Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CORTLAND BANCORP INC | d544703d8k.htm |

| Annual Shareholders' Meeting May 28, 2013 Exhibit 99.1 |

| Chief Financial Officer David J. Lucido |

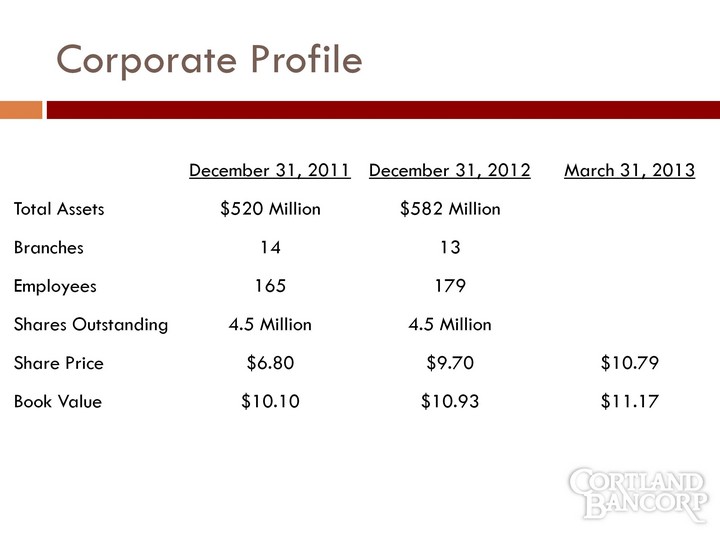

| Corporate Profile Corporate Profile |

| Condensed Statements of Income (Amounts in Thousands) |

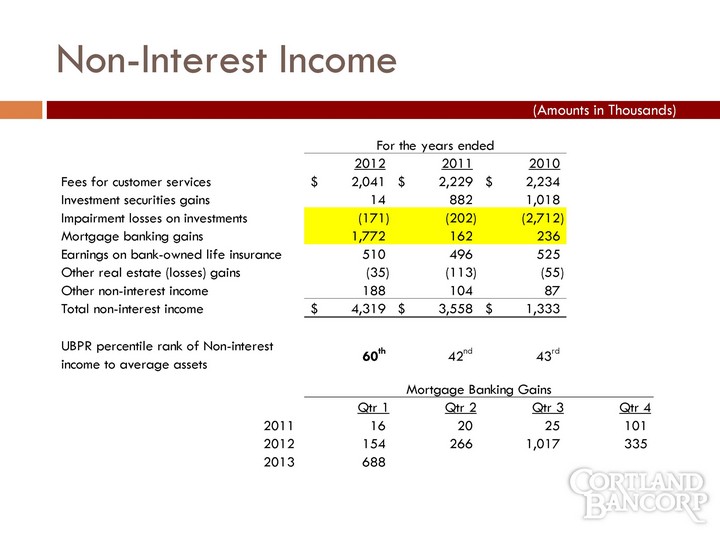

| Non-Interest Income (Amounts in Thousands) |

| Balance Sheet Composition |

| Net Interest Margin Net Interest Margin |

| Credit Quality (Amounts in Thousands) |

| Capital Adequacy Capital Adequacy Prior year cushion $22.4 million $24.7 million $12.6 million How much cushion is needed to absorb any asset quality or investment issues remaining in this post-recessionary period? =STRESS TEST Any excess may be available for dividends and share repurchases. + $0.6 million |

