Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LegacyTexas Financial Group, Inc. | a8k2q2013covererslides.htm |

| EX-99.1 - EXHIBIT 99.1 - LegacyTexas Financial Group, Inc. | ex991q213earningsrelease.htm |

| EX-99.2 - EXHIBIT 99.2 - LegacyTexas Financial Group, Inc. | ex9922q2013dividendannounc.htm |

1 NASDAQ: VPFG Second Quarter 2013 Earnings Kevin Hanigan – President and Chief Executive Officer Patti McKee – Executive Vice President and Chief Financial Officer Exhibit 99.3

2 Safe Harbor Statement Certain matters discussed on this call may contain forward‐looking statements, which are subject to risks and uncertainties. A number of factors, many of which are beyond ViewPoint Financial Group, Inc.’s control, could cause actual results to differ materially from future results expressed or implied by such forward‐looking statements. These risks and uncertainties include the risk of adverse impacts from general economic conditions, competition, interest rate sensitivity and exposure to regulatory and legislative changes. These and other factors that could cause results to differ materially from those described in the forward‐looking statements can be found in our annual report on Form 10‐K for the year ended December 31, 2012, and in other filings made by ViewPoint Financial Group, Inc. with the Securities and Exchange Commission.

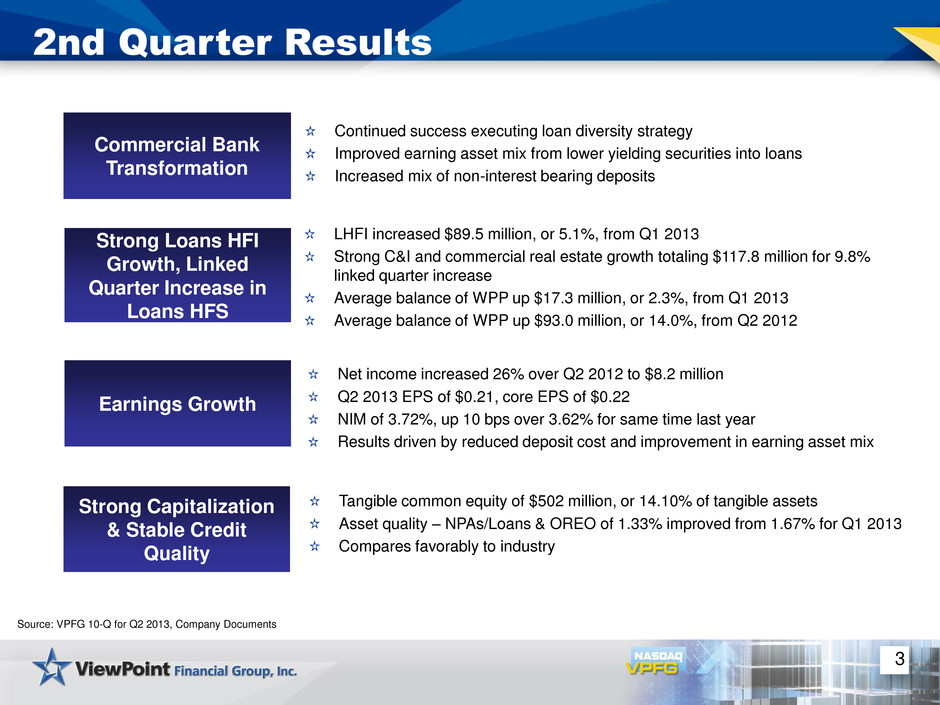

3 2nd Quarter Results Continued success executing loan diversity strategy Improved earning asset mix from lower yielding securities into loans Increased mix of non-interest bearing deposits Commercial Bank Transformation Strong Loans HFI Growth, Linked Quarter Increase in Loans HFS LHFI increased $89.5 million, or 5.1%, from Q1 2013 Strong C&I and commercial real estate growth totaling $117.8 million for 9.8% linked quarter increase Average balance of WPP up $17.3 million, or 2.3%, from Q1 2013 Average balance of WPP up $93.0 million, or 14.0%, from Q2 2012 Net income increased 26% over Q2 2012 to $8.2 million Q2 2013 EPS of $0.21, core EPS of $0.22 NIM of 3.72%, up 10 bps over 3.62% for same time last year Results driven by reduced deposit cost and improvement in earning asset mix Strong Capitalization & Stable Credit Quality Tangible common equity of $502 million, or 14.10% of tangible assets Asset quality – NPAs/Loans & OREO of 1.33% improved from 1.67% for Q1 2013 Compares favorably to industry Source: VPFG 10-Q for Q2 2013, Company Documents Earnings Growth

