Attached files

| file | filename |

|---|---|

| 8-K - 8-K - W R GRACE & CO | a8-kx091013keybancpresenta.htm |

W. R. Grace & Co. KeyBanc Basic Materials and Packaging Conference September 10, 2013 Hudson La Force Senior Vice President and Chief Financial Officer © 2013 W. R. Grace & Co.

2 © 2013 W. R. Grace & Co. Disclaimer Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995 This presentation contains forward-looking statements, that is, statements related to future, not past, events. Such statements generally include the words “believes,” “plans,” “intends,” “targets,” “will,” “expects,” “suggests,” “anticipates,” “outlook,” “continues” or similar expressions. Forward-looking statements include, without limitation, all statements regarding Grace’s Chapter 11 case; expected financial positions; results of operations; cash flows; financing plans; business strategy; budgets; capital and other expenditures; competitive positions; growth opportunities for existing products; benefits from new technology and cost reduction initiatives, plans and objectives; and markets for securities. For these statements, Grace claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Like other businesses, Grace is subject to risks and uncertainties that could cause its actual results to differ materially from its projections or that could cause other forward-looking statements to prove incorrect. Factors that could cause actual results to materially differ from those contained in the forward-looking statements include, without limitation: developments affecting Grace’s bankruptcy, proposed plan of reorganization and settlements with certain creditors, the cost and availability of raw materials (including rare earth) and energy, developments affecting Grace’s underfunded and unfunded pension obligations, risks related to foreign operations, especially in emerging regions, acquisitions and divestitures of assets and gains and losses from dispositions or impairments, the effectiveness of its research and development and growth investments, its legal and environmental proceedings, costs of compliance with environmental regulation and those factors set forth in Grace’s most recent Annual Report on Form 10-K, quarterly report on Form 10-Q and current reports on Form 8-K, which have been filed with the Securities and Exchange Commission and are readily available on the Internet at www.sec.gov. Reported results should not be considered as an indication of future performance. Readers are cautioned not to place undue reliance on Grace’s projections and forward-looking statements, which speak only as of the date thereof. Grace undertakes no obligation to publicly release any revisions to the forward-looking statements contained in this presentation, or to update them to reflect events or circumstances occurring after the date of this presentation. Non-GAAP Financial Terms These slides contain certain “non-GAAP financial terms” which are defined in the Appendix. Reconciliations of non-GAAP terms to the closest GAAP term (i.e., net income) are provided in the Appendix.

3 © 2013 W. R. Grace & Co. Discussion Outline Overview • Fast Facts • Delivering Shareholder Value Segment Updates • Catalyst Technologies • Materials Technologies • Construction Products 2013 Earnings Outlook 2014 Earnings Goal Strategy for Return of Capital Summary – Why Grace

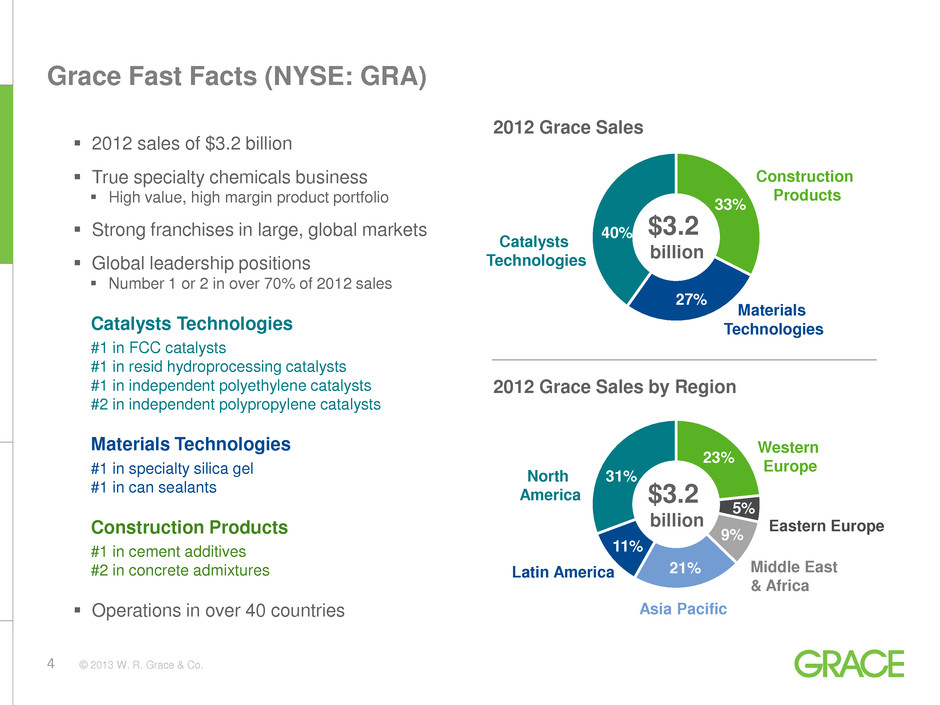

4 © 2013 W. R. Grace & Co. 23% 5% 9% 21% 11% 31% 33% 27% 40% Grace Fast Facts (NYSE: GRA) 2012 sales of $3.2 billion True specialty chemicals business High value, high margin product portfolio Strong franchises in large, global markets Global leadership positions Number 1 or 2 in over 70% of 2012 sales Catalysts Technologies #1 in FCC catalysts #1 in resid hydroprocessing catalysts #1 in independent polyethylene catalysts #2 in independent polypropylene catalysts Materials Technologies #1 in specialty silica gel #1 in can sealants Construction Products #1 in cement additives #2 in concrete admixtures Operations in over 40 countries 2012 Grace Sales 2012 Grace Sales by Region $3.2 billion $3.2 billion Catalysts Technologies Construction Products Materials Technologies North America Western Europe Eastern Europe Middle East & Africa Asia Pacific Latin America

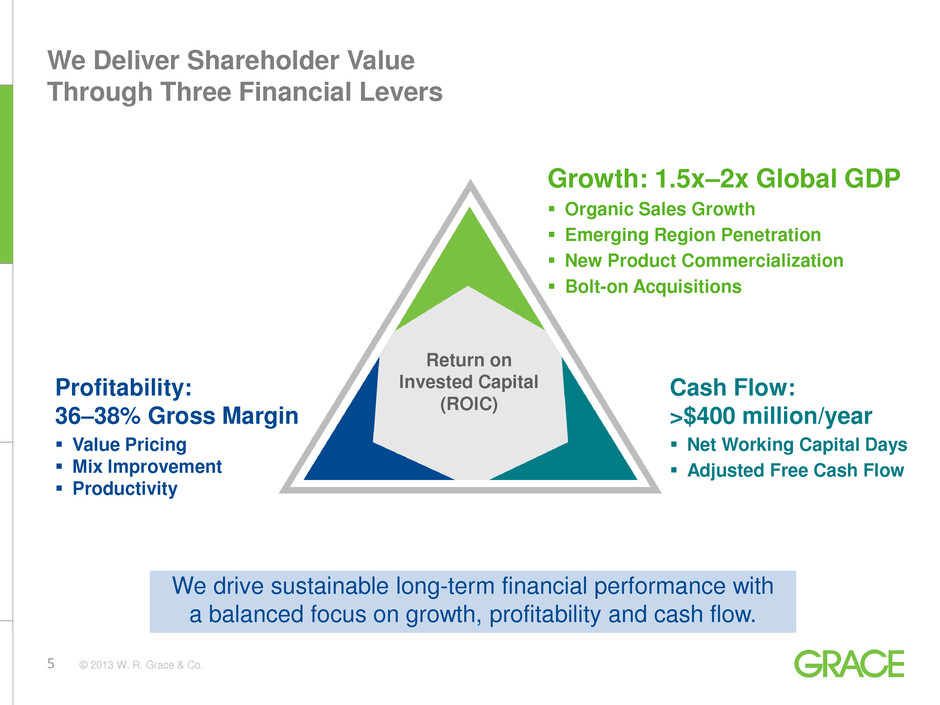

5 © 2013 W. R. Grace & Co. We drive sustainable long-term financial performance with a balanced focus on growth, profitability and cash flow. We Deliver Shareholder Value Through Three Financial Levers Growth: 1.5x–2x Global GDP Organic Sales Growth Emerging Region Penetration New Product Commercialization Bolt-on Acquisitions Cash Flow: >$400 million/year Net Working Capital Days Adjusted Free Cash Flow Profitability: 36–38% Gross Margin Value Pricing Mix Improvement Productivity Return on Invested Capital (ROIC)

