Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BOISE CASCADE Co | a2214383z8-k.htm |

| EX-23.1 - EX-23.1 - BOISE CASCADE Co | a2214383zex-23_1.htm |

QuickLinks -- Click here to rapidly navigate through this document

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Boise Cascade Company

Consolidated Statements of Operations

| |

Year Ended December 31 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2011 | 2012 | |||||||

| |

(thousands, except per-share data) |

|||||||||

Sales |

||||||||||

Trade |

$ | 2,215,332 | $ | 2,229,325 | $ | 2,759,290 | ||||

Related parties |

25,259 | 18,763 | 19,772 | |||||||

|

2,240,591 | 2,248,088 | 2,779,062 | |||||||

Costs and expenses |

||||||||||

Materials, labor, and other operating expenses (excluding depreciation) |

1,947,362 | 1,952,619 | 2,343,174 | |||||||

Materials, labor, and other operating expenses from related parties (excluding depreciation) |

33,613 | 40,058 | 60,271 | |||||||

Depreciation and amortization |

34,899 | 37,022 | 33,407 | |||||||

Selling and distribution expenses |

202,464 | 204,998 | 235,055 | |||||||

General and administrative expenses |

38,463 | 37,242 | 43,122 | |||||||

General and administrative expenses from related party |

1,576 | — | — | |||||||

Other (income) expense, net |

(4,624 | ) | 3,195 | 902 | ||||||

|

2,253,753 | 2,275,134 | 2,715,931 | |||||||

Income (loss) from operations |

(13,162 | ) | (27,046 | ) | 63,131 | |||||

Foreign exchange gain (loss) |

352 | (497 | ) | 37 | ||||||

Gain on repurchase of long-term debt |

28 | — | — | |||||||

Interest expense |

(21,005 | ) | (18,987 | ) | (21,757 | ) | ||||

Interest income |

790 | 407 | 392 | |||||||

|

(19,835 | ) | (19,077 | ) | (21,328 | ) | ||||

Income (loss) before income taxes |

(32,997 | ) | (46,123 | ) | 41,803 | |||||

Income tax provision |

(300 | ) | (240 | ) | (307 | ) | ||||

Net income (loss) |

$ | (33,297 | ) | $ | (46,363 | ) | $ | 41,496 | ||

Net income (loss) per common share: |

||||||||||

Basic and diluted |

$ | (1.12 | ) | $ | (1.56 | ) | $ | 1.40 | ||

Weighted average shares outstanding: |

||||||||||

Basic and diluted |

29,700 | 29,700 | 29,700 | |||||||

See accompanying notes to consolidated financial statements.

1

Boise Cascade Company

Consolidated Statements of Comprehensive Income (Loss)

| |

Year Ended December 31 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2011 | 2012 | |||||||

| |

(thousands) |

|||||||||

Net income (loss) |

$ | (33,297 | ) | $ | (46,363 | ) | $ | 41,496 | ||

Other comprehensive income (loss) |

||||||||||

Defined benefit pension plans |

||||||||||

Net actuarial loss |

(4,027 | ) | (83,528 | ) | (8,432 | ) | ||||

Amortization of actuarial loss |

556 | 2,703 | 7,632 | |||||||

Amortization of prior service costs and other |

178 | 175 | 416 | |||||||

Other comprehensive loss |

(3,293 | ) | (80,650 | ) | (384 | ) | ||||

Comprehensive income (loss) |

$ | (36,590 | ) | $ | (127,013 | ) | $ | 41,112 | ||

See accompanying notes to consolidated financial statements.

2

Boise Cascade Company

Consolidated Balance Sheets

| |

December 31 | ||||||

|---|---|---|---|---|---|---|---|

| |

2011 | 2012 | |||||

| |

(thousands) |

||||||

ASSETS |

|||||||

Current |

|||||||

Cash and cash equivalents |

$ | 182,455 | $ | 54,507 | |||

Receivables |

|||||||

Trade, less allowances of $2,142 and $2,696 |

118,901 | 134,743 | |||||

Related parties |

1,236 | 674 | |||||

Other |

3,796 | 6,204 | |||||

Inventories |

283,978 | 325,806 | |||||

Prepaid expenses and other |

4,684 | 5,523 | |||||

|

595,230 | 527,457 | |||||

Property and equipment, net |

266,456 | 265,924 | |||||

Timber deposits |

8,327 | 6,221 | |||||

Deferred financing costs |

4,962 | 7,562 | |||||

Goodwill |

12,170 | 12,170 | |||||

Intangible assets |

8,900 | 8,900 | |||||

Other assets |

6,786 | 8,164 | |||||

Total assets |

$ | 902,831 | $ | 836,398 | |||

See accompanying notes to consolidated financial statements.

3

Boise Cascade Company

Consolidated Balance Sheets (Continued)

| |

December 31 | ||||||

|---|---|---|---|---|---|---|---|

| |

2011 | 2012 | |||||

| |

(thousands, except per share data) |

||||||

LIABILITIES AND STOCKHOLDER'S EQUITY |

|||||||

Current |

|||||||

Accounts payable |

|||||||

Trade |

$ | 116,758 | $ | 140,192 | |||

Related parties |

1,142 | 1,950 | |||||

Accrued liabilities |

|||||||

Compensation and benefits |

32,267 | 61,814 | |||||

Interest payable |

3,326 | 3,188 | |||||

Other |

24,486 | 29,043 | |||||

|

177,979 | 236,187 | |||||

Debt |

|||||||

Long-term debt |

219,560 | 275,000 | |||||

Other |

|||||||

Compensation and benefits |

200,248 | 206,668 | |||||

Other long-term liabilities |

13,676 | 14,336 | |||||

|

213,924 | 221,004 | |||||

Redeemable equity |

8,749 | 6,433 | |||||

Commitments and contingent liabilities |

|||||||

Stockholder's equity |

|||||||

Preferred stock, $0.01 par value per share; 50,000 shares authorized, no shares issued and outstanding |

— | — | |||||

Common stock, $0.01 par value per share; 300,000 shares authorized, 29,700 shares issued and outstanding |

297 | 297 | |||||

Additional paid-in capital |

482,894 | 256,927 | |||||

Accumulated other comprehensive loss |

(120,845 | ) | (121,229 | ) | |||

Accumulated deficit |

(79,727 | ) | (38,231 | ) | |||

Total stockholder's equity |

282,619 | 97,764 | |||||

Total liabilities and stockholder's equity |

$ | 902,831 | $ | 836,398 | |||

See accompanying notes to consolidated financial statements.

4

Boise Cascade Company

Consolidated Statements of Cash Flows

| |

Year Ended December 31 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2011 | 2012 | |||||||

| |

(thousands) |

|||||||||

Cash provided by (used for) operations |

||||||||||

Net income (loss) |

$ | (33,297 | ) | $ | (46,363 | ) | $ | 41,496 | ||

Items in net income (loss) not using (providing) cash |

||||||||||

Depreciation and amortization, including deferred financing costs and other |

37,674 | 39,232 | 37,211 | |||||||

Pension expense |

7,449 | 11,368 | 12,653 | |||||||

Management equity units expense |

1,625 | — | — | |||||||

Other |

(371 | ) | 2,220 | (471 | ) | |||||

Decrease (increase) in working capital, net of acquisitions |

||||||||||

Receivables |

(6,338 | ) | (15,675 | ) | (17,238 | ) | ||||

Inventories |

(28,428 | ) | (20,899 | ) | (41,828 | ) | ||||

Prepaid expenses and other |

(300 | ) | (72 | ) | (652 | ) | ||||

Accounts payable and accrued liabilities |

32,419 | 1,878 | 53,041 | |||||||

Pension contributions |

(3,873 | ) | (13,621 | ) | (8,486 | ) | ||||

Other |

3,727 | (1,049 | ) | 4,410 | ||||||

Net cash provided by (used for) operations |

10,287 | (42,981 | ) | 80,136 | ||||||

Cash provided by (used for) investment |

||||||||||

Expenditures for property and equipment |

(35,751 | ) | (33,537 | ) | (27,386 | ) | ||||

Acquisitions of businesses and facilities |

— | (5,782 | ) | (2,355 | ) | |||||

Proceeds from sales of assets |

1,254 | 3,126 | 246 | |||||||

Other |

(956 | ) | (424 | ) | 61 | |||||

Net cash used for investment |

(35,453 | ) | (36,617 | ) | (29,434 | ) | ||||

Cash provided by (used for) financing |

||||||||||

Issuances of long-term debt |

45,000 | — | 300,000 | |||||||

Payments of long-term debt |

(128,451 | ) | — | (244,560 | ) | |||||

Distributions to Boise Cascade Holdings, L.L.C. |

— | — | (228,268 | ) | ||||||

Proceeds from Boise Cascade Holdings, L.L.C., for sale of shares of Boise Inc. |

86,117 | — | — | |||||||

Financing costs |

— | (2,548 | ) | (5,822 | ) | |||||

Net cash provided by (used for) financing |

2,666 | (2,548 | ) | (178,650 | ) | |||||

Net decrease in cash and cash equivalents |

(22,500 | ) | (82,146 | ) | (127,948 | ) | ||||

Balance at beginning of the period |

287,101 |

264,601 |

182,455 |

|||||||

Balance at end of the period |

$ | 264,601 | $ | 182,455 | $ | 54,507 | ||||

See accompanying notes to consolidated financial statements.

