Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - MoneyOnMobile, Inc. | clpi_8k.htm |

EXHIBIT 99.1

CALPIAN, INC.

CORPORATE PROFILE

August 19, 2013

MARKET DATA AND INDUSTRY INFORMATION REFERRED TO IN THIS MEMORANDUM ARE DERIVED FROM INDUSTRY SOURCES AND ESTIMATES BY THE MANAGEMENT OF DIGITAL PAYMENTS PROCESSING LIMITED, A COMPANY IN WHICH THE COMPANY HAS RECENTLY INVESTED. SUCH ESTIMATES ARE INHERENTLY IMPRECISE. ACCORDINGLY, READERS SHOULD NOT PLACE UNDUE RELIANCE ON SUCH INFORMATION.

CERTAIN PROJECTIONS PREPARED BY THIRD PARTIES AND STATEMENTS FROM THIRD-PARTY SOURCES ARE CONTAINED HEREIN. THE PROJECTIONS AND STATEMENTS WERE NOT PREPARED WITH A VIEW TOWARD COMPLYING WITH THE SEC’S PUBLISHED GUIDELINES REGARDING PROJECTED FINANCIAL INFORMATION. BECAUSE SUCH PROJECTIONS AND STATEMENTS ARE BASED ON A NUMBER OF ASSUMPTIONS AND ARE SUBJECT TO SIGNIFICANT UNCERTAINTIES AND CONTINGENCIES, MANY OF WHICH ARE BEYOND THE CONTROL OF THE COMPANY, THERE IS NO ASSURANCE THAT THEY WILL BE REALIZED, AND ACTUAL RESULTS WILL LIKELY VARY SIGNIFICANTLY FROM THOSE SHOWN. UNDER NO CIRCUMSTANCES SHOULD SUCH INFORMATION BE CONSTRUED AS A REPRESENTATION OR PREDICTION THAT THE COMPANY WILL ACHIEVE, OR IS LIKELY TO ACHIEVE, ANY PARTICULAR RESULTS.

THIS CORPORATE PROFILE SHALL NOT CONSTITUTE AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY ANY SECURITIES.

1

Executive Summary

Organizational History

Calpian was incorporated on May 30, 2006, as Toyzap.com, Inc., and became a public company on May 7, 2008, through a self-underwritten registered public offering of 4,000,000 shares of common stock. The offering raised $150,000 that was used to pursue a business strategy that never commenced operations. The “shell company” Toyzap.com, Inc. was acquired by members of the Company’s current management team, affiliates thereof, and certain other purchasers, on April 23, 2010, pursuant to purchase agreements whereby approximately 99% of the Company’s issued and outstanding Common Stock was acquired. At such time, the former management team and Board of Directors resigned and new Company management and Board of Directors was appointed, who then redirected the business focus of the Company to the business plan described below. On September 3, 2010, the Company changed its name to “Calpian, Inc.” pursuant to approval obtained at a meeting of our shareholders. The Company’s par value $.001 common stock (“Common Stock”) began trading on the OTCQB® (formerly the OTC Bulletin Board®) on March 4, 2009, and trades there under the symbol “CLPI.”

Business Overview

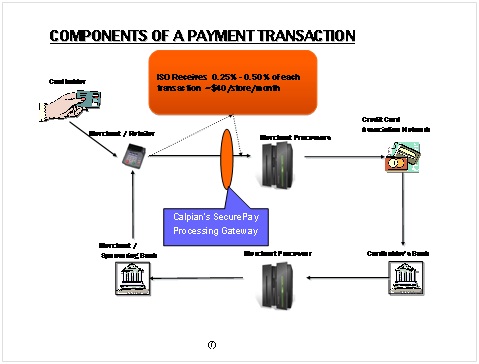

Headquartered in Dallas, Texas, Calpian, Inc. ("Company", "we", "our" and similar) are leaders in one section of the electronic payments industry known as "merchant acquiring". We acquire recurring monthly residual income streams derived from credit card processing fees paid by retail merchants in the United States (“residual portfolios”). Small and medium-sized retail merchants typically buy their credit card processing and acquiring services from Independent Sales Organizations (“ISOs”). ISOs are sales agents authorized by contract with one or more credit card processors to sell processing and acquiring services on their behalf. ISOs shepherd the merchant’s application for processing and acquiring services through the labyrinth of approvals, credit checks, guarantees, etc. that are required before the merchant can be approved to accept consumer credit cards for payment. We act not as a credit card processor, but simply as a purchaser of revenue streams resulting from the relationships between processors and ISOs and other ISOs. In addition, we may also seek to acquire servicing rights with respect to residual portfolios acquired from ISOs.

Our purchases of merchant residual portfolios are expected to range in size and complexity from one-time events involving a single portfolio to multiple events over an extended period covering the entire current and possibly future portfolios of an ISO. Our aim is to acquire merchant residual portfolios by acquiring them directly from the ISOs that originated the contracts with the merchants. In a residual portfolio purchase, we buy the rights to the residual revenue streams owned by the ISO for a negotiated amount. Prior to acquisition of the residual portfolio from the ISO, our Company and the ISO notify the processor that we plan to acquire the rights to the residual portfolio and that all future residual payments should be paid to us. Processors are required to approve all such acquisitions as a condition of closing.

In addition to acquiring established portfolios of merchant residuals, we also acquire ISOs who maintain direct sales forces to engage merchants directly and arrange credit and debit card processing services from notable processors. One such acquisition was to become our wholly-owned subsidiary, Calpian Commerce, Inc. for which we acquired assets in March 2013 for a purchase price of $9.75 million.

We advertise in industry trade journals, including Transaction World Magazine, to inform the ISO community of our acquisition capabilities. The most recent issue of Transaction World Magazine publishes monthly and circulates to nearly 14,000 readers. Transaction World Magazine is a wholly-owned subsidiary of ART Holdings, Inc. (“ART”). Harold Montgomery and Craig Jessen, both directors, executive officers, and controlling shareholders of Calpian, are founders, controlling shareholders, directors, and executive officers of ART.

2

Money-on-Mobile

(All currency references are quoted in U.S. dollars unless otherwise noted)

In March 2012, the Company began acquiring shares in Digital Payments Processing Limited, a newly formed Indian company of Mumbai, India ("DPPL") from DPPL’s founders. Such DPPL founders are the controlling shareholders of My Mobile Payments Limited (“MMPL”), an Indian company who, together with DPPL, offers a service, “Money on Mobile”, (DPPL, MMPL, and Money on Mobile collectively “MoM”) that is engaged in mobile payment processing. Calpian plans to acquire additional shares in DPPL in exchange for cash and shares of Calpian stock (utilizing a portion of the proceeds from this offering) until reaching an ownership interest in DPPL of approximately 74%. Accordingly, if all expected investment tranches are made, Calpian would have invested a total of $10.8 million in cash and issued a total of 6,123,077 shares of its common stock. A total of 4,863,077 of the Calpian shares subject to issuance are subject to being reclaimed by Calpian if certain financial performance metrics are not achieved by MoM. To date, Calpian has funded its purchase through the sale of its equity securities and through the issuance of subordinated debt. The following chart summarizes the terms of this investment opportunity:

Basic Investment Terms

|

Timing (Note 5)

|

Cash

|

CLPI Common

Shares (Note 1)

|

% of DPPL Acquired

|

|

Through July 30, 2013

|

$7,366,000

|

3,661,540

|

62.5% (Note 3)

|

|

MoM Management Equity Bonus

|

(26.8%) (Note 4)

|

||

|

Quarterly purchases of additional shares (or more frequently as funds are raised)

|

$3,434,000

|

2,461,537

|

38.3%

|

|

Maximum investment 24 months from initial closing

|

$10,800,000

|

6,123,077

|

74.0%

|

Notes:

Notes:

|

1.

|

1,260,000 of the Calpian shares granted at closing to the DPPL founders are fully vested and non-reclaimable. The remaining granted pursuant to this investment are subject to a reclamation formula based on achieving a percentage of profit goals through year 5 of the business plan.

|

|

2.

|

Calpian has the right, but not the obligation, to fund each quarter. Certain non-monetary penalties apply if Calpian is unable or unwilling to fund any particular quarterly tranche. Among the penalty provisions, Calpian would lose its exclusive right to fund future tranches of the investment program.

|

|

3.

|

Includes funds advanced but not yet certificated by DPPL. Under the Indian Companies Act, 1956, a 26% shareholding position provides protections for minority shareholders against dilution, debt, sale, and other events which might damage the minority’s interest.

|

|

4.

|

July 2013 Performance Bonus to Shashank Joshi – President MoM

|

|

5.

|

Calpian can accelerate the funding schedule at its discretion.

|

3

Use of Cash Funded by Calpian:

