Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WEST PHARMACEUTICAL SERVICES INC | form8kinvestorconfsept11-1.htm |

1 West Pharmaceutical Services, Inc. Investor Conference New York, NY September 11-12, 2013

2 Safe Harbor Statement Cautionary Statement Under the Private Securities Litigation Reform Act of 1995 This presentation and any accompanying management commentary contain “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about expected financial results for 2013 and future years. Each of these estimates is based on preliminary information, and actual results could differ from these preliminary estimates. We caution investors that the risk factors listed under “Cautionary Statement” in our press releases, as well as those set forth under the caption "Risk Factors" in our most recent Annual Report on Form 10-K as filed with the Securities and Exchange Commission and as revised or supplemented by our quarterly reports on Form 10-Q, could cause our actual results to differ materially from those estimated or predicted in the forward-looking statements. You should evaluate any statement in light of these important factors. Except as required by law or regulation, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events, or otherwise. Non-GAAP Financial Measures Certain financial measures included in these presentation materials, or which may be referred to in management’s discussion of the Company’s results and outlook, have not been calculated in accordance with generally accepted accounting principles (“GAAP”), and therefore are referred to as non-GAAP financial measures. Non-GAAP financial measures should not be considered in isolation or as an alternative to such measures determined in accordance with GAAP.

3 West’s Story Foundations for growth: • “By your side” for 90 Years Growth drivers Results and outlook

Partnering with our pharmaceutical, device and biotechnology customers from their beginnings, we’ve grown… …to become the preeminent supplier of products used in containing and administering small-volume parenteral drugs

5

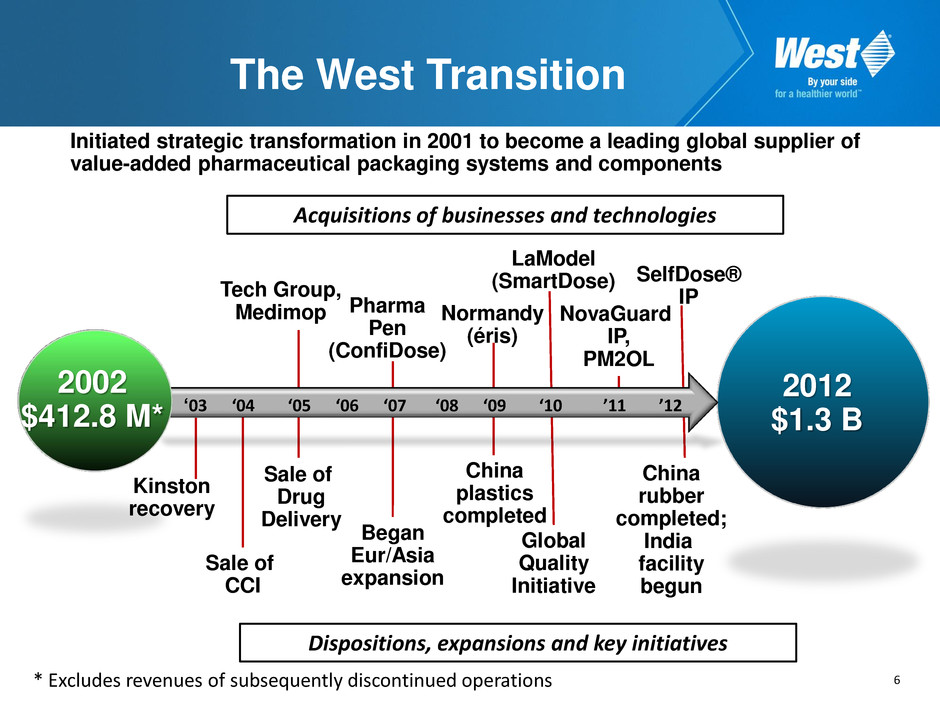

6 The West Transition Initiated strategic transformation in 2001 to become a leading global supplier of value-added pharmaceutical packaging systems and components ‘03 ‘04 ‘05 ‘06 ‘07 ‘08 ‘09 ‘10 ’11 ’12 2002 $412.8 M* 2012 $1.3 B Kinston recovery Sale of CCI Sale of Drug Delivery Tech Group, Medimop Began Eur/Asia expansion Pharma Pen (ConfiDose) Normandy (éris) LaModel (SmartDose) China plastics completed Global Quality Initiative SelfDose® IP China rubber completed; India facility begun * Excludes revenues of subsequently discontinued operations NovaGuard IP, PM2OL Acquisitions of businesses and technologies Dispositions, expansions and key initiatives

