Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Escalera Resources Co. | d520695d8k.htm |

Exhibit 99.1

| 1 OGIS Conference New York April 15-17, 2013 Double Eagle Petroleum Co KSH |

| 2 Corporate Information & Disclaimer This presentation may contain projections and other forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. Any such projections or statements reflect the Company's current views with respect to future events and financial performance. No assurances can be given, however, that these events will occur or that such projections will be achieved and actual results could differ materially from those projected. A discussion of important factors that could cause actual results to differ materially from those projected, such as decreases in oil and gas prices and/or unexpected decreases in oil and gas production, is included in the Company's periodic reports filed with the Securities and Exchange Commission. Cautionary Note to U.S. Investors - The United States Securities and Exchange Commission permits oil and gas companies, in their filings with the SEC, to disclose proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. Effective for the Company's December 31, 2010 Form 10-K, SEC guidelines were changed to also allow for disclosure of "probable" and "possible" reserves. We may use these terms in this presentation. Investors are urged to consider closely the disclosure in our 2012 Form 10-K, File No. 1-33571, available from us at Double Eagle Petroleum, 1675 Broadway, Suite 2200, Denver, Colorado 80202, attention Investor Relations. You can also obtain this form from the SEC by calling 1-800-SEC-0330. NASDAQ: DBLE Shares Outstanding: 11,326,168 52 Week Price Range: $3.74-$6.20 90 Day Average Volume: 21,039 *information quoted above as of April 1, 2012 Corporate Office: 1675 Broadway, Suite 2200 Denver, CO 80202 Contact Information: Kurtis Hooley, Chief Operating Officer 303-794-8445 www.dble.com |

| Building Shareholder Value Building Shareholder Value 3 Niobrara Shale Play Midstream Pipeline Table Top Unit Atlantic Rim CBM and Pinedale Anticline |

| Main Fork Unit Main Fork Unit 4 Company estimated 2-3 Tcfe oil and gas target 44,000 gross (11,000 net) acres Well previously drilled but not completed in 2007 Option farm-in right by major oil and gas company whereby they fund future costs related to the first well completion Reprocessed prior seismic, commissioned an EIS and submitted project development plan to BLM at their expense Initiated full field development environmental impact study in 2011 Currently identified 40+ development locations, pipeline and roads Surveys and studies are being conducted in preparation for additional 2D seismic in 2013 Assuming the farm-in right is exercised, Double Eagle will have an estimated 14% carried working interest after payout |

| 5 Niobrara Shale Double Eagle Acreage Powder River Basin Greater Green River Basin DJ Basin WR Basin 20+ miles of 3D Seismic reprocessed in Catalina Unit Heavy natural fracturing based on well data Existing historical Niobrara production adjacent to Atlantic Rim Most of Atlantic Rim acreage is HBP TOTAL TOTAL Location Location GROSS NET Atlantic Rim--Greater Green River Atlantic Rim--Greater Green River Atlantic Rim--Greater Green River 61,310 36,508 DJ Basin-Wyoming DJ Basin-Wyoming DJ Basin-Wyoming 6,674 6,674 DJ Basin- Nebraska DJ Basin- Nebraska DJ Basin- Nebraska 4,198 4,198 Powder River Basin Powder River Basin Powder River Basin 16,283 16,283 Laramie/Hanna Basin Laramie/Hanna Basin Laramie/Hanna Basin 8,669 8,669 Wind River Basin Wind River Basin Wind River Basin 640 640 Totals Totals 97,774 72,972 |

| 6 Niobrara Shale Central Wyoming & Colorado |

| Niobrara Shale Niobrara Shale 7 Niobrara Shale Play * Initial test well completed in Q1 2013 * 24 hour IP rate of 467 BOE * API density consistent with WTI * Significantly all Atlantic Rim acreage HBP * 1500' of pay * DBLE has 95 % WI in well * 825 gross potential drill locations |

| 8 Proven Execution Cont. Cost Control Low cost growth through the drill bit F&D Costs three year weighted average of $ 0.87 Mcfe; 2012 Production Costs, including taxes--$ 1.51 per Mcfe G&A Costs equals 16 % of revenues; among lowest of peer group with revenues < $150 million |

