Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - HANDY & HARMAN LTD. | hnh12312015ex32.htm |

| EX-21.1 - EXHIBIT 21.1 - HANDY & HARMAN LTD. | hnh12312015ex211.htm |

| EX-23.2 - EXHIBIT 23.2 - HANDY & HARMAN LTD. | hnh12312015ex232.htm |

| EX-99.1 - EXHIBIT 99.1 - HANDY & HARMAN LTD. | ex991financialstatementsof.htm |

| EX-23.3 - EXHIBIT 23.3 - HANDY & HARMAN LTD. | hnh12312015ex233.htm |

| EX-31.1 - EXHIBIT 31.1 - HANDY & HARMAN LTD. | hnh12312015ex311.htm |

| EX-23.1 - EXHIBIT 23.1 - HANDY & HARMAN LTD. | hnh12312015ex231.htm |

| EX-31.2 - EXHIBIT 31.2 - HANDY & HARMAN LTD. | hnh12312015ex312.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to

Commission File Number 1-2394

HANDY & HARMAN LTD. |

(Exact name of registrant as specified in its charter) |

DELAWARE | 13-3768097 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

1133 Westchester Avenue, Suite N222 White Plains, New York | 10604 |

(Address of principal executive offices) | (Zip Code) |

914-461-1300 | |

(Registrant's telephone number, including area code) | |

Securities registered pursuant to Section 12(b) of the Act: | |

Title of each class | Name of each exchange on which registered |

Common stock, $.01 par value | NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer x |

Non-accelerated filer o | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the voting and non-voting common equity held by non-affiliates of registrant as of June 30, 2015 totaled approximately $98.5 million based on the then-closing stock price.

On February 25, 2016, there were 12,208,016 shares of common stock outstanding, par value $0.01 per share.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Items 10, 11, 12, 13 and 14 of Part III will be incorporated by reference to certain portions of a definitive proxy statement, which is expected to be filed by the Registrant within 120 days after the close of its fiscal year.

HANDY & HARMAN LTD.

FORM 10-K

December 31, 2015

Page | 1

PART I

Item 1. | Business |

The Company

Handy & Harman Ltd. ("HNH") is a diversified manufacturer of engineered niche industrial products with leading market positions in many of the markets it serves. Through its wholly-owned operating subsidiaries, HNH focuses on high margin products and innovative technology and serves customers across a wide range of end markets. HNH sells its products and services through direct sales forces, distributors and manufacturer's representatives. It serves a diverse customer base, including the construction, electrical, electronics, transportation, utility, medical, oil and gas exploration, aerospace and defense, and food industries. As of December 31, 2015, HNH and its subsidiaries employed over 2,100 people at 33 locations in eight countries. All references herein to "we," "our," "its" or the "Company" refer to HNH together with all of its subsidiaries.

HNH's diverse product offerings are marketed throughout the United States and internationally. HNH owns Handy & Harman Group Ltd. ("H&H Group"), which owns Handy & Harman ("H&H") and Bairnco, LLC, formerly Bairnco Corporation. HNH manages its group of businesses on a decentralized basis with operations principally in North America. HNH's business units encompass the following segments: Joining Materials, Tubing, Building Materials, Performance Materials and Kasco Blades and Route Repair Services ("Kasco"). Financial information for our reportable segments is contained in Note 21 to our consolidated financial statements included in "Item 8 - Financial Statements and Supplementary Data."

We manage our portfolio of businesses on a continuous basis. In 2015, we acquired certain assets and assumed certain liabilities of ITW Polymers Sealants North America Inc. ("ITW"), which are used in the business of manufacturing two-component polyurethane adhesive for the roofing industry, and also acquired JPS Industries, Inc. ("JPS"), a manufacturer of mechanically formed glass and aramid substrate materials for specialty applications in a wide expanse of markets requiring highly engineered components. In 2014, we entered into an agreement to sell Arlon, LLC, which operations comprised substantially all of the Company's former Arlon Electronic Materials ("Arlon") segment. The sale was finalized in January 2015. In 2013, we acquired substantially all of the assets of Wolverine Joining Technologies, LLC ("Wolverine Joining") used for the development, manufacturing and sale of brazing, flux and soldering products, and the alloys for electrical, catalyst and other industrial specialties, and also acquired PAM Fastening Technology, Inc. ("PAM"), a distributor of screw guns, collated screws and hot melt systems. Also during 2013, we divested substantially all of the assets and existing operations of our Continental Industries, Inc. ("Continental") and Canfield Metal Coating Corporation business units, and sold substantially all of the equipment owned or utilized by Indiana Tube de México, S. De R.L. de C.V. Further discussion of our acquisitions and divestitures is contained in Notes 4 and 5, respectively, to our consolidated financial statements included in "Item 8 - Financial Statements and Supplementary Data."

Products and Product Mix

Joining Materials Segment

Joining Materials segment primarily fabricates precious metals and their alloys into brazing alloys. Brazing alloys are used to join similar and dissimilar metals, as well as specialty metals and some ceramics, with strong, hermetic joints. Joining Materials segment offers these metal joining products in a wide variety of alloys, including gold, silver, palladium, copper, nickel, aluminum and tin. These brazing alloys are fabricated into a variety of engineered forms and are used in many industries, including electrical, appliance, transportation, construction and general industrial, where dissimilar material and metal joining applications are required. Operating income from precious metal products is principally derived from the "value added" of processing and fabricating and not from the direct purchase and resale of precious metals. Joining Materials segment enters into commodity futures and forward contracts to mitigate the impact of price fluctuations on its precious and certain non-precious metal inventories that are not subject to fixed price contracts. We believe that the business unit that comprises our Joining Materials segment is the North American market leader in many of the markets that it serves.

Tubing Segment

Tubing segment manufactures a wide variety of steel tubing products. We believe that the Tubing segment manufactures the world's longest continuous seamless stainless steel tubing coils, in excess of 5,000 feet, serving the petrochemical infrastructure and shipbuilding markets. In addition, we believe it is the number one supplier of small diameter (less than 3 mm) coil tubing to industry leading specifications serving the aerospace, defense and semiconductor fabrication markets. This segment also manufactures welded carbon steel tubing in coiled and straight lengths with a primary focus on products for the transportation,

Page | 2

appliance and heating, and oil and gas industries. In addition to producing bulk tubing, it produces value added fabrications for several of these industries.

Building Materials Segment

Building Materials segment manufactures and supplies products primarily to the commercial construction and building industries. It manufactures fasteners and fastening systems for the U.S. commercial low slope roofing industry, which are sold to building and roofing material wholesalers, roofing contractors and private label roofing system manufacturers, and a line of engineered specialty fasteners for the building products industry for fastening applications in the remodeling and construction of homes, decking and landscaping. We believe that our primary business unit in the Building Materials segment is the market leader in fasteners and accessories for commercial low-slope roofing applications and that the majority of the net sales for the segment are for the commercial construction repair and replacement market. The results of the Building Materials segment include the operations of ITW from its acquisition on March 31, 2015.

Performance Materials Segment

Performance Materials segment manufactures sheet and mechanically formed glass and aramid materials for specialty applications in a wide expanse of markets requiring highly engineered components. Its products are used in a wide range of advanced composite applications, such as civilian and military aerospace components, printed electronic circuit boards, filtration and insulation products, specialty commercial construction substrates, automotive and industrial components, and soft body armor for civilian and military applications. The Performance Materials segment is currently comprised solely of the operations of JPS, which was acquired on July 2, 2015.