Calpian’s investment in DPPL funds the growth of DPPL. Shares issued by Calpian go to existing DPPL shareholders. DPPL management has informed us that it plans to use cash funded by Calpian as follows:

|

1.

|

Acceleration of distributor acquisition. This effort is expected to take the form of incentives to distributors to join the system and advertising and promotional activities.

|

|

2.

|

Finalization of bulk buying arrangements with major mobile phone service and television time providers (the later known as “Direct to Home” or “DTH”), in an effort to improve margins by as much as 100%.

|

|

3.

|

Acceleration of consumer customer acquisition. Funds devoted to incentives to retailers to add consumers to the system, and advertising and promotion efforts.

|

|

4.

|

Expansion of MoM’s IT infrastructure.

|

|

5.

|

Payment of MoM’s accrued expenses (<$100,000 USD).

|

|

6.

|

Adoption of new services to sell through the MoM platform such as utility bill payments, life insurance, entertainment and other similar products and services.

|

|

7.

|

Providing POS credit/debit card acceptance devices at MoM's leading 15,000 retailers located throughout India

|

|

8.

|

General working capital.

|

Certain Risks to Success for MoM:

Competitive – MoM believes it has the largest store network for mobile phone based transactions providing mobile top-up and DTH recharge services in India. Another company known as Beam Money (P) Limited (“Beam”) also provides these services, as well as domestic remittance transfers. However, it is not known whether other start-ups are attempting to launch businesses similar to MoM. In addition, several cell phone carriers have indicated an intent to enter the mobile money transfer business, notably Airtel and Vodafone (parent of Safaricom, the provider of M-PESA). These companies represent competitors with access to large markets of existing phone subscribers. MoM believes that the services these carriers intend to offer are different than MoM’s range of offerings. Further, MoM’s services are bank and phone provider interoperable which MoM believes positions it well against phone carrier-specific offerings.

Phone handset maker Nokia also launched a service known as Nokia Money, but withdrew the service in April 2012. Nokia Money is no longer active in the market.

Regulatory – The Reserve Bank of India (“RBI”) writes and enforces regulations that govern MoM’s activities. Pertinent regulations are new. RBI may change its approach or reverse certain regulations which may make it difficult or impossible for the company to operate or achieve the level of equity ownership desired. The Foreign Investment Promotion Board also grants permission and sets standards for foreign investment in India.

Financial – Calpian may not be able to fund subsequent tranches of investment in MoM.

MoM is in the early stages of its development. Although its business plan has been carefully designed to assist in capturing market share as fast as possible, unexpected events could force management to use cash faster than planned or to require more cash than currently projected.

Our investment in DPPL is based upon an initial business plan and financial projections. If those projections prove not to be accurate, MoM's need for cash to affect its business plan could be more or less than the original projections.

Governance -- Calpian’s investment strategy calls for sequential investments over time, at the end of which, Calpian is expected to own approximately 74% of DPPL. Under Indian law, a 26% stake entitles minority shareholders to minority protection rights. Specifically minority shareholders are protected against dilution, debt, sale, and other events, which might damage the minority’s interest. Calpian will have representation on the MoM board and plans to visit the company’s offices in India several times annually or more often as needed.

4

Consumer Acceptance – MoM has identified two potential revenue streams – first, business-to-business (B2B) activity, consisting of the reselling of prepaid phone and prepaid TV time to retailers who then resell that time to consumers. This activity is currently operational and generating revenues. The second way MoM plans to generate revenues is to empower consumers to use their cell phones to make payments directly to their vendors including phone, TV, utility and even other consumers. Such direct person-to-person transfer payments are known as domestic remittances. According to BankNetIndia, the total transaction value of domestic remittance in India stood at US$ 13.0 billion in 2010 with 80% of domestic remittance directed towards rural areas. This overall market is expected to reach about US$ 20.3 billion by 2014, growing at a compound annual growth rate of 12%. Since the majority of domestic remittance transactions are conducted in cash, official data reports of domestic remittance volume are believed to account for less than 100% of the total volume.

MoM's business model generates revenue from two primary; phone and TV bulk buying discounts (a proven current source of revenue), and consumer fees (3% per transaction) applied to transactions not involving purchase of a service. In other words, if a consumer purchases mobile top up time, MoM receives a bulk discount from the phone carrier averaging about 5%, which is one source of the company’s $14.6 million in gross revenues for the month of March 2013, along with fees and discounts associated with Direct to Home (Satellite) TV sales. If the consumer sends money to another consumer, MoM charges a 3% transaction fee. It is not proven that consumers will accept this charge point although examples in other markets such as M-PESA (Kenya) suggest that they will, and this charge is significantly cheaper and the service is more reliable than alternatives.

Split organizational structure that includes MoM – Reserve Bank of India regulations currently restricts foreign ownership of a company holding the license to operate the types of services MoM provides, specifically electronic payments companies. Because of the RBI regulations, Calpian has structured its investment in the Indian opportunity around this constraint by splitting MoM’s functions into two parts – one part, known currently as MMPL, holds the license to operate, owns and manages the data center, and owns the customer and distributor contracts. The other, DPPL, is the operating entity that provides the sales and other support functions, and is the entity in which Calpian has a direct interest. MMPL has agreed to an exclusive operating contract with DPPL to provide the specified services. The agreed upon allocation of revenues is 10% to MMPL and 90% to DPPL. On August 2, 2013, the company applied to the Foreign Investment Promotion Board for permission to invest in DPPL. As of this date, the application is under review.

Currency Value Fluctuation Risk - Because Calpian is a U.S. based company with shares traded in the U.S. public markets and with its accounting done in accordance with U.S. generally accepted accounting principles it will be accounting for activity in India in U.S. dollars. Fluctuation of relative value of the Indian New Rupee can be substantial and may affect the net results of the investment in DPPL.

Other - Other risks relative to the business in general and MoM specifically, are included in our periodic reports filed on Forms 10-K and 10-Q, and can be found on the website of the Securities and Exchange Commission.

5

Background - The Indian Market

India has an overall population in excess of 1.2 billion people with 50% under 25 years of age. Per Capita Income is $1,219 per year (World Bank, “Poverty at a Glance,” 2010).

Indians work more hours per week than workers in almost any other country, and have correspondingly less free time. According to the Indian consulting firm Payscale, Inc., the average workday for urban workers is 9 hours, six days a week, for a total of 54 hours plus 9 commuting hours. The average Indian urbanite has about 5 hours per workday in free time plus one weekend day, compared to the average American with 8 hours of free time per workday, plus two weekend days.

Indian workers are disproportionally under-banked. Most consumers in India do not see utility in a bank account and do not want to pay the costs. Workers earning the per capita average of $200 per month tend to spend their earnings rapidly, typically save very little, and therefore have no need of a bank account. The number of bank accounts in India is estimated to be between 200 and 300 million. Without a bank account, consumers are left without transaction tools to conduct routine business using non-cash means such as a checkbook or credit card.

Indian workers function in an inefficient environment that requires payment for basic services in cash in advance (prepaid) and often in person. Ways to reduce the time allotted to basic daily functions are few, but have a very high value in India.

What is Money on Mobile?

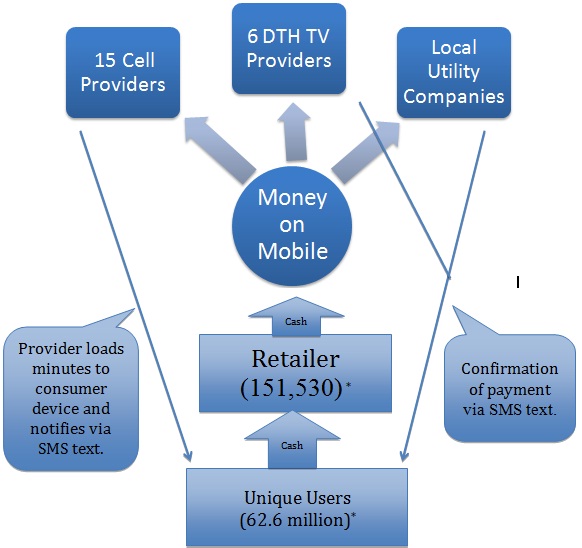

Money on Mobile is a cash value transfer service which allows cell phone users to move cash from their account with MoM to any approved vendor (such as telephone or television provider), or individual with a cell phone number whether a commercial enterprise or an individual. Users can pay bills, buy cell phone or TV time or send money to a retail store or even another individual (domestic remittances).

