Attached files

| file | filename |

|---|---|

| 8-K - 8-K - JANUS CAPITAL GROUP INC | a13-10416_18k.htm |

| EX-99.1 - EX-99.1 - JANUS CAPITAL GROUP INC | a13-10416_1ex99d1.htm |

Exhibit 99.2

|

|

First Quarter 2013 Earnings Presentation April 23, 2013 Dick Weil Chief Executive Officer Bruce Koepfgen Chief Financial Officer |

|

|

Executive summary Janus is becoming a stronger and more diverse company, but faces challenges, primarily as a result of fundamental equity performance 1Q 2013 performance in several our largest fundamental equity strategies was below expectations; however, fixed income and mathematical equity strategies continued to perform well We saw a continuation of growing confidence in the global equity markets in 1Q 2013, which led to a better flow environment in the active equity space In our fundamental equity strategies with strong performance, the improved market conditions led to improved sales; gross sales in this area of the business increased 29% compared to 4Q 2012 Our strategic priorities reflect our pursuit of intelligent diversification and are a continuation of the initiatives we have focused on over the last 2 years: Deliver strong long-term investment performance Build a more client centric organization and brand Expand and diversify our investment and distribution capabilities to better serve our clients Continue to focus on delivering operational excellence and financial discipline while investing in the business for long-term success |

|

|

Janus Capital Group 1Q 2013 results EPS AUM Long-Term Net Flows Margin 1Q 2013 EPS of $0.15 compared to $0.17 in 4Q 2012 Assets Under Management at March 31, 2013 of $163.8 billion increased 4.5% versus December 31, 2012 Operating margin in 1Q 2013 of 25.5% versus 26.8% in 4Q 2012 Total company long-term net flows were $(3.9) billion in 1Q 2013 compared to $(3.6) billion in 4Q 2012 LTM Cash Flow From Operations Generated LTM cash flow from operations of $201 million |

|

|

1Q 2013 results Bruce Koepfgen Chief Financial Officer |

|

|

1Q 2013 financial overview EPS Average AUM ($ in billions) Total Revenues ($ in millions) Operating Income & Operating Margin ($ in millions) Quarter over Quarter Year over Year $216.6 $214.2 4Q 2012 1Q 2013 $155.6 $161.8 4Q 2012 1Q 2013 $218.4 $214.2 1Q 2012 1Q 2013 $158.9 $161.8 1Q 2012 1Q 2013 $58.0 $54.7 26.8% 25.5% 4Q 2012 1Q 2013 $56.5 $54.7 25.9% 25.5% 1Q 2012 1Q 2013 $0.17 $0.15 $0.12 $0.15 4Q 2012 1Q 2013 1Q2012 1Q 2013 |

|

|

Morningstar ratings are based on risk-adjusted returns. Notes: References Morningstar relative performance on an asset-weighted basis as of 3/31/2013. Refer to p. 12 and 25 for the 1-, 3- and 5-year periods and p. 29 for the 10-year period for percent of assets, percent of funds in top 2 Morningstar quartiles for all periods and quantity of funds in analysis. References relative performance net of fees as of 3/31/2013, as shown on p. 26 and 27. Refer to p. 28 for INTECH mutual fund analysis and disclosure. Complex-wide as of 3/31/2013. Refer to p. 29 for 3-, 5- and 10-year Morningstar ratings and quantity of funds in the analysis. 1Q 2013 investment performance summary Period Ending March 31, 2013 1-Year 3-Year 5-Year % of Assets in Top Two Morningstar Quartiles Complex-Wide Mutual Fund Assets (1) 57% 31% 46% Fundamental Equity Mutual Fund Assets (1) 57% 24% 38% Fixed Income Mutual Fund Assets (1) 54% 74% 100% % of Strategies Which Outperformed Respective Benchmarks Mathematical Equity Strategies (2) 89% 93% 82% % of Complex-Wide Mutual Funds with 4- or 5-Star Overall Morningstar Rating TM Complex-Wide Mutual Funds (3) 49% (1) (2) (3) |

|

|

Note: Long-term flows exclude money market flows. Annualized sales and redemption rates calculated as a percentage of beginning of period assets. Total company net flows declined slightly in 1Q 2013 24% 20% 25% 20% 25% Total Company Long-Term Flows (1) ($ in billions) Mathematical Equity Long-Term Flows (1) ($ in billions) Fundamental Equity Long-Term Flows (1) ($ in billions) Gross Redemptions Gross Sales Net Sales 31% 29% 30% 29% 35% Annualized Redemption Rate Annualized Gross Sales Rate Fixed Income Long-Term Flows (1) ($ in billions) 24% 18% 18% 18% 24% 33% 28% 33% 31% 33% Annualized Redemption Rate Annualized Gross Sales Rate Annualized Redemption Rate Annualized Gross Sales Rate 58% 56% 47% 41% 53% 35% 37% 30% 29% 49% Annualized Redemption Rate Annualized Gross Sales Rate $8.7 $8.0 $9.4 $7.9 $9.6 ($11.2) ($11.9) ($11.4) ($11.5) ($13.5) ($2.5) ($3.9) ($2.0) ($3.6) ($3.9) ($32) ($16) $0 $16 $32 1Q12 2Q12 3Q12 4Q12 1Q13 $5.2 $4.2 $4.0 $4.1 $5.3 ($7.1) ($6.7) ($7.3) ($6.8) ($7.1) ($1.9) ($2.5) ($3.3) ($2.7) ($1.8) ($20) ($10) $0 $10 $20 1Q12 2Q12 3Q12 4Q12 1Q13 $0.5 $0.6 $2.6 $1.2 $0.8 ($2.3) ($3.1) ($2.3) ($2.8) ($3.2) ($1.8) ($2.5) $0.3 ($1.6) ($2.4) ($10) ($5) $0 $5 $10 1Q12 2Q12 3Q12 4Q12 1Q13 $3.0 $3.2 $2.8 $2.6 $3.5 ($1.8) ($2.1) ($1.8) ($1.9) ($3.2) 35% 37% 30% 29% 49% 1Q12 2Q12 3Q12 4Q12 1Q13 ($6) ($3) $0 $3 $6 $1.2 $1.1 $1.0 $0.7 $0.3 (1) |

