Attached files

| file | filename |

|---|---|

| EX-32 - SurgePays, Inc. | naey10qex321.htm |

| EX-31 - SurgePays, Inc. | naey10qex311.htm |

| EX-32 - SurgePays, Inc. | naey10qex322.htm |

| EXCEL - IDEA: XBRL DOCUMENT - SurgePays, Inc. | Financial_Report.xls |

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

QUARTERLY REPORT UNDER SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended: October 31, 2011

File No. 000-52522

North American Energy Resources, Inc.

(Name of small business issuer in our charter)

| Nevada | 98-0550352 | |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

228 Saint Charles Ave., Suite 724, New Orleans, LA 70130

(Address of principal executive offices) (Zip Code)

Registrant's telephone number: (504) 561-1151

Indicate by check mark whether the registrant: (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [ X ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes [ ] No[X]

State the number of shares outstanding of each of the issuer's classes of common equity, as of the latest practicable date: 21,554,945 shares of common stock outstanding as of November 30, 2011.

The accompanying unaudited financial statements have been prepared in accordance with generally accepted accounting principles for interim financial reporting and pursuant to the rules and regulations of the Securities and Exchange Commission ("Commission"). While these statements reflect all normal recurring adjustments which are, in the opinion of management, necessary for fair presentation of the results of the interim period, they do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements. For further information, refer to the financial statements and footnotes thereto, contained in North American Energy Resources, Inc.’s Form 10-K dated April 30, 2011.

TABLE OF CONTENTS

Page

PART I – FINANCIAL INFORMATION (Unaudited)

Item 1: Condensed Consolidated Financial Statements 3

Item 2: Management's Discussion and Analysis of Financial Condition and Results of Operations 15

Item 3: Quantitative and Qualitative Disclosures About Market Risk 18

Item 4T: Controls and Procedures 18

PART II - OTHER INFORMATION 19

Item 1: Legal Proceedings

Item 1A: Risk Factors

Item 2: Unregistered Sales of Equity Securities and Use of Proceeds

Item 3: Defaults upon Senior Securities

Item 4: Submission of Matters to a Vote of Security Holders

Item 5: Other Information

Item 6: Exhibits

PART I - Financial Information

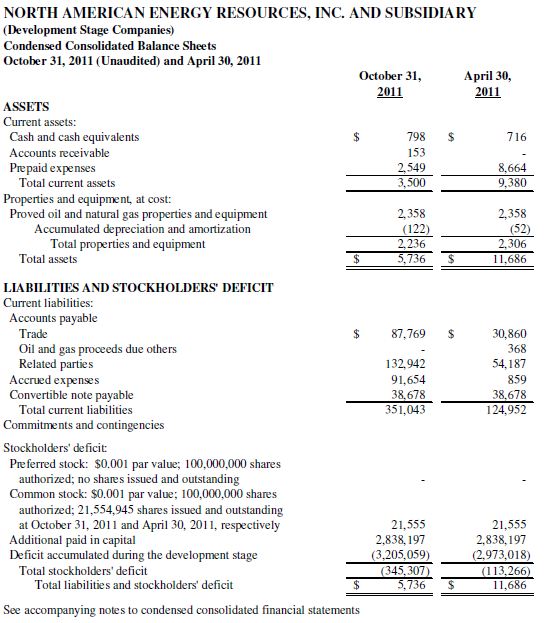

Item 1: Financial Statements

NORTH AMERICAN ENERGY RESOURCES, INC. AND SUBSIDIARY

(Development Stage Companies)

Notes to Condensed Consolidated Financial Statements

July 31, 2011

Note 1: Organization and summary of significant accounting policies

Organization

The consolidated financial statements include the accounts of North American Energy Resources, Inc. (“NAER”) and its wholly owned subsidiary, North American Exploration, Inc. (“NAE”) (collectively the “Company”). All significant intercompany balances and transactions have been eliminated in consolidation.

NAER was incorporated in Nevada on August 22, 2006 as Mar Ked Mineral Exploration, Inc. and changed its name to North American Energy Resources, Inc. on August 11, 2008. NAE was incorporated in Nevada on August 18, 2006 as Signature Energy, Inc. and changed its name to North American Exploration, Inc. on June 2, 2008.

