Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WireCo WorldGroup Inc. | q2investorcallslides.htm |

Investor Call Q2 2013 Review

Cautionary Statement Forward-Looking Statements This presentation contains statements that relate to future events and expectations and as such constitute forward-looking statements. Forward-looking statements include those containing such words as “anticipates,” “estimates,” “expects,” “forecasts,” “intends,” “outlook,” “plans,” “projects,” “should,” “targets,” “will,” or other words of similar meaning. All statements that reflect our expectations, assumptions, or projections about the future other than statements of historical fact are forward-looking statements. Our risk factors are summarized in our Form 10-K for the year ended December 31, 2012. We disclaim any obligation to update publicly any forward-looking statements, whether in response to new information, future events or otherwise, except as required by applicable law. Non-GAAP Financial Measures Some of the information included in this presentation is derived from our consolidated financial information but is not presented in our financial statements prepared in accordance with U.S. generally accepted accounting principles (GAAP). Certain of these data are considered “non-GAAP financial measures” under SEC rules. These non-GAAP financial measures supplement our GAAP disclosures and should not be considered an alternative to the GAAP measure. Reconciliations to the most directly comparable GAAP financial measures can be found in the Appendix to this presentation. These non-GAAP measures are provided because management uses them in evaluating the Company’s performance and in determining debt covenant calculations. Any reference during the discussion today to EBITDA means Adjusted EBITDA or Acquisition Adjusted EBITDA, for which we have provided reconciliations in the Appendix. 2

WireCo WorldGroup Overview Steel Large diameter, highly engineered rope and electrical signal transmission cable Engineered specialty wire products used in general industrial end markets Highly engineered, made-to-order synthetic ropes and technical products that have strength characteristics of steel but weigh significantly less Synthetic 3 Highly engineered plastic molding from recycled materials used in a variety of industrial, structural and oil and gas applications Rope (73% of Sales) Broad Product Offering Specialty Wire (15% of Sales) Engineered Products (12% of Sales) Rope: Diverse End Market Applications Oil & Gas Commercial & Industrial Fishing Marine Mining Structures 3 Note: Product as a % of YTD 2013 sales

Q2 Results Income Statement 2012 2013 LTM Q3 Q4 Q1 Q2 Pro Forma Sales $204.1 $210.3 $222.6 $189.8 $826.8 Acq. Adjusted EBITDA $33.8 $33.8 $37.6 $31.0 $136.2 EBITDA Margin 16.6% 16.1% 16.9% 16.3% 16.5% Quarterly Sales Growth - 3% 6% (15%) - Quarterly EBITDA Growth - 0% 11% (18%) - ($ in millions) Net Working Capital $337 $318 $329 $333 $333 NWC as % of Sales 38.0% 36.3% 38.0% 40.3% 40.3% Capital Expenditures $11 $15 $11 $7 $44 Cash Interest Payments $7 $31 $6 $31 $75 Net Debt - $875.2 $876.1 $891.9 $891.9 Change in Net Debt - - ($1) ($16) n/a Net Leverage - - 5.64x 6.13x 6.13x Net Senior Secured Leverage - - 2.60x 2.64x 2.64x Balance Sheet / Cash Flows (2) (1) See appendix for Adjusted EBITDA and Acquisition Adjusted EBITDA reconciliation. (2) Defined as Inventory and Accounts Receivable less Accounts Payable. See appendix for net working capital reconciliation. (3) Defined as NWC over TTM Sales (Pro-forma). (4) See appendix for Net Debt reconciliation. (3) 4 Q2 Results below expectations (1) (4)

Q2 EBITDA Bridge vs. Q1 5 Q2 sales of $190 million were ($33) million or (15%) under Q1; Q2 Adjusted EBITDA of $31.0 million was ($6.6) million or (18%) under Q1 Q2 results impacted versus Q1 based on the following – Rope accounts for $6.3 million of the deficit; (i) delays in offshore projects, (ii) weak industrial markets, primarily in Europe and Asia, (iii) rig counts at lower levels – Engineered Products off relative to 1st quarter record levels; delayed offshore shipments – Wire business in line with 1st quarter; (i) fewer infrastructure projects in Mexico, (ii) rationalized low margin business Impact of variable SG&A cost structure and SG&A initiatives for positive impact in EBITDA of $3.2 million ($ in millions) Q2 Adjusted EBITDA vs. Q1 Adjusted EBITDA Sales: ($9.8) million SG&A +$3.2 million $37.6 $31.3 $28.0 $27.8 $27.8 $31.0 $6.3 $3.3 $0.2 $3.2 Q1 EBITDA Rope Engineered Products Wire SG&A Q2 EBITDA $5.3 Volume $1.0 Mix