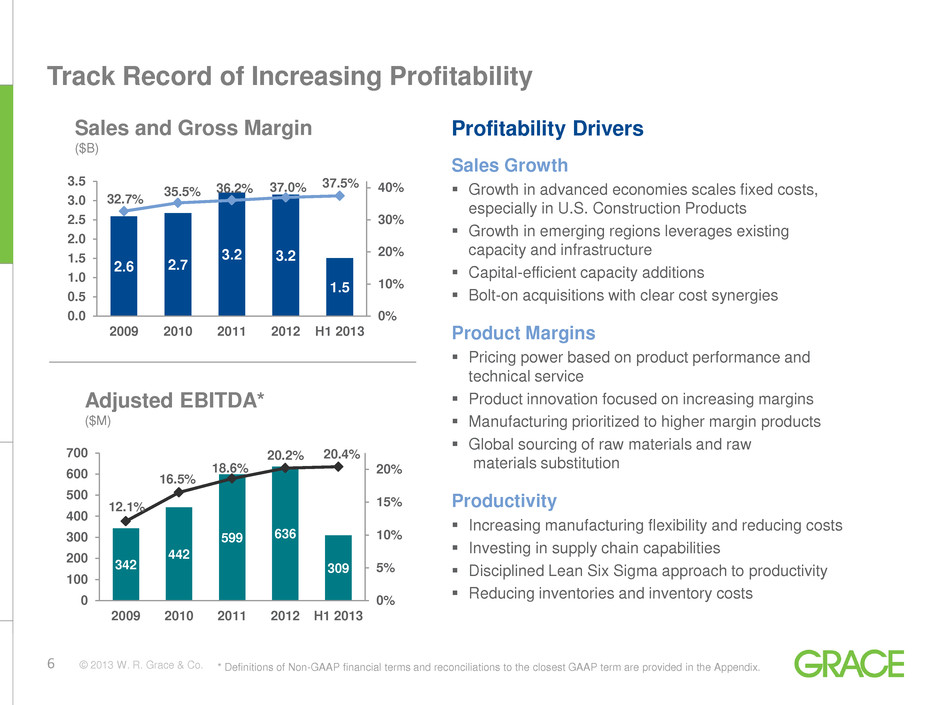

6 © 2013 W. R. Grace & Co. Track Record of Increasing Profitability * Definitions of Non-GAAP financial terms and reconciliations to the closest GAAP term are provided in the Appendix. 2.6 2.7 3.2 3.2 1.5 32.7% 35.5% 36.2% 37.0% 37.5% 0% 10% 20% 30% 40% 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 2009 2010 2011 2012 H1 2013 Sales and Gross Margin ($B) Profitability Drivers Sales Growth Growth in advanced economies scales fixed costs, especially in U.S. Construction Products Growth in emerging regions leverages existing capacity and infrastructure Capital-efficient capacity additions Bolt-on acquisitions with clear cost synergies Product Margins Pricing power based on product performance and technical service Product innovation focused on increasing margins Manufacturing prioritized to higher margin products Global sourcing of raw materials and raw materials substitution Productivity Increasing manufacturing flexibility and reducing costs Investing in supply chain capabilities Disciplined Lean Six Sigma approach to productivity Reducing inventories and inventory costs 342 442 599 636 309 12.1% 16.5% 18.6% 20.2% 20.4% 0% 5% 10% 15% 20% 0 100 200 300 400 500 600 700 2009 2010 2011 2012 H1 2013 Adjusted EBITDA* ($M)

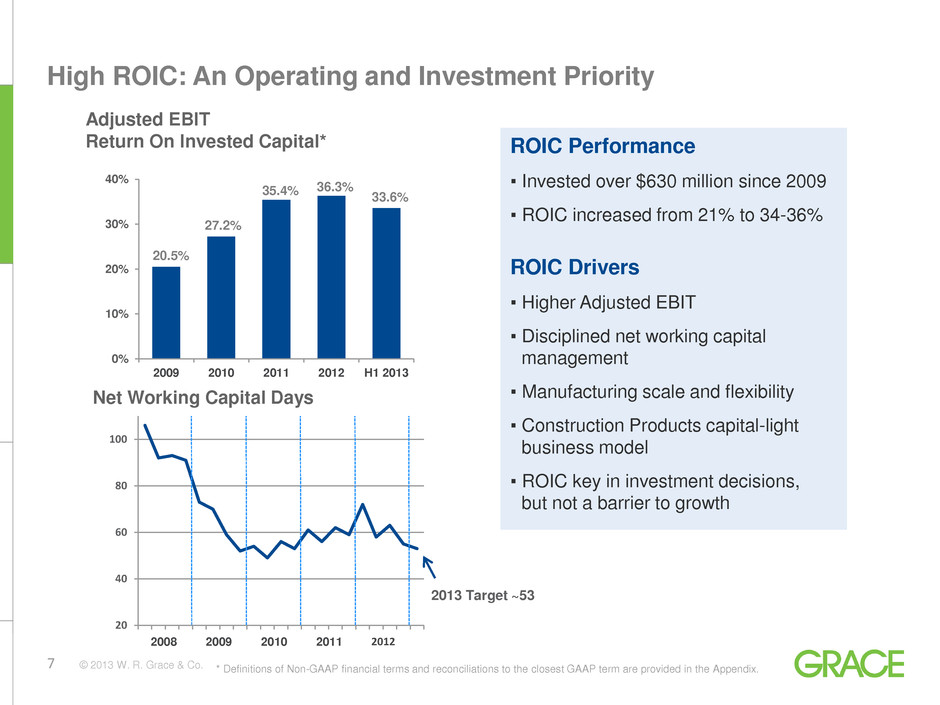

7 © 2013 W. R. Grace & Co. 0% 10% 20% 30% 40% 2009 2010 2011 2012 H1 2013 ROIC Performance ▪ Invested over $630 million since 2009 ▪ ROIC increased from 21% to 34-36% ROIC Drivers ▪ Higher Adjusted EBIT ▪ Disciplined net working capital management ▪ Manufacturing scale and flexibility ▪ Construction Products capital-light business model ▪ ROIC key in investment decisions, but not a barrier to growth Adjusted EBIT Return On Invested Capital* High ROIC: An Operating and Investment Priority 27.2% 35.4% 20.5% 36.3% Net Working Capital Days 20 40 60 80 100 2008 2011 2010 2009 2012 2013 Target ~53 33.6% * Definitions of Non-GAAP financial terms and reconciliations to the closest GAAP term are provided in the Appendix.