|

|

Quarter-over-quarter decline in revenue was driven by an expected seasonal decline in private account performance fees Total Revenue ($ in millions) Note: Includes mutual fund and private account performance fees. Average AUM ($ in billions) (1) Management Fees Shareowner Servicing Fees and Other Performance Fees 36.4 35.5 ($13.6) ($19.5) $193.8 $198.2 $216.6 $214.2 4Q 2012 1Q 2013 $155.6 $161.8 4Q 2012 1Q 2013 (1) |

|

|

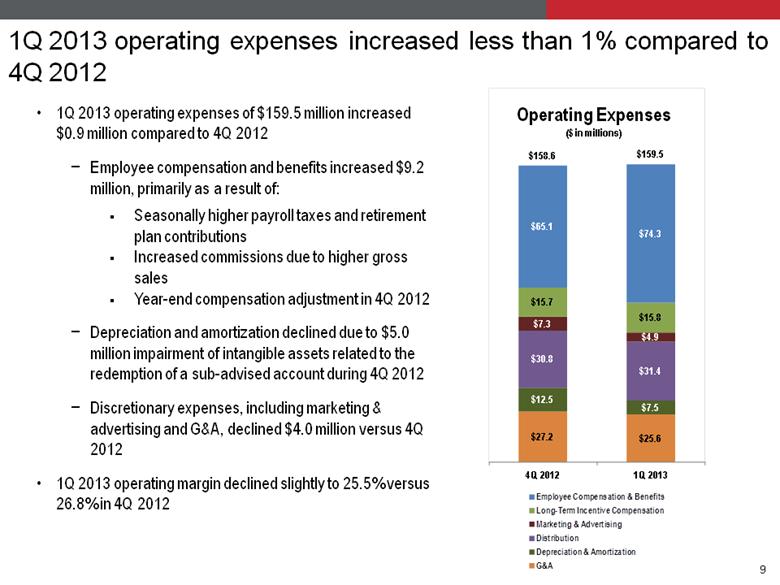

1Q 2013 operating expenses of $159.5 million increased $0.9 million compared to 4Q 2012 Employee compensation and benefits increased $9.2 million, primarily as a result of: Seasonally higher payroll taxes and retirement plan contributions Increased commissions due to higher gross sales Year-end compensation adjustment in 4Q 2012 Depreciation and amortization declined due to $5.0 million impairment of intangible assets related to the redemption of a sub-advised account during 4Q 2012 Discretionary expenses, including marketing & advertising and G&A, declined $4.0 million versus 4Q 2012 1Q 2013 operating margin declined slightly to 25.5% versus 26.8% in 4Q 2012 1Q 2013 operating expenses increased less than 1% compared to 4Q 2012 Operating Expenses ($ in millions) $27.2 $25.6 $12.5 $7.5 $30.8 $31.4 $7.3 $4.9 $15.7 $15.8 $65.1 $74.3 $158.6 $159.5 4Q 2012 1Q 2013 Employee Compensation & Benefits Long - Term Incentive Compensation Marketing & Advertising Distribution Depreciation & Amortization G&A |

|

|

1Q 2013 balance sheet Balance Sheet Profile (Carrying Value) – 12/31/2012 versus 3/31/2013 ($ in millions) 3/31/2013 Seed Investments 2017 Maturity Compensation-Related Assets (1) 12/31/2012 Cash Debt Cash Debt Cash and Cash Equivalents Notes: Includes Investments in Advised Mutual Funds of $89.0 million and Deferred Compensation Plans of $11.9 million as of December 31, 2012; includes Investments in Advised Mutual Funds of $55.8 million and Deferred Compensation Plans of $12.7 million as of March 31, 2013. Includes $38.9 million of 6.119% Senior Notes and $154.0 million of 3.250% Convertible Senior Notes as of December 31, 2012; includes $38.9 million of 6.119% Senior Notes and $156.4 million of 3.250% Convertible Senior Notes as of March 31, 2013. 2014 Maturities (2) Cash and cash equivalents decreased 17% quarter over quarter due to annual incentive cash payments and additional funding of existing seed products Seed capital of $331 million increased 33%, due to incremental funding and market impact During 1Q 2013, we reinvested $4 million in antidilutive share buybacks The Board of Directors approved a 17% increase in the quarterly dividend $387 $320 $101 $69 $250 $331 $738 $720 $193 $195 $352 $352 $545 $548 (1) (2) |

|

|

Top Questions from Shareholders Dick Weil Chief Executive Officer Bruce Koepfgen Chief Financial Officer |

|

|

Could you provide additional color around investment performance in the fundamental equity business? Fundamental Equity: Percent in Top 2 Morningstar Quartiles Based on Total Returns 1-Year 3-Year 5-Year % of Funds % of Assets Note: References Morningstar relative performance as of 3/31/2013. Refer to p. 29 for 10-year periods and quantity of funds in the analysis. 52% 39% 21% 23% 20% 27% 26% 40% 25% 18% 79% 65% 61% 48% 38% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 3/31/12 6/30/12 9/30/12 12/31/12 3/31/13 46% 61% 63% 61% 48% 24% 27% 31% 33% 39% 88% 94% 88% 94% 71% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 3/31/09 6/30/09 9/30/09 12/31/09 3/31/10 Percent of Janus Managed Equity JIF Funds . 1st Quartile 2nd Quartile 27% 23% 20% 44% 17% 22% 26% 22% 22% 37% 49% 49% 41% 66% 54% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 3/31/12 6/30/12 9/30/12 12/31/12 3/31/13 47% 41% 28% 31% 26% 31% 28% 38% 28% 29% 78% 69% 66% 59% 55% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 3/31/12 6/30/12 9/30/12 12/31/12 3/31/13 17% 7% 7% 17% 13% 4% 9% 11% 3% 11% 21% 16% 18% 20% 24% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 3/31/12 6/30/12 9/30/12 12/31/12 3/31/13 26% 14% 14% 26% 15% 17% 20% 23% 12% 24% 43% 34% 37% 38% 39% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 3/31/12 6/30/12 9/30/12 12/31/12 3/31/13 (1) |