7 PHARMACEUTICAL / BIOTECHNOLOGY GENERIC MEDICAL DEVICE A Diverse, Stable Customer Base (representative healthcare customers) Industry-leading market shares in Europe and North America

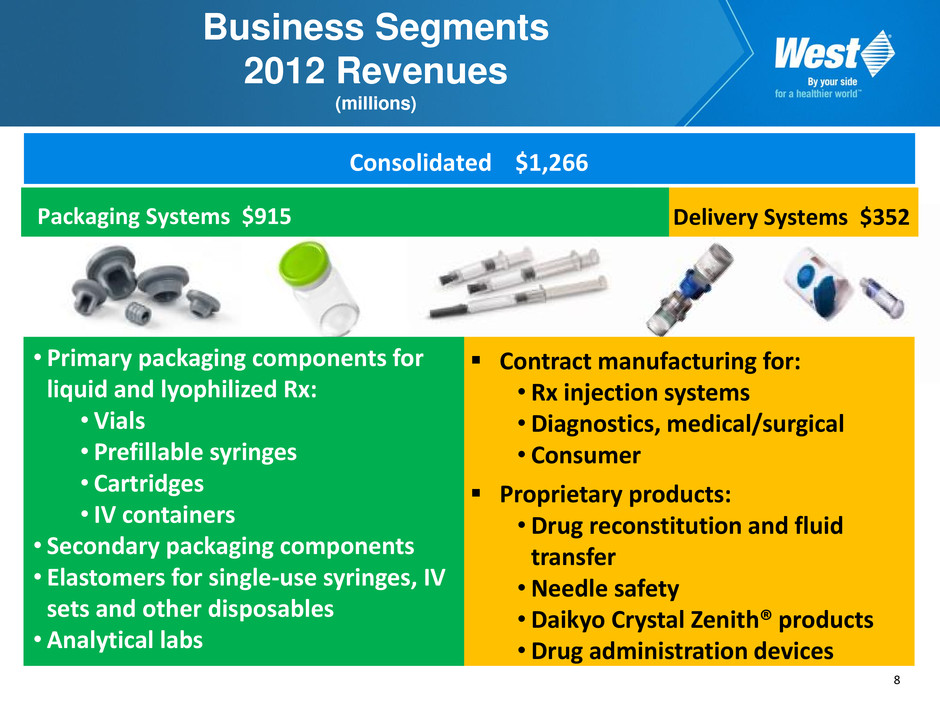

8 Business Segments 2012 Revenues (millions) Contract manufacturing for: • Rx injection systems • Diagnostics, medical/surgical • Consumer Proprietary products: • Drug reconstitution and fluid transfer • Needle safety •Daikyo Crystal Zenith® products • Drug administration devices • Primary packaging components for liquid and lyophilized Rx: • Vials • Prefillable syringes • Cartridges • IV containers • Secondary packaging components • Elastomers for single-use syringes, IV sets and other disposables • Analytical labs Packaging Systems $915 Delivery Systems $352 Consolidated $1,266