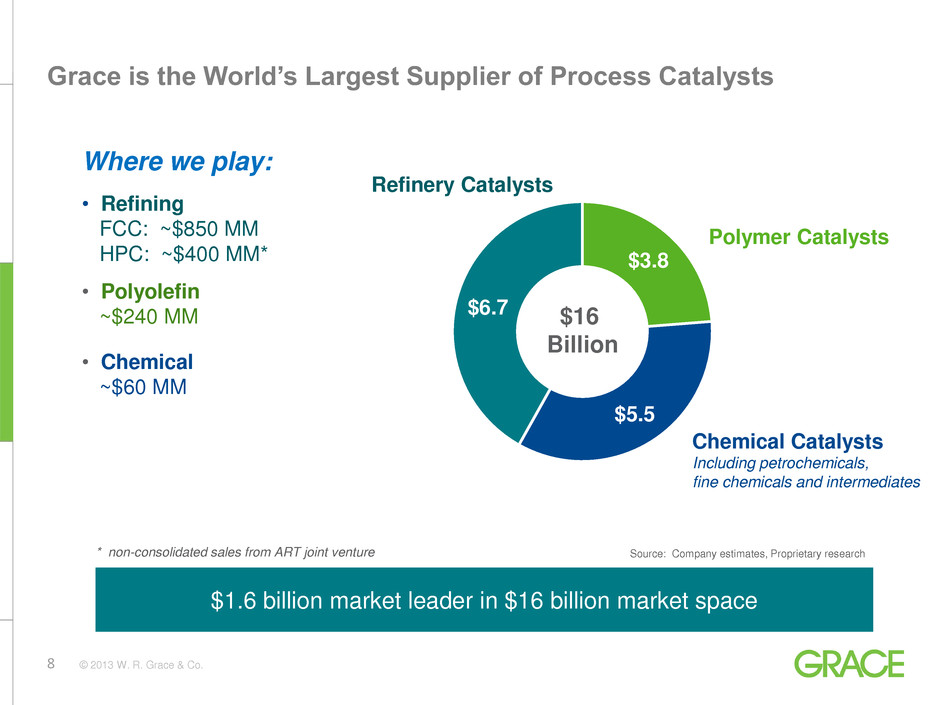

8 © 2013 W. R. Grace & Co. Grace is the World’s Largest Supplier of Process Catalysts * non-consolidated sales from ART joint venture Source: Company estimates, Proprietary research Where we play: • Refining FCC: ~$850 MM HPC: ~$400 MM* • Polyolefin ~$240 MM • Chemical ~$60 MM $1.6 billion market leader in $16 billion market space $6.5 B $5.6 B $3.9 B $3.8 $5.5 $6.7 $16 Billion Polymer Catalysts Refinery Catalysts Chemical Catalysts Including petrochemicals, fine chemicals and intermediates

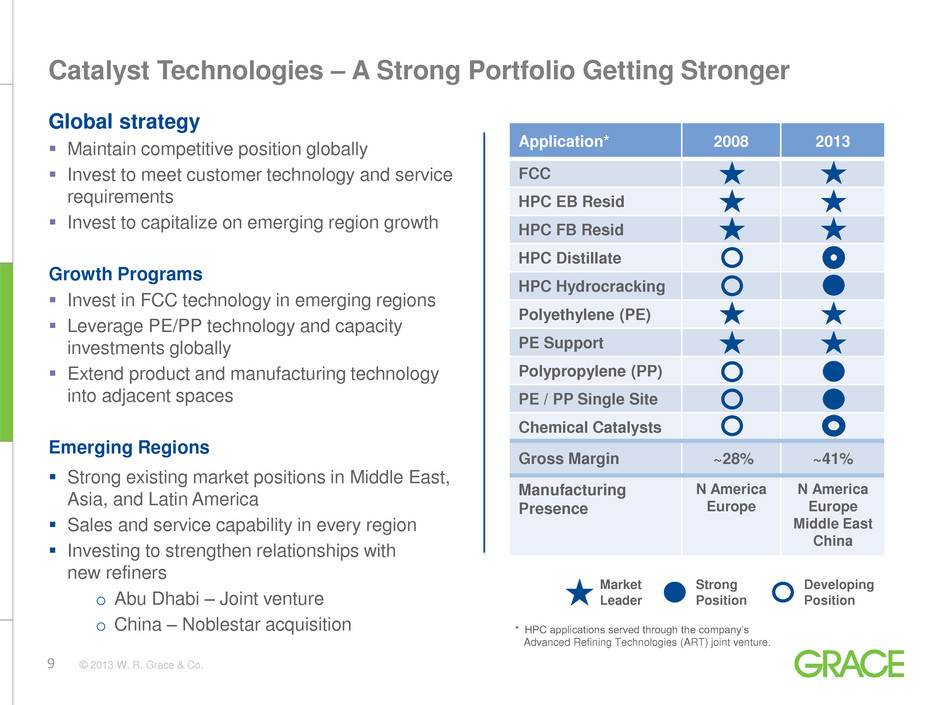

9 © 2013 W. R. Grace & Co. Catalyst Technologies – A Strong Portfolio Getting Stronger Global strategy Maintain competitive position globally Invest to meet customer technology and service requirements Invest to capitalize on emerging region growth Growth Programs Invest in FCC technology in emerging regions Leverage PE/PP technology and capacity investments globally Extend product and manufacturing technology into adjacent spaces Emerging Regions Strong existing market positions in Middle East, Asia, and Latin America Sales and service capability in every region Investing to strengthen relationships with new refiners o Abu Dhabi – Joint venture o China – Noblestar acquisition Application* 2008 2013 FCC HPC EB Resid HPC FB Resid HPC Distillate HPC Hydrocracking Polyethylene (PE) PE Support Polypropylene (PP) PE / PP Single Site Chemical Catalysts Gross Margin ~28% ~41% Manufacturing Presence N America Europe N America Europe Middle East China Market Leader Developing Position Strong Position * HPC applications served through the company’s Advanced Refining Technologies (ART) joint venture.

10 © 2013 W. R. Grace & Co. FCC Catalyst – Growth Drivers Demand for transportation fuel: Global demand for transportation fuels growing ~2-3% annually Refining capacity, crude slate, regulation: 70+ new FCC units planned through 2018, primarily resid focused Heavier feedstocks to grow ~5% annually, primarily in emerging regions Environmental regulation and legislation Demand for petrochemical feedstocks: Growth in emerging regions driving demand for propylene FCC units a primary source of propylene supply Source: Oil and Gas Journal, May 2013 Worldwide Construction Update Demand growth driving tighter FCC supply conditions Site Country Capacity (K-bbl/day) Target Completion Jubail Saudia Arabia 400 2013 Nagarjuna India 120 2013 Tianjin China 200 2013 Nghi Son Vietnam 200 2013 Guangdong China 200 2014 Takreer Abu Dhabi 417 2014 Orissa India 300 2014 Zhangjiang China 300 2015 Pengerang Malaysia 300 2016 Examples of New Refineries Under Construction in Emerging Regions

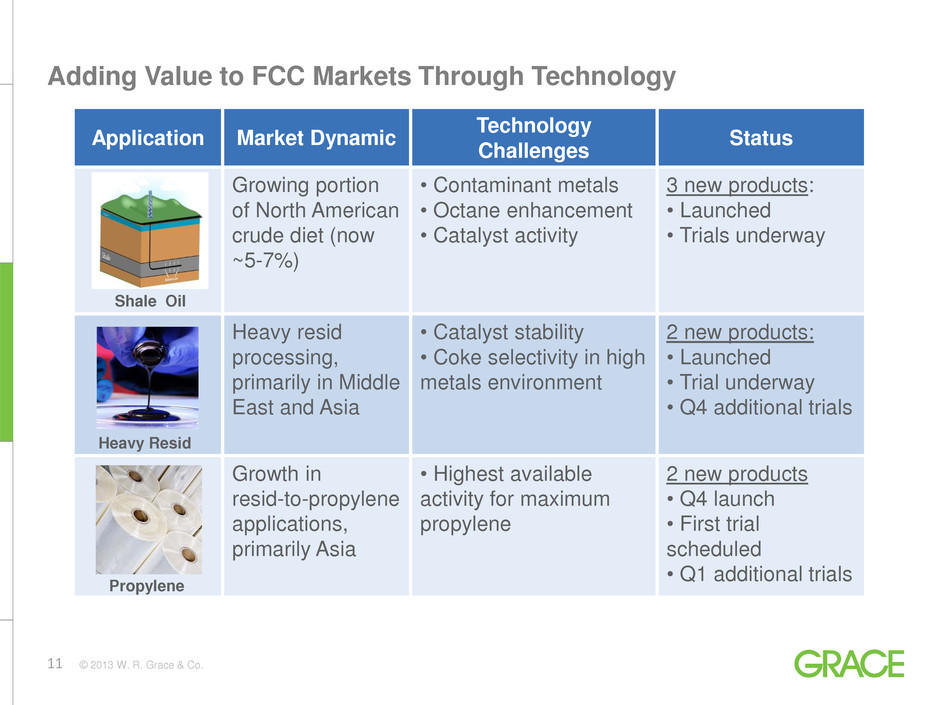

11 © 2013 W. R. Grace & Co. Adding Value to FCC Markets Through Technology Application Market Dynamic Technology Challenges Status Growing portion of North American crude diet (now ~5-7%) • Contaminant metals • Octane enhancement • Catalyst activity 3 new products: • Launched • Trials underway Heavy resid processing, primarily in Middle East and Asia • Catalyst stability • Coke selectivity in high metals environment 2 new products: • Launched • Trial underway • Q4 additional trials Growth in resid-to-propylene applications, primarily Asia • Highest available activity for maximum propylene 2 new products • Q4 launch • First trial scheduled • Q1 additional trials Shale Oil Heavy Resid Propylene

