Attached files

| file | filename |

|---|---|

| 8-K - 8-K - U.S. CONCRETE, INC. | a8-kitem701investorpresent.htm |

Investor Presentation May 20, 2013

Forward-Looking Statements Certain statements provided in this presentation, including those that express a belief, expectation or intention and those that are not of historical fact, are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements involve a number of risks and uncertainties and are intended to qualify for the safe harbors from liability established by the Private Securities Litigation Reform Act of 1995. These risks and uncertainties may cause actual results to differ materially from expected results and are described in detail in filings made by U.S. Concrete, Inc. (the “Company”) with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K for the year ended December 31, 2012 and subsequent Quarterly Reports. The forward-looking statements speak only as of the date of this presentation. Investors are cautioned not to rely unduly on them. Many of these forward-looking statements are based on expectations and assumptions about future events that may prove to be inaccurate. The Company’s management considers these expectations and assumptions to be reasonable, but they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond the Company’s control. The Company undertakes no obligation to update these statements unless required by applicable securities laws. Page 2

Company Overview

Page 4 Company Overview 3.3 million tons and 6% of total revenue in 2012 7 aggregate and sand and gravel operations 1 recycle aggregate facility Primary focus is supply of U.S. Concrete ready- mixed operations Ag g rega te s 89% of total 2012 revenue 4.8 million cubic yards in 2012 101 fixed and 11 portable concrete plants Leading market position in four regions with attractive fundamentals Rea d y -Mi x e d Co n cret e

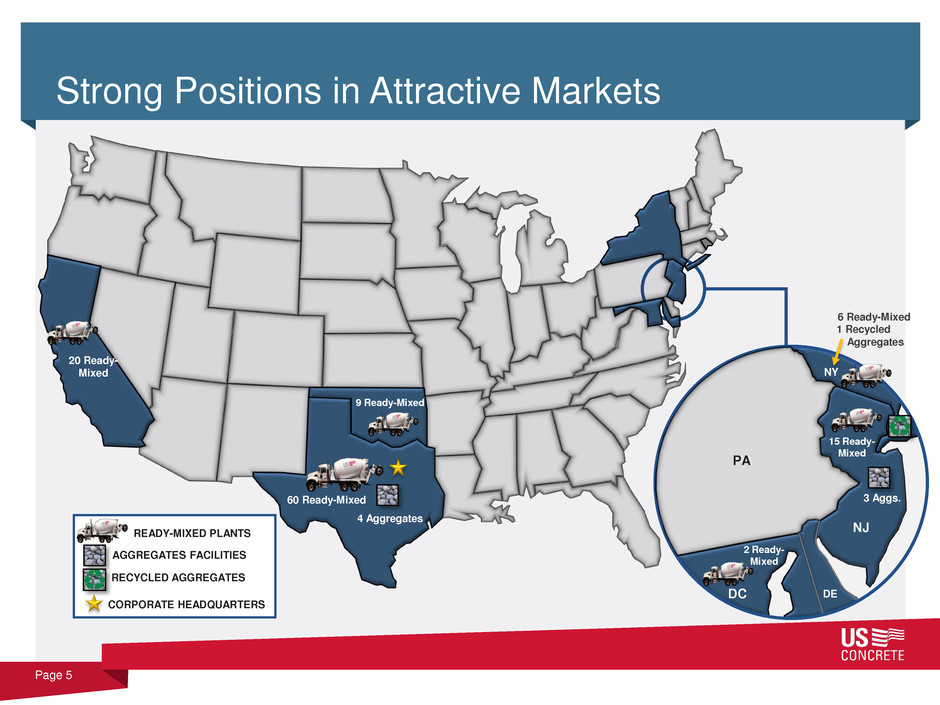

SAN FRANCISCO Strong Positions in Attractive Markets Page 5 READY-MIXED PLANTS AGGREGATES FACILITIES RECYCLED AGGREGATES CORPORATE HEADQUARTERS DC NJ DE PA 20 Ready- Mixed 60 Ready-Mixed 4 Aggregates 9 Ready-Mixed 2 Ready- Mixed 15 Ready- Mixed 3 Aggs. 6 Ready-Mixed 1 Recycled Aggregates NY

