Attached files

|

|

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION |

|

Washington, D.C. 20549 |

|

|

|

FORM 10-K |

|

|

|

x ANNUAL REPORT PURSUANT TO SECTION 13 OR

15(d) OF THE SECURITIES |

|

For the fiscal year ended December 31, 2012 |

|

|

|

OR |

|

|

|

o TRANSITION REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES |

|

For the transition period from _______ to ________ |

|

|

|

Commission File Number: 000-53681 |

|

|

|

|

|

|

ECHO AUTOMOTIVE, INC. |

|

|

|

|

|

|

(Exact name of registrant as specified in its charter) |

||

|

|

|

|

Nevada |

98-0599680 |

|

(State or Other Jurisdiction of |

(I.R.S. Employer |

16000 North 80th Street, Suite E Scottsdale, AZ 85260

(Address of Principal Executive Offices)

(855) 324-7288

(Registrant’s telephone number)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, Par Value $0.001

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment of this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company þ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was $0 as of June 30, 2012.

| Class | Outstanding at April 10, 2013 | |

| Common stock, par value $.001 | 75,000,000 |

| TABLE OF CONTENTS | |||||

| Page Numbers | |||||

| PART I | |||||

| Item 1. | Business | 2 | |||

| Item 1A. | Risk Factors | 9 | |||

| Item 1B. | Unresolved Staff Comments | 19 | |||

| Item 2. | Properties | 19 | |||

| Item 3. | Legal Proceedings | 20 | |||

| Item 4. | Mine Safety Disclosures | 20 | |||

| PART II | |||||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities | 21 | |||

| Item 6. | Selected Financial Data | 21 | |||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 22 | |||

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 26 | |||

| Item 8. | Financial Statements and Supplementary Data | 26 | |||

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 26 | |||

| Item 9A. | Controls and Procedures | 27 | |||

| Item 9B. | Other Information | 28 | |||

| PART III | |||||

| Item 10. | Directors, Executive Officers and Corporate Governance | 29 | |||

| Item 11. | Executive Compensation | 33 | |||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 36 | |||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 37 | |||

| Item 14. | Principal Accounting Fees and Services | 38 | |||

| PART IV | |||||

| Item 15. | Exhibits, Financial Statement Schedules | 39 | |||

| SIGNATURES | 43 | ||||

PART I

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some discussions in this Annual Report on Form 10-K contain forward-looking statements that have been made pursuant to the provisions of the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties and relate to future events or future financial performance. A number of important factors could cause our actual results to differ materially from those expressed in any forward-looking statements made by us in this Form 10-K. Forward-looking statements are often identified by words such as “believe,” “expect,” “estimate,” “anticipate,” “intend,” “project,” “plans,” “seek” and similar expressions or words which, by their nature, refer to future events. In some cases, you can also identify forward-looking statements by terminology such as “may,” “will,” “should,” “plans,” “predicts,” “potential” or “continue” or the negative of these terms or other comparable terminology.

These forward-looking statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” below that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. In addition, you are directed to factors discussed in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section as well as those discussed elsewhere in this Form 10-K.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results. However, readers should carefully review the risk factors set forth in other reports or documents the Company files from time to time with the Securities and Exchange Commission (the “SEC”), particularly the Company’s Quarterly Reports on Form 10-Q and any Current Reports on Form 8-K. All written and oral forward-looking statements made subsequent to the date of this report and attributable to us or persons acting on our behalf are expressly qualified in their entirety by this section.

Unless otherwise indicated, references to “we,” “our,” “us,” “ECAU,” the “Company” or the “Registrant” refer to Echo Automotive, Inc., a Nevada corporation and its wholly owned subsidiary Echo Automotive, LLC, an Arizona limited liability company (“Echo LLC”).

| 1 |

ITEM 1. BUSINESS

Corporate History

We were organized under the laws of the State of Nevada on September 2, 2008. On August 27, 2012, we effected a stock dividend of four shares of common stock of the Company for each share of common stock issued and outstanding. Effective September 24, 2012, we amended our Articles of Incorporation to change our name from “Canterbury Resources, Inc.” to “Echo Automotive, Inc.” On October 11, 2012, we closed a voluntary exchange transaction (the “Exchange”) with Echo Automotive, LLC, an Arizona limited liability company (“Echo LLC”), and DBPJ Stock Holding, LLC, an Arizona limited liability company and sole member of Echo (the “Echo LLC Member”) pursuant to an Exchange Agreement dated September 21, 2012 (the “Exchange Agreement”) by and among the Company, Echo LLC, and the Echo LLC Member. As a result of the Exchange, the Echo LLC Member acquired 70% of our issued and outstanding common stock, Echo LLC became our sole wholly-owned subsidiary, and we acquired the business and operations of Echo LLC.

Nature of Operations

Echo LLC, formerly known as Controlled Carbon, LLC, was incorporated on November 25, 2009. Echo LLC is an Arizona limited liability company in the development stage with several technologies and specific methods that we believe, allow commercial fleet vehicles to reduce their overall fuel expenses. The business plan for Echo LLC is based on providing the marketplace a business proposition for reducing the use of fossil fuels by augmenting power trains within existing commercial fleet vehicles with energy efficient electrical assist delivered through electric motors powered by Echo LLC’s modular plug-in battery modules to achieve tangible operating results including the potential of a quick return on the investment (of the EchoLLCconversion) for such amended vehicles.

Echo LLC operations to date have been funded by advances, private “family and friends” capital contributions, and subsequent equity conversions by the majority stockholders. Echo LLC’s working and growth capital is dependent on more significant future funding expected to be provided in part by equity investments from other accredited investors including institutional investors. There can be no assurance that any of these strategies will occur or be achieved on satisfactory terms.

For the year ended December 31, 2012, we had a net loss of $2,362,922 as compared to a net loss of $300,542 for the year ended December 31, 2011. In 2011, we shifted from our previous business plan of marketing carbon credits and entered into a new business model of the development of technology that allows commercial vehicle fleets to reduce their overall fuel expense.

Strategy

We develop technologies and products that allow the conversion of existing vehicles into fuel efficient hybrids and plug-in hybrids. Key to our strategy is the bolt-on nature of our solutions that introduce little, or in some cases, no additional points of failure, making our offerings very low risk compared to other solutions.

We have developed a modular platform called EchoDrive™. This platform includes component technologies, such as battery modules, control systems, propulsion modules and vehicle interface systems that can then be deployed in different configurations on a broad range of vehicles. By leveraging the EchoDrive™ platform, solutions can be configured as hybrid, plug-in hybrid or even pseudo electric, where electrons generated by braking are captured as electricity and harnessed in the battery cells for electric motor use.