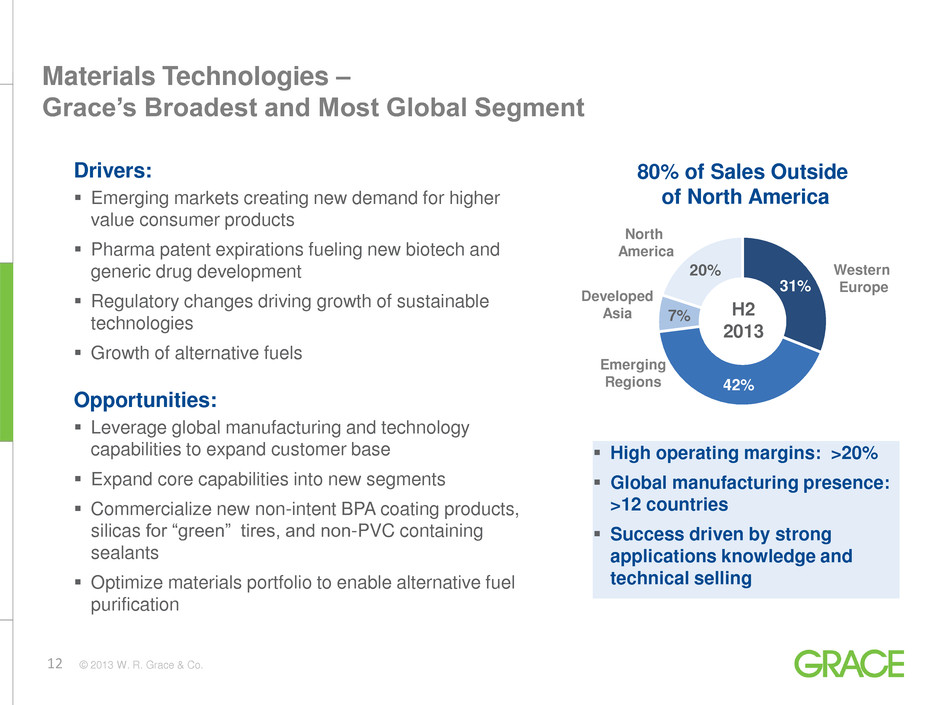

12 © 2013 W. R. Grace & Co. Drivers: Emerging markets creating new demand for higher value consumer products Pharma patent expirations fueling new biotech and generic drug development Regulatory changes driving growth of sustainable technologies Growth of alternative fuels Opportunities: Leverage global manufacturing and technology capabilities to expand customer base Expand core capabilities into new segments Commercialize new non-intent BPA coating products, silicas for “green” tires, and non-PVC containing sealants Optimize materials portfolio to enable alternative fuel purification 31% 42% 7% 20% 80% of Sales Outside of North America North America Western Europe Emerging Regions Developed Asia H2 2013 High operating margins: >20% Global manufacturing presence: >12 countries Success driven by strong applications knowledge and technical selling Materials Technologies – Grace’s Broadest and Most Global Segment

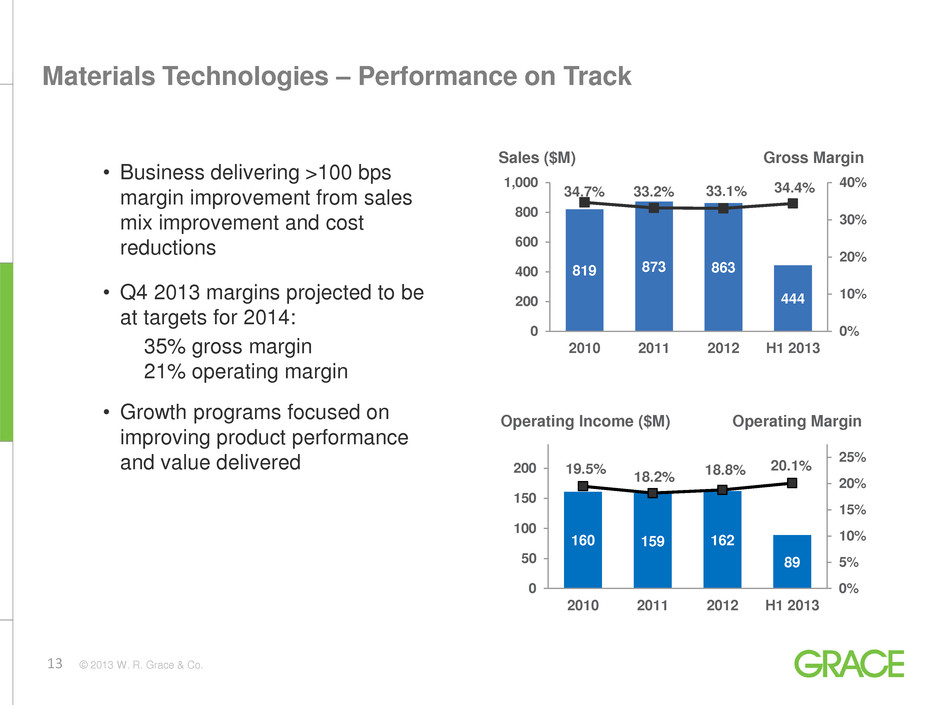

13 © 2013 W. R. Grace & Co. 819 873 863 444 34.7% 33.2% 33.1% 34.4% 0% 10% 20% 30% 40% 0 200 400 600 800 1,000 2010 2011 2012 H1 2013 160 159 162 89 19.5% 18.2% 18.8% 20.1% 0% 5% 10% 15% 20% 25% 0 50 100 150 200 2010 2011 2012 H1 2013 • Business delivering >100 bps margin improvement from sales mix improvement and cost reductions • Q4 2013 margins projected to be at targets for 2014: 35% gross margin 21% operating margin • Growth programs focused on improving product performance and value delivered Materials Technologies – Performance on Track Sales ($M) Gross Margin Operating Income ($M) Operating Margin

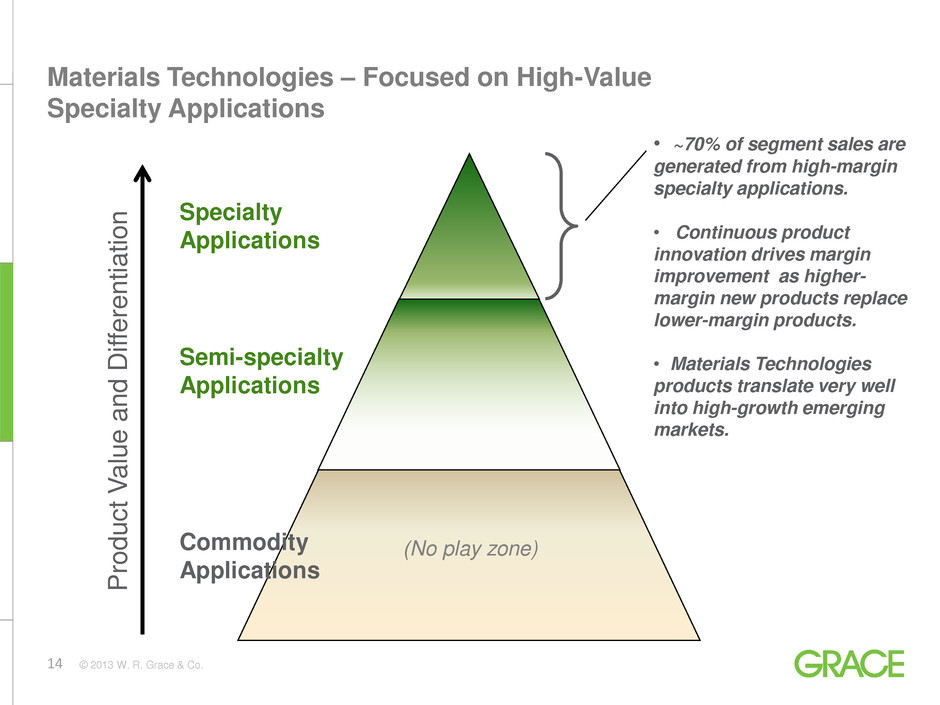

14 © 2013 W. R. Grace & Co. Specialty Applications Semi-specialty Applications Commodity Applications Produ c t V alue and Di fferentiatio n • ~70% of segment sales are generated from high-margin specialty applications. • Continuous product innovation drives margin improvement as higher- margin new products replace lower-margin products. • Materials Technologies products translate very well into high-growth emerging markets. Materials Technologies – Focused on High-Value Specialty Applications (No play zone)