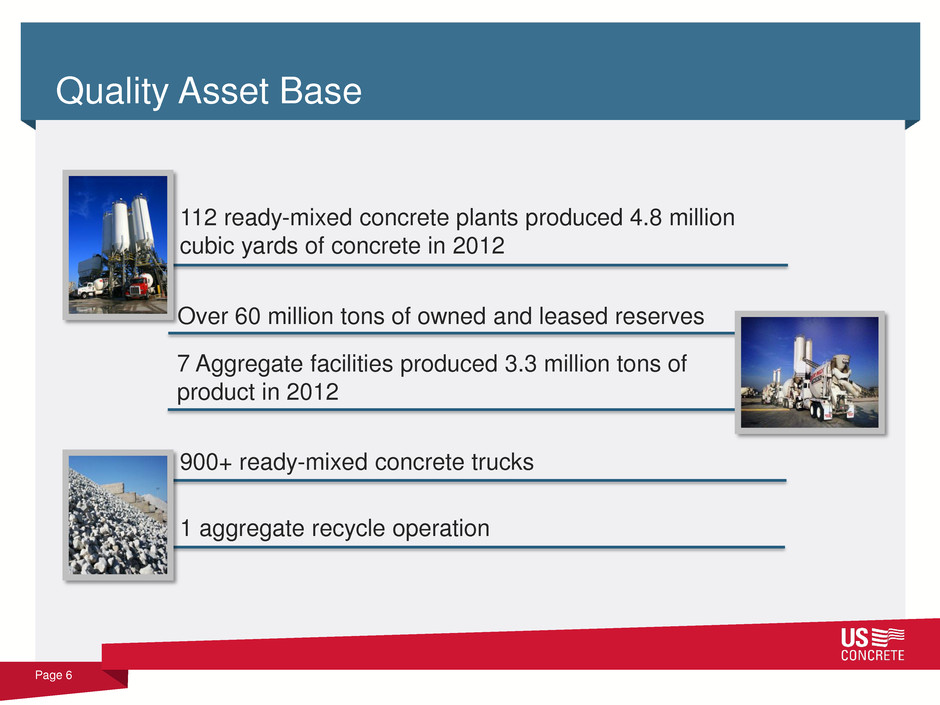

Over 60 million tons of owned and leased reserves Quality Asset Base Page 6 112 ready-mixed concrete plants produced 4.8 million cubic yards of concrete in 2012 900+ ready-mixed concrete trucks 1 aggregate recycle operation 7 Aggregate facilities produced 3.3 million tons of product in 2012

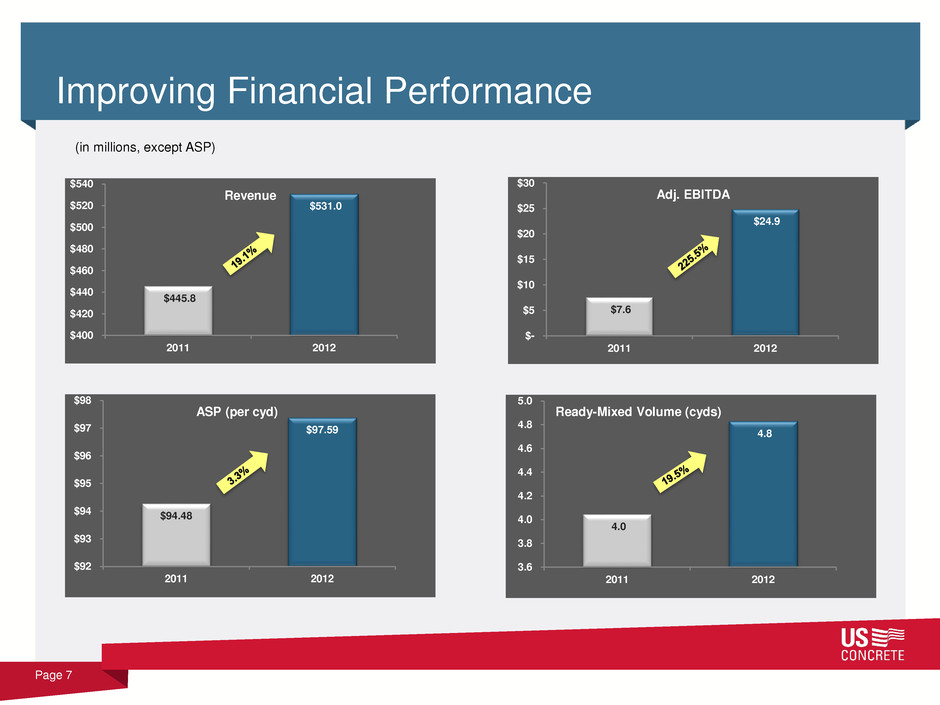

Improving Financial Performance $445.8 $531.0 $400 $420 $440 $460 $480 $500 $520 $540 2011 2012 Revenue Page 7 (in millions, except ASP) 4.0 4.8 3.6 3.8 4.0 4.2 4.4 4.6 4.8 5.0 2011 2012 Ready-Mixed Volume (cyds) $94.48 $97.59 $92 $93 $94 $95 $96 $97 $98 2011 2012 ASP (per cyd) $7.6 $24.9 $- $5 $10 $15 $20 $25 $30 2011 2012 Adj. EBITDA