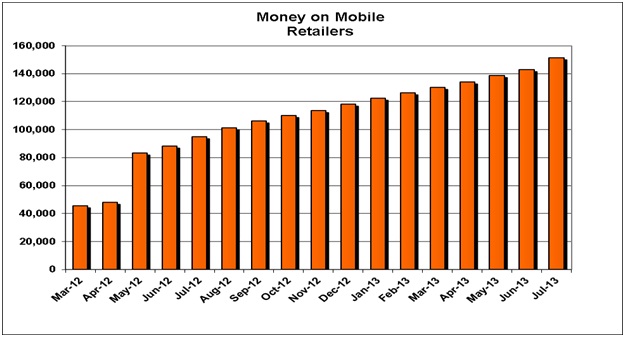

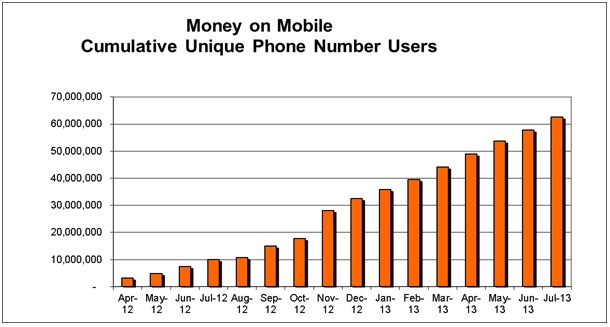

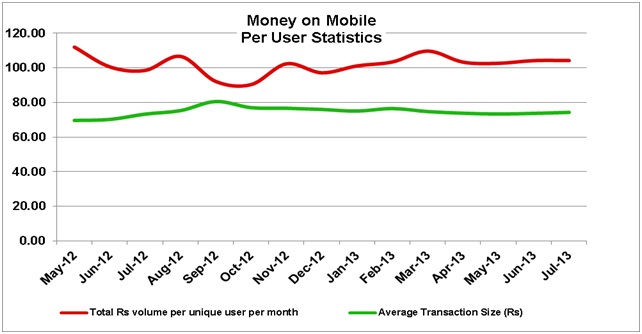

The MoM service has grown rapidly. In only 33 months of operations, MoM has recruited over 900 distributors, more than 151,000 retail distribution partners and adds approximately 3,000 retailers per month, however in July, 2013, the company added over 8,000 retailers to its network. The company had over 62 million unique consumer users between April 1, 2012 and July 31, 2013, and the company processes over 402,000 transactions per day. In July 2013, MoM processed transactions with a total value in of approximately 912.0 million Rupees or about $15.0 million USD, and generated gross profit of approximately $258,000, resulting in a net loss after overhead and expenses of approximately $171,000 in June 2013.

The MoM payment system is based on SMS text messaging capabilities built into every one of the more than 860 million phone handsets in India and supported by every mobile carrier in India. The company operates on all mobile networks and is Interoperable with respect to cell carriers and banks. A bank account is not required to use MoM services. Smart phones are not required to use MoM. MoM uses SMS text messages carried by the existing cell phone network to enable consumers to move money from their account with MoM to another account with MoM using instructions conveyed to MoM via SMS text messages. MoM tracks each account by cell phone number. To load cash into the MoM system, consumers visit a MoM retail store partner and pay cash to the retailer in exchange for an equal amount of credit associated with their phone number in the MoM computer system. Retailers are capable of initiating a credit to the consumer’s phone number using their (retailer’s) cell phone or a web interface. This credit amount can then be used for any of the purposes MoM enables, including purchase of prepaid cell phone minutes or TV minutes. Currently, retailers typically perform these functions for a consumer as a convenience. This version of the service is the bedrock of MoM today and is known as the “B2B” product line. MoM retains a 0.5% margin in this model after sharing revenue with the distribution channel.

6

When processing a utility bill payment, MoM receives Rs 2-5 per transaction regardless of size.

MoM also plans to add to its functionality the ability for consumers themselves to direct funds to various vendors serving the consumer – cell phone, DTH television vendor, or utility bills for example. In this version of the service, a consumer loads funds on the MoM account at the retail location. After funds are loaded and the consumer’s account credited with the funds, consumers themselves may direct funds to any vendor they choose in any amount. This aggregation of vendors is a convenience to the consumer that saves a great deal of time and cost compared to existing bill pay methods. This extension of the service is called the “B2C” model and MoM believes it represents the largest growth opportunity for MoM since volumes of charges are higher in this model. Also, MoM receives a margin of 1.5% on processed volume in this model. When processing a utility bill payment, MoM receives Rs 2-5 per transaction regardless of size.

Consumers will also be allowed to transfer funds to other users such as friends or relatives living in other parts of the country. This service is known as “P2P” or “domestic remittances”. This version of the service will enable domestic remittances of small amounts ($1,000 or less per transaction). While MoM believes this service is important and of great value to the average Indian consumer, revenue from this service is not included in MoM's business plan since the rate of adoption and usage is uncertain. The total documented domestic remittance market in India is approximately $13 billion, according to BankNetIndia. If other developing countries are a guide, the actual amount of undocumented transfers is far higher. Most domestic remittance transactions occur through informal, undocumented networks known as “hawalas”. The Indian Postal Service also provides money transfer services for a 6% fee. Money on Mobile intends to charge 3% for domestic remittances.

All MoM transactions are initiated and verified by SMS texts, providing a record of each transaction and a confirmation of success, as well as account balance for cell phone time and TV time. Transactions are completed in seconds, typically while the consumer is still in the store.

Other Uses for the Money on Mobile Service

MoM currently supports a wide variety of other daily tasks such as utility bill payment, movie ticketing, and money transfer. Many of these tasks are time-consuming and often inefficient when performed through other means.

In addition, MoM is a transaction processing platform that allows financial and other simple transactions currently not possible due to the lack of infrastructure in India such as non-cash retail purchases.

Money on Mobile Is...

Low cost relative to existing methods. Lowering the cost threshold for payment collection makes the business case for many low cost services and products possible. Life insurance, for example, is a product most Indians do without, but which would be highly beneficial. A small amount of life insurance would shield a family from financial ruin caused by the death of a breadwinner and associated funeral costs and loss of income. But small insurance amounts paid weekly are not cost effective to collect. MoM enables this service by providing a low cost method of collecting payments from subscribers and making payouts to beneficiaries.

7

Additional examples include other forms of insurance such as health insurance, accident insurance, property and casualty and others. Such plans do not exist in India in large part because the cost of collecting funds is simply too onerous. For example, the Life Insurance Corporation of India ("LIC"), one of the country’s largest insurers, offers a low premium product currently distributed through non-governmental organizations in small villages. Known as “Jeevan Madhur” or “Sweet Life” policies, a term life insurance policy on the primary household breadwinner, can have a benefit amount of up to Rupees (Rs) 30,000 ($600) for a cost of about Rs 25 ($0.50) per week. But physical collection of the cash required to fund the plan makes it difficult to provide it. Currently, such plans are delivered with the assistance of NGO workers in various villages at no cost to LIC. However, MoM gives insurance companies and consumers a frictionless, authenticated, trusted and low cost way to conduct this business which could be applied to any village anywhere in the country and greatly expand the scope of the MoM offering.

According to a study by Gautama Buddha University, banks find that extending financial services throughout the country is not cost effective. See http://www.scribd.com/tarrunn/d/29753200-Financial-Inclusion-in-rural-India-an-initiative

Instantaneous – the service uses SMS text messaging in real time. Users receive instantaneous feedback on their transactions. The system builds trust in this way.

Confirmed – each transaction has a receipt associated with it. Current methods of bill payment or domestic remittance do not confirm receipt of funds.

A Service Aggregator – both retailers and consumers benefit in the MoM system through an aggregation of vendors, making a ‘one stop shop’ of typical daily needs. MoM resells all cell provider time and all DTH time for example, providing retailers with a wide product array by becoming a member of the MoM Network. Consumers know that they can accomplish a wide variety of tasks using MoM.

The combination of these attributes creates a new business environment that affects many products and services. MoM provides a critical piece of the business infrastructure required for these services. MoM effectively lowers the cost of delivery for a wide variety of services making them possible where they were not possible before MoM existed.

Virtual products and services such as third party provided apps, games, ringtones, and information services become possible through Money on Mobile.

Longer Term Uses...

Financial Services - A key use for MoM could be micro finance payments and collections. India is currently a focal point for micro finance initiatives, which are mostly conducted in person on a village to lender basis with frequent visits by staff to collect payments or hand out loan amounts. Using MoM however, much of this work could be done via SMS text, making the cost of delivering microfinance services much lower than today. A reduction in lender staff time dedicated to payment collection would greatly decrease the cost structure of the lender and thereby allow staff to cover more villages and make more loans with less risk. Many micro finance loans are made with weekly repayment schedules for which MoM is an ideal tool.

Consumer Credit Bureau - By nature, MoM provides a track record for each transaction which allows consumers to build a credit history – something completely unheard of in India today. A transaction history with MoM proves spending power and payment history facts, documenting the timing and amounts of each payment made. Each MoM user builds a credit record of sorts forming a body of information that could grow into India’s first and more reliably accurate and accessible credit bureau function. The lack of a reliable credit bureau is often cited as a key reason financial services are not more available to Indian consumers.