We believe by developing these technologies in modular fashion, we can efficiently modify, augment and reposition our offerings to fulfill a broad range of customer needs or quickly adapt to changes in the marketplace. In addition, the characteristics of each vehicle as well the mission of each customer is different, so the EchoDrive™ platform will allow for unparalleled configurability from motor placement to battery capacity. This flexibility, we believe, allows EchoDrive™’s to be easily bolted on to or retrofit in an existing vehicle and assist it with inexpensive electrical energy to increase its fuel efficiency. This modular solution will likely allow us to deploy our solution on a broad range of vehicles quickly and with reduced research and development expense.

| 2 |

By targeting the commercial fleet vehicle market, we plan to benefit from the need to reduce overall operating costs by selling multiple kits to each customer for like type vehicles. We are currently in the process of assembling a financing program as an option to our customers to acquire EchoDrive™kits.

Our sales and marketing strategy employs both direct as well as indirect sales channels, including distribution partnerships with service companies, fleet financing and other entities that currently serve the fleet market.

The Opportunity

Although there has been much promise and excitement surrounding next generation hybrids, alternative fuel and electric vehicles, to date in the world of commercial fleet vehicle electrification, there has yet to be any significant adoption due to the overwhelming capital expenditure required to realize a sustainable and profitable business. We believe that widespread adoption of these new vehicles will probably take a decade or more as fleet operators are, by their nature, risk adverse and slow in their adoption of unproven vehicles. The current electric fleet vehicle industry is largely fragmented and has been relatively inept in its ability to profitably and reliably deliver vehicles, parts and know-how in any volume. With failures of two of the top leaders in fleet electrification within the first half of 2011 (Bright Automotive and Azure Dynamics), we believe fleet operators will remain skeptical for years to come. Until the cost of producing electric vehicles drops drastically, and the return on investment is reasonably shorter than the vehicle’s expected lifetime, we believe that fleets will not adopt these vehicles in mass.

The Solution

EchoDrive™ system is a solution for converting commercial fleet vehicles into fuel-efficient plug-in hybrids. Today’s internal combustion engines are highly inefficient in that they still only use a small percentage of the energy received from fossil fuels consumed. We believe that fleet operators can reduce their operating expenses with EchoDrive™. EchoDrive™ can be bolted onto new and existing vehicles to reduce a vehicle’s fuel consumption. The EchoDrive™ components include an electric motor, system controller and modular battery-packs that enable the ‘right-sizing’ of the battery and align to the customer’s needs and budget. With EchoDrive™ installed, these vehicles are then plugged in using any available power source from a standard 110 voltage outlet to any industry standard rapid charger via the integrated ‘J-Plug’, thereby increasing energy efficiency with grid power.

During operation of the vehicle, EchoDrive™ applies the stored energy via the electric motor to assist the power train when the internal combustion engine is most inefficient, reducing the workload of the engine and the use of fossil fuels. Like hybrid vehicles, EchoDrive™ recaptures energy (electrons) for its battery packs when the vehicles utilize their brakes. Additionally, EchoDrive™’s engineering allows for uninterrupted driving in the unlikely event of most system or component failures, making EchoDrive™a good alternative for critical fleet operations.

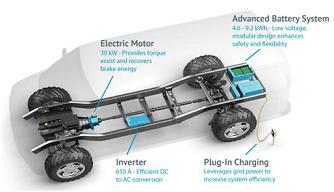

Technology, Products and Distribution

EchoDrive™ is a modular set of components that can be assembled in different configurations to support a broad range of client requirements (see diagram below). This approach will enable us to move our offerings into other product areas including hybrids and OEM fittings. We have developed our system and software to be component sourcing independent therefore allowing for flexible system revisions and changes where necessary. We are also employing a “self-learning” type programming style that will allow for the system to improve itself over time. This programming approach analyzes captured real data and permits additional adjustments for use of the electric motor and battery components in response to actual drive demand to optimize potential incremental efficiency gain.

| 3 |

Products in Development

We have developed a plug-in hybrid electric vehicle (PHEV) technology, branded as EchoDrive™. EchoDrive™ is being targeted at commercial vehicle fleets in the United States and internationally.

We have EchoSolutions™ as a consulting business unit to assist with product and service development for customers or within the supplier chain including auto manufacturers.

Additionally, we are in the process of launching our financing solution for customers for renting EchoDrive™ through EchoFinance™.

Distribution

We are focused on direct sales via our in-house marketing team to reach large-scale U.S. fleet customers, while national and regional distribution partners will also be leveraged to access medium and small-sized fleets. Internationally, we will partner with leading distribution agents to deploy the EchoDrive™ product through a licensing strategy. No distribution agreements are currently in place.

Strategic Advantages of EchoDrive™

Short Term Return on Investment

EchoDrive™’s solution objective is to achieve a more competitive payback with less reliance on extensive government subsidies and by being a price sensitive provider relative to the gained efficiencies and fuel savings.

Low Risk to Fleet Operations

In the unlikely event of a component failure, the vehicle will simply revert to its pre conversion operating capabilities of full gasoline powered engine operation. This reduces the fear of unproven new technologies affecting operations.

Flexible Electric Energy System

We believe our scalable and modular electrical storage system allows fleets to deploy the right amount of expensive batteries for the need on each vehicle to shorten the return on investment and align to the customer needs and budget. Battery cells are relatively expensive and therefore wedo not provide a “one size fits all” approach with our

| 4 |

battery approach. We perform a significant review of how many battery packs are required for any given customer which alleviates the incremental cost.

Flexible Solution Set

EchoDrive™’s flexible strategy and design is designed for broad deployment. Complete retrofit kits and new vehicles require significant design and regulatory approval. EchoDrive™ can be fitted on most vehicles with simply engineered adapter plates and brackets. Our strategy is to fit many types of fleet vehicles through its “simple” design and flexible component approach.

Scalable

By leveraging mostly off-the-shelf components from industry leading automotive suppliers, EchoDrive™ can scale without the same manufacturing risks that plague full retrofit providers and Original Equipment Manufacturers (“OEMs”).

Disadvantages of EchoDrive™

While we believe that EchoDrive™ substantially reduces energy costs, it does not provide the full benefit of anall-electric vehicle or range-extending hybrid. In the case of an electric vehicle, efficiency ratings are significantly higher. Range-extending hybrid vehicles also offer significant efficiency results compared to EchoDrive™. Furthermore, EchoDrive™ does not include start/stop capability, which is a feature that shuts the internal combustion engine off at idle conditions thereby further increasing efficiency where drive cycles have more frequent idle opportunities.

