MathStar then changed its name to “Sajan, Inc.” and continues the language translation technology and service business of pre-Merger Sajan. For accounting purposes, pre-Merger Sajan is treated as the continuing reporting entity that acquired MathStar because pre-Merger Sajan obtained effective control of MathStar as a result of the Merger. This transaction is referred to throughout this report as the “Merger” and, unless otherwise indicated, we refer to the surviving public company following the Merger as “Sajan”, “Sajan, Inc.”, “we”, “us”, “our” or the “Company” and to MathStar prior to the Merger as “MathStar.”

Sajan (formerly MathStar) was incorporated under Minnesota law in April 1997, and was reincorporated under Delaware law on June 14, 2005. During the three months ended June 30, 2008, MathStar curtailed its operations as its board of directors evaluated strategic alternatives, including, but not limited to, restarting the company, merging with or acquiring another company, increasing operations in another structure, or liquidation. Until it curtailed operations, MathStar was a fabless semiconductor company engaged in the development, marketing and selling of its high-performance, programmable platform field programmable object array, or FPOA, chips and design tools required to program its chips. Immediately before the date of the Merger, MathStar was a “shell company”, as defined in Rule 12b-2 under the Securities and Exchange Act of 1934, as amended, having no or nominal operations, and assets consisting solely cash and cash equivalents.

3

As a result of the Merger, pre-Merger Sajan’s 5,573,742 shares of common stock were exchanged for 6,827,734 shares of pre-Merger Sajan common stock, or an exchange of 1 pre-Merger Sajan common share for 1.225 pre-Merger Sajan common shares. Options to purchase pre-Merger Sajan common stock issued under pre-Merger Sajan’s 2001 Stock Option Plan and certain non-plan options and warrants were converted into options and warrants to purchase MathStar common stock and remain outstanding as options and warrants to purchase shares of pre-Merger Sajan common stock. Immediately after the closing of the Merger, the former stockholders of pre-Merger Sajan owned approximately 43% of the outstanding shares of pre-Merger Sajan common stock. At the time of Merger, 112,500 shares, valued at $364,000 per management’s determination of fair value at the time of the Merger, were recorded for dissenter shares.

In 2009, we established Sajan Software Ltd (“Sajan Software”), which is based in Dublin, Ireland. The Ireland facility serves as both a Global Language Service Center and is home to Sajan Software Ltd, the producer of Sajan’s technology tools. Sajan India Software Private Limited (“Sajan – India”), based in Delhi, India, houses our development center at which we conduct substantially all of our software development activities. Sajan-India is a wholly-owned subsidiary of Sajan. In 2010, we also established a Global Language Service Center in Spain, Sajan Spain S.L., to serve the European market. All of these operations are wholly-owned subsidiaries of Sajan.

Products and Services

Our robust language translation solution incorporates an innovative technology product that serves as a single platform to meet the needs of the smallest user to the largest enterprise customer. The solution is a hosted platform and requires no installed software. The technology runs in the “cloud”, which means customers can access all our translation lifecycle components via an Internet browser. It is typically delivered as a software as a service (SaaS) model. We combine both language translation services and our own proprietary technology to give customers a single source solution to meet all of their translation needs. For those customers that require language service vendor flexibility, Sajan offers the technology in a Managed Service model. The solution integrates people, processes and data into a service and technology solution that is designed to deliver measurable value in the form of cost reduction, business process automation, improved quality and integrated version control and audit trail.

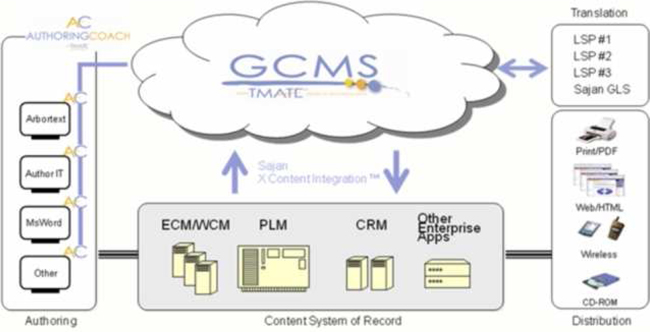

GCMS. Our Global Communication Management System (“GCMS”) is our cloud-based technology platform. By categorical definition it is a Translation Management System (TMS) which means the technology encompasses features which span the entire language translation lifecycle. The technology has seen two significant upgrade releases during 2010. Our GCMS platform is an integrated, fully SaaS-enabled solution suite that provides the tools to authors, linguists, graphic artists, project operations, administration and publishing staff needed to automate the project cycle for content localization from creation to delivery and to leverage enterprise translation memory (“TM”). Translation services are traditionally delivered on a per word cost basis, with ancillary fees for related services such as pre-and post-production content lay-out and TM integration. TM is the repository of past translation work which, in the case of GCMS, is parsed and stored contextually in a readily accessible data environment using proprietary algorithms that attempts to match current content with past translations. Properly optimized, the re-use of past translations from TM can significantly reduce operating costs and is an asset that is often under-utilized within the enterprise due to a lack of technology investment, fragmented responsibility of TM across the enterprise, fragmented service providers, or a lack of awareness of the economic value of TM. Our business model and strategy are focused on providing services and technologies to remedy such situations and facilitate enterprise customers’ optimization of TM. Our solutions increase worker productivity, accelerate critical time-to-market for customers, enhance the quality of globalized enterprise content, increase operational efficiency and reduce operating costs. Beyond the differentiated feature set and advanced multilingual data management capabilities of Sajan’s GCMS, the technology offers universal content connectors to easily integrate with our business systems such as Content Management Systems (CMS). Recognizing that language translation is part of a larger business process, this integration can prove quite beneficial to Sajan customers.