| Building Shareholder Value Building Shareholder Value 9 Pinedale Anticline * Interest in 184 producing wells * 26% of proved reserves * 260+ future potential wells * Operated by QEP Midstream Pipeline * 12.5 miles of transportation assets * 20% utilized * Ability to expand North to WIC Atlantic Rim CBM * Interest in 283 producing CBM wells * 64% of proved reserves * 1,400 future drilling locations * Catalina Unit Company operated * Other unit operated by Warren Resources |

| 10 Historical drilling activity Catalina Unit 83 gross (64 net) wells ~175 total potential future drilling locations 52.6 Bcfe net proved reserves (based upon forward strip pricing at 12/31/2012) Spyglass Hill Unit (including former Sun Dog/Doty Mnt Units) 200 gross (46.9 net wells) ~1,225 total potential future drilling locations 50.0 Bcfe net proved reserves (based upon forward strip pricing at 12/31/2012) 2013 Planned Activity Potential drilling additional Niobrara wells Recompletions in Catalina Unit The Atlantic Rim |

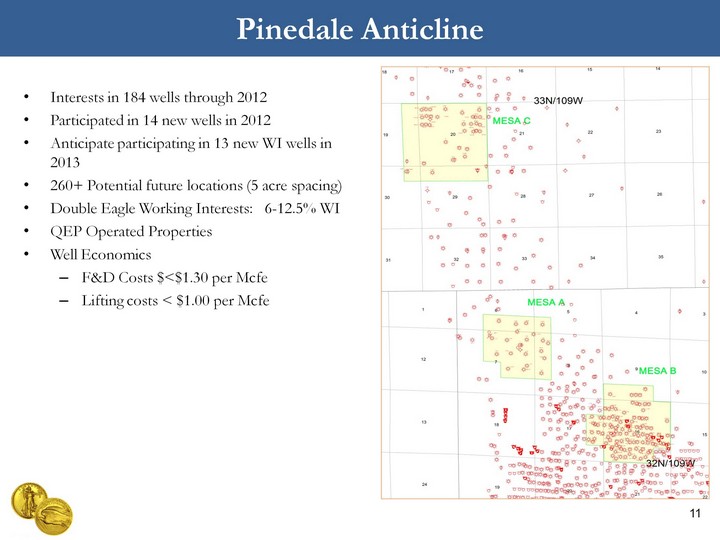

| 11 Pinedale Anticline Interests in 184 wells through 2012 Participated in 14 new wells in 2012 Anticipate participating in 13 new WI wells in 2013 260+ Potential future locations (5 acre spacing) Double Eagle Working Interests: 6-12.5% WI QEP Operated Properties Well Economics F&D Costs $<$1.30 per Mcfe Lifting costs < $1.00 per Mcfe |

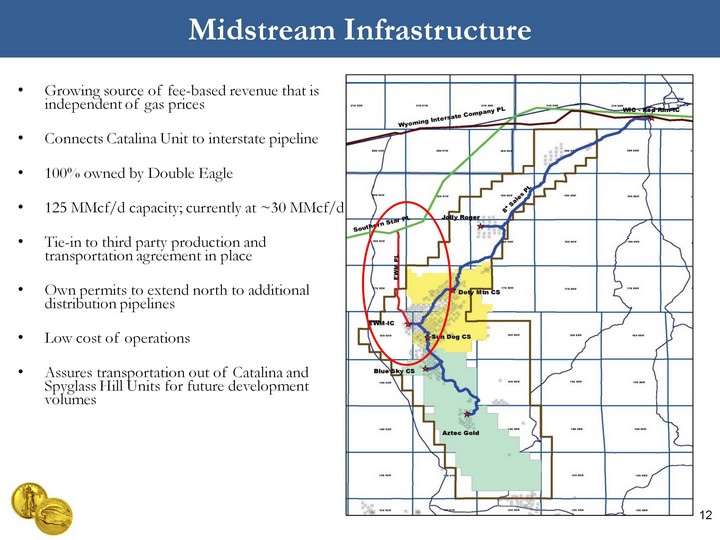

| Midstream Infrastructure Growing source of fee-based revenue that is independent of gas prices Connects Catalina Unit to interstate pipeline 100% owned by Double Eagle 125 MMcf/d capacity; currently at ~30 MMcf/d Tie-in to third party production and transportation agreement in place Own permits to extend north to additional distribution pipelines Low cost of operations Assures transportation out of Catalina and Spyglass Hill Units for future development volumes 12 |