|

|

Growth / Core (1) Global / International Mathematical Equity (2) Fixed Income (1) Gross Sales Quarter over Quarter Redemptions Quarter over Quarter Notes: Growth / core and fixed income assets reflect a 50% / 50% split of the Janus Balanced Fund between the two categories. Represents all assets managed by INTECH Investment Management LLC. Represents all assets managed by Perkins Investment Management LLC. What is driving flow activity? Value (3) Quarter-over-Quarter Long-Term Gross Sales and Redemptions: ($ in billions) $0.8 $0.9 4Q 2012 1Q 2013 $2.6 $3.5 4Q 2012 1Q 2013 ($1.7) ($1.6) 4Q 2012 1Q 2013 ($2.8) ($3.2) 4Q 2012 1Q 2013 $0.9 $0.9 4Q 2012 1Q 2013 ($3.5) ($3.4) 4Q 2012 1Q 2013 ($1.9) ($3.2) 4Q 2012 1Q 2013 $2.4 $3.5 4Q 2012 1Q 2013 $1.2 $0.8 4Q 2012 1Q 20134Q 2012 1Q 2013 ($1.6)($2.1)

|

|

|

What is management’s philosophy regarding use of capital? We follow a hierarchy of cash uses in our Capital Planning: Available Cash & Equivalents Reserve cash for liquidity needs and regulatory requirements in order to maintain business flexibility 4 1 2 3 Set aside capital for contractual obligations, recurring programmatic payments (i.e. regular dividends, anti-dilutive share repurchases) and planned debt retirement Plan for organic and inorganic reinvestment in the business to drive future growth (i.e. seed funding, distribution / investment team build-outs, advertising spend and acquisitions) Give back excess cash through dividend increases, additional share buybacks, special dividends or the early retirement of outstanding debt Starting with cash and marketable securities Strategic Spending Capital Set-Asides Regulatory &Liquidity Needs |

|

|

Quarter-over-Quarter Change in Compensation & Benefits: (2) Notes: “Other” includes subsidiary profits-driven compensation plan, severance expenses and increased per-employee health insurance costs. Go-Forward Compensation and Benefits assumes an “all things equal” scenario in 2Q 2013, including flat AUM ($163.8 billion), flat total company gross sales ($9.6 billion) and flat revenue ($214.2 million). Go-Forward Comp-to-Revenue ratio is based off of revenue of $214.2 million. What drove the increase in 1Q 2013 compensation expense, and how should we think about compensation going forward? (1) Comp-to-Revenue Ratio 30.1% 34.7% 33.6% ($ in millions) (3) $74.3 $71.9 $2.4 $3.1 $2.4 $1.9 $1.8 $65.1 $50.0 $55.0 $60.0 $65.0 $70.0 $75.0 $80.0 4Q 2012 Compensation & Benefits Year-End Compensation Adjustments Seasonal Pension & Payroll Tax Base Salaries & Commissions Other 1Q 2013 Compensation & Benefits Less Seasonal Pension & Payroll Tax Go-Forward Compensation & Benefits (1) (2) (3) (1) |

|

|

Due to the 3-year nature of our performance fee calculation, 2011 underperformance will weigh on our annual performance fees through 2013 As of 3/31/2013, 93% of our fund AUM with performance fees were generating the maximum negative performance fee rate of -15bps Strong performance during 2013 and 2014 would enable us to generate over $60 million(1) of incremental revenue during 2014 Year-Over-Year Change in Mutual Fund Performance Fee Revenue ($ in millions) +400bps Annual Outperformance (1) Benchmark Performance (3) (no out / underperformance) -400bps Annual Underperformance (4) How should we look at performance fees going forward? Based on the historical nature of the calculation, we are currently near the mathematical maximum negative impact from performance fees Potential Year-Over-Year Change in Mutual Fund Performance Fee Revenue ($ in millions) Notes: Assumes 400bps of outperformance versus benchmark on all products annually through 2014 and flat AUM as of 3/31/2013. Percent of average long-term domestic mutual fund AUM. Funds counted in year that financial impact began. Assumes performance at benchmark on all products annually through 2014 and flat AUM as of 3/31/2013. Assumes 400bps of underperformance versus benchmark on all products annually through 2014 and flat AUM as of 3/31/2013. 27% 25% 26% 27% 66% 61% $11 $0 $5 ($6) ($32) ($67) 2007 2008 2009 2010 2011 2012 % of Domestic Fund AUM with Performance Fees (2) Mutual Fund Performance Fee Y/Y $ Change $(2) $28 2013F 2014F $(2) $7 2013F 2014F $0 $63 2013F 2014F (1) (2) (3) (4) |

|

|

Q&A Dick Weil Chief Executive Officer Bruce Koepfgen Chief Financial Officer |

|

|

Appendix |

|

|

Retail Intermediary ($106.3bn) $163.8 billion in AUM as of 3/31/13 By Investment Discipline By Distribution Channel Growth / Core ($57.8bn) Money Market ($1.4bn) Mathematical ($41.7bn) Institutional ($39.4bn) International ($18.1bn) AUM by investment discipline and distribution channel Fixed Income ($27.4bn) Global / International ($17.9bn) Value ($17.6bn) 35% 25% 17% 11% 11% 1% 65% 24% 11% |

|

|

1Q 2013 EPS of $0.15 compared to $0.17 in 4Q 2012 March 31, December 31, Variance March 31, March 31, Variance ($ in millions, except AUM and per share) 2013 2012 (%) 2013 2012 (%) Average AUM ($ in billions) $161.8 $ 155.6 $ 4.0% $161.8 $ 158.9 $ 1.8% Revenues $ 214.2 $ 216.6 $ -1.1% $ 214.2 $ 218.4 $ -1.9% Operating expenses 159.5 158.6 0.6% 159.5 161.9 -1.5% Operating income $ 54.7 $ 58.0 $ -5.7% $ 54.7 $ 56.5 $ -3.2% Operating margin 25.5% 26.8% 25.5% 25.9% Interest expense $ (11.2) $ (11.1) $ -0.9% $ (11.2) $ (11.8) $ 5.1% Investment gains (losses), net 4.6 4.2 9.5% 4.6 6.3 -27.0% Other income, net 1.8 1.0 80.0% 1.8 0.1 n/m Loss on early extinguishment of debt - - n/a - (7.2) n/m Income tax provision (20.2) (19.3) -4.7% (20.2) (17.2) -17.4% Net income $ 29.7 $ 32.8 $ -9.5% $29.7 $ 26.7 $ 11.2% Noncontrolling interests (1.7) (1.6) -6.3% (1.7) (4.1) 58.5% Net income attributable to JCG $28.0 $ 31.2 $ -10.3% $ 28.0 $ 22.6 $ 23.9% Diluted earnings per share attributable to JCG common shareholders $ 0.15 $ 0.17 $ -11.8% 0.15 $ 0.12 $ 25.0% Diluted weighted average shares outstanding (in millions) 186.3 185.7 0.3% 186.3 185.4 0.5% Quarter Ended Quarter Ended |

