Attached files

| file | filename |

|---|---|

| 8-K - 8-K - General Motors Financial Company, Inc. | d575870d8k.htm |

| EX-99.1 - EX-99.1 - General Motors Financial Company, Inc. | d575870dex991.htm |

July 25, 2013

1

2

nd

Quarter 2013 Earnings Call

Exhibit 99.2 |

2

Safe Harbor Statement

This presentation contains several “forward-looking statements”.

Forward-looking statements are those that use words such as

“believe”, “expect”, “anticipate”, “intend”, “plan”, “may”, “likely”,

“should”, “estimate”, “continue”,

“future” or other comparable expressions. These words indicate

future events and trends. Forward-looking statements are General Motors

Financial Company, Inc.’s (the “Company’s”) current

views with respect to future events and financial performance. These

forward-looking statements are subject to many assumptions, risks and uncertainties that

could cause actual results to differ significantly from historical results or from

those anticipated by the Company. The most significant risks are detailed

from time to time in the Company’s filings and reports with the

Securities and Exchange Commission, including the Company’s Report on Form

10-K

for

the

year

ended

December

31,

2012.

Such

risks

include

-

but

are

not

limited

to

-

our

ability

to close the acquisition of the remaining portions of Ally Financial Inc.’s

international operations and integrate those operations that we have yet to

acquire into our business successfully, changes in general economic and

business conditions, GM’s ability to sell new vehicles in the areas in which

we operate in North America, Europe and Latin America that we finance, interest

rate fluctuations, our financial condition and liquidity, as well as future

cash flows and earnings, competition, the effect, interpretation or

application of new or existing laws, regulations, court decisions and

accounting pronouncements, the availability of sources of financing, the level of

net credit losses, delinquencies and prepayments on the loans and leases we

originate, the prices at which used cars are sold in the wholesale auction

markets, changes in business strategy, including acquisitions and expansion

of product lines and credit risk appetite, and significant litigation. If one or more of these

risks of uncertainties materializes, or if underlying assumptions prove incorrect,

actual events or results may differ materially. It is advisable not to place

undue reliance on the Company’s forward- looking

statements.

The

Company

undertakes

no

obligation

to,

and

does

not,

publicly

update

or

revise any forward-looking statements, except as required by federal securities

laws, whether as a result of new information, future events or otherwise.