Recent Developments

Bright Automotive, Inc. Facilities and Key Staff

Bright Automotive, Inc. was established in 2008 as an offspring of the non-profit Rocky Mountain Institute to commercialize and develop the IDEA plug-in hybrid electric fleet vehicle. Bright Automotive ceased operations in March 2012 after failing to obtain a loan through the Advanced Technology Vehicles Manufacturing Loan Program. We successfully hired key members of the Bright Automotive team and acquired certain facilities and intellectual property in a bid to accelerate EchoDrive™’s commercialization in spring of 2012.In the first quarter of 2013, Bright Automotive, Inc.’s assets, including all of its intellectual properties and patents, were auctioned off and were purchased by Advanced Technical Asset Holdings, LLC (“ATAH”). Subsequent to our fiscal year ended December 31, 2012, we acquired ATAH for 6,000,000 shares of our common stock as part of an exchange agreement with ATAH in which we received full ownership of the assets described above (“ATAH Exchange”). We plan to use the intellectual property and patents to develop additional electrification solutions for the marketplace.

System Patent Filed

In January 2012, a System Patent (Dual Fuel Plug-in Hybrid, Provisional Patent #: 61587987) was filed by CleanFutures. As discussed in detail in the “Intellectual Property” section below, we which we have a binding licensing with CleanFutures for the use of their technology.

We have a Bright perpetual license to develop and sell derivative works that are derived from Bright intellectual property regarding battery design. Those intellectual property rights for us include U.S Patents Applications No. 12/569,987 and No. 61/482,908. As noted above, in the first quarter of 2013, Bright Automotive, Inc.’s assets, including all of its intellectual properties and patents, were auctioned off and were purchased by ATAH. We have full ownership of those licenses and patents as part of the ATAH Exchange.

To further protect EchoDrive™, we have a provisional utility patent filed for electric drive retrofitting to internal combustion automobiles.

| 5 |

Revenues and Customers

we are in the research and development phase and therefore currently have no contracted customers. Our sales plan intends to generate revenue through the following distribution channels:

- Pre–Sales Activities such as Fleet Evaluations

- EchoDrive™ Product Sales

- Installation and Support Services

- Echo Solutions™ Consulting Services

- Referral and commission revenue from such partners as financing partners.

- Territory sales for Echo Automotive™ distributors.

We will focus our initial sales efforts on the fleet vehicle market. We will aim to increase our conversion rate and enhance our margins by focusing on fleets that will benefit most from the EchoDrive™ technology.

Additionally, through Echo Solutions™, we intend to provide services to automotive companies and component manufacturers and specialty equipment manufacturers and converters. We anticipate the annual revenue contribution from the foregoing to be less than $1,000,000.

Intellectual Property

We entered into a License Agreement with CleanFutures, LLC (“CleanFutures”) dated February 1, 2012 (the “License Agreement”). In accordance with the License Agreement, CleanFutures has agreed to provide us, within the original equipment, service parts and aftermarket passenger automobile, light truck, field, heavy truck industries and any other automotive sector (with the exception of the hummer market), an exclusive license, with the right to grant sublicenses, under CleanFutures’ patents and CleanFutures’ technology, to make, have made, use, sell or import any products using CleanFutures’ dual-fuel, plugin hybrid technology (Provisional Patent #61587987). After execution of the License Agreement, we and CleanFutures determined that the original intent of the License Agreement was not being met or adhered to. Therefore, we and CleanFutures voluntarily negotiated and on April 5, 2013 agreed upon a revised license agreement that is more aligned with the actual metrics of our relationship with CleanFutures. The revised agreement provides us with a non-exclusive perpetual right to the CleanFutures Patents and Technology, which provides us with additional technology to include in our platform, royalty free by providing a promissory note to issue CleanFutures1,850,000 shares of our restricted common stock.

Further, we have entered into a License Agreement with Bright Automotive, Inc. (“Bright”) dated June 28, 2012 (the “Bright Agreement”). In accordance with the Bright Agreement, Bright has provided to us a royalty-free, perpetual, fully-paid up, worldwide, non-exclusive, non-transferable and non-sub-licensable limited license to use Bright’s Battery Management Software and CAD, and certain other intellectual property of Bright, as detailed in the Bright Agreement, to develop, modify and/or sell, offer for sale, market, distribute, import and export derivative works. In consideration of the granting of the license, we paid to Bright a one time up-front license fee in the amount of $50,000, which we have included within intangible assets in the accompanying balance sheet as of December 31, 2012

As noted above, in the first quarter of 2013, Bright Automotive, Inc.’s assets, including all of its intellectual properties and patents, were auctioned off and were purchased by ATAH. We have full ownership of those licenses and patents as part of the ATAH Exchange.

We are developing additional intellectual property and are taking all necessary steps to protect our ability to do so. However, the validity of patents, even when licensed, approved and issued, can still be challenged by third parties. There is the risk that there are competing patents or technologies existing at the time the patent was issued, prior or afterwards, that were overlooked when the patent was filed and/or issued. Patents can be challenged and lost based on previously existing prior art. There are also multiple rules and regulations one must follow when challenging a patent or making claims when prosecuting a patent. Patent law is complex and expensive. Although we feel secure with our patents and respective licenses, there always remains the possibility that challenges to the licenses or underlying patents may arise and make our patents invalid.

We will continue to evaluate the business benefits in pursuing patents in the future. We have engaged with both our legal team and outside intellectual property process experts to create an internal workflow to capture, protect and file

| 6 |

the appropriate documentation to best protect our intellectual property. However, third parties may, in an unauthorized manner, attempt to use, copy or otherwise obtain and market or distribute our intellectual property or technology or otherwise develop a product with the same functionality as our IP. Policing unauthorized use of intellectual property rights is difficult, and nearly impossible on a worldwide basis. Therefore, we cannot be certain that the steps we have taken or will take in the future will prevent misappropriation of our technology or intellectual property, particularly in foreign countries where we may do business, where the laws may not protect proprietary rights as fully as do the laws of the United States or where the enforcement of such laws is not common or effective.

We also have a number of trademarks we have filed which include, but are not limited to Echo Automotive™, EchoDrive™, and EchoFinance™. Echo Solutions™ is a common law trademark of ours. We have also filed a number of patents as part of our component design.

Manufacturing

We intend to rely on third party suppliers for the manufacture of existing components and outsource proprietary product manufacturing to subcontractors. We believe this approach allows for greater agility in responding to changing market demands, while effective communication and transfer of information between our suppliers will ensure products are drop shipped as per our requirements.