|

|

1Q 2013 operating margin of 25.5% versus 26.8% in 4Q 2012 March 31, December 31, Variance March 31, March 31, Variance ($ in millions, except AUM) 2013 2012 (%) 2013 2012 (%) Average AUM ($ in billions) $ 161.8 $ 155.6 $ 4.0% $ 161.8 $ 158.9 $ 1.8% Revenues Investment management fees 198.2 $ 193.8 $ 198.2 $ 202.0 $ Performance fees - mutual funds (21.8) (21.9) (21.8) (19.5) Performance fees - private accounts 2.3 8.3 2.3 0.5 Shareowner servicing fees and other 35.5 36.4 35.5 35.4 Total revenues 214.2 $ 216.6 $ -1.1% 214.2 $ 218.4 $ -1.9% Basis points Investment management fees 49.7 49.5 49.7 51.1 Investment management fees and performance fees 44.8 46.1 44.8 46.3 Operating expenses Employee compensation and benefits 74.3 $ 65.1 $ 74.3 $ 72.0 $ Long-term incentive compensation 15.8 15.7 15.8 19.6 Marketing and advertising 4.9 7.3 4.9 4.8 Distribution 31.4 30.8 31.4 32.3 Depreciation and amortization 7.5 12.5 7.5 8.1 General, administrative and occupancy 25.6 27.2 25.6 25.1 Total operating expenses 159.5 $ 158.6 $ 0.6% 159.5 $ 161.9 $ -1.5% Operating income 54.7 $ 58.0 $ -5.7% 54.7 $ 56.5 $ -3.2% Operating margin 25.5% 26.8% 25.5% 25.9% Quarter Ended Quarter Ended |

|

|

Mutual funds with performance-based advisory fees Please refer to footnotes on p. 23. Mutual Funds with Performance Fees (1) (AUM $ in millions, performance fees $ in thousands) EOP AUM 3/31/2013 Benchmark Base Fee Performance Fee (2) Performance Hurdle vs. Benchmark 1Q 2013 P&L Impact Janus Contrarian Fund (3) $2,928.6 S&P 500 ® Index 0.64% ± 15 bps ± 7.00% ($1,218.6) Janus Aspen Worldwide Fund (3) 712.0 MSCI World Index SM 0.60% ± 15 bps ± 6.00% (157.9) Janus Research Fund (3) 3,534.6 Russell 1000 ® Growth Index 0.64% ± 15 bps ± 5.00% (1,035.7) Janus Global Research Fund (4) 2,433.0 MSCI World Index SM 0.60% ± 15 bps ± 6.00% (237.6) Janus Global Real Estate Fund (5) 138.1 FTSE EPRA / NAREIT Developed Index 0.75% ± 15 bps ± 4.00% (24.7) Janus International Equity Fund (6) 251.0 MSCI EAFE ® Index 0.68% ± 15 bps ± 7.00% 10.2 INTECH U.S. Core Fund (7) 391.3 S&P 500 ® Index 0.50% ± 15 bps ± 4.00% 118.9 Perkins Mid Cap Value Fund (3) 12,702.1 Russell Midcap ® Value Index 0.64% ± 15 bps ± 4.00% (4,975.3) Perkins Small Cap Value Fund (8) 2,596.0 Russell 2000 ® Value Index 0.72% ± 15 bps ± 5.50% (1,086.2) Perkins Large Cap Value Fund (8) 127.6 Russell 1000 ® Value Index 0.64% ± 15 bps ± 3.50% (45.5) Janus Fund (9) 8,905.3 Core Growth Index 0.64% ± 15 bps ± 4.50% (3,263.8) Perkins Global Value Fund (9,10) 163.3 MSCI World Index SM 0.64% ± 15 bps ± 7.00% (17.0) Janus Aspen Overseas Portfolio (11) 1,417.8 MSCI All Country World ex-U.S. Index SM 0.64% ± 15 bps ± 7.00% (723.1) Janus Overseas Fund (12) 5,665.0 MSCI All Country World ex-U.S. Index SM 0.64% ± 15 bps ± 7.00% (3,801.1) Janus Twenty Fund (13) 8,525.0 Russell 1000 ® Growth Index 0.64% ± 15 bps ± 8.50% (3,163.6) Janus Forty Fund (13) 4,559.5 Russell 1000 ® Growth Index 0.64% ± 15 bps ± 8.50% (2,202.1) Janus Emerging Markets Fund (14) 29.7 MSCI Emerging Markets Index SM 1.00% ± 15 bps ± 6.00% (6.9) Janus Asia Equity (15) 15.4 MSCI All Country Asia ex-Japan Index SM 0.92% ± 15 bps ± 7.00% 0.6 Perkins Select Value (16) 69.9 Russell 3000 ® Value Index 0.70% ± 15 bps ± 5.00% (24.1) Total Existing Funds with Fees $55,165.2 ($21,853.4) |

