Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WEST PHARMACEUTICAL SERVICES INC | wst-q22013form8k.htm |

| EX-99.1 - EXH 99.1 EARNINGS RELEASE - WEST PHARMACEUTICAL SERVICES INC | exh991q22013earningsrelease.htm |

| EX-99.3 - EXH 99.3 STOCK SPLIT AND DIVIDEND ANNOUNCEMENT - WEST PHARMACEUTICAL SERVICES INC | exh993stocksplitdividendan.htm |

1 Speakers: Donald E. Morel, Jr. Chairman and Chief Executive Officer William J. Federici Senior Vice President and Chief Financial Officer All trademarks and registered trademarks are the property of West Pharmaceutical Services, Inc., unless noted otherwise. West Pharmaceutical Services, Inc. Second-Quarter 2013 Analyst Conference Call 9 a.m. Eastern Time, August 1, 2013 A webcast of today’s call can be accessed in the “Investors” section of the Company’s web site www.westpharma.com To participate please dial: U.S. toll-free (866) 318-8613 International (617) 399-5132 The passcode is 88976013 A replay will be available on the web site two hours after the live call and through August 8, 2013. To access the replay by telephone please dial: U.S. toll-free - (888) 286-8010 or International - (617) 801-6888. The passcode is 99015893 These presentation materials are intended to accompany today’s press release announcing the Company’s results for the quarter and management’s discussion of those results during today’s conference call.

2 Cautionary Statement Under the Private Securities Litigation Reform Act of 1995 This presentation and any accompanying management commentary contain “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to statements about expected financial results for 2013 and future years. Each of these estimates is based on preliminary information, and actual results could differ from these preliminary estimates. We caution investors that the risk factors listed under “Cautionary Statement” in today’s press release, as well as those set forth under the caption "Risk Factors" in our most recent Annual Report on Form 10-K as filed with the Securities and Exchange Commission and as revised or supplemented by our quarterly reports on Form 10-Q, could cause our actual results to differ materially from those estimated or predicted in the forward-looking statements. You should evaluate any statement in light of these important factors. Except as required by law or regulation, we undertake no obligation to publicly update any forward- looking statements, whether as a result of new information, future events, or otherwise. Non-GAAP Financial Measures Certain financial measures included in today’s press release and accompanying tables, in these presentation materials, and which may be referred to in management’s discussion of the Company’s results and outlook, are Non-GAAP (Generally Accepted Accounting Principles) financial measures. Non-GAAP financial measures should not be considered in isolation or as an alternative to such measures determined in accordance with GAAP. Please refer to the “Non-GAAP Financial Measures” and “Notes to Non-GAAP Financial Measures” at the end of these materials for more information.

3 Quarterly Highlights Good operating results in both businesses: • Sales growth driven by pre-filled components, proprietary products • Significant gross margin gain • Adjusted diluted EPS grew 8.9% $20 million exclusivity fee for SmartDoseTM Raising our annual EPS guidance Stock to split in September 2013 Twenty-first consecutive annual dividend increase