Kasco Blades and Route Repair Services Segment

Kasco provides meat-room blade products, repair services and resale products for the meat and deli departments of supermarkets, restaurants, meat and fish processing plants, and for distributors of electrical saws and cutting equipment, principally in North America and Europe. Kasco also provides wood cutting blade products for the pallet manufacturing, pallet recycler and portable saw mill industries in North America.

Business Strategy

Our business strategy is to enhance the growth and profitability of the HNH business units and to build upon their strengths through internal growth and strategic acquisitions. We expect HNH to continue to focus on high margin products and innovative technology. We also will continue to evaluate, from time to time, the sale of certain businesses and assets, as well as strategic and opportunistic acquisitions.

HNH uses a set of tools and processes called the Steel Business System to drive operational and sales efficiencies across each of its business units. The Steel Business System is designed to drive strategy deployment and sales and marketing based on lean principles. HNH pursues a number of ongoing strategic initiatives intended to improve its performance, including objectives relating to manufacturing improvement, idea generation, product development, and global sourcing of materials and services. HNH utilizes lean tools and philosophies in operations and commercialization activities to increase sales, improve business processes, and reduce and eliminate waste, coupled with the tools targeted at variation reduction.

Customers

HNH is diversified across industrial markets and customers. HNH sells to customers in the construction, electrical, electronics, transportation, utility, medical, oil and gas exploration, aerospace and defense, and food industries.

No customer accounted for more than 10% of consolidated net sales in 2015, 2014 or 2013. The Company's 15 largest customers accounted for approximately 33% of consolidated HNH net sales in 2015.

Foreign Revenue

The following table presents foreign revenue for the years ended December 31.

Page | 3

Revenue | ||||||||||||

(in thousands) | 2015 | 2014 | 2013 | |||||||||

United States | $ | 603,079 | $ | 550,071 | $ | 518,631 | ||||||

Foreign | 46,389 | 50,397 | 52,533 | |||||||||

Total | $ | 649,468 | $ | 600,468 | $ | 571,164 | ||||||

Foreign revenue is based on the country in which the legal subsidiary generating the revenue is domiciled.

Raw Materials

Besides precious metals, the raw materials used in the operations of the Joining Materials, Tubing, Building Materials and Kasco segments consist principally of stainless, galvanized and carbon steel, copper, tin, nickel alloys, a variety of high-performance alloys and various plastic compositions. The raw materials used in the operations of the Performance Materials segment consist principally of fiberglass, quartz and aramid yarns. HNH purchases all such raw materials at open market prices from domestic and foreign suppliers. HNH has not experienced any significant problem in obtaining the necessary quantities of raw materials. Prices and availability, particularly of raw materials purchased from foreign suppliers, are affected by world market conditions and government policies. The raw materials used by HNH in its non-precious metal products are generally readily available from more than one source.

Capital Investments

The Company believes that in order to be and remain competitive, its businesses must continuously strive to improve productivity and product quality, and control and/or reduce manufacturing costs. Accordingly, HNH's segments expect to continue to incur capital investments that reduce overall manufacturing costs, improve the quality of products produced and broaden the array of products offered to the industries HNH serves, as well as replace equipment as necessary to maintain compliance with environmental, health and safety laws and regulations. HNH's capital expenditures for 2015, 2014 and 2013 for continuing operations were $15.2 million, $12.7 million and $11.7 million, respectively. HNH anticipates funding its capital expenditures in 2016 from funds generated by operations and borrowed funds. HNH anticipates its capital expenditures to range between $17 and $27 million per year for the next several years.

Energy Requirements

HNH requires significant amounts of electricity and natural gas to operate its facilities and is subject to price changes in these commodities. A shortage of electricity or natural gas, or a government allocation of supplies resulting in a general reduction in supplies, could increase costs of production and could cause some curtailment of production.

Employment

As of December 31, 2015, the Company employed 2,125 employees worldwide. Of these employees, 355 were sales employees, 466 were office employees, 79 were covered by collective bargaining agreements and 1,225 were non-union operating employees.

Competition

There are many companies, both domestic and foreign, which manufacture products of the type the Company manufactures. Some of these competitors are larger than the Company and have financial resources greater than it does. Some of these competitors enjoy certain other competitive advantages, including greater name recognition, greater financial, technical, marketing and other resources, a larger installed base of customers, and well-established relationships with current and potential customers. Competition is based on quality, technology, service, and price, and in some industries, new product introduction. The Company may not be able to compete successfully, and competition may have a negative impact on its business, operating results or financial condition by reducing volume of products sold and/or selling prices, and accordingly reducing sales and profits.

In its served markets, the Company competes against large, as well as smaller-sized private and public companies. This results in intense competition in a number of markets in which it operates. Significant competition could in turn lead to lower prices, lower levels of shipments and/or higher costs in some markets that could have a negative effect on results of operations.

Sales Channels

Page | 4

HNH distributes products to customers through Company sales personnel, outside sales representatives and distributors in North and South America, Europe, Australia, Asia and several other international markets.

Patents and Trademarks

The Company owns patents and registered trademarks under which certain of its products are sold. In addition, the Company owns a number of U.S. and foreign utility patents and utility models related to certain of its products, as well as a number of design patents. The Company does not believe that the loss of any or all of these patents or trademarks would have a material adverse effect on its businesses. The Company's patents have remaining durations ranging from less-than-one year to 18 years, with expiration dates occurring at various times in 2016 through 2034.

Environmental Regulation

The Company is subject to laws and regulations relating to the protection of the environment. The Company does not presently anticipate that compliance with currently applicable environmental regulations and controls will significantly change its competitive position, capital spending or earnings during 2016. The Company believes it is in compliance with all orders and decrees consented to by the Company with environmental regulatory agencies. Please see "Item 1A - Risk Factors," "Item 3 - Legal Proceedings" and Note 19 to our consolidated financial statements included in "Item 8 - Financial Statements and Supplementary Data."

Other Information

Our internet website address is www.handyharman.com. Copies of the following reports are available free of charge through the internet website, as soon as reasonably practicable after they have been filed with or furnished to the Securities and Exchange Commission ("SEC") pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended ("Exchange Act"): annual reports on Form 10-K; quarterly reports on Form 10-Q; current reports on Form 8-K; any amendments to such reports; and proxy statements. Information on the website does not constitute part of this or any other report filed with or furnished to the SEC.

Item 1A. | Risk Factors |

This report includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended ("Securities Act"), and Section 21E of the Exchange Act, including, in particular, forward-looking statements under the headings "Item 7 - Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Item 8 - Financial Statements and Supplementary Data." These statements appear in a number of places in this report and include statements regarding the Company's intent, belief or current expectations, such as those relating to future business, future results of operations or financial condition, new or planned products or services, or management strategies, including those with respect to (i) the Company's financing plans, (ii) trends affecting its financial condition or results of operations and (iii) the impact of competition. The words "expect," "anticipate," "intend," "plan," "believe," "seek," "estimate" and similar expressions are intended to identify such forward-looking statements; however, this report also contains other forward-looking statements in addition to historical information.

These forward-looking statements involve risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in our forward-looking statements. Such risks and uncertainties include, among others, those discussed in "Item 1A - Risk Factors" of this Annual Report on Form 10-K, as well as in our consolidated financial statements, related notes, and the other information appearing elsewhere in this report and our other filings with the SEC. We do not intend, and undertake no obligation, to update any of our forward-looking statements after the date of this report to reflect actual results or future events or circumstances. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

Factors that could cause the actual results of the Company in future periods to differ materially include, but are not limited to, the following:

Risks Relating to Our Business

HNH sponsors defined benefit pension plans, which could subject it to substantial cash funding requirements in the future and could have a substantial adverse effect on cash flow and financial viability.