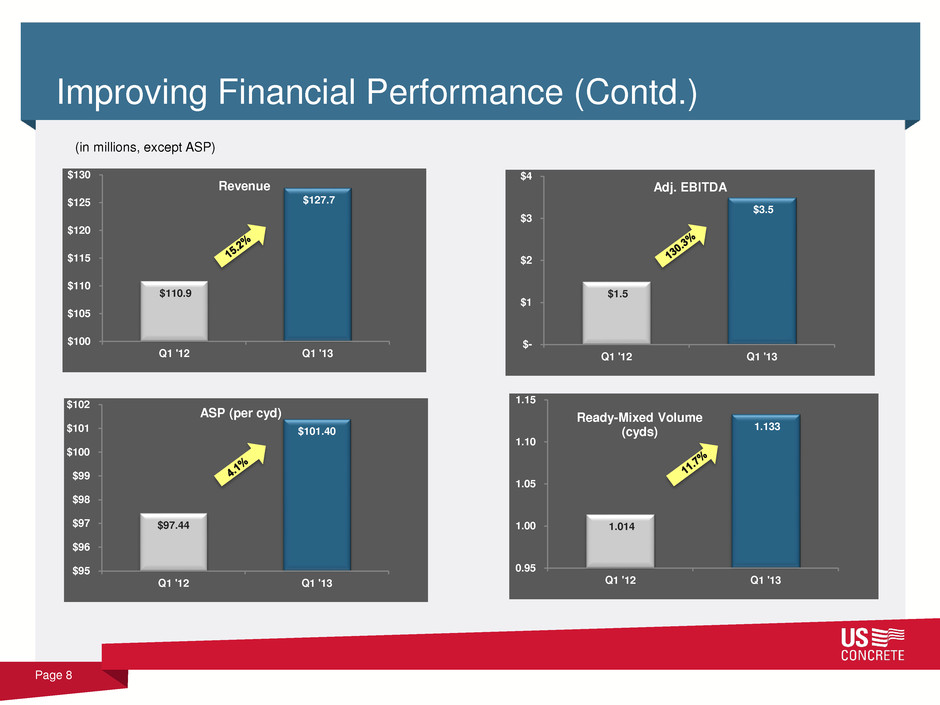

Improving Financial Performance (Contd.) $1.5 $3.5 $- $1 $2 $3 $4 Q1 '12 Q1 '13 Adj. EBITDA Page 8 (in millions, except ASP) $110.9 $127.7 $100 $105 $110 $115 $120 $125 $130 Q1 '12 Q1 '13 Revenue $97.44 $101.40 $95 $96 $97 $98 $99 $100 $101 $102 Q1 '12 Q1 '13 ASP (per cyd) 1.014 1.133 0.95 1.00 1.05 1.10 1.15 Q1 '12 Q1 '13 Ready-Mixed Volume (cyds)

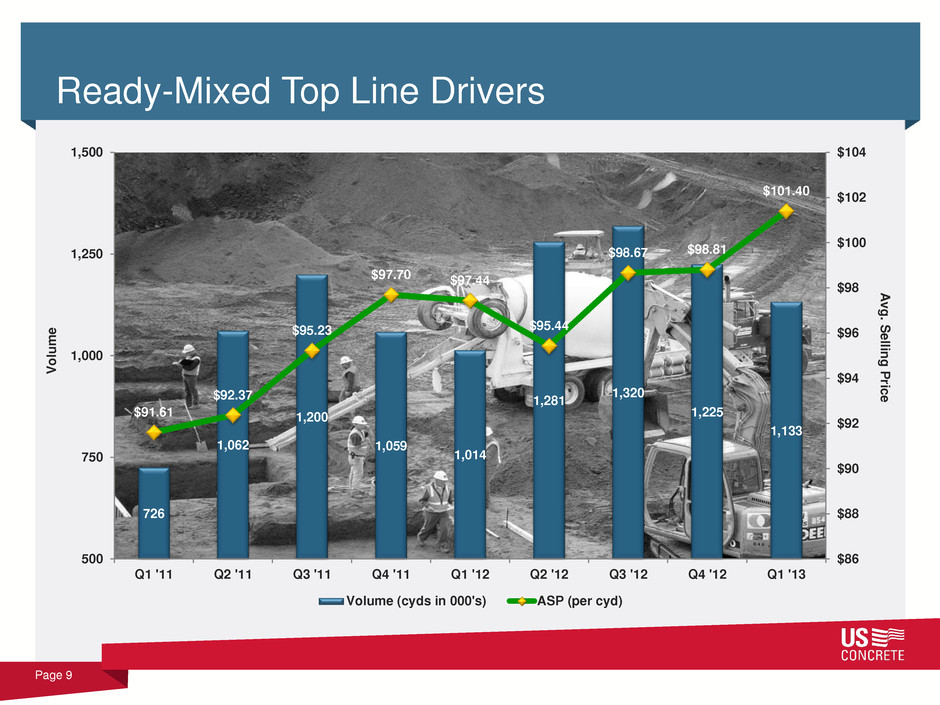

Ready-Mixed Top Line Drivers 726 1,062 1,200 1,059 1,014 1,281 1,320 1,225 1,133 $91.61 $92.37 $95.23 $97.70 $97.44 $95.44 $98.67 $98.81 $101.40 $86 $88 $90 $92 $94 $96 $98 $100 $102 $104 500 750 1,000 1,250 1,500 Q1 '11 Q2 '11 Q3 '11 Q4 '11 Q1 '12 Q2 '12 Q3 '12 Q4 '12 Q1 '13 A v g . S el lin g P ric e V o lu m e Volume (cyds in 000's) ASP (per cyd) Page 9