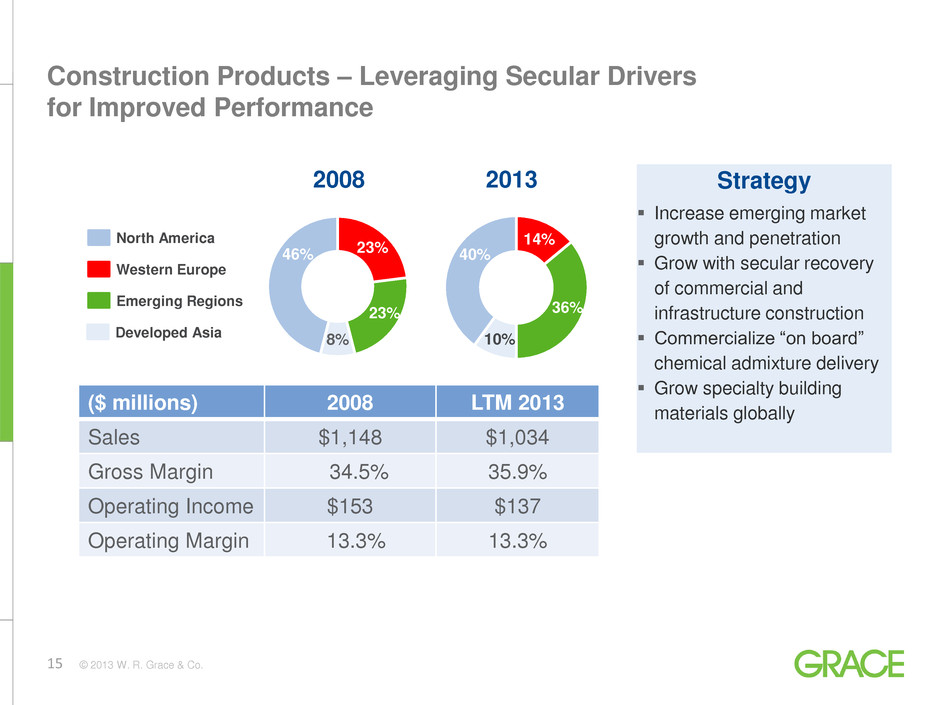

15 © 2013 W. R. Grace & Co. Strategy Increase emerging market growth and penetration Grow with secular recovery of commercial and infrastructure construction Commercialize “on board” chemical admixture delivery Grow specialty building materials globally Construction Products – Leveraging Secular Drivers for Improved Performance FY 2008 23% 23% 8% 46% North America Western Europe 14% 36% 10% 40% Developed Asia ($ millions) 2008 LTM 2013 Sales $1,148 $1,034 Gross Margin 34.5% 35.9% Operating Income $153 $137 Operating Margin 13.3% 13.3% North America Western Europe Developed Asia Emerging Regions 2008 2013

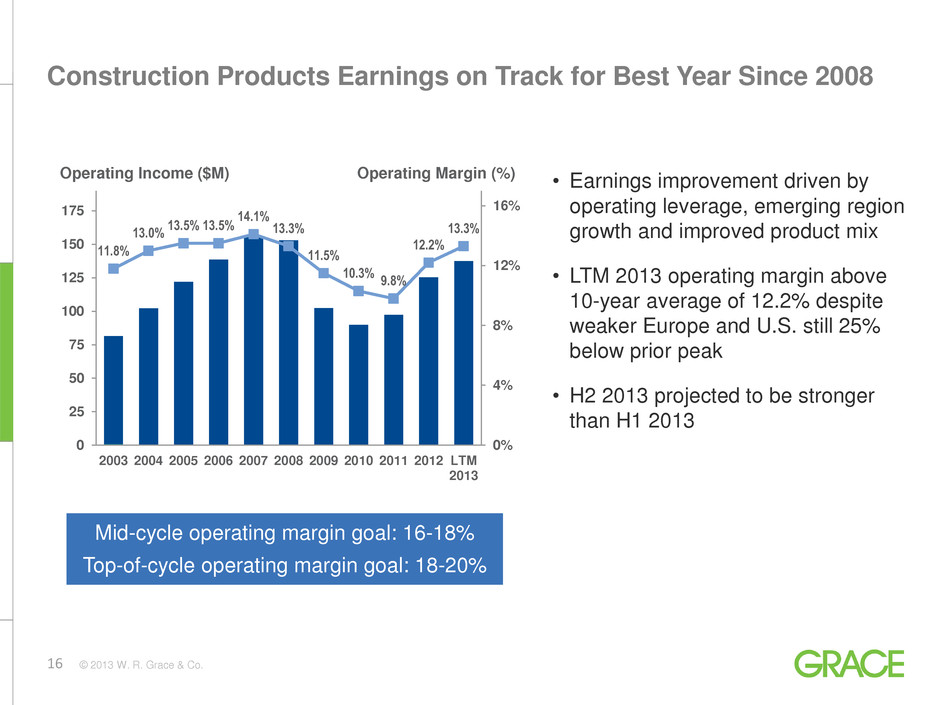

16 © 2013 W. R. Grace & Co. Construction Products Earnings on Track for Best Year Since 2008 11.8% 13.0% 13.5% 13.5% 14.1% 13.3% 11.5% 10.3% 9.8% 12.2% 13.3% 0% 4% 8% 12% 16% 0 25 50 75 100 125 150 175 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 LTM 2013 • Earnings improvement driven by operating leverage, emerging region growth and improved product mix • LTM 2013 operating margin above 10-year average of 12.2% despite weaker Europe and U.S. still 25% below prior peak • H2 2013 projected to be stronger than H1 2013 Operating Income ($M) Operating Margin (%) Mid-cycle operating margin goal: 16-18% Top-of-cycle operating margin goal: 18-20%