Page | 5

HNH's ongoing operating cash flow requirements include arranging for the funding of the minimum requirements of the WHX Corporation Pension Plan ("WHX Pension Plan") and the Retirement Plan for Employees of JPS Industries, Inc. ("JPS Pension Plan"). The performance of the financial markets and interest rates, as well as health care trends and associated mortality rates, impact our defined benefit pension plan expense and funding obligations. Significant changes in these factors, including adverse changes in discount rates, investment losses on plan assets and increases in participant life expectancy, may increase our funding obligations and adversely impact our financial condition. HNH expects to have required minimum pension plan contributions to the WHX Pension Plan and the JPS Pension Plan for 2016, 2017, 2018, 2019, 2020 and for the five years thereafter totaling $16.5 million, $34.3 million, $42.0 million, $38.8 million, $35.3 million and $92.5 million, respectively. Such required future contributions are estimated based upon assumptions regarding such matters as discount rates on future obligations, assumed rates of return on plan assets and legislative changes. Actual future pension costs and required funding obligations will be affected by changes in the factors and assumptions described above, as well as other changes such as any plan termination or other acceleration events, and could have a substantial adverse effect on cash flow and financial viability.

HNH, the parent company, has ongoing requirements to fund its pension plan obligations and meet other administrative expenses. However, H&H Group's debt facilities contain covenants that limit HNH's access to cash. If HNH is unable to access funds generated by its subsidiaries, it may not be able to meet its financial obligations.

As of December 31, 2015, HNH, the parent company, had cash and cash equivalents of approximately $16.1 million and current liabilities of approximately $0.2 million. Because HNH is a holding company that conducts operations through its subsidiaries, it depends on those entities for dividends, distributions and other payments to generate the funds necessary to meet its financial obligations. H&H Group's credit facilities restrict H&H Group's ability to transfer any cash or other assets to HNH, subject to certain exceptions including required pension payments to the WHX Pension Plan, but these exceptions are subject to the satisfaction of certain conditions and financial covenants. Failure by one or more of its subsidiaries to generate sufficient cash flow or meet the requirements of H&H Group's credit facilities, restricting future dividends or distributions to HNH, could have a material adverse effect on HNH's business, financial condition and results of operations.

HNH holds a significant investment in the common stock of another public company, and fluctuations in the value of this investment may adversely impact the Company's financial condition and results of operations.

HNH owned 8,436,715 and 6,383,005 shares of the common stock of ModusLink Global Solutions, Inc. ("ModusLink") at December 31, 2015 and December 31, 2014, respectively, and has elected the option to value its investment in ModusLink using fair value, calculated based on the closing market price for ModusLink common stock. The value of this investment decreased from $23.9 million at December 31, 2014 to $20.9 million at December 31, 2015 due to a decrease in the share price of ModusLink's common stock, partially offset by the additional shares of ModusLink common stock purchased by the Company during 2015. ModusLink primarily provides supply chain and logistics services to companies in consumer electronics, communications, computing, medical devices, software and retail. Fluctuations in the price of ModusLink common stock are subject to market fluctuations and other factors outside our control, which are not directly linked to the financial and operational performance of the Company.

Future cash flows from operations or through financings may not be sufficient to enable the Company to meet its obligations, and this would likely have a material adverse effect on its businesses, financial condition and results of operations.

The Company's debt is principally held by H&H Group, which is a wholly-owned subsidiary of HNH. The Company's ability to meet its cash requirements to fund its activities in the ordinary course of business is dependent, in part, upon its ability to access cash from H&H Group's credit facilities, and also on the Company's continuing ability to materially meet its business plans. There can be no assurance that the funds available from operations and under the Company's credit facilities will be sufficient to fund its debt service costs, working capital demands, pension plan contributions, environmental remediation costs or any of the Company's other existing or future obligations. As of December 31, 2015, H&H Group's availability under its senior secured revolving credit facility was $183.2 million, and as of January 31, 2016, it was $181.8 million.

There can be no assurances that H&H Group will continue to have access to its lines of credit if the financial performance of its subsidiaries does not satisfy the financial covenants set forth in the applicable financing agreements. If H&H Group does not meet certain of its financial covenants , and if it is unable to secure necessary waivers or other amendments from the respective lenders on terms acceptable to management, its ability to access available lines of credit could be limited, its debt obligations could be accelerated by the respective lenders, liquidity could be adversely affected for H&H Group, and H&H Group might not be able to provide funds to HNH, its parent, to enable HNH to meet its own financial obligations.

If the Company's cash needs are significantly greater than anticipated or the Company does not materially meet its business plans, the Company may be required to seek additional or alternative financing sources. There can be no assurance that such

Page | 6

financing will be available or available on terms acceptable to the Company. The Company's inability to generate sufficient cash flows from its operations or through financing could impair its liquidity and would likely have a material adverse effect on its businesses, financial condition and results of operations.

Credit market volatility may affect our ability to refinance our existing debt, borrow funds under our existing lines of credit or incur additional debt.

Future disruption and volatility in credit market conditions could have a material adverse impact on our ability to refinance our debt when it comes due on terms similar to our current credit facilities, or to draw upon our existing lines of credit or incur additional debt if needed as a result of unanticipated downturns in the markets for our products and services, which may require us to seek other funding sources to meet our cash requirements. We cannot be certain that alternative sources of financing would be available to the Company in the future on terms and conditions acceptable to us, or at all.

Economic downturns could disrupt and materially harm our business.

Negative trends in the general economy could cause a downturn in the market for our products and services. A significant portion of our revenues are received from customers in transportation, oil and gas exploration, and construction related industries, which have experienced significant financial downturns in the past. These industries are cyclical and demand for their products tends to fluctuate due to changes in national and global economic conditions, availability of credit and other factors. A worsening of consumer demand in these industries would adversely affect our revenues, profitability, operating results and cash flows. We may also experience a slowdown if some customers experience difficulty in obtaining adequate financing due to tightness in the credit markets. Furthermore, the financial stability of our customers or suppliers may be compromised, which could result in additional bad debts for us or non-performance by suppliers. Our assets may also be impaired or subject to write-down or write-off as a result of these conditions. These adverse effects would likely be exacerbated if global economic conditions worsen, resulting in wide-ranging, adverse and prolonged effects on general business conditions, and materially and adversely affect our operations, financial results and liquidity.

In many cases, our competitors are larger than us and have manufacturing and financial resources greater than we do, which may have a negative impact on our business, operating results or financial condition.

In our served markets, we compete against foreign and domestic private and public companies that manufacture products of the type we manufacture. Some of these competitors are larger than we are and have financial resources greater than we do. This results in intense competition in a number of markets in which we operate. Some of these competitors enjoy certain other competitive advantages, including greater name recognition, greater financial, technical, marketing and other resources, a larger installed base of customers, and well-established relationships with current and potential customers. Competition is based on quality, technology, service, and price, and in some industries, new product introduction. We may not be able to compete successfully, and competition may have a negative impact on our business, operating results or financial condition by reducing volume of products sold and/or selling prices, and accordingly reducing our sales and profits.

Our sales and profitability may be adversely affected by fluctuations in the cost and supply of raw materials and commodities.