|

|

Notes: The funds listed have a performance-based investment advisory fee that adjusts upward or downward based on each fund’s performance relative to an approved benchmark index over a performance measurement period. Please see the funds’ Statements of Additional Information for more details. Actual performance measurement periods used for calculating the performance fees are from 12 months up to 36 months, and then over 36-month rolling periods. Adjustment of ± 15 bps assumes constant assets and could be higher or lower depending on asset fluctuations. The performance measurement period began on 2/1/2006, and the performance adjustment was implemented as of 2/1/2007. Effective close of business on March 15, 2013, Janus Global Research Fund merged with and into Janus Worldwide Fund; following the merger, Janus Worldwide Fund was renamed Janus Global Research Fund (the “Combined Fund”). The Combined Fund’s surviving performance track record is that of the former Janus Global Research Fund, and the performance measurement benchmark is the MSCI World Index. For three years after the merger, Janus will waive its management fee to at least a level that is equivalent to the fee rate the Combined Fund would have paid if, after the merger, the performance history of Janus Worldwide Fund were used to calculate the performance fee adjustment to the base management fee. The performance measurement period began on 12/1/2007 and the performance adjustment was implemented as of 12/1/2008. Beginning 7/1/2010, Janus Global Real Estate Fund’s benchmark index changed from the FTSE EPRA/NAREIT Developed Index to the FTSE EPRA/NAREIT Global Index for purposes of measuring the Fund’s performance and calculating the performance adjustment. Because the Fund’s performance adjustment is based upon a rolling 36-month performance measurement period, comparisons to the FTSE EPRA/NAREIT Global Index will not be fully implemented until 36 months after July 1, 2010. During this transition period, the Fund's returns will be compared to a blended index return. The performance measurement period began on 12/1/2006, and the performance adjustment was implemented as of 12/1/2007. The performance measurement period began on 1/1/2006, and the performance adjustment was implemented as of 1/1/2007. Effective 12/7/11, INTECH Risk-Managed Core Fund was renamed INTECH U.S. Core Fund. The performance measurement period began on 1/1/2009, and the performance adjustment was implemented as of 1/1/2010. The performance measurement period began on 7/1/2010, and the performance adjustment was implemented as of 6/30/2011. Effective 7/1/10, Janus Global Opportunities Fund was renamed Perkins Global Value Fund. The performance measurement period began on 7/1/2010, and the performance adjustment was implemented as of 9/30/2011. The performance measurement period began on 8/1/2010, and the performance adjustment was implemented as of 10/31/2011. The performance measurement period began on 7/1/2010, and the performance adjustment was implemented as of 12/31/2011. The performance measurement period began on 12/31/2010, and the performance adjustment was implemented as of 12/31/2011. The performance measurement period began on 7/29/2011, and the performance adjustment was implemented as of 7/31/2012. The performance measurement period began on 1/1/2012, and the performance adjustment was implemented as of 12/31/2012. Mutual funds with performance-based advisory fees (cont.) (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11) (12) (13) (14) (15) (16) |

|

|

Notes: Schedule reflects LTI awards granted as of 3/31/2013 and includes a reduction related to forfeitures taken, excluding any future forfeitures. All grants include mutual fund share awards, which are subject to market/fund performance adjustments and do not include Perkins senior profit interest awards. Perkins senior profit interest awards were granted on December 31, 2008 and have a formula-driven terminal value based on revenue growth and relative investment performance. Janus can call or terminate any or all awards on the 5th, 7th or each subsequent anniversary of the grant. Grants are expensed on a pro rata basis. Grant includes $2.4 million of awards that vest ratably over four years and $1.2 million in awards that are subject to performance-based vesting and are expensed 52% in 2012, 27% in 2013, 15% in 2014 and 6% in 2015. LTI amortization schedule Full-Year 2013 Long-Term Incentive Compensation Amortization (1)(2) ($ in millions) Date of Grant Amount Remaining to Vest 2010 Grant February 2010 16.6 $ 2011 Grant February 2011 30.3 2012 Grant February 2012 41.2 2013 Grant February 2013 47.9 Additional Grants INTECH 2009 January 2009 3.0 $ Janus CEO 2011 (3) December 2011 2.4 Grants vest over 4 years Janus CEO 2012 December 2012 2.9 Grants vest over 10 years |

|

|

57%, 31% and 46% of complex-wide mutual fund assets outperformed the majority of Morningstar peers over the 1-, 3- and 5-year periods, respectively (1) Complex-Wide: Percent in Top 2 Morningstar Quartiles Based on Total Returns 1-Year 3-Year 5-Year % of Funds % of Assets Note: References Morningstar relative performance as of 3/31/2013. Refer to p. 29 for 10-year periods and quantity of funds in the analysis. 57% 46% 31% 33% 27% 24% 23% 35% 22% 19% 81% 70% 67% 55% 46% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 3/31/12 6/30/12 9/30/12 12/31/12 3/31/13 46% 61% 63% 61% 48% 24% 27% 31% 33% 39% 88% 94% 88% 94% 71% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 3/31/09 6/30/09 9/30/09 12/31/09 3/31/10 Percent of Janus Managed Equity JIF Funds . 1st Quartile 2nd Quartile 46% 61% 63% 61% 48% 24% 27% 31% 33% 39% 88% 94% 88% 94% 71% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 3/31/09 6/30/09 9/30/09 12/31/09 3/31/10 Percent of Janus Managed Equity JIF Funds . 1st Quartile 2nd Quartile 28% 25% 18% 35% 23% 28% 31% 28% 27% 35% 57% 56% 46% 62% 58% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 3/31/12 6/30/12 9/30/12 12/31/12 3/31/13 49% 45% 35% 35% 28% 28% 30% 35% 28% 33% 77% 75% 70% 63% 62% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 3/31/12 6/30/12 9/30/12 12/31/12 3/31/13 15% 7% 8% 15% 12% 5% 17% 18% 12% 19% 20% 23% 26% 27% 31% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 3/31/12 6/30/12 9/30/12 12/31/12 3/31/13 23% 19% 21% 29% 22% 21% 23% 23% 17% 27% 44% 42% 44% 45% 49% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 3/31/12 6/30/12 9/30/12 12/31/12 3/31/13 |