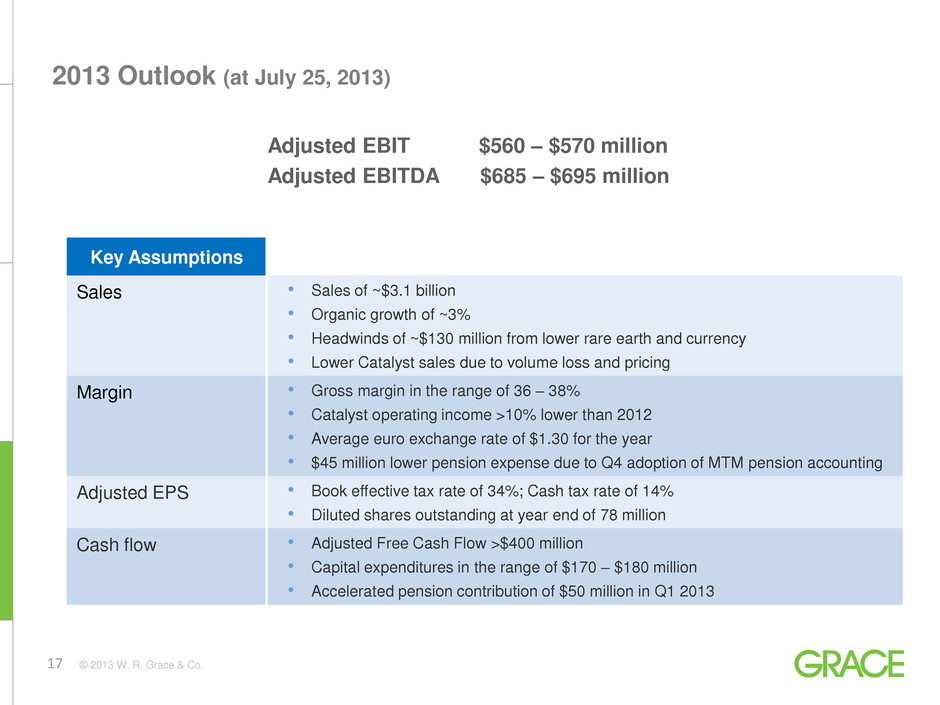

17 © 2013 W. R. Grace & Co. 2013 Outlook (at July 25, 2013) Key Assumptions Sales • Sales of ~$3.1 billion • Organic growth of ~3% • Headwinds of ~$130 million from lower rare earth and currency • Lower Catalyst sales due to volume loss and pricing Margin • Gross margin in the range of 36 – 38% • Catalyst operating income >10% lower than 2012 • Average euro exchange rate of $1.30 for the year • $45 million lower pension expense due to Q4 adoption of MTM pension accounting Adjusted EPS • Book effective tax rate of 34%; Cash tax rate of 14% • Diluted shares outstanding at year end of 78 million Cash flow • Adjusted Free Cash Flow >$400 million • Capital expenditures in the range of $170 – $180 million • Accelerated pension contribution of $50 million in Q1 2013 Adjusted EBIT $560 – $570 million Adjusted EBITDA $685 – $695 million

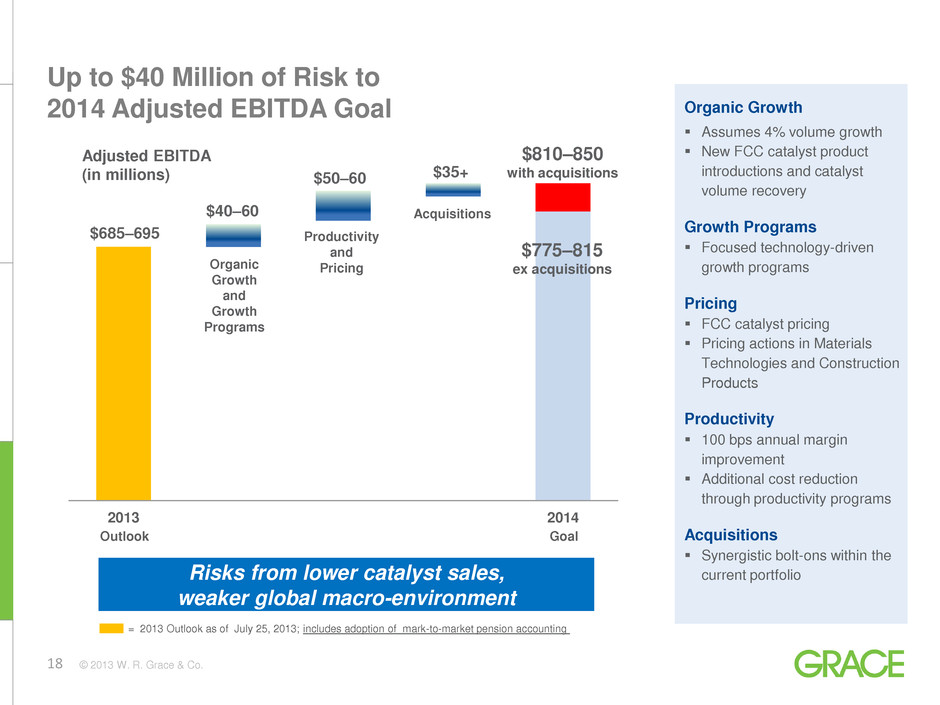

18 © 2013 W. R. Grace & Co. Organic Growth Assumes 4% volume growth New FCC catalyst product introductions and catalyst volume recovery Growth Programs Focused technology-driven growth programs Pricing FCC catalyst pricing Pricing actions in Materials Technologies and Construction Products Productivity 100 bps annual margin improvement Additional cost reduction through productivity programs Acquisitions Synergistic bolt-ons within the current portfolio Up to $40 Million of Risk to 2014 Adjusted EBITDA Goal 2013 2014 Risks from lower catalyst sales, weaker global macro-environment Organic Growth and Growth Programs Productivity and Pricing $35+ Adjusted EBITDA (in millions) $40–60 $685–695 Outlook Goal Acquisitions = 2013 Outlook as of July 25, 2013; includes adoption of mark-to-market pension accounting $50–60 $810–850 with acquisitions $775–815 ex acquisitions

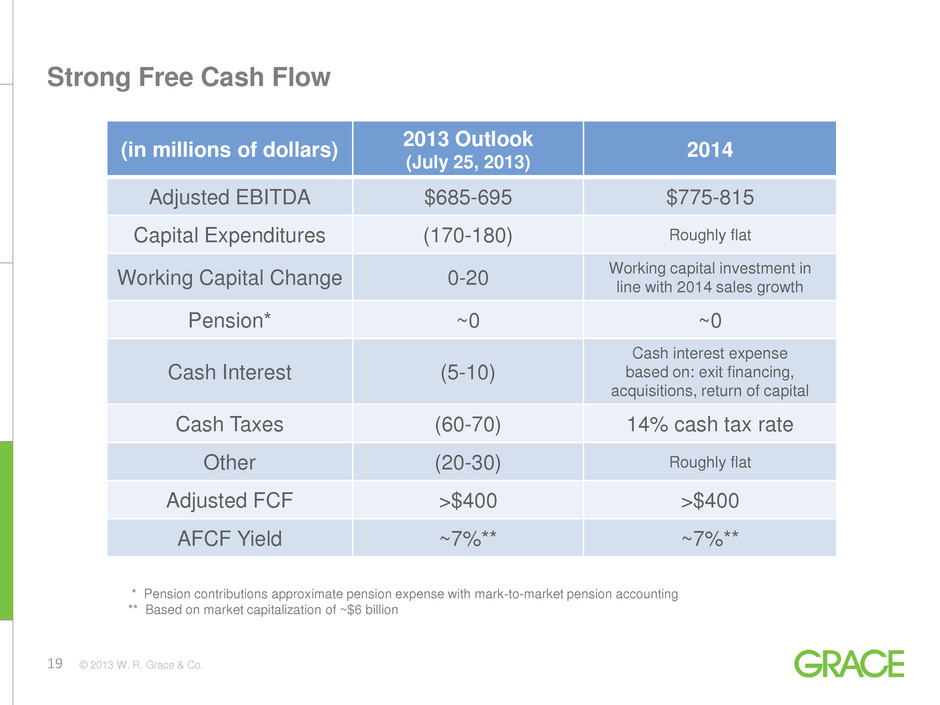

19 © 2013 W. R. Grace & Co. Strong Free Cash Flow (in millions of dollars) 2013 Outlook (July 25, 2013) 2014 Adjusted EBITDA $685-695 $775-815 Capital Expenditures (170-180) Roughly flat Working Capital Change 0-20 Working capital investment in line with 2014 sales growth Pension* ~0 ~0 Cash Interest (5-10) Cash interest expense based on: exit financing, acquisitions, return of capital Cash Taxes (60-70) 14% cash tax rate Other (20-30) Roughly flat Adjusted FCF >$400 >$400 AFCF Yield ~7%** ~7%** * Pension contributions approximate pension expense with mark-to-market pension accounting ** Based on market capitalization of ~$6 billion