5

Boise Cascade Company

Consolidated Statements of Stockholder's Equity

| |

Common Stock | |

Accumulated Other Comprehensive Loss |

|

|

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Additional Paid-In Capital |

Accumulated Deficit Income |

|

||||||||||||||||

| |

Shares | Amount | Total | ||||||||||||||||

| |

(thousands) |

||||||||||||||||||

Balance at December 31, 2009 |

29,700 | $ | 297 | $ | 395,957 | $ | (36,902 | ) | $ | (67 | ) | $ | 359,285 | ||||||

Net loss |

(33,297 | ) | (33,297 | ) | |||||||||||||||

Other comprehensive loss |

(3,293 | ) | (3,293 | ) | |||||||||||||||

Transfer of proceeds from Boise Cascade Holdings, L.L.C., for sale of Boise Inc. shares |

86,123 | 86,123 | |||||||||||||||||

Other |

275 | 275 | |||||||||||||||||

Balance at December 31, 2010 |

29,700 | $ | 297 | $ | 482,355 | $ | (40,195 | ) | $ | (33,364 | ) | $ | 409,093 | ||||||

Net loss |

(46,363 | ) | (46,363 | ) | |||||||||||||||

Other comprehensive loss |

(80,650 | ) | (80,650 | ) | |||||||||||||||

Allocation of redeemable equity to stockholder's equity |

550 | 550 | |||||||||||||||||

Other |

(11 | ) | (11 | ) | |||||||||||||||

Balance at December 31, 2011 |

29,700 | $ | 297 | $ | 482,894 | $ | (120,845 | ) | $ | (79,727 | ) | $ | 282,619 | ||||||

Net income |

41,496 | 41,496 | |||||||||||||||||

Other comprehensive loss |

(384 | ) | (384 | ) | |||||||||||||||

Distributions to Boise Cascade Holdings, L.L.C. |

(228,268 | ) | (228,268 | ) | |||||||||||||||

Allocation of redeemable equity to stockholder's equity |

2,306 | 2,306 | |||||||||||||||||

Other |

(5 | ) | (5 | ) | |||||||||||||||

Balance at December 31, 2012 |

29,700 | $ | 297 | $ | 256,927 | $ | (121,229 | ) | $ | (38,231 | ) | $ | 97,764 | ||||||

See accompanying notes to consolidated financial statements.

6

Notes to Consolidated Financial Statements

1. Nature of Operations and Basis of Presentation

Nature of Operations

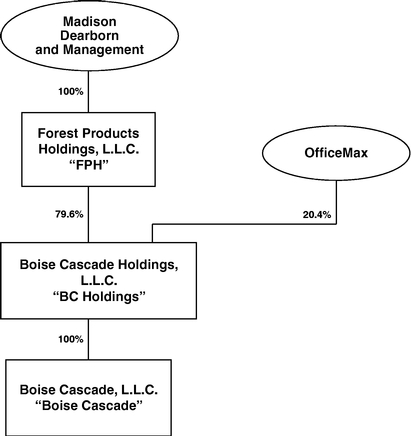

We are a building products company headquartered in Boise, Idaho. Our operations began on October 29, 2004 (inception), when we acquired the forest products and paper assets of OfficeMax (the Forest Products Acquisition). As used in these consolidated financial statements, the terms "Boise Cascade," "we," and "our" refer to Boise Cascade, L.L.C., and its consolidated subsidiaries prior to our conversion to a Delaware corporation and to Boise Cascade Company and its consolidated subsidiaries on or after such conversion, as discussed in Note 16, Subsequent Events. Prior to the initial public offering of shares of common stock of Boise Cascade Company, discussed in Note 13, Equity, Boise Cascade was 100% owned by Boise Cascade Holdings, L.L.C. (BC Holdings). We are a leading U.S. wholesale distributor of building products and one of the largest producers of engineered wood products (EWP) and plywood in North America.

We operate our business using three reportable segments: (1) Wood Products, which manufactures and sells EWP, plywood, studs, particleboard, and ponderosa pine lumber, (2) Building Materials Distribution, which is a wholesale distributor of building materials, and (3) Corporate and Other, which includes corporate support staff services, related assets and liabilities, and foreign exchange gains and losses. For more information, see Note 14, Segment Information.

The following sets forth our corporate structure and equity ownership at December 31, 2012 (prior to our initial public offering):

7

Notes to Consolidated Financial Statements (Continued)

1. Nature of Operations and Basis of Presentation (Continued)

Basis of Presentation and Comparability of Data

In connection with the sale of our Paper and Packaging & Newsprint assets in 2008, we received $1,277.2 million of cash consideration, a $41 million paid-in-kind promissory note receivable, and $285.2 million of net stock consideration.

Immediately following the sale, we distributed the securities received in the transaction to BC Holdings, as the securities were not subject to the collateral liens of the bank credit facility of the company then in effect. However, the cash and securities received in the transaction were subject to the covenants of the company's subordinated note indenture in effect at the time of the distribution and the guaranty provided by BC Holdings. As a result of receiving stock in Boise Inc., BC Holdings had a significant indirect financial interest in the results of the sold businesses. The equity interest BC Holdings owned in Boise Inc. and the related-party transactions we had with Boise Inc. after the sale represented a significant continuing involvement. In 2008, BC Holdings sold the paid-in-kind promissory note receivable for $52.7 million after selling expenses and transferred the net proceeds to us. In 2009 and 2010, BC Holdings sold 18.8 million and 18.3 million shares of Boise Inc. and transferred the net proceeds of $83.2 million and $86.1 million to us. The cash received as a reinvestment in us by BC Holdings was reflected in our Consolidated Statements of Cash Flows. We used the cash received from BC Holdings in 2008, 2009, and 2010 to repay senior debt and for capital spending in accordance with the asset sale covenant of our subordinated note indenture. The 18.3 million shares sold in 2010 represented BC Holdings' remaining investment in Boise Inc. Because of the disposition, Boise Inc. is no longer a related party. The related-party activity with Boise Inc. included in the Consolidated Financial Statements includes only those sales and costs and expenses transacted prior to March 2010, when Boise Inc. was a related party. As a result, beginning in March 2010, transactions with Louisiana Timber Procurement Company, L.L.C. (LTP) (discussed in Note 4, Transactions With Related Parties) represent the only remaining significant related-party activity recorded in our consolidated financial statements.

2. Summary of Significant Accounting Policies

Principles of Consolidation

The consolidated financial statements include the accounts of Boise Cascade and its subsidiaries. Intercompany balances and transactions have been eliminated.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions about future events. These estimates and the underlying assumptions affect the amounts of assets and liabilities reported, disclosures about contingent assets and liabilities, and reported amounts of revenues and expenses. Such estimates include the valuation of accounts receivable, inventories, goodwill, intangible assets, and other long-lived assets; legal contingencies; guarantee obligations; indemnifications; assumptions used in retirement benefits; and vendor and customer rebates, among others. These estimates and assumptions are based on management's best estimates and judgment. Management evaluates its estimates and assumptions on an ongoing basis using historical experience and other factors, including the current economic environment, which management believes to be reasonable under the circumstances. We adjust such estimates and assumptions when facts and circumstances dictate. As future events and their effects cannot be determined with precision, actual results could

8

Notes to Consolidated Financial Statements (Continued)

2. Summary of Significant Accounting Policies (Continued)

differ significantly from these estimates. Changes in these estimates resulting from continuing changes in the economic environment will be reflected in the consolidated financial statements in future periods.