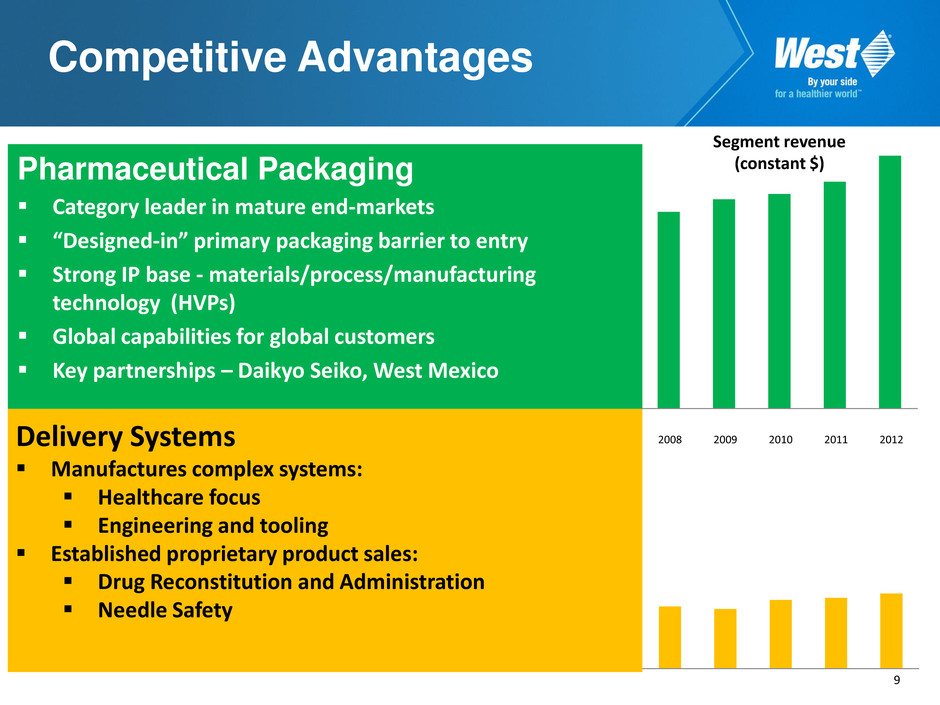

9 Competitive Advantages Pharmaceutical Packaging Category leader in mature end-markets “Designed-in” primary packaging barrier to entry Strong IP base - materials/process/manufacturing technology (HVPs) Global capabilities for global customers Key partnerships – Daikyo Seiko, West Mexico Delivery Systems Manufactures complex systems: Healthcare focus Engineering and tooling Established proprietary product sales: Drug Reconstitution and Administration Needle Safety 2008 2009 2010 2011 2012 Segment revenue (constant $)

10 Injectable Drug Growth: More, better, different Persistent growth of injectable therapeutics: • Insulins • Biologics and specialty drugs • Orphan drugs • Generics and biosimilars Increasing industry and regulatory standards: • Quality • Safety Changing point-of-care: • Patient focused - Ease of use • Needle safety Higher value per Rx and course of therapy Competitive end-markets: Differentiation Aging population Broader access to care: • Affordable Care Act • Pharmerging home markets