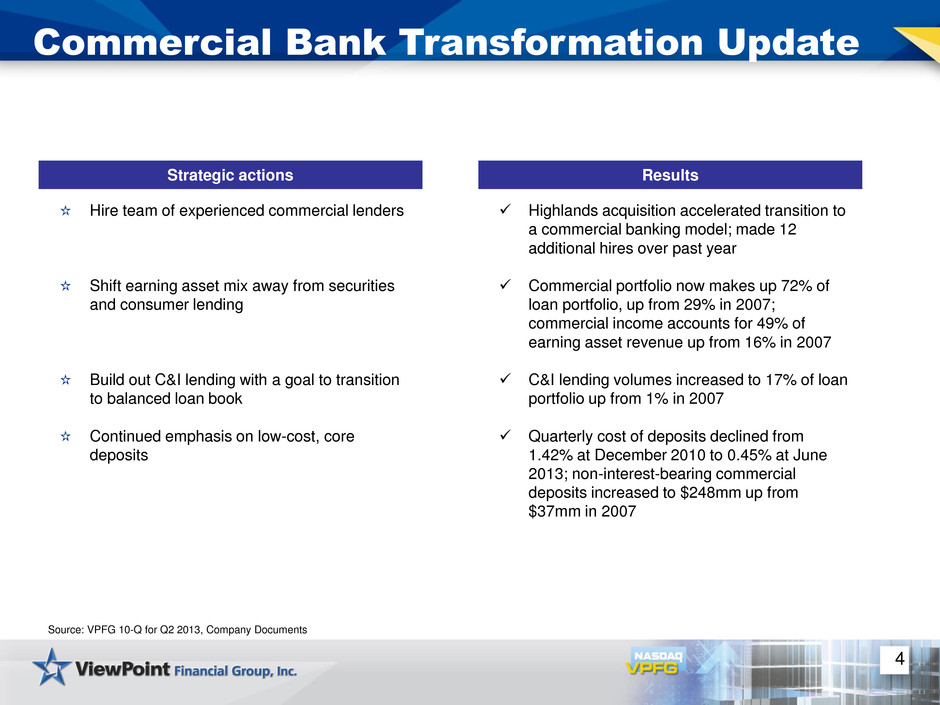

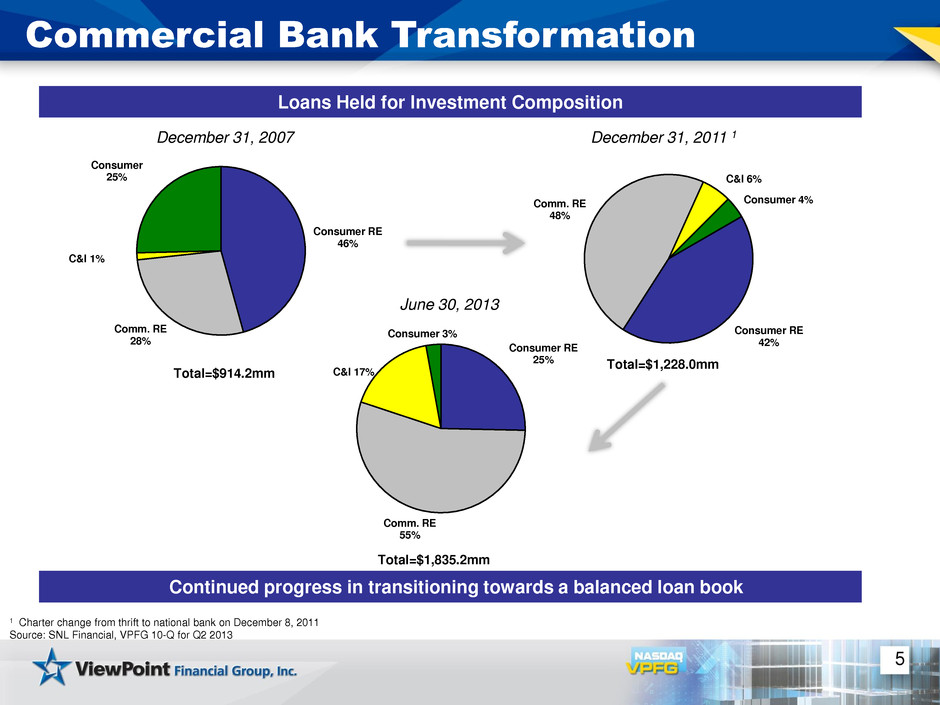

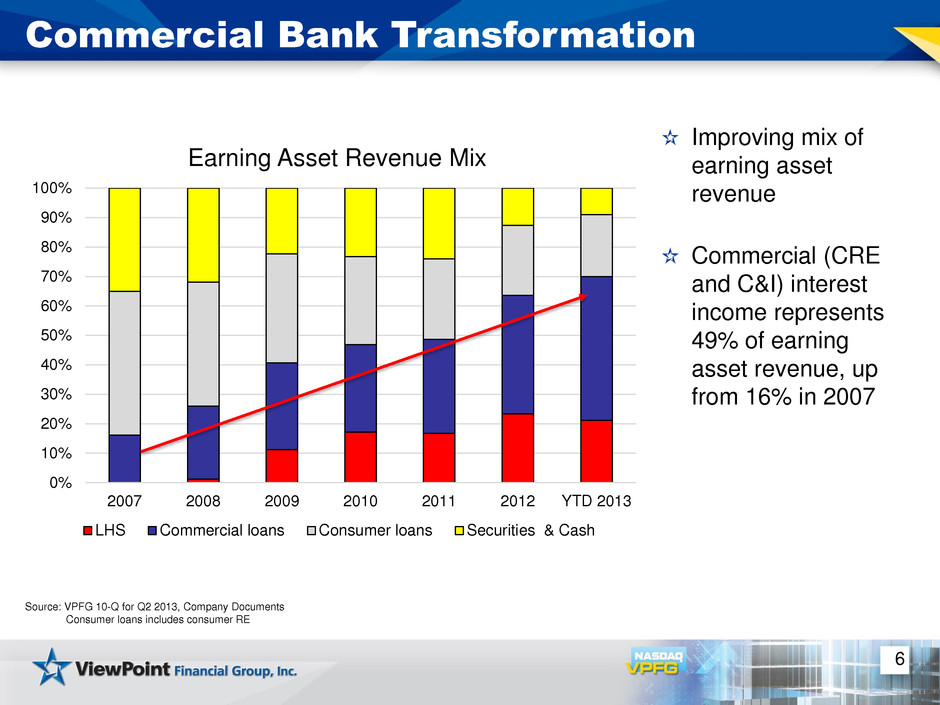

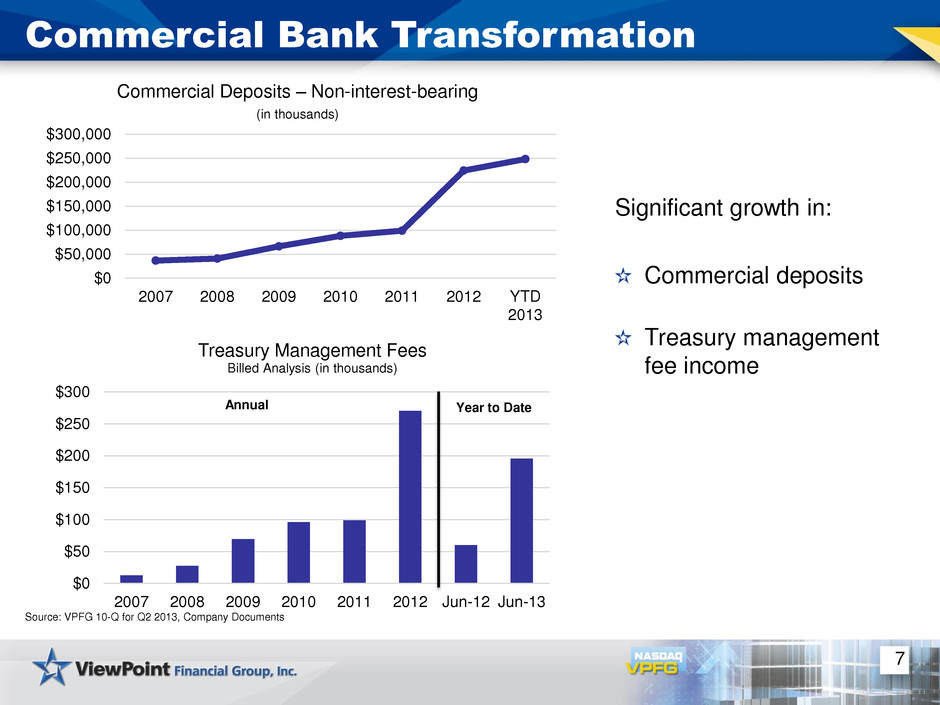

4 Commercial Bank Transformation Update Source: VPFG 10-Q for Q2 2013, Company Documents Strategic actions Results Hire team of experienced commercial lenders Shift earning asset mix away from securities and consumer lending Build out C&I lending with a goal to transition to balanced loan book Continued emphasis on low-cost, core deposits Highlands acquisition accelerated transition to a commercial banking model; made 12 additional hires over past year Commercial portfolio now makes up 72% of loan portfolio, up from 29% in 2007; commercial income accounts for 49% of earning asset revenue up from 16% in 2007 C&I lending volumes increased to 17% of loan portfolio up from 1% in 2007 Quarterly cost of deposits declined from 1.42% at December 2010 to 0.45% at June 2013; non-interest-bearing commercial deposits increased to $248mm up from $37mm in 2007

Consumer RE 25% Comm. RE 55% C&I 17% Consumer 3% 1 Charter change from thrift to national bank on December 8, 2011 Source: SNL Financial, VPFG 10-Q for Q2 2013 Consumer RE 42% Comm. RE 