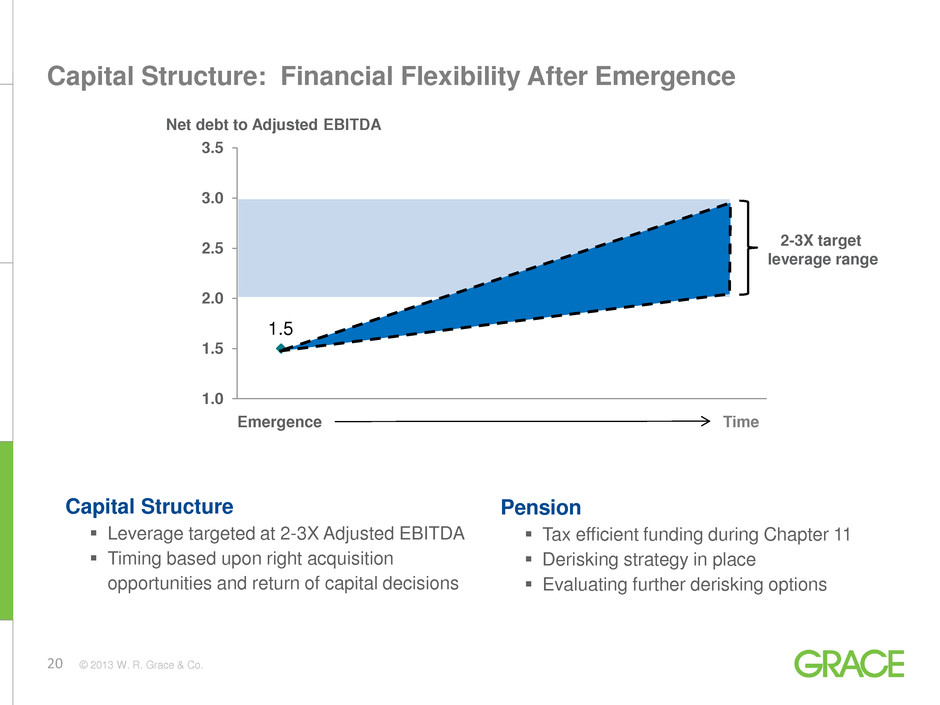

20 © 2013 W. R. Grace & Co. Capital Structure Leverage targeted at 2-3X Adjusted EBITDA Timing based upon right acquisition opportunities and return of capital decisions 1.5 1.0 1.5 2.0 2.5 3.0 3.5 Net debt to Adjusted EBITDA 2-3X target leverage range Emergence Time Pension Tax efficient funding during Chapter 11 Derisking strategy in place Evaluating further derisking options Capital Structure: Financial Flexibility After Emergence

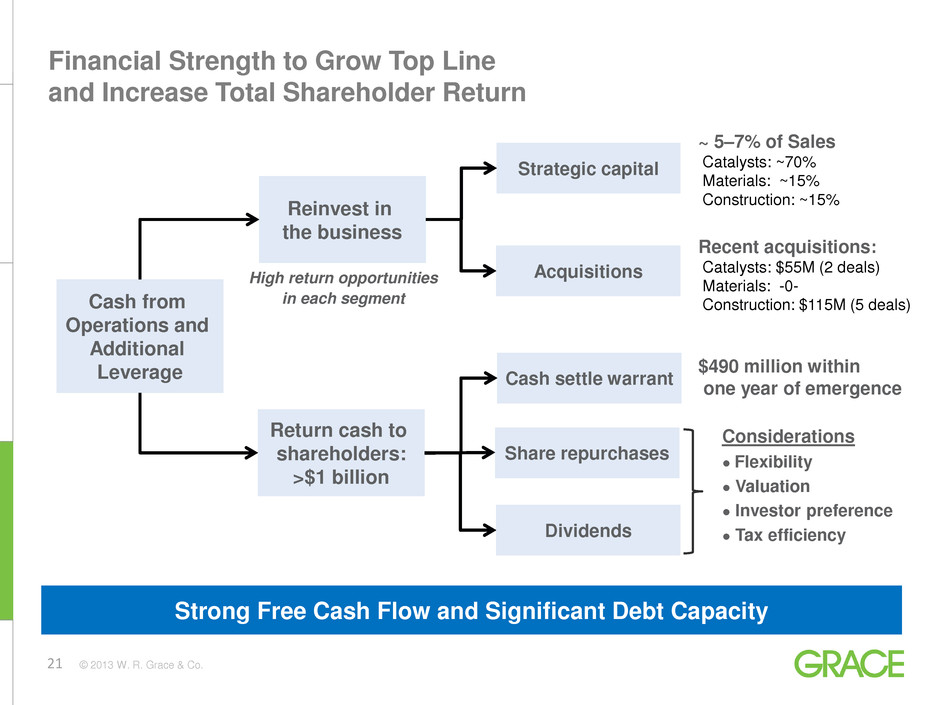

21 © 2013 W. R. Grace & Co. Cash from Operations and Additional Leverage Reinvest in the business Return cash to shareholders: >$1 billion Strategic capital Acquisitions Dividends Share repurchases High return opportunities in each segment ~ 5–7% of Sales Catalysts: ~70% Materials: ~15% Construction: ~15% Considerations ● Flexibility ● Valuation ● Investor preference ● Tax efficiency Recent acquisitions: Catalysts: $55M (2 deals) Materials: -0- Construction: $115M (5 deals) Financial Strength to Grow Top Line and Increase Total Shareholder Return Cash settle warrant $490 million within one year of emergence Strong Free Cash Flow and Significant Debt Capacity

22 © 2013 W. R. Grace & Co. Summary – Why Grace? Proven market leader delivering high-value technology in large global industries Strong financial track record Execution-focused management team Financial flexibility to return cash to shareholders post emergence Compelling valuation

23 © 2013 W. R. Grace & Co. For additional information, please visit www.grace.com or contact: J. Mark Sutherland Vice President, Investor Relations +1 410.531.4590 Mark.Sutherland@grace.com

24 © 2013 W. R. Grace & Co. Appendix I: Bankruptcy Update • Joint Plan of Reorganization approved by Bankruptcy Court and District Court • Favorable rulings received from Third Circuit Court on asbestos-related appeals – Garlock request for en banc rehearing denied September 5 – Other appeals denied September 4 • Court opinion on default interest appeal still pending • Emergence targeted for Q4 2013 – 60 to 90 days required for completing emergence documents – No exit financing required to implement Joint Plan – Appeals to the Supreme Court the remaining uncertainty • Emergence timing does not impact strategy, operating performance, capital investment priorities or investment opportunities

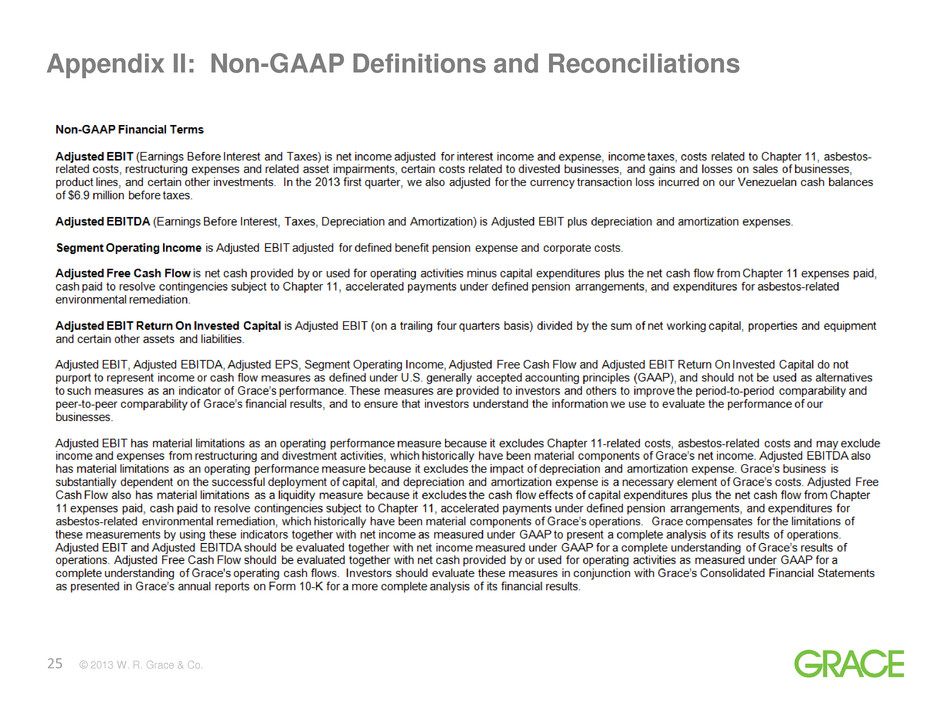

25 © 2013 W. R. Grace & Co. Appendix II: Non-GAAP Definitions and Reconciliations