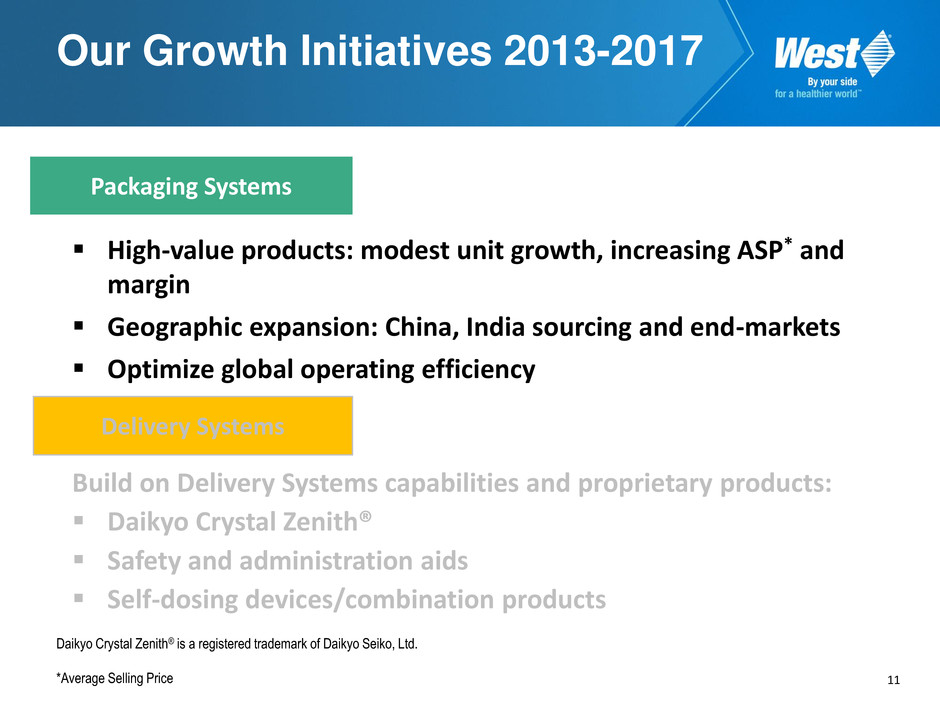

11 Our Growth Initiatives 2013-2017 Daikyo Crystal Zenith® is a registered trademark of Daikyo Seiko, Ltd. *Average Selling Price Packaging Systems Delivery Systems High-value products: modest unit growth, increasing ASP* and margin Geographic expansion: China, India sourcing and end-markets Optimize global operating efficiency Build on Delivery Systems capabilities and proprietary products: Daikyo Crystal Zenith® Safety and administration aids Self-dosing devices/combination products

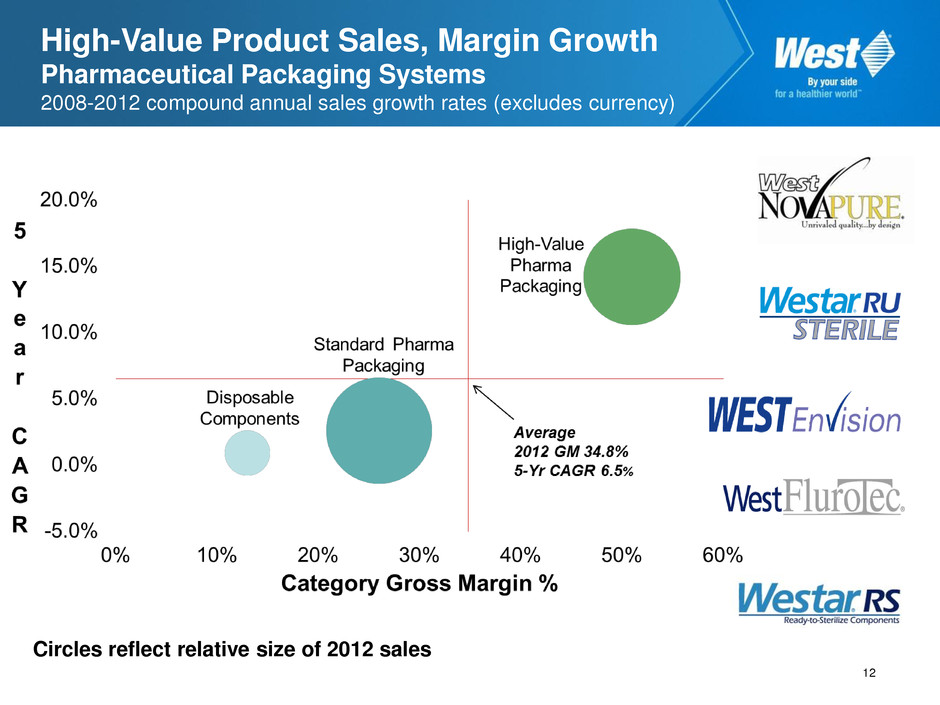

High-Value Product Sales, Margin Growth Pharmaceutical Packaging Systems 2008-2012 compound annual sales growth rates (excludes currency) Circles reflect relative size of 2012 sales 12

