Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Williams Industrial Services Group Inc. | d566483d8k.htm |

| EX-99.2 - EX-99.2 - Williams Industrial Services Group Inc. | d566483dex992.htm |

Exhibit 99.1

GlobalPower IBI Power Acquisition: Expanding Our PCH Offering July 9, 2013 NASDAQ: GLPW www.globalpower.com

Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of that term set forth in the Private Securities Litigation Reform Act of 1995. These statements reflect our current views of future events and financial performance and are subject to a number of risks and uncertainties. Our actual results, performance or achievements may differ materially from those expressed or implied in the forward-looking statements. Risks and uncertainties that could cause or contribute to such material differences include, but are not limited to, decreased demand for new gas turbine power plants, reduced demand for, or increased regulation of, nuclear power, loss of any of our major customers, cost increases and project cost overruns, unforeseen schedule delays, poor performance by our subcontractors, cancellation of projects, competition for the sale of our products and services, shortages in, or increases in prices for, energy and materials such as steel that we use to manufacture our products, damage to our reputation, warranty or product liability claims, increased exposure to environmental or other liabilities, failure to comply with various laws and regulations, failure to attract and retain highly-qualified personnel, volatility of our stock price, deterioration or uncertainty of credit markets, and changes in the economic, social and political conditions in the United States and other countries in which we operate, including fluctuations in foreign currency exchange rates, the banking environment or monetary policy. Other important factors that may cause actual results to differ materially from those expressed in the forward-looking statements are discussed in our filings with the Securities and Exchange Commission, including the section of our Annual Report on Form 10-K filed with the SEC on March 7, 2013 titled “Risk Factors.” Except as may be required by applicable law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, and we caution you not to rely upon them unduly. .com Global Power 2

IBI Power…. Delivers custom power packaging and integration solutions focused on industrial/distributed power and oil & gas markets Two manufacturing facilities providing geographic reach 58,000 square ft. operation in Caldwell, ID (headquarters location) 105,000 square ft. eastern division fabrication facility in Chattanooga, TN Three primary product categories serving oil and gas industry end markets Packaged control houses Generator enclosures Storage tanks .co

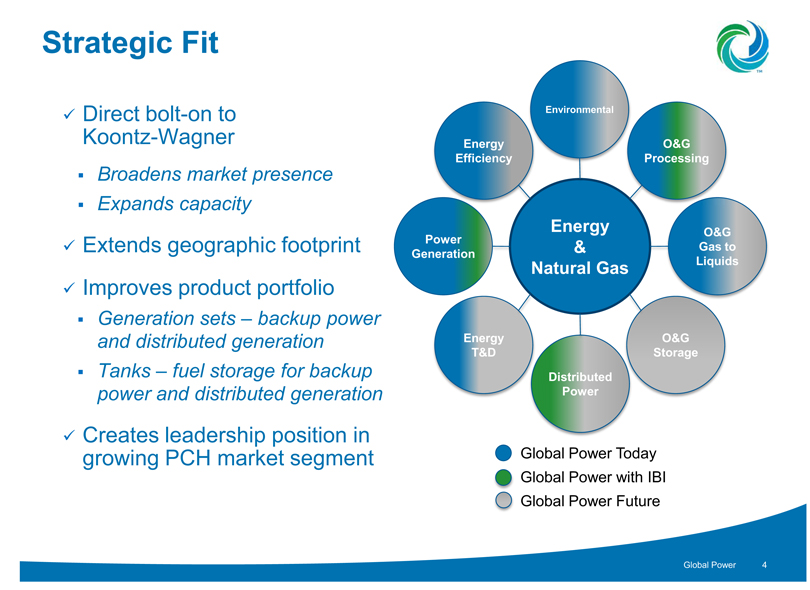

Strategic Fit Direct bolt-on to Koontz-Wagner Broadens market presence Expands capacity Extends geographic footprint Improves product portfolio Generation sets – backup power and distributed generation Tanks – fuel storage for backup power and distributed generation Creates leadership position in growing PCH market segment Energy Efficiency Environmental Power Generation Energy & Natural Gas Energy T&D O&G Processing O&G Gas to Liquids O&G Storage Distributed Power Global Power Today Global Power with IBI Global Power Future com Global Power 4

Strategic Considerations Market opportunities Attractive end markets with strong tail winds Expanded exposure into distributed power, midstream oil & gas Synergies Excess capacity at IBI facilities to fulfill Koontz-Wagner orders Application expertise Niche market – high engineering content and application expertise Margin expansion potential Adds manufacturing expertise for PCH product line Operating leverage potential Acquired from private owner <7.5X TTM EBITDA Global Power 5 m Global Power 3

Customer Landscape Powering Business Worldwide SIEMENS ABB IEM BECHTEL Several major customer relationships complementary to Koontz-Wagner Strengthens positioning with OEMs Strong financial performance March 31, 2013 TTM revenue of $31.1 million Cash purchase price of $19.5 million