Attached files

| file | filename |

|---|---|

| 10-K/A - SurgePays, Inc. | form10ka.htm |

| EX-3.2 - SurgePays, Inc. | ex3-2.htm |

| EX-3.1 - SurgePays, Inc. | ex3-1.htm |

| EX-32.2 - SurgePays, Inc. | ex32-2.htm |

| EX-10.4 - SurgePays, Inc. | ex10-4.htm |

| EX-23.1 - SurgePays, Inc. | ex23-1.htm |

| EX-10.7 - SurgePays, Inc. | ex10-7.htm |

| EX-10.3 - SurgePays, Inc. | ex10-3.htm |

| EX-31.2 - SurgePays, Inc. | ex31-2.htm |

| EX-32.1 - SurgePays, Inc. | ex32-1.htm |

| EX-31.1 - SurgePays, Inc. | ex31-1.htm |

| EX-10.6.1 - SurgePays, Inc. | ex10-6_1.htm |

| EX-10.5.3 - SurgePays, Inc. | ex10-5_3.htm |

| EX-10.5.2 - SurgePays, Inc. | ex10-5_2.htm |

| EX-10.6.3 - SurgePays, Inc. | ex10-6_3.htm |

| EX-10.6.2 - SurgePays, Inc. | ex10-6_2.htm |

| EX-10.5.1 - SurgePays, Inc. | ex10-5_1.htm |

EXHIBIT 99.1

CHRISTOPHER ENERGY, LLC

Petroleum Engineering & Evaluation

8801 South Yale, Suite 150

Tulsa, Oklahoma 74137

(918) 488-8694

April 18, 2013

REVISED REPORT

North American Energy Resources, Inc.

228 St. Charles Ave.

Suite 724

New Orleans, LA 70130

Attn: Clinton W. Coldren, CEO

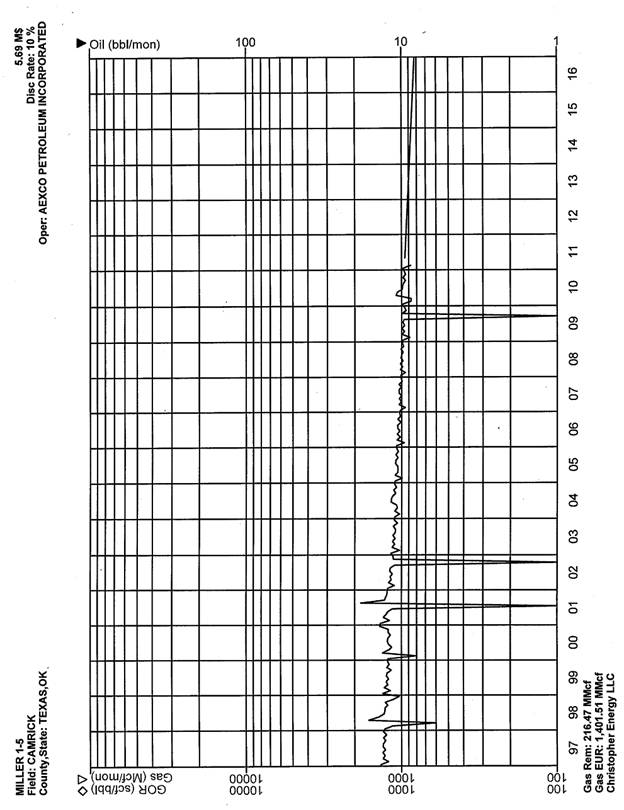

On May 16, 2011 the Proved Developed Producing reserves and future net revenues were evaluated as of May 1, 2011 for the single oil and gas property.in which North American Energy Resources, Inc. (NAEI) owns an interest. NAEI represents it owns a 7.5% working interest in one gas well, the Miller 1-5, operated by Aexco Petroleum. This property is located in Texas County, Oklahoma. NAEI represents this property is 100% of their total reserves. The property was evaluated to the net interest owned by NAEI. The Working and Net Revenue Interest contained in this report were provided by NAEI and not verified by the undersigned. A summary of the net reserves and discounted net revenue is as follows:

| Net Oil | Net Gas | Future Net | Present Worth | |||||||||||||

| Reserve Type | (MBbls) | (MMCF) | Revenue,M$ | Disc@10%.M$ | ||||||||||||

| Proved Developed Producing | 0 | 13.32 | $ | 10.74 | $ | 5.69 |

The discounted future net revenue for is not represented to be the fair market value of these reserves.