Key Initiatives Streamline operation to run more efficiently SG&A discipline by forcing return on dollars spent; expected reduction as result Operating spend reduction through process improvement and investment in assets and systems Cost Reduction Leadership Created global leadership structure aligned under our most talented resources Renewed focus on accountability in all areas of organization Sales Growth “Go to Market” brand strategy began implementation Q3 ‘13 – Consistent global message Customer centric focus New opportunities in selected markets to gain share Cash Generation More rigorous capital spending programs designed to generate higher ROI Inventory optimization by removal of excess and right place, right time inventory planning Actively managing receivables and payables 6

$153 $148 $160 $146 Q3 '12 Q4 '12 Q1 '13 Q2 '13 LTM Rope: $607 Rope Update 7 Sales Results – Two large offshore projects underway end of Q2 – Continued strong order intake for offshore – Refocus to customer centric organization – Cost reduction initiatives in plants – Internal supply increases providing reduced costs – Adding assets in select low cost areas – Optimize steel rope finish goods – Actively managing receivables Rope Initiatives ($ in millions) Market Outlook & Trends Oil & Gas Commercial & Industrial Fishing Marine Mining ─ Fewer rigs in operation, but stable outlook ─ No projects in Q2 ─ Key initiatives to increase share ─ Soft markets in Europe and Asia ─ Pockets of strength in US & FSU-TPM ─ Q2 impact from systems change ─ Stable outlook ─ Overall market decline with drop in commodity prices ─ Higher sales than prior year due to market share gains and expansion in emerging markets ─ Fishing in Mauritania, a key market, blocked ─ Combatting with expanded production capabilities and sales in new markets ─ Stable performance ─ Market suffering with less cargo shipped and low freight rates ─ Focused brand strategy momentum ─ Pursuing new geographies and high-end markets Outlook Note Cost Reduction Sales Growth Cash Generation Structures ─ US funding and International markets flat ─ Expanding product offering ─ International market penetration focus

Wire & Engineered Products Update 8 Sales Results Wire Engineered Products $35 $34 $32 $31 Q3 '12 Q4 '12 Q1 '13 Q2 '13 $16 $29 $30 $13 Q3 '12 Q4 '12 Q1 '13 Q2 '13 LTM Wire: $132 LTM Engineered Products: $88 ─ Mexican market suffering from fewer infrastructure projects during Q1 and Q2 ─ New projects have been released for 2nd half of year ─ European performance stable compared to 2012 Market Outlook & Trends ─ Better offshore results expected in Q3 ─ Steel storage systems continue to perform at record levels ─ Poultry market mixed, with growth in emerging markets ─ Infrastructure projects in Europe picking up ($ in millions) Cost Reduction Sales Growth Cash Generation – New customer penetration in Europe – Managing cost to mitigate impact of lower demand – Completion of key capital projects adding new products – Payable opportunity through supplier terms – Just-in-time delivery for largest customer, WireCo Rope Plants – Success in new product development (cross ties) – Improvement in supply of recycled raw materials – Asset investment for increased automation – AP supplier rationalization, improving terms

Working Capital 9 We expect balance sheet opportunity in short term from number of initiatives already implemented Working capital management a core organizational focus Meaningful opportunity to deleverage through better management of working capital $226 $246 $233 $242 $253 $253 $268 $248 $239 $244 2.93 x 2.92 x 2.91 x 2.89 x 2.77 x 2.82 x 2.68 x 2.73 x 2.73 x 2.52 x 2.2 x 2.4 x 2.6 x 2.8 x 3. x 200 220 240 260 280 Q1 '11 Q2 '11 Q3 '11 Q4 '11 Q1 '12 Q2 '12 Q3 '12 Q4 '12 Q1 '13 Q2 '13 Inv e n tor y T urn $ ( in m ill io n s ) Inventory, net Inventory Turns $168 $172 $155 $149 $166 $167 $160 $153 $174 $172 70 65 64 61 65 66 70 66 70 82 0 25 50 75 100 135 150 165 180 Q1 '11 Q2 '11 Q3 '11 Q4 '11 Q1 '12 Q2 '12 Q3 '12 Q4 '12 Q1 '13 Q2 '13 D a y s S a le s Ou ts ta nd in g $ ( in m ill io n s ) AR Days sales outstanding (DSO) (a) $308 $334 $319 $304 $332 $336 $337 $318 $329 $333 145 147 151 147 148 153 165 157 154 181 50 100 150 200 280 290 300 310 320 330 340 Q1 '11 Q2 '11 Q3 '11 Q4 '11 Q1 '12 Q2 '12 Q3 '12 Q4 '12 Q1 '13 Q2 '13 C a s h C onv e rs ion C y c le $ ( in m ill io n s ) NWC Cash conversion cycle $87 $83 $70 $88 $87 $84 $91 $83 $84 $83 47 41 37 48 44 43 49 46 45 51 15 20 25 30 35 40 45 50 55 60 - 20 40 60 80 100 Q1 '11 Q2 '11 Q3 '11 Q4 '11 Q1 '12 Q2 '12 Q3 '12 Q4 '12 Q1 '13 Q2 '13 D a y s P a y a b le s Ou ts ta nd in g $ ( in m ill io n s ) AP Days payables outstanding (DPO) (c) A/P Inventory Net Working Capital A/R Q1 '11 Q2 '11 Q3 '11 Q4 '11 Q1 '12 Q2 '12 Q3 '12 Q4 '12 Q1 '13 Q2 '13 n/a n/a n/a 34. % 36.6% 37.6% 8.0% 36.3% 38.0% 40.3% NWC % of TTM Sales Note: All figures Pro-forma for Lankhorst and Drumet Acquisition A Defined as (Trade Receivables / (T3M External Sales / 90)) C Defined as (Trade Payables / (T3m COGS / 90))