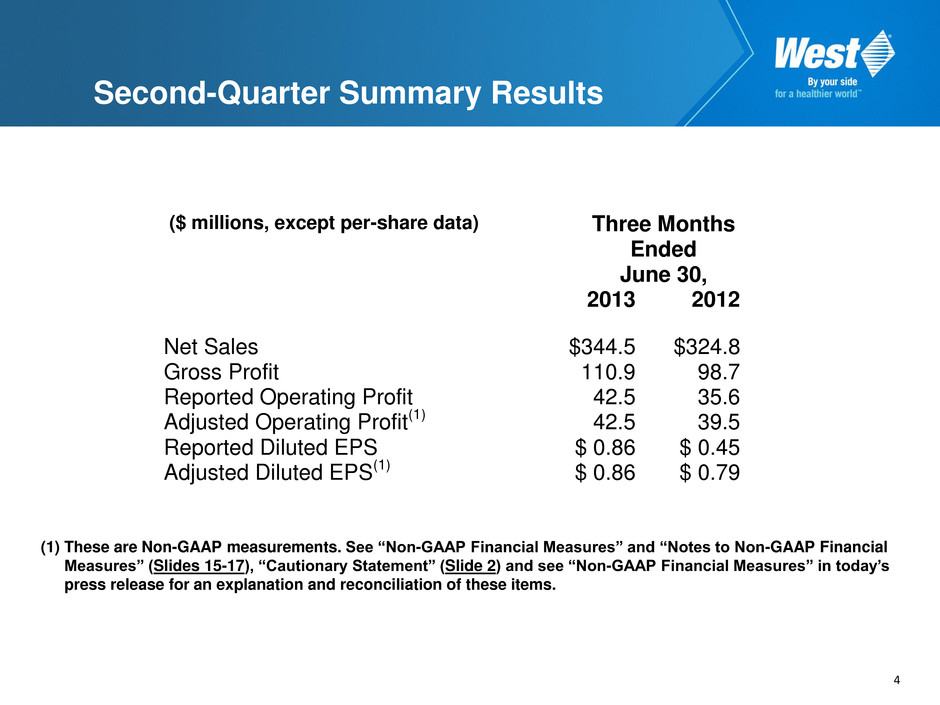

4 Second-Quarter Summary Results (1) These are Non-GAAP measurements. See “Non-GAAP Financial Measures” and “Notes to Non-GAAP Financial Measures” (Slides 15-17), “Cautionary Statement” (Slide 2) and see “Non-GAAP Financial Measures” in today’s press release for an explanation and reconciliation of these items. ($ millions, except per-share data) Three Months Ended June 30, 2013 2012 Net Sales $344.5 $324.8 Gross Profit 110.9 98.7 Reported Operating Profit 42.5 35.6 Adjusted Operating Profit(1) 42.5 39.5 Reported Diluted EPS $ 0.86 $ 0.45 Adjusted Diluted EPS(1) $ 0.86 $ 0.79