In our production and distribution processes, we consume significant amounts of electricity, natural gas, fuel and petroleum-based commodities, including adhesives, and other products, such as yarns, precious metals, steel products and certain non-ferrous metals used as raw materials. The availability and pricing of these commodities are subject to market forces that are beyond our control. Our suppliers contract separately for the purchase of such commodities, and our sources of supply could be interrupted should our suppliers not be able to obtain these materials due to higher demand or other factors interrupting their availability. Our results of operations may be adversely affected during periods in which either the prices of such commodities are unusually high, or their availability is restricted, or if we are unable to pass through the unfavorable impact of raw material price fluctuations to our customers, including any change associated with the margins we generate from the material portion of our products. In addition, we hold precious metal positions that are subject to market fluctuations. We enter into precious metal forward or futures contracts with major financial institutions to attempt to mitigate the economic risk of these price fluctuations, however, the Company's hedging strategy is designed to protect it against normal volatility; therefore, abnormal price changes in these commodities or markets could negatively impact HNH's earnings.

We do not have long-term contracts with all of our customers, the loss of which customers could materially adversely affect our financial condition, business and results of operations.

Our businesses are based primarily upon individual orders and sales with our customers and not long-term supply contracts. As such, our customers could cease buying products at any time and for any reason, and we will have no recourse in the event a

Page | 7

customer no longer wants to purchase products from us. If a significant number of our customers elect not to purchase products, it could materially adversely affect our financial condition, business and results of operations. No single customer accounted for more than 10% of HNH's consolidated net sales in 2015. However, the Company's 15 largest customers accounted for approximately 33% of consolidated net sales in 2015. If we were to lose our relationship with several of these customers, revenues and profitability could fall significantly.

Some of our businesses are subject to certain risks associated with the movement of businesses offshore.

Some of our businesses are potentially at risk of losing business to competitors operating in lower cost countries. An additional risk is the movement offshore of some of our businesses' customers, leading them to procure products from more closely located companies. Either of these factors could negatively impact our financial condition, business and results of operations.

Our business strategy includes acquisitions, and acquisitions entail numerous risks, including the risk of management diversion and increased costs and expenses, all of which could negatively affect the Company's profitability.

Our business strategy includes, among other things, strategic acquisitions, as well as potential opportunistic acquisitions. This element of our strategy entails several risks, including the diversion of management's attention from other business concerns and the need to finance such acquisitions with additional equity and/or debt.

In addition, once completed, acquisitions entail further risks, including: unanticipated costs and liabilities of the acquired businesses, including environmental liabilities that could materially adversely affect our results of operations; difficulties in assimilating acquired businesses; negative effects on existing business relationships with suppliers and customers; and losing key employees of the acquired businesses. If our acquisition strategy is not successful or if acquisitions are not well integrated into our existing operations, the Company's profitability could be negatively affected.

Divestitures could negatively impact our business, and contingent liabilities from businesses that we have sold could adversely affect our financial condition.

We continually assess the strategic fit of our existing businesses and may divest businesses that are deemed not to fit with our strategic plans or are not achieving the desired return on investment. Divestitures pose risks and challenges that could negatively impact our business. For example, when we decide to sell a business or assets, we may be unable to do so on satisfactory terms and within our anticipated timeframe, and even after reaching a definitive agreement to sell a business, the sale is typically subject to satisfaction of pre-closing conditions, which may not become satisfied. In addition, divestitures may dilute the Company's earnings per share, have other adverse accounting impacts and distract management, and disputes may arise with buyers. In addition, we have retained responsibility for and/or have agreed to indemnify buyers against some known and unknown contingent liabilities related to a number of businesses we have sold. The resolution of these contingencies has not had a material effect on our consolidated financial statements, but we cannot be certain that this favorable pattern will continue.

Our competitive advantage could be reduced if our intellectual property or related proprietary manufacturing processes become known by our competitors or if technological changes reduce our customers' need for our products.

We own a number of trademarks and patents in the United States and other jurisdictions on our products and related proprietary manufacturing processes. In addition to trademark and patent protection, we rely on trade secrets, proprietary know-how and technological advances that we seek to protect. If our intellectual property is not properly protected by us or is independently discovered by others or otherwise becomes known or if technological changes reduce our customers' need for our proprietary products, our protection against competitive products could be diminished, and our profitability could be substantially impaired.

We could incur significant costs, including remediation costs, as a result of complying with environmental laws.

Our facilities and operations are subject to extensive environmental laws and regulations imposed by federal, state, foreign and local authorities relating to the protection of the environment. Although we maintain insurance coverage for certain environmental matters, we could incur substantial costs, including cleanup costs, fines or sanctions, and third-party claims for property damage or personal injury, as a result of violations of, or liabilities under, environmental laws. We have incurred, and in the future may continue to incur, liability under environmental statutes and regulations with respect to the contamination detected at sites owned or operated by the Company (including contamination caused by prior owners and operators of such sites, abutters or other persons) and the sites at which we have disposed of hazardous substances. As of December 31, 2015, we have established reserves totaling $2.5 million with respect to certain presently estimated environmental remediation costs. These reserves may not be adequate to cover the ultimate costs of remediation, including discovery of additional contaminants or the imposition of additional cleanup obligations, which could result in significant additional costs. In addition, we expect that future regulations,

Page | 8

and changes in the text or interpretation of existing regulations, may subject us to increasingly stringent standards. Compliance with such requirements may make it necessary for us to retrofit existing facilities with additional pollution-control equipment, undertake new measures in connection with the storage, transportation, treatment and disposal of by-products and wastes or take other steps, which may be at a substantial cost to us.

Our future success depends greatly upon attracting and retaining qualified personnel, which could increase our labor costs and impair our profitability.

A significant factor in our future profitability is our ability to attract, develop and retain qualified personnel. We receive certain executive and corporate services, including, without limitation, legal, tax, accounting, treasury, consulting, auditing, administrative, compliance, environmental health and safety, human resources, marketing, investor relations, operating group management and other similar services under a management agreement with a related party. Our success in attracting qualified personnel is affected by changing demographics of the available pool of workers with the training and skills necessary to fill available positions, the impact on the labor supply due to general economic conditions, and our ability to offer competitive compensation and benefit packages.

If we suffer loss to our facilities, supply chains or distribution systems to catastrophe or other events, our operations could be seriously harmed.

Our facilities, supply chains, distribution systems and information technology systems are subject to catastrophic loss due to fire, flood, earthquake, hurricane, terrorism or other natural or man-made disasters. If any of these facilities, supply chains or systems were to experience a catastrophic loss, it could disrupt our operations, delay production and shipments, result in defective products or services, damage customer relationships and our reputation and result in legal exposure and large repair or replacement expenses. The third-party insurance coverage that we maintain with respect to these and other risks will vary from time to time in both type and amount depending on cost, availability and our decisions regarding risk retention, and may be insufficient or unavailable to protect us against losses.

A significant disruption in, or breach in security of, our information technology systems could adversely affect our business.

We rely on information technology systems, some of which are managed by third parties, to process, transmit and store electronic information, and to manage or support a variety of critical business processes and activities. We also collect and store sensitive data, including confidential business information and personal data. These systems may be susceptible to damage, disruptions or shutdowns due to attacks by computer hackers, computer viruses, employee error or malfeasance, power outages, hardware failures, telecommunication or utility failures, catastrophes or other unforeseen events. Upgrading our information technology systems is costly and subject to delay, and there is no assurance new systems will provide the benefits expected. In addition, security breaches of our systems could result in the misappropriation or unauthorized disclosure of confidential information or personal data belonging to us or to our employees, partners, customers or suppliers. Any such events could disrupt our operations, delay production and shipments, result in defective products or services, damage customer relationships and our reputation and result in legal claims or proceedings, liability or penalties under privacy laws, each of which could adversely affect our business and our financial condition.

Litigation or compliance failures could adversely affect our profitability.