The condensed consolidated financial statements included in this report have been prepared by the Company pursuant to the rules and regulations of the Securities and Exchange Commission for interim reporting and include all adjustments (consisting only of normal recurring adjustments) that are, in the opinion of management, necessary for a fair presentation. These condensed consolidated financial statements have not been audited.

Certain information and footnote disclosures normally included in consolidated financial statements prepared in accordance with accounting principles generally accepted in the United States have been condensed or omitted pursuant to such rules and regulations for interim reporting. The Company believes that the disclosures contained herein are adequate to make the information presented not misleading. However, these consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto included in the Company’s Annual Report for the year ended April 30, 2011, which is included in the Company’s Form 10-K dated April 30, 2011. The financial data for the interim periods presented may not necessarily reflect the results to be anticipated for the complete year.

Business

NAE is an independent oil and natural gas company engaged in the acquisition, exploration and development of oil and natural gas properties and the production of oil and natural gas. The Company operates in the upstream segment of the oil and gas industry which includes the drilling, completion and operation of oil and gas wells. The Company has an interest in a pipeline in Oklahoma which is currently shut-in, but has been used to gather natural gas production. The Company's gas production was shut-in due to low prices in February 2009 in Washington County, Oklahoma and was sold effective October 1, 2010. The Company has acquired a non-operated interest in a gas well in Texas County, Oklahoma and is continuing to seek additional acquisition possibilities.

On December 15, 2010, the Company introduced a new Executive Team. Clinton W. Coldren became the new Chairman and Chief Executive Officer and Alan G. Massara became Director, President and Chief Financial Officer. The new Executive Team is actively reviewing opportunities to acquire additional oil and gas production, development and exploration properties. The initial focus is on properties that are currently producing, but which contain upside drilling and workover potential. If successful, any acquisition will require significant new external financings which could materially change the existing capital structure of the Company. There can be no guarantee that the Company will successfully conclude an acquisition.

Development stage

The Companies are in the development stage and have realized only nominal revenue to date. The decline in gas prices and limited reserves caused the Company's original gas development plans in Washington County, Oklahoma to be cancelled and these properties were sold effective October 1, 2010. Accordingly, the operation of the Companies are presented as those of a development stage enterprise, from their inception (August 18, 2006).

Going concern

The accompanying consolidated financial statements have been prepared assuming the Company will continue as a going concern. The Company commenced operations in September 2006.

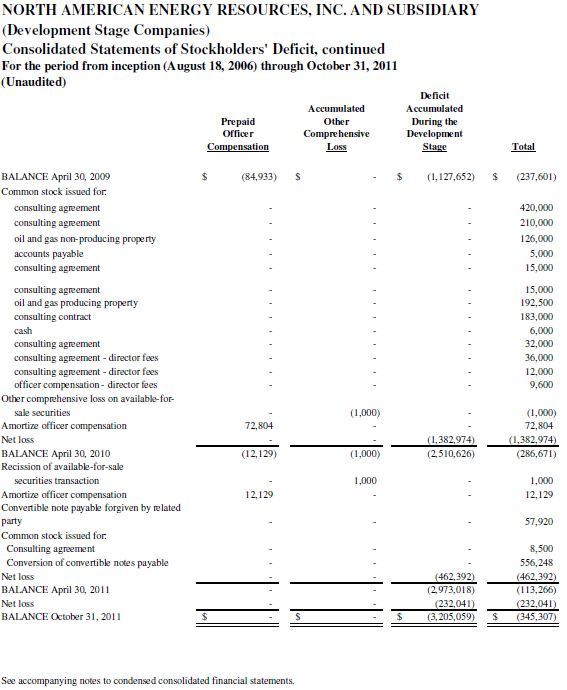

At October 31, 2011 and April 30, 2011 the Company had a working capital deficit of $347,543 and $115,572, respectively. The Company has an accumulated deficit of $3,205,059 which includes a loss of $232,041 during the six months ended October 31, 2011. By December 5, 2010, the Company had exchanged 3,329,406 shares of common stock for convertible notes payable principal of $474,358 and $81,890 in accrued interest. In January 2011, the Company exchanged $38,678 in accounts payable for a convertible note payable due in January 2012 with interest accruing at 4% per annum. The note is convertible into common stock at $0.10 per share.