The estimated future net revenue shown is that revenue which is forecast to be realized from the sale of the estimated net reserves after deduction of royalties, ad valorem and production taxes, direct operating expenses and drilling and completion costs, when applicable. Future net revenue as stated in this report is before the deduction of federal and state income taxes.

REVISED REPORT

North American Energy Resources, Inc.

April 18,2013

Page 2

SEC guidelines were used for the oil and gas price forecast used in this report. The gas product price used was the actual price received as of NAEI’s year end as per SEC guidelines. This price was held constant throughout the economic life of the property. NAEI provided this pricing data. Operating expenses were held constant throughout the life of the property. The operating expense used was provided by NAEI and was calculated using an average of historic operating expense.

Reserve estimates and rate projections are based on the extrapolation of established performance trends, pressure data and by comparison to analogous wells in the immediate area. The remaining gas reserves were estimated by the extrapolation of the historic decline curve. The well has been producing in excess of 30 years and has been on a constant 2.5% decline rate for at least the past 10 years. The assumptions, data, methods and procedures used were appropriate for the purpose served by the report in compliance with Item 1202(a)(8)(iv) of Regulation S-K. This method is appropriate for a well of this type. The reserves included in this study are estimates only and should not be construed as exact quantities. Future conditions may affect recovery of the estimated remaining reserves and revenue, including the volatility of natural gas prices and the mechanical integrity of the well equipment, and these reserves may be subject to revision as more performance data become available. The actual net income that will be received may be more or less than those projected.

Well tests, prices, costs, production and other data, including the extent and character of ownership, were accepted as furnished by NAEI or from public information. No tests or lease inspections were made by the undersigned in conjunction with this study. The basic data and work data for these estimates is not included in this report but is available for inspection and study by authorized interested parties.

In order to estimate the reserves, costs and future revenues shown in this report, I have relied in part on geologic, engineering and economic data furnished by the client. Although best efforts have been made to acquire all pertinent data and to analyze it carefully with methods accepted by the petroleum industry, there is no guarantee the volumes of oil and gas or the revenues projected will be realized. The reserves and revenue projections presented in this report may require revision upward or downward as additional data become available.

The proved reserves presented in the report conform to the definition as set forth in the Securities and Exchange Commission’s Regulations Part 210.4-10(a).

Any distribution or publication of this report or any part thereof must include this letter in its entirety.

|

||

| Gary R. Christopher | ||

| Petroleum Engineer |

| Date: 05/16/2011 | |||

| NORTH AMERICAN ENERGY RESOURCES, INC | |||

| As Of Date: 05/01/2011 | Case: | MILLER 1-5 | |

| Discount Rate (%): 10.00 | Reserve Cat: | Proved Producing | |

| SEC PRICING | Field: | CAMRICK | |

| Operator: | AEXCO PETROLEUM | ||

| Reservoir: | MORROW | ||

| Co., State: | TEXAS, OK | ||

| Cum Oil (Mbbl): | 0.61 | |

| Cum Gas (MMcf) : | 1,185.04 |

| Year | Gross

Oil (Mbbl) | Gross Gas (MMcf) | Net Oil (Mbbl) | Net Gas (MMcf) | Oil Price ($/bbl) | Gas Price ($/Mcf) | Oil Revenue (M$) | Gas Revenue (M$) | Misc. Revenue (M$) | |||||||||||||||||||||||||||