48% C&I 6% Consumer 4% Total=$1,228.0mm 5 Commercial Bank Transformation Loans Held for Investment Composition December 31, 2007 Consumer RE 46% Comm. RE 28% C&I 1% Consumer 25% December 31, 2011 1 June 30, 2013 Total=$914.2mm Total=$1,835.2mm Continued progress in transitioning towards a balanced loan book

6 Commercial Bank Transformation 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2007 2008 2009 2010 2011 2012 YTD 2013 Earning Asset Revenue Mix LHS Commercial loans Consumer loans Securities & Cash Improving mix of earning asset revenue Commercial (CRE and C&I) interest income represents 49% of earning asset revenue, up from 16% in 2007 Source: VPFG 10-Q for Q2 2013, Company Documents Consumer loans includes consumer RE

$0 $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 2007 2008 2009 2010 2011 2012 YTD 2013 Commercial Deposits – Non-interest-bearing (in thousands) $0 $50 $100 $150 $200 $250 $300 2007 2008 2009 2010 2011 2012 Jun-12 Jun-13 Treasury Management Fees Billed Analysis (in thousands) 7 Commercial Bank Transformation Significant growth in: Commercial deposits Treasury management fee income Source: VPFG 10-Q for Q2 2013, Company Documents Annual Year to Date