Effective October 1, 2010, the Company sold all of its shut-in gas properties and its producing oil properties in Washington County, Oklahoma. The Company invested in its first non-operated gas well in October 2010 and plans to continue this course as funds become available.

These conditions raise substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustments that may result from the outcome of these uncertainties.

Fiscal year

2012 refers to periods ending during the fiscal year ending April 30, 2012 and 2011 refers to periods ended during the fiscal year ended April 30, 2011.

Reclassification

Certain reclassifications have been made in the financial statements at July 31, 2010 and for the periods then ended to conform to the July 31, 2011 presentation. The reclassifications had no effect on net loss.

Recent adopted and pending accounting pronouncements

We have evaluated all recent accounting pronouncements as issued by the Financial Accounting Standards Board ("FASB") in the form of Accounting Standards Updates ("ASU") through November 30, 2011 and find none that would have a material impact on the financial statements of the Company.

Note 2: related party transactions

Accounts payable - related parties includes the following expense reimbursements due to related parties at October 31, 2011 and April 30, 2011. Amounts due include reimbursements for D&O insurance, rent, travel, legal and cash advances for payment of other administrative expenses.

Effective June 15, 2011, the Board of Directors approved compensation to begin accruing at the rate of $10,000 per month for each of the two listed executive officers. At October 31, 2011, accrued expenses included $90,000 accrued for compensation. Beginning effective November 1, 2011, the compensation rate for Mr. Coldren will increase to $20,833 per month and for Mr. Massara will increase to $18,750 per month.

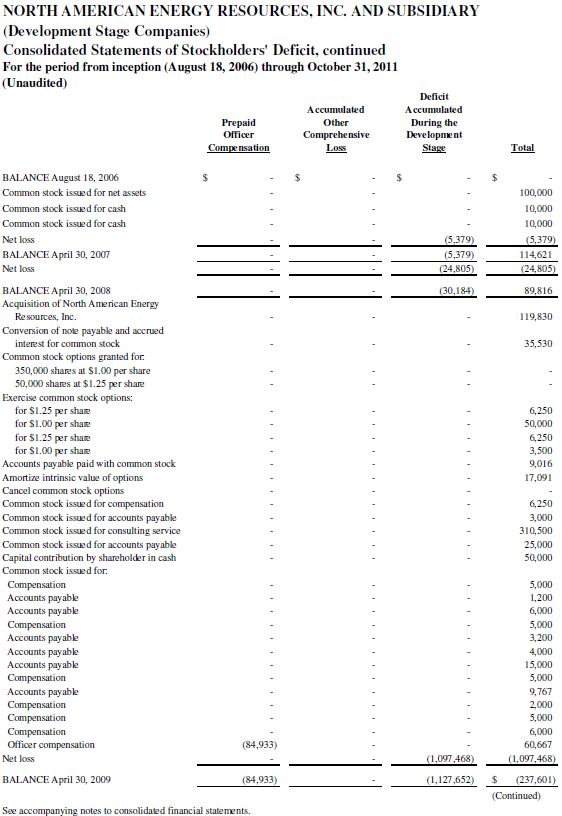

Note 3: Stockholder’s equity

PREFERRED STOCK

The Company has 100,000,000 shares of its $0.001 par value preferred stock authorized. At October 31, 2011 and April 30, 2011, the Company had no shares issued and outstanding.

COMMON STOCK

The Company has 100,000,000 shares of its $0.001 par value common stock authorized. At October 31, 2011 and April 30, 2011 the Company has 21,554,945 shares issued and outstanding, respectively.

WARRANTS

As a part of their initial compensation, the new Executive Team was granted Warrants with the following primary terms and conditions. The strike price exceeded the market price when the Warrants were granted.

a) Each Warrant shall entitle the owner to purchase one share of common stock of the Company. The warrants will contain price protection should shares be used for an acquisition at a price lower than the conversion price in force. The anti dilution provision will not apply to financings done below the strike price.

b) The Executive Team is granted three Warrant Certificates as follows:

1. Certificate #1 for 10,000,000 warrants with a strike price of $0.025 per share must be exercised within one year of the date Executive Team begins collecting salaries from the Company,

2. Certificate #2 for 10,000,000 warrants with a strike price of $0.04 per share and a Term of 5 years from the vesting date, and

3. Certificate #3 for 10,000,000 warrants with a strike price of $0.055 per share and a Term of 5 years from the vesting date.

c) Other warrant terms are as follows:

1. Certificate #1 vests immediately, Certificate #2 shall vest upon execution of Certificate #1 and Certificate #3 shall vest upon execution of Certificate #1.