| 2011 | 0.00 | 7.58 | 0.00 | 0.47 | 0.00 | 2.97 | 0.00 | 1.39 | 0.00 | |||||||||||||||||||||||||||

| 2012 | 0.00 | 11.09 | 0.00 | 0.68 | 0.00 | 2.97 | 0.00 | 2.03 | 0.00 | |||||||||||||||||||||||||||

| 2013 | 0.00 | 10.78 | 0.00 | 0.66 | 0.00 | 2.97 | 0.00 | 1.97 | 0.00 | |||||||||||||||||||||||||||

| 2014 | 0.00 | 10.51 | 0.00 | 0.65 | 0.00 | -2.97 | 0.00 | 1.92 | 0.00 | |||||||||||||||||||||||||||

| 2015 | 0.00 | 10.25 | 0.00 | 0.63 | 0.00 | 2.97 | 0.00 | 1.87 | 0.00 | |||||||||||||||||||||||||||

| 2016 | 0.00 | 10.02 | 0.00 | 0.62 | 0.00 | 2.97 | 0.00 | 1.83 | 0.00 | |||||||||||||||||||||||||||

| 2017 | 0.00 | 9.74 | 0.00 | 0.60 | 0.00 | 2.97 | 0.00 | 1.78 | 0.00 | |||||||||||||||||||||||||||

| 2018 | 0.00 | 9.50 | 0.00 | 0.58 | 0.00 | 2.97 | 0.00 | 1.74 | 0.00 | |||||||||||||||||||||||||||

| 2019 | 0.00 | 9.26 | 0.00 | 0.57 | 0.00 | 2.97 | 0.00 | 1.69 | 0.00 | |||||||||||||||||||||||||||

| 2020 | 0.00 | 9.06 | 0.00 | 0.56 | o.oo | 2.97 | 0.00 | 1.66 | 0.00 | |||||||||||||||||||||||||||

| 2021 | 0.00 | 8.81 | 0.00 | 0.54 | 0.00 | 2.97 | 0.00 | 1.61 | 0.00 | |||||||||||||||||||||||||||

| 2022 | 0.00 | 8.59 | 0.00 | 0.53 | 0.00 | 2.97 | 0.00 | 1.57 | 0.00 | |||||||||||||||||||||||||||

| 2023 | 0.00 | 8.37 | 0.00 | 0.52 | 0.00 | 2.97 | o.oo | 1.53 | 0.00 | |||||||||||||||||||||||||||

| 2024 | 0.00 | 8.18 | 0.00 | 0.50 | 0.00 | 2.97 | 0.00 | 1.50 | 0.00 | |||||||||||||||||||||||||||

| 2025 | 0.00 | 7.96 | 0.00 | 0.49 | 0.00 | 2.97 | 0.00 | 1.46 | 0.00 | |||||||||||||||||||||||||||

| Rem | 0.00 | 76.76 | 0.00 | 4.72 | 0.00 | 2.97 | 0.00 | 14.04 | 0.00 | |||||||||||||||||||||||||||

| Total | 0.00 | 216.47 | 0.00 | 13.32 | 0.00 | 2.97 | 0.00 | 39.58 | 0.00 | |||||||||||||||||||||||||||

| Ult | 0.61 | 1,401.51 | ||||||||||||||||||||||||||||||||||

| Year | Well Count | Net Tax Production (M$) | Net Tax AdValorem (M$) | Net Investment (M$) | Net Lease Costs (M$) | Net Well Costs (M$) | Other Costs (M$) | Net Profits (M$) | Annual Cash Flow (M$) | Cum Disc. Cash Flow (M$) | ||||||||||||||||||||||||||||||

| 2011 | 1.00 | 0.10 | 0.00 | 0.00 | 0.67 | 0.00 | 0.00 | 0.00 | 0.62 | 0.60 | ||||||||||||||||||||||||||||||