4

GCMS encapsulates a multilingual content repository, with built-in parsing technology that maintains language segment context. Retention of language context is, we believe, unique to our solutions and valuable for improving re-use of translated content. Simply stated, it makes the content smarter. GCMS also offers a workflow component that streamlines the language translation process. Our solution comes standard with built-in version control and audit trail, which is often well-suited for businesses in highly-regulated industries, such as life sciences companies complying with requirements imposed by the United States Food and Drug Administration. The GCMS is designed to be a modular, secure, online solution that is appropriate for any business environment. The application is an Internet-based development and computer technology, commonly referred to as a “cloud solution ,” that provides high availability and reliability to worldwide customers. In addition, we provide business analytics directly to customers through our system. Using web services, system features can be integrated to other business systems.

Technological Features. We have developed a number of tools that are designed to create value throughout the language translation process, particularly in the pre-translation process of authoring or content creation. Authoring Coach™ is a desktop tool, sold individually to any source content producer, using a Windows™ based editor. It presents similar or like phrases, sentences or paragraphs to the creator and enables the creator to draw from previously translated content. The result is information that is more consistent and reduces the need for new translation. In addition, we developed our TMate™ search technology to enhance intelligent multilingual search. TMate™ is our proprietary advanced multilingual search algorithm.

Process. Utilizing the GCMS platform, human translators who provide translation services to Sajan are first systematically ranked and qualified to ensure that a high-quality language resource is performing translation on a particular project. Incorporating pre-translation processes, such as Authoring Coach and advanced search using TMate™, further differentiates the platform and we believe provides greater price and value differentiation. We believe our technological advances, detailed process methodology, and ISO 9000 practices result in reduced costs while delivering a higher value to the customer. This method offers a blend of both service and technology. Customers may sign in online, request translation of new content, view the status of pending projects, and obtain completed projects. All content is stored at a granular level, referred to as a segment, with language context retained, and each translated segment is stored indefinitely. This capability allows us to offer audit trail and version control, which are useful to regulated businesses operating in industries where compliance is important. An illustration of the content translation lifecycle is provided below.

5

GCMS Advantages. By utilizing a language management platform such as GCMS, we believe that customers are able to reduce the time-to-market for their products. The platform also enables enterprises to simultaneously launch products into all markets, which can result in more rapid revenue growth and a competitive advantage. The GCMS platform has been designed to ensure improved quality of multilingual content. GCMS uses advanced features, which increase the contextual accuracy of re-used multilingual content. For customers whose content accuracy and contextual sensitivity is vital, the GCMS platform offers an attractive solution to these problems. In the most recent broad research assessment, our technology was ranked as the top language Translation Management System (TMS) technology by Common Sense Advisory in its report, “Translation Management Systems, Assessments of Commercial and LSP-Specific TMS Offerings.”

We have a patent pending on a number of components that make up the GCMS platform. Specifically, the structure in which both source and target content is stored results in a logical and contextually accurate placement of content. This means that the content becomes more intelligent and can be used in ways that are more meaningful for future language translation services.

ISO Certified. According to leading industry analysts, approximately 10% of suppliers in this market claim ISO certification. The certification requires significant investment of time and money. The benefits to clients are the assurance of quality controls and defined business structure. We received our ISO 9001:2000 certification in 2005, and are currently ISO 9001:2008 certified.

Market Description

Language is often a barrier in global commerce. The demand for effective language translation continues to grow. The industry has historically been very service centric, but, as is the case in many service industries, price pressures and other market demands impose the need for innovation and new solution paradigms.

Language translation services, although often treated like a commodity service, have historically been expensive, labor intensive and relatively slow in delivery. Human translators can typically translate 2,500 words per day on average, although this varies based on the complexity of the subject matter. This creates constraints on the available supply of translation services and, when positioned against growing demand, we believe will provide translation technology innovators with an advantage. As a result, based on the rising demand for translation services and the looming shortage of human translators worldwide, we expect a favorable pricing environment for Language Service Providers (LSPs) in the coming years.

Global economic challenges have created opportunities. As the U.S. Dollar declines against foreign currency, this influences United States business executives to seek revenue from foreign markets. We believe recent negative worldwide economic conditions have hastened the trend towards globalization. In addition, growth in emerging markets will also help fuel market growth. Language translation is becoming more synonymous with revenue as critical company messages can now reach broader audiences.

We believe the shortage in human translators cast against a rising demand will result in increased opportunities for companies that offer technology-based solutions and improve the efficiency of language translation services. In theory, the language translation service market should shrink if technology is offering improved content reuse. To compete effectively, language translation companies need to obtain translation in an accurate, timely, and cost effective manner. With advances in content management and the growth of the Internet, providers will also need to integrate their multilingual content with other enterprise systems to establish a cohesive single repository of all global content. Content is no longer monolingual content; it is multilingual. Industry analysts and general business analysts have indicated that a more integrated solution, often referred to as the Global Content Lifecycle, will be required to be successful in the future for both global enterprises and for the LSPs that support them. As a result, language translation is no longer likely to be treated as an afterthought in the globalization process, but rather as an integral part of an enterprise system. Further, as the annual spending by multinational companies for language translation solutions accelerates over the next several years, we believe a more technology-based solution will be required to keep pace with the rate of growth in the amount of content and increasingly sophisticated content management solutions.

6

An additional advantage that Sajan provides is flexibility in our solution against a transforming market landscape. Many have speculated as to when the language translation technology industry will realize strong independent growth. Conceptually it makes perfect sense, however adoption of independent technology solutions, comparable with other markets like Content Management have been very slow to take off. We feel this is in part due to the complexity of the translation lifecycle and internal subject matter expertise required by companies to manage both the process and technology themselves. Sajan is well positioned as it is presently using and enhancing an industrialized technology offering, but aligning the offering to the preferred customer method. If the industry matures to a more independent technology approach, Sajan need only modify how it offers its solution, as the base technology already exists and has been stress tested.