2. All Warrants may vest early if the Company has revenue of $12,500,000 total for two consecutive quarters and records a pre-tax net profit for the two quarters and other conditions including change in control, termination, etc.

3. The Warrant Certificates may be allocated among the Executive Team as they so determine.

4. The Warrants shall be registered in the first registration statement the Company files, subject to legal counsel approval.

COMMON STOCK OPTIONS

The North American Energy Resources, Inc. 2008 Stock Option Plan ("Plan") was filed on September 11, 2008 and reserved 2,500,000 shares for awards under the Plan. The Company's Board of Directors is designated to administer the Plan and may form a Compensation Committee for this purpose. The Plan terminates on July 23, 2013.

Options granted under the Plan may be either "incentive stock options" intended to qualify as such under the Internal Revenue Code, or "non-qualified stock options." Options outstanding under the Plan have a maximum term of up to ten years, as designated in the option agreements. No options are outstanding at October 31, 2011. At October 31, 2011, there are 1,242,333 shares available for grant.

Note 4: CONVERTIBLE NOTES PAYABLE

The Company has a convertible note payable in the amount of $38,678 which is due January 6, 2012 with interest accruing at 4% per annum. The note is convertible into the Company's common stock at $0.10 per share.

Note 5: COMMITMENTS AND CONTINGENCIES

On October 28, 2011, the Company and a private seller ("Seller") entered into an asset purchase agreement (the "Asset Purchase Agreement") for the acquisition by the Company of certain onshore and offshore oil and gas fields of Seller (the "Assets") for $175 Million in cash, subject to certain purchase price adjustments at closing. The Assets include about 110 producing wells in 34 fields with average net production of 12 million cubic feet per day (MMcf/d) of natural gas and 900 barrels per day of oil (BBl/d), or a total of 2,900 BOE/d. The Assets have Proven Reserves of approximately 15.5 Million BOE with additional Probable and Possible potential of over 10 Million BOE. The closing of the purchase and sale of the Assets is expected to occur upon the satisfaction or waiver of the conditions set forth in the Asset Purchase Agreement, but no later than December 31, 2011, and will have an effective date of June 1, 2011, unless Seller and the Company mutually agree in writing to extend the closing date. Completion of the purchase is subject to preferential rights-to-purchase held by other working interest owners in a number of the Assets, as well as, several industry-standard closing conditions, including, without limitation, the completion by the Company of satisfactory due diligence and the receipt of all necessary regulatory approvals. Additionally, the Company's ability to close the purchase is contingent on its ability to raise sufficient capital, and the failure to do so could result in termination of the purchase and sale agreement between the Company and the Seller. The Company intends to utilize a combination of debt and equity to fund the purchase.

Interim financing for due diligence expenses and operations is being funded pursuant to a $500,000 multiple advance bridge loan provided to the Company by Clinton W. Coldren. In evidence of the loan, on November 3, 2011, the Company issued to Clinton W. Coldren that certain 8% Convertible Note in the principal amount of $500,000. The Convertible Note has a term of one year and is convertible into shares of common stock of the Company, in whole or in part at any time, at an initial conversion price equal to 130% of the volume-weighted average price of the common stock for the 50 trading days following October 31, 2011, subject to adjustment for distributions to shareholders, stock splits, reclassification of shares and tender or exchange offers. Notwithstanding the above, should prior to December 31, 2011, the Company complete the previously announced Gulf Coast acquisition and in connection therewith files a registration statement covering the shares of Common Stock underlying the Note, then the Note shall convert on the 23rd trading day following effectiveness of the registration statement into shares of Common Stock at a price equal to 90% of the Volume Weighted Average Price of the Common Shares for the 20 trading days following effectiveness of such registration statement. The Company does not have the right to prepay all or any portion of the Note prior to the Maturity Date.