Revenue Recognition

We recognize revenue when the following criteria are met: persuasive evidence of an agreement exists, delivery has occurred or services have been rendered, our price to the buyer is fixed or determinable, and collectibility is reasonably assured. Delivery is not considered to have occurred until the customer takes title and assumes the risks and rewards of ownership. The timing of revenue recognition is dependent on shipping terms. Revenue is recorded at the time of shipment for terms designated free on board (fob) shipping point. For sales transactions designated fob destination, revenue is recorded when the product is delivered to the customer's delivery site. Fees for shipping and handling charged to customers for sales transactions are included in "Sales." For our Wood Products segment, costs related to shipping and handling are included in "Materials, labor, and other operating expenses (excluding depreciation)." In our Wood Products segment, we view our shipping and handling costs as a cost of the manufacturing process and the movement of product to our end customers. For our Building Materials Distribution segment, costs related to shipping and handling of $77.9 million, $79.9 million, and $89.3 million are included primarily in "Selling and distribution expenses" for the years ended December 31, 2010, 2011, and 2012, respectively. In our Building Materials Distribution segment, our activities relate to the purchase and resale of finished product, and excluding shipping and handling costs from "Materials, labor, and other operating expenses (excluding depreciation)" provides us a clearer view of our operating performance and the effectiveness of our sales and purchasing functions. We present sales taxes collected from customers and remitted to governmental authorities on a net basis in our Consolidated Statements of Operations.

Cash and Cash Equivalents

Cash equivalents consist of short-term investments that have a maturity of three months or less at the date of purchase. At December 31, 2011 and 2012, the majority of our cash and cash equivalents were invested in money market funds that are broadly diversified and invest in high-quality, short-duration securities, including commercial paper, certificates of deposit, U.S. government agency securities, and similar instruments. We have significant amounts of cash and cash equivalents that are in excess of federally insured limits. Though we have not experienced any losses on our cash and cash equivalents to date and we do not anticipate incurring any losses, we cannot be assured that we will not experience losses on our cash and cash equivalents.

Trade Accounts Receivables and Allowance for Doubtful Accounts

Trade accounts receivable are stated at the amount we expect to collect. Trade accounts receivable do not bear interest. We make ongoing estimates relating to the collectibility of our accounts receivable and maintain a reserve for estimated losses resulting from the inability of our customers to meet their financial obligations to us. At December 31, 2011 and 2012, we had $2.1 million and $2.7 million, respectively, recorded as allowances for doubtful accounts. In determining the amount of the reserve, we consider our historical level of credit losses, customer concentrations, current economic trends, and changes in customer creditworthiness. Our sales are principally to customers in the building products industry located in the United States and Canada. A significant portion of our sales are concentrated with a relatively small number of customers. In 2012, our top ten customers represented approximately

9

Notes to Consolidated Financial Statements (Continued)

2. Summary of Significant Accounting Policies (Continued)

29% of sales. In order to manage credit risk, we consider customer concentrations and current economic trends and monitor the creditworthiness of significant customers based on ongoing credit evaluations. At both December 31, 2011 and 2012, receivables from a single customer accounted for approximately 14% of total receivables. No other customer accounted for 10% or more of total receivables. Adjustments to the valuation allowance are charged to income. Trade accounts receivable balances that remain outstanding after we have used reasonable collection efforts are written off through a charge to the valuation allowance and a credit to accounts receivable.

The low level of new residential construction in the U.S. and more restrictive lending standards have affected the ability of our customers and our customers' customers to fund their operations, which makes it difficult for us to estimate future credit losses. Although we have not experienced material credit losses in recent years, our actual future losses from uncollectible accounts may differ materially from our current estimates. As additional information becomes known, we may change our estimates. In the event we determine that a change in the reserve is appropriate, we will record a charge to "Selling and distribution expenses" in our Consolidated Statements of Operations in the period we make such a determination.

Fair Value

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair value hierarchy under U.S. generally accepted accounting principles (GAAP) gives the highest priority to quoted market prices (Level 1) and the lowest priority to unobservable inputs (Level 3). In general, and where applicable, we use quoted prices in active markets for identical assets or liabilities to determine fair value (Level 1). If quoted prices in active markets for identical assets or liabilities are not available to determine fair value, we use quoted prices for similar assets and liabilities or inputs that are observable either directly or indirectly (Level 2). If quoted prices for identical or similar assets are not available or are unobservable, we may use internally developed valuation models, whose inputs include bid prices, and third-party valuations utilizing underlying asset assumptions (Level 3). See Note 11, Retirement and Benefit Plans, for the fair value measurements of our defined benefit plans' assets.

Financial Instruments

Our financial instruments are cash and cash equivalents, accounts receivable, accounts payable, and long-term debt. Our cash is recorded at cost, which approximates fair value, and our cash equivalents are money market funds measured at fair value. As of December 31, 2011 and 2012, we held $164.6 million and $10.6 million, respectively, in money market funds that are measured at fair value on a recurring basis using Level 1 inputs. The recorded values of accounts receivable and accounts payable approximate fair values based on their short-term nature. At December 31, 2012, the book value of our fixed-rate debt was $250.0 million, and the fair value was estimated to be $251.6 million. The difference between the book value and the fair value is derived from the difference between the period-end market interest rate and the stated rate of our fixed-rate, long-term debt. We estimated the fair value based on quoted market prices for similar traded debt (Level 2 measurement). The interest rate on our revolving credit facility is based on market conditions such as the London Interbank Offered Rate (LIBOR) or a base rate. Because the interest rate on the revolving credit facility is based on current market conditions, we believe that the estimated fair value of the outstanding balance on our revolving credit facility approximates book value.

10

Notes to Consolidated Financial Statements (Continued)

2. Summary of Significant Accounting Policies (Continued)

We are exposed to financial risks such as changes in interest rates, foreign currency exchange rates, and commodity price risk. We employ a variety of practices to manage these risks, including operating and financing activities and, where deemed appropriate, the use of derivative instruments. During the years ended December 31, 2011 and 2012, we had no derivative instruments.

Vendor and Customer Rebates and Allowances

We receive rebates and allowances from our vendors under a number of different programs, including vendor marketing programs. At December 31, 2011 and 2012, we had $2.8 million and $4.1 million, respectively, of vendor rebates and allowances recorded in "Receivables, Other" on the Consolidated Balance Sheets. Rebates and allowances received from our vendors are recognized as a reduction of "Materials, labor, and other operating expenses (excluding depreciation)" when the product is sold, unless the rebates and allowances are linked to a specific incremental cost to sell a vendor's product. Amounts received from vendors that are linked to specific selling and distribution expenses are recognized as a reduction of "Selling and distribution expenses" in the period the expense is incurred.

We also provide rebates to our customers and our customers' customers based on the volume of their purchases. We provide the rebates to increase the sell-through of our products. The rebates are recorded as a decrease in "Sales, Trade." At December 31, 2011 and 2012, we had $15.6 million and $19.7 million, respectively, of rebates payable to our customers recorded in "Accrued liabilities, Other" on our Consolidated Balance Sheets.

Foreign Currency

The functional currency for our operations outside the United States is the U.S. dollar. Nonmonetary assets and liabilities and related depreciation and amortization for these foreign operations are remeasured into U.S. dollars using historical exchange rates. Monetary assets and liabilities are remeasured into U.S. dollars using the exchange rates as of the Consolidated Balance Sheet date. Revenue and expense items are remeasured into U.S. dollars using an average exchange rate prevailing during the year.

Leases

We assess lease classification as either capital or operating at lease inception or upon modification. We lease a portion of our distribution centers as well as other property and equipment under operating leases. Substantially all lease agreements have fixed payment terms based on the passage of time. Some lease agreements provide us with the option to purchase the leased property. Additionally, some agreements contain renewal options generally ranging from two to five years, with fixed payment terms similar to those in the original lease agreements. For purposes of determining straight-line rent expense, the lease term is calculated from the date we first take possession of the facility, including any periods of free rent and any renewal option periods we are reasonably assured of exercising.