Based on the current globalization and language translation market dependence upon non-technology oriented, small language translation firms (see chart below), we believe that vendors who provide both language translation capabilities and offer a strong technology platform will enjoy a competitive advantage.

Market Revenues. Research completed by Common Sense Advisory (“CSA”) confirms an opportune, growing market. According to CSA’s research, the global language services market is expected to reach $38 billion by 2013, nearly 90% of companies outsource some or all of their translation and localization work, and 67% of language buyers say that a vendor’s automation capabilities are important.

The global multi-lingual content delivery market is very fragmented. The combined revenues of the world’s top 40 translation firms account for less than 16% of the overall market, and most are service-only agencies. No single language translation provider exceeds 2% market share.

The breakdown of LSPs in 2008, not materially different by revenue category today, as outlined in the table below, reveals that small providers constitute a very large portion of this market. Generally, these providers have little to offer in the way of technology or value added services.

|

Revenue

|

|

Number of LSPs

|

|

Less than $1 million

|

6,380

|

|

|

$1 million-$5 million

|

391

|

|

|

$5 million-$10 million

|

64

|

|

|

$10-$50 million

|

42

|

|

|

$50 million-$500 million

|

8

|

Market Size. According to CSA, the worldwide global multi-lingual content delivery market in 2010 was $26 billion and is expected to grow to $38 billion by 2013. This equates into an approximate 13% compound annual growth rate over the three-year period. Human translation services account for over 90% of the global translation market and are generally delivered through a network of freelance linguists that freely associate among the LSPs on a per job basis. Nearly 90% of companies outsource some or all of their translation and localization work, and 67% of language buyers say that a vendor’s automation capabilities are important.

7

|

Region

|

Market

Share

|

2009

US$ M

|

2010

US$ M

|

2011

US$ M

|

2012

US$ M

|

2013

US$ M

|

||||||||||||||||||

|

North America

|

48.50 | % | 11,284 | 12,769 | 14,448 | 16,347 | 18,497 | |||||||||||||||||

|

Northern Europe

|

19.00 | % | 4,421 | 5,002 | 5,660 | 6,404 | 7,246 | |||||||||||||||||

|

Western Europe

|

11.10 | % | 2,583 | 2,922 | 3,307 | 3,741 | 4,233 | |||||||||||||||||

|

Southern Europe

|

8.59 | % | 1,999 | 2,264 | 2,559 | 2,895 | 3,276 | |||||||||||||||||

|

Asia

|

7.67 | % | 1,785 | 2,019 | 2,285 | 2,585 | 2,925 | |||||||||||||||||

|

Eastern Europe

|

4.49 | % | 1,045 | 1,182 | 1,338 | 1,513 | 1,712 | |||||||||||||||||

|

Latin America

|

0.35 | % | 81 | 92 | 104 | 118 | 133 | |||||||||||||||||

|

Africa

|

0.18 | % | 42 | 47 | 54 | 61 | 69 | |||||||||||||||||

|

Oceania

|

0.13 | % | 30 | 34 | 39 | 44 | 50 | |||||||||||||||||

|

Growth Totals

|

100 | % | 23,267 | 26,327 | 29,789 | 33,706 | 38,138 | |||||||||||||||||

Table 1: Projected Language Services Revenues and Regional Distribution

Source: Common Sense Advisory, Inc.

Source: Projected Language Services Revenues for 2009-2013 in U.S. Millions of Dollars, Common Sense Advisory, Inc.

The ability of a traditional LSP to compete is growing more challenging. While demand for the service may be rising, which should allow for price increases, the buyers currently are demanding that providers hold or reduce prices. Without technological differentiation, a traditional LSP will continue to operate at a severe disadvantage, not only in its ability to manage the delivered cost, but also to integrate and interoperate with technologies used by its clients such as content management systems and other enterprise class business systems.

Key Market Trends and Influences. Several distinct trends and influences within the global multi-lingual content delivery market have emerged, and we believe they will provide significant opportunities for market innovation. The underlying motivators for many of these include historic objectives such as cost reduction, quality improvement and schedule predictability. However, new factors are rapidly becoming apparent, such as revenue growth derived from foreign market penetration, improving global customer experience and brand support worldwide.

Competition

The global multi-lingual content delivery market is highly competitive and highly-fragmented with numerous existing competitors. We believe the principal competitive factors in providing language translation solutions include the ability to provide a comprehensive solution to customers; infrastructure that supports cost effective and high quality delivery to customers; project management expertise; quality and speed of service delivery; and corporate reputation. We believe that we have competed favorably with respect to these factors and have developed a strong reputation in our industry.

While many potential customers utilize internal resources to address their translation and localization requirements, we believe our primary competition is external and within our industry. Competitors within our industry are categorized into three primary segments: Language Service Providers, Technology Only Providers, and Technology-Enabled Service Providers.

Language Service Providers. The largest segment is comprised of competitors that offer only human language translation services and make limited use of technology on either an internal basis or as part of their solution. These service vendors are abundant due to low barriers to entry and often have only a small number of key, ongoing relationships. These providers make up the largest segment of the translation market and account for approximately 75% of the number of industry participants. The challenge for these providers is that they have little that differentiates them from other providers, with no technology and often unproven processes and quality controls. We believe that such firms offer an opportunity to increase our scale, gain access to critical linguistic skills and also open new geographic markets. We believe providing our technologies and business processes to these organizations will solidify their account base and enhance their margins.

8

Technology Only Providers. The second segment consists of pure technology providers. This group is a disparate collection of point solution and suite providers to enterprises for handling their own translation requirements. These technology solutions handle a wide range of requirements and leave much to the customers to do on their own to integrate and operate across multiple applications. Examples of competitive technology only companies are SDL Plc (SDL), Across Systems GmbH, Kilgray Translation Technologies, LingoTek, Inc., Atril and Wordfast LLC.