Item 2: Management's Discussion and Analysis of Financial Condition and Results of Operations

This statement contains forward-looking statements within the meaning of the Securities Act. Discussions containing such forward-looking statements may be found throughout this statement. Actual events or results may differ materially from those discussed in the forward-looking statements as a result of various factors, including the matters set forth in this statement.

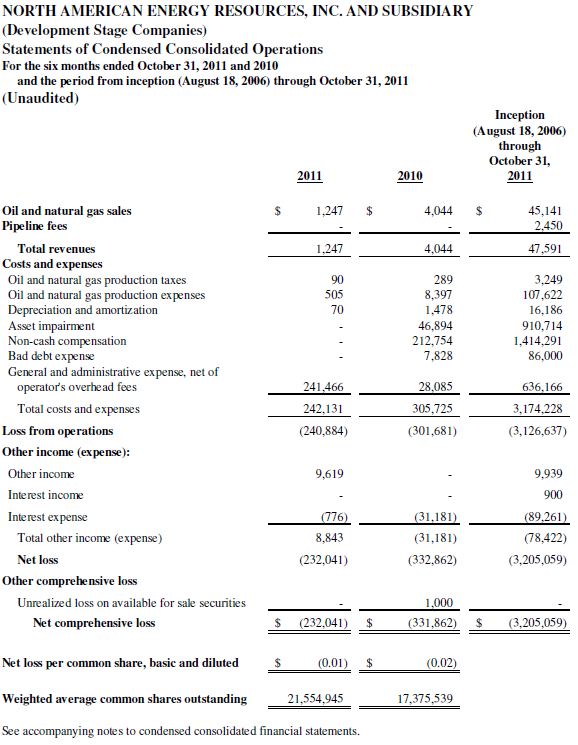

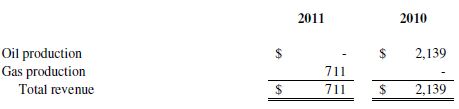

COMPARISON OF THREE MONTHS ENDED OCTOBER 31, 2011 AND 2010

Revenues during the three months ended October 31, 2011 and 2010 were as follows:

Gas production included 227 MCF sold in 2011. Oil revenues included 32 net barrels sold in 2010. As a result of continuing high operating costs, the Company sold all of its producing oil properties and its non-producing gas properties effective October 1, 2010 and acquired one new gas property in a different geographic area.

Costs and expenses during the three months ended October 31, 2011 and 2010 were as follows:

The decline in direct oil and natural gas costs is a result of the sale of the high maintenance oil properties effective October 1, 2010 and the simultaneous purchase of an interest in a producing gas well. The gas well has produced a small profit whereas the operating costs of the oil production always exceeded its revenue.

Non-cash compensation declined primarily due to completion of the amortization of consulting agreements in 2010.

Other general and administrative expense, net of operator's overhead fee increased in the 2011 period from $4,918 in 2010 to $136,352 in 2011, primarily due to new costs associated with the expanding staff and the new office location. Rent increased $17,342; officer compensation increased $60,000; legal costs increased $42,372; travel and entertainment increased $4,207; and other costs associated with maintaining a separate office also increased.

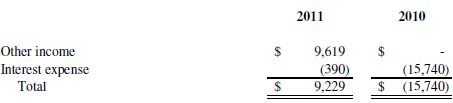

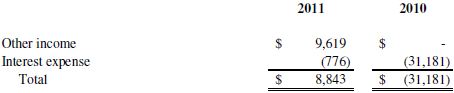

Other income (expense) during the three months ended October 31, 2011 and 2010 is as follows:

The interest bearing debt decreased during the 2011 period as compared to the 2010 period primarily due to the exchange of common stock for convertible notes payable in December 2010.

COMPARISON OF SIX MONTHS ENDED OCTOBER 31, 2011 AND 2010

Revenues during the six months ended October 31, 2011 and 2010 were as follows:

Gas production included 404 MCF sold in 2011. Oil revenues included 64 net barrels sold in 2010. As a result of continuing high operating costs, the Company sold all of its producing oil properties and its non-producing gas properties effective October 1, 2010 and acquired one new gas property in a different geographic area.

Costs and expenses during the six months ended October 31, 2011 and 2010 were as follows:

The decline in direct oil and natural gas costs is a result of the sale of the high maintenance oil properties effective October 1, 2010 and the simultaneous purchase of an interest in a producing gas well. The gas well has produced a small profit whereas the operating costs of the oil production always exceeded its revenue.