|

|

Mathematical equity performance (1) Past performance is no guarantee of future results. Notes:Returns for periods greater than 1 year are annualized. Refer to p. 28 for performance disclosure.(2) Differences may not agree with input data due to rounding. Inception Since Composite and Respective Benchmark Date 1 Year 3 Year 5 Year 10 Year Inception U.S. Enhanced Plus Gross 7/87 14.85 13.36 6.39 9.69 10.45 U.S. Enhanced Plus Net 14.50 13.01 6.06 9.34 10.05 S&P 500 ® Index 13.96 12.67 5.81 8.53 9.03 Difference versus S&P 500 ® Index Net of Fees 0.54 0.34 0.25 0.81 1.02 U.S. Large Cap Growth Gross 7/93 12.13 13.43 7.57 9.27 12.36 U.S. Large Cap Growth Net 11.61 12.90 7.07 8.75 11.79 S&P 500 ® Growth Index 11.61 13.31 7.48 8.08 8.64 Difference versus S&P 500 ® Growth Index Net of Fees (0.00) (0.41) (0.41) 0.67 3.14 U.S. Large Cap Value Gross 7/93 18.43 13.82 5.34 10.36 10.35 U.S. Large Cap Value Net 17.97 13.38 4.94 9.94 9.92 S&P 500 ® Value Index 16.64 12.12 4.07 8.92 8.32 Difference versus S&P 500 ® Value Index Net of Fees 1.33 1.26 0.87 1.02 1.60 U.S. Enhanced Index Gross 4/98 14.91 13.14 6.54 9.22 5.43 U.S. Enhanced Index Net 14.54 12.78 6.20 8.87 5.08 S&P 500 ® Index 13.96 12.67 5.81 8.53 4.27 Difference versus S&P 500 ® Index Net of Fees 0.58 0.11 0.39 0.34 0.81 U.S. Broad Large Cap Growth Gross 11/00 10.67 14.15 6.87 9.04 2.88 U.S. Broad Large Cap Growth Net 10.12 13.58 6.33 8.49 2.35 Russell 1000 ® Growth Index 10.09 13.06 7.30 8.62 0.56 Difference versus Russell 1000 ® Growth Index Net of Fees 0.03 0.51 (0.98) (0.14) 1.79 U.S. Broad Enhanced Plus Gross 4/01 15.73 14.07 6.72 9.63 6.37 U.S. Broad Enhanced Plus Net 15.37 13.71 6.40 9.29 6.03 Russell 1000 ® Index 14.43 12.93 6.15 8.97 5.01 Difference versus Russell 1000 ® Index Net of Fees 0.94 0.78 0.25 0.32 1.03 U.S. Large Cap Core Gross 8/01 15.92 13.24 6.33 9.98 6.16 U.S. Large Cap Core Net 15.36 12.69 5.81 9.47 5.67 S&P 500 ® Index 13.96 12.67 5.81 8.53 4.29 Difference versus S&P 500 ® Index Net of Fees 1.40 0.02 0.00 0.94 1.38 U.S. Broad Large Cap Value Gross 8/04 21.62 14.88 6.69 - 7.86 U.S. Broad Large Cap Value Net 21.17 14.44 6.29 - 7.45 Russell 1000 ® Value Index 18.76 12.74 4.85 - 6.44 Difference versus Russell 1000 ® Value Index Net of Fees 2.41 1.70 1.44 - 1.01 Global Large Cap Core Gross 1/05 16.19 11.64 4.33 - 7.13 Global Large Cap Core Net 15.65 11.10 3.80 - 6.57 MSCI World ® Index 12.53 9.08 2.83 - 5.23 Difference versus MSCI World ® Index Net of Fees 3.13 2.02 0.97 - 1.34 Enhanced Plus USA Gross 1/06 15.58 14.20 6.54 - 5.87 Enhanced Plus USA Net 15.21 13.82 6.19 - 5.53 MSCI USA ® Index 13.90 12.80 5.93 - 5.54 Difference versus MSCI USA ® Index Net of Fees 1.30 1.02 0.26 - (0.01) Annualized Returns (%) for Periods Ended 3/31/2013 (2) |

|

|

Mathematical equity performance (cont.) (1) Past performance is no guarantee of future results. Notes: Returns for periods greater than 1 year are annualized. Refer to p. 28 for performance disclosure. Differences may not agree with input data due to rounding. Global Low Volatility product is engineered to reduce the portfolio’s absolute standard deviation for a given target excess return rather than its tracking error relative to a cap-weighted benchmark. Inception Since Composite and Respective Benchmark Date 1 Year 3 Year 5 Year 10 Year Inception International Large Cap Core Gross 11/06 15.70 8.41 0.93 - 3.47 International Large Cap Core Net 15.21 7.95 0.50 - 3.04 MSCI EAFE ® Index 11.79 5.49 (0.40) - 0.92 Difference versus MSCI EAFE ® Index Net of Fees 3.41 2.46 0.90 - 2.12 U.S. Broad Enhanced Index Gross 10/08 15.67 13.39 - - 9.69 U.S. Broad Enhanced Index Net 15.41 13.13 - - 9.39 Russell 1000 ® Index 14.43 12.93 - - 9.68 Difference versus Russell 1000 ® Index Net of Fees 0.99 0.20 - - (0.29) Global Large Cap Core ex Japan (Kokusai) Gross 5/09 16.60 11.85 - - 17.67 Global Large Cap Core ex Japan (Kokusai) Net 15.97 11.24 - - 17.03 MSCI KOKUSAI ® World ex Japan Index 12.90 9.68 - - 16.77 Difference versus MSCI KOKUSAI ® World ex Japan Index Net of Fees 3.06 1.56 - - 0.26 European Large Cap Core Gross (EUR) 1/10 21.75 12.08 - - 13.04 European Large Cap Core Net (EUR) 21.09 11.46 - - 12.42 MSCI Europe ® Index (EUR) 15.42 7.33 - - 8.11 Difference versus MSCI Europe ® Index (EUR) Net of Fees 5.66 4.13 - - 4.31 U.S. Broad Large Cap Core Gross 2/11 18.65 - - - 14.01 U.S. Broad Large Cap Core Net 18.00 - - - 13.39 Russell 1000 ® Index 14.43 - - - 12.09 Difference versus Russell 1000 ® Index Net of Fees 3.58 - - - 1.30 Global Enhanced Index ex Australia Gross 6/11 14.26 - - - 7.27 Global Enhanced Index ex Australia Net 13.96 - - - 6.99 MSCI World ® ex Australia Index 12.17 - - - 5.97 Difference versus MSCI World ® ex Australia Index Net of Fees 1.79 - - - 1.02 Global Enhanced All Country Gross 11/11 12.58 - - - 15.47 Global Enhanced All Country Net 12.19 - - - 15.08 MSCI All Country World ® Index Net of Fees 11.19 - - - 14.19 Difference versus MSCI All Country World ® Index Net of Fees 1.00 - - - 0.89 Global Low Volatility Gross (3) 1/12 20.02 - - - 20.37 Global Low Volatility Net 19.60 - - - 19.95 MSCI World ® Index 12.53 - - - 20.09 Difference versus MSCI World ® Index Net of Fees 7.07 - - - (0.14) Global High Dividend Core Gross 4/12 17.16 - - - 17.16 Global High Dividend Core Net 16.52 - - - 16.52 MSCI World ® High Dividend Index 16.90 - - - 16.90 Difference versus MSCI World ® High Dividend Yield Index Net of Fees (0.38) - - - (0.38) Annualized Returns (%) for Periods Ended 3/31/2013 (2) Past performance is no guarantee of future results. Notes: (1) Returns for periods greater than 1 year are annualized. Refer to p. 28 for performance disclosure. (2) Differences may not agree with input data due to rounding. (3) Global Low Volatility product is engineered to reduce the portfolio’s absolute standard deviation for a given target excess return rather than its tracking error relative to a cap-weighted benchmark. |

