Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HANDY & HARMAN LTD. | a8k-annualmeetingpresentat.htm |

Annual Meeting of Shareholders May 21, 2013

2 This document may contain certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that reflect Handy & Harman Ltd.’s (“HNH” or the “Company”) current expectations and projections about its future results, performance, prospects and opportunities. Forward-looking statements are based on information currently available to the Company and are subject to a number of risks, uncertainties and other factors that could cause its actual results, performance, prospects or opportunities in 2013 and beyond to differ materially from those expressed in, or implied by, these forward-looking statements. These factors include, without limitation, the Company’s need for additional financing and the terms and conditions of any financing that is consummated, their customers' acceptance of its new and existing products, the risk that the Company and its subsidiaries will not be able to compete successfully, and the possible volatility of the Company's unit price and the potential fluctuation in its operating results. Although HNH believes that the expectations reflected in its forward-looking statements are reasonable and achievable, any such statements involve significant risks and uncertainties and no assurance can be given that the actual results will be consistent with the forward-looking statements. Investors should read carefully the factors described in the “Risk Factors” section of the Company's filings with the SEC, including the Company's Form 10-K for the year ended December 31, 2012 for information regarding risk factors that could affect the Company's results. Except as otherwise required by federal securities laws, HNH undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason. Forward-Looking Statements

3 Handy & Harman Companies Manufacturers of diversified engineered niche industrial products with leading brands and market positions