Inventory Valuation

Inventories are valued at the lower of cost or market. Cost is based on the first-in, first-out (FIFO) method of inventory valuation or average cost, which approximates the FIFO method. Manufactured inventories include costs for materials, labor, and factory overhead. Log inventories include costs to harvest and deliver the timber.

11

Notes to Consolidated Financial Statements (Continued)

2. Summary of Significant Accounting Policies (Continued)

Inventories include the following (work in process is not material):

| |

December 31, 2011 |

December 31, 2012 |

|||||

|---|---|---|---|---|---|---|---|

| |

(thousands) |

||||||

Finished goods and work in process |

$ | 223,605 | $ | 267,115 | |||

Logs |

41,243 | 37,273 | |||||

Other raw materials and supplies |

19,130 | 21,418 | |||||

|

$ | 283,978 | $ | 325,806 | |||

Property and Equipment

Property and equipment are recorded at cost. Cost includes expenditures for major improvements and replacements and the amount of interest cost associated with significant capital additions. For the years ended December 31, 2010, 2011, and 2012, we did not capitalize any interest. We expense all repair and maintenance costs as incurred. When property and equipment are retired, sold, or otherwise disposed of, the asset's carrying amount and related accumulated depreciation are removed from the accounts and any gain or loss is included in income (loss). We use the straight-line method of depreciation.

Property and equipment consisted of the following asset classes with the following general range of estimated useful lives:

| |

December 31, 2011 |

December 31, 2012 |

General Range of Estimated Useful Lives in Years |

|||||

|---|---|---|---|---|---|---|---|---|

| |

(thousands) |

|

||||||

Land |

$ | 35,469 | $ | 35,662 | ||||

Buildings |

84,510 | 88,129 | 20 - 40 | |||||

Improvements |

32,645 | 34,526 | 10 - 15 | |||||

Office equipment and vehicles |

74,349 | 80,857 | 3 - 7 | |||||

Machinery and equipment |

253,933 | 264,084 | 7 - 12 | |||||

Construction in progress |

5,812 | 11,176 | ||||||

|

486,718 | 514,434 | ||||||

Less accumulated depreciation |

(220,262 | ) | (248,510 | ) | ||||

|

$ | 266,456 | $ | 265,924 | ||||

Long-Lived Asset Impairment

We review long-lived assets for impairment when events or changes in circumstances indicate that the carrying amount of assets may not be recoverable. An impairment of long-lived assets exists when the carrying value is not recoverable through future undiscounted cash flows from operations and when the carrying value of an asset or asset group exceeds its fair value.

During fiscal 2011, long-lived assets with a net carrying amount of $2.5 million were written down to their fair value of $0.5 million, resulting in an impairment charge of $2.0 million. These impairment charges were measured at fair value using Level 3 inputs, including discounted cash flows and appraisals.

12

Notes to Consolidated Financial Statements (Continued)

2. Summary of Significant Accounting Policies (Continued)

Goodwill and Intangible Assets

We maintain two reporting units for purposes of our goodwill impairment testing, Building Materials Distribution and Wood Products, which are the same as our operating segments discussed in Note 14, Segment Information. We test goodwill in each of our reporting units and intangible assets with indefinite lives for impairment annually in the fourth quarter or sooner if events or changes in circumstances indicate that the carrying value of the asset may exceed fair value.

We completed our annual assessment of goodwill in fourth quarter 2012 using a qualitative approach. The qualitative goodwill impairment assessment requires evaluating factors, based on the weight of evidence, to determine whether a reporting unit's carrying value would more likely than not exceed its fair value. As part of our goodwill qualitative testing process for each reporting unit, we evaluate various factors that are specific to the reporting unit as well as industry and macroeconomic factors in order to determine whether it is reasonably likely to have a material impact on the fair value of our reporting units. Examples of the factors that were considered include the results of the most recent quantitative impairment test, current and long-term forecasted financial results, changes in the discount rate between current and prior years, and operating strategy for each reporting unit. Based on the qualitative analysis performed in 2012, we concluded that there were no changes that were reasonably likely to cause the fair value of the reporting units to be less than the reporting units' carrying value and determined that there was no impairment of our goodwill. In the event we were to determine that a reporting unit's carrying value would more likely than not exceed its fair value, quantitative testing would be performed comparing carrying values to estimated fair values.

For our intangible asset impairment testing, we use a discounted cash flow approach, based on a relief from royalty method (Level 3 measurement). This method assumes that, through ownership of trademarks and trade names, we avoid royalty expenses associated with licensing, resulting in cost savings. An estimated royalty rate, determined as a percentage of the related net sales, is used to estimate the value of the intangible assets. Based on the impairment tests of our intangible assets with indefinite lives, we determined that the fair value of our intangible assets exceeds their carrying value.

See Note 8, Goodwill and Intangible Assets, for additional information.

Asset Retirement Obligations

We recognize our asset retirement obligations in the period in which they are incurred if sufficient information is available to reasonably estimate the fair value of the obligation. Fair value estimates are determined using Level 3 inputs in the fair value hierarchy. The fair values of our asset retirement obligations are measured using expected future cash outflows discounted using the company's credit-adjusted risk-free interest rate. When we record the liability, we capitalize the cost by increasing the carrying amount of the related long-lived asset. Over time, the liability is accreted to its settlement value, and the capitalized cost is depreciated over the useful life of the related asset. Upon settlement of the liability, we will recognize a gain or loss for any difference between the settlement amount and the liability recorded.

At December 31, 2011 and 2012, we had $0.2 million and $0.3 million, respectively, of asset retirement obligations recorded in "Other, Other long-term liabilities" on our Consolidated Balance Sheets. At December 31, 2012, these liabilities related primarily to landfill closure costs. The liabilities are based on the best estimate of current costs and are updated periodically to reflect current

13

Notes to Consolidated Financial Statements (Continued)

2. Summary of Significant Accounting Policies (Continued)

technology, laws and regulations, inflation, and other economic factors. We do not have any assets legally restricted for purposes of settling asset retirement obligations.

We have additional asset retirement obligations with indeterminate settlement dates. The fair value of these asset retirement obligations cannot be estimated due to the lack of sufficient information to estimate the settlement dates of the obligations. These asset retirement obligations include, for example, (i) removal and disposal of potentially hazardous materials on equipment and/or an operating facility if the equipment and/or facility were to undergo major maintenance, renovation, or demolition; (ii) retention ponds that may be required to be drained and/or cleaned if the related operating facility is closed; and (iii) storage sites or owned facilities for which removal and/or disposal of chemicals and other related materials are required if the operating facility is closed. We will recognize a liability in the period in which sufficient information becomes available to reasonably estimate the fair value of these obligations.

Pension and Other Postretirement Benefits

Several estimates and assumptions are required to record pension costs and liabilities, including discount rates, expected return on plan assets, expected rate of compensation increases, retirement and mortality rates, expected contributions, and other factors. We review and update these assumptions annually unless a plan curtailment or other event occurs requiring that we update the estimates on an interim basis. See Note 11, Retirement and Benefit Plans, for additional information related to our pension and other postretirement benefit plans. While we believe that the assumptions used to measure our pension and other postretirement obligations are reasonable, differences in actual experience or changes in assumptions may materially affect our pension and other postretirement obligations and future expense.

Deferred Software Costs

We defer internal-use software costs that benefit future years. These costs are amortized using the straight-line method over the expected life of the software, typically three to five years. "Other assets" in the Consolidated Balance Sheets includes $4.6 million and $3.7 million of deferred software costs at December 31, 2011 and 2012, respectively. For the years ended December 31, 2010, 2011, and 2012, amortization of deferred software costs was $0.8 million, $1.0 million, and $1.2 million, respectively.

Labor Concentration and Unions

As of December 31, 2012, we had approximately 4,560 employees. Approximately 30% of these employees work pursuant to collective bargaining agreements. As of December 31, 2012, we had ten collective bargaining agreements. Two agreements, covering 356 employees at our facility in Florien, Louisiana, and 273 employees at our facility in Oakdale, Louisiana, are set to expire on July 15, 2013. We expect these two agreements to be bargained together.