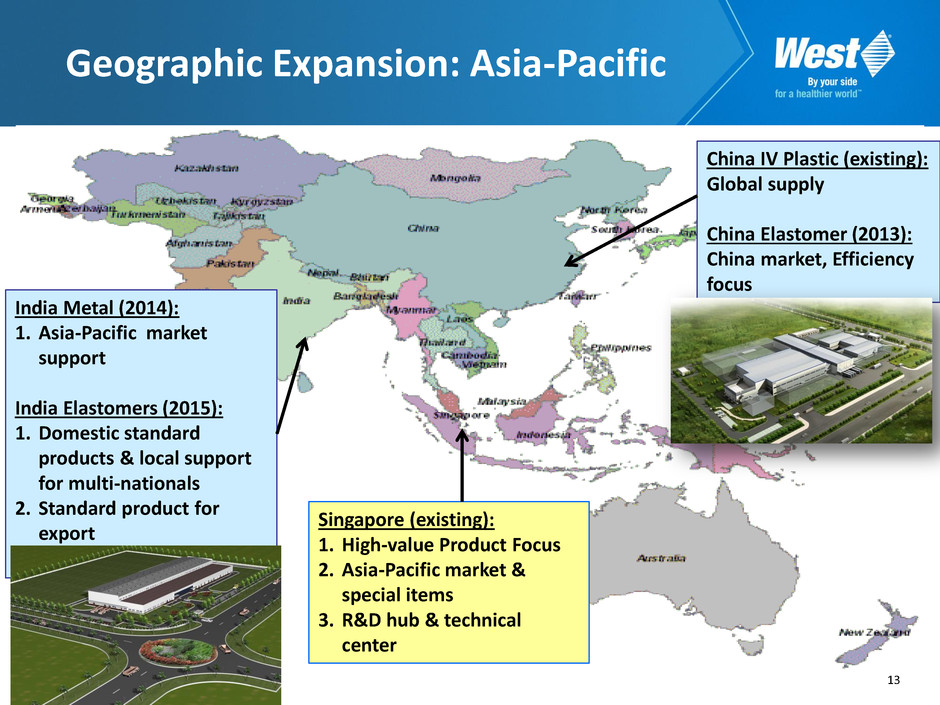

13 Geographic Expansion: Asia-Pacific Singapore (existing): 1. High-value Product Focus 2. Asia-Pacific market & special items 3. R&D hub & technical center China IV Plastic (existing): Global supply China Elastomer (2013): China market, Efficiency focus India Metal (2014): 1. Asia-Pacific market support India Elastomers (2015): 1. Domestic standard products & local support for multi-nationals 2. Standard product for export

14 Our Growth Initiatives 2013-2017 Daikyo Crystal Zenith® is a registered trademark of Daikyo Seiko, Ltd. *Average Selling Price Packaging Systems Delivery Systems High-value products: modest unit growth, increasing ASP* and margin Geographic expansion: China, India sourcing and end-markets Optimize global operating efficiency Build on Delivery Systems capabilities and proprietary products: Daikyo Crystal Zenith® Safety and administration aids Self-dosing devices/combination products

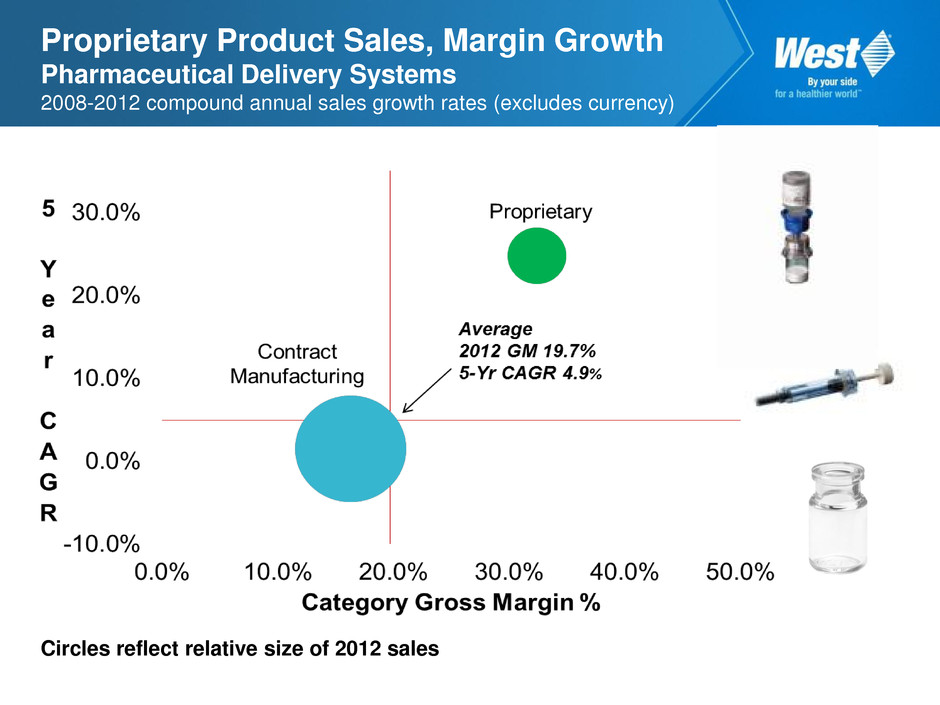

Proprietary Product Sales, Margin Growth Pharmaceutical Delivery Systems 2008-2012 compound annual sales growth rates (excludes currency) Circles reflect relative size of 2012 sales