The nature of our businesses expose us to various litigation matters, including product liability claims, employment, health and safety matters, intellectual property infringement claims, commercial disputes, or acquisition or divestiture-related matters. We contest these matters vigorously and make insurance claims where appropriate. However, litigation is inherently costly and unpredictable, making it difficult to accurately estimate the outcome of any litigation. These lawsuits may include claims for compensatory damages, punitive and consequential damages and/or injunctive relief. The defense of these lawsuits may divert our management's attention, we may incur significant expenses in defending these lawsuits, and we may be required to pay damage awards or settlements or become subject to equitable remedies that could adversely affect our operations and financial condition. Moreover, any insurance or indemnification rights that we may have may be insufficient or unavailable to protect us against such losses. In addition, developments in legal proceedings in any given period may require us to adjust the loss contingency estimates that we have recorded in our consolidated financial statements, record estimates or reserves for liabilities or assets previously not susceptible of reasonable estimates or pay cash settlements or judgments. Any of these developments could adversely affect our financial condition in any particular period. Although we make accruals as we believe warranted, the amounts that we accrue could vary significantly from any amounts we actually pay due to the inherent uncertainties in the estimation process.

Our businesses are subject to extensive regulation; failure to comply with those regulations could adversely affect our financial condition and reputation.

Page | 9

Our businesses are subject to extensive regulation by U.S. and non-U.S. governmental and self-regulatory entities at the federal, state and local levels, including laws related to anti-corruption, environmental matters, health and safety, import laws and export control and economic sanctions, and the sale of products and services to government entities.

In addition, the Dodd-Frank Wall Street Reform and Consumer Protection Act contains provisions to improve transparency and accountability concerning the supply of certain minerals, known as conflict minerals, originating from the Democratic Republic of Congo ("DRC") and adjoining countries. As a result, the SEC has adopted annual disclosure and reporting requirements for those companies who use conflict minerals mined from the DRC and adjoining countries in their products. The implementation of these rules could adversely affect the sourcing, supply and pricing of materials used in our products. As there may be only a limited number of suppliers offering "conflict free" conflict minerals, we cannot be sure that we will be able to obtain necessary conflict minerals from such suppliers in sufficient quantities or at competitive prices. Also, we may face reputational challenges if we determine that certain of our products contain minerals not determined to be conflict free or if we are unable to sufficiently verify the origins for all conflict minerals used in our products through the procedures we may implement.

These are not the only regulations that our businesses must comply with. Failure to comply with these or any other regulations could result in civil and criminal, monetary and non-monetary penalties, damage to our reputation, disruptions to our business, limitations on our ability to manufacture, import, export and sell products and services, disbarment from selling to certain federal agencies, damage to our reputation and loss of customers and could cause us to incur significant legal and investigatory fees. Compliance with these and other regulations may also require us to incur significant expenses. Our products and operations are also often subject to the rules of industrial standards bodies such as the International Organization for Standardization (ISO), and failure to comply with these rules could result in withdrawal of certifications needed to sell our products and services and otherwise adversely impact our financial condition.

Our internal controls over financial reporting may not be effective, and our independent auditors may not be able to certify as to their effectiveness, which could have a significant and adverse effect on our business and reputation.

We are subject to the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 and the rules and regulations of the SEC thereunder ("Section 404"). Section 404 requires us to report on the design and effectiveness of our internal controls over financial reporting. Section 404 also requires an independent registered public accounting firm to test our internal controls over financial reporting and report on the effectiveness of such controls. There can be no assurance that our auditors will issue an unqualified report attesting to our internal controls over financial reporting. As a result, there could be a negative reaction in the financial markets due to a loss of confidence in the reliability of our consolidated financial statements or our consolidated financial statements could change. Further, we completed the acquisition of JPS on July 2, 2015, and we have excluded the operations of this business from our evaluation of, and conclusion on, the effectiveness of our internal control over financial reporting as of December 31, 2015. Any failure to maintain or implement new or improved controls, or any difficulties we encounter in their implementation, could result in significant deficiencies or material weaknesses, and cause us to fail to meet our periodic reporting obligations, or result in material misstatements in our consolidated financial statements. We may also be required to incur costs to improve our internal control system and hire additional personnel. This could negatively impact our results of operations.

Risk Relating to Our Ownership Structure

Warren G. Lichtenstein, our Chairman, and certain other Officers and Directors, through their affiliation with Steel Partners Holdings GP Inc., have the ability to exert significant influence over our operations.

Steel Partners Holdings L.P. ("SPLP") owns directly or indirectly through its subsidiaries 8,560,592 shares of the Company's common stock, representing approximately 70.1% of the outstanding shares at December 31, 2015. SPLP may increase its ownership position in the Company's common stock in the future. The power to vote and dispose of the securities held by SPLP is controlled by Steel Partners Holdings GP Inc. ("SPH GP"). Warren G. Lichtenstein, our Chairman of the Board of Directors, is also the Executive Chairman of SPH GP. As Executive Chairman of our majority owner, Mr. Lichtenstein has the ability to exert significant influence over our policies and affairs and over the outcome of any action requiring a stockholder vote, including the election of our Board of Directors, the approval of amendments to our amended and restated certificate of incorporation, and the approval of mergers or sales of substantially all of our assets. The interests of Mr. Lichtenstein and SPH GP in such matters may differ from the interests of our other stockholders in some respects. In addition, certain other affiliates of SPH GP hold positions with HNH, including Jack L. Howard as Vice Chairman and Principal Executive Officer, John H. McNamara Jr., as Director, James F. McCabe, Jr., as Senior Vice President and Chief Financial Officer and Leonard J. McGill as Senior Vice President and Chief Legal Officer.

Factors Affecting the Value of Our Common Stock

Page | 10

Transfer restrictions contained in our charter and other factors could hinder the development of an active market for our common stock.

There can be no assurance as to the volume of shares of our common stock or the degree of price volatility for our common stock traded on the NASDAQ Capital Market. There are transfer restrictions contained in our charter to help preserve our net operating tax loss carryforwards that will generally prevent any person from acquiring amounts of our common stock such that such person would hold 5% or more of our common stock, for up to three years after July 29, 2015, as specifically provided in our charter. The transfer restrictions could hinder development of an active market for our common stock.

We do not anticipate paying dividends on our common stock in the foreseeable future, which may limit investor demand.

We do not anticipate paying any dividends on our common stock in the foreseeable future. Such lack of dividend prospects may have an adverse impact on the market demand for our common stock as certain institutional investors may invest only in dividend-paying equity securities or may operate under other restrictions that may prohibit or limit their ability to invest in our common stock.

Future offerings of our equity securities may result in dilution of our common stock and a reduction in the price of our common stock.

We are authorized to issue 180,000,000 shares of common stock. On February 25, 2016, 12,208,016 shares of common stock were outstanding. In addition, we are authorized to issue 5,000,000 shares of preferred stock. On February 25, 2016, no shares of our preferred stock were outstanding. Although our Board of Directors is expressly authorized to fix the designations, preferences and rights, limitations or restrictions of the preferred stock by adoption of a Preferred Stock Designation resolution, our Board of Directors has not yet done so. Our Board of Directors may elect to issue shares of common stock or preferred stock in the future to raise capital or for other financial needs. Any future issuances of equity may be at prices below the market price of our stock, and our stockholders may suffer significant dilution, and the terms of any preferred stock issuance may adversely affect the rights of our common stockholders.

Item 1B. | Unresolved Staff Comments |

There are no unresolved SEC Staff comments.