|

GM

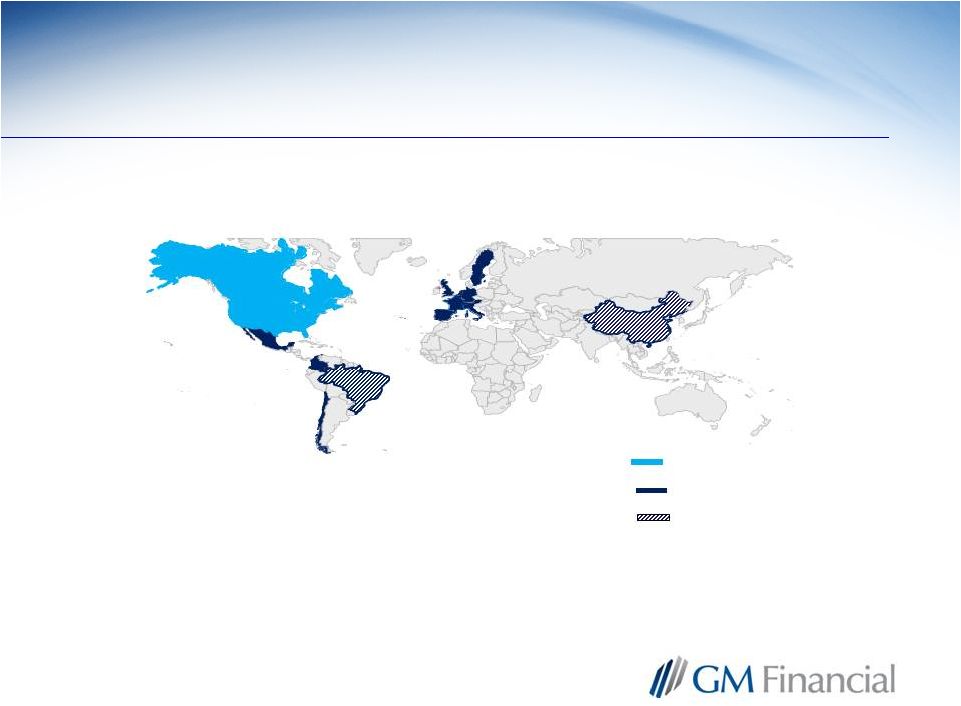

Financial Operations 3

Provide a full spectrum of financing solutions for GM dealers with a focus

at June 30, 2013

Existing markets

Acquired markets

Markets pending close

on specific market segments that are at times underserved

|

Key

Metrics – June 2013 Quarter

4

($MM)

North

America

1

International

2

Total Co.

Earnings Before Tax

$213

$43

$264

(3)

Ending Earning Assets

$15,198

$11,035

$26,233

Total Originations

(Loan & Lease)

$2,185

$1,117

$3,302

GM as a % of Total Originations

58.8%

86.0%

68.0%

Annualized Net Credit Loss as a % of Avg.

Consumer Finance Receivables

2.1%

0.3%

1.4%

1.

United States and Canada

2.

Beginning April 1, 2013, Germany, the United Kingdom, Italy, Sweden, Switzerland,

Austria, Belgium, the Netherlands, Chile, Colombia, Mexico, Spain,

Greece and beginning June 1, 2013, France and Portugal

3.

Reflects net impact of intercompany allocations |

North

America – GM and GMF Penetration Statistics

5

GM

Industry Average

(excluding GM)

Sep-10

Jun-13

Sep-10

Jun-13

Sales Penetrations

U.S. Subprime Loans

4.8%

8.6%

4.6%

6.4%

U.S. Leases

8.6%

20.0%

20.5%

24.3%

Canada Leases

2.1%

9.2%

13.8%

21.2%

GM / GMF Linkage

GM as % of GMF Loan and Lease Originations

(GM New / GMF Consumer Loan & Lease)

15.7%

58.8%

GMF as % of GM U.S. Subprime

27.6%

33.9%

GMF as % of GM U.S. Lease

(1)

--

21.0%

GMF wholesale dealer penetration

(1)

--

4.0%

(1) GM Financial did not offer a lease or commercial lending product when acquired

by GM. The lease product was launched in the U.S. and Canada in Q4 2010 and Q2 2011,

respectively. Commercial lending was launched in the U.S. and Canada in Q2

2012 and Q1 2013, respectively. |

6

North America –

Loan Origination Volume

•

GM Financial and Ally have a dominant share of less than prime lending for new

vehicles sold in GM dealerships •

Market share leaders in the subprime used auto finance space remain consistent (GM

Financial, Wells Fargo, Capital One, and Santander Consumer USA)

–

Capital flowing into the space causing increased competitive conditions as some

lenders seek volume –

Competition

is

driving

extended

loan

terms,

higher

loan

to

value

and

reduced

pricing

in

the

market

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

Jun

-12

Sep-12

Dec-12

Mar-13

Jun

-13

Quarterly

($MM)