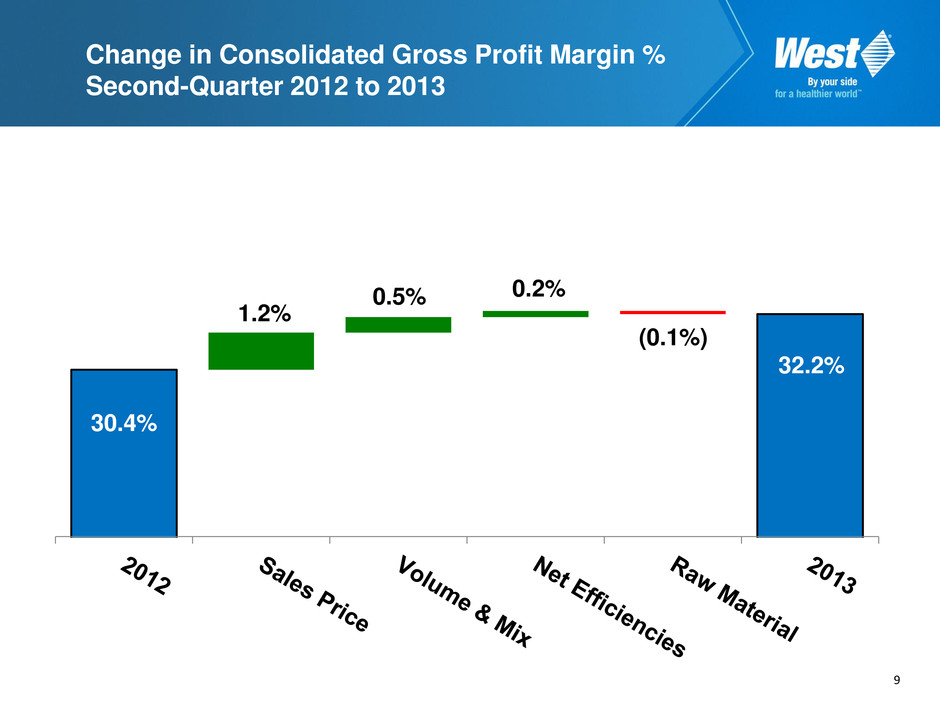

5 Second-Quarter Operating Results Overall sales growth 5.7% (All growth rates are based on comparisons excluding currency) • Pharmaceutical Packaging Systems up 6.3% High-value products growth slowed to 3.3% vs. strong prior-year quarter Pre-fillable syringe components led 7.4% growth in standard products Backlog 14% higher than Q2 2012 (17% including currency) • Pharmaceutical Delivery Systems 4.3% higher Persistent strength in U.S. healthcare manufacturing CZ and administration products drove 32.7% growth in proprietary products Comprise 26% of segment sales Gross Profit Margin up 1.8 percentage points to 32.2% • Pricing improvements, stable material costs and other efficiencies Will recognize exclusivity fee income over life of agreement SG&A cost increases outpace sales: employee benefit costs, supply- chain and IT initiatives, performance based compensation.

6 Expansion and Product Development Geographic expansion: • China producing validation samples for customers • India plant is on schedule Metals production in 2014 Elastomers to follow in 2015 Proprietary systems • Growing share of PDS sales • SmartDose exclusivity fee milestone • Pre-commercial and generic demand for Daikyo CZ® products • Reconstitution and safety products account for most proprietary sales Daikyo CZ® is a registered trademark of Daikyo Seiko, Ltd.

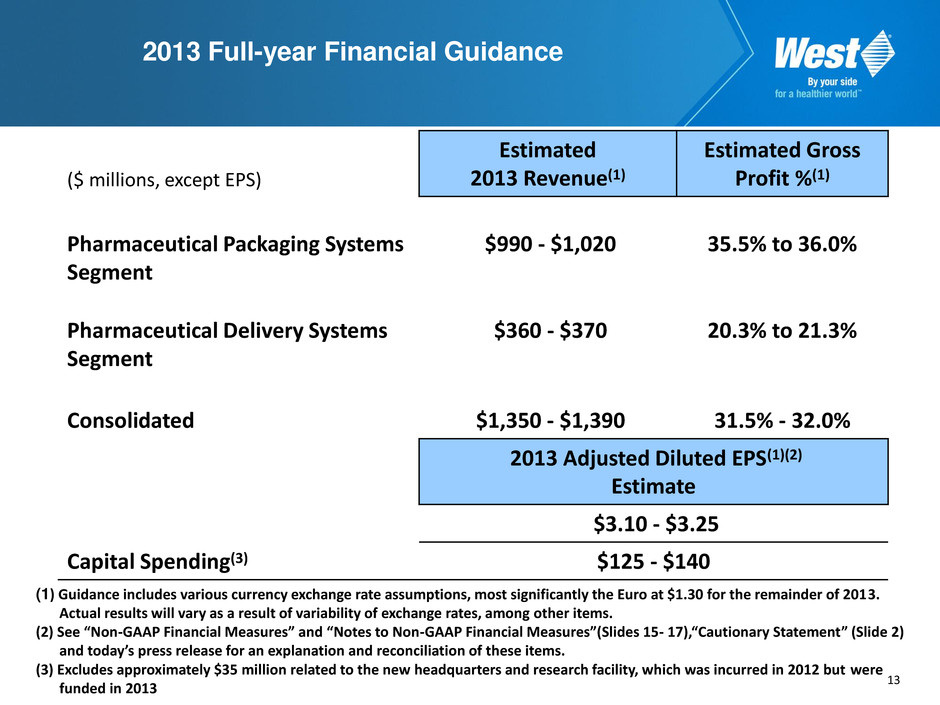

7 2013 Outlook Sales growth 6% to 9%, excluding currency Pharmaceutical Systems: • High-value products growth expected to improve sales mix • Margins improving on mix, raw material costs and efficiencies • Efforts to shorten order lead-times will continue Delivery Systems: • Proprietary product sales accelerating • Contract manufacturing growth slowed by project delays R&D Investments continue Expect slower SG&A growth relative to sales Adjusted diluted EPS in the range of $3.10 to $3.25 Further details provided on slides 13, 14 and 17