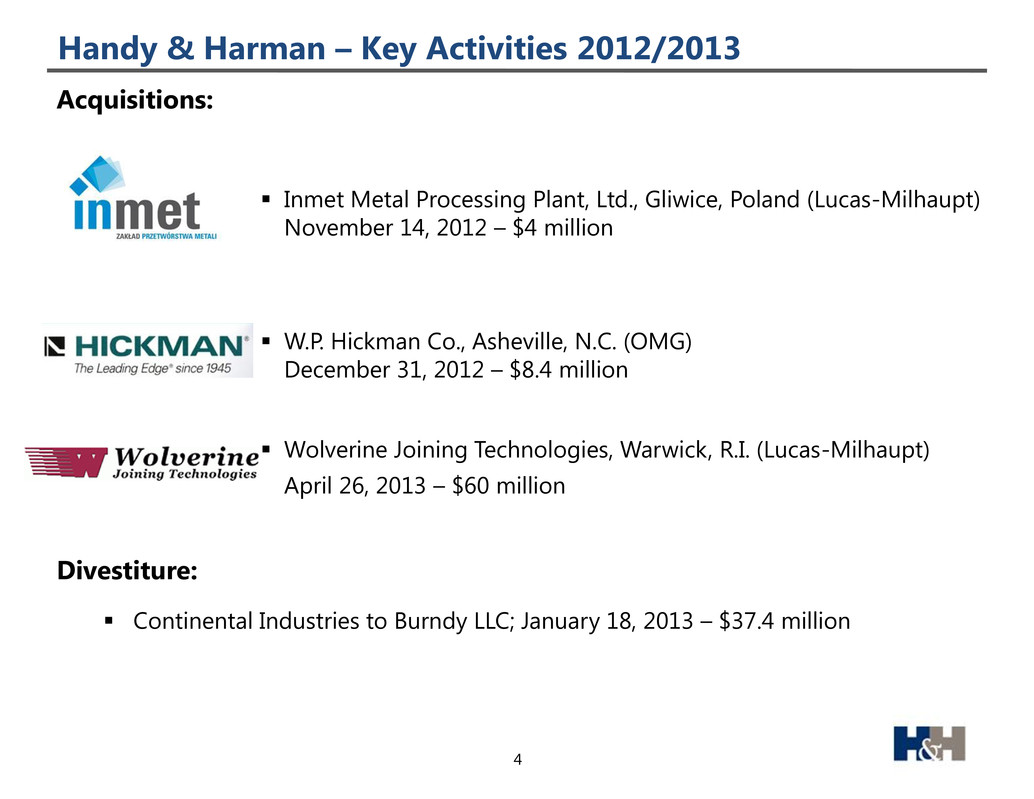

4 Handy & Harman – Key Activities 2012/2013 Acquisitions: Inmet Metal Processing Plant, Ltd., Gliwice, Poland (Lucas-Milhaupt) November 14, 2012 – $4 million W.P. Hickman Co., Asheville, N.C. (OMG) December 31, 2012 – $8.4 million Wolverine Joining Technologies, Warwick, R.I. (Lucas-Milhaupt) April 26, 2013 – $60 million Divestiture: Continental Industries to Burndy LLC; January 18, 2013 – $37.4 million

5 Handy & Harman – Key Activities 2012/2013 (cont.) Financing: Handy & Harman Group $205 million senior secured credit facility; November 8, 2012 Paid off $31.8 million of 10% subordinated secured notes; April 25, 2013 Increased facility by $30 million with WJT acquisition; April 26, 2013 NOLs: $163 million (as of March 31, 2013) Pension Liability: $216 million (as of March 31, 2013)