Item 2. | Properties |

As of December 31, 2015, the Company had 23 active operating plants in the United States, Canada, China, United Kingdom, Germany, France, Poland and Mexico, with a total area of approximately 2,676,389 square feet, including warehouse, office, sales, service and laboratory space. The Company also owns or leases sales, service, office and warehouse facilities at 10 other locations in the United States, which have a total area of approximately 290,828 square feet, and owns or leases 5 non-operating locations with a total area of approximately 535,350 square feet. Manufacturing facilities are located in: Camden, Delaware; Addison, Illinois; Evansville, Indiana; Agawam, Massachusetts; Rockford, Minnesota; Middlesex, New Jersey; Arden and Statesville, North Carolina; St. Louis, Missouri; Anderson and Slater, South Carolina; Cudahy, Wisconsin; Warwick, Rhode Island; Toronto and Montreal, Canada; Matamoros, Mexico; Gwent, Wales, United Kingdom; Pansdorf, Germany; Riberac, France; Gliwice, Poland; and Suzhou, China. All plants are owned except for the Addison, Middlesex, Arden, Rockford, Montreal, Suzhou and one of two Gliwice plants, which are leased.

The Company considers its manufacturing plants and service facilities to be well maintained and efficiently equipped, and therefore suitable for the work being done. The productive capacity and extent of utilization of its facilities is dependent in some cases on general business conditions and in other cases on the seasonality of the utilization of its products. Capacity can be expanded at some locations.

Item 3. | Legal Proceedings |

In the ordinary course of our business, we are subject to periodic lawsuits, investigations, claims and proceedings, including, but not limited to, contractual disputes, employment, environmental, health and safety matters, as well as claims associated with our historical acquisitions and divestitures. Although we cannot predict with certainty the ultimate resolution of lawsuits, investigations, claims and proceedings asserted against us, we do not believe any currently pending legal proceeding to

Page | 11

which we are a party will have a material adverse effect on our business, prospects, financial condition, cash flows, results of operations or liquidity. Additional discussion of certain pending legal matters is included in Note 19 to our consolidated financial statements included in "Item 8 - Financial Statements and Supplementary Data" and is incorporated in its entirety into this Part 1, Item 3 by this reference.

Item 4. | Mine Safety Disclosures |

Not applicable.

Page | 12

PART II

Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Market Price of Our Common Stock

The Company's common stock is listed on the NASDAQ Capital Market under the symbol "HNH." The price range per share reflected in the table below is the highest and lowest per share sales price for our stock as reported by the NASDAQ Capital Market during each quarter of the two most recent years.

2015 | HIGH | LOW | ||||||

First Quarter | $ | 48.17 | $ | 39.21 | ||||

Second Quarter | $ | 42.32 | $ | 30.95 | ||||

Third Quarter | $ | 34.54 | $ | 23.77 | ||||

Fourth Quarter | $ | 26.85 | $ | 19.00 | ||||

2014 | HIGH | LOW | ||||||

First Quarter | $ | 23.68 | $ | 18.02 | ||||

Second Quarter | $ | 26.77 | $ | 20.66 | ||||

Third Quarter | $ | 27.14 | $ | 21.66 | ||||

Fourth Quarter | $ | 46.51 | $ | 27.89 | ||||

The number of shares of common stock outstanding on February 25, 2016 was 12,208,016. Also, on February 25, 2016, there were approximately 122 holders of record of common stock, and the closing price per share of our common stock was $17.67.

Dividend Policy

The Company has never declared or paid any cash dividends on its common stock. The Company intends to retain any future earnings and does not expect to pay any dividends in the foreseeable future. H&H Group is restricted by the terms of its financing agreements in making dividends to HNH.

Securities Authorized for Issuance Under Equity Compensation Plans

The following table details information regarding our existing equity compensation plans as of December 31, 2015.

Equity Compensation Plan Information | ||||||||||

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in first column) | |||||||

Equity compensation plans approved by security holders | 13,000 | $ | 90.00 | 661,594 | ||||||

Equity compensation plans not approved by security holders | — | — | — | |||||||

Total | 13,000 | $ | 90.00 | 661,594 | ||||||

Stock Performance Graph

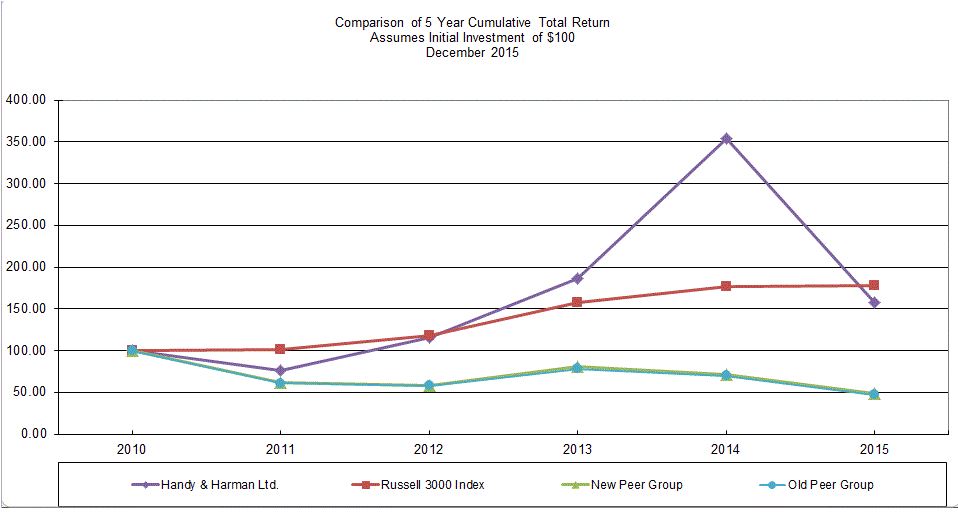

The line graph below compares the cumulative total stockholder return on our common stock with the cumulative total return of the Russell 3000 Index and a peer group of five companies, which operate in similar industries to the Company's five operating segments, that includes: AK Steel Holding Corporation, Materion Corporation, Quanex Building Products Corporation, Shiloh Industries Inc. and Core Molding Technologies, Inc. for the five years ended December 31, 2015. The graph and table assume that $100 was invested on December 31, 2010 in each of our common stock, the Russell 3000 index and the peer group, and that all dividends were reinvested. We did not declare or pay any dividends during the comparison period. Core Molding

Page | 13

Technologies, Inc. was added to our peer group in 2015 in connection with the acquisition of JPS and our associated new Performance Materials segment.

2010 | 2011 | 2012 | 2013 | 2014 | 2015 | |||||||||||||||||||

HNH | $ | 100.00 | $ | 76.04 | $ | 115.75 | $ | 185.94 | $ | 353.53 | $ | 157.53 | ||||||||||||

Russell 3000 Index | $ | 100.00 | $ | 101.03 | $ | 117.61 | $ | 157.07 | $ | 176.79 | $ | 177.64 | ||||||||||||

New Peer Group | $ | 100.00 | $ | 61.81 | $ | 58.57 | $ | 80.26 | $ | 71.80 | $ | 49.08 | ||||||||||||

Old Peer Group | $ | 100.00 | $ | 60.89 | $ | 57.92 | $ | 78.42 | $ | 69.80 | $ | 47.07 | ||||||||||||

The unit price performance included in this graph is not necessarily indicative of future unit price performance.

The stock performance graph shall not be deemed to be incorporated by reference by means of any general statement incorporating by reference this Form 10-K into any filing under the Securities Act or the Exchange Act, except to the extent that we specifically incorporate such information by reference, and shall not otherwise be deemed filed under such acts.

Issuer Purchases of Equity Securities

There were no issuer purchases of its equity securities during the three months ended December 31, 2015.

Item 6. | Selected Financial Data |

The following table summarizes certain selected consolidated financial data, which should be read in conjunction with our consolidated financial statements and the notes thereto and with "Item 7 - Management's Discussion and Analysis of Financial Condition and Results of Operations" included elsewhere in this Annual Report on Form 10-K. The selected consolidated financial data has been derived from our annual consolidated financial statements.