8 Change in Consolidated Sales Second-Quarter 2012 to 2013 ($ millions) $344.5 $12.5 $6.0 $1.2 $324.8 2012 Sales Volume & Mix Sales Price Currency 2013 Sales

9 Change in Consolidated Gross Profit Margin % Second-Quarter 2012 to 2013 32.2% (0.1%) 1.2% 0.5% 0.2% 30.4%

10 Change in SG&A Costs Second-Quarter 2012 to 2013 ($ millions) $59.7 $1.8 $1.1 $0.9 $0.7 $0.8 $54.4

11 Cash Flow Metrics ($ millions) Six Months Ended June 30, 2013 2012 Depreciation and amortization $41.2 $37.4 Operating cash flow $98.4 $66.0 Capital expenditures $83.8 $69.4

12 Summary Balance Sheet Information ($ millions) As of June 30, 2013 December 31, 2012 Cash and cash equivalents $190.6 $161.9 Debt $394.8 $411.5 Equity $784.2 $728.9 Net debt to total invested capital† 20.7% 25.5% Working capital $394.6 $295.5 † Net debt to total invested capital is a Non-GAAP measure, which management believes provides a useful measure of the comparative degree of West’s financial leverage. Net debt is determined by reducing total debt by the amount of cash and cash equivalents, and for purpose of measuring net debt to invested capital, total invested capital is the sum of net debt and shareholders’ equity.

13 2013 Full-year Financial Guidance ($ millions, except EPS) Estimated 2013 Revenue(1) Estimated Gross Profit %(1) Pharmaceutical Packaging Systems Segment $990 - $1,020 35.5% to 36.0% Pharmaceutical Delivery Systems Segment $360 - $370 20.3% to 21.3% Consolidated $1,350 - $1,390 31.5% - 32.0% 2013 Adjusted Diluted EPS(1)(2) Estimate $3.10 - $3.25 Capital Spending(3) $125 - $140 (1) Guidance includes various currency exchange rate assumptions, most significantly the Euro at $1.30 for the remainder of 2013. Actual results will vary as a result of variability of exchange rates, among other items. (2) See “Non-GAAP Financial Measures” and “Notes to Non-GAAP Financial Measures”(Slides 15- 17),“Cautionary Statement” (Slide 2) and today’s press release for an explanation and reconciliation of these items. (3) Excludes approximately $35 million related to the new headquarters and research facility, which was incurred in 2012 but were funded in 2013