Self-Insurance

We are self-insured for certain losses related to workers' compensation and medical claims as well as general and auto liability. The expected ultimate costs for claims incurred are recognized as liabilities in the Consolidated Balance Sheets and are estimated based principally on an analysis of historical claims data and estimates of claims incurred but not reported. Losses are accrued and charged to operations when it is probable that a loss has been incurred and the amount can be

14

Notes to Consolidated Financial Statements (Continued)

2. Summary of Significant Accounting Policies (Continued)

reasonably estimated. We maintain third-party stop-loss insurance policies to cover these liability costs in excess of predetermined retained amounts. Costs related to the administration of the plans and related claims are expensed as incurred. At December 31, 2011 and 2012, self-insurance related liabilities of $7.6 million and $7.2 million were classified within "Accrued liabilities," and $9.7 million and $10.0 million were classified within "Other long-term liabilities" on our Consolidated Balance Sheets, respectively.

New and Recently Adopted Accounting Standards

In February 2013, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2013-02, Comprehensive Income (Topic 220): Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income. This ASU requires entities to disclose additional information about changes in and significant items reclassified out of accumulated other comprehensive income. The guidance is effective for annual and interim reporting periods beginning after December 15, 2012. We do not believe the adoption of this update will have a material effect on our consolidated financial statements.

In July 2012, the FASB issued ASU 2012-02, Intangibles—Goodwill and Other (Topic 350): Testing Indefinite—Lived Intangible Assets for Impairment, which gives entities the option first to assess qualitative factors to determine whether the existence of events and circumstances indicates that it is more likely than not that the indefinite-lived intangible asset is impaired. If, after assessing the totality of events and circumstances, an entity concludes that it is not more likely than not that the indefinite-lived intangible asset is impaired, the entity is not required to take further action. However, if an entity concludes otherwise, then it is required to determine the fair value of the indefinite-lived intangible asset and perform the quantitative impairment test by comparing the fair value with the carrying amount. The amended guidance is effective for annual and interim impairment tests performed for fiscal years beginning after September 15, 2012, with early adoption permitted. We do not believe the adoption of this guidance will have a material impact on our consolidated financial statements.

In September 2011, the FASB issued ASU 2011-08, Intangibles—Goodwill and Other (Topic 350): Testing Goodwill for Impairment, which gives entities testing goodwill for impairment the option of performing a qualitative assessment before calculating the fair value of a reporting unit in step 1 of the goodwill impairment test. If entities determine, on the basis of qualitative factors, that the fair value of a reporting unit is more likely than not less than the carrying amount, the two-step impairment test would be required. Otherwise, further testing would not be needed. We adopted the provisions of this guidance January 1, 2012, and it had no effect on our financial position and results of operations. For additional information, see the Goodwill and Intangible Assets section of Note 2 above.

In June 2011, the FASB issued ASU 2011-05, Comprehensive Income (Topic 220): Presentation of Comprehensive Income, which amends current comprehensive income guidance. This accounting update eliminates the option to present the components of other comprehensive income as part of the statement of equity, among other amendments. Instead, the company must report comprehensive income in either a single continuous statement of comprehensive income which contains two sections, net income and other comprehensive income, or in two separate but consecutive statements. We adopted this guidance retrospectively as of January 1, 2012, by adding the Consolidated Statements of Comprehensive Income (Loss) to our consolidated financial statements.

15

Notes to Consolidated Financial Statements (Continued)

2. Summary of Significant Accounting Policies (Continued)

In May 2011, the FASB issued ASU 2011-04, Fair Value Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and International Financial Reporting Standards (IFRS). This ASU was issued to provide largely identical guidance about fair value measurement and disclosure requirements for entities that disclose the fair value of an asset, a liability, or an instrument classified in shareholders' equity in their consolidated financial statements as that provided in the International Accounting Standards Board's new IFRS 13, Fair Value Measurement. This ASU does not extend the use of fair value but, rather, provides guidance about how fair value should be applied where it already is required or permitted under GAAP. We adopted the provisions of ASU 2011-04 on January 1, 2012. The adoption of this guidance did not have a material effect on our financial statement disclosures.

There were no other accounting standards recently issued that had or are expected to have a material impact on our consolidated financial statements and associated disclosures.

Reclassifications

Certain amounts in prior years' consolidated financial statements have been reclassified to conform with the current year's presentation, none of which were considered material.

3. Outsourcing Services Agreement

Under an Outsourcing Services Agreement, Boise Inc. provides a number of corporate staff services to us at cost. These services include information technology, accounting, and human resource transactional services. The agreement, as extended, expires on February 22, 2015. The agreement automatically renews for successive one-year terms unless either party provides notice of termination to the other party at least 12 months in advance of the expiration date. The Outsourcing Services Agreement gives us (but not Boise Inc.) the right to terminate all or any portion of the services provided to us on 30 days' notice. Total expenses incurred under the Outsourcing Services Agreement, including both related party and nonrelated party, were $14.4 million, $14.7 million, and $15.0 million for the years ended December 31, 2010, 2011, and 2012, respectively. The majority of these expenses are recorded in "General and administrative expenses" in our Consolidated Statements of Operations or "General and administrative expenses from related party" for the period Boise Inc. was a related party. See Note 4, Transactions With Related Parties, for more information.

4. Transactions With Related Parties

In early March 2010, BC Holdings sold its remaining investment in Boise Inc., and because of the disposition, Boise Inc. is no longer a related party. The 2010 related-party activity with Boise Inc. in the consolidated financial statements includes only those sales and costs and expenses transacted prior to March 2010, when Boise Inc. was a related party. As a result, beginning in March 2010, transactions with Louisiana Timber Procurement Company, L.L.C. (LTP) represent the only remaining significant related-party activity recorded in our consolidated financial statements. LTP is an unconsolidated variable-interest entity that is 50% owned by us and 50% owned by Boise Inc. LTP procures sawtimber, pulpwood, residual chips, and other residual wood fiber to meet the wood and fiber requirements of Boise Inc. and Boise Cascade in Louisiana. We are not the primary beneficiary of LTP, as we do not have power to direct the activities that most significantly affect the economic performance of LTP. Accordingly, we do not consolidate LTP's results in our financial statements.

16

Notes to Consolidated Financial Statements (Continued)

4. Transactions With Related Parties (Continued)

Sales

Related-party sales to LTP from our Wood Products segment in our Consolidated Statements of Operations were $20.4 million, $18.8 million, and $19.8 million during the years ended December 31, 2010, 2011, and 2012 respectively. We also recorded $4.9 million of related-party sales to Boise Inc. (for the period they were a related party) during the year ended December 31, 2010. These pulpwood and chip sales were made at prices designed to approximate market.

Costs and Expenses

Related-party fiber purchases from LTP were $33.0 million, $40.1 million, and $60.3 million during the years ended December 31, 2010, 2011, and 2012, respectively. During the year ended December 31, 2010, we also recorded $0.3 million of related-party expenses for transportation services from Boise Inc. (for the period they were a related party). We purchased the fiber and transportation services at prices designed to approximate market. These costs are recorded in "Materials, labor, and other operating expenses from related parties (excluding depreciation)" in our Consolidated Statements of Operations.

During the year ended December 31, 2010, we recorded the following expenses from the Outsourcing Services Agreement as related-party expenses in our Consolidated Statements of Operations. As mentioned above, after we sold our remaining investment in Boise Inc. in March 2010, expenses incurred under the Outsourcing Services Agreement were no longer related-party and are not included in the table below.

| |

Year Ended December 31, 2010 |

|||

|---|---|---|---|---|

| |

(thousands) |

|||

Materials, labor, and other operating expenses from related parties (excluding depreciation) |

$ | 332 | ||

Selling and distribution expenses |

456 | |||

General and administrative expenses from related party |

1,576 | |||

|

$ | 2,364 | ||

5. Other (Income) Expense

Other (income) expense includes miscellaneous income and expense items. The components of "Other (income) expense, net" in the Consolidated Statements of Operations are as follows:

| |

Year Ended December 31 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2011 | 2012 | |||||||

| |

(thousands) |

|||||||||

Facility closure and curtailments(a) |

$ | — | $ | 1,292 | $ | — | ||||

Litigation settlement(b) |

(4,613 | ) | — | — | ||||||

Other, net(c) |

(11 | ) | 1,903 | 902 | ||||||

|

$ | (4,624 | ) | $ | 3,195 | $ | 902 | |||

- (a)

- In 2011, we permanently closed a laminated beam manufacturing plant in Emmett, Idaho.