|

|

For the period ending March 31, 2013, 100%, 100%, 50% and 67% of the mathematical equity mutual funds were beating their benchmarks on a 1-, 3-, 5-year and since-fund inception basis. Funds included in the analysis and their inception dates are: INTECH U.S. Growth Fund – Class S (1/03); INTECH U.S. Core Fund – Class T (2/03); INTECH U.S. Value Fund – Class I (12/05); INTECH International Fund – Class I (5/07); INTECH Global Dividend Fund – Class I (12/11) and Janus INTECH U.S. Low Volatility Portfolio – Service Shares (9/12). The proprietary mathematical process used by INTECH may not achieve the desired results. Since the portfolios are regularly re-balanced, this may result in a higher portfolio turnover rate, higher expenses and potentially higher net taxable gains or losses compared to a "buy and hold" or index fund strategy. Past performance cannot guarantee future results. Investing involves risk, including the possible loss of principal and fluctuation of value. Performance results reflect the reinvestment of dividends and other earnings. Composite performance results shown are time-weighted rates of return using daily valuation, include the effect of transaction costs (commissions, exchange fees, etc.), and are gross of non-reclaimable withholding taxes, if any. The composites include all actual fee-paying accounts managed on a fully discretionary basis according to the investment strategy from inception date, including those no longer under management. Portfolios meeting such criteria enter the composite upon the full first month under management. Reporting currency is USD, unless otherwise noted. The gross performance results presented do not reflect the deduction of investment advisory fees. Returns will be reduced by such advisory fees and other contractual expenses as described in each client’s individual contract. The net performance results do not reflect the deduction of investment advisory fees actually charged to the accounts in the composite. However, the net performance results do reflect the deduction of model investment advisory fees. Through 12/31/04, net returns were derived using the maximum fixed fee in effect for each strategy. As of 1/1/05, net returns are calculated by applying the standard fee schedule in effect for the respective period to each account in the composite on a monthly basis. Actual advisory fees may vary among clients invested in this strategy. Actual advisory fees paid may be higher or lower than model advisory fees. Some clients may utilize a performance-based fee. For U.S. Large Cap Growth from inception to 12/31/05, the composite’s benchmark was the S&P 500/Barra Growth Index (“Barra Growth Index”). In 2005, S&P announced index name and methodology changes affecting the Barra Growth Index, which later became the S&P 500/Citigroup Growth Index (“Citigroup Growth Index”). During the transitional period, from 1/1/06 to 3/31/06, the benchmark return consisted partially of the return of the Barra Growth Index and the Citigroup Growth Index. On 4/1/06, the composite’s benchmark was changed to the Citigroup Growth Index. Effective 12/9/2009, the Citigroup Growth Index's name was changed to S&P 500 Growth Index. The S&P 500 Growth Index is a market-capitalization-weighted index developed by Standard and Poor's consisting of those stocks within the S&P 500 Index that exhibit strong growth characteristics. The index measures the performance of the growth style of investing in large cap U.S. stocks. The S&P 500 Growth Index will be reconstituted annually. For U.S. Large Cap Value from inception to 12/31/05, the composite’s benchmark was the S&P 500/Barra Value Index (“Barra Value Index”). In 2005, S&P announced index name and methodology changes affecting the Barra Value Index, which later became the S&P 500/Citigroup Value Index (“Citigroup Value Index”). During the transitional period, from 1/1/06 to 3/31/06, the benchmark return consisted partially of the return of the Barra Value Index and the Citigroup Value Index. On 4/1/06, the composite’s benchmark was changed to the Citigroup Value Index. Effective 12/9/2009, the Citigroup Value Index's name was changed to S&P 500 Value Index. The S&P 500 Value Index is a market-capitalization-weighted index developed by Standard and Poor’s consisting of those stocks within the S&P 500 Index that exhibit strong value characteristics. The index measures the performance of the value style of investing in large cap U.S. stocks. The S&P 500 Value Index will be reconstituted annually. Prior to May 21, 2010, with respect to non-U.S. securities traded on non-U.S. exchanges, INTECH used fair value prices that reflected current market conditions at the end of regular trading hours of the NYSE, normally 4:00 PM ET, rather than unadjusted closing prices in local markets. Therefore, the prices as well as foreign exchange rates used to calculate the U.S. dollar market values of securities may have differed from those used by an index. Indices typically use the unadjusted closing price in local markets instead of fair value pricing. As of May 21, 2010, prices for non-U.S. securities traded on non-U.S. exchanges are valued as of the close of their respective local markets. Non-U.S. securities are translated into U.S. dollars using the 4:00 PM London spot rate. Non-U.S. investments are subject to certain risks of overseas investing, including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. With respect to European Large Cap Core, prices assigned to investments are published prices on their primary markets or exchanges since the composite’s inception. The returns for the indices shown do not include any transaction costs, management fees or other costs and are gross of dividend tax withholdings. Mathematical equity strategies included in the investment performance summaries include only those strategies with at least a 1-year track record. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products This report has not been approved, reviewed or produced by MSCI. Mathematical equity performance disclosure |