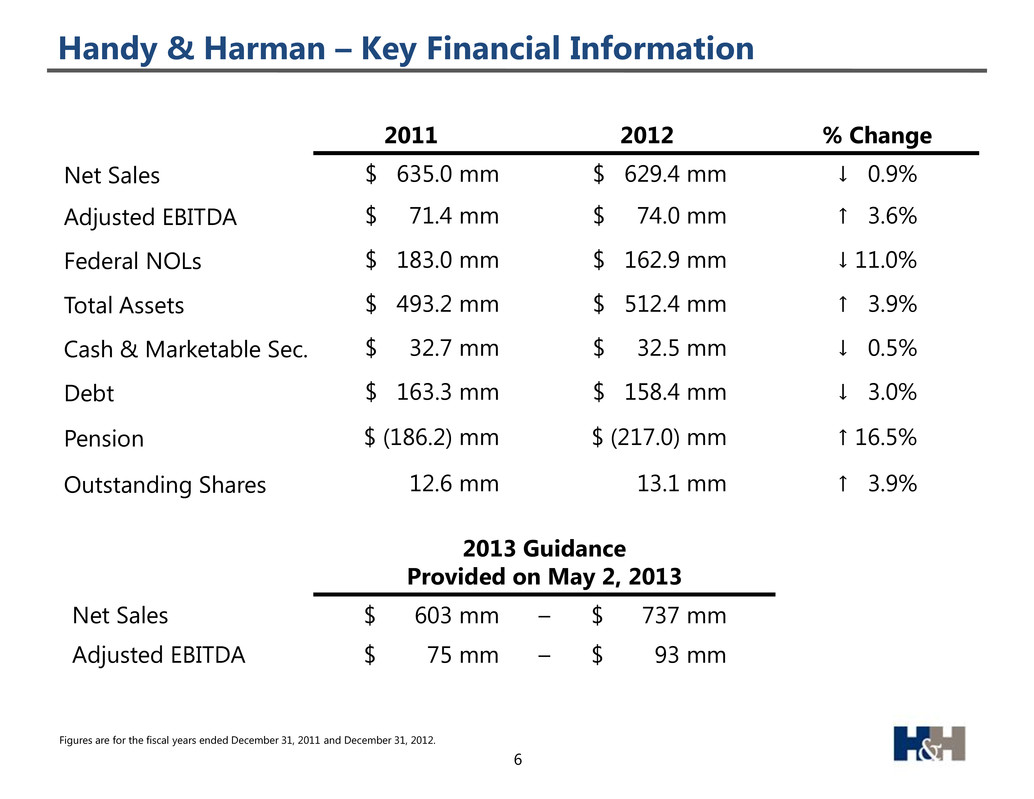

6 Handy & Harman – Key Financial Information 2011 2012 % Change Net Sales $ 635.0 mm $ 629.4 mm ↓ 0.9% Adjusted EBITDA $ 71.4 mm $ 74.0 mm ↑ 3.6% Federal NOLs $ 183.0 mm $ 162.9 mm ↓ 11.0% Total Assets $ 493.2 mm $ 512.4 mm ↑ 3.9% Cash & Marketable Sec. $ 32.7 mm $ 32.5 mm ↓ 0.5% Debt $ 163.3 mm $ 158.4 mm ↓ 3.0% Pension $ (186.2) mm $ (217.0) mm ↑ 16.5% Outstanding Shares 12.6 mm 13.1 mm ↑ 3.9% 2013 Guidance Provided on May 2, 2013 Net Sales $ 603 mm – $ 737 mm Adjusted EBITDA $ 75 mm – $ 93 mm Figures are for the fiscal years ended December 31, 2011 and December 31, 2012.

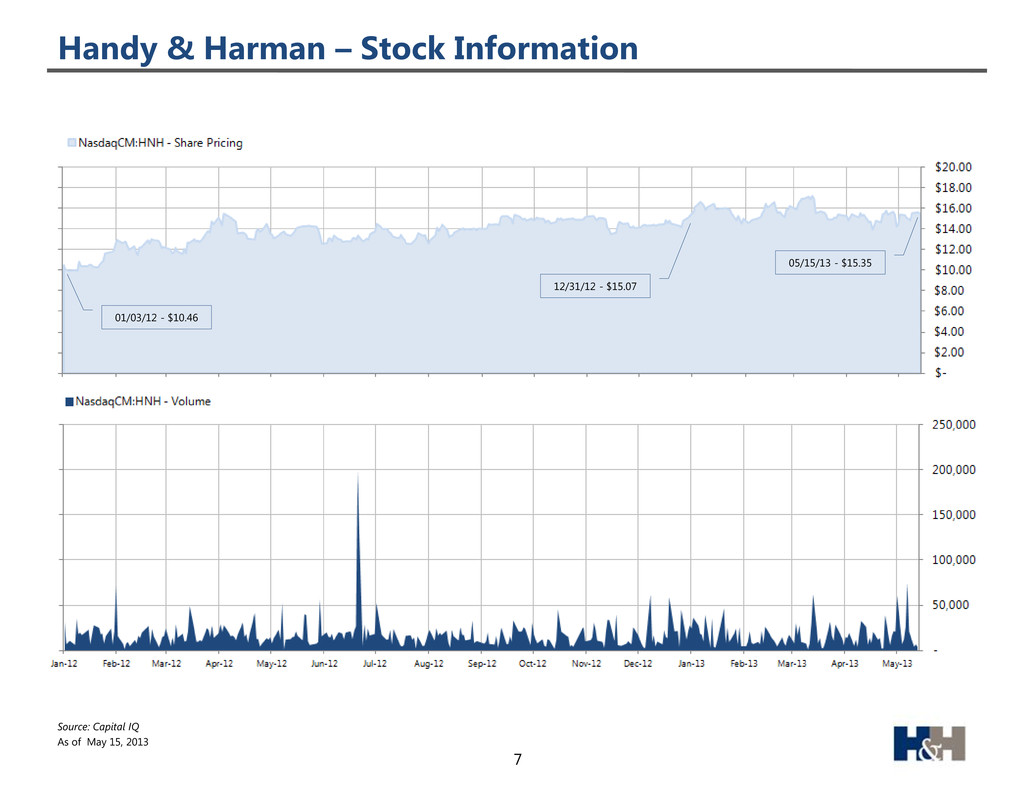

7 Handy & Harman – Stock Information Source: Capital IQ As of May 15, 2013 01/03/12 - $10.46 12/31/12 - $15.07 05/15/13 - $15.35

Annual Meeting of Shareholders May 21, 2013