Within the category of technology only provider, there are two subsets. One subset consists of providers that serve the translator market most often with what is referred to as Translation Memory tools (a data management application). Often these are inexpensive productivity tools used by translators or small language service providers. The second subset are those technology providers that serve corporate enterprises. These providers operate beyond data management and include business process and analytics. These systems are often referred to as Translation Management Systems (TMS). Technology providers as a whole represent a very small portion of market participants. There has been a trend among the technology solution providers towards new, more nimble entrants embracing SaaS architecture over the more traditional enterprise software model.

Technology-Enabled Service Providers. The third segment consists of companies like us that combine both language translation services and comprehensive technology solutions, often referred to as Technology-Enabled Service Providers. The largest such company is publicly-held Lionbridge Technologies, Inc. (“Lionbridge”), with 2010 revenues of $405.2 million. There is only a small number of Technology-Enabled Service Providers. Within this group, based on the most recent CSA report, we enjoy the highest ranking for our TMS technology offering.

We believe that only a very small number of the largest LSPs, such as SDL, Transperfect and Lionbridge, provide legitimate full featured TMS technology offerings. Each takes a very different technological approach. SDL has acquired many technology companies, both directly relating to the global multi-lingual content delivery industry and others that are peripheral to the industry. We believe that this has alienated SDL from some buyers and partners, as SDL directly competes with them. Lionbridge promotes a SaaS solution. This solution utilizes a legacy technology product called LogoportTM, which was originally designed as a Translation Memory solution. Lionbridge has incorporated some web interfaces to this product. Nearly all of the direct technology competition employs a very common strategy to TM data management. We believe this simplistic approach limits the ability for a customer to maximize reuse of past content and does not permit effective enterprise level integration with high performance business systems, which we believe is inferior to a more robust solution.

We believe the remaining LSPs, while potentially competent in the delivery of language translation service, do not possess significant technology. If they do, they are likely to be using Translation Memory tools to achieve some level of content reuse so as to enable them to make some technological value claim.

Marketing and Sales

Substantially all of our revenues have been generated through our internal direct sales force and the efforts of our senior management team. As of March 15, 2011, we had 17 direct sales professionals in the United States and Europe.

Our sales force has developed relationships with an increasing number of customers. Our sales approach involves planning for a customer organization’s unique ongoing requirements, including future versions of products, and ongoing support, maintenance, and training, related to both technology products and content. A significant focus of our near-term sales effort is to expand the breadth of services and solutions we offer to customers and to gain a larger portion of their language translation business.

9

Customers

All of our customers sell products outside the United States and require content such as warnings, instructions, directions, and other information to be translated into a number of languages. Our customers are predominantly Fortune 1000 companies in the technology, medical, industrial, and manufacturing sectors. Most of our customers are located in the United States, with a high concentration located in the Midwest region. We anticipate that the percentage of our customers located outside of the United States will increase as we expand our sales efforts and Sajan Software hires additional sales personnel.

Major Customers

We derive a significant portion of our revenues from a limited number of customers. For the years ended December 31, 2010 and 2009, our largest customer accounted for approximately 15% and 14%, respectively, of our revenue, and our ten largest customers accounted for approximately 64% and 65%, respectively, of our revenue.

Geographic Areas of Operations

We generate revenues worldwide and during the year ended December 31, 2010, 76% of our revenues were generated within the United States and 24% were generated internationally. Currently, our largest international market is Spain, which accounted for 72% of our international revenues.

Intellectual Property

The development, utilization and protection of technology is an important component of our overall operating strategy. We have filed a patent application with the U.S. Patent and Trademark Office covering aspects of our GCMS solution. We have not filed any applications for patent protection in any country other than the United States. As a result, we do not and will not have the right to enforce our rights under any United States patent, if issued to us, in any foreign country, or to prevent others in foreign countries from utilizing our proprietary technology covered by that patent. We may apply for patent protection on our future technology developments to the extent we believe such protection is available and economically warranted. Despite these efforts, others could independently develop technology that is similar to our technology, or offer or sell products or services in foreign countries that use our technology.

We have registered and use domain names sajan.com, authoringcoach.com, and sajansoftware.com. We use, or intend to use, and claim rights to various trade names and trademarks to identify our language translation services and products. We have obtained a registered U.S. mark for the Sajan logo. We also use and claim rights to the “Sajan™”, “GCMS™”, “X-Content Integration™”, “TMate™”, “Context Intelligence™” and “Authoring Coach™” marks.

We intend to protect our intellectual property to the extent such protection is warranted. In addition to efforts to obtain patent and trademark rights, we rely on a combination of trade secret, license, nondisclosure and other contractual agreements and copyright laws to protect our intellectual property rights. Existing trade secret and copyright laws afford us only limited protection. We enter into confidentiality agreements with our employees and contractors, and limit access to and distribution of our proprietary information. These arrangements may not be adequate to deter misappropriation of our proprietary information and we may not be able to detect unauthorized use and take appropriate steps to enforce our intellectual property rights.

Research and Development

During the years ended December 31, 2010 and 2009, we spent approximately $1,716,000 and $760,000, respectively, on research and development. Research and development expenses consist primarily of wages and benefits for product strategy and development personnel. We have focused our research and development efforts more recently on the commercialization of the GCMS platform and its component modules for general release and independent use by participants in the content globalization process and for the ability to host GCMS using cloud computing methodologies. Functional development has continued in parallel on improving ease of use, functionality, scalability and efficiency of TM processing.

10

Our research and development primarily occurs in the United States, India and Ireland. We expect that on an annual basis, the dollar amount of research and development expenses will remain relatively constant with 2010 levels as we continue to enhance and expand our product offerings, but decrease as a percentage of revenues, as we anticipate that our revenues will grow at a faster rate than the growth of research and development spending.