8

Governments Benefits Distribution - The Indian government distributes subsidies to the public for a variety of purposes ranging from welfare type support payments for the disabled to Kerosene subsidies for the rural poor. Electronic distribution of these payments would reduce or eliminate graft that currently plagues existing distribution channels.

Unknown Additional Uses - Additional uses may emerge over time. The innovation of Money on Mobile is expected to enable a wide variety of products and services to be created in India and spur entrepreneurship in these areas. MoM enhances the revenue streams of small retailers by offering them a service they were not reselling previously and it enables a host of other existing businesses as well as new entrepreneurial opportunities.

Current Main Market Application: Cell Phones and Television

According to the Indian government, there were 861.7 million cell phones in use throughout India as of February 28, 2013 - 571 million urban subscribers and 340 million rural subscribers.1

Almost all services are prepaid in cash, usually in small amounts, in keeping with consumer’s low monthly income. For example, a typical cell phone time purchase, a process known as ‘mobile top-up’, may be 10-60 minutes of talk time. The average top up transaction has a value of Rs 58, or about $1.00 (July 2013). The consumer may make this purchase weekly or several times a month depending on need. A similar dynamic applies to television time, which is also prepaid and delivered via satellite dish, known as “Direct to Home” service or “DTH”. Consumers must pay their bills in person and in cash, a time consuming process, which often has delays and late fees associated with it. MoM makes it possible for all bills to be paid in real time, thereby eliminating delays and associated penalties, and saving the consumer many hours each week.

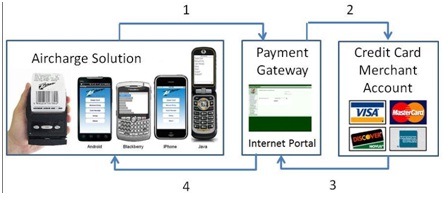

There are currently 15 cell providers and six DTH providers India. No one player is dominant in either market. Minutes of talk and viewing time are sold through company-owned or large retail stores. However, this proliferation of vendors presents a problem for small retailers who would like to sell minutes for a profit. In order to make sure they have minutes in inventory from the right provider, the retailer must have a relationship with each provider which requires a deposit. Stores face a major capital expense in establishing this relationship and maintaining multiple inventories. MoM provides an essential service to the retailer by acting as an intermediary – a single vendor providing minutes inventory from all cell and DTH providers. MoM is interoperable between all cell and DTH providers. This service allows a small retailer to sell minutes from any provider on demand from a consumer

(See diagram on next page).

_______________________

1 http://www.trai.gov.in/WriteReadData/WhatsNew/Documents/Monthly_press_release_February_2013_16april2013.pdf

1 http://www.trai.gov.in/WriteReadData/WhatsNew/Documents/Monthly_press_release_February_2013_16april2013.pdf

9

* As of July 31, 2013

10

By combining all vendors into one package, MoM greatly increases the number of small retailers who can resell phone, DTH, and billing services. In turn, this ubiquity of presence creates a strong distribution network for the company and a much greater level of utility for the consumer. Whereas the consumer may have to travel on foot or by bus to 3 to 4 destinations to pay routine bills at least once a week, he can now visit one store, make a deposit with MoM and pay all bills using his cell phone. The resulting gains in efficiency and time savings are dramatic and compelling. The company believes that this increase in efficiency is an important driver to adoption of the MoM service in both the retail and consumer populations. Similar examples elsewhere around the world indicate that rapid adoption of the service is possible. (See discussion on M-PESA). As an example, MoM has gone from a few thousand users in January 2011 to 62.1 million cumulative unique users having used the system at least once between April 1, 2012, and July 31, 2013.

Retail Purchases

MoM can be used to pay for physical goods in the retail store using money stored on MoM. Retailers accepting cash on behalf of MoM also recognize MoM credit as a viable medium of exchange thus allowing consumers to use their MoM credits to purchase physical inventory in the store as well. For example, a city dwelling worker in Mumbai may send $10 back to his wife living in their home village 500 miles away. The wife will receive a text message on her cell phone indicating that she has $10 in her MoM account. She can then use it to top up her cell phone or DTH account and purchase goods in the local retail store, provided that store is a MoM retailer. The retailer receives MoM credits transferred to his account thus replenishing his inventory of credits for sale to another customer for cash. In this way, MoM acts as a replacement for physical currency. MoM is safer, not subject to loss, theft or destruction, more easily accounted for and cheap to store and transfer.

Encashment of Money on Mobile credit

MoM users – both retailers and consumers – may redeem their MoM credits for cash through a process known as ‘encashment.’ In order to do this, users must accept their cash on a prepaid card or receive cash from a correspondent bank branch including accessing an ATM. The Times of India reports that there are 104,500 ATMs in the country as of November 2012.2 In order to expand the encashment opportunities, MoM plans to enroll their retailers in the Reserve Bank of India’s correspondent bank program. This relatively low cost program allows basic banking services to be delivered to remote locations without a full-blown branch bank. The RBI has made this effort part of its overall push to increase financial inclusion – increasing the availability of financial services to the general Indian population. (See section on Regulation).

Consumer amounts deposited in the MoM system are viable for 180 days. At the end of this period, amounts expire. Consumer users must spend their money or withdraw it within that time period or forfeit its value.

Example Target Populations with a Demonstrated Need for MoM

MoM plans to approach targeted populations of users as part of its expansion strategy where there is a perceived clear and compelling need to adopt MoM services. College campuses are an ideal example, and the company is pursuing 7 such arrangements now. Further, there are tie-ins with Internet shopping portals, wagering sites and other similar opportunities.

_________________

2 http://timesofindia.indiatimes.com/business/india-business/ATMs-cross-1-lakh-mark-SBI-controls-59/articleshow/17205587.cms

11

Students Living Away From Home

Students at Delhi University North Campus receive money from their parents, typically by having it deposited in a bank account. However, the students must then wait at the ATM to receive cash. Wait times at the few ATMs serving the campus’s 220,000 students can range from 20 minutes to two hours in length. Students using MoM for basic services could reduce their reliance on cash as their primary medium of exchange and save significant time in the process.

Working Couples

Urban working couples are constrained for time and convenience conducting life in a highly inefficient society. Working couples often have servants minding children at home and the ability to transfer value through cell phones to vendors or employees saves time and eliminates uncertainty.

The Money on Mobile Distribution Network

The retail market in India is composed of very few large stores. Consumers generally lack transportation to travel to large shopping center style environments, as is the case in developed economies. Rather, neighborhoods, cities, and villages are characterized by having many very small stores selling a variety of goods. It is common to see stores of 500 square feet selling clothes, cell phones, batteries, electronics, some food items, and a few books. Consumers need this sort of variety since they generally must walk everywhere to get what they need and also because they typically buy small amounts of items due to limited cash availability.

According to Wikipedia, over 14 million outlets operate in the country and only 4% of them being larger than 500 sq. ft. (46 m2) in size. India has about 11 shop outlets for every 1000 people (90 people per store)3.

Shoppers in India depend on small retail locations for the vast majority of their shopping needs. Each store typically sells a wide variety of goods ranging from food, to clothes, to cell phones and other items within the same store. Customers are accustomed to buying a diversity of goods in the same retail store, and MoM’s experience has been that both stores and customers readily accept payment processing as an add-on to existing product lines.

Importantly, MoM provides retailers with a way to make money by selling its services. Unlike payment processing services in the US, where payment processing is a cost of doing business, in India, MoM is a revenue opportunity. This leads to store owners being active salespeople for MoM’s services, and helps to build profitability for the small retail entrepreneur.

MoM receives an average of a 5% discount on telephone and DTH time purchases from providers such as Airtel, Aircell, and others. MoM shares this discount amount with the retail distribution channel, turning each store into a commissioned sales person for MoM.

Differentiation through Distribution

One of Money on Mobile’s innovations is the ability to unlock the sales potential of these micro- retailers. Typically, given the number of cell phone and DTH vendors in the market, small stores have not been able to sell top-up time, since each cell provider requires the retailer to be an exclusive vendor and place large deposit for prepaid time. Only larger stores are capable of doing this. MoM makes it possible for each small retailer to be a cell time top up reseller with a very low cost of entry, thereby broadening the number of stores willing to participate. In addition, stores can resell top up time from any cell or DTH provider, thereby providing a service to any consumer who walks in the store regardless of who that consumer’s provider might be. Over the course of 2012, MoM’s total volume of transactions processed has been about 69% cell phone top up and 27% DTH top up with the remainder being bill payment, domestic remittance, and other uses.