Loans originated

on new vehicles

by GM dealers

Loans originated

on used vehicles

by GM dealers

Loans originated

on vehicles by

Non-GM dealers

$1,489

$1,478

$1,216

$1,359

$1,351 |

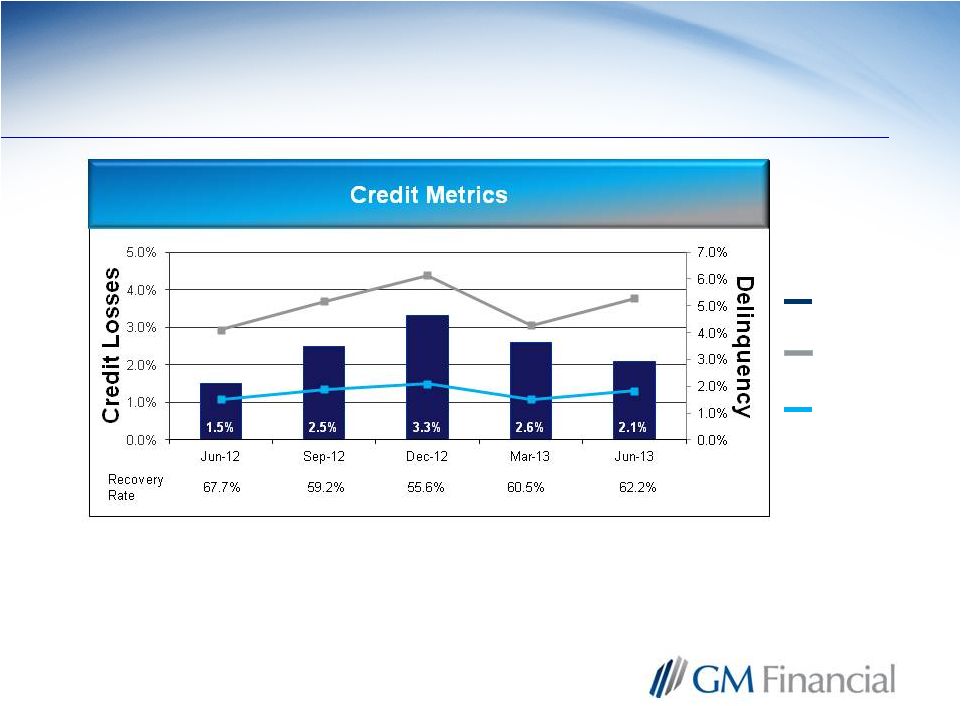

North

America – Consumer Loan Credit Performance

7

NA Annualized

quarterly net credit

losses

NA 31-60 day

delinquency

NA 61+ day

delinquency

•

Credit metrics impacted by seasonality and normalizing of the

credit environment |

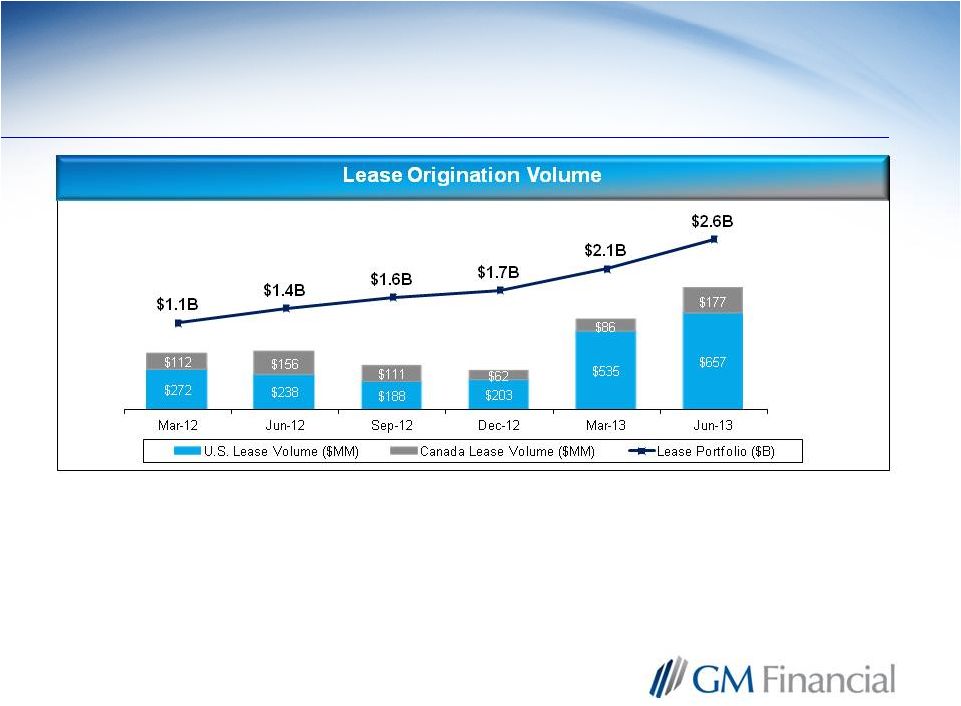

North

America – Lease Originations

8

•

Continued growth of the lease product in both the U.S. and Canada

|

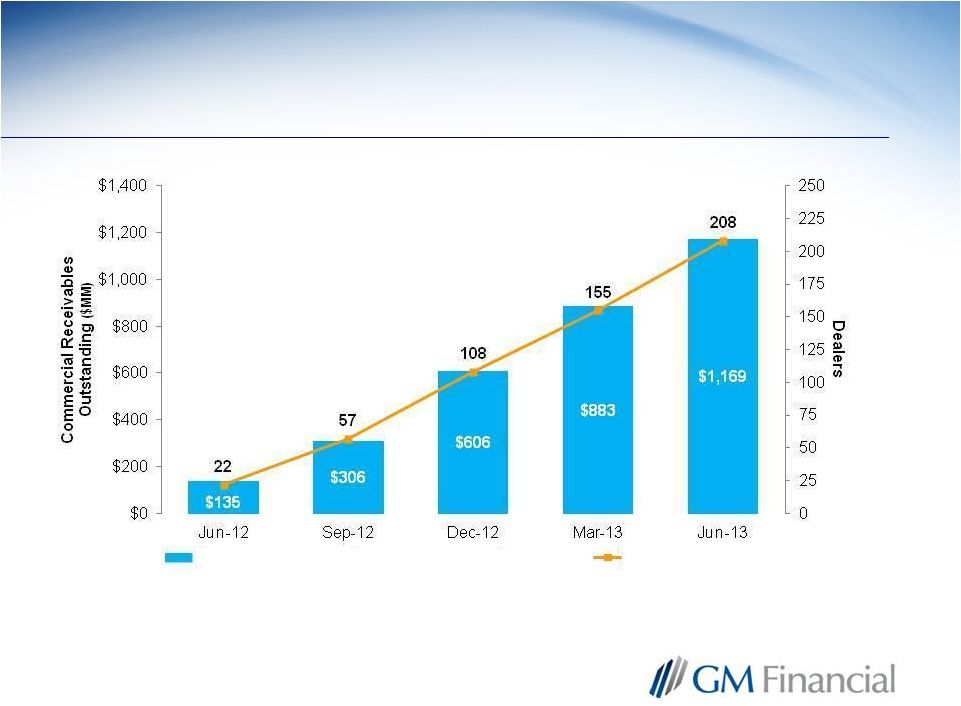

9

North America –

Commercial Lending

Commercial Finance Receivables Outstanding

Number of Dealers |

International Operations–

GM and GMF Penetration Statistics

10

Jun-13

Sales Penetrations

GMF as a % of GM Retail Sales

30.3%

Europe

27.6%

Latin America

36.0%

GMF wholesale dealer penetration

94.9%

Europe

97.7%

Latin America

88.0%

GM / GMF Linkage

GM as % of GMF Consumer Originations

(GM New / GMF Consumer Loan)

86.0%

Europe

79.7%

Latin America

96.1% |

International Operations–

Consumer Loan Originations

11

•

Comprised of predominately

prime quality customers

purchasing new GM vehicles

•

Solid performance in the UK

and Mexico …

softer in

continental Europe

Other 7%

$1.1B

Europe

Latin

America

Mexico

19%

Germany

30%

U.K.

31%

Other 7%

June 2013 Quarter

Other 13% |

International Operations–

Consumer Loan Portfolio

12

Other

8%

Other

18%

•

Credit performance consistent with

prime make up of portfolio

•

For June 2013 quarter

-

Annualized quarterly net credit losses

of 0.3%

-

31-60 day delinquencies of 0.6%

-

61+ day delinquencies of 0.6%

U.K.

23%

Germany

38%

Mexico

13%

At June 30, 2013

$7.2 B

Europe

Latin

America |

International Operations–

Commercial Lending Portfolio

13

•

Providing a full range of

commercial lending products

…

utilizing a high-

touch/relationship focused

model

•

Strong penetration of GM

dealers at 95 %

•

Floorplan financing

represents the largest share

U.K.