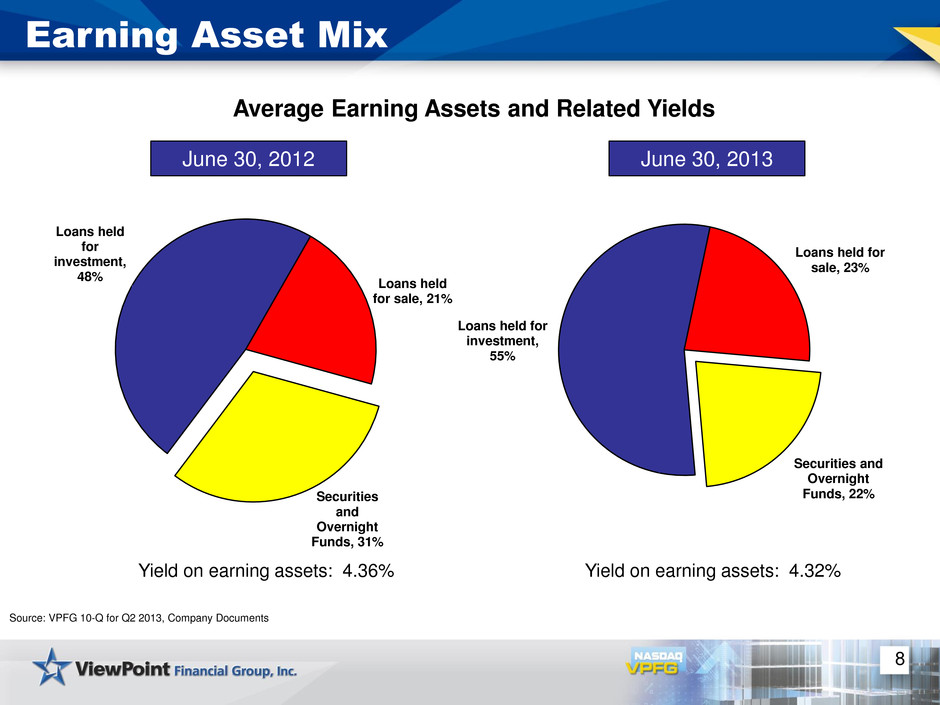

8 Earning Asset Mix Source: VPFG 10-Q for Q2 2013, Company Documents Loans held for investment, 48% Loans held for sale, 21% Securities and Overnight Funds, 31% Average Earning Assets and Related Yields June 30, 2012 June 30, 2013 Yield on earning assets: 4.36% Yield on earning assets: 4.32% Loans held for investment, 55% Loans held for sale, 23% Securities and Overnight Funds, 22%

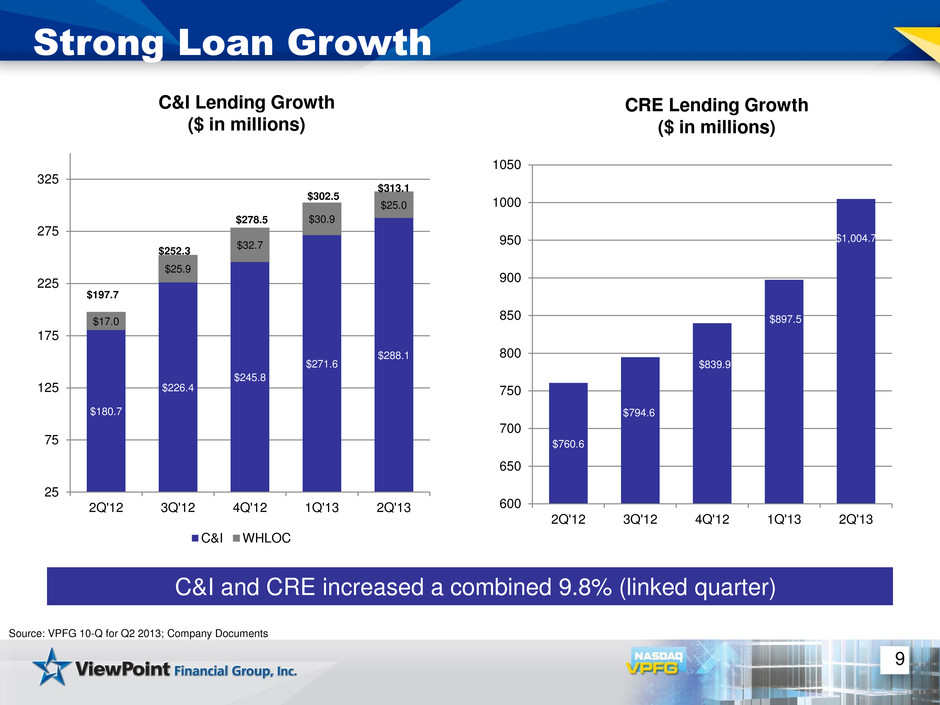

9 Strong Loan Growth C&I Lending Growth ($ in millions) Source: VPFG 10-Q for Q2 2013; Company Documents $180.7 $226.4 $245.8 $271.6 $288.1 $17.0 $25.9 $32.7 $30.9 $25.0 25 75 125 175 225 275 325 2Q'12 3Q'12 4Q'12 1Q'13 2Q'13 C&I WHLOC $197.7 $252.3 $278.5 $302.5 $313.1 $760.6 $794.6 $839.9 $897.5 $1,004.7 600 650 700 750 800 850 900 950 1000 1050 2Q'12 3Q'12 4Q'12 1Q'13 2Q'13 CRE Lending Growth ($ in millions) C&I and CRE increased a combined 9.8% (linked quarter)