16 Evolving with the Marketplace Since 2005, we have expanded our offering by adding innovative technologies and solutions through acquisition, licensing, strategic partnerships and internal development. Acquired The Tech Group Acquired Medimop Administration Systems 2005 Licensed NovaGuard™ Safety System 2006 Acquired PharmaPen Auto-injector 2007 Licensed Daikyo CZ Insert Needle Prefillable Syringe Systems 2008 Acquired éris needle safety device Prefillable Syringe Safety 2009 Acquired LaModel Electronic Patch Injector 2010 Marketing agreement Product Development Formation of PDS Division Acquired PM2OL Engineering Acquired NovaGuard SA Prefilled syringe safety 2011 SelfDose agreement with Janssen Self Injection System 2012

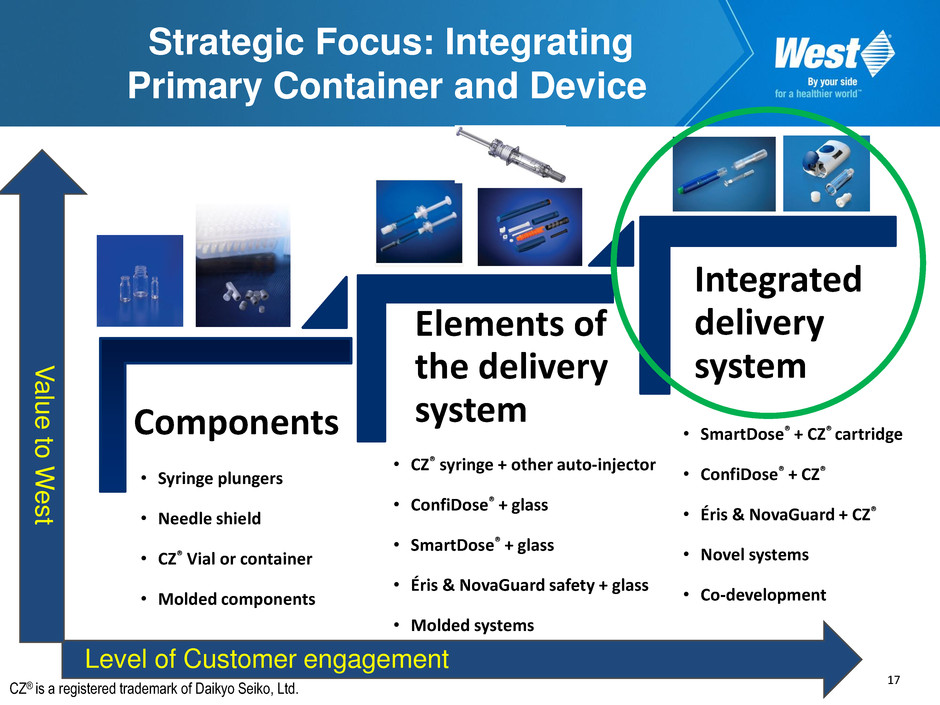

17 Strategic Focus: Integrating Primary Container and Device Components Elements of the delivery system Integrated delivery system • CZ® syringe + other auto-injector • ConfiDose® + glass • SmartDose® + glass • Éris & NovaGuard safety + glass • Molded systems • SmartDose® + CZ® cartridge • ConfiDose® + CZ® • Éris & NovaGuard + CZ® • Novel systems • Co-development Level of Customer engagement V alue to W e s t • Syringe plungers • Needle shield • CZ® Vial or container • Molded components CZ® is a registered trademark of Daikyo Seiko, Ltd.

18 Daikyo CZ Solution with Daikyo FluroTec® Barrier Film Reduces: • Drug exposure to extractables • Risk of protein aggregation caused by silicone oil • In-process breakage and product returns caused by broken glass • Risk of delamination and glass-particulate contamination • Associated product recall risk/cost Consistent piston release and travel forces All drug-contact materials have been used for marketed products FluroTec® is a registered trademark of Daikyo Seiko, Ltd.