Page | 14

(in thousands, except per share amounts) | 2015 (a) | 2014 (b) | 2013 (c) | 2012 | 2011 (d) | |||||||||||||||

Consolidated Income Statement Data: | ||||||||||||||||||||

Net sales | $ | 649,468 | $ | 600,468 | $ | 571,164 | $ | 498,713 | $ | 498,842 | ||||||||||

Operating income | $ | 45,914 | $ | 45,720 | $ | 40,203 | $ | 38,401 | $ | 37,230 | ||||||||||

Income from continuing operations before tax and equity investment | $ | 41,520 | $ | 39,302 | $ | 27,496 | $ | 23,861 | $ | 20,092 | ||||||||||

Income from continuing operations, net of tax | $ | 16,991 | $ | 15,193 | $ | 21,341 | $ | 14,224 | $ | 128,371 | ||||||||||

Income from continuing operations, net of tax, per share-basic and diluted | $ | 1.49 | $ | 1.23 | $ | 1.61 | $ | 1.09 | $ | 10.22 | ||||||||||

Consolidated Balance Sheet Data: | ||||||||||||||||||||

Total assets | $ | 624,673 | $ | 538,759 | $ | 509,723 | $ | 512,361 | $ | 493,190 | ||||||||||

Total debt | $ | 99,568 | $ | 203,403 | $ | 157,191 | $ | 158,444 | $ | 163,281 | ||||||||||

(a) | 2015 operating income includes an asset impairment charge of $1.4 million associated with certain unused, real property located in Norristown, Pennsylvania. 2015 income from continuing operations, net of tax includes a $6.5 million loss from our investment in ModusLink. |

(b) | 2014 operating income includes asset impairment charges totaling $1.2 million associated with certain equipment owned by the Company's Joining Materials segment located in Toronto, Canada and certain unused, real property owned by the Company's Kasco segment located in Atlanta, Georgia. 2014 income from continuing operations, net of tax includes a $7.1 million loss from our investment in ModusLink. |

(c) | 2013 income from continuing operations before tax and equity investment includes expenses totaling $6.5 million associated with the Company's redemption of its outstanding 10% subordinated secured notes due 2017 ("Subordinated Notes"). Income from continuing operations, net of tax in 2013 includes a $6.0 million gain from our investment in ModusLink. |

(d) | Income from continuing operations, net of tax in 2011 reflects a tax benefit of $108.3 million, primarily due to the reversal of a deferred income tax valuation allowance. |

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our consolidated financial statements and related notes thereto that are available elsewhere in this Annual Report on Form 10-K. The following is a discussion and analysis of HNH's consolidated results of operations for the years ended December 31, 2015, 2014 and 2013. In addition to historical consolidated financial information, the following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to these differences include those discussed below and elsewhere in this Annual Report on Form 10-K, particularly in "Item 1A - Risk Factors."

Business Segments

HNH's business units encompass the following segments: Joining Materials, Tubing, Building Materials, Performance Materials and Kasco. Management has determined that certain operating companies should be aggregated and presented within a single segment on the basis that such segments have similar economic characteristics and share other qualitative characteristics. Management reviews net sales, gross profit and operating income to evaluate segment performance. Operating income for the segments generally includes costs directly attributable to the segment and excludes other unallocated general corporate expenses. Interest expense, other income and expense, and income taxes are not presented by segment since they are excluded from the measures of segment profitability reviewed by the Company's management. For a more complete description of the Company's business segments, see "Item 1 - Business - Products and Product Mix."

Recent Developments

During 2015, we entered into a series of transactions to improve liquidity, enhance our product offerings and position us for growth in our niche markets.

• | We completed the sale of Arlon, LLC, which operations comprised substantially all of the Company's former Arlon segment, for $155.5 million in cash, reflecting transaction fees, a final working capital adjustment and certain reductions as provided in the stock purchase agreement. |

Page | 15

• | We acquired ITW for $27.4 million in cash, including a final working capital adjustment. ITW was the exclusive supplier of certain adhesive products to our Building Materials segment, and the acquisition will provide us with greater control of our supply chain and allow us to expand our product development initiatives. |

• | We acquired all of the outstanding shares of common stock of JPS not already owned by HNH's affiliates for $11.00 per share in cash, with the remaining JPS shares acquired from HNH's affiliates through the issuance of 1,429,407 HNH common shares, for a total purchase price of $114.5 million. The Performance Materials segment is currently comprised solely of the operations of JPS. |

• | We made investments in capital projects totaling $15.2 million. |

• | We purchased an additional 2,053,710 shares of ModusLink common stock, increasing the Company's and its affiliates' combined ownership percentage in ModusLink to 31.5%. |

Results of Operations

Comparison of the Years Ended December 31, 2015 and 2014

The Company's consolidated operating results for the years ended December 31, 2015 and 2014 are summarized in the following table:

Year Ended | ||||||||

December 31, | ||||||||

(in thousands) | 2015 | 2014 | ||||||

Net sales | $ | 649,468 | $ | 600,468 | ||||

Gross profit | 178,214 | 164,779 | ||||||

Gross profit margin | 27.4 | % | 27.4 | % | ||||

Selling, general and administrative expenses | 123,422 | 114,141 | ||||||

Pension expense | 7,480 | 3,739 | ||||||

Asset impairment charges | 1,398 | 1,179 | ||||||

Operating income | 45,914 | 45,720 | ||||||

Other: | ||||||||

Interest expense | 4,598 | 7,544 | ||||||

Realized and unrealized gain on derivatives | (588 | ) | (1,307 | ) | ||||

Other expense | 384 | 181 | ||||||

Income from continuing operations before tax and equity investment | 41,520 | 39,302 | ||||||

Tax provision | 17,997 | 17,008 | ||||||

Loss from associated company, net of tax | 6,532 | 7,101 | ||||||

Income from continuing operations, net of tax | $ | 16,991 | $ | 15,193 | ||||

Net Sales

Net sales for the year ended December 31, 2015 increased by $49.0 million, or 8.2%, to $649.5 million, as compared to $600.5 million in 2014. The change in net sales reflects approximately $59.5 million in incremental sales associated with our acquisition of JPS and a net increase from core growth of approximately $6.5 million, which was partially offset by a reduction of approximately $17.1 million in net sales due to lower average silver prices. Excluding the impact of the JPS acquisition, our value added sales, defined as net sales less revenue from the direct purchase and resale of precious metals, increased by approximately $6.5 million on higher volume, primarily from the Building Materials segment. The average silver market price was approximately $15.70 per troy ounce during 2015, as compared to $19.05 per troy ounce in 2014.

Gross Profit

Gross profit for the year ended December 31, 2015 increased to $178.2 million, as compared to $164.8 million in 2014, and was consistent with 2014 as a percentage of net sales. The change in gross profit reflects a net increase from core growth of approximately $5.5 million, and the incremental gross profit and lower manufacturing costs resulting from the JPS and ITW acquisitions, which were partially offset by a reduction of approximately $2.3 million in gross profit due to lower average silver prices. Higher sales volume from the Building Materials segment and Kasco segment led to the increase in gross profit from our

Page | 16

core business. Gross profit in the 2015 period also reflects $3.4 million of nonrecurring expense associated with the amortization of the fair value adjustment to acquisition-date inventories associated with the JPS acquisition.