Employees

As of March 15, 2011, we had 112 full-time employees. Our employees include software development engineers, project managers, language specialists, and graphic designers, as well as sales and marketing, quality assurance and administrative team members. We have approximately 70 employees in our River Falls, Wisconsin office, four employees that work from their home offices in the United States, nine employees in our Dublin, Ireland office, 23 employees in our New Delhi, India office and 6 employees in our Madrid, Spain office. None of our employees are covered by a collective bargaining agreement. We consider our relationship with our employees to be good. In addition, we utilize the services of approximately 3,500 human translators, all of whom are independent contractors, and utilize consultants to perform short-term project-based services, which is a more cost-effective strategy than hiring additional full-time employees.

Corporate Information

General

Our corporate offices are located in River Falls, Wisconsin, which is located approximately 30 miles east of Minneapolis, Minnesota. Our River Falls corporate offices contain our core Global Language Service operations, our administrative, product management, marketing, sales, and professional services functions. Our offices are located at 625 Whitetail Blvd., River Falls, Wisconsin 54022, and our telephone number is (715) 426-9505.

The Company’s fiscal year runs from January 1 through December 31. Neither the Company nor any of its predecessors have been in bankruptcy, receivership or any similar proceeding.

ITEM 1A. RISK FACTORS

You should consider the following risk factors, in addition to the other information presented or incorporated by reference into this Annual Report on Form 10-K, in evaluating our business and your investment in us.

The Company’s common stock involves a high degree of risk. Investors and potential investors should carefully consider the following risk factors, together with all of the other information included in this report, before making investment decisions about shares of our common stock. The risks and uncertainties described below are not the only risks and uncertainties facing the Company in the future. Additional risks and uncertainties not presently known or that are currently considered to be immaterial may also materially and adversely affect the Company’s business operations or the stock price of the Company’s common stock. If any of the following risks or uncertainties occurs, the Company’s business, financial condition, operating results and future growth prospects could materially suffer. In that event, the trading price of your securities could decline, and you may lose all or part of your investment.

11

Risk Related to Our Business and Industry

Our past results may not be indicative of future results, and, therefore, we may be unable to continue to grow at our historical growth rates.

Sajan, Inc. began selling language translation services utilizing its proprietary technology in 2002 and generated only nominal revenues during that year. From 2003 to 2010, however, revenue increased more rapidly. The annual revenues of Sajan, Inc. for the year ended December 31, 2009 were approximately $12.7 million and increased to $16.0 million in the year ended December 31, 2010. Increasing revenues by growing our business operation under the Sajan name is a key component of our strategy. These expansion plans have placed and may continue to place significant demands on our management and operational resources. You should not consider recent revenue growth as indicative of our future performance. In fact, in future periods, we may not have any revenue growth, or our revenues could decline.

We do not have long-term contracts with our customers who provide us with recurring revenue, and our success will depend on our ability to maintain a high level of customer satisfaction and a strong reputation in the global multi-lingual content delivery industry.

Our contracts with our customers who provide us with recurring revenue typically allow the customer to cancel the contract for any reason with 30 days’ prior notice to us. Our continued success therefore depends significantly on our ability to meet or exceed the expectations of these customers because most of such customers do not make long-term commitments to use our solutions. In addition, if our reputation in the global multi-lingual content delivery industry is harmed or diminished for any reason, this may cause our recurring revenue customers to terminate their relationships with us on short notice and seek alternative globalization and translation solutions. If a significant number of recurring revenue customers terminate their relationships with us, our business, results of operations and financial condition would be adversely affected in a short period of time.

We rely on a limited number of customers, and the loss of or reduction in revenue from a major customer could negatively affect our business, financial condition and operations.

We derive a significant portion of our revenues from a limited number of large customers. For the years ended December 31, 2010 and 2009, our largest customer accounted for approximately 15% and 14%, respectively, of our revenue, and our ten largest customers accounted for approximately 64% and 65%, respectively, of our revenue. As a result of the concentration of our revenue to a limited number of customers, we have experienced fluctuations in collection of our revenues. The loss of any major customer or a significant reduction in a large customer’s use of our language translation solutions could materially reduce our revenue and cash flow and adversely affect our business, financial condition and operations.

Continued economic weakness and uncertainty could adversely affect our revenue, lengthen our sales cycle and make it difficult for us to forecast operating results accurately.

Our revenues depend significantly on general economic conditions and the health of large companies that sell products internationally. Economic weakness and constrained globalization spending adversely affected our revenue growth rates and gross margins in 2010, and similar and continuing circumstances may result in slower growth or reductions in our revenues and gross profits in the future. We have experienced, and may experience in the future, reduced spending in our business due to the current financial turmoil affecting the U.S. and global economy and other macroeconomic factors affecting spending behavior. Uncertainty about future economic conditions makes it difficult for us to forecast operating results and to make decisions about future investments. In addition, economic conditions or uncertainty may cause current and potential customers to reduce or delay globalization expenditures, including purchases of our solutions. Our sales cycle may lengthen if purchasing decisions are delayed as a result of uncertain information technology or contracted development budgets or if contract negotiations become more protracted or difficult as customers institute additional internal approvals for globalization and information technology purchases. Delays or reductions in globalization and information technology spending could have a material adverse effect on demand for our software and services, and consequently on our business, financial condition and results of operations.

12

If we are unable to attract new customers or sell additional solutions, or if our customers do not increase their use of our solutions, our revenue growth and profitability will be adversely affected.