| First Quarter Results (Amounts in Thousands) |

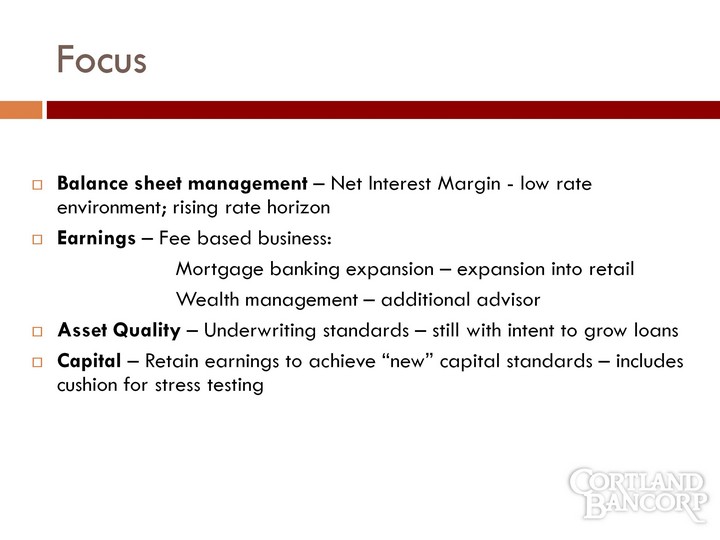

| Focus Balance sheet management - Net Interest Margin - low rate environment; rising rate horizon Earnings - Fee based business: Mortgage banking expansion - expansion into retail Wealth management - additional advisor Asset Quality - Underwriting standards - still with intent to grow loans Capital - Retain earnings to achieve "new" capital standards - includes cushion for stress testing |

| President and Chief Executive Officer James M. Gasior |

| "It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is the most adaptable to change." -Charles Darwin |

| 2009-2013 Strategic Plan Situational Assessment Security Investments account for approximately 1/2 of the bank's earning assets. High cost borrowings as asset funding source. High overhead expenses to operate branches in markets with little growth opportunity. Financial performance for 2008 and 2009 reflect limited growth and the deterioration of earnings and capital to levels that challenge ability to maintain "well capitalized" status. Non-Interest Income lags the peer group. Regulatory actions - dividends suspended. Shareholder confidence at stake. |

| Cortland Banks Strategy Map 2009-2012 |

| Strategic Plan Initiatives Balance sheet restructured achieved through commitment to grow loans. Replace high cost borrowings with core deposits through concentrated cross-selling and relationship management initiatives. Reduced expenses with no significant deposit loss achieved through Bristol-North Bloomfield branch consolidation. Application filed to operate a newly formed mortgage wholesale subsidiary - CSB Mortgage provided an avenue for revenue diversification. Bank partners with Investment Professional Inc. to offer non-deposit investment products through Cortland Investment Group providing for additional and enhanced revenue diversification service offerings. Capital enhanced through earnings retention. Terms of informal assurances given to the regulatory agencies successfully fulfilled. Dividends reinstated. Dividend Reinvestment Program amended. |

| Business Model Transition From To Wholesale "money" desk focus with 50% loan to deposit ratio Core banking services growth supplemented with diversified revenue services - CSB and Wealth 95% of Commercial Lending - CRE Complete business solutions offering CRE, C&I, SBA, and Small Business Lending No compensating balance requirements Compensating balances Transactional focus / Friendly service Advisory focus / Friendly service coupled with value added solutions Difficult to recruit "top" performing talent to work for the Company Recognized as an employer of choice. Successful in recruiting "top" talent to the Company Advertising Marketing and Branding |

| Growth Rates Growth Rates |

| 5 Year Chart (CHART) Data Source: SNL Financial |

| Strategy Map |

| 2013-2015 Strategic Plan Initiatives Sustain earnings growth in prolonged low rate environment. Manage NIM through proactive management of balance sheet with emphasis on continued loan growth. Implement a small business banking initiative. Continue to develop the retail mortgage origination channel to supplement the wholesale channel. Execute branch strategies through staff realignment, continued development of a sales oriented culture and diversified product offerings through non-deposit product investment services, retail mortgage origination and merchant services diversification. Improve branch and operational efficiencies. Consider staff realignments, branch consolidation/closures, emerging technologies when applicable. Enhance capital through earnings retention, optional cash contributions, acquisitions, other capital raising measures. Continue to proactively and identify regulatory compliance and changing capital requirements. |