| 2012 | 1.00 | 0.14 | 0.00 | 0.00 | 1.01 | 0.00 | 0.00 | 0.00 | 0.88 | 1.38 | ||||||||||||||||||||||||||||||

| 2013 | 1.00 | 0.14 | 0.00 | 0.00 | 1.01 | 0.00 | 0.00 | 0.00 | 0.83 | 2.05 | ||||||||||||||||||||||||||||||

| 2014 | 1.00 | 0.14 | 0.00 | 0.00 | 1.01 | 0.00 | 0.00 | 0.00 | 0.78 | 2.63 | ||||||||||||||||||||||||||||||

| 2015 | 1.00 | 0.13 | 0.00 | 0.00 | 1.01 | 0.00 | 0.00 | 0.00 | 0.74 | 3.13 | ||||||||||||||||||||||||||||||

| 2016 | 1.00 | 0.13 | 0.00 | 0.00 | 1.01 | 0.00 | 0.00 | 0.00 | 0.70 | 3.55 | ||||||||||||||||||||||||||||||

| 2017 | 1.00 | 0.13 | 0.00 | 0.00 | 1.01 | 0.00 | 0.00 | 0.00 | 0.65 | 3.91 | ||||||||||||||||||||||||||||||

| 2018 | 1.00 | 0.12 | 0.00 | 0.00 | 1.01 | 0.00 | 0.00 | 0.00 | 0.61 | 4.22 | ||||||||||||||||||||||||||||||

| 2019 | 1.00 | 0.12 | 0.00 | 0.00 | 1.01 | 0.00 | 0.00 | 0.00 | 0.57 | 4.48 | ||||||||||||||||||||||||||||||

| 2020 | 1.00 | 0.12 | 0.00 | 0.00 | 1.01 | 0.00 | 0.00 | 0.00 | 0.53 | 4.70 | ||||||||||||||||||||||||||||||

| 2021 | 1.00 | 0.11 | 0.00 | 0.00 | 1.01 | 0.00 | 0.00 | 0.00 | 0.49 | 4.89 | ||||||||||||||||||||||||||||||

| 2022 | 1.00 | 0.11 | 0.00 | 0.00 | 1.01 | 0.00 | 0.00 | 0.00 | 0.45 | 5.04 | ||||||||||||||||||||||||||||||

| 2023 | 1.00 | 0.11 | 0.00 | 0.00 | 1.01 | 0.00 | 0.00 | 0.00 | 0.42 | 5.17 | ||||||||||||||||||||||||||||||

| 2024 | 1.00 | 0.11 | 0.00 | 0.00 | 1.01 | 0.00 | 0.00 | 0.00 | 0.38 | 5.28 | ||||||||||||||||||||||||||||||

| 2025 | 1.00 | 0.10 | 0.00 | 0.00 | 1.01 | 0.00 | 0.00 | 0.00 | 0.35 | 5.37 | ||||||||||||||||||||||||||||||

| Rem. | 1.00 | 0.00 | 0.00 | 11.28 | 0.00 | 0.00 | 0.00 | 1.76 | 0.32 | |||||||||||||||||||||||||||||||

| Total | 2.81 | 0.00 | 0.00 | 26.04 | 0.00 | 0.00 | 0.00 | 10.74 | 5.69 |

| Major Phase: | Gas | Abandonment Date: | 03/19/2037 | ||||

| Perfs : | 6782 - 6804 | Working Int: | 0.07500000 | Present Worth Profile (M$) | |||

| Initial Rate: | 950.00 | Mcf/month | Revenue Int: | 0.06152945 | PW | 5.00% : | 7.51 |

| Abandonment: | 493.28 | Mcf/month | PW | 8.00% : | 6.31 | ||

| Initial Decline: | 2.50 | PW | 10.00% : | 5.69 | |||

| PW | 12.00% : | 5.18 | |||||

| PW | 15.00% : | 4.56 | |||||

| PW | 20.00% : | 3.82 | |||||

| Christopher Energy LLC | 1 |