To increase our revenues and achieve and maintain profitability, we must regularly add new customers and sell additional solutions, and our customers must increase their use of our solutions they currently utilize. We intend to grow our business by hiring additional inside sales personnel and increasing our marketing activities. If we are unable to hire or retain quality sales personnel, convert customer prospects into paying customers, or ensure the effectiveness of our marketing programs, or if our existing or new customers do not perceive our solutions to be of sufficiently high value and quality, we might not be able to increase sales, and our operating results will be adversely affected. In addition, if we fail to sell our new solutions to existing or new customers, we will not generate anticipated revenues from these solutions, our operating results will suffer and we might be unable to grow our revenues or achieve or maintain profitability.

We have incurred operating losses in the past and may incur operating losses in the future.

For the years ended December 31, 2010 and 2009, Sajan generated net loss of $3.0 million and $1.1 million, respectively. Throughout most of our history, we have experienced net losses and negative cash flows from operations. We expect our operating expenses to increase in the future as we expand our operations. Furthermore, as a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. If our revenues do not grow to offset these increased expenses, we may not be profitable. We cannot assure you that we will be able to achieve or maintain profitability.

Our inability to adapt to rapid technological change could impair our ability to remain competitive.

The global multi-lingual content delivery industry in which we compete is characterized by rapid technological change, introductions of new products and evolving industry standards. Our ability to attract new customers and increase revenues from customers will depend in significant part on our ability to anticipate industry standards and to continue to enhance existing solutions or introduce or acquire new solutions on a timely basis to keep pace with technological developments. The success of any enhancement or new solution depends on several factors, including the timely completion, introduction and market acceptance of any enhancement to our solution. Any new solution we develop or acquire might not be introduced in a timely or cost-effective manner and might not achieve the broad market acceptance necessary to generate significant revenues. If any of our competitors implements new technologies before we are able to implement them, those competitors may be able to provide more effective solutions than ours at lower prices. Any delay or failure in the introduction of new or enhanced solutions could adversely affect our business, results of operations and financial condition.

Our business may be harmed by defects or errors in the services we provide to customers.

Many of the services we provide are critical to the business operations of our customers. While we maintain general liability insurance, including coverage for errors and omissions, defects or errors in the services we provide could interrupt our customers’ abilities to provide products and services to their customers, resulting in delayed or lost revenue. This could damage our reputation through negative publicity, make it difficult to attract new and retain existing customers, and cause customers to terminate our contracts and seek damages. We may incur additional costs to correct errors or defects. There can be no assurance that our general liability and errors and omissions insurance coverage will be available in amounts sufficient to cover one or more large claims, or that the insurer will not disclaim coverage as to any future claims.

13

An interruption or failure of our information technology and communications systems could impair our ability to effectively provide our services, which could damage our reputation and business.

The provision of our services depends on the continuing operation of our information technology and communications systems. Any damage to or failure of our systems could result in interruptions in our services. Interruptions in our services could reduce our revenues and profits, and the Sajan brand could be damaged if people believe our system is unreliable. Our systems are vulnerable to damage or interruption from terrorist attacks, floods, tornados, fires, power loss, telecommunications failures, computer viruses or attempts to harm our systems. Our data centers may be subject to break-ins, sabotage and intentional acts of vandalism, and to other potential disruptions. Some of our systems may not be fully redundant, and our disaster recovery planning may not be able to account for all eventualities. The occurrence of a natural disaster, a decision to close a facility we are using without adequate notice for financial reasons, or other unanticipated problems at our data centers could result in lengthy interruptions in our services. Any unscheduled interruption in our service will put a burden on the entire organization and would result in an immediate loss of revenue. If we experience frequent or persistent system failures on our web site, our reputation and the Sajan brand could be permanently harmed. The steps required to increase the reliability and redundancy of our systems are expensive, will reduce our operating margins, and may not be successful in reducing the frequency or duration of unscheduled downtime.

The intellectual property of our customers may be damaged, misappropriated, stolen, or lost while in our possession, subjecting us to litigation and other adverse consequences.

In the course of providing globalization and language translation services to our customers, we take possession of or are granted access to certain intellectual property of our customers. If such intellectual property is damaged, misappropriated, stolen, or lost, we could suffer, among other consequences:

|

|

·

|

claims under indemnification provisions in customer agreements or other liability for damages;

|

|

|

·

|

delayed or lost revenue due to adverse customer reaction;

|

|

|

·

|

negative publicity; and

|

|

|

·

|

litigation that could be costly and time consuming.

|

Any adverse impact attributable to any of the foregoing factors would have a material adverse effect on our business and revenues.

We rely on third parties for key aspects of the process of providing services to our customers, and any failure or interruption in the services provided by these third parties could harm our ability to operate our business and damage our reputation.

We rely on third-party vendors, including data center and bandwidth providers, and we also rely on third parties for key aspects of the process of providing language translation services to our customers. Our revenues and margins are subject to our ability to continue to maintain satisfactory relationships with freelance linguists, who are in high demand worldwide for specific languages. Any disruption in the network access or co-location services provided by these third-party providers or any failure of these third-party providers and freelance linguists to handle current or higher volumes of use could significantly harm our business. Any financial or other difficulties the providers face may have negative effects on our business, the nature and extent of which cannot be predicted. We exercise little control over these third party vendors, which increases our vulnerability to problems with the services they provide. We also license technology and related databases from third parties to facilitate aspects of our translation processes and our data center and connectivity operations including, among others, Internet traffic management and search services. Any errors, failures, interruptions or delays experienced in connection with these third-party technologies and information services could negatively impact our relationships with customers and adversely affect the Sajan brand, and could expose us to liabilities to third parties.

14

Evolving regulation of the Internet may increase our expenditures related to compliance efforts, which may adversely affect our financial condition.

As Internet commerce continues to evolve, increasing regulation by federal, state or foreign agencies becomes more likely. We are particularly sensitive to these risks because the Internet is a critical component of our on-demand business model. In addition, taxation of services provided over the Internet or other charges imposed by government agencies or by private organizations for accessing the Internet may be imposed. Any regulation imposing greater fees for Internet use or restricting information exchange over the Internet could result in a decline in the use of the Internet and the viability of Internet-based services, which could harm our business.