We will continuously monitor product demand to evaluate the optimal lot size. The optimal manufacturing lot size determines the cost effectiveness of the production process. The frequency and the volume of the production runs are then evaluated to enable just-in-time delivery from our vendor and supplier partners, while a range of production and control methods will be utilized to implement this across all aspects of the manufacturing process.

We believe that the manufacturing process will allow us to synchronize our inventory management system with our supply chain operations to ensure better inventory maintenance, inventory record accuracy and inventory access speed.

Quality Control & Warranties

Our staff includes employees, contractors and consultants who are six sigma certified and trained and will therefore include best business practices when deemed applicable as part of our quality assurance program intended to result in OEM grade processes and quality control. We will require third party providers to adhere to these practices and/or standards. All components and systems analysis work will encompass Design Failure Mode and Effects Analysis (DFMEA) work, which is in concert with OEM vehicle design and validation practices. Furthermore, each EchoDrive™ kit will be fully tested on in-house simulation equipment for effective operation of each component and system prior to shipment.

Industry

The demand for advance powertrain vehicles is on the rise. With increasing energy costs the market continues to grow. We believe the top 100 U.S. commercial fleets represent a significant opportunity for EchoDrive™. The industry is very fragmented, however, with small component technology randomly appearing in the market resulting in cohesive end-to-end providers being scarce and the commercialization of these products being at a premium. As material costs such as lithium ion (used in most battery storage systems) decrease, the adoption rate for such technologies will increase. The focus on advanced vehicle technology is growing and we believe a variety of opportunities are emerging as a result.

| 7 |

Markets

The U.S. Market

According to the U.S. Department of Transportation, there are over 100 million light-to-medium duty trucks on the road in the U.S. today. Many of these vehicles are used in commercial or government fleets. Initially, we intend to focus on selling EchoDrive™ into the existing fleet market, which consists of roughly 25 to 30 million vehicles in use today and approximately 2 million new vehicles purchased annually. We are initially focused on the top 100 commercial fleets, which represent significant potential opportunity for EchoDrive™.

Short ROI Drives International Adoption

We believe that there is opportunity internationally for achieving even greater ROI from use of our products due to the higher fuel prices relative to the United States. We believe international territory licensing will be key to servicing these markets to execute our international strategy.

Competition

Many companies today rely on commercial fleets to conduct business and with the ever-increasing energy costs,we believe the demand for advance vehicle technology solutions has never been higher. With that demand, there are new companies bringing technologies to market; however, most are focused on achieving very high efficiency ratings, which creates a very capital-intensive enterprise resulting in an expensive end-product for the customer. In most cases these technologies require the removal of most of the original powertrain, which is replaced with technologies that often have not been time-tested, therefore adding inherent risk to fleet operations. Additionally many competitors rely on government subsidies to support their financial equations, leaving them at the mercy of often varying political mandates.

Some of our competitors include Alt-e, Via Motors and AMP Electric Vehicles. Alt-e, requiresa complete transformation of the original drivetrain including removal of the engine and transmission and replacing it with a completely new powertrain. Via Motors also removes the original components in favor of an all-new system. AMP Electric Vehicles, which converts existing vehicles to full electric, offers conversions for very select models and again removes the entire drivetrain for purposes of adapting new technology in order to provide efficiency. Most of our competitors’ pricing is three times the cost of EchoDrive™.

Government Regulation

We conduct business within the confines of local, state and federal regulations, both in operations and for our products. Internationally, each unique market has specific requirements which are fully evaluated prior to solicitation.

Our products are subject to product safety regulations by federal, state, and local organizations. Accordingly, we may be required, or may voluntarily determine to obtain approval of our products from one or more of the organizations engaged in regulating product safety. These approvals could require significant time and resources from our technical staff and, if redesign were necessary, could result in a delay in the introduction of our products in various markets and applications.

All products must meet or exceed Federal Motor Vehicle Safety Standards (FMVSS) requirements; however, we also voluntarily comply with Environmental Protection Agency emission standards.

The Department of Transportation, National Highway Traffic Safety Administration (NHTSA) is charged with writing and enforcing safety, theft-resistance, and fuel economy standards for motor vehicles through their Federal Motor Vehicle Safety Standards. These standards require manufacturers to design their electrically powered vehicles so that, in the event of a crash, the electrical energy storage, conversion, and traction systems are either electrically isolated from the vehicle's chassis or their voltage is below specified levels considered safe from electric shock hazards. Our products are designed to meet or exceed FMVSS requirements.

Our products have been designed to comply with EPA emission standards and we believe they will comply with future requirements if and when they go into effect. Because we expect that environmental standards

| 8 |

will become even more stringent over time, we will continue to incur some level of research, development and production costs in this area for the foreseeable future.

Further, federal, state, and local regulations impose significant environmental requirements on the manufacture, storage, transportation, and disposal of various components of plug-in hybrid electric systems. Although we believe that our operations are in material compliance with current applicable environmental regulations, there can be no assurance that changes in such laws and regulations will not impose costly compliance requirements on us or otherwise subject us to future liabilities. Moreover, federal, state, and local governments may enact additional regulations relating to the manufacture, storage, transportation, and disposal of components of plug-in hybrid electric systems. Compliance with such additional regulations could require us to devote significant time and resources and could adversely affect demand for our products. There can be no assurance that additional or modified regulations relating to the manufacture, storage,transportation, and disposal of components of plug-in hybrid electric systems will not be imposed.

The Magnuson-Moss Warranty Act enables purchasers of vehicles to make modifications to a vehicle without affecting the vehicle’s manufacture warranty. In the event of a related failure, the burden of proof is on the manufacture to show the failure was due to the installation of said component(s).

While we do not construct our products around government subsidies and tax incentives, there are many state and federal subsidies which our products would be eligible for. For example, in Colorado, consumers can qualify for up to $6,000 in government rebates for plug-in hybrid electric vehicle (“PHEV”) conversions. There are a number of other states that offer a variety of incentives for such conversions. The federal government also offers up to $7,500 in tax credits for similar PHEV conversions.

Employees

We have 10 full-time employees. All employees are required to execute non-disclosure agreements as part of their employment.

Corporate Information

Our principal executive offices are located at: 16000 North 80th Street,Suite E,Scottsdale, AZ 85260. Our main telephone number is: (855) 324-7288. The Registrant’s website is located at: http://www.echoautomotive.com/.