The Company recorded an asset impairment charge for the difference between the sales price of its remaining assets in 2010 and the carrying value of the assets at the time of the sale.

Non-cash compensation declined primarily due to completion of the amortization of consulting agreements in 2010.

Other general and administrative expense, net of operator's overhead fee increased in the 2011 period from $28,085 in 2010 to $241,466 in 2011, primarily due to new costs associated with the expanding staff and the new office location. Rent increased $34,685; officer compensation increased $90,000; legal costs increased $74,850; travel and entertainment increased $9,707; and other costs associated with maintaining a separate office also increased.

Other income (expense) during the six months ended October 31, 2011 and 2010 is as follows:

The interest bearing debt decreased during the 2011 period as compared to the 2010 period primarily due to the exchange of common stock for convertible notes payable in December 2010.

LIQUIDITY AND CAPITAL RESOURCES

Historical information

At October 31, 2011, we had $798 in cash, $153 in accounts receivable and a working capital deficit of $347,543. Comparatively, we had cash of $716 and a working capital deficit of $115,572 at April 30, 2011.

We have entered into an Asset Purchase Agreement described in Note 5 which requires us to raise $175 Million for the cash purchase price.

Evaluation of the amounts and certainty of cash flows

Our current cash flow is nominal and insufficient to pay current expenses. If we are successful in raising the $175 Million purchase price to complete the asset acquisition discussed in Note 5, our cash flow will change dramatically.

Cash requirements and capital expenditures

We currently require a minimum of $175 Million in cash to meet our initial capital requirements. We have made arrangement with our CEO to loan us up to $500,000 to meet the initial operating expenses during the due diligence phase of the acquisition and the initial operating requirements while we attempt to raise the capital required.

Known trends and uncertainties

The Company is in a very competitive business. The economy has been very uncertain over the past two to three years and may make it very difficult to raise the capital required to complete the Asset Purchase Agreement.

Expected changes in the mix and relative cost of capital resources

The initial phase for the Company is raising the purchase price for the acquisition. In order to take advantage of the undeveloped properties, the Company will require additional financing to continue development plans. The actual amounts required and the timing of the requirements have not been developed.

What balance sheet, income or cash flow items should be considered in assessing liquidity

We are actively seeking funding to complete the acquisition discussed in Note 5, which will require significant new external financing which will materially change the existing capital structure of the Company.

Our prospective sources for and uses of cash

Our current significant issue is raising the funds to complete the acquisition discussed in Note 5. If successful, the Company expects to use a combination of debt and equity .