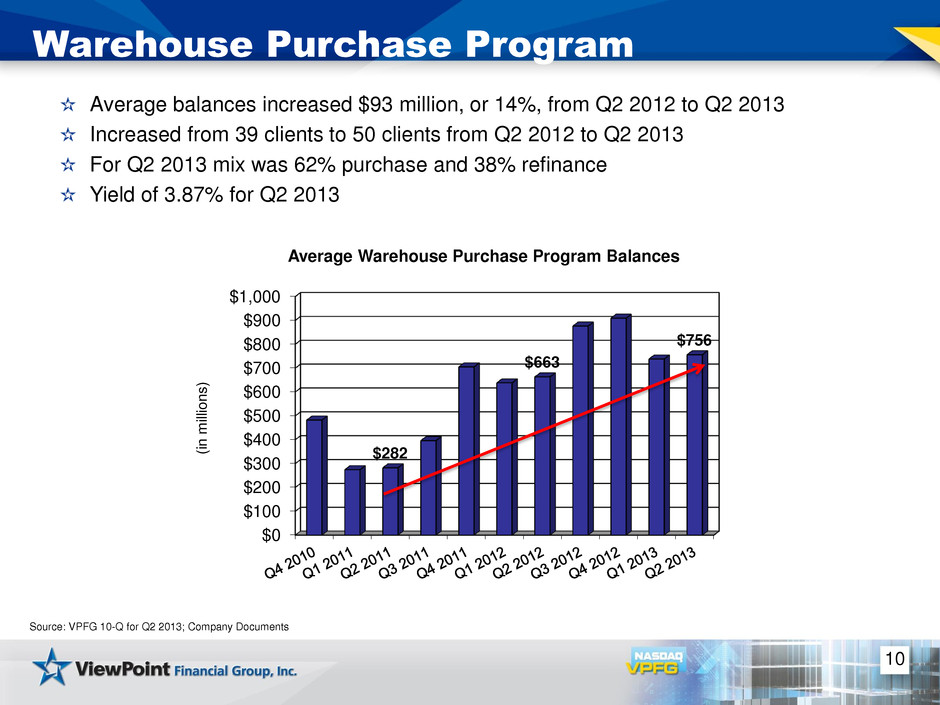

10 Warehouse Purchase Program Average balances increased $93 million, or 14%, from Q2 2012 to Q2 2013 Increased from 39 clients to 50 clients from Q2 2012 to Q2 2013 For Q2 2013 mix was 62% purchase and 38% refinance Yield of 3.87% for Q2 2013 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 $282 $663 $756 (i n m ill io n s ) Average Warehouse Purchase Program Balances Source: VPFG 10-Q for Q2 2013; Company Documents

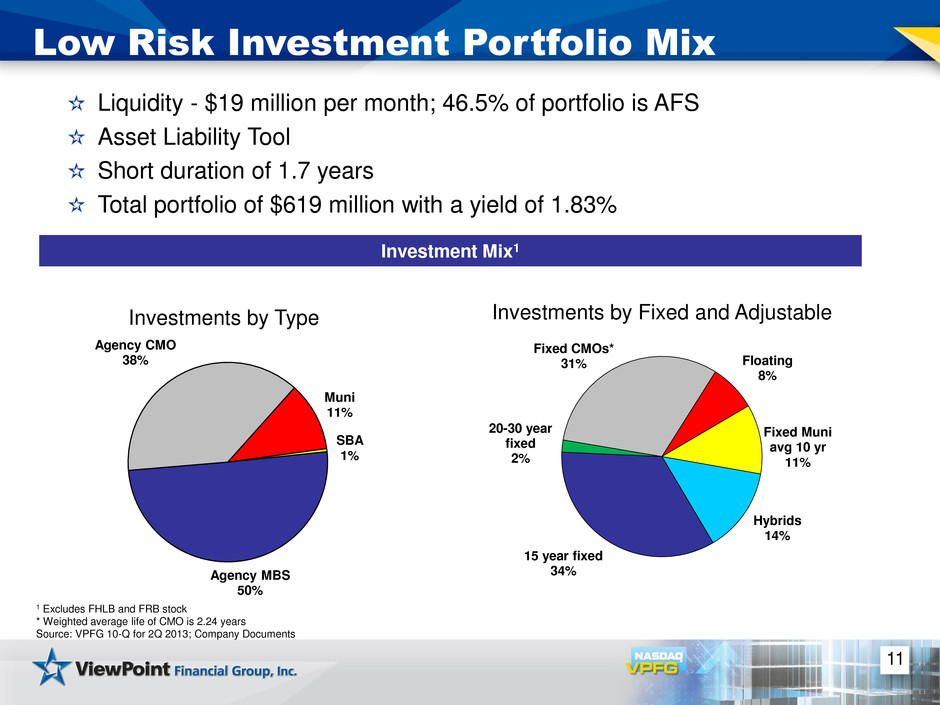

Agency MBS 50% Agency CMO 38% Muni 11% SBA 1% Investments by Type 11 Low Risk Investment Portfolio Mix 1 Excludes FHLB and FRB stock * Weighted average life of CMO is 2.24 years Source: VPFG 10-Q for 2Q 2013; Company Documents Liquidity - $19 million per month; 46.5% of portfolio is AFS Asset Liability Tool Short duration of 1.7 years Total portfolio of $619 million with a yield of 1.83% Investment Mix1 Hybrids 14% 15 year fixed 34% 20-30 year fixed 2% Fixed CMOs* 31% Floating 8% Fixed Muni avg 10 yr 11% Investments by Fixed and Adjustable