ITEM 1A. RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in our public filings before making an investment decision with regard to our securities. If any of the following events described in these risk factors actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Business and Industry

We have incurred losses in prior periods and may incur losses in the future.

We cannot be assured that we can achieve or sustain profitability on a quarterly or annual basis in the future. Our operations are subject to the risks and competition inherent in the establishment of a business enterprise. There can be no assurance that future operations will be profitable. We may not achieve our business objectives and the failure to achieve such goals would have an adverse impact on us.

Our future is dependent upon our ability to obtain financing. If we do not obtain such financing, we may have to cease our activities and investors could lose their entire investment.

| 9 |

There is no assurance that we will operate profitably or generate positive cash flow in the future. We will require additional financing in order to proceed with the manufacture and distribution of our products, including our Echo Drive™ technology. We will also need more funds if the costs of the development and operation of our existing technologies are greater than we have anticipated. We will also require additional financing to sustain our business operations if we are not successful in earning revenues. We may not be able to obtain financing on commercially reasonable terms or terms that are acceptable to us when it is required. Our future is dependent upon our ability to obtain financing. If we do not obtain such financing, our business could fail and investors could lose their entire investment.

Because we may never earn significant revenues from our operations, our business may fail and investors may lose all of their investment in our Company.

We have a history of limited revenues from operations. We have yet to generate positive earnings and there can be no assurance that we will ever operate profitably. Additionally, our company has a limited operating history. If our business plan is not successful and we are not able to operate profitably, then our stock may become worthless and investors may lose all of their investment in our company.

Prior to obtaining meaningful customers and distribution for our products, we anticipate that we will incur increased operating expenses without realizing any significant revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the sale of our products in the future, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide no assurance that we will generate sufficient revenues or ever achieve profitability. If we are unsuccessful in addressing these risks, our business will fail and investors may lose all of their investment in our company.

Our limited operating history makes evaluating our business and future prospects difficult, and may increase the risk of your investment.

We have a very limited operating history on which investors can base an evaluation of our business, operating results and prospects. Of even greater significance is the fact that we have no operating history with respect to augmenting existing power trains with highly efficient electrical energy delivered by electric motors powered by our modular plug-in battery modules.

While the basic technology has been verified, we only recently have begun the commercialization of the complete plug-in hybrid electric vehicle (PHEV) system in preparation for our initial conversion of a vehicle. This limits our ability to accurately forecast the cost of the conversions or to determine a precise date on which the commercial platform for vehicle conversions will be widely released.

We are currently evaluating, qualifying and selecting our suppliers for the hybrid conversion system. However, we may not be able to engage suppliers for the remaining components in a timely manner, at an acceptable price or in the necessary quantities. In addition, we may also need to do extensive testing to ensure that the conversions are in compliance with applicable National Highway Traffic Safety Administration (NHTSA) safety regulations and United States Environmental Protection Agency (EPA) regulations prior to full distribution to our licensees. Our plan to complete the initial commercialization of the hybrid conversion system is dependent upon the timely availability of funds, upon our finalizing the engineering, component procurement, build out and testing in a timely manner. Any significant delays would materially adversely affect our business, prospects, financial condition and operating results. Consequently, it is difficult to predict our future revenues and appropriately budget for our expenses, and we have limited insight into trends that may emerge and affect our business. In the event that actual results differ from our estimates or we adjust our estimates in future periods, our operating results and financial position could be materially affected. If the markets for hybrid electric conversions and/or electric motors and generators do not develop as we expect or develop more slowly than we expect, our business, prospects, financial condition and operating results will be harmed.

Decreases in the price of oil, gasoline and diesel fuel may influence the conversions to plug-in hybrid electric vehicles, which may slow the growth of our business and negatively impact our financial results.

| 10 |

The market for plug-in hybrid electric vehicle conversions is relatively new, rapidly evolving, characterized by rapidly changing technologies, evolving government regulation, and changing consumer demands and behaviors.Prices for oil, gasoline and diesel fuel can be very volatile. Increases in the price of fuels will likely raise interest in plug-in hybrid conversions. Decreases in the price of fuels will likely reduce interest in conversions and reduced interest could slow the growth of our business.

Our growth depends in part on environmental regulations and programs mandating the use of vehicles that get better gas mileage and generate fewer emissions and any modification or repeal of these regulations may adversely impact our business.

Enabling commercial customers to meet environmental regulations and programs in the United States that promote or mandate the use of vehicles that get better gas mileage and generate fewer emissions is an integral part of our business plan. Industry participants with a vested interest in gasoline and diesel invest significant time and money in efforts to influence environmental regulations in ways that delay or repeal requirements for cleaner vehicle emissions. Furthermore, the economic recession may result in the delay, amendment or waiver of environmental regulations due to the perception that they impose increased costs on the transportation industry or the general public that cannot be absorbed in a shrinking economy. The delay, repeal or modification of federal or state regulations or programs that encourage the use of more efficient and/or cleaner vehicles could slow our growth and adversely affect our business.

Some aspects of our business will depend in part on the availability of federal, state and local rebates and tax credits for hybrid electric vehicles, and as such, a reduction in these incentives would increase the cost of conversions for our customers and could significantly reduce our revenue.

Hybrid conversions for the general public will depend in part on tax credits, rebates and similar federal, state and local government incentives that promote hybrid electric vehicles. We anticipate that fleet owners will be less reliant on incentives. As for other products we create, there should be no reliance at all. Nonetheless, any reduction, elimination or discriminatory application of federal, state and local government incentives and other economic subsidies or tax credits because of policy changes, the reduced need for such subsidies or incentives due to the perceived success of the hybrid conversions, fiscal tightening or other reasons may have a direct or indirect material adverse effect on our business, financial condition, and operating results.

We may experience significant delays in the design and implementation of our technology into the motors of the companies with which we may have research and development agreements with, which could harm our business and prospects.

Any delay in the financing, design, and implementation of our technology into the motor of the companies with which we may have research and development agreements could materially damage our brand, business, prospects, financial condition and operating results. Motor manufacturers often experience delays in the design, manufacture and commercial release of new product lines.

If we are unable to adequately control the costs associated with operating our business, including our costs of sales and materials, our business, financial condition, operating results and prospects will suffer.

If we are unable to maintain a sufficiently low level of costs for designing, marketing, selling and distributing our conversion system relative to their selling prices, our operating results, gross margins, business and prospects could be materially and adversely impacted. We have made, and will be required to continue to make, significant investments for the design and sales of our system and technologies. There can be no assurances that our costs of producing and delivering our system and technologies will be less than the revenue we generate from sales, licenses and/or royalties or that we will achieve our expected gross margins.