25%

Germany

25%

Other

31%

Mexico

15%

Other

4%

at June 30, 2013

$3.8 B

Europe

Latin

America |

14

International Acquisition –

Financial Transaction Summary

Sources

Uses

Unsecured senior notes

$2.5

Operations purchase price to date

$2.6

GM equity contribution

1.3

Remaining operations purchase

price`

1.6

Additional GM equity contribution

0.7

Inter-company loan

(1)

1.5

GMF liquidity

1.2

Total sources

$5.7

Total uses

$5.7

(1) Includes $1.4B to repay inter-company loan from Ally to European

Operations ($B)

•

Remaining GM capital contribution to be received in connection with

subsequent closing

–

No additional debt financing needed

•

Preliminary goodwill = $50 million

–

Subject to further adjustment pending closure of Brazil and China, including

potential adjustments from the finalization of the closing balance sheet

audits •

Purchase accounting applied to fair value assets and liabilities

–

Minimal impact |

15

Financial Results –

Earnings

Before

Taxes

($MM)

Three Months Ended June 30,

Six months ended June 30,

Note: Results from international operations are reflected beginning in Q2 2013

from the date of their acquisition

(1) Total Co. reflects net impact of intercompany allocations

(1)

(1)

$264

$213

$43

$217

$217

Total Co.

North America

International

2013

2012

$434

$397 $398

$37

$398

Total Co.