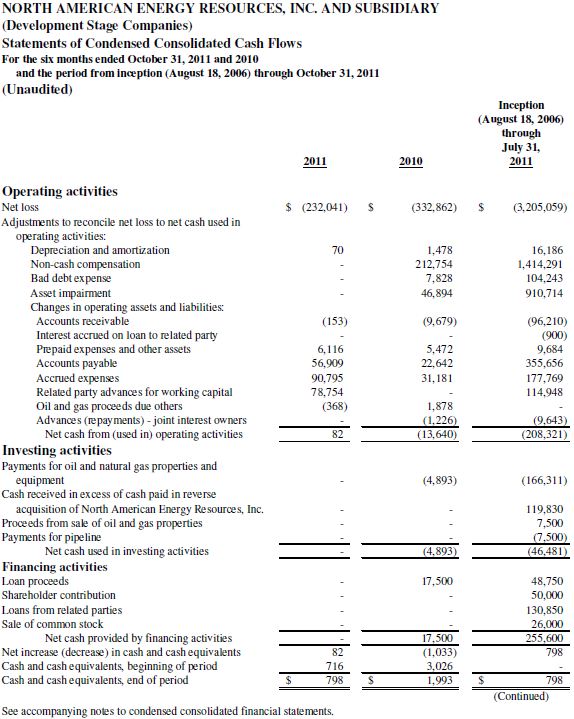

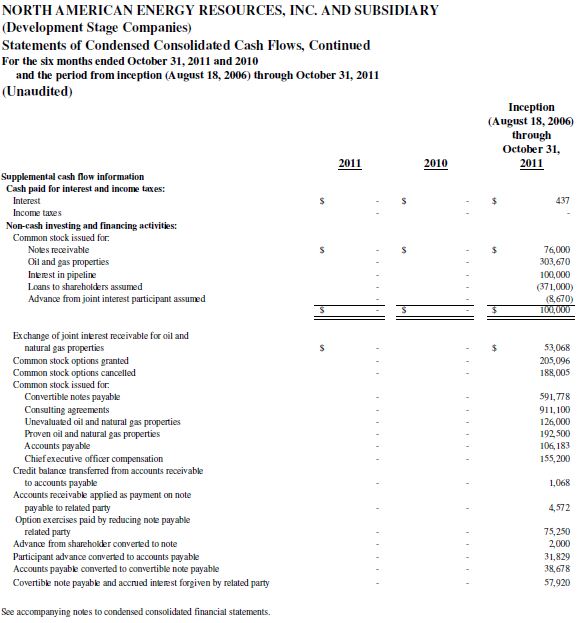

CASH FROM OPERATING ACTIVITIES

Cash provided by operating activities was $82 for the six-month period ended October 31, 2011 and cash used in operations was $13,640 for the comparable 2010 period. There has been only nominal activity with a significant portion of the operating loss being paid with advances from related parties or common stock.

CASH USED IN FINANCING ACTIVITIES

We incurred capital costs of $4,893 in the six months ended October 31, 2010 and none in the 2011 period.

GOING CONCERN

We have not attained profitable operations and are dependent upon obtaining substantial debt and equity financing to complete our planned acquisition. For these reasons, there is substantial doubt we will be able to continue as a going concern, since we are dependent upon an as yet unknown source to provide sufficient funds to finance future operations until our revenues are adequate to fund our cost of operations. The financial statements do not include any adjustments that may result from the outcome of these uncertainties.

OFF-BALANCE SHEET ARRANGEMENTS

None.

Item 3: QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

Item 4T: Controls and Procedures

Evaluation of disclosure controls and procedures

Under the PCAOB standards, a control deficiency exists when the design or operation of a control does not allow management or employees, in the normal course of performing their assigned functions, to prevent or detect misstatements on a timely basis. A significant deficiency is a deficiency, or a combination of deficiencies, in internal control over financial reporting that is less severe than a material weakness, yet important enough to merit the attention by those responsible for oversight of the company's financial reporting. A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the company's annual or interim financial statements will not be prevented or detected on a timely basis.

Under the supervision and with the participation of our management, including our principal executive officer and principal financial officer, we conducted an evaluation of our disclosure controls and procedures, as such term is defined under Rule 13a-15(e) and Rule 15d-15(e) promulgated under the Securities Exchange Act of 1934, as amended (Exchange Act), as of October 31, 2011. Our management has determined that, as of October 31, 2011, the Company's disclosure controls and procedures are effective.

Changes in internal control over financial reporting

There have been no significant changes in internal controls or in other factors that could significantly affect these controls during the quarter ended October 31, 2011, including any corrective actions with regard to significant deficiencies and material weaknesses.

PART II - OTHER INFORMATION

Item 1: Legal Proceedings

None

Item 1A: RISK FACTORS

Not applicable.

Item 2: UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

None.

Item 3: Defaults upon Senior Securities.

None

Item 4: Submission of Matters to a Vote of Security Holders.

None

Item 5: Other Information.

None

Item 6: Exhibits

Exhibit 31.1 Certification pursuant to 18 U.S.C. Section 1350 Section 302 of the Sarbanes-Oxley Act of 2002 - Chief Executive Officer

Exhibit 31.1 Certification pursuant to 18 U.S.C. Section 1350 Section 302 of the Sarbanes-Oxley Act of 2002 - Chief Financial Officer

Exhibit 32.1 Certification pursuant to 18 U.S.C. Section 1350 Section 906 of the Sarbanes-Oxley Act of 2002 - Chief Executive Officer

Exhibit 32.1 Certification pursuant to 18 U.S.C. Section 1350 Section 906 of the Sarbanes-Oxley Act of 2002 - Chief Financial Officer

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

NORTH AMERICAN ENERGY RESOURCES, INC.

Date: December 13, 2011

By: /s/ Alan G. Massara

President and Chief Financial Officer