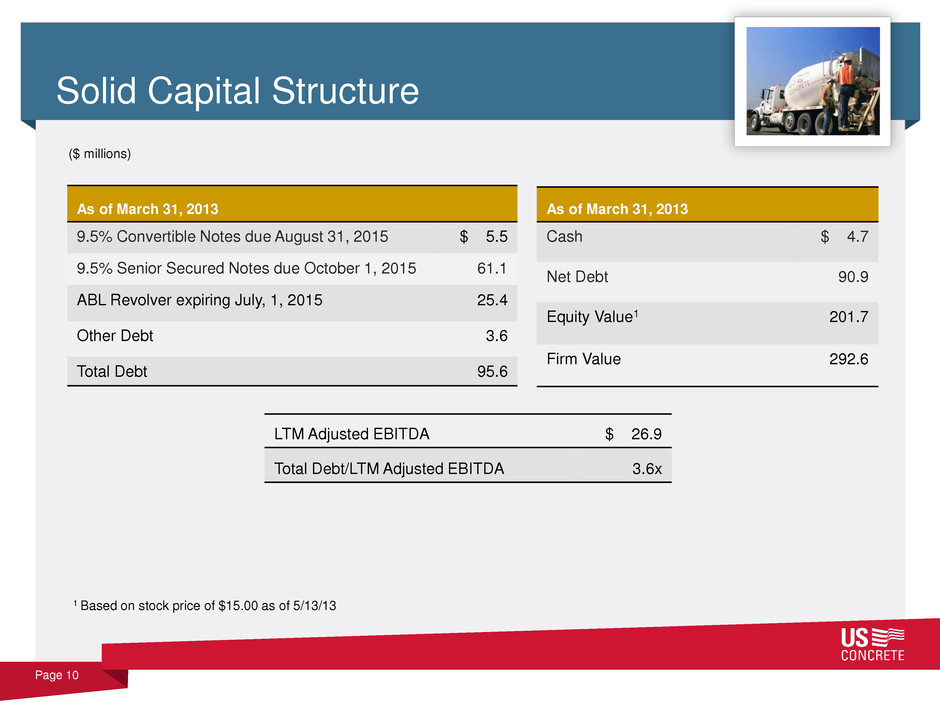

Solid Capital Structure As of March 31, 2013 9.5% Convertible Notes due August 31, 2015 $ 5.5 9.5% Senior Secured Notes due October 1, 2015 61.1 ABL Revolver expiring July, 1, 2015 25.4 Other Debt 3.6 Total Debt 95.6 1 Based on stock price of $15.00 as of 5/13/13 As of March 31, 2013 Cash $ 4.7 Net Debt 90.9 Equity Value1 201.7 Firm Value 292.6 LTM Adjusted EBITDA $ 26.9 Total Debt/LTM Adjusted EBITDA 3.6x Page 10 ($ millions)

Industry Overview

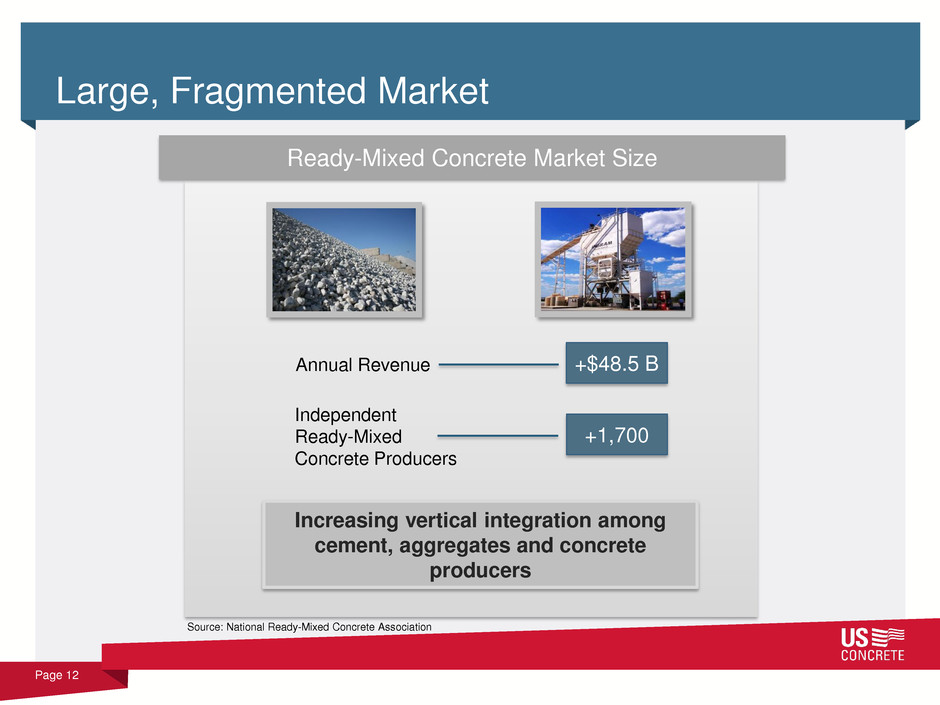

Increasing vertical integration among cement, aggregates and concrete producers Source: National Ready-Mixed Concrete Association Annual Revenue +$48.5 B Independent Ready-Mixed Concrete Producers +1,700 Ready-Mixed Concrete Market Size Large, Fragmented Market Page 12