North America

International

2013

2012 |

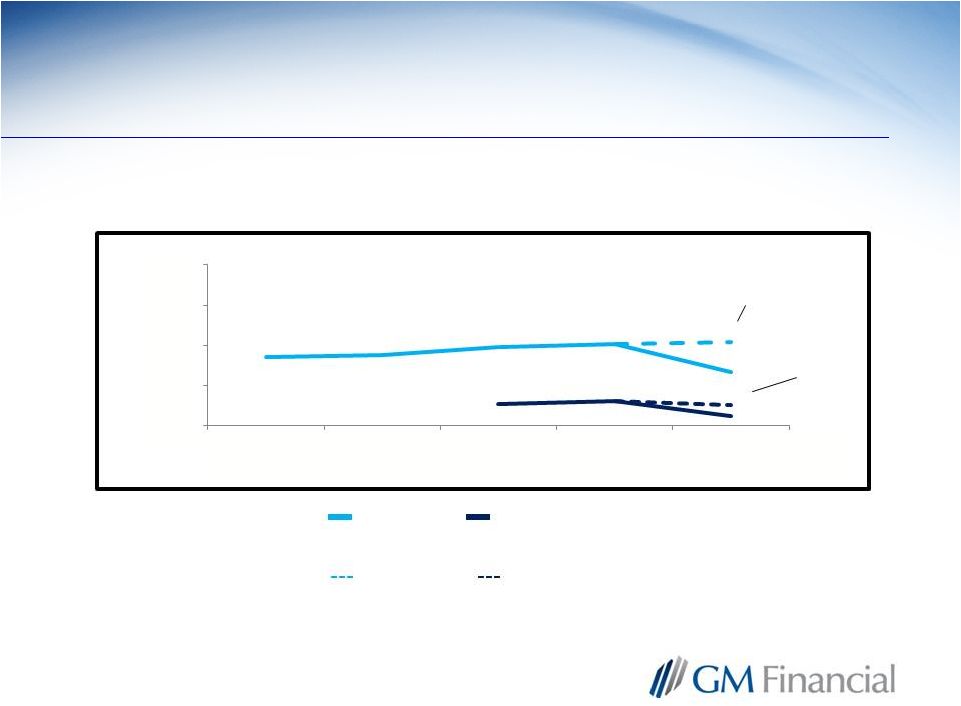

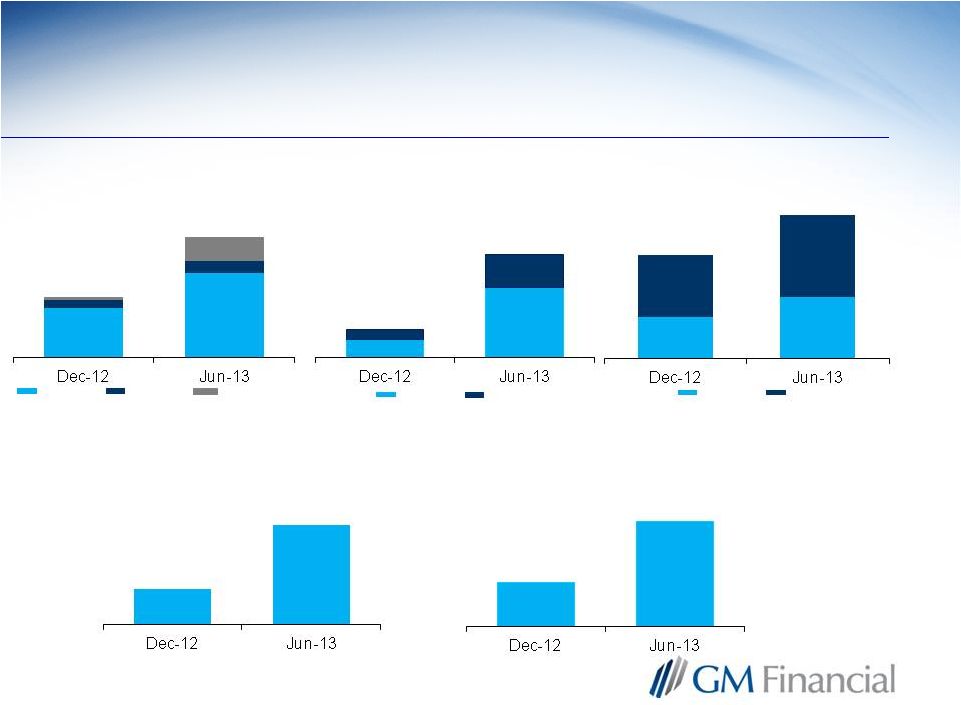

16

Financial Results –

Allowance for Loan Losses

Allowance for Loan Loss as a Percentage of Post-Acquisition Finance

Receivables Consumer

Allowance

Commercial

Allowance

North

America Only

North America

Only

NA Only

3.4%

3.5%

3.9%

4.1%

2.7%

1.1%

1.2%

0.5%

4.2%

1.0%

0.0%

2.0%

4.0%

6.0%

8.0%

Jun-12

Sep-12

Dec-12

Mar-13

Jun-13

NA Only |

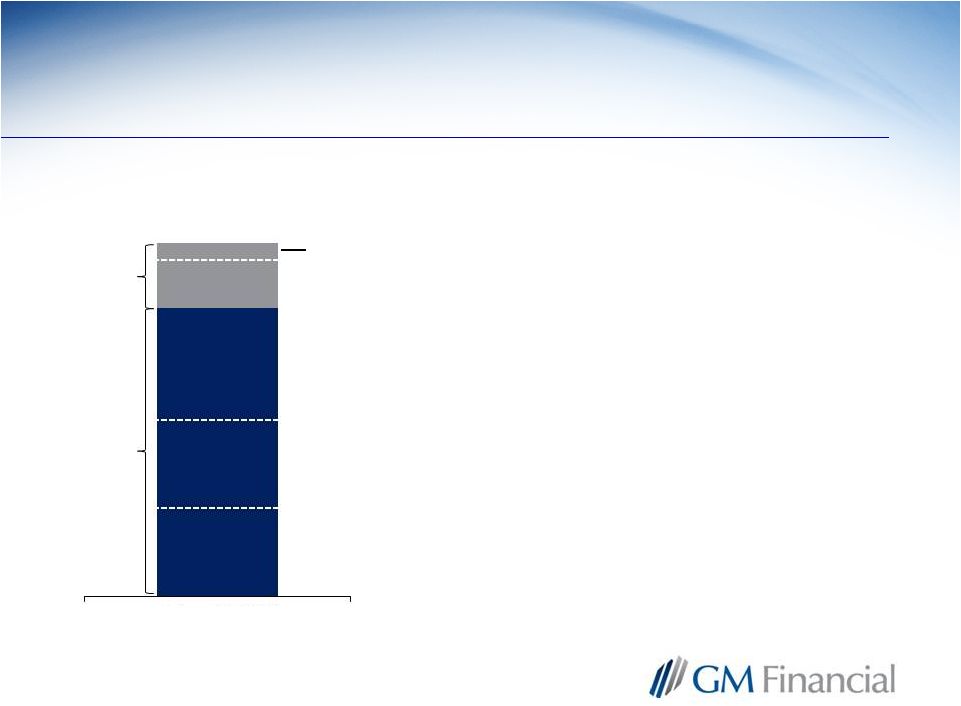

Financial Results –

Operating Expenses

17

Operating Expense as a Percentage of Average Earning Assets

3.0%

NA Only

Total Company

North America Only

3.2%

3.4%

3.1%

3.2%

3.0%

2.50%

3.00%

3.50%

4.00%

Jun

-12

Sep-12

Dec-12

Mar-13

Jun

-13 |

Solid

Balance Sheet 18

Tangible Net Worth ($B)

Consumer

Lease

Consumer

Loans

Commercial

Loans

(1)

Liquidity includes unrestricted cash, available borrowing capacity on unpledged

eligible receivables, available borrowing capacity on committed unsecured

credit lines and unused balance on GM line of credit (2)

Earning assets to tangible net worth

Unsecured

Debt

Secured

Debt

Other

Cash

$13.3

$26.2

$10.9

$22.8

$2.9

$4.1

$3.3

$4.7

4.1x

5.5x

Earning Assets ($B)

Total Debt ($B)

Liquidity

1

($B)

Leverage

(2) |

Funding Overview

•

Funding platform evolving

–

Fund locally

–

Expect to be a frequent issuer of senior notes

to support both growth and as credit rating

improves

–

IO funding composition utilizes more

unsecured funding

–

Expand ABS platforms in NA and IO

–

Intercompany funding for Europe

•

$11.2 B committed funding provided

by 20 banks across 21 facilities

•

GM support via

–

$2B equity contribution for international

acquisition

–

$600M Line of Credit

–

$1B tax deferral program through Dec. 2014

–

Co-borrower on GM Revolver (up to $4 billion)

Unsecured

Tangible