We may be required to incur substantial marketing costs and expenses to promote our systems and technologies, even though our marketing expenses to date have been relatively limited. If we are unable to keep our operating costs aligned with the level of revenues we generate, our operating results, business and prospects will be harmed. Many of the factors that impact our operating costs are beyond our control. For example, the costs of our

| 11 |

components could increase due to shortages as global demand for these products increases. Indeed, if the popularity of hybrid conversions exceeds current expectations without significant expansion in battery production capacity and advancements in battery technology, shortages could occur which would result in increased costs to us.

We will be dependent on our suppliers, some of which are single or limited source suppliers, and the inability of these suppliers to continue to deliver, or their refusal to deliver, necessary components at prices and volumes acceptable to us would have a material adverse effect on our business, prospects and operating results.

We are currently and continually evaluating, qualifying and selecting suppliers for our conversion system. We will source globally from a number of suppliers, some of whom may be single source suppliers for these components. While we obtain components from multiple sources whenever possible, it may not always be possible to avoid purchasing from a single source. To date, we have not qualified alternative sources for any of our single sourced components.

While we believe that we may be able to establish alternate supply relationships and can obtain or engineer replacements for our single source components, we may be unable to do so in the short term or at all at prices or costs that are favorable to us. In particular, while we believe that we will be able to secure alternate sources of supply for almost all of our single-sourced components in a relatively short time frame, qualifying alternate suppliers or developing our own replacements for certain highly customized components may be time consuming and costly.

The supply chain will expose us to potential sources of delivery failure or component shortages. If we experience significant increased demand, or need to replace our existing suppliers, there can be no assurance that additional supplies of component parts will be available when required on terms that are favorable to us, at all, or that any supplier would allocate sufficient supplies to us in order to meet our requirements or fill our orders in a timely manner. The loss of any single or limited source supplier or the disruption in the supply of components from these suppliers could lead to delays to our customers, which could hurt our relationships with our customers and also materially adversely affect our business, prospects and operating results.

Changes in our supply chain may result in increased cost and delay. A failure by our suppliers to provide the necessary components could prevent us from fulfilling customer orders in a timely fashion which could result in negative publicity, damage our brand and have a material adverse effect on our business, prospects, financial condition and operating results.

The use of plug-in hybrid electric vehicles in vehicle components or electric motors may not become sufficiently accepted for us to expand our business.

To expand our conversion business, we must license new fleet, dealer and service center customers. We cannot guarantee that we will be able to develop these customers or that they will sign our license contracts. Whether we will be able to expand our customer base will depend on a number of factors, including the level of acceptance of plug-in hybrid electric vehicles by fleet owners and the general public. A failure to expand our customer base could have a material adverse effect on our business, prospects, financial condition and operating results.

If there are advances in other alternative vehicle fuels or technologies, or if there are improvements in gasoline or diesel engines, demand for hybrid electric conversions and/or our other products may decline and our business may suffer.

Technological advances in the production, delivery and use of alternative fuels that are, or are perceived to be, cleaner, more cost-effective than our traditional fuel or electric combination have the potential to slow adoption of plug-in hybrid electric vehicles. Hydrogen, compressed natural gas and other alternative fuels in experimental or developmental stages may eventually offer a cleaner, more cost-effective alternative to our gasoline or diesel and electric combination. Equally, any significant improvements in the fuel economy or efficiency of the internal combustion engine may slow conversions to plug-in hybrid vehicles and, consequently, would have a detrimental effect on our business and operations.

| 12 |

While we are not aware of any pending innovations in or introductions of new heat reduction or heat transfer technologies, that does not mean none are in the offing. We have no control of what our competitors are doing nor awareness of their plans until such information is released for general consumption. The introduction of any new technology that offers better or equivalent results at a lower price would have a detrimental effect on our business and operations.

Our research and commercialization efforts may not be sufficient to adapt to changes in electric vehicle technology.

As technologies change, we plan to upgrade or adapt our conversion system in order to continue to provide vehicles with the latest technology, in particular battery technology. However, our conversions may not compete effectively with alternative vehicles if we are not able to source and integrate the latest technology into our conversion system. For example, we do not manufacture battery cells and that makes us dependent upon other suppliers of battery cell technology for our battery packs.

Any failure to keep up with advances in electric or internal combustion vehicle technology would result in a decline in our competitive position which would materially and adversely affect our business, prospects, operating results and financial condition.

The cyclical nature of business cycles can adversely affect our business.

Our business is directly related to general economic conditions which can be cyclical. It also depends on other factors, such as corporate and consumer confidence and preferences. A significant increase in global sales of electric or hybrid vehicles could have a direct impact on our earnings and cash flows by lowering the need to convert existing vehicles to plug-in hybrids. Equally, a significant decrease in the global sales of electric motors and generators could have a direct impact on our earnings and cash flows. The realization of either situation would also have an adverse effect on our business, results of operations and financial condition.

A prolonged economic downturn or economic uncertainty could adversely affect our business and cause us to require additional sources of financing, which may not be available.

Our sensitivity to economic cycles and any related fluctuation in the businesses of our fleet customers, electric motor manufacturers or income of the general public may have a material adverse effect on our financial condition, results of operations or cash flows. If global economic conditions deteriorate or economic uncertainty increases, our customers and potential customers may experience lowered incomes or deterioration of their businesses, which may result in the delay or cancellation of plans to convert their vehicles, reduced license sales or reduced royalties from sales by licensees. As a consequence, our cash flow could be adversely impacted.

Any changes in business credit availability or cost of borrowing could adversely affect our business.

Declines in the availability of business credit and increases in corporate borrowing costs could negatively impact the number of conversions performed and the number of electric motors manufactured. Substantial declines in the number of conversions by our customers could have a material adverse effect on our business, results of operations and financial condition. In addition, the disruption in the capital markets that began in 2008 has reduced the availability of debt financing to support the conversion of existing vehicles into plug-in hybrids. If our potential customers are unable to access credit to convert their vehicles, it would impair our ability to grow our business.

We may incur material losses and costs as a result of warranty claims and product liability actions that may be brought against us.