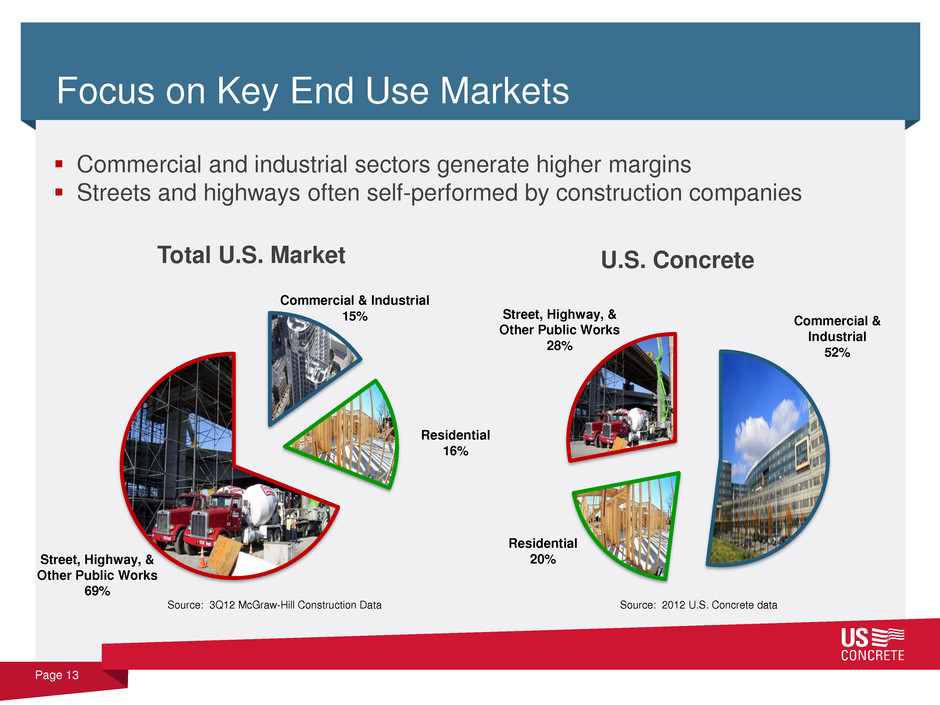

Focus on Key End Use Markets Page 13 Source: 3Q12 McGraw-Hill Construction Data Total U.S. Market Commercial and industrial sectors generate higher margins Streets and highways often self-performed by construction companies Source: 2012 U.S. Concrete data U.S. Concrete Residential 16% Commercial & Industrial 15% Street, Highway, & Other Public Works 69% Residential 20% Commercial & Industrial 52% Street, Highway, & Other Public Works 28%

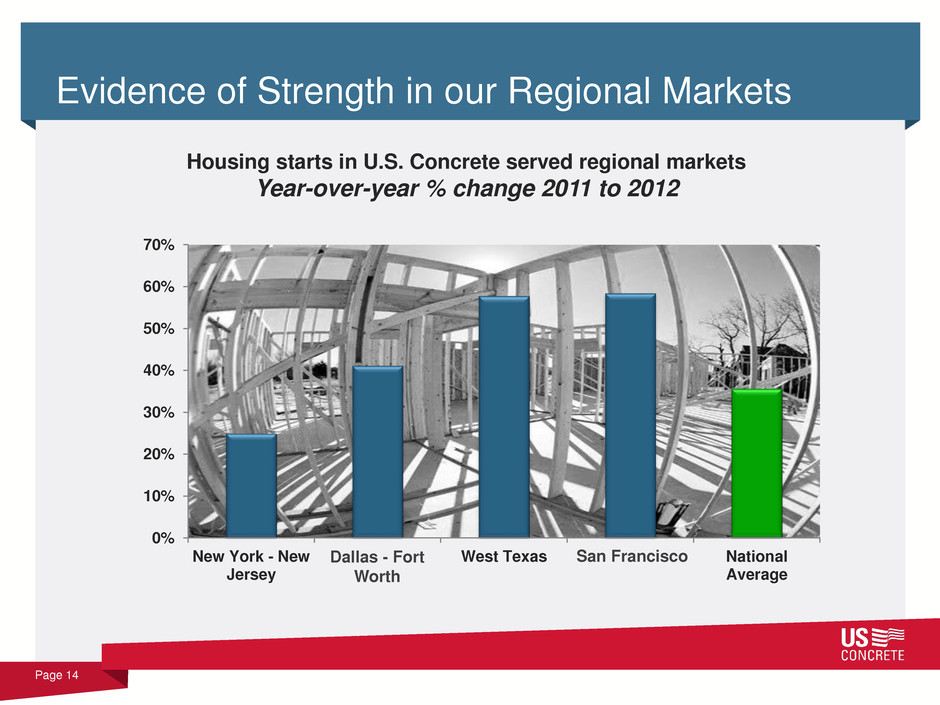

Evidence of Strength in our Regional Markets Page 14 Housing starts in U.S. Concrete served regional markets Year-over-year % change 2011 to 2012 0% 10% 20% 30% 40% 50% 60% 70% New York - New Jersey Dallas- Fort Worth West Texas San Franscisco National Average Dalla - Fort ort San Franci

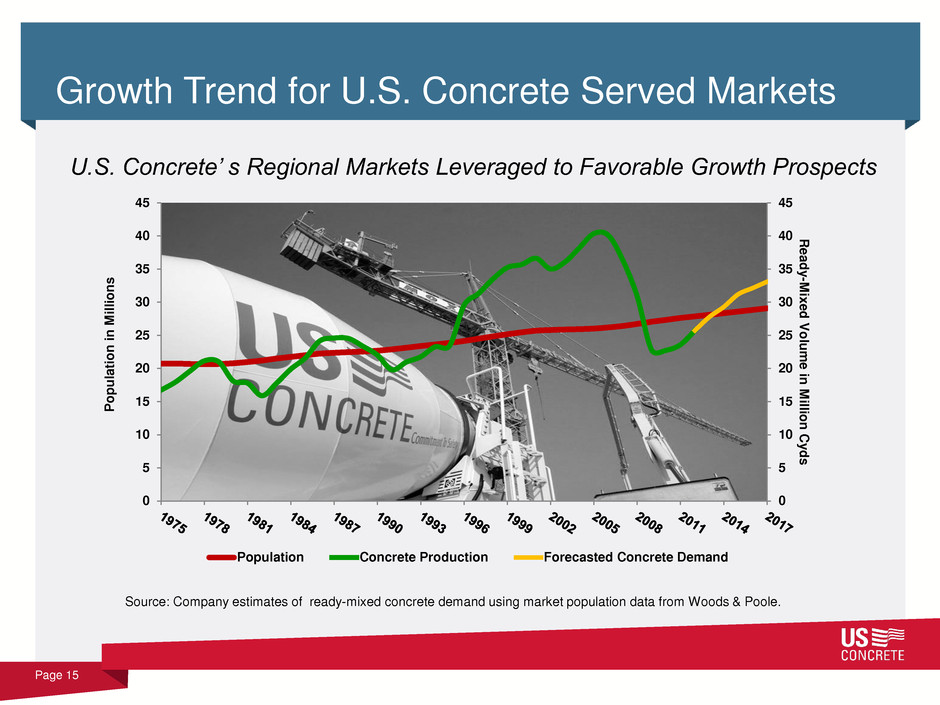

Growth Trend for U.S. Concrete Served Markets Page 15 Source: Company estimates of ready-mixed concrete demand using market population data from Woods & Poole. U.S. Concrete’ s Regional Markets Leveraged to Favorable Growth Prospects 0 5 10 15 20 25 30 35 40 45 0 5 10 15 20 25 30 35 40 45 Read y -M ix e d V o lu m e in M ill io n C y d s P o p u lati o n in M ill io n s Population Concrete Production Forecasted Concrete Demand