Equity

Secured

Unrestricted

Cash

19

$9.4B

66%

$3.3B

23%

$1.3B

$1.5B

11%

$17.5B

64%

$5.2B

19%

$4.7B

17%

$1.8B

6/30/2013

Post –

International Acquisition

12/31/2012

Pre –

International Acquisition |

20

North America Funding Strategy

•

Utilize secured bank provided credit facilities to support

interim

and

semi-permanent

financing

-

total

capacity

$6.3

billion across five facilities

–

Separate facilities in US and Canada for loans, leases and

commercial lending product lines

–

sized to support

prospective/forecasted volumes from six months to two years

–

Credit facilities to be increased or created as needed to

support product offerings

•

Asset-backed securitizations provide permanent financing

–

Completed over 80 public auto loan securitizations since

1994 with approximately $70 billion in notes issued, including

three in 2013

–

Plan to develop securitization programs for lease and

floorplan

(1) Senior Notes

Funding Composition

June 30, 2013

$15.1B

Unsecured (1)

26.5%

Secured

73.5% |

International Funding Strategy

21

Affiliate

Funding

Unsecured

Funding

Secured

Funding

IO Funding Composition

June 30, 2013

$9.1 Billion

•

Established funding platform, with credit facilities rolling over

with the acquisition

•

Total committed banks lines of $4.9B

•

Fund primarily with local sources to minimize currency and

country risk

–

Currently, Latin America Operations are entirely funded locally

–

European Operations have $1.5B intercompany loan from

GMF US

•

Mix of funding sources varies by country

–

Utilization of both secured and unsecured credit facilities

–

Access

to

public

securitization

markets

–

in

the

UK

and

Germany

for consumer finance receivables

–

Other funding sources exist in certain countries

–

Maintain and develop strong relationships globally with financial

institutions and investors

16%

13%

71% |