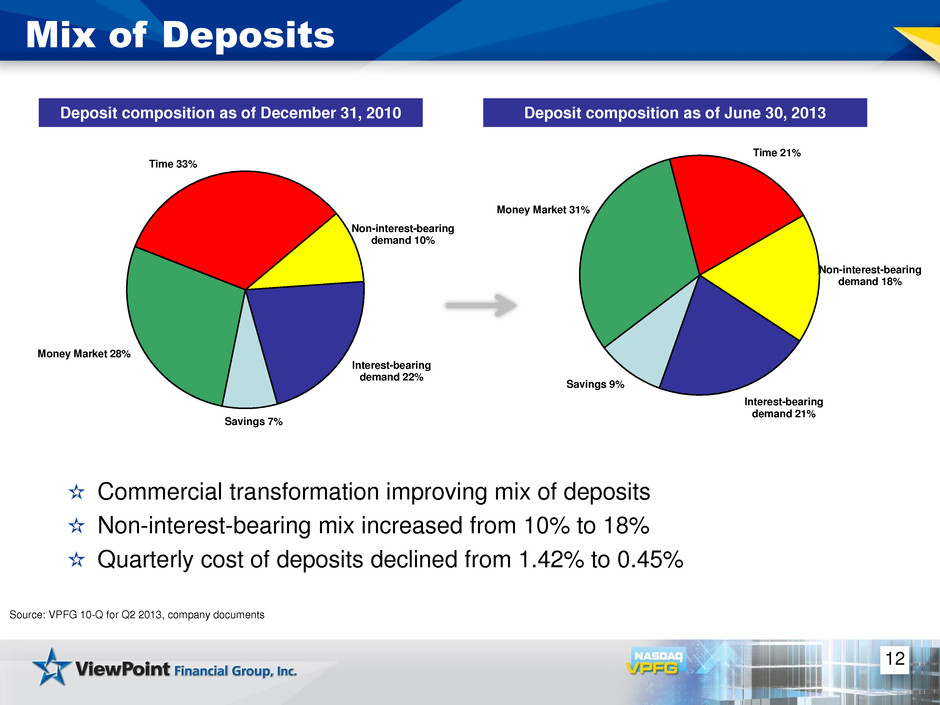

12 Mix of Deposits Source: VPFG 10-Q for Q2 2013, company documents Non-interest-bearing demand 10% Interest-bearing demand 22% Savings 7% Money Market 28% Time 33% Non-interest-bearing demand 18% Interest-bearing demand 21% Savings 9% Money Market 31% Time 21% Commercial transformation improving mix of deposits Non-interest-bearing mix increased from 10% to 18% Quarterly cost of deposits declined from 1.42% to 0.45% Deposit composition as of December 31, 2010 Deposit composition as of June 30, 2013

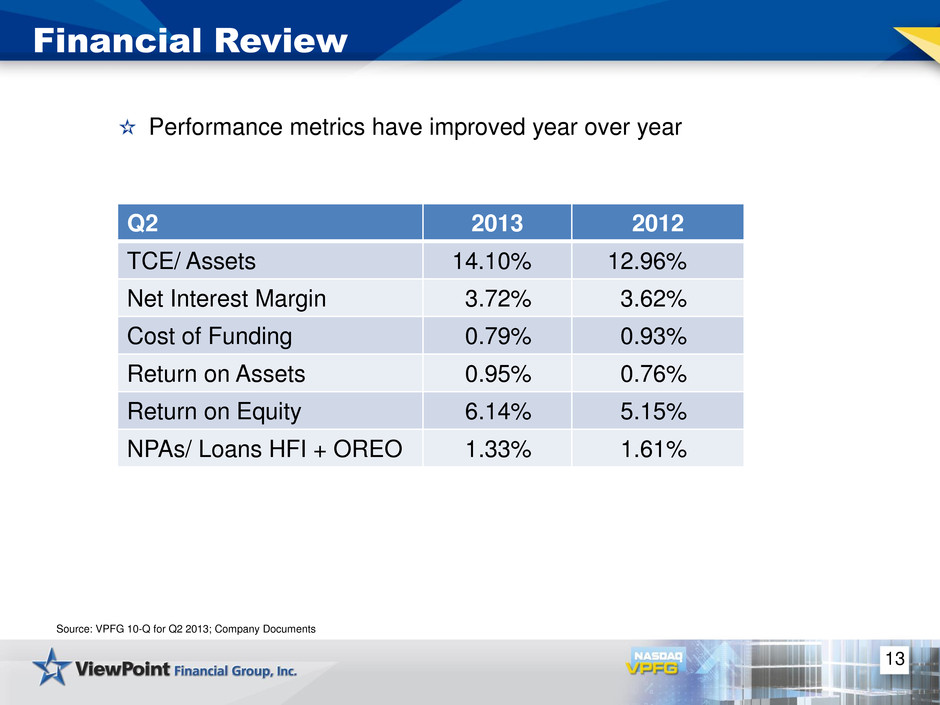

13 Financial Review Q2 2013 2012 TCE/ Assets 14.10% 12.96% Net Interest Margin 3.72% 3.62% Cost of Funding 0.79% 0.93% Return on Assets 0.95% 0.76% Return on Equity 6.14% 5.15% NPAs/ Loans HFI + OREO 1.33% 1.61% Performance metrics have improved year over year Source: VPFG 10-Q for Q2 2013; Company Documents