We face an inherent business risk of exposure to product liability in the event that our hybrid conversions or other products fail to perform as expected and, in the case of product liability, failure of our products results in bodily injury and/or property damage. Our customers have expectations of proper performance and reliability of our hybrid conversions and any other products that we may supply. If flaws in the design of our products were to occur, we could experience a rate of failure in our hybrid conversions or other products that could result in significant charges

| 13 |

for product re-work or replacement costs. Although we will engage in extensive quality programs and processes, these may not be sufficient to avoid conversion or product failures, which could cause us to:

| ● lose revenue; | |

| ● incur increased costs such as costs associated with customer support; | |

| ● experience delays, cancellations or rescheduling of conversions or orders for our products; | |

| ● experience increased product returns or discounts; or | |

| ● damage our reputation; |

all of which could negatively affect our financial condition and results of operations. If any of our hybrid conversions or other products are or are alleged to be defective, we may be required to participate in a recall involving such conversions or products. A recall claim brought against us, or a product liability claim brought against us in excess of our available insurance, may have a material adverse effect on our business.

If we are unable to enforce our intellectual property rights or if our intellectual property rights become obsolete, our competitive position could be adversely impacted.

We utilize a variety of intellectual property rights in our products. We view our portfolio of process and design technologies as one of our competitive strengths and we use it as part of our efforts to differentiate our product offerings. We may not be able to successfully preserve these intellectual property rights in the future and these rights could be invalidated, circumvented, challenged or infringed upon. In addition, the laws of some foreign countries in which our products may be sold do not protect intellectual property rights to the same extent as the laws of the United States. If we are unable to protect and maintain our intellectual property rights, or if there are any successful intellectual property challenges or infringement proceedings against us, our ability to differentiate our product offerings could diminish. In addition, if our intellectual property rights or work processes become obsolete, we may not be able to differentiate our product offerings and some of our competitors may be able to offer more attractive products to our customers. As a result, our business and financial performance could be materially and adversely affected.

Developments or assertions by us or against us relating to intellectual property rights could materially impact our business.

We expect to own or license significant intellectual property, including patents, and intend to be involved in numerous licensing arrangements. Our intellectual property should play an important role in maintaining our competitive position in a number of the markets we intend to serve. We will attempt to protect proprietary and intellectual property rights to our products and conversion system through available patent laws and licensing and distribution arrangements with reputable domestic and international companies. Despite these precautions, patent laws afford only limited practical protection in certain countries.

Litigation may also be necessary in the future to enforce our intellectual property rights or to determine the validity and scope of the proprietary rights of others or to defend against claims of invalidity. Such litigation could result in substantial costs and the diversion of resources. As we create or adopt new technology, we will also face an inherent risk of exposure to the claims of others that we have allegedly violated their intellectual property rights.

We cannot assure that we will not experience any intellectual property claim losses in the future or that we will not incur significant costs to defend such claims nor can we assure that infringement or invalidity claims will not materially adversely affect our business, results of operations and financial condition. Regardless of the validity or the success of the assertion of these claims, we could incur significant costs and diversion of resources in enforcing our intellectual property rights or in defending against such claims, which could have a material adverse effect on our business, results of operations and financial condition.

Any such imposition of a liability that is not covered by insurance, is in excess of insurance coverage or is not covered by an indemnification could have a material adverse effect on our business, results of operations and financial condition.

| 14 |

Liability or alleged liability could harm our business by damaging our reputation, requiring us to incur expensive legal costs in defense, exposing us to awards of damages and costs and diverting our attention away from our business operations. Any such liability could severely impact our business operations and/or revenues. If any claims or actions are asserted against us, we may seek to settle such claim by obtaining a license from the plaintiff covering the disputed intellectual property rights. We cannot provide any assurances, however, that under such circumstances a license, or any other form of settlement, would be available on reasonable terms or at all.

We may incur material losses, additional costs or even interruption of business operations as a result of fines or sanctions brought by government regulators.

We will likely be subject to various U.S. federal, state and local, and non-U.S. environmental, transportation and safety laws and regulations, such as requirements for aftermarket fuel conversion certification by the Environmental Protection Agency or separate requirements for aftermarket fuel conversion certification by California and other states. We cannot assure you that we will be at all times in complete compliance with such laws, regulations and permits. If we violate or fail to comply with these laws, regulations or certifications, we could be fined or otherwise sanctioned by regulators.

We may face risks from doing business internationally.

We may license, sell or distribute products outside the U.S., and derive revenues from these sources. Consequently, our revenues and results of operations will be vulnerable to currency fluctuations. We will report our revenues and results of operations in U.S. dollars, but a significant portion of our revenues could be earned outside of the U.S. We cannot accurately predict the impact of future exchange rate fluctuations on revenues and operating margins. Such fluctuations could have a material adverse effect on our business, results of operations and financial condition. Our business will also be subject to other risks inherent in the international marketplace, many of which are beyond our control. These risks include:

● laws and policies affecting trade, investment and taxes, including laws and policies relating to the repatriation of funds and withholding taxes, and changes in these laws;

● changes in local regulatory requirements, including restrictions on conversions;

● differing cultural tastes and attitudes;

● differing degrees of protection for intellectual property;

● financial instability;

● the instability of foreign economies and governments;

● war and acts of terrorism.

Any of the foregoing could have a material adverse effect on our business, financial condition and results of operations.

Our long-term growth depends upon technological innovation and commercialization.

Our ability to deliver our long-term growth strategy depends in part on the commercialization of new technology. A central aspect of our growth strategy is to improve our products and services through innovation, to obtain technologically advanced products through internal research and development and/or acquisitions, to protect proprietary technology from unauthorized use and to expand the markets for new technology by leveraging our infrastructure. Our success will depend on our ability to commercialize the technology that we have acquired and demonstrate the enhanced value our technology brings to our customers’ operations. Our major technological advances include, but are not limited to, those related to the design of technology to reduce overall fuel expenses in commercial fleet vehicles by augmenting existing power trains with highly efficient electrical energy delivered by electric motors powered by our modular plug-in battery modules. We cannot be assured of the successful commercialization of, and above-average growth from, our new products and services, as well as legal protection of our intellectual property rights. Any failure in the commercialization of our technology could adversely affect our business and results of operations.

| 15 |

Risks Relating to our Securities and our Status as a Public Company

The relative lack of public company experience of our management team may put us at a competitive disadvantage.

Our management team lacks public company experience and is generally unfamiliar with the requirements of the United States securities laws and U.S. Generally Accepted Accounting Principles, which could impair our ability to comply with legal and regulatory requirements such as those imposed by Sarbanes-Oxley Act of 2002. The majority of the individuals who now constitute our senior management team have never had responsibility for managing a publicly traded company. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Our senior management may not be able to implement programs and policies in an effective and timely manner that adequately responds to such increased legal, regulatory compliance and reporting requirements. Our failure to comply with all applicable requirements could lead to the imposition of fines and penalties and distract our management from attending to the growth of our business.