19 Daikyo Crystal Zenith Product Approvals hyaluronic acid MRI contrast media bone cement 6 Contrast Media 5 MRI 2 Hyaluronic Acid 1 Calcitonin 1 Proton Pump Inhibitor fluconazole oncology anticoagulant 2 oncology 1 acyclovir hyaluronic acid 3 oncology API Container Japan MHLW Europe EMEA US FDA Calcitonin Bone cement Zometa Hyaluronic acid 19

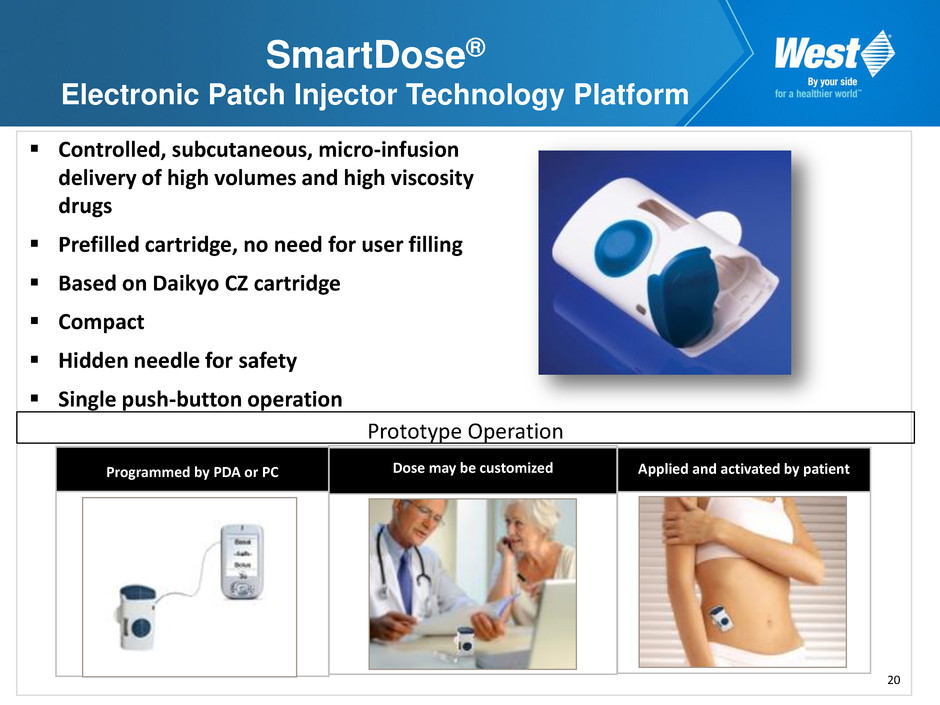

20 SmartDose® Electronic Patch Injector Technology Platform Programmed by PDA or PC Dose may be customized Applied and activated by patient Controlled, subcutaneous, micro-infusion delivery of high volumes and high viscosity drugs Prefilled cartridge, no need for user filling Based on Daikyo CZ cartridge Compact Hidden needle for safety Single push-button operation Prototype Operation

21 Recent Highlights Second-quarter results: • Revenue grew to $344.5 million, 5.7% higher ex-currency • Gross profit margin increased 180 bps, to 32.2% • $20 million exclusivity fee for SmartDoseTM Stock-split distributable September 26, 2013 • Record date of September 12, 2013 Twenty-first consecutive annual increase in cash dividend • Increase is for dividend payable November 6, 2013

22 Looking Forward 2013 expectations: • HVP growth continues to enhance sales mix Modest price increases vs. 2012 Customer inventory requirements • Lead times and backlog • New facility start-up costs to impact margins • Exchange-rate, commodity, and West share price volatility Expect long-term performance to be driven by: • Further HVP market penetration • “Lean” productivity gains • Execution in China, India • Commercialization of proprietary products See Risk Factors included in the Company’s 2012 annual report on Form 10-K, and any updates on Form 10-Q, for a complete listing of risk factors.

23 Key Take-Away Messages Key partner to pharmaceutical, biotech and medical device customers “Sticky” core business: significant barriers to change/entry Well positioned in fast-growing Asian markets Strong balance sheet, operating cash flow Disciplined, experienced, management team Incentives focus on growth, capital efficiency Twenty-one consecutive annual dividend increases Third-quarter 2013 earnings release and analyst call are currently scheduled for October 31, 2013

24 West Pharmaceutical Services, Inc.