_________________

3 http://en.wikipedia.org/wiki/Retailing_in_India

12

Further, MoM has created a revenue waterfall that creates a clear economic incentive for retailers to sell top-up services and to load consumer cash onto MoM for other uses. In its initial phase, MoM’s B2B service pays both distributors and retailers a discount percentage on minutes sold. In its subsequent service enhancement phase, B2C, MoM pays the retailer 1.5% of funds loaded by consumers. When consumers spend the funds, MoM either makes a margin on top-up minutes or charges the consumer 3% to transfer funds when no discount revenue is applicable.

In its B2B business, MoM is a product for retailers - retailers make money selling cell phone and DTH minutes. In its B2C phase, the company becomes a consumer oriented service as consumers learn to deposit money with a MoM retailer and then direct it to various vendors for a wide array of services including cell phone and DHT minutes top-up, movie tickets, travel arrangements, or other users. This evolution is only possible if the company achieves a large retail distribution network rapidly and cheaply. The company further believes that retailers are adequately incented to use the system and bring consumers into it as users.

Further, the revenue waterfall acts as an incentive scheme for retailers to bring consumers into the system and promote usage. This powerful incentive has yielded strong results so far. In effect, each retailer is a salesman for MoM.

MoM has created a vibrant and large distribution network for its services. The company’s phone and DTH TV vendor aggregation model creates a new product set that small retailers can now incorporate into their existing store with no modification and no significant capital investment. Retailers pay $10 to join the MoM system and purchase basic promotional materials from MoM.

13

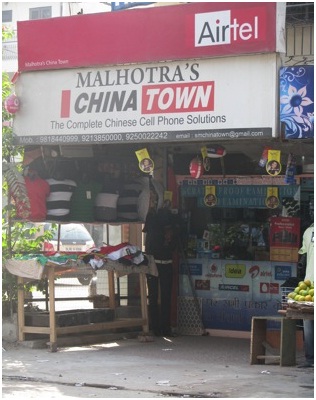

Money on Mobile retail outlet – Mumbai. Note the Yellow MoM ‘dangle’ signs

Money on Mobile dangle signs close up

14

Money on Mobile Retailer Window Poster – New Delhi

Money on Mobile Retailer – Delhi

15

Retailer demonstrating Money on Mobile web interface for loading cell phone and DTH TV.

Interior view of a typical Money on Mobile retailer – note the variety of goods offered in the store.

16

MoM designed its distribution strategy around the existing infrastructure of small retailers throughout India. MoM approached local and regional suppliers of physical retail consumer goods (soap, shampoo, clothes, cell phones, etc.) offering them a master and area distributor package deal including an override on all sales in the distributor’s retail network (about 2.0% of revenues generated from their network). Distributors have been eager to adopt the service since it represents additional revenues to them with no physical product inventory or capital investment. One distributor noted that after 4 months in the network, he had recruited 2,000 stores and is generating over Rs 180,000 ($3,600) per month in commissions to his company. Such revenue is 100% profit margin to the retailer and the distributor and would represent the equivalent of increasing retail sales by at least Rs 3.6 million ($72,000/month or almost $1 million/year – a very large number for India). In addition, retailers are paid immediately in credits from MoM.

As distributors took the product out to their existing retail store clients, MoM gained acceptance in the small retail community due to its attractive advantages.

The company aggregates all cell and DTH vendors and therefore allows a small store the ability to resell time on any of these vendors as opposed to an exclusive relationship with just one.

Small retailers have little product differentiation and brand name identity in India. Any service they can offer that will bring customers in the store is desirable, especially something as ubiquitously needed as cell phone and DTH top-up. MoM distributors report that the acceptance rate among retailers has been above 90%. In one-on-one interviews, retailers report that they like the service, it works, and it is reliable. They further report that it brings additional customers to the store who then often purchase other goods and services. Mobile and DTH top-up are frequent purchases for small amounts, and having MoM services available means more store visits and, therefore, more collateral purchases.

As of May 1, 2013, MoM had signed relationships with over 900 distributors and over 151,530 retailers as of July 31. MoM added in excess of 4,500 retailers per month in2013, and expects to continue at this pace or faster in 2014 and beyond, with the goal of reaching over 300,000 retailers by 2016.

|

Feature

|

Distributor/Retailer

|

Consumer

|

|

Satisfies Compelling Need

|

Add mobile and DTH top up revenues with pure profit stream; no inventory cost

|

Time savings through consolidated transaction capability and security

|

|

Ease of Adoption and Use

|

No capital expenditure required; easy to understand and use

|

Intuitive interface using familiar text message format

|

|

Low Cost

|

Pay as used

|

Pay as used. Much cheaper than alternatives especially domestic remittances

|

|

Incentives Aligned

|

Earn money only when minutes sold; more sales means more users; more customers and more profits.

|

More services added to MoM the more convenience the customer experiences.

|

|

Access

|

Can be used anywhere cell service applies - does NOT require an Internet connection or a POS terminal. Any cell phone can be sued to resell service.

|

No fixed location; universally available on all text-capable cell phones regardless of handset maker or carrier;

does NOT require an Internet connection, bank account or credit card

|

|

General Utility

|

Can sell cell phone and DTH minutes from any provider

|

Many functions available means frequent and repetitive usage pattern and predictable revenue.

|

17

MoM services are not tied to any particular:

Bank - Users do not need a bank account. The Reserve Bank of India estimates the percentage of the population in India without a bank account as high as 60% (720 million).4 Further, the percentage of unbanked is higher in urbanized areas since migrant workers do not tend to have bank accounts owing to their temporary status, low living standards, fringe living locations, and lack of bank branches. In addition, men moving to cities tend to earn money for the purpose of sending it back to the village and therefore do not need a bank account and do not want to incur the cost of having one. Government efforts to provide a "no-frills" bank account have been only marginally successful.

Cell phone provider - The Company does not limit itself to one cell provider. The company depends on SMS text services provided by all the cell phone providers in India, whichever the consumer has. The company’s services are not tied to the workings of the mobile phone system providers.

Phone hardware maker - The Company’s services can work on any cell phone that can generate an SMS text message. The service uses simple SMS text messages for all interactions between retailers, consumers and cell phone and DTH time providers. The company’s services can work on the simplest model phones as well as smart phones. Its services are text enabled and do not require an application download.

By design, MoM is vendor Interoperable. In this way, the company ensures its approach to the largest possible target market and lowers users' hurdles to adoption and repeat usage.

How Money on Mobile Makes Money

Presently, MoM derives most of its revenues through the contractually specified discount that cell phone and DTH providers give to bulk buyers of airtime – averaging approximately 5%. This means MoM can acquire airtime at 95% of retail price and resell at 100%.

MoM funds its distribution network revenue share from the discount it receives from mobile and DTH providers. In general, the company passes along about 2.25% of all airtime sales revenue in its retailer group to area distributors and about 2.25% to retailers for airtime sold in their store. Currently, MoM retains .5% of processed volume for itself for mobile top up and DTH transactions.

MoM expects its margins to improve over time as volumes of cell phone time and DTH purchases increase, thereby driving the discount percentage higher. MoM’s projections show that margins will increase from the current .5% to 1.0% and, in some cases, higher. Currently, due to its relatively small size, MoM purchases some minutes from an aggregator. When volumes with each provider reach sufficient levels, MoM expects it will acquire minutes directly from providers, with the potential to increase margins depending on the vendor and service. When MoM processes a utility payment, the company receives between Rs 2-5 rupees per utility bill processed regardless of transaction size.

In its initial B2B service, all MoM transactions are conducted by the retailer on behalf of the consumer. Starting with the initiation of the B2C service in early 2013, consumers are now able to use their cell phone to direct MoM to top up minutes or pay bills themselves without the assistance of a retailer. In this way, consumers can pay MoM an amount of money and then conduct business using their cell phone from any location at any time. MoM does not pay a commission to the distribution network on these direct transactions (i.e. those not conducted by a retailer). MoM will pay 1.5% of funds loaded at the retailer and will charge consumer 3% convenience fee, retaining the difference of 1.5%.

_____________________

1 http://www.bloomberg.com/news/2013-03-19/hidden-cash-lures-subbarao-to-indian-villages-worth-24-billion.html

18

As B2C services increase as a percentage of overall processed volume, MoM expects its margins to increase.

Regulatory Framework

The government of India, through the RBI, has embarked on a sweeping drive to increase the population’s access to basic financial services. This initiative is known as the “India Financial Inclusion Initiative” and includes encouraging efforts to increase the number of ATMs in the country, to establish village level correspondent banks that can deliver basic financial services such as savings accounts, prepaid cards, and various electronic payments services such as Money on Mobile.

RBI established the regulatory framework supporting business-to-consumer and consumer-to-consumer payments in August 2011, and Money on Mobile received its license authority from the RBI on October 5, 2011. The RBI audits the company’s processing and custodial functions each quarter to assure compliance with its regulations.