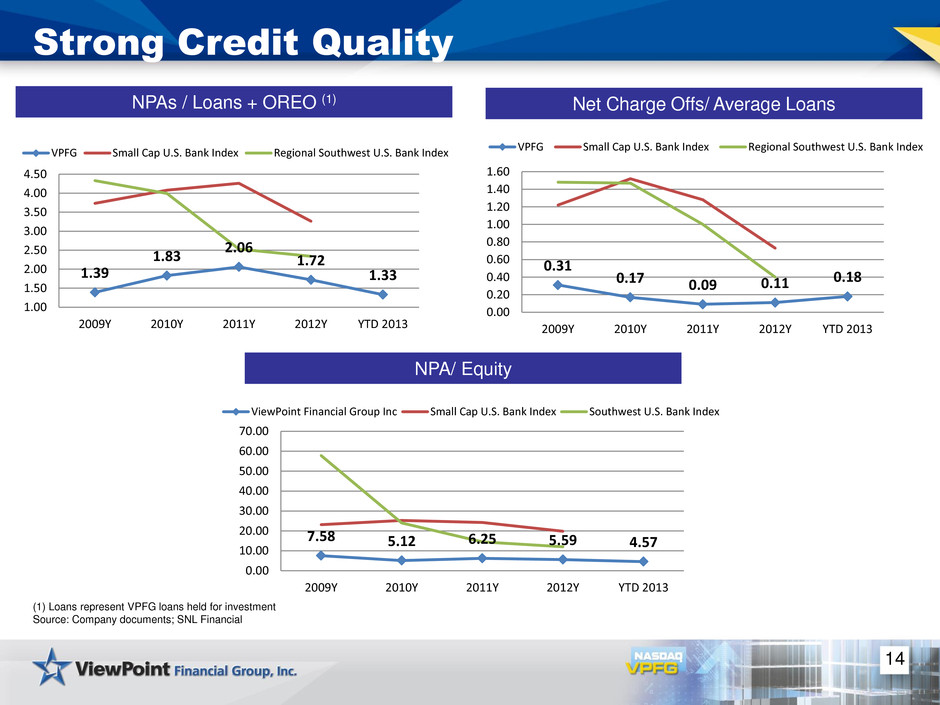

14 Strong Credit Quality Net Charge Offs/ Average Loans NPAs / Loans + OREO (1) (1) Loans represent VPFG loans held for investment Source: Company documents; SNL Financial NPA/ Equity 1.39 1.83 2.06 1.72 1.33 1.00 1.50 2.00 2.50 3.00 3.50 4.00 4.50 2009Y 2010Y 2011Y 2012Y YTD 2013 VPFG Small Cap U.S. Bank Index Regional Southwest U.S. Bank Index 0.31 0.17 0.09 0.11 0.18 0.00 0.20 0.40 0.60 0.80 1.00 1.20 1.40 1.60 2009Y 2010Y 2011Y 2012Y YTD 2013 VPFG Small Cap U.S. Bank Index Regional Southwest U.S. Bank Index 7.58 5.12 6.25 5.59 4.57 0.00 10.00 20.00 30.00 40.00 50.00 60.00 70.00 2009Y 2010Y 2011Y 2012Y YTD 2013 ViewPoint Financial Group Inc Small Cap U.S. Bank Index Southwest U.S. Bank Index

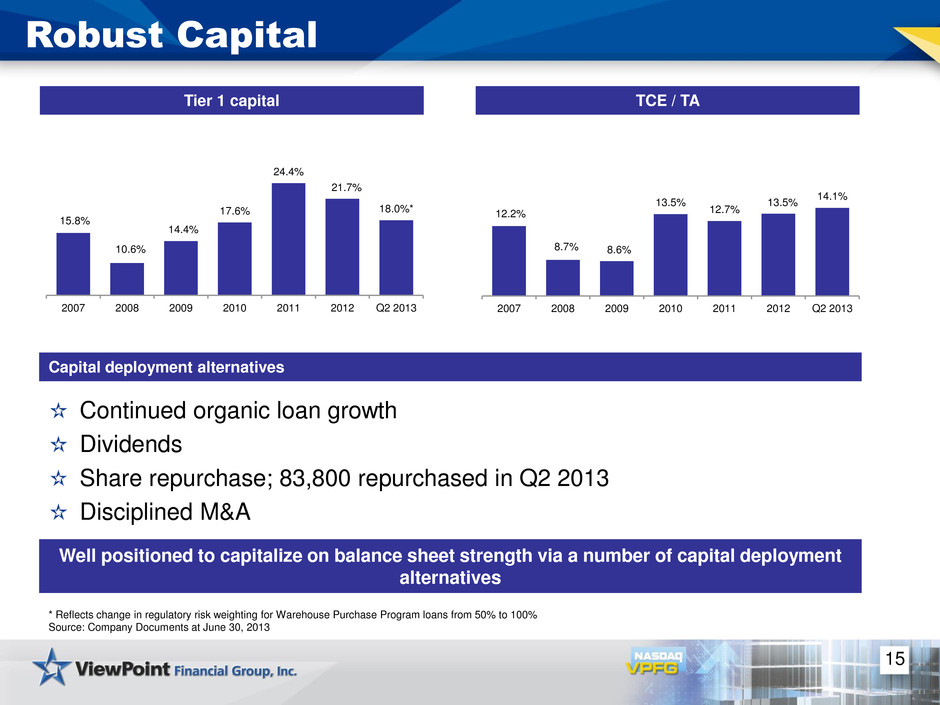

12.2% 8.7% 8.6% 13.5% 12.7% 13.5% 14.1% 2007 2008 2009 2010 2011 2012 Q2 2013 15.8% 10.6% 14.4% 17.6% 24.4% 21.7% 18.0%* 2007 2008 2009 2010 2011 2012 Q2 2013 15 Continued organic loan growth Dividends Share repurchase; 83,800 repurchased in Q2 2013 Disciplined M&A * Reflects change in regulatory risk weighting for Warehouse Purchase Program loans from 50% to 100% Source: Company Documents at June 30, 2013 Robust Capital Tier 1 capital TCE / TA Capital deployment alternatives Well positioned to capitalize on balance sheet strength via a number of capital deployment alternatives

16 Closing Comments We are executing our plan to be a premier Texas community bank Strong core loan growth Credit quality continues to outpace our peers Well positioned for offense with robust capitalization and pristine asset quality

17 Questions?

18 Appendix The subsequent table presents non-GAAP reconciliations of the following calculations: TCE (Tangible Common Equity) to TCA (Tangible Common Assets) ratio TCE per share Core (non-GAAP) net income and earnings per share