17

Notes to Consolidated Financial Statements (Continued)

5. Other (Income) Expense (Continued)

- (b)

- In

2010, we recorded $4.6 million of income for cash received from a litigation settlement related to vendor product pricing.

- (c)

- In 2011, we recorded noncash asset write-downs of $2.0 million.

6. Leases

Rental expense for operating leases was $14.2 million, $14.5 million, and $14.3 million for the years ended December 31, 2010, 2011, and 2012, respectively. Sublease rental income was not material in any of the periods presented.

As of December 31, 2012, our minimum lease payment requirements for noncancelable operating leases with remaining terms of more than one year are as follows (in thousands):

2013 |

$ | 12,346 | ||

2014 |

11,613 | |||

2015 |

10,919 | |||

2016 |

9,061 | |||

2017 |

8,520 | |||

Thereafter |

36,723 | |||

Total |

$ | 89,182 | ||

These future minimum lease payment requirements have not been reduced by sublease rentals due in the future under noncancelable subleases. Minimum sublease income expected to be received in the future is not material.

7. Income Taxes

Income Tax Provision

On February 4, 2013, we converted from a limited liability company to a corporation. In addition, we filed an entity classification election with the Internal Revenue Service to elect to be treated as a corporation for federal and state income tax purposes effective as of January 1, 2013. As a result of our conversion to a corporation, we expect to record deferred tax assets, net of deferred tax liabilities, on our consolidated balance sheet, the effect of which will be recorded as an income tax benefit in the Consolidated Statement of Operations. As a limited liability company, we were not subject to entity-level federal or state income taxation. Our income tax provision generally consisted of income taxes payable to state jurisdictions that do not allow for the income tax liability to be passed through to our equityholder as well as income taxes payable by our separate subsidiaries that are taxed as corporations. As a limited liability company, we had an effective tax rate of less than 1%. For the years ended December 31, 2010, 2011, and 2012, income tax expense was $0.3 million, $0.2 million, and $0.3 million, respectively. As a corporation, we are subject to typical corporate U.S. federal and state income tax rates, which we expect to result in a statutory tax rate of approximately 38% under current tax law.

At December 31, 2011 and 2012, our tax basis was $167.5 million and $182.3 million, respectively, higher than the reported amount of net assets recorded on our Consolidated Balance Sheets. In 2011 and 2012, the difference related primarily to changes in pension obligations.

Boise Cascade Wood Products Holdings Corp., a wholly owned, fully consolidated operating entity, has an investment in foreign subsidiaries. At December 31, 2011 and 2012, the foreign subsidiaries had

18

Notes to Consolidated Financial Statements (Continued)

7. Income Taxes (Continued)

$13.6 million and $15.4 million, respectively, of deferred tax assets. The deferred tax assets resulted primarily from net operating losses and were fully offset by a valuation allowance. In addition, at both December 31, 2011 and 2012, Boise Cascade Wood Products Holdings Corp. had $16.0 million of capital loss carryforward from the sale of our subsidiaries in Brazil and the United Kingdom. The capital loss carryforward was fully offset by a valuation allowance, because it is more likely than not that we will not be able to utilize the capital loss carryforward before it expires in 2013.

In 2010, 2011, and 2012, we paid $0.2 million, $0.3 million, and $0.2 million, respectively, of income taxes, net of other refunds received.

Income Tax Uncertainties

Boise Cascade, or one of its subsidiaries, files federal income tax returns in the U.S. and Canada and various state and foreign income tax returns in the major state jurisdictions of Alabama, California, Idaho, Oregon, Texas, and Washington.

We recognize tax liabilities and adjust these liabilities when our judgment changes as a result of the evaluation of new information not previously available or as new uncertainties occur. As of December 31, 2011 and 2012, we have no unrecognized tax benefits recorded on our Consolidated Balance Sheets, and we do not expect a significant change to the amount of unrecognized tax benefits over the next 12 months.

For the years ended December 31, 2010, 2011, and 2012, we recognized an insignificant amount of interest and penalties related to taxes.

8. Goodwill and Intangible Assets

Goodwill represents the excess of the purchase price and related costs over the value assigned to the net tangible and intangible assets of businesses acquired. The carrying amount of our goodwill by segment is as follows:

| |

Building Materials Distribution |

Wood Products |

Corporate and Other |

Total | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

(thousands) |

||||||||||||

Balance at December 31, 2011 and 2012 |

$ | 5,593 | $ | 6,577 | $ | — | $ | 12,170 | |||||

At December 31, 2011 and 2012, intangible assets represent the values assigned to trade names and trademarks, which have indefinite lives and are not amortized. The carrying amount of our trade names and trademarks was $8.9 million at both December 31, 2011 and 2012.

19

Notes to Consolidated Financial Statements (Continued)

9. Debt

Long-term debt consisted of the following:

| |

December 31, 2011 |

December 31, 2012 |

|||||

|---|---|---|---|---|---|---|---|

| |

(thousands) |

||||||

Asset-based revolving credit facility |

$ | — | $ | 25,000 | |||

6.375% senior notes |

— | 250,000 | |||||

7.125% senior subordinated notes |

219,560 | — | |||||

Long-term debt |

$ | 219,560 | $ | 275,000 | |||

Asset-Based Revolving Credit Facility

On July 13, 2011, Boise Cascade and its principal operating subsidiaries, Boise Cascade Wood Products, L.L.C., and Boise Cascade Building Materials Distribution, L.L.C., as borrowers, and Boise Cascade Wood Products Holdings Corp., as guarantor, entered into a $250 million senior secured asset-based revolving credit facility (Revolving Credit Facility) with Wells Fargo Capital Finance, L.L.C., as agent, and the banks named therein as lenders. Borrowings under the Revolving Credit Facility are constrained by a borrowing base formula dependent upon levels of eligible receivables and inventory reduced by outstanding borrowings and letters of credit (Availability). On September 7, 2012, we entered into a First Amendment to Credit Agreement, which increased the aggregate lending commitments under the Revolving Credit Facility to $300 million. Other key terms of the Credit Agreement were unchanged by the Amendment. On December 20, 2012, we entered into a Limited Consent and Amendment to Loan Documents with the lenders under our revolving credit facility. The consent and amendment provided consent to, among other things, the distributions of $225.0 million in aggregate to BC Holdings made in late December 2012 and our conversion to a corporation effected on February 4, 2013.

The Revolving Credit Facility has a maturity date of July 13, 2016, and is secured by a first-priority security interest in substantially all of our assets, except for property and equipment. The proceeds of borrowings under the agreement are available for working capital and other general corporate purposes.

Interest rates under the Revolving Credit Facility are based, at the company's election, on either the London Interbank Offered Rate (LIBOR) or a base rate, as defined in the agreement, plus a spread over the index elected that ranges from 1.75% to 2.25% for loans based on LIBOR and from 0.75% to 1.25% for loans based on the base rate. The spread is determined on the basis of a pricing grid that results in a higher spread as average quarterly Availability declines. Letters of credit are subject to a fronting fee payable to the issuing bank and a fee payable to the lenders equal to the LIBOR margin rate. In addition, we are required to pay an unused commitment fee at a rate ranging from 0.375% to 0.50% per annum (based on facility utilization) of the average unused portion of the lending commitments.

The Revolving Credit Facility contains customary nonfinancial covenants, including a negative pledge covenant and restrictions on new indebtedness, investments, distributions to equityholders, asset sales, and affiliate transactions, the scope of which are dependent on the Availability existing from time to time. The Revolving Credit Facility also contains a requirement that we meet a 1:1 fixed-charge coverage ratio (FCCR) if Availability falls below the greater of $31.25 million or 12.5% of the aggregate lending commitments. Availability exceeded the minimum threshold amounts required for

20

Notes to Consolidated Financial Statements (Continued)

9. Debt (Continued)

testing of the FCCR at all times since entering into the Revolving Credit Facility, and Availability at December 31, 2012, was $195.6 million.