We depend on intellectual property rights to protect proprietary technologies, although we may not be able to successfully protect these rights.

We rely on our proprietary technology to enhance our software and service offerings. We use a combination of patent, trademark, trade secret and copyright law in addition to contractual restrictions to protect our technology. Although we have filed a patent application with the U.S. Patent and Trademark Office covering certain aspects of our technology, there can be no assurance that this application will result in an issued patent or that such patent, if issued, would adequately protect our technology or provide us with a competitive advantage. We may apply for patent protection on our future technology developments to the extent we believe such protection is available and economically warranted. However, there is no assurance that we will file additional applications for patent protection in the United States or in other countries, that any application that we may file will result in an issued patent, or that any issued patent will provide us with a competitive advantage. We have not filed any applications for patent protection in any country other than the United States. As a result, we do not have the right to enforce our rights under any United States patent, if issued, in any foreign country, or to prevent others in foreign countries from utilizing the proprietary technology covered by our patents. Despite our efforts, there can be no assurance that others will not independently develop technology that is similar to our technology, or offer or sell products or services in foreign countries that utilize our technology. The development by others of technology that is similar to our technology, or the sale of products or services in foreign countries that incorporate our technology, would harm our competitive position and have a material adverse effect on our business, results of operations and financial condition.

We may be involved in disputes from time to time relating to our intellectual property and the intellectual property of third parties.

We may become parties to disputes from time to time over rights and obligations concerning intellectual property, and we may not prevail in these disputes. Third parties may raise claims against us alleging infringement or violation of the intellectual property of that third party. Some third party intellectual property rights may be extremely broad, and it may not be possible for us to conduct our operations in such a way as to avoid violating those intellectual property rights. Any such intellectual property claim could subject us to costly litigation and impose a significant strain on our financial resources and management personnel regardless of whether such claim has merit. Our liability insurance, if any, may not cover potential claims of this type adequately or at all, and we may be required to alter products or pay monetary damages or license fees to third parties, which could have a material adverse affect on our financial condition and results of operations.

Our strategy includes pursuing acquisitions, and our potential inability to successfully integrate newly-acquired companies, businesses or technologies may adversely affect our financial results.

We believe part of our growth will be driven by acquisitions of other companies or their businesses or technologies. If we complete acquisitions, we face many risks commonly encountered with growth through acquisitions, including:

|

|

·

|

incurring significantly higher than anticipated capital expenditures and operating expenses;

|

|

|

·

|

failing to assimilate the operations and personnel of the acquired company or business;

|

|

|

·

|

disrupting our ongoing business;

|

|

|

15

|

|

·

|

dissipating our management resources;

|

|

|

·

|

failing to maintain uniform standards, controls and policies; and

|

|

|

·

|

impairing relationships with employees and customers as a result of changes in management.

|

Fully integrating an acquired company, business or technology into our operations may take a significant amount of time. We cannot assure you that we will be successful in overcoming these risks or any other problems encountered with acquisitions. To the extent we do not successfully avoid or overcome the risks or problems related to any acquisitions, our results of operations and financial condition could be adversely affected. Future acquisitions also could impact our financial position and capital needs, and could cause substantial fluctuations in our quarterly and yearly results of operations. Acquisitions could include significant goodwill and intangible assets, which may result in future impairment charges that would reduce our stated earnings.

Our ability to use our U.S. net operating loss carryforwards might be limited or eliminated.

As of December 31, 2010, we had net operating loss carryforwards of approximately $32.2 million, which are potentially available for U.S. federal tax purposes. These loss carryforwards expire between 2015 and 2030. To the extent these net operating loss carryforwards are available, we intend to use them to reduce any corporate income tax liability associated with our operations. Section 382 of the U.S. Internal Revenue Code generally imposes an annual limitation on the amount of net operating loss carryforwards that may be used to offset taxable income when a corporation has undergone significant changes in stock ownership. As a result, prior or future changes in ownership could put limitations on or eliminate the availability of our net operating loss carryforwards to offset any profit. Rules governing the use of net operating loss carryforwards are complex, and any use of our net operating loss carryforwards could be challenged given our change of control in 2007 and 2010. To the extent our use of net operating loss carryforwards is significantly limited or eliminated, any income generated by us could be subject to corporate income tax earlier than if we were able to use net operating loss carryforwards, which could result in lower profit. Future changes of control may result in additional expiration of a portion of the remaining net operating loss carryforward before it can be used. The use of our carryforward is dependent upon our ability to attain profitable operations in the future.

The markets in which we operate are highly competitive, and our failure to compete successfully would make it difficult for us to add and retain customers and would reduce or impede the growth of our business.

The markets for global multi-lingual content delivery software and services are increasingly competitive and global. We expect competition to increase in the future both from existing competitors and new companies that may enter our markets. In addition to our existing competitors, we may face competition in the future from companies that do not currently offer globalization or translation services. We may also face competition from internal globalization departments of Fortune 1000 and large emerging companies. Technology companies, information technology services companies, business process outsourcing companies, web consulting firms, technical support call centers, hosting companies and content management providers may choose to broaden their range of services to include globalization or language translation as they expand their operations internationally. Increased competition could result in pricing pressure, reduced sales, lower margins or the failure of our solutions to achieve or maintain broad market acceptance. However, we cannot assure you that new or established competitors will not offer solutions that are superior to or lower in price than ours. We may not have sufficient resources to continue the investments in all areas of software development and marketing needed to maintain our competitive position. In addition, some of our competitors are better capitalized than us, which may provide them with an advantage in developing, marketing or servicing new solutions. Increased competition could reduce our market share, revenues and operating margins, increase our costs of operations and otherwise adversely affect our business.