The RBI has stated that it expects to liberalize banking regulation that will increase financial inclusion over time, but has not committed to a timetable or specific steps for such liberalization. All of MoM’s activities, both current and planned, are within established licensing and written regulatory permissions granted by the RBI.

MoM services appeal to both banked and unbanked consumers as a payment utility. Not all banks offer bill payment services or cell phone interface to bank accounts. MoM offers a utility attractive to virtually all Indian consumers, but especially the unbanked. Similar services with less utility such as M-PESA in Kenya have been widely adopted only in their local markets by both banked and unbanked consumers.

Mobile Network Provider Initiatives in India

While MoM believes there is one direct competitor, Beam, the company has identified payment utilities with some characteristics in common with the company’s services. However, the company believes that each of these services has distinct and clear disadvantages to rapid market adoption and that MoM’s distribution channel and ease of adoption for consumers makes it a superior alternative.

|

Name

|

Number of Subscribers (Millions)

|

Announced Mobile Money Initiative

|

|

Airtel

|

170

|

www.airtelmoney.in

focus on banked and Airtel customers

|

|

Reliance Communications

|

143

|

Partnership w/ ICICI Bank and focused on their accounts

|

|

Vodafone

|

142

|

Announced, not yet launched. Expected to be like M-PESA; limited to P2P transfers

|

|

Idea

|

95

|

Announced in 2008; focused on UAE-India transfers. No recent data found

|

|

BSNL (State owned)

|

94

|

Post Office partnership; launched in 2011; limited to P2P transfer

|

|

Tata Group/Virgin

|

91

|

Launched 2009; limited to Tata stores

|

|

All Others (9 companies)

|

118

|

Unknown

|

19

Other E-commerce and Mobile Initiatives

Some companies have started various payment initiatives over the last few years.

|

Name

|

Retailer Capex Required

|

PC + Internet Connection Required

|

Credit Card Required

|

Card Based Spending Solution

|

Bank Account Required

|

|

Suvidhaa

|

X

|

X

|

|||

|

Oxicash

|

X

|

X

|

X

|

||

|

Mcheck

|

X

|

X

|

X

|

X

|

|

|

Itz Cash

|

X

|

MoM believes it is well positioned relative to these nearby services in that MoM is either different enough to be considered unique relative to the specific service either by retailers or consumers or its competitive characteristics are superior.

While none of the above companies is positioned as a direct competitor to MoM at the present time, there may be other start up or small ventures addressing the same market of which MoM and Calpian are not aware.

User Retention and Volume over Time

User Retention

Money on Mobile recently completed a study of user behavior over the first six months of a consumers' use of the Money on Mobile service. The study examined a sample unit of 1.5 million users who used Money on Mobile for the first time in October 2012. The sample represents about 44% of new users added during the month. The study followed their usage pattern through each subsequent month through March 2013, inclusive. The study revealed that, of customers using Money on Mobile for the first time in October 2012, over 17% of those customers completed a transaction in March 2013.

|

Date

|

# Users

|

% Users Remaining

|

|

October 2012

|

1,509,685

|

|

|

March 2013

|

264,980

|

17.55%

|

The company believes this retention rate is a positive sign for its longer-term development. For example, if the company’s ambition is to create a core group of consistent users numbering 30 million. If the company retains 17.55% of all new users, it will need to attract 171 million new users in order to build the desired 30 million core repeat user group. The company attracted 62 million unique users (identified by phone number) between April 1, 2012, and July 31, 2013.

20

User Transaction Volume

Average revenue per user rose in the study population by 55%, on average, meaning that, 6 months after being introduced to Money on Mobile, users were transacting 55% more volume in Rupees.

|

Date

|

Average Revenue per User (Rupees)

|

% Increase in Average Revenue per User

|

|

October 2012

|

106

|

|

|

March 2013

|

165

|

+ 55%

|

User Transaction Frequency

After 6 months using Money on Mobile, users increased the number of transactions from 1.45 per month to 2.11 per month, on average, reflecting an increase of 45% in transaction frequency. This means that, on average, users used Money on Mobile almost 50% more than when they were new to the system.

|

Date

|

Transactions per User

|

% Increase in Transactions

|

|

October 2012

|

1.45

|

|

|

March 2013

|

2.11

|

+45%

|

User Transaction Size

Transaction size did not change appreciably during the study period.

|

Date

|

Average Transaction Size

|

% Increase in Transaction Size

|

|

October 2012

|

73

|

|

|

March 2013

|

78

|

+7%

|

Store Data

During the same study period, the company studied a sample of stores to understand their development over time. The sample unit was composed of new stores added in September and October 2012 plus a unit of previously existing stores selected unsystematically.

Store Retention

There were 16,759 stores in the sample and, after 6 months, 11,068 were still active.

|

Date

|

# Stores

|

% Stores Active

|

|

October 2012

|

16,759

|

|

|

March 2013

|

11,068

|

66%

|

Store Transaction Volume

During the study period, the total amount transacted by the store (analogous to same store sales) increased from 9,558 Rupees in October 2012 to 19,427 Rupees in March 2013 – an increase of 103%.

|

Date

|

Average Revenue Per Store (Rupees)

|

% Increase in Average Revenue

|

|

October 2012

|

9,558

|

|

|

March 2013

|

19,427

|

+103%

|

21

Store Transaction Frequency

During the study period, the number of transactions per store remaining active during the study period increased 101% from 131 per month to 263 per month.

|

Date

|

# Transactions per Store

|

% Increase in Number of Transactions

|

|

October 2012

|

131

|

|

|

March 2013

|

263

|

+101%

|

Conclusion

The study of customer retention and same store sales shows:

|

1.

|

Six months after a user is exposed to Money on Mobile, transaction frequency and volume increase 50%.

|

|

2.

|

After 6 months with Money on Mobile, stores transact twice as often and produce twice as much volume per month.

|

|

3.

|

It is possible that these two effects reinforce one another in that experienced stores bring users who use the system more and establish a pattern of behavior which incorporates Money on Mobile into their daily lives.

|

Of the above data points, we consider the key measures to be: store count, user count, and processed volume, and we would expect to report these statistics regularly.

Direct Competitors

One company that is in the market is Beam (). According to available information, Beam has had one round of U.S. based venture capital in 2009, and is currently searching for additional financing. Beam has 50,000 retail distribution relationships and processes Rs 4 million ($80,000) in mobile top up transactions per day. Beam offers a wide range of payment options - utilities, travel, cell phone, and DTH top up. Beam claims that, as of December 2011, 7 million users have used the system once and in any given month, 480,000 of them (14.5%) conduct a transaction. -- All information obtained from Beam in an interview conducted January 2011.

Beam does appear to be a direct competitor to MoM but, so far, the market is large enough that the two companies have not encountered one another in any significant way. However, MoM’s volumes of cell phone and DTH top up are at least 6 times larger than Beam’s, and its distribution network is more than three times as large.

Another similar service is Zipcash which distributes its service through a partnership with Loop Mobile Phone Company. Loop has 31 million phone users, is focused on Mumbai, and has 6,000 retail distribution outlets. Zipcash offers the same range of products and services as MoM. Zipcash appears to be small and does not have a stated strategy to move outside Mumbai as of January 2012. Since that time, Zipcash has not been a visible factor in the market.

The most high-profile entry in the cell phone payments space was Nokia Money, announced on December 15, 2011, by Nokia, the Swedish phone handset maker. However, in April 2012, Nokia discontinued the service and is in the process of winding it down. At the time Nokia stated that its corporate priority was to focus on lagging handset sales in India and elsewhere. In June 2012, Fino announced that it had acquired all the assets of Nokia Money in a cash transaction. Fino is a company focused on mobile banking. As of April 2013, Fino has been searching for capital and has not launched a service.

22

Paymate. Started in 2006 and funded by Kleiner Perkins, Paymate is a cell phone based payment software and transaction processing company. Paymate claims 15,000 retail distribution partners and 30 bank customers for its software. Paymate enables the same transactions as MoM, but does not distribute to users, but rather to banks. Paymate allows consumers to charge purchases on their credit cards or pay through a bank draft. Paymate’s services are aimed at the banked customer and do not apply to the unbanked.

EKO is a rural focused money transfer system that brings unbanked customers into the banking system.

CyberPlat is a Russian firm specializing in providing processing systems to Multi Network Operators (MNOs) to support their transaction processing needs. CyberPlat India claims to have 70,000 retail touch points and to have processed 1.5 billion transactions.

Payworld (http://payworldindia.com/) is a small competitor to Money on Mobile providing electronic voucher distribution. No statistics about the company are publicly available.

Done Card is a prepaid physical card that allows consumers to acquire bus, air, rail and theater tickets, mobile top up, DTH top up and retail goods. Done card distributes though 80,000 retailers and reports that only 30,000 are active. Done Card processes approximately $18 million per month in total transaction volume.