The Revolving Credit Facility generally permits dividends only if certain conditions are met, including complying with the minimum Availability requirements and having a fixed-charge coverage ratio of 1:1 on a pro forma basis.

At December 31, 2011, we had no borrowings outstanding under the Revolving Credit Facility. On October 12, 2012, we borrowed $50.0 million under the Revolving Credit Facility to partially fund the redemption of $75.0 million of our senior subordinated notes, as discussed further below. On December 20, 2012, we repaid $25.0 million, resulting in $25.0 million outstanding under the Revolving Credit Facility at December 31, 2012. The minimum and maximum borrowings under the Revolving Credit Facility were zero and $50.0 million, respectively, during the year ended December 31, 2012. At December 31, 2011 and 2012, we had approximately $11.3 million and $10.0 million, respectively, of letters of credit outstanding. These letters of credit and borrowings reduced our borrowing capacity under the Revolving Credit Facility by an equivalent amount.

Senior Subordinated Notes

In October 2004, Boise Cascade issued $400 million of 7.125% senior subordinated notes due in 2014. In July 2005, we completed an exchange offer whereby all of our senior subordinated notes were exchanged for registered securities with identical terms (other than terms relating to registration rights) to the notes issued in October 2004. We could redeem all or part of the senior subordinated notes at any time at redemption prices set forth in the indenture governing such notes. Redemption prices reduced to par value in October 2012. Subsequent to the exchange offer, we purchased a portion of the senior subordinated notes, resulting in $219.6 million of notes outstanding at December 31, 2011. On October 15, 2012, we redeemed $75.0 million of the senior subordinated notes at par value with $25.0 million of cash on hand and $50.0 million borrowed under our Revolving Credit Facility. Net proceeds from our senior notes offering (as discussed below in "Debt Refinancing") were used to redeem $144.6 million of the senior subordinated notes, plus $1.0 million of interest through the related redemption date of November 21, 2012.

Debt Refinancing

On October 22, 2012, Boise Cascade, L.L.C. (as the predecessor to Boise Cascade Company) and its wholly owned subsidiary, Boise Cascade Finance Corporation ("Boise Finance" and together with Boise Cascade, L.L.C., the "Co-issuers"), issued $250 million of 6.375% senior notes due November 1, 2020 (Senior Notes) through a private placement that is exempt from the registration requirements of the Securities Act of 1933, as amended (Securities Act). Interest on our Senior Notes is payable semiannually in arrears on May 1 and November 1, commencing on May 1, 2013. As a result of this refinancing, we extended the maturity of our debt and lowered our interest rate. The Senior Notes are guaranteed by each of our existing and future direct or indirect domestic subsidiaries that is a guarantor or co-borrower under our Revolving Credit Facility, other than Boise Finance.

Following the sale of our Senior Notes, as noted above, we used a portion of the net proceeds of the sale to repay the senior subordinated notes at par plus interest through the redemption date. The remaining proceeds are available for general corporate purposes.

21

Notes to Consolidated Financial Statements (Continued)

9. Debt (Continued)

In connection with the issuance of the Senior Notes, the Co-issuers entered into a registration rights agreement, dated as of October 22, 2012 (Senior Notes Registration Rights Agreement). The Senior Notes Registration Rights Agreement requires us to register under the Securities Act the Senior Notes having substantially identical terms to those of the Senior Notes (Exchange Notes) and to complete an exchange of the privately placed Senior Notes for the publicly registered Exchange Notes on or prior to October 21, 2013, or in certain circumstances, to file and keep effective a shelf registration statement for resale of the Senior Notes. If we fail to satisfy these obligations, we will pay additional interest up to 0.25% per annum to holders of the Senior Notes for the first 90-day period immediately following such date and an additional 0.25% per annum with respect to each subsequent 90-day period, up to a maximum rate of 1.0% per annum.

The Senior Notes are senior unsecured obligations and rank equally with all of the Co-issuers' and guarantors' existing and future senior indebtedness, senior to all of their existing and future subordinated indebtedness, effectively subordinated to all of their present and future senior secured indebtedness (including all borrowings with respect to our Revolving Credit Facility to the extent of the value of the assets securing such indebtedness), and structurally subordinated to the indebtedness of any subsidiaries that do not guarantee the Senior Notes.

The terms of the indenture governing the Senior Notes, among other things, limit the ability of the Co-issuers and certain Boise Cascade subsidiaries to: incur additional debt; declare or pay dividends; redeem stock or make other distributions to stockholders; make investments; create liens on assets; consolidate, merge, or transfer substantially all of their assets; enter into transactions with affiliates; and sell or transfer certain assets.

The indenture governing the Senior Notes provides for customary events of default, which include (subject in certain cases to customary grace and cure periods and notification requirements), among others: nonpayment of principal or interest; breach of other agreements in the indenture governing the Senior Notes; defaults in failure to pay certain other indebtedness; the rendering of judgments to pay certain amounts of money against the Co-issuers, the guarantors, or certain Boise Cascade subsidiaries; the failure of certain guarantees to be enforceable; and certain events of bankruptcy or insolvency.

Cash Paid for Interest

For the years ended December 31, 2010, 2011, and 2012, cash payments for interest were $18.6 million, $16.7 million, and $18.1 million, respectively.

10. Financial Instrument Risk

In the normal course of business, we are exposed to financial risks such as changes in interest rates, foreign currency exchange rates, and commodity price risk. In 2010, 2011, and 2012, we did not use derivative instruments.

Interest Rate Risk

When we have loan amounts outstanding on our Revolving Credit Facility, we are exposed to interest rate risk arising from fluctuations in interest rates. In 2010, 2011, and 2012, we did not use any interest rate swap contracts to manage this risk.

22

Notes to Consolidated Financial Statements (Continued)

10. Financial Instrument Risk (Continued)

Foreign Currency Risk

We have sales in countries outside the United States. As a result, we are exposed to movements in foreign currency exchange rates, primarily in Canada, but we do not believe our exposure to currency fluctuations is significant. In 2010, 2011, and 2012, we did not use any foreign currency hedges to manage this risk.

Commodity Price Risk

Many of the products we manufacture or purchase and resell and some of our key production inputs are commodities whose price is determined by the market's supply and demand for such products. Price fluctuations in our selling prices and key costs have a significant effect on our financial performance. The markets for most of these commodities are cyclical and are affected by factors such as global economic conditions, including the strength of the U.S. housing market, changes in or disruptions to industry production capacity, changes in inventory levels, and other factors beyond our control. In 2010, 2011, and 2012, we did not manage commodity price risk with derivative instruments.

11. Retirement and Benefit Plans

Our retirement plans consist of noncontributory defined benefit pension plans, including supplemental nonqualified pension plans for certain salaried employees, contributory defined contribution savings plans, a deferred compensation plan, and postretirement benefit plans.

Defined Benefit Plans

Some of our employees are covered by noncontributory defined benefit pension plans. Our defined benefit plan for salaried employees (Salaried Plan) and our nonqualified salaried pension plans were frozen so that no future benefits have accrued since December 31, 2009.

In September 2012, we amended Plan A (Plan A), one of our defined benefit pension plans. The amendment affected certain union hourly employees of Plan A by closing participation and freezing future benefits to that group after December 31, 2012. The benefit for hourly employees is generally based on a fixed amount per year of service (years of service determined as of December 31, 2012). In connection with this amendment, we recognized a $0.3 million noncash curtailment loss during the year ended December 31, 2012. As a result, only certain hourly employees in Plan A continue to accrue benefits after December 31, 2012.

On November 9, 2011, we amended our defined benefit pension plan for hourly employees of Plan B (Plan B) to freeze Plan B so that no future benefits accrue after December 31, 2011. The benefit for hourly employees is generally based on a fixed amount per year of service (years of service for Plan B participants determined as of December 31, 2011). In connection with this amendment, we recognized a $0.1 million noncash curtailment loss during the year ended December 31, 2011. Also, in connection with the Plan B amendment, Plan B was merged into the Salaried Plan to simplify administration of the plans, effective January 1, 2012.