Company Strategy and Focus

Our Focus Today Pursue Strategic Development Opportunities Stick to our knitting Evaluate assets, business units and opportunities Continue to aggressively manage cost structure Page 17

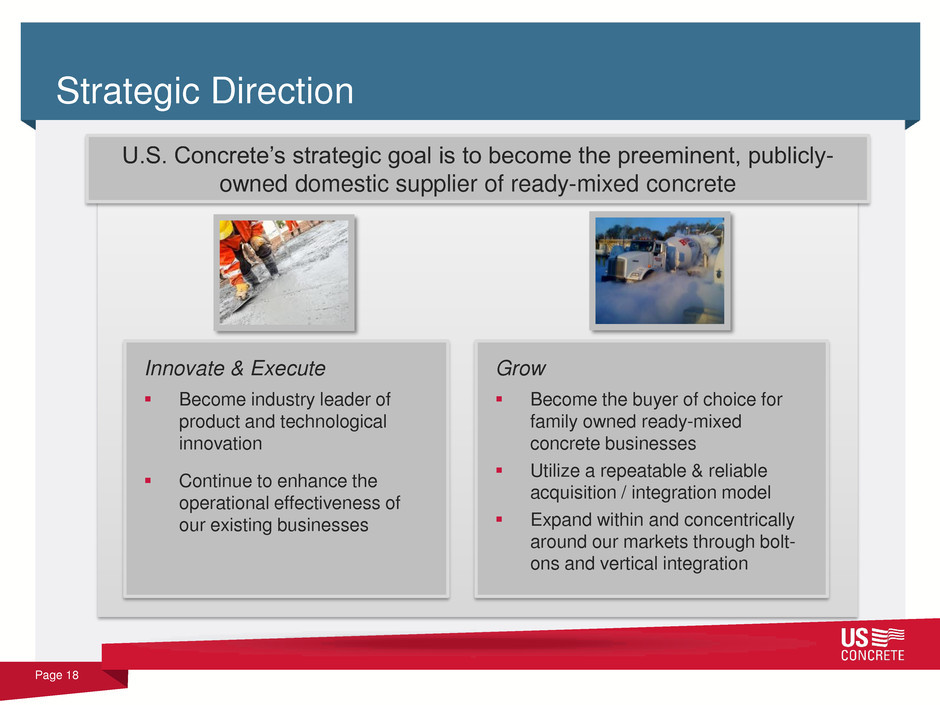

Strategic Direction Page 18 Innovate & Execute Become industry leader of product and technological innovation Continue to enhance the operational effectiveness of our existing businesses U.S. Concrete’s strategic goal is to become the preeminent, publicly- owned domestic supplier of ready-mixed concrete Grow Become the buyer of choice for family owned ready-mixed concrete businesses Utilize a repeatable & reliable acquisition / integration model Expand within and concentrically around our markets through bolt- ons and vertical integration

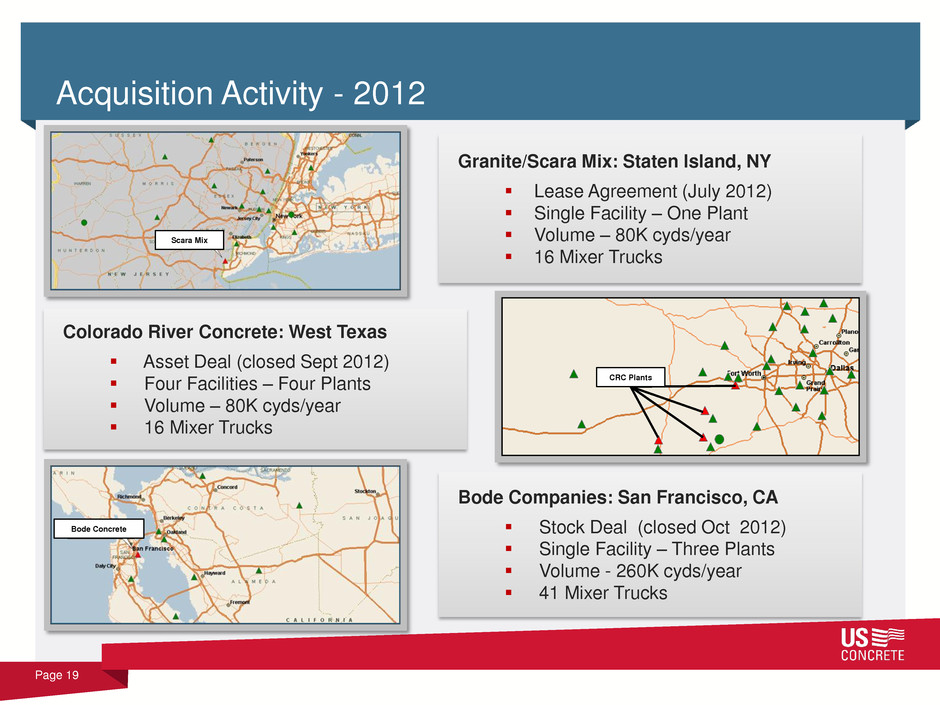

Acquisition Activity - 2012 Page 19 Bode Companies: San Francisco, CA Stock Deal (closed Oct 2012) Single Facility – Three Plants Volume - 260K cyds/year 41 Mixer Trucks Colorado River Concrete: West Texas Asset Deal (closed Sept 2012) Four Facilities – Four Plants Volume – 80K cyds/year 16 Mixer Trucks Granite/Scara Mix: Staten Island, NY Lease Agreement (July 2012) Single Facility – One Plant Volume – 80K cyds/year 16 Mixer Trucks Scara Mix Bode Concrete CRC Plants