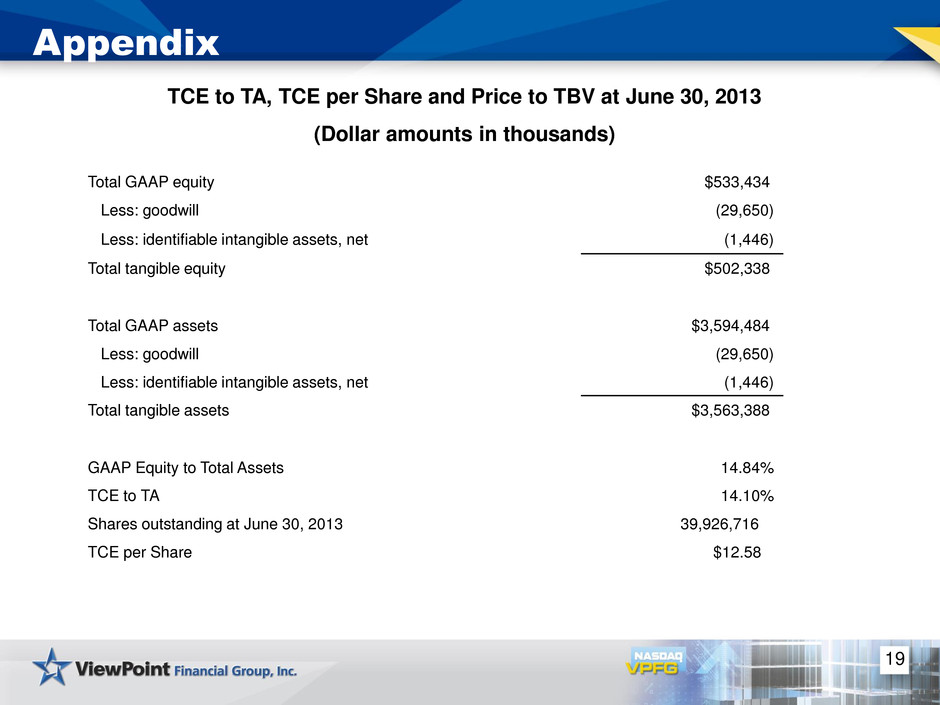

19 Appendix TCE to TA, TCE per Share and Price to TBV at June 30, 2013 (Dollar amounts in thousands) Total GAAP equity $533,434 Less: goodwill (29,650) Less: identifiable intangible assets, net (1,446) Total tangible equity $502,338 Total GAAP assets $3,594,484 Less: goodwill (29,650) Less: identifiable intangible assets, net (1,446) Total tangible assets $3,563,388 GAAP Equity to Total Assets 14.84% TCE to TA 14.10% Shares outstanding at June 30, 2013 39,926,716 TCE per Share $12.58

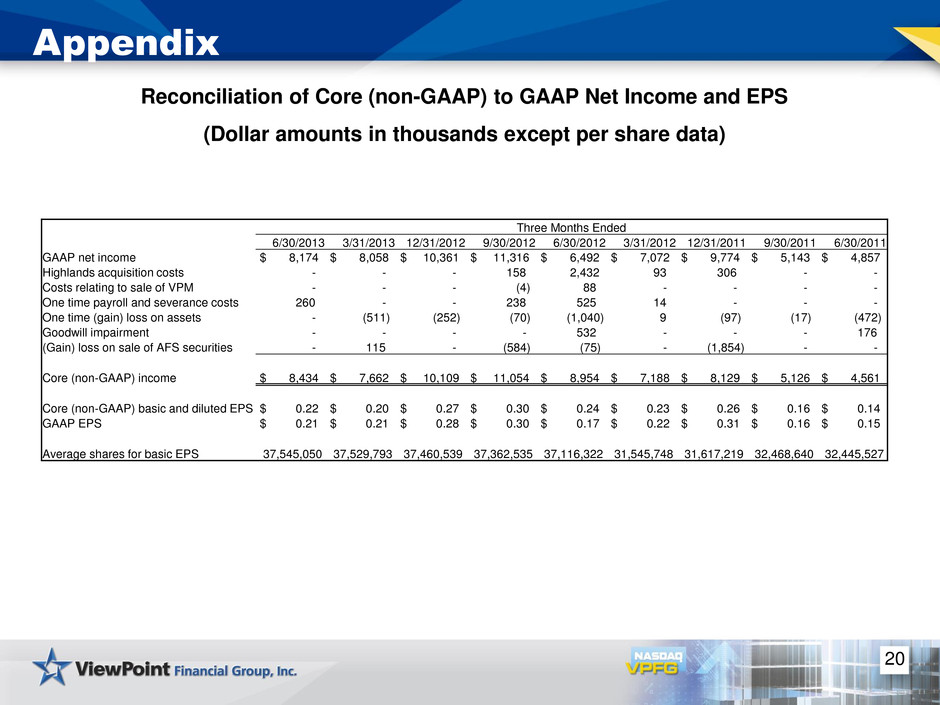

20 Appendix Reconciliation of Core (non-GAAP) to GAAP Net Income and EPS (Dollar amounts in thousands except per share data) Three Months Ended 6/30/2013 3/31/2013 12/31/2012 9/30/2012 6/30/2012 3/31/2012 12/31/2011 9/30/2011 6/30/2011 GAAP net income $ 8,174 $ 8,058 $ 10,361 $ 11,316 $ 6,492 $ 7,072 $ 9,774 $ 5,143 $ 4,857 Highlands acquisition costs - - - 158 2,432 93 306 - - Costs relating to sale of VPM - - - (4) 88 - - - - One time payroll and severance costs 260 - - 238 525 14 - - - One time (gain) loss on assets - (511) (252) (70) (1,040) 9 (97) (17) (472) Goodwill impairment - - - - 532 - - - 176 (Gain) loss on sale of AFS securities - 115 - (584) (75) - (1,854) - - Core (non-GAAP) income $ 8,434 $ 7,662 $ 10,109 $ 11,054 $ 8,954 $ 7,188 $ 8,129 $ 5,126 $ 4,561 Core (non-GAAP) basic and diluted EPS $ 0.22 $ 0.20 $ 0.27 $ 0.30 $ 0.24 $ 0.23 $ 0.26 $ 0.16 $ 0.14 GAAP EPS $ 0.21 $ 0.21 $ 0.28 $ 0.30 $ 0.17 $ 0.22 $ 0.31 $ 0.16 $ 0.15 Average shares for basic EPS 37,545,050 37,529,793 37,460,539 37,362,535 37,116,322 31,545,748 31,617,219 32,468,640 32,445,527