Attached files

| file | filename |

|---|---|

| 8-K - AMERICAN CAMPUS COMMUNITIES, INC. 8-K - AMERICAN CAMPUS COMMUNITIES INC | a50711948.htm |

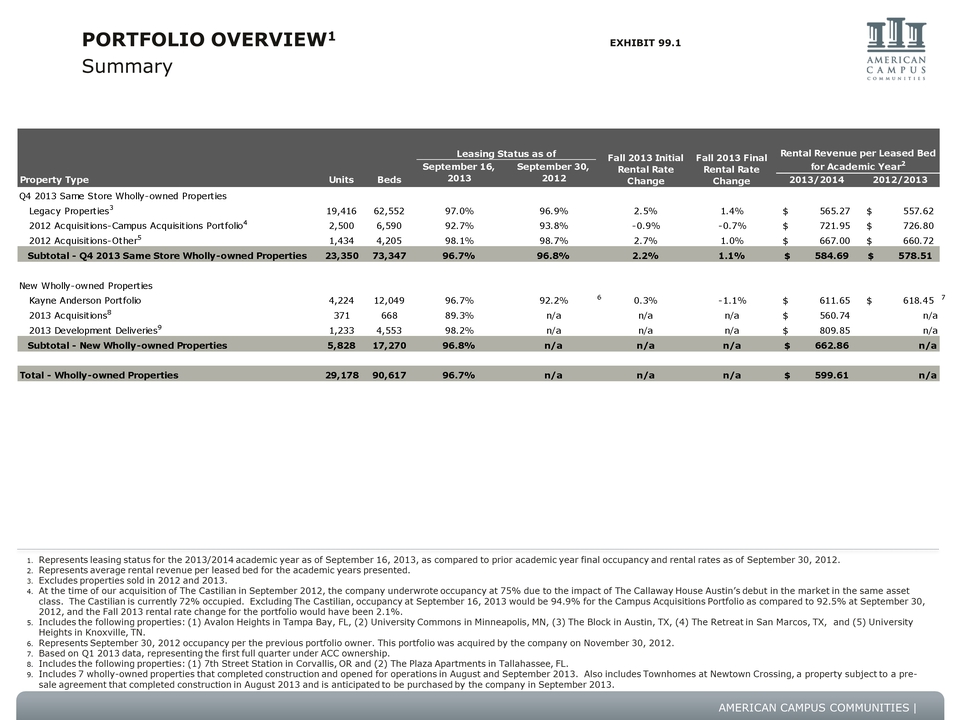

AMERICAN CAMPUS COMMUNITIES | PORTFOLIO OVERVIEW1 EXHIBIT 99.1 Summary 1. Represents leasing status for the 2013/2014 academic year as of September 16, 2013, as compared to prior academic year final occupancy and rental rates as of September 30, 2012. 2. Represents average rental revenue per leased bed for the academic years presented. 3. Excludes properties sold in 2012 and 2013. 4. At the time of our acquisition of The Castilian in September 2012, the company underwrote occupancy at 75% due to the impact of The Callaway House Austin’s debut in the market in the same asset class. The Castilian is currently 72% occupied. Excluding The Castilian, occupancy at September 16, 2013 would be 94.9% for the Campus Acquisitions Portfolio as compared to 92.5% at September 30, 2012, and the Fall 2013 rental rate change for the portfolio would have been 2.1%. 5. Includes the following properties: (1) Avalon Heights in Tampa Bay, FL, (2) University Commons in Minneapolis, MN, (3) The Block in Austin, TX, (4) The Retreat in San Marcos, TX, and (5) University Heights in Knoxville, TN. 6. Represents September 30, 2012 occupancy per the previous portfolio owner. This portfolio was acquired by the company on November 30, 2012. 7. Based on Q1 2013 data, representing the first full quarter under ACC ownership. 8. Includes the following properties: (1) 7th Street Station in Corvallis, OR and (2) The Plaza Apartments in Tallahassee, FL. 9. Includes 7 wholly-owned properties that completed construction and opened for operations in August and September 2013. Also includes Townhomes at Newtown Crossing, a property subject to a presale agreement that completed construction in August 2013 and is anticipated to be purchased by the company in September 2013. Units Beds 2013/2014 2012/2013 Q4 2013 Same Store Wholly-owned Properties Legacy Properties3 19,416 62,552 97.0% 96.9% 2.5% 1.4% 565.27 $ 557.62 $ 2012 Acquisitions-Campus Acquisitions Portfolio4 2,500 6,590 92.7% 93.8% -0.9% -0.7% 721.95 $ 726.80 $ 2012 Acquisitions-Other5 1,434 4,205 98.1% 98.7% 2.7% 1.0% 667.00 $ 660.72 $ Subtotal - Q4 2013 Same Store Wholly-owned Properties 23,350 73,347 96.7% 96.8% 2.2% 1.1% 584.69 $ 578.51 $ New Wholly-owned Properties Kayne Anderson Portfolio 4,224 12,049 96.7% 92.2% 6 0.3% -1.1% 611.65 $ 618.45 $ 7 2013 Acquisitions8 371 668 89.3% n/a n/a n/a 560.74 $ n/a 2013 Development Deliveries9 1,233 4,553 98.2% n/a n/a n/a 809.85 $ n/a Subtotal - New Wholly-owned Properties 5,828 17,270 96.8% n/a n/a n/a 662.86 $ n/a Total - Wholly-owned Properties 29,178 90,617 96.7% n/a n/a n/a 599.61 $ n/a Rental Revenue per Leased Bed for Academic Year2 Leasing Status as of Property Type Fall 2013 Initial Rental Rate Change Fall 2013 Final Rental Rate Change September 16, 2013 September 30, 2012