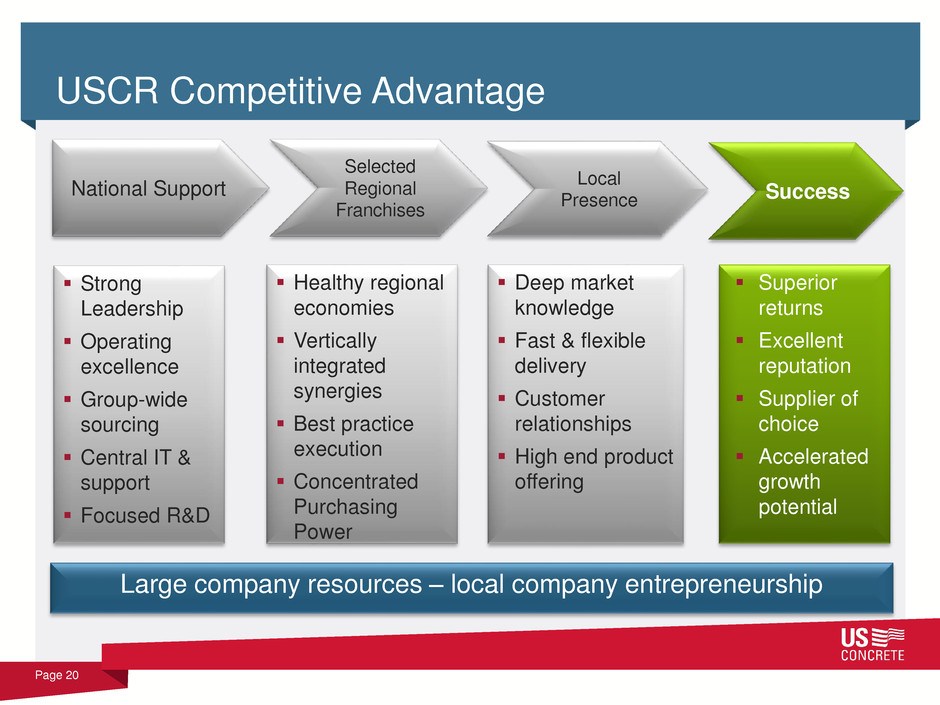

USCR Competitive Advantage Strong Leadership Operating excellence Group-wide sourcing Central IT & support Focused R&D Page 20 Healthy regional economies Vertically integrated synergies Best practice execution Concentrated Purchasing Power Deep market knowledge Fast & flexible delivery Customer relationships High end product offering Superior returns Excellent reputation Supplier of choice Accelerated growth potential National Support Selected Regional Franchises Local Presence Success Large company resources – local company entrepreneurship

Benefits of Our Sustainable Strategy Page 21 Sustainable demand to grow at a higher rate Increase product demand Higher priced value-added products drive margins Increase revenue and profit per yard Lower cost of cement alternatives Reduce raw material cost per yard Cement companies remain focused on core cement Differentiate Company from competition First mover offering solution to owners Create competitive advantage

Improving financial performance and leverage Well positioned to benefit from rebound in construction market Experienced management team Favorable exposure to commercial projects with higher margins and barriers to entry Sharp focus on optimizing core ready-mix operations Investment Highlights Page 22 Strong position in selected regions with attractive fundamentals Long-term customer relationships