| 13 Proven Execution Reserve Growth 2003-2012 Reserves Prepared by Netherland, Sewell & Associates, Inc. as of December 31 for each respective year. Reserves based upon forward strip pricing as of 12/31/2012 Reserve Replacement Reserve Replacement 2004 2005 2006 2007 2008 2009 2010 2011 2012 2012 (2) 574% 511% 147% 864% 326% 134% 447% 236% -455% 62% 2012 Reserves (2) --132.5 Bcfe --$162.7 million |

| Hedge Contracts 14 Double Eagle Petroleum Double Eagle Petroleum Double Eagle Petroleum Double Eagle Petroleum Double Eagle Petroleum Double Eagle Petroleum Current Hedging Positions Current Hedging Positions Current Hedging Positions Current Hedging Positions Current Hedging Positions Current Hedging Positions Volume/day (Mcfe)* Price Beginning Date End Date 2013 Expirations Natural Gas Collar - NYMEX 6,000 $5.00 $5.35 1/1/2013 12/31/2013 Natural Gas Swap - NYMEX 6,000 $5.16 1/1/2013 12/31/2013 Natural Gas Collar - NYMEX 6,000 $3.25 $4.00 1/1/2013 12/31/2013 18,000 approx. % of estimated production 60% 2014 Expirations Natural Gas Swap - NYMEX 5,000 $4.27 1/1/2014 12/31/2014 Natural Gas Collar - NYMEX 5,000 $4.00 $4.50 1/1/2014 12/31/2014 Natural Gas Swap - NYMEX 5,000 $4.20 1/1/2014 12/31/2014 15,000 approx. % of estimated production 60% 2015 Expirations Natural Gas Swap - NYMEX 8,300 $4.28 1/1/2015 12/31/2015 approx. % of estimated production 25% *approximately, these contracts are not daily, but are monthly blocks. *approximately, these contracts are not daily, but are monthly blocks. *approximately, these contracts are not daily, but are monthly blocks. *approximately, these contracts are not daily, but are monthly blocks. |

| Summary of Double Eagle Value Proposition 15 Reserves (1) Reserves (1) Bcfe $ PV-10 Proved 132.5 162.7 Probable 40.0 23.2 Possible 100.8 118.0 Total 3P Total 3P 273.25 303.9 Gross Locations Gross Acreage Additional Potential Drilling (2) Additional Potential Drilling (2) Additional Potential Drilling (2) Atlantic Rim Atlantic Rim CBM 1,405 135,000 Niobrara/Dakota/Frontier Niobrara/Dakota/Frontier 825 66,000 Pinedale (3) Pinedale (3) 260+ 2,400 Main Fork Main Fork 40+ 44,000 Pipeline --12 inch-12.5 mile pipeline with 125 Mmcfe/d capacity --12 inch-12.5 mile pipeline with 125 Mmcfe/d capacity --12 inch-12.5 mile pipeline with 125 Mmcfe/d capacity --12 inch-12.5 mile pipeline with 125 Mmcfe/d capacity --Transports Catalina and Niobrara/Dakota/Frontier gas --Transports Catalina and Niobrara/Dakota/Frontier gas --Transports Catalina and Niobrara/Dakota/Frontier gas --Transports Catalina and Niobrara/Dakota/Frontier gas --Utilization is 25% --Utilization is 25% (1) Based upon 12/31/2012 forward strip pricing (1) Based upon 12/31/2012 forward strip pricing (1) Based upon 12/31/2012 forward strip pricing (2) Assumes full development under existing spacing (2) Assumes full development under existing spacing (2) Assumes full development under existing spacing (2) Assumes full development under existing spacing (3) includes both WI and Royalty interest (3) includes both WI and Royalty interest (3) includes both WI and Royalty interest |

| Senior Management Senior Management 16 |