Questions / Conclusion 10 Investing to build a world class organization for sustainable long-term growth Cost Reduction Leadership Sales Growth Cash Generation Initiatives Results Top and Bottom Line Growth Margin Enhancement Cash Generation Deleveraging

Non-GAAP Reconciliations

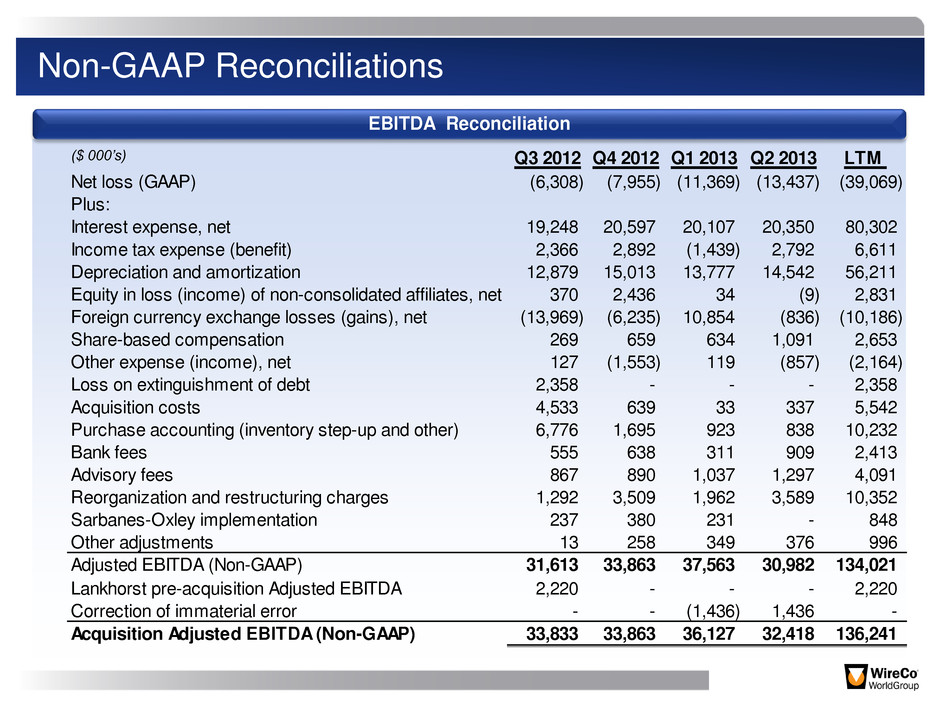

Non-GAAP Reconciliations EBITDA Reconciliation Q3 2012 Q4 2012 Q1 2013 Q2 2013 LTM Net loss (GAAP) (6,308) (7,955) (11,369) (13,437) (39,069) Plus: Interest expense, net 19,248 20,597 20,107 20,350 80,302 Income tax expense (benefit) 2,366 2,892 (1,439) 2,792 6,611 Depreciation and amortization 12,879 15,013 13,777 14,542 56,211 Equity in loss (income) of non-consolidated affiliates, net 370 2,436 34 (9) 2,831 Foreign currency exchange losses (gains), net (13,969) (6,235) 10,854 (836) (10,186) Share-based compensation 269 659 634 1,091 2,653 Other expense (income), net 127 (1,553) 119 (857) (2,164) Loss on extinguishment of debt 2,358 - - - 2,358 Acquisition costs 4,533 639 33 337 5,542 Purchase accounting (inventory step-up and other) 6,776 1,695 923 838 10,232 Bank fees 555 638 311 909 2,413 Advisory fees 867 890 1,037 1,297 4,091 Reorganization and restructuring charges 1,292 3,509 1,962 3,589 10,352 Sarbanes-Oxley implementation 237 380 231 - 848 Other adjustments 13 258 349 376 996 Adjusted EBITDA (Non-GAAP) 31,613 33,863 37,563 30,982 134,021 Lankhorst pre-acquisition Adjusted EBITDA 2,220 - - - 2,220 Correction of immaterial error - - (1,436) 1,436 - Acquisition Adjusted EBITDA (Non-GAAP) 33,833 33,863 36,127 32,418 136,241 ($ 000’s)