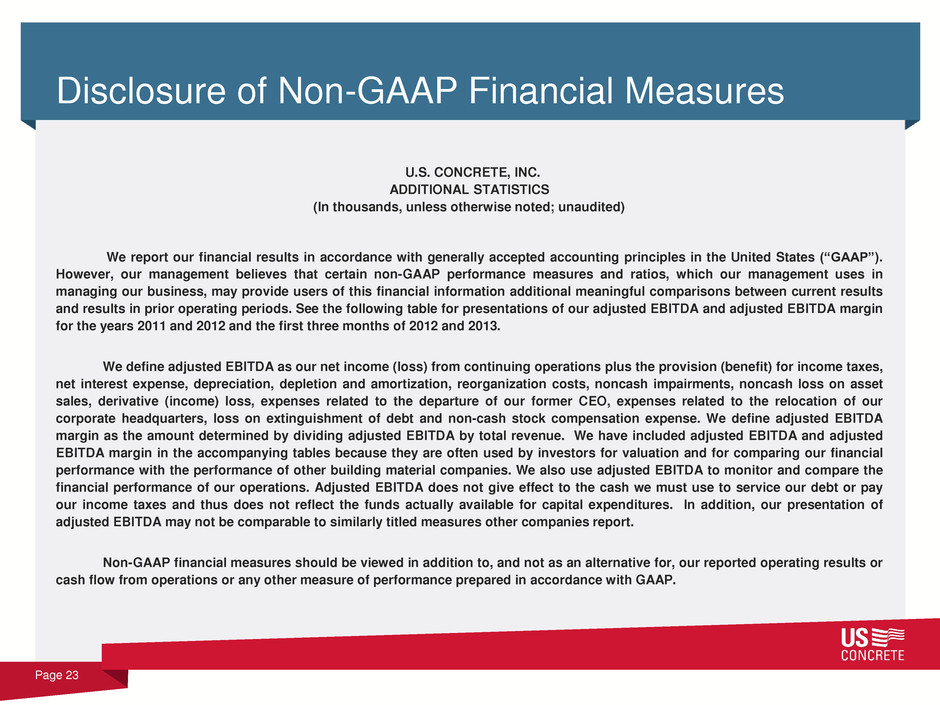

Disclosure of Non-GAAP Financial Measures U.S. CONCRETE, INC. ADDITIONAL STATISTICS (In thousands, unless otherwise noted; unaudited) We report our financial results in accordance with generally accepted accounting principles in the United States (“GAAP”). However, our management believes that certain non-GAAP performance measures and ratios, which our management uses in managing our business, may provide users of this financial information additional meaningful comparisons between current results and results in prior operating periods. See the following table for presentations of our adjusted EBITDA and adjusted EBITDA margin for the years 2011 and 2012 and the first three months of 2012 and 2013. We define adjusted EBITDA as our net income (loss) from continuing operations plus the provision (benefit) for income taxes, net interest expense, depreciation, depletion and amortization, reorganization costs, noncash impairments, noncash loss on asset sales, derivative (income) loss, expenses related to the departure of our former CEO, expenses related to the relocation of our corporate headquarters, loss on extinguishment of debt and non-cash stock compensation expense. We define adjusted EBITDA margin as the amount determined by dividing adjusted EBITDA by total revenue. We have included adjusted EBITDA and adjusted EBITDA margin in the accompanying tables because they are often used by investors for valuation and for comparing our financial performance with the performance of other building material companies. We also use adjusted EBITDA to monitor and compare the financial performance of our operations. Adjusted EBITDA does not give effect to the cash we must use to service our debt or pay our income taxes and thus does not reflect the funds actually available for capital expenditures. In addition, our presentation of adjusted EBITDA may not be comparable to similarly titled measures other companies report. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, our reported operating results or cash flow from operations or any other measure of performance prepared in accordance with GAAP. Page 23

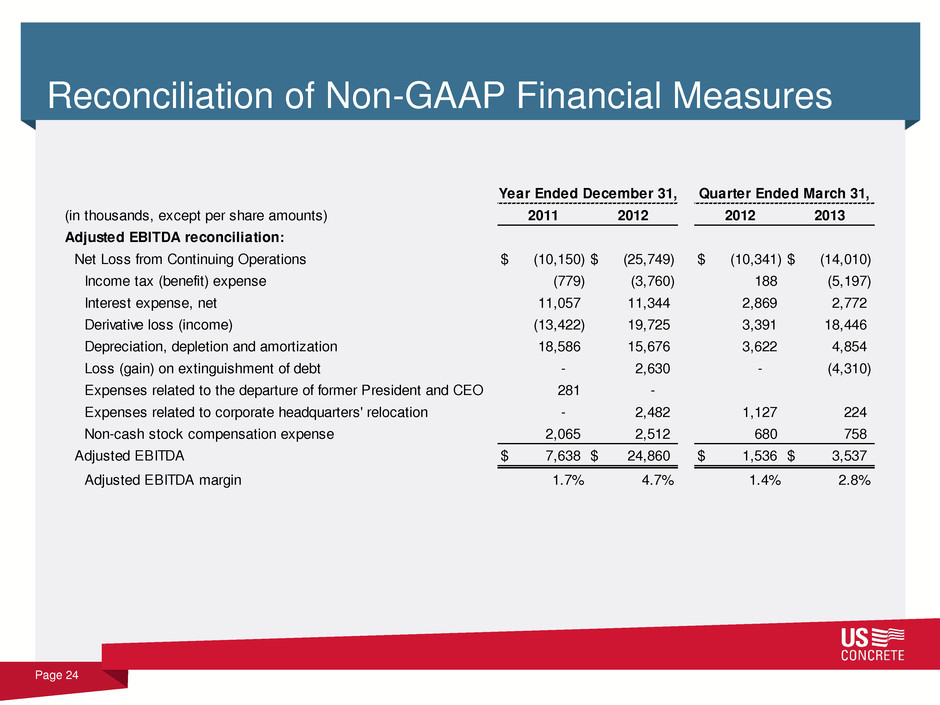

Reconciliation of Non-GAAP Financial Measures Page 24 (in thousands, except per share amounts) 2011 2012 2012 2013 Adjusted EBITDA reconciliation: Net Loss from Continuing Operations (10,150)$ (25,749)$ (10,341)$ (14,010)$ Income tax (benefit) expense (779) (3,760) 188 (5,197) Interest expense, net 11,057 11,344 2,869 2,772 Derivative loss (income) (13,422) 19,725 3,391 18,446 Depreciation, depletion and amortization 18,586 15,676 3,622 4,854 Loss (gain) on extinguishment of debt - 2,630 - (4,310) Expenses related to the departure of former President and CEO 281 - Expenses related to corporate headquarters' relocation - 2,482 1,127 224 Non-cash stock compensation expense 2,065 2,512 680 758 Adjusted EBITDA 7,638$ 24,860$ 1,536$ 3,537$ Adjusted EBITDA margin 1.7% 4.7% 1.4% 2.8% Quarter Ended March 31,Year Ended December 31,

Investor Presentation May 20, 2013