The competitive landscape is a fast changing environment,

Online Mobile Malls

Mobile malls connect retailers and consumers through the cell phone. The companies take in cash through bank account draft or credit card charge and then allow the consumer to buy merchandise or services from retailers. Two companies currently operating in India doing this are:

NGPay: Essentially the same as Paymate, NGPay claims to be the largest mobile mall in India with 1.5 million users.

Mobile malls differ from Money on Mobile’s efforts in three key ways:

1. They require a bank account or credit card. Money on Mobile allows users to deposit cash with one of its 41,500 (December 2011) retail partners. No bank account or credit card is required.

2. No physical world retail distribution partners. MoM has over 41,500 retail distributions partners where customers can deposit cash.

3. Complex software issues. The software required to display retail goods on a cell phone is much more complex than MoM’s simple SMS text engine. These companies are really more about software integration than payment processing.

23

Similar Initiatives outside India

Other similar initiatives have been launched in Paraguay, Honduras, Tanzania, West Africa, and a few other countries around the world. Mobile phone operators have formed a study group around mobile payments and banking initiatives known as “Mobile Money for the Unbanked” – (www.gsmworld.com).

The largest and most successful mobile money initiative outside India and also the best known is M-PESA, a phone-to-phone money transfer system. Safaricom is the leading cell phone company in Kenya with 70% market share. Safaricom launched M-PESA in 2007 expecting that approximately 100,000 users would adopt the system as a way to facilitate microfinance initiatives in the country. The ability to transfer money from one phone to another caught on quickly as a simple utility, easy to use and understand, with very high value for users in terms of safety, certainty, convenience and cost. According to the Safaricom 2013 Annual Report, in five years, M-PESA has added 21 million members, +90% of the adult population, and annually handles $32 billion in funds transfers, an amount equivalent to 45% of the entire Kenyan GDP.

Disruptive Effects of Mobile Money

Mobile money has proven to lower the transaction cost of collecting small amounts of value from consumers or small businesses. As the cost of collection declines, more and more products or services with small price points become possible.

For example, any product with a price of $0.50 is not worth marketing if the cost to collect payment for that product is higher than $0.50.

Mobile money makes this process much cheaper than other methods and therefore makes it possible to offer a vast array of new services and products to low income customers. Examples may include:

Insurance - Life Insurance Company of India has a term life policy that costs Rs 25 per week (US $0.50).

Companies that broadcast media to cell phones charge about RS 10 (US$0.20) to watch a movie.

Micro Surveys - Companies interested in consumer information will pay cell phone users to answer simple survey questions. Until now, those surveys were rewarded with cell phone top up time. Money on Mobile would allow users to be rewarded with cash value usable in a variety of ways.

Retail Couponing - Cash rebates for small consumer goods purchases can be made cost effectively through MoM. For example, a manufacturer could offer a cash rebate incentive for each purchase of toothpaste as a brand promotion.

MoM Management Team

Shashank M. Joshi - 38, Managing Director

Shashank has over eighteen years of professional experience in the areas of IT and ITES, outsourcing, transition and management consulting. During the last 10 years, he has been an entrepreneur and pioneer in the successful execution of merchant cash advance and merchant processing businesses in the U.S. through an offshore operation in India. Shashank has cross-border global experience of more than six years in simplifying payments. Shashank also specializes in motivational and leadership training. His vision is that of simplifying payments while his goal is to bring the convenience of simplified mobile payments to mobile subscribers across India. Shashank holds a degree in Mechanical Engineering from MIT.

24

Rajesh Mishra - 43, President

Rajesh is a sales and management leader with 18 years' experience leading successful sales efforts. He was educated at D.G. Vaishnav College, Chennai (BSc in Physics) and the Madras Institute of Technology and the SP Jain Institute of Management and Research (PGDM). For the last four years, Rajesh worked at Euronet as Director of E-Payments handling large projects such as the National Payment Corporation of India and others. He was responsible for integrating bank and retail channels of distribution into Euronet’s systems, and grew the business substantially. Before Euronet, he was at Tata Teleservices Maharastra, LTD, Reliance Communications, Bharti Broadband, and Compaq Computer.

Rajat Sharma - 40, Director

Rajat has over 18 years of experience in the fields of Telecom, IT, ITES and Networking. He started his career by assisting and handling Motorola Business Partners and launching the Motorola range of wireless and paging products in India. Being an execution focused leader in the fields of telecom and information technology, Rajat has played key strategic roles in launching new businesses and has more than 5 successful new product launches to his credit. He also has a track record in leading large projects, managing large teams and setting up and growing business lines. Being an avid technophile, Rajat successfully headed the countrywide operations for a U.S.-based technology company for over four years. Rajat is an engineering graduate with a Master’s in Business Administration.

Jolly Mathur - 47, Director

Jolly’s focus for the last 25 years has been on identifying growth opportunities in new markets. Jolly has extensive experience in the value added services business in the telecom sector which makes him a key driver in the mobile payments vertical. Jolly is a graduate in Science & Computer Programming from Bombay University.

Ranjeet Oak - 41, Chief Operating Officer

During the last 15 years, Ranjeet has headed various divisions of IT education, ITES and BPO organizations. His assignments have included a broad spectrum of responsibilities including BPO operations, client servicing, business development, relationship management, and soft skill training. Ranjeet’s forte has been business process re-engineering and process improvement. In his last assignment, he was an Associate Director at WNS and was honored with the Best Performer Award for year the 2007-08. Prior to WNS, Ranjeet worked with public limited companies such as GTL and Aptech.

In connection with its purchase of the DPPL shares, Calpian was granted the right to control the Board of Directors of DPPL. In this regard, Calpian appointed Harold Montgomery and David Pilotte, two of the current four Board members of DPPL, and Harold was additionally appointed Chairman of DPPL having an additional "casting" or tie-breaking vote. Additionally, Calpian received the right to appoint one member to the Board of MMPL.

25

Performance History

MMPL has provided the following operational and performance information regarding MoM to Calpian, including the financial projections, none of which information has been independently verified by Calpian:

*Since Calpian’s first investment in March 2012, MoM has increased retailers from 45,562 to 151,530 for a 332.6% increase in retailers to act as sales touch points as of July 2013.

**Since Calpian’s first investment in March 2012, MoM has increased cumulative unique users from 3.3 million to 62.6 million for a 1,919.8% increase though July 2013.

26

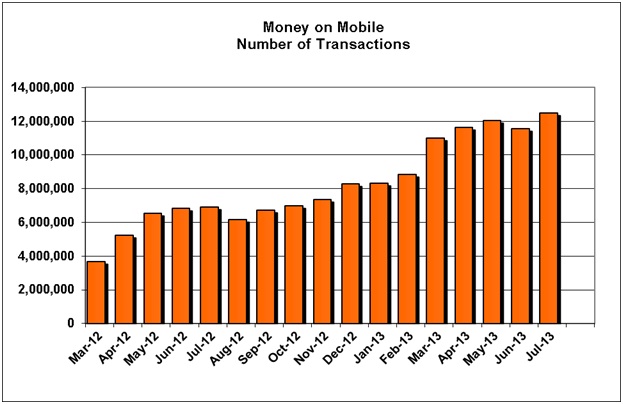

Since Calpian’s first investment in March 2012, MoM has increased processed transactions from 3.6 million monthly to12.5 million for a 338.8% increase though July 2013.

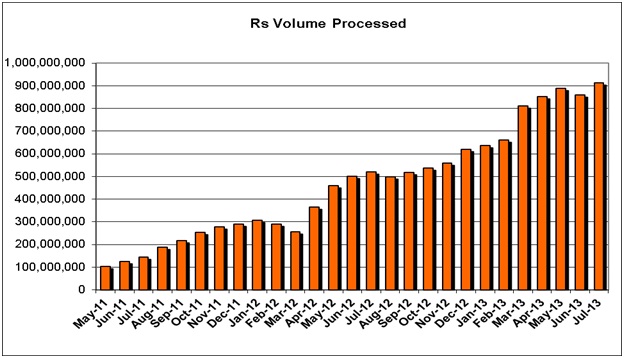

Since Calpian’s first investment in March 2012, MoM has increased volume from Rs 225 million monthly to Rs 912.4 million ($15.0 million) for a 357.5% increase though July 2013.

27

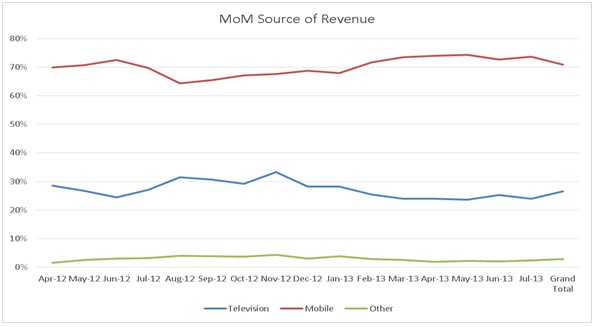

MoM’s operating data show that users have maintained a consistent mix of transaction use for DTH TV, Mobile Phone and other uses each month.