Shares of our common stock that have not been registered under the Securities Act of 1933, as amended, regardless of whether such shares are restricted or unrestricted, are subject to resale restrictions imposed by Rule 144, including those set forth in Rule 144(i) which apply to a “shell company.” In addition, any shares of our common stock that are held by affiliates, including any received in a registered offering, will be subject to the resale restrictions of Rule 144(i).

Pursuant to Rule 144 of the Securities Act of 1933, as amended (“Rule 144”), a “shell company” is defined as a company that has no or nominal operations; and, either no or nominal assets; assets consisting solely of cash and cash equivalents; or assets consisting of any amount of cash and cash equivalents and nominal other assets. As such, we may be deemed a “shell company” pursuant to Rule 144 prior to the Exchange, and as such, sales of our securities pursuant to Rule 144 are not able to be made until a period of at least twelve months has elapsed from the date on which our Current Report on Form 8-K is filed with the Commission reflecting our status as a non-“shell company.” Therefore, any restricted securities we sell in the future or issue to consultants or employees, in consideration for services rendered or for any other purpose will have no liquidity until and unless such securities are registered with the Commission and/or until a year after the date of the filing of our Current Report on Form 8-K reflecting our status as a non-“shell company” and we have otherwise complied with the other requirements of Rule 144. As a result, it may be harder for us to fund our operations and pay our employees and consultants with our securities instead of cash. Furthermore, it will be harder for us to raise funding through the sale of debt or equity securities unless we agree to register such securities with the Commission, which could cause us to expend additional resources in the future. Our previous status as a “shell company” could prevent us from raising additional funds, engaging employees and consultants, and using our securities to pay for any acquisitions (although none are currently planned), which could cause the value of our securities, if any, to decline in value or become worthless. Lastly, any shares held by affiliates, including shares received in any registered offering, will be subject to the resale restrictions of Rule 144(i).

We will be required to incur significant costs and require significant management resources to evaluate our internal control over financial reporting as required under Section 404 of the Sarbanes-Oxley Act, and any failure to comply or any adverse result from such evaluation may have an adverse effect on our stock price.

As a smaller reporting company as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, we are required to evaluate our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002 (“Section 404”). Section 404 requires us to include an internal control report with the Annual Report on Form 10-K. This report must include management’s assessment of the effectiveness of our internal control over financial reporting as of the end of the fiscal year. This report must also include disclosure of any material weaknesses in internal control over financial reporting that we have identified. Failure to comply,or any adverse results from such evaluation, could result in a loss of investor confidence in our financial reports and have an adverse effect on the trading price of our equity securities. Management believes that our internal controls and procedures are currently not effective to detect the inappropriate application of U.S. GAAP rules. Management realize there are deficiencies in the design or operation of our internal control that adversely affect our internal controls which management considers to be material weaknesses including those described below:

| 16 |

| i) | We have insufficient quantity of dedicated resources and experienced personnel involved in reviewing and designing internal controls. As a result, a material misstatement of the interim and annual financial statements could occur and not be prevented or detected on a timely basis. | |

| ii) | We do not have an audit committee. While not being legally obligated to have an audit committee, it is our view that to have an audit committee, comprised of independent board members, is an important entity-level control over our financial statements. | |

| iii) | We did not perform an entity level risk assessment to evaluate the implication of relevant risks on financial reporting, including the impact of potential fraud-related risks and the risks related to non-routine transactions, if any, on our internal control over financial reporting. Lack of an entity-level risk assessment constituted an internal control design deficiency which resulted in more than a remote likelihood that a material error would not have been prevented or detected, and constituted a material weakness. | |

| iv) | We lack personnel with formal training to properly analyze and record complex transactions in accordance with U.S. GAAP. | |

| v) | We have not achieved the optimal level of segregation of duties relative to key financial reporting functions. | |

| vi) | Our computer controls are weak due to lack of IT personnel and protocol infrastructure. |

Achieving continued compliance with Section 404 may require us to incur significant costs and expend significant time and management resources. We cannot assure you that we will be able to fully comply with Section 404 or that we and our independent registered public accounting firm would be able to conclude that our internal control over financial reporting is effective at fiscal year end. As a result, investors could lose confidence in our reported financial information, which could have an adverse effect on the trading price of our securities, as well as subject us to civil or criminal investigations and penalties. In addition, our independent registered public accounting firm may not agree with our management’s assessment or conclude that our internal control over financial reporting is operating effectively.

If we lose our key management personnel, we may not be able to successfully manage our business or achieve our objectives, and such loss could adversely affect our business, future operations and financial condition.

Our future success depends in large part upon the leadership and performance of our executive management team and key consultants. If we lose the services of one or more of our executive officers or key consultants, or if one or more of them decides to join a competitor or otherwise compete directly or indirectly with us, we may not be able to successfully manage our business or achieve our business objectives. We do not have “Key-Man” life insurance policies on our key executives. If we lose the services of any of our key consultants, we may not be able to replace them with similarly qualified personnel, which could harm our business. The loss of our key executives or our inability to attract and retain additional highly skilled employees may adversely affect our business, future operations, and financial condition.

The elimination of monetary liability against our directors, officers and employees under Nevada law and the existence of indemnification rights to our directors, officers and employees may result in substantial expenditures by our company and may discourage lawsuits against our directors, officers and employees.

Our Articles of Incorporation contain a provision permitting us to eliminate the personal liability of our directors to our company and stockholders for damages for breach of fiduciary duty as a director or officer to the extent provided by Nevada law. The foregoing indemnification obligations could result in us incurring substantial expenditures to cover the cost of settlement or damage awards against directors and officers, which we may be unable to recoup. These provisions and resultant costs may also discourage our company from bringing a lawsuit against directors and officers for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our stockholders against our directors and officers even though such actions, if successful, might otherwise benefit our company and stockholders.

Our stock is categorized as a penny stock. Trading of our stock may be restricted by the SEC’s penny stock regulations which may limit a stockholder’s ability to buy and sell our stock.

| 17 |

Our stock is categorized as a penny stock. The SEC has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than US$ 5.00 per share or an exercise price of less than US$ 5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and accredited investors. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

FINRA sales practice requirements may also limit a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

To date, we have not paid any cash dividends and no cash dividends will be paid in the foreseeable future.

We do not anticipate paying cash dividends on our common stock in the foreseeable future and we may not have sufficient funds legally available to pay dividends. Even if the funds are legally available for distribution, we may nevertheless decide not to pay any dividends. We presently intend to retain all earnings for our operations.

A limited public trading market exists for our common stock, which makes it more difficult for our stockholders to sell their common stock in the public markets.