|

|

Other important disclosures Data presented reflects past performance, which is no guarantee of future results. Due to market volatility, current performance may be higher or lower than the performance shown. Call 877.33JANUS (52687) or visit janus.com/advisor/mutual-funds for performance, rankings and ratings current to the most recent month-end. Janus Capital Group Inc. (“JCG”) provides investment advisory services through its primary subsidiaries, Janus Capital Management LLC (“Janus”), INTECH Investment Management LLC (“INTECH”) and Perkins Investment Management LLC (“Perkins”). “Complex-Wide Mutual Funds” means all affiliated mutual funds managed by Janus, INTECH and Perkins. “Fundamental Equity Mutual Funds” means all mutual funds managed by Janus or Perkins that invest in equity securities. “Fixed Income Mutual Funds” means all mutual funds managed by Janus that invest primarily in fixed income securities. “Mathematical Equity Strategies” means all discretionary managed accounts (not mutual funds) that are advised or sub-advised by INTECH. Mutual fund relative performance analysis shown is for each Fund's initial share class: Class T, S or I Shares in the Janus retail fund (“JIF”) trust and the Institutional or Service Shares in the Janus Aspen Series (“JAS”). These share classes may not be eligible for purchase by all investors. Other share classes may have higher sales and management fees, which can result in differences in performance. Morningstar Comparative Performance Morningstar performance on an asset-weighted basis is calculated by taking all funds and assigning the assets under management ("AUM") in each respective fund to either the 1st, 2nd, 3rd or 4th quartile bucket based on each fund's respective Morningstar relative ranking. The total AUM of each quartile’s bucket is then divided by complex-wide total AUM to arrive at the respective percent of AUM in each bucket. The Morningstar percentile ranking is based on the fund’s total-return percentile rank relative to all funds that have the same category for the same time period. The highest (or most favorable) percentile rank is 1%, and the lowest (or least favorable) percentile rank is 100%. Morningstar total-return includes both income and capital gains or losses and is not adjusted for sales charges. The top-performing funds in a category will always receive a rank of 1. For the 1-, 3-, 5- and 10-year periods ending March 31, 2013, 58%, 49%, 62% and 77% of the 52, 41, 39 and 30 Complex-Wide mutual funds; 54%, 39%, 55% and 79% of the 41, 33, 31 and 24 Fundamental Equity mutual funds; and 50%, 75%, 100% and 75% of the 6,4,4 and 4 Fixed Income mutual funds outperformed the majority of their Morningstar peers based on total returns. On an asset-weighted basis, 79% of the Complex-Wide mutual fund assets, 79% of the Fundamental Equity mutual fund assets and 79% of the Fixed Income mutual fund assets outperformed the majority of their Morningstar peers based on total returns for the 10-year period. The Overall Morningstar RatingTM for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar RatingTM metrics. For each fund with at least a three-year history, Morningstar calculates a Morningstar RatingTM based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of the funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.) The Morningstar RatingTM may differ among share classes of a mutual fund as a result of different sales loads and/or expense structures. It may be based, in part, on the performance of a predecessor fund. Morningstar does not rank funds with less than a 3-year performance history. For the period ending March 31, 2013, 44%, 46% and 60% of Complex-Wide mutual funds had a 4- or 5-star Morningstar rating for the 3-, 5- and 10-year periods based on risk-adjusted returns for 41, 39 and 30 funds, respectively. 41 funds were included in the analysis for the Overall period. Investing involves risk, including the possible loss of principal. The value of your investment will fluctuate over time and you may gain or lose money. A fund’s performance may be affected by risks that include those associated with non-diversification, non-investment grade debt securities, high-yield/high-risk securities, undervalued or overlooked companies, investments in specific industries or countries and potential conflicts of interest. Additional risks to funds may include those associated with investing in foreign securities, emerging markets, initial public offerings, real estate investment trusts (REITs), derivatives, short sales and companies with relatively small market capitalizations. Each fund has different risks, please see a Janus prospectus for more information about risk, fund holdings and other details. |

|

|

Indexes are not available for direct investment; therefore, their performance does not reflect the expenses associated with the active management of an actual portfolio. Russell 1000® Growth Index measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. Russell 1000® Value Index measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. Russell Midcap® Value Index measures the performance of those Russell Midcap® companies with lower price-to-book ratios and lower forecasted growth rates. Russell 2000® Value Index measures the performance of those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values. S&P 500® Index is a commonly recognized, market capitalization weighted index of 500 widely held equity securities, designed to measure broad U.S. equity performance. MSCI World IndexSM is a market capitalization weighted index composed of companies representative of the market structure of Developed Market countries in North America, Europe and the Asia/Pacific Region. MSCI EAFE® Index is a market capitalization weighted index composed of companies representative of the market structure of Developed Market countries in Europe, Australasia and the Far East. MSCI World Growth Index is a subset of the Morgan Stanley Capital WorldSM Index which is a market capitalization weighted index composed of companies representative of the market structure of developed market countries around the world. The index includes reinvestment of dividends, net of foreign withholding taxes. MSCI World High Dividend Yield Index is a free float-adjusted market capitalization-weighted index based on the MSCI World Index, its parent index, which includes large- and mid-cap stocks across 24 Developed Market Countries. The MSCI World High Dividend Yield Index is designed to reflect the performance of equities with higher-than-average dividend yields and pass dividend sustainability and persistence screens. MSCI All Country World Index is a free float-adjusted market capitalization weighted index that is designed to measure performance of global developed and emerging equity markets. MSCI All Country World ex-U.S. IndexSM is an unmanaged, free float-adjusted, market capitalization weighted index composed of stocks of companies located in countries throughout the world, excluding the United States. It is designed to measure equity market performance in global developed and emerging markets outside the United States. The index includes reinvestment of dividends, net of foreign withholding taxes. Russell 1000 Index measures performance of the 1,000 largest companies in the Russell 3000 Index. Core Growth Index is an internally calculated, hypothetical combination of unmanaged indices that combines total returns from the Russell 1000® Growth Index (50%) and the S&P 500® Index (50%). MSCI USA Index is a free float-adjusted market capitalization index that is designed to measure large and mid cap U.S. equity market performance. MSCI World ex Australia Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets excluding Australia. MSCI KOKUSAI World ex Japan Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets excluding Japan. MSCI Europe Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe. Please consider the charges, risks, expenses and investment objectives carefully before investing. For a prospectus or, if available, a summary prospectus containing this and other information, please call Janus at 1-800-525-3713 or download the file from www.janus.com. Read it carefully before you invest or send money. Funds distributed by Janus Distributors LLC C-0413-37093 07-15-13 Other important disclosures |

|

|

Safe harbor statement This presentation includes statements concerning potential future events involving Janus Capital Group Inc. that could differ materially from the events that actually occur. The differences could be caused by a number of factors including those factors identified in Janus’ Annual Report on Form 10-K for the year ended December 31, 2012, on file with the Securities and Exchange Commission (Commission file no. 001-15253), including those that appear under headings such as “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Many of these factors are beyond the control of the company and its management. Any forward-looking statements contained in this presentation are as of the date on which such statements were made. The company assumes no duty to update them, even if experience, unexpected events, or future changes make it clear that any projected results expressed or implied therein will not be realized. |