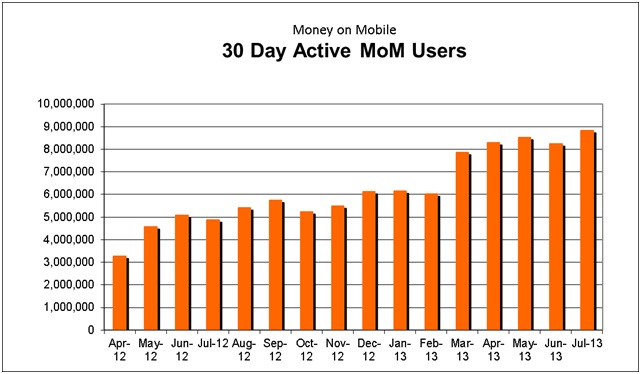

Since Calpian’s first investment in March 2012, MoM has increased number of monthly 30 day active users from 3.2 Million monthly to 8.8 million for a 275.0% increase though July 2013.

28

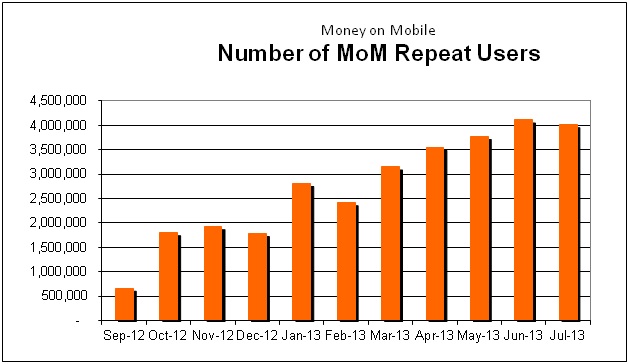

Since Calpian’s first investment in March 2012, MoM has increased number of repeat users from 0.6 Million users monthly to 4.0 million for a 667.0% increase though July 2013.

The Investment Tranches

Calpian has been investing in DPPL in a series of tranches over an approximate 13-month period beginning March 2012, with all proceeds going to fund the growth and market expansion of MoM. When, and if, fully completed, the Calpian investment in DPPL will result in Calpian owning an expected 74% of DPPL. Each investment tranche combines cash and shares, invested according to specific achievements of the MoM management’s business plan.

29

Through Calpian’s staged investment in DPPL, Calpian seeks to achieve an increasing amount of control over MoM. Calpian has had Board control of DPPL from day one. The staging of the investment in tranches incrementally allows Calpian to terminate the investment cycle at any time without monetary penalty, albeit acquiring a lower total percentage ownership of DPPL depending upon the point that Calpian terminates further investment.

Calpian’s U.S. Market and Business Overview

The U.S. Electronic Payment Processing Industry Overview

Calpian receives substantially all of our revenue from processing contracts with small- and medium-sized merchants for electronic payment (e.g., credit and debit card) processing services that have been sold by ISOs. Within the industry, small and medium-sized merchants are categorized as the more than 7 million merchants in the U.S. with annual processing volumes up to $1 million.

Payment processors focusing on large merchants, including Elavon (formerly NOVA Information Systems), Paymentech, First Data Merchant Services, RBS Lynk, Global Payments, and Vantiv, leverage their capital investment in processing infrastructure over the largest number of transactions to lower their marginal cost of processing a transaction. This scale allows these large processors to sell services at low per-transaction cost to the largest merchants with high processing volumes.

The payment processors with a medium-sized merchant focus compete based on a similar ability to leverage their infrastructure, but typically focus on regional and smaller national merchants.

The small merchant segment is traditionally best served by the ISO sales channel. ISOs are independent sales agents (or a group of agents) that sell processing services on behalf of a larger payment processor to small merchants that are typically too small for a large processor to effectively sell, service, or reach with its centralized, national sales force. We are currently in the process of negotiating contracts with Elavon and Paymentech.

Independent Sales Organizations (“ISOs”)

Small merchants typically buy their credit card processing services from an ISO. ISOs are contractual sales agents, authorized to sell credit card processing related services on behalf of one or more credit card processors. ISOs shepherd a small merchant’s application for processing services through the labyrinth of approvals, credit checks, guarantees and other approval steps required before a merchant can be approved to accept consumer credit cards for payment.

ISOs have two primary sources of revenues and profitability:

| ● |

Sale of Point of Sale (“POS”) Credit Card Processing Terminals. Sales of credit card equipment to merchants represent one-time profit events for ISOs. Historically, terminal markups were the most important source of immediate cash flow for ISOs, but due to market saturation and the lack of replacement technology, this source of cash flow for ISOs has diminished significantly in recent years.

|

| ● |

Credit Card Residual Portfolios. For every merchant an ISO signs up on behalf of a processor, the ISO receives a revenue stream based on the fees paid by the merchant to the processor. The ISO sells credit card processing services at a retail price to the merchant, retaining the difference between the retail price and the wholesale price received from the processor. These payments are the ISO’s monthly residual revenues (“residuals”) and are a contractual obligation of the processor. The residuals vary month-to-month based on the sales volume at the merchant, and the residual may terminate for a variety of reasons.

|

30

Processors

In addition to other tasks, processors handle credit card transactions originated by merchants, they bill those merchants and collect service fees from their merchant customers monthly. During the subsequent month, processors send each ISO a report detailing merchant activity and residuals due the ISO along with a remittance of the funds, eliminating the need for ISOs to collect directly from the merchant. Residuals remain in effect for as long as that merchant is a customer of the processor.

Contracts for credit card processing services between the merchant and processor can be year-to-year with automatic renewals, but can have up to a three-year initial term. Merchant processing, however, is a competitive business, and merchants do change processors, usually for a lower rate or promise of better service.

Attrition occurs when a merchant leaves its processor either by going out of business or moving to another provider of processing services. In exchange for the residual payment, the ISO is responsible for providing first-line customer service to the merchant on behalf of the processor. Common support issues include, but are not limited to, addressing malfunctioning POS terminals, answering questions about billing statements, and training issues. Most of these issues are successfully addressed by telephone, with replacement terminals commonly provided to merchants through overnight shipping services. ISOs are sales-focused organizations almost exclusively devoted to selling POS terminals and processing services.

Calpian’s Business Model

Calpian is in the business of acquiring ISO debit and credit processing residual revenue streams paid by transaction processors to ISOs, known in the industry as “residual streams” or “residuals.” We focus on and take legal possession of the residual stream. Once Calpian acquires a residual stream, the processor will pay corresponding residuals directly to Calpian, instead of to the ISO.

Calpian’s ISO target market is segmented into two categories, each with defined financial needs:

| ● |

Small ISOs with less than 2,000 merchants and financial requirements typically arising from the personal needs of the ISO’s owner (medical, educational, etc.); and

|

| ● |

Larger ISOs (2,000 merchants and above) with financial needs driven by business issues such as partnership splits, expansion funding and exit plans.

|

Merchant Risk of Chargebacks

A chargeback occurs when a consumer disputes a charge made on a credit card. Reasons for chargebacks may include, but are not limited to, consumer buyer’s remorse, failure of the retailer to deliver goods as promised, and credit card fraud, among others. Chargeback risk is borne first by the merchant. In cases where the merchant cannot make good on a charged-back transaction for whatever reason, this risk is contractually shifted from the merchant to either the ISO or the credit card processor pursuant to the terms of the processing contract between these two parties. In situations where the merchant’s ISO retains this risk, the original principal amount of the disputed sale, plus an additional fee and any residual amount due to the ISO for that particular transaction are all charged against the ISO’s account and reduce the residual stream paid by the processor to the ISO. In cases where the risk is borne by the ISO’s processor, the ISO residual stream is unaffected by the risk except for any residual amount related to the particular transaction in question. In completing acquisitions, we intend to eliminate the risk to us wherever possible by shifting this risk to the processors in exchange for a nominal cost, estimated to be approximately two basis points. However, there may be instances where we are unable to eliminate this risk.

31

Marketing and Public Relations

Due to its strategic value in marketing Calpian to the ISO community, we maintain an administrative support, marketing, and advertising relationship with Transaction World Magazine and have funded all of the magazine’s net expenses since March 2011. Such expenses are approximately $30,000 per month. Transaction World Magazine, Inc. is a wholly-owned subsidiary of ART. Harold Montgomery and Craig Jessen, both directors, executive officers and controlling shareholders of Calpian, are founders, controlling shareholders, directors, and executive officers of ART.

Acquisition Criteria and Process