Defined Contribution Plans

We sponsor contributory defined contribution savings plans for most of our salaried and hourly employees, and we generally provide company contributions to the savings plans. Due to poor business conditions, we suspended the company match for salaried employees for the period of April 1, 2009,

23

Notes to Consolidated Financial Statements (Continued)

11. Retirement and Benefit Plans (Continued)

through February 28, 2010. Since March 1, 2010, we have contributed 4% of each salaried participant's eligible compensation to the plan as a nondiscretionary company contribution. In addition, for the years that a performance target is met, we will contribute an additional amount that will range from 2% to 4% of the employee's eligible compensation, depending on the employee's years of service. Further, the plan allows for an additional discretionary contribution of 1% for achieving a second, higher performance target. Each of these performance targets were met during the year ended December 31, 2012. The company contributions for hourly employees vary by location. Company contributions paid, or to be paid, to our defined contribution savings plans for the years ended December 31, 2010, 2011, and 2012, were $6.7 million, $7.7 million, and $14.3 million, respectively.

Deferred Compensation Plan

We sponsor a deferred compensation plan. In 2008, Congress passed tax legislation that required participants in our deferred compensation plan to recognize income (and therefore be taxed) on their deferrals of income earned in 2009 and beyond and earnings thereon. Deferrals, company match, and interest on contributions made to the plan on or before December 31, 2008, were not affected by the changes. As long as contributions to the plan are taxable under the new legislation, there will be no future contributions to the deferred compensation plan, but participant account balances remaining after the distributions will continue to accrue earnings in accordance with the terms of the plan.

The deferred compensation plan is unfunded; therefore, benefits are paid from our general assets. For the years ended December 31, 2010, 2011, and 2012, we recognized $0.8 million, $0.7 million, and $0.6 million, respectively, of interest expense related to the plan. At December 31, 2011 and 2012, we had $11.4 million and $10.9 million, respectively, of liabilities related to the plan, of which $1.0 million and $1.1 million, respectively, were recorded in "Accrued liabilities, Compensation and benefits" and $10.4 million and $9.8 million, respectively, were recorded in "Other, Compensation and benefits" on our Consolidated Balance Sheets.

Postretirement Benefit Plans

Certain executives participate in our Supplemental Life Plan, which provides them with an insured death benefit during their employment with us. The plan provides the officer with a target death benefit equal to two times his or her base salary while employed and a target postretirement death benefit equal to one times his or her final base salary, in each case less any amount payable under our group term life insurance policy. At both December 31, 2011 and 2012, our benefit obligation related to the Supplemental Life Plan was $0.1 million.

We participate in a multiemployer health and welfare plan that covers medical, dental, and life insurance benefits for certain active employees as well as benefits for retired employees. As of December 31, 2012, approximately 610 of our employees participated in this plan. Per the terms of the representative collective bargaining agreements, we were required to contribute $5.50 per hour per active employee through June 1, 2012. Since June 1, 2012, we are required to contribute $5.00 per hour per active employee. Company contributions to the multiemployer health and welfare plan for the years ended December 31, 2010, 2011, and 2012, were $6.8 million, $6.9 million, and $6.7 million, respectively. After required contributions, we have no further obligation to the plan. The trustees of the plan determine the allocation of benefits between active and retired employees.

24

Notes to Consolidated Financial Statements (Continued)

11. Retirement and Benefit Plans (Continued)

Defined Benefit Obligations and Funded Status

The following table, which includes only company-sponsored defined benefit plans, reconciles the beginning and ending balances of our projected benefit obligation and fair value of plan assets. We recognize the underfunded status of our defined pension plans on our Consolidated Balance Sheets. We recognize changes in funded status in the year changes occur through other comprehensive income (loss).

| |

December 31 | ||||||

|---|---|---|---|---|---|---|---|

| |

2011 | 2012 | |||||

| |

(thousands) |

||||||

Change in benefit obligation |

|||||||

Benefit obligation at beginning of year |

$ | 391,485 | $ | 470,104 | |||

Service cost |

5,112 | 4,762 | |||||

Interest cost |

20,484 | 19,234 | |||||

Actuarial loss(a) |

67,121 | 26,686 | |||||

Special termination benefits |

503 | — | |||||

Closure and curtailments |

224 | — | |||||

Benefits paid |

(14,825 | ) | (16,102 | ) | |||

Benefit obligation at end of year |

470,104 | 504,684 | |||||

Change in plan assets |

|||||||

Fair value of plan assets at beginning of year |

281,972 | 282,195 | |||||

Actual return on plan assets |

1,427 | 37,645 | |||||

Employer contributions |

13,621 | 8,486 | |||||

Benefits paid |

(14,825 | ) | (16,102 | ) | |||

Fair value of plan assets at end of year |

282,195 | 312,224 | |||||

Underfunded status |

$ | (187,909 | ) | $ | (192,460 | ) | |

Amounts recognized on our Consolidated Balance Sheets |

|||||||

Current liabilities |

$ | (759 | ) | $ | (1,271 | ) | |

Noncurrent liabilities |

(187,150 | ) | (191,189 | ) | |||

Net liability |

$ | (187,909 | ) | $ | (192,460 | ) | |

Amounts recognized in accumulated other comprehensive loss |

|||||||

Net actuarial loss |

$ | 120,125 | $ | 120,925 | |||

Prior service cost |

720 | 304 | |||||

Net loss recognized |

$ | 120,845 | $ | 121,229 | |||

- (a)

- The actuarial losses were primarily due to decreases in discount rate assumptions.

The accumulated benefit obligation for all defined benefit pension plans was $470.1 million and $504.7 million at December 31, 2011 and 2012, respectively. All of our defined benefit pension plans have accumulated benefit obligations that exceed the fair value of plan assets.

25

Notes to Consolidated Financial Statements (Continued)

11. Retirement and Benefit Plans (Continued)

Net Periodic Benefit Cost and Other Comprehensive (Income) Loss

The components of net periodic benefit cost and other amounts recognized in other comprehensive (income) loss are as follows:

| |

Year Ended December 31 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2011 | 2012 | |||||||

| |

(thousands) |

|||||||||

Service cost |

$ | 4,931 | $ | 5,112 | $ | 4,762 | ||||

Interest cost |

20,258 | 20,484 | 19,234 | |||||||

Expected return on plan assets |

(18,474 | ) | (17,910 | ) | (19,390 | ) | ||||

Amortization of actuarial loss |

556 | 2,703 | 7,632 | |||||||

Amortization of prior service costs and other |

178 | 175 | 165 | |||||||

Plan settlement/curtailment expense |

— | 804 | 250 | |||||||

Net periodic benefit cost |

7,449 | 11,368 | 12,653 | |||||||

Changes in plan assets and benefit obligations recognized in other comprehensive (income) loss |

||||||||||

Net actuarial loss |

4,048 | 83,528 | 8,432 | |||||||

Amortization of actuarial loss |

(556 | ) | (2,703 | ) | (7,632 | ) | ||||

Amortization of prior service costs and other |

(178 | ) | (175 | ) | (416 | ) | ||||

Total recognized in other comprehensive loss |

3,314 | 80,650 | 384 | |||||||

Total recognized in net periodic cost and other comprehensive loss |

$ | 10,763 | $ | 92,018 | $ | 13,037 | ||||

In 2013, we estimate net periodic pension expense will be approximately $11 million, including $9.0 million of net actuarial loss and $0.1 million of prior service cost that will be amortized from accumulated other comprehensive loss.

Assumptions

The assumptions used in accounting for our plans are estimates of factors that will determine, among other things, the amount and timing of future contributions. The following table presents the assumptions used in the measurement of our benefit obligations:

| |

December 31 | ||||||

|---|---|---|---|---|---|---|---|

| |

2011 | 2012 | |||||

Weighted average assumptions |

|||||||

Discount rate |

4.20 | % | 3.75 | % | |||

Rate of compensation increases(a) |

— | % | — | % | |||

26

Notes to Consolidated Financial Statements (Continued)

11. Retirement and Benefit Plans (Continued)

The following table presents the assumptions used in the measurement of net periodic benefit cost:

| |

December 31 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2011 | 2012 | |||||||

Weighted average assumptions |

||||||||||

Discount rate |

5.90 | % | 5.35 | % | 4.20 | % | ||||

Expected long-term rate of return on plan assets |

7.25 | % | 7.00 | % | 6.75 | % | ||||

Rate of compensation increases(a) |

— | % | — | % | — | % | ||||

- (a)