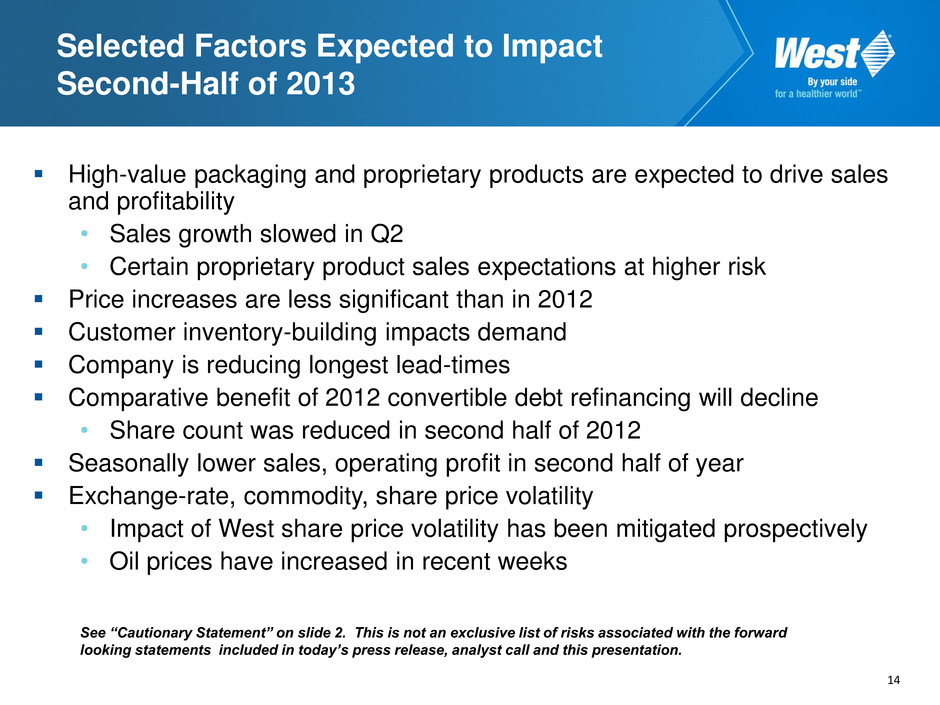

14 Selected Factors Expected to Impact Second-Half of 2013 High-value packaging and proprietary products are expected to drive sales and profitability • Sales growth slowed in Q2 • Certain proprietary product sales expectations at higher risk Price increases are less significant than in 2012 Customer inventory-building impacts demand Company is reducing longest lead-times Comparative benefit of 2012 convertible debt refinancing will decline • Share count was reduced in second half of 2012 Seasonally lower sales, operating profit in second half of year Exchange-rate, commodity, share price volatility • Impact of West share price volatility has been mitigated prospectively • Oil prices have increased in recent weeks See “Cautionary Statement” on slide 2. This is not an exclusive list of risks associated with the forward looking statements included in today’s press release, analyst call and this presentation.

15 Non-GAAP Financial Measures(1) Three Months Ended June 30, 2012 (in millions, except per share data) (1) See “Notes to Non-GAAP Financial Measures” (Slides 16-17), “Cautionary Statement” (Slide 2) and today’s press release for an explanation and reconciliation of these items. Three-months ended June 30, 2012 Operating Profit Loss on Debt Extinguishment Income Tax Expense Net Income Diluted EPS Reported (GAAP) $35.6 $11.6 $6.5 $15.6 $0.45 Restructuring, impairment & related charges 3.7 - 1.4 2.3 0.06 Acquisition-related contingencies 0.2 - - 0.2 0.01 Extinguishment of debt - (11.6) 1.8 9.8 0.27 Adjusted (Non-GAAP) $39.5 $- $9.7 $27.9 $0.79 There were no adjustments to GAAP results for the three months ended June 30, 2013

16 NOTES TO NON-GAAP FINANCIAL MEASURES For additional details, please see today’s press release and Safe Harbor Statement. Today’s press release, these presentation materials and associated presentation use the following financial measures that have not been calculated in accordance with generally accepted accounting principles (GAAP) accepted in the U.S., and therefore are referred to as non- GAAP financial measures: Adjusted operating profit Adjusted net income Adjusted diluted EPS Net debt Total invested capital Net debt to total invested capital West believes that these non-GAAP measures of financial results provide useful information to management and investors regarding business trends, results of operations, and the Company’s overall performance and financial position. Our executive management team uses these financial measures to evaluate the performance of the Company in terms of profitability and efficiency, to compare operating results to prior periods, to evaluate changes in the operating results of each segment, and to measure and allocate financial resources to our segments. The Company believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends in comparing its financial measures with other companies. Our executive management does not consider such non-GAAP measures in isolation or as an alternative to such measures determined in accordance with GAAP. The principal limitation of these financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded. In addition, they are subject to inherent limitations as they reflect the exercise of judgment by management about which items are excluded. In order to compensate for these limitations, non-GAAP financial measures are presented in connection with GAAP results. We urge investors and potential investors to review the reconciliations of our non-GAAP financial measures to the comparable GAAP financial measures, and not to rely on any single financial measure to evaluate the Company’s business. In calculating adjusted operating profit, adjusted net income and adjusted diluted EPS, we exclude the impact of items that are not considered representative of ongoing operations. Such items include restructuring and related costs, certain asset impairments, other specifically identified gains or losses, and discrete income tax items. A reconciliation of these adjusted non-GAAP measures to the comparable GAAP financial measures is included in the accompanying tables. Please see “Non-GAAP Financial Measures” in today’s press release for further information concerning reconciling items.