Selling, General and Administrative Expenses

Selling, general and administrative expenses ("SG&A") for the year ended December 31, 2015 were $123.4 million, as compared to $114.1 million in 2014. SG&A expenses from the Performance Materials segment were approximately $4.9 million during 2015. Excluding the impact of the JPS acquisition, the increased SG&A during 2015 was driven by higher personnel costs and business development expenses, primarily associated with our 2015 acquisitions, which were partially offset by lower stock-based compensation charges.

Pension Expense

Pension expense was $7.5 million for the year ended December 31, 2015, which was $3.7 million higher than 2014. The increased pension expense was due to a decline in discount rates based on changes in corporate bond yields, an increase in participant life expectancy reflected in revised mortality assumptions, and also due to the fact that the investment returns on the assets of the WHX Pension Plan were lower than actuarial assumptions during 2014, which were partially offset by income of $0.5 million from the JPS Pension Plan from the date of acquisition to December 31, 2015. We currently expect pension expense to be approximately $8.8 million in 2016.

Asset Impairment Charges

In the fourth quarter of 2015, a non-cash asset impairment charge of $1.4 million was recorded related to certain unused, real property located in Norristown, Pennsylvania to reflect its current market value.

In the fourth quarter of 2014, a non-cash asset impairment charge of $0.6 million was recorded related to certain equipment owned by the Company's Joining Materials segment located in Toronto, Canada to be sold or scrapped as part of the Company's integration activities associated with the Wolverine Joining acquisition. In addition, the Company recorded a $0.6 million non-cash asset impairment charge associated with certain unused, real property owned by the Company's Kasco segment located in Atlanta, Georgia in the fourth quarter of 2014.

Interest Expense

Interest expense for the year ended December 31, 2015 was $4.6 million, as compared to $7.5 million in 2014. The lower interest expense was primarily due to lower borrowing levels and lower average interest rates in 2015.

Realized and Unrealized Gain on Derivatives

H&H utilizes commodity forward and futures contracts to mitigate the impact of price fluctuations on its precious metal and certain non-precious metal inventories. The factors that affect the gain or loss on these derivative instruments are changes in the price of the associated metals and the amount of ounces hedged.

Tax Provision

For the years ended December 31, 2015 and 2014, tax provisions from continuing operations of $18.0 million and $17.0 million, respectively, were recorded. The effective tax rates in the years ended December 31, 2015 and 2014 were 43.3% and 43.3%, respectively. Changes in the effective tax rate arise principally from differences in the mix of income between taxable jurisdictions, including the impact of foreign sourced income, as well as changes in estimates associated with our state tax rates.

Loss from Associated Company

The Company carries its investment in ModusLink at fair value, calculated based on the closing market price for ModusLink common stock, and the losses recorded during the years ended December 31, 2015 and 2014 are due entirely to changes in the share price of ModusLink's common stock.

Segment Analysis

The following table summarizes information about HNH's segment operating results for the years ended December 31, 2015 and 2014:

Page | 17

Year Ended | |||||||||||||||

December 31, | |||||||||||||||

(in thousands) | 2015 | 2014 | Inc./(Decr.) | % Change | |||||||||||

Net sales: | |||||||||||||||

Joining Materials | $ | 182,702 | $ | 207,320 | $ | (24,618 | ) | (11.9 | )% | ||||||

Tubing | 79,539 | 81,264 | (1,725 | ) | (2.1 | )% | |||||||||

Building Materials | 266,859 | 253,644 | 13,215 | 5.2 | % | ||||||||||

Performance Materials | 59,535 | — | 59,535 | N/A | |||||||||||

Kasco | 60,833 | 58,240 | 2,593 | 4.5 | % | ||||||||||

Total net sales | $ | 649,468 | $ | 600,468 | $ | 49,000 | 8.2 | % | |||||||

Segment operating income (loss): | |||||||||||||||

Joining Materials (a) | $ | 19,906 | $ | 19,428 | $ | 478 | 2.5 | % | |||||||

Tubing | 13,081 | 13,340 | (259 | ) | (1.9 | )% | |||||||||

Building Materials | 37,480 | 30,217 | 7,263 | 24.0 | % | ||||||||||

Performance Materials | (2,212 | ) | — | (2,212 | ) | N/A | |||||||||

Kasco (b) | 4,336 | 3,176 | 1,160 | 36.5 | % | ||||||||||

Total segment operating income | $ | 72,591 | $ | 66,161 | $ | 6,430 | 9.7 | % | |||||||

(a) | The results of the Joining Materials segment in 2014 include a non-cash impairment charge of $0.6 million related to certain equipment located in Toronto, Canada to be sold or scrapped as part of the Company's integration activities associated with the Wolverine Joining acquisition. |

(b) | The results of the Kasco segment in 2014 include a non-cash impairment charge of $0.6 million related to certain unused, real property located in Atlanta, Georgia. |

Joining Materials

For the year ended December 31, 2015, the Joining Materials segment net sales decreased by $24.6 million, or 11.9%, to $182.7 million, as compared to net sales of $207.3 million in 2014. The change in net sales reflects a reduction of approximately $17.1 million in net sales due to a $3.35 per troy ounce decline in the average market price of silver and lower value added sales volume, primarily in North America, due to reduced demand from the oil and gas markets.

Segment operating income for the year ended December 31, 2015 increased by $0.5 million, or 2.5%, to $19.9 million, as compared to $19.4 million in 2014. Higher operating income in 2015 was principally due to improved product mix, lower plant overhead costs and reduced SG&A due to higher severance and recruitment costs incurred during 2014, partially offset by the reduced sales volume and lower silver prices. The effect of lower average silver prices reduced operating income by approximately $2.3 million in 2015.

Tubing

For the year ended December 31, 2015, the Tubing segment net sales decreased by $1.7 million, or 2.1%, to $79.5 million, as compared to $81.3 million in 2014. The decrease was primarily driven by reduced demand for our welded carbon and stainless steel products in the energy services, oil and gas, and chemical processing markets, due to historically low crude oil prices in 2015.

Segment operating income for the year ended December 31, 2015 decreased by $0.3 million, or 1.9%, to $13.1 million, as compared to $13.3 million in 2014. Lower operating income for the year ended December 31, 2015, as compared to 2014, was primarily driven by lower sales volume and higher SG&A, as a result of higher personnel costs, partially offset by lower plant overhead and operating costs.

Building Materials

For the year ended December 31, 2015, the Building Materials segment net sales increased by $13.2 million, or 5.2%, to $266.9 million, as compared to $253.6 million in 2014. Sales of both our roofing and FastenMaster products were higher, as compared to 2014, due to growth from our company branded and roof edge roofing products and strong demand from home centers and lumberyards for our FastenMaster products.

Page | 18

Segment operating income increased by $7.3 million, or 24.0%, to $37.5 million for the year ended December 31, 2015, as compared to $30.2 million in 2014, reflecting higher sales volume and lower manufacturing costs. Gross profit margin in 2015 was higher, as compared to 2014, primarily due to lower manufacturing costs as a result of the ITW acquisition and favorable overhead absorption, partially offset by higher freight costs, in part due to the West Coast port slowdown in early 2015, as well as costs associated with the consolidation of our Midwest manufacturing and warehouse facilities into a single location. SG&A also increased, reflecting increased employee headcount and benefit costs.

Performance Materials

As indicated above, the Performance Materials segment is currently comprised solely of the operations of JPS, which were acquired on July 2, 2015.

For the year ended December 31, 2015, the Performance Materials segment net sales were $59.5 million, driven by continued strong demand for fiberglass fabrics from the aerospace sector, partially offset by weakness in a number of industrial markets, including power generation, oil and gas, and electronics. Decreased domestic defense spending and troop drawdowns have also reduced demand for military ballistic materials.