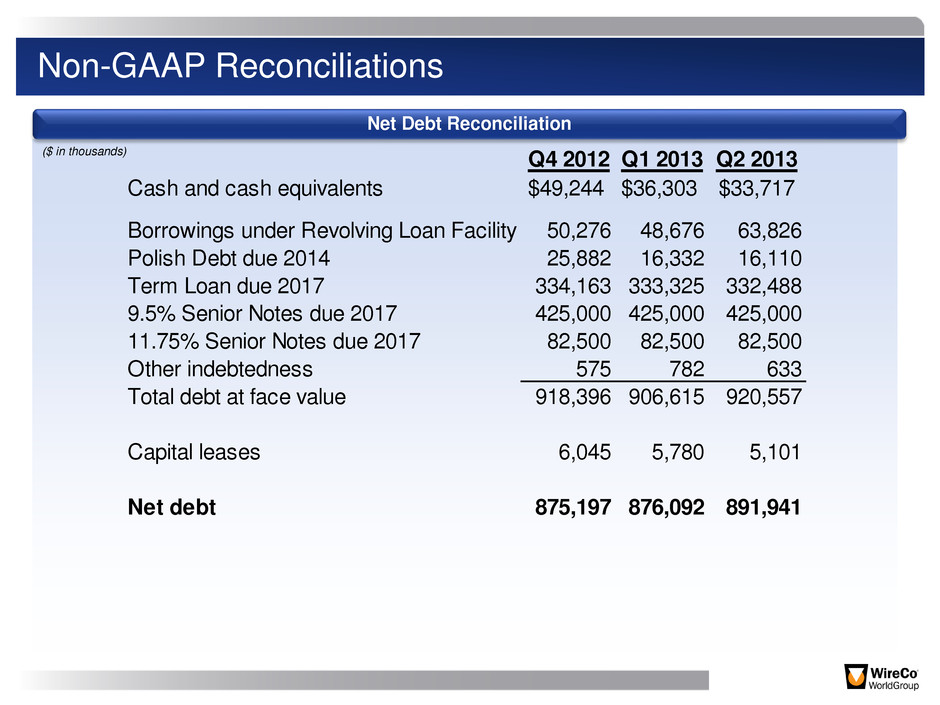

Non-GAAP Reconciliations Net Debt Reconciliation Q4 2012 Q1 2013 Q2 2013 Cash and cash equivalents $49,244 $36,303 $33,717 Borrowings under Revolving Loan Facility 50,276 48,676 63,826 Polish Debt due 2014 25,882 16,332 16,110 Term Loan due 2017 334,163 333,325 332,488 9.5% Senior Notes due 2017 425,000 425,000 425,000 11.75% Senior Notes due 2017 82,500 82,500 82,500 Other indebtedness 575 782 633 Total debt at face value 918,396 906,615 920,557 Capital leases 6,045 5,780 5,101 Net debt 875,197 876,092 891,941 ($ in thousands)

Non-GAAP Reconciliations Net Working Capital Reconciliation Q1'11 Q2'11 Q3'11 Q4'11 Q1'12 Q2'12 Q3'12 Q4'12 Q1'13 Q2'13 A/R as reported $104 $105 $117 $109 $121 $121 $160 $153 $174 $172 Drumet pre-acquisition A/R 16 17 0 0 0 0 0 0 0 0 Lankhorst pre-acquisition A/R 48 50 38 40 45 46 0 0 0 0 Pro forma A/R 168 172 155 149 166 167 160 153 174 172 Inventory as reported $153 $166 $178 $188 $192 $191 $268 $248 $239 $244 Drumet pre-acquisition Inventory 17 17 0 0 0 0 0 0 0 0 Lankhorst pre-acquisition Inventory 56 63 55 54 61 62 0 0 0 0 Pro forma Inventory 226 246 233 242 253 253 268 248 239 244 A/ as reported $48 $46 $48 $60 $57 $54 $91 $83 $84 $83 Drumet pre-acquisition A/P 8 8 0 0 0 0 0 0 0 0 Lankhorst pre-acquisition A/P 31 29 22 28 30 30 0 0 0 0 Pro forma A/P 87 83 70 88 87 84 91 83 84 83 Net Working Capital $307 $335 $318 $303 $332 $336 $337 $318 $329 $333 ($ in millions)