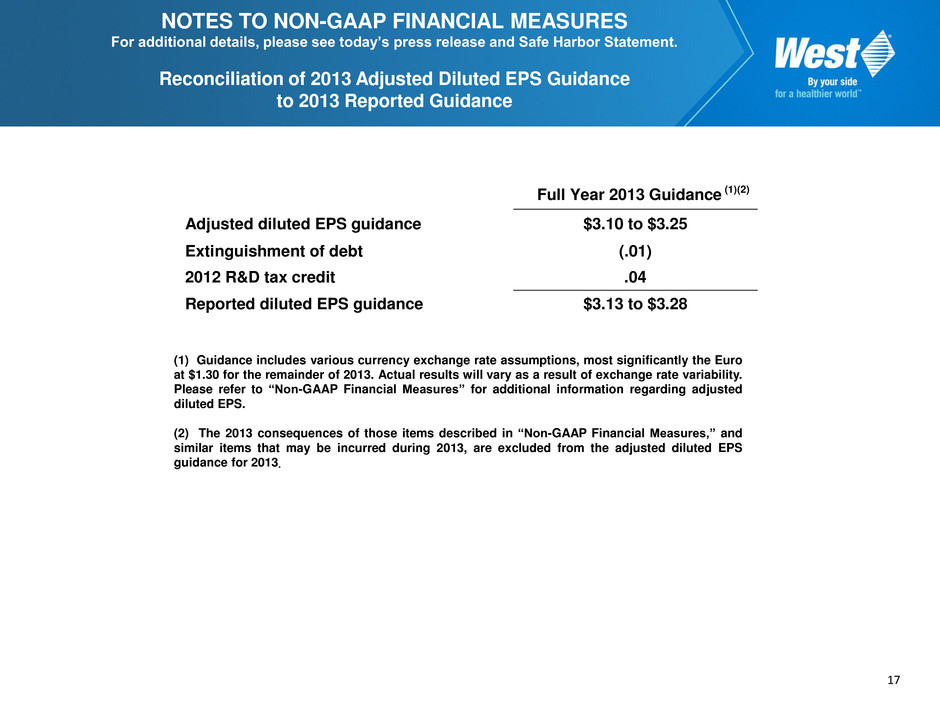

17 NOTES TO NON-GAAP FINANCIAL MEASURES For additional details, please see today’s press release and Safe Harbor Statement. Reconciliation of 2013 Adjusted Diluted EPS Guidance to 2013 Reported Guidance Full Year 2013 Guidance (1)(2) Adjusted diluted EPS guidance $3.10 to $3.25 Extinguishment of debt (.01) 2012 R&D tax credit .04 Reported diluted EPS guidance $3.13 to $3.28 (1) Guidance includes various currency exchange rate assumptions, most significantly the Euro at $1.30 for the remainder of 2013. Actual results will vary as a result of exchange rate variability. Please refer to “Non-GAAP Financial Measures” for additional information regarding adjusted diluted EPS. (2) The 2013 consequences of those items described in “Non-GAAP Financial Measures,” and similar items that may be incurred during 2013, are excluded from the adjusted diluted EPS guidance for 2013.