16

If we fail to retain our Chief Executive Officer and other key personnel, our business would be harmed and we might not be able to implement our business plan successfully.

Given the complex nature of the technology on which our business is based and the speed with which such technology advances, our future success is dependent, in large part, upon our ability to attract and retain highly qualified managerial, technical and sales personnel. In particular, Shannon Zimmerman, President and Chief Executive Officer and Angel Zimmerman, Chief Operating Officer, are critical to the management of our business and operations. Competition for talented personnel is intense, and we cannot be certain that we can retain our managerial, technical and sales personnel or that we can attract, assimilate or retain such personnel in the future. Our inability to attract and retain such personnel could have an adverse effect on our business, results of operations and financial condition.

Our continued growth could strain our personnel resources and infrastructure, and if we are unable to implement appropriate controls and procedures to manage our growth, we will not be able to implement our business plan successfully.

We have experienced a period of rapid growth in our headcount and operations. To the extent that we are able to sustain such growth, it will place a significant strain on our management, administrative, operational and financial infrastructure. Our success will depend in part upon the ability of our senior management to manage this growth effectively. To do so, we must continue to hire, train and manage new employees as needed. If our new hires perform poorly, or if we are unsuccessful in hiring, training, managing and integrating these new employees, or if we are not successful in retaining our existing employees, our business would be harmed. To manage the expected growth of our operations and personnel, we will need to continue to improve our operational, financial and management controls and our reporting systems and procedures. The additional headcount we are adding will increase our cost base, which will make it more difficult for us to offset any future revenue shortfalls by reducing expenses in the short term. If we fail to successfully manage our growth, we will be unable to execute our business plan.

We may be exposed to potential risks relating to internal controls over financial reporting and our ability to have those controls attested to by our independent registered public accounting firm.

As a public company, we are required, pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, to furnish a report by management on, among other things, the effectiveness of our internal control over financial reporting. Management first evaluation of our internal control systems is presented in this Annual Report on Form 10-K.

In prior years, Baker Tilly Virchow Krause, LLP, the independent registered public accounting firm of Sajan, Inc., identified a number of deficiencies in internal control that it considered to be material weaknesses and other deficiencies that it considered to be significant deficiencies. During 2010, we expended significant resources to develop the necessary documentation and testing procedures required by Section 404. This process resulted in a conclusion that we had remediated the previously identified material weaknesses and significant deficiencies and no other material weaknesses or significant deficiencies were identified. However, there can be no assurance that additional material weaknesses in internal controls will not occur in the future and that we may be unable to remediate the material weaknesses in internal controls identified in a timely manner. In this event, it is possible that investors and others with whom we do business may lose confidence in the reliability of our financial statements, and in our ability to obtain equity or debt financing could suffer.

Because our long-term success depends, in part, on our ability to expand the sales of our solutions to customers located outside of the United States, our business will be susceptible to risks associated with international operations.

We have limited experience operating in foreign jurisdictions. In 2008, we opened Sajan-India in New Delhi, India, in 2009, we opened Sajan Software in Dublin, Ireland and in 2010 we opened Sajan, Spain. Our inexperience in operating our business outside of North America increases the risk that our current and any future international expansion efforts will not be successful. Conducting international operations subjects us to risks that, generally, we have not faced in the United States, including:

|

|

·

|

fluctuations in currency exchange rates;

|

17

|

|

·

|

unexpected changes in foreign regulatory requirements;

|

|

|

·

|

longer accounts receivable payment cycles and difficulties in collecting accounts receivable;

|

|

|

·

|

difficulties in managing and staffing international operations;

|

|

|

·

|

potentially adverse tax consequences, including the complexities of foreign value-added tax systems and restrictions on the repatriation of earnings;

|

|

|

·

|

the burdens of complying with a wide variety of foreign laws and different legal standards, including laws and regulations related to privacy;

|

|

|

·

|

increased financial accounting and reporting burdens and complexities;

|

|

|

·

|

political, social and economic instability abroad, and terrorist attacks and security concerns in general; and

|

|

|

·

|

reduced or varied protection for intellectual property rights in some countries.

|

The occurrence of any one of these risks could negatively affect our international business and, consequently, our results of operations generally. Additionally, operating in international markets also requires significant management attention and financial resources. We cannot be certain that the investment and additional resources required in establishing, acquiring, operating or integrating operations in other countries will produce desired levels of revenues or profitability.

Our management has limited experience operating as a public company.

The members of our current management have limited experience operating a public company. We have six directors. Of these individuals, only directors Michael W. Rogers, Richard C. Perkins and Benno G. Sand, have experience managing a public company. Therefore, most of our officers and directors have had limited experience in complying with the various rules and regulations that are required of a public company. We may not be able to operate successfully as a public company, even if our business operations are successful. Our inability to successfully operate as a public company could have a material adverse effect on our business, financial condition and operating results and on our ability to obtain equity or debt financing.

We cannot predict the outcome of the lawsuit with Ms. Natzel, and an unfavorable outcome of this lawsuit could have a material adverse effect on our business, financial condition and operating results.

As described in section titled “Legal Proceedings” above, Sajan is a party to the lawsuit filed by Mary Jo Natzel. Although our management believes that Ms. Natzel’s claims are without merit, we cannot predict the outcome of either of this lawsuit. It is possible that the ultimate resolution of this lawsuit, if unfavorable, could have a material adverse effect on our business, financial condition and operating results. Even if we ultimately prevail in the lawsuit, legal and other fees associated with the lawsuit could be significant. In addition, there may also be adverse publicity associated with legal proceedings that could negatively affect the perception of our business, regardless of whether the allegations made by Ms. Natzel are valid or whether we are ultimately found liable. As a result, this lawsuit may have a material adverse effect on our business, financial condition and operating results.

18

We may need additional financing in the future, which may not be available, and any such financing will likely dilute our existing stockholders.