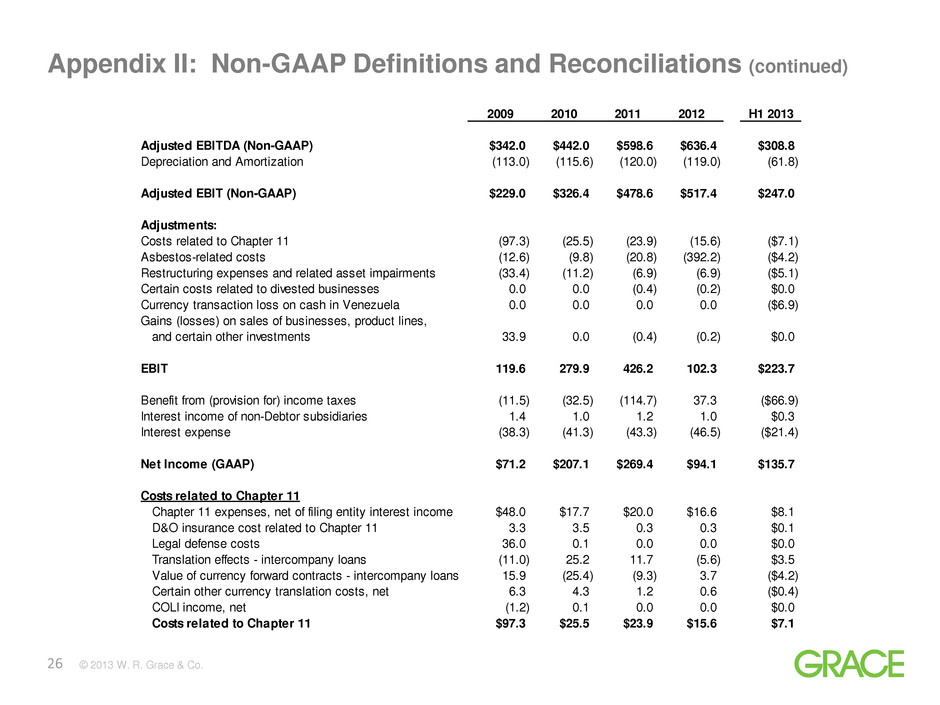

26 © 2013 W. R. Grace & Co. Appendix II: Non-GAAP Definitions and Reconciliations (continued) 2009 2010 2011 2012 H1 2013 Adjusted EBITDA (Non-GAAP) $342.0 $442.0 $598.6 $636.4 $308.8 Depreciation and Amortization (113.0) (115.6) (120.0) (119.0) (61.8) Adjusted EBIT (Non-GAAP) $229.0 $326.4 $478.6 $517.4 $247.0 Adjustments: Costs related to Chapter 11 (97.3) (25.5) (23.9) (15.6) ($7.1) Asbestos-related costs (12.6) (9.8) (20.8) (392.2) ($4.2) Restructuring expenses and related asset impairments (33.4) (11.2) (6.9) (6.9) ($5.1) Certain costs related to divested businesses 0.0 0.0 (0.4) (0.2) $0.0 Currency transaction loss on cash in Venezuela 0.0 0.0 0.0 0.0 ($6.9) Gains (losses) on sales of businesses, product lines, and certain other investments 33.9 0.0 (0.4) (0.2) $0.0 EBIT 119.6 279.9 426.2 102.3 $223.7 Benefit from (provision for) income taxes (11.5) (32.5) (114.7) 37.3 ($66.9) Interest income of non-Debtor subsidiaries 1.4 1.0 1.2 1.0 $0.3 Interest expense (38.3) (41.3) (43.3) (46.5) ($21.4) Net Income (GAAP) $71.2 $207.1 $269.4 $94.1 $135.7 Costs related to Chapter 11 Chapter 11 expenses, net of filing entity interest income $48.0 $17.7 $20.0 $16.6 $8.1 D&O insurance cost related to Chapter 11 3.3 3.5 0.3 0.3 $0.1 Legal defense costs 36.0 0.1 0.0 0.0 $0.0 Translation effects - intercompany loans (11.0) 25.2 11.7 (5.6) $3.5 Value of currency forward contracts - intercompany loans 15.9 (25.4) (9.3) 3.7 ($4.2) Certain other currency translation costs, net 6.3 4.3 1.2 0.6 ($0.4) COLI income, net (1.2) 0.1 0.0 0.0 $0.0 Costs related to Chapter 11 $97.3 $25.5 $23.9 $15.6 $7.1

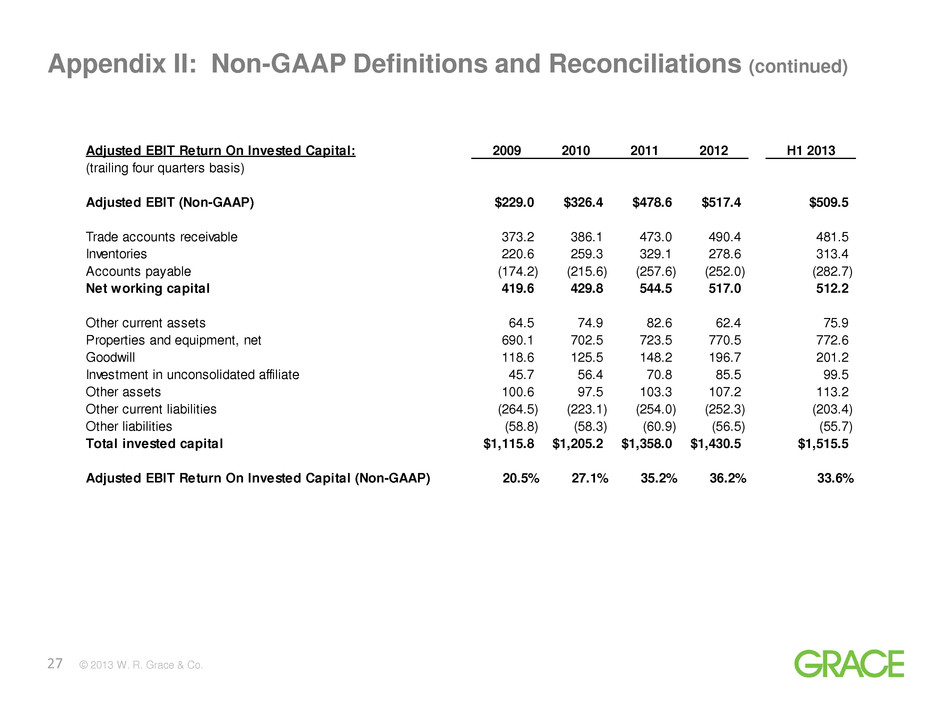

27 © 2013 W. R. Grace & Co. Appendix II: Non-GAAP Definitions and Reconciliations (continued) Adjusted EBIT Return On Invested Capital: 2009 2010 2011 2012 H1 2013 (trailing four quarters basis) Adjusted EBIT (Non-GAAP) $229.0 $326.4 $478.6 $517.4 $509.5 Trade accounts receivable 373.2 386.1 473.0 490.4 481.5 Inventories 220.6 259.3 329.1 278.6 313.4 Accounts payable (174.2) (215.6) (257.6) (252.0) (282.7) Net working capital 419.6 429.8 544.5 517.0 512.2 Other current assets 64.5 74.9 82.6 62.4 75.9 Properties and equipment, net 690.1 702.5 723.5 770.5 772.6 Goodwill 118.6 125.5 148.2 196.7 201.2 Investment in unconsolidated affiliate 45.7 56.4 70.8 85.5 99.5 Other assets 100.6 97.5 103.3 107.2 113.2 Other current liabilities (264.5) (223.1) (254.0) (252.3) (203.4) Other liabilities (58.8) (58.3) (60.9) (56.5) (55.7) Total invested capital $1,115.8 $1,205.2 $1,358.0 $1,430.5 $1,515.5 Adjusted EBIT Return On Invested Capital (Non-GAAP) 20.5% 27